Economical Analysis of Flexibility in Micro Grids

Angan Mitra

1

, Corinne Touati

2

, Stephane Ploix

3

, Ujjwal Maulik

1

and Nouredine Hadjsaid

3

1

Jadavpur University, Kolkata, India

2

Inria and LIG laboratory, Grenoble, France

3

University Grenoble Alpes, Grenoble, France

Keywords:

Smart-grid, Economical Analysis, Energy Optimization, Flexible Consumption.

Abstract:

As energy demand increased and production means diversified, conventional approaches of looking into distri-

bution grids need to evolve. The Smart Grid paradigm introduces new possibilities of real-time market sensing

and interaction models between producers and consumers. In particular, by understanding the types of con-

sumers and their potential willingness to adapt their energy demand with price incentives, innovative pricing

strategies in the Smart Grid are expected to lead to better production management, profit maximization and

end consumers satisfaction levels. In this work we propose a novel framework and a simulation scenario of

a global energy network with heterogeneous types of producers and consumers from which different types of

behaviors and interactions can be studied.

1 INTRODUCTION

As energy demand increased and production diver-

sified, conventional approaches of looking into dis-

tribution grids needed to change. The overarch-

ing goal being to equilibrate an (up until now) non-

controllable consumption with a volatile and partly

non-controllable production, there is a strong need

to understand, model and interact with consumers.

The smart grid paradigm emerged from these consid-

erations. It is a communication network coupled to

the electricity one, allowing real-time information ex-

changes (and thus interactions) between energy pro-

ducers and consumers.

The formulation for the smart grid was aided by

the works of (Albadi and El-Saadany, 2007). Fur-

ther improvement were made in (Chen et al., 2011)

and (Mohsenian-Rad et al., 2010a), where attempts

were done to schedule the needs of the consumers

in response to the tariff announced by the electricity

provider. (Momoh et al., 2009) talked about develop-

ing the tools to bring the concept into reality. The eco-

nomics analysis of smart grids took a new direction

with the application of game theory as pointed out

This work was partially supported by the DST-

INRIA-CNRS (IFCPAR/CEFIPRA) sponsored project, ti-

tled: ”BiDee: A big data perspective for energy manage-

ment in smart grids and dwellings”.

by (Maity and Rao, 2010) who proposed competing

pricing mechanism for markets involved in the smart

grid model based on the auction theory. (Fadlullah

et al., 2011), (Mohsenian-Rad et al., 2010b), (Saad

et al., 2012), (Nguyen et al., 2013) studied strategies

from the consumer and producer point of view to in-

crease their revenues. (Gkatzikis et al., 2013) pro-

posed a new kind of electricity distributor who can

vary its energy need with tariff which led to much in-

terest in developing aggregators’ flexibility.

All these references solve a local optimization

problem either at the consumer or at the market level

rather than addressing the global problem of introduc-

ing flexibility at distributor level and analyzing its ef-

fect with respect to market and profits. Flexibility is

the ability to respond i.e. to modulate its energy need

with tariff. In our work, we propose a novel frame-

work of a general grid taking into account flexibility.

More precisely, we propose a general interaction

model which takes into account the developing diver-

sity of actors in new electricity markets (Section 2).

We describe the roles and specifics of each actor in the

subsequent sections (producers, consumers, schedul-

ing operators in Sections 3 to 5 respectively). We

briefly comment on the demand market (Section 6).

Finally, we present the simulator we have developed,

written in Python (Section 7) and some preliminary

results and observations obtained (Section 8).

Mitra, A., Touati, C., Ploix, S., Maulik, U. and Hadjsaid, N.

Economical Analysis of Flexibility in Micro Grids.

In Proceedings of the 5th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS 2016), pages 351-356

ISBN: 978-989-758-184-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

351

2 PROBLEM STATEMENT

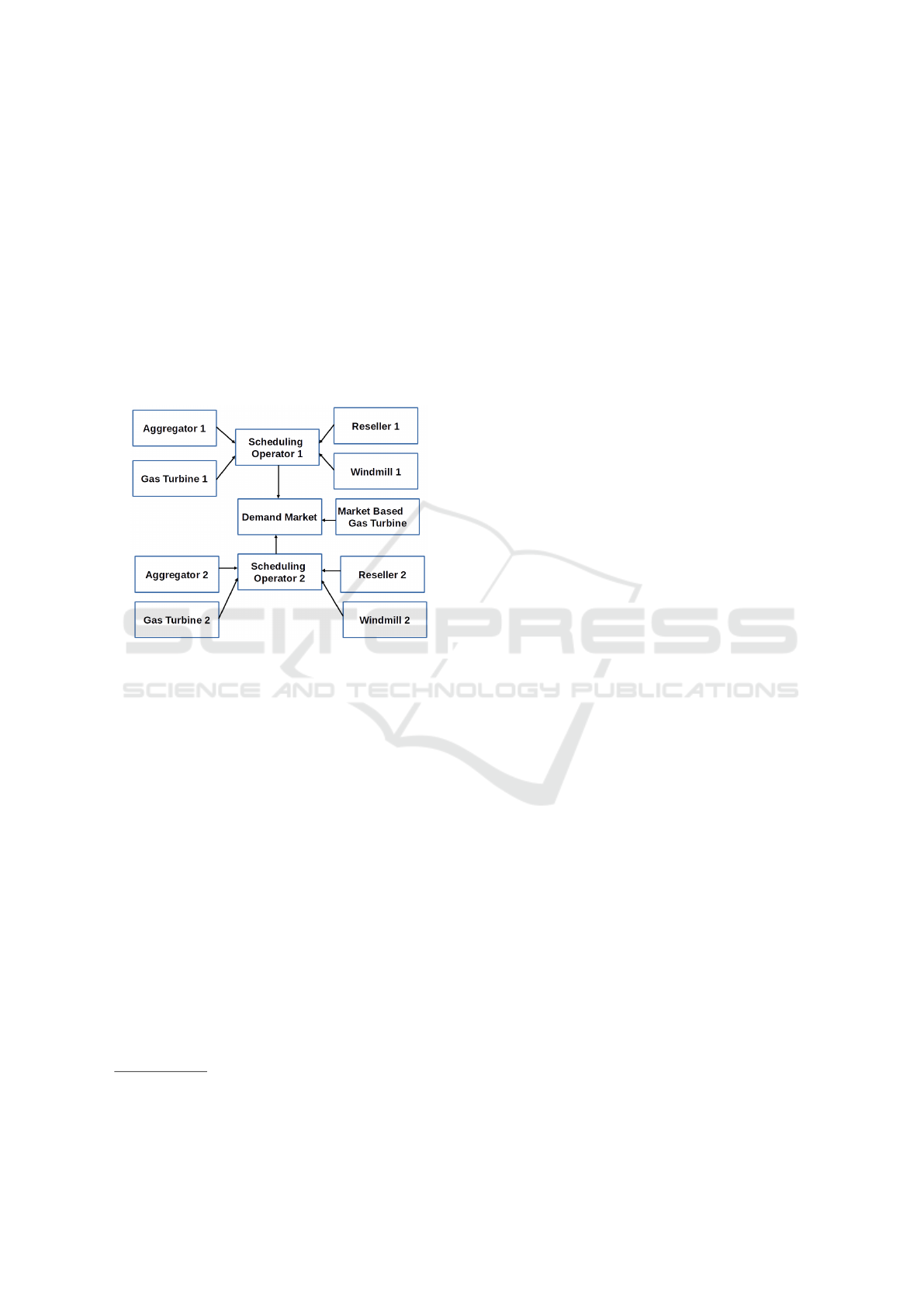

Figure 1 represents the micro grid model which we

study. Here, a scheduling operator, an aggregator,

a reseller, and a windmill form a coalition and two

such coalitions interact with each other through the

demand market. We have simulated an hour ahead

scenario of energy exchanges where both demand and

production is flexible (i.e. adaptive to tariff) and com-

pared it to the non flexible case. We formulated the

situation as an optimizing problem, solving which

gives optimal tariffs for the distributors and allows to

assess the impact of flexibility in both energy savings

and revenue maximization.

Figure 1: Interaction model among various actors of the

micro grid.

3 MODELING OF THE

PRODUCER

In this study, it is assumed that an electricity producer

is either dealing with one and only one scheduling op-

erator or directly selling energy on the demand mar-

ket. Further, producer is a role corresponding to only

one production means

1

. In this study, only windmills

and gas turbines are taken into consideration.

3.1 Windmill

Since we are interested in an hourly interaction be-

tween the coalitions, one time investment costs are

not considered. As thus the windmill is assumed to

produce energy at cost 0. The windmills are always

in contract with a scheduling operator and thus can-

not contribute in the market. The production level of

a windmill is partially uncertain and thus modeled as a

1

There exist many production means: windmill, photo-

voltaic plant, hydro-power plant (over water, or in moun-

tains), gas turbine, nuclear plants to name a few.

random process. E

wm

is the hourly energy production

expectancy calculated on the basis of past history.

3.2 Gas Turbine

A gas turbine sells energy as requested by the

scheduling operators or market. Thus, it charges the

price as per amount of energy produced. Since we

worked with real life data, we used the General Elec-

tric 9E gas turbine series and work of (Roche, 2012)

to model the gas turbine pricing function as given by

Equation (1).

Local Gas Turbine are in contract with a schedul-

ing operator. Therefore, the scheduling operator buys

from its contracted gas turbine before going to the

market to buy extra energy if needed. P

`

gt

(E

`

gt

) denotes

the cost for producing E

`

gt

amount of energy. E

`

max

is

the maximum amount of energy that can be produced

by the local gas turbine.

Market based Gas Turbine are similar to local gas

turbines except they have no capacity constraint and

are connected to the demand market. They have a

higher charge than their local counterparts since they

are not guaranteed to make profit via selling at every

hour. P

m

gt

(E

m

gt

) is the price for selling E

m

gt

amount of

energy. While selling, the market based gas turbine

keeps an additional constant profit margin C

m

> 0 per

unit of energy sold.

P

α

gt

(E

α

gt

) = 0.2(E

α

gt

)

2

+ (143 +C

α

)E

α

gt

+ 6088,

with α ∈ {`, m}, C

`

= 0, E

α

gt

> 0

(1)

4 MODELING OF THE

CONSUMER

We model the consumers and classify them into two

broad groups. Those who are willing to accept a

power offering which is less than the power they de-

manded, in exchange for a monetary compensation

can be thought to draw power from a flexible distrib-

utor. Those with non flexible demand needs like hos-

pitals can be labeled as a separate group who draw

power from a non flexible distributor.

4.1 Reseller

The reseller is an actor in the smart grid, who serves as

a non flexible distributor. It buys energy from the con-

tracted scheduling operator and sells to its customers.

It has no bound on the energy level it can sell.

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

352

For a reseller, T

r

is the price per unit of energy

at which it buys from the scheduling operator and E

r

is corresponding amount of energy bought. C

r

is the

effective cost to the reseller and is given by C

r

= E

r

T

r

.

4.2 Aggregator

An aggregator is in business with a scheduling opera-

tor and behaves as a flexible distributor. It has its own

customers with their energy needs. The distinguish-

ing role of an aggregator (compared to a reseller) is

that it can influence its customers to reduce their en-

ergy needs with price incentives.

4.2.1 Flexibility Curve for Aggregator

Let us define the allotted energy ratio for the aggrega-

tor as

E

∗

a

=

E

a

E

da

,

where E

a

and E

da

represent the energy allotted to the

aggregator and actual demand of the aggregator re-

spectively. The minimum allotted energy ratio that

has to be provided is

E

∗

min,a

=

E

min,a

E

da

,

where E

min,a

is the minimum energy that has to be

consumed by aggregator even at infinite cost. E

∗

a

may

be time varying while E

∗

min,a

is kept constant and is

fixed at 0.7. E

∗

min,a

can be also made time varying so

as to decrease it during hours of high requirement and

increase in the opposite case.

Let T

a

be the tariff charged to the aggregator. The

tariff of the aggregator can be modeled by:

T

∗

=

T

a

T

r

.

The relation between E

∗

a

and T

∗

is given by a lin-

ear flexibility function

φ(T

a

) = 1 −

T

a

T

r

= 1 − T

∗

.

The proposed linear function for energy bought by

aggregator is

E

∗

a

= φ(T

a

)+(1−φ(T

a

))E

∗

min,a

, with T

a

∈ [0, T

r

]. (2)

Equation (2) expresses the fact as T

∗

decreases, the

energy satisfaction increases while at a higher tariff

lower energy is consumed by the aggregator. Thus a

flexibility is observed with respect to tariff charged to

the aggregator.

Simplifying the algebra, the energy bought by ag-

gregator E

a

can finally be written

E

a

= E

da

1 − (1 − E

∗

min,a

)T

∗

, with T

∗

∈ [0,1].

The effective price charged by the scheduling

operator can then be calculated by multiplying the

amount of energy sold by per per unit price:

C

a

(E

∗

a

) = T

a

E

a

= E

da

E

∗

a

T

r

1 − E

∗

a

1 − E

∗

min,a

. (3)

4.2.2 Compensation Function

Although selected through trial and error, the ratio-

nale behind a compensation function is that the com-

pensation tariff should be more than the buying tar-

iff. Consequently, the larger the unsatisfied energy,

the larger the penalty incurred. The sample function

which is used for this model is given by

F

c

(E

∗

a

) = (1 − E

∗

a

)E

∗

da

T

r

log(T

r

). (4)

5 DEFINING THE SCHEDULING

OPERATOR

A scheduling operator is an actor connected with sev-

eral electricity producers and one or several electricity

distributors. Its responsibility is to equilibrate produc-

tion with consumption. If the suppliers, with whom it

is dealing with, cannot provide enough energy, it can

buy electricity on the demand market. Reciprocally, if

the consumption is lower than the production, it can

sell excess energy on the market.

5.1 Market Strategy

Each scheduling operator needs to develop an expec-

tation of market demand per hour. In addition to that,

it needs to formulate its buying and selling valuation

functions for E

x

, the energy in exchange with the mar-

ket. The convention is E

x

> 0 if the scheduling opera-

tor buys from the market and E

x

< 0 if the scheduling

operator sells to the market. Underlying the energy

exchange, lies the energy conservation law, which can

be formulated in our case by

E

wm

+ E

`

gt

+ E

x

= E

r

+ E

a

. (5)

Selling to the Market. The selling price for |E

x

|

amount of energy comes from the difference of pro-

duction cost for total amount of energy generated by

the local gas turbine given by E

gt

and the production

cost for the supply of energy supplied to the aggrega-

tor and reseller which is E

gt

+ E

x

− E

wm

. The selling

price is of the same sign as E

x

, and therefore non pos-

itive by convention and its absolute value is the excess

cost for producing |E

x

|:

P

s,m

(E

x

) = P

l,gt

(E

`

gt

) − P

`

gt

(E

`

gt

− E

x

). (6)

Economical Analysis of Flexibility in Micro Grids

353

Buying from the Market. An amount E

x

of energy

can be bought either (i) from a selling scheduling op-

erator or (ii) from the market gas turbine or (iii) a con-

tribution from both. So the buying price estimation of

a scheduling operator is taken in between the expected

selling price of that amount by the other scheduling

operator and by the market-based gas turbine:

P

b,m

(E

x

) = (γ − 1)P

s,m

(E

x

) + γP

m,gt

(E

x

). (7)

where γ is a parameter between 0 and 1. A high

value of γ signifies that the energy is more likely to

come from the market gas turbine, while a lower value

denotes likeliness to come from the selling schedul-

ing operator. Since the pricing function of the other

scheduling operator for |E

x

| amount of energy is un-

known, we assume each scheduling operator expects

the other to value |E

x

|, the same way it would have.

Thus the expected market function is given by

P

m

(E

x

) =

P

s,m

(E

x

) if E

x

< 0,

P

b,m

(E

x

) otherwise.

(8)

Finally, the value of γ is learned through past ex-

periences.

5.2 Utility / Profit for the Scheduling

Operator

Utility U represents the profit made by any scheduling

operator. It is formulated as the revenue obtained in

selling to the aggregator and the reseller minus the

production cost from the local gas turbine, buying

cost from the market, and the compensation to the ag-

gregator:

U(E

∗

a

,E

x

,E

`

gt

) = C

r

+C

a

(E

∗

a

) − P

m

(E

x

)

−P

l,gt

(E

`

gt

) − F

c

(E

∗

a

).

(9)

Note that with the previous conventions P

m

(E

x

) is

non negative if the scheduling operator is buying en-

ergy from the market and non positive otherwise. The

strategy of the scheduling operator (SO) is then:

max

E

∗

a

,E

x

,E

`

gt

U s.t.

E

wm

+ E

`

gt

+ E

x

= E

r

+ E

∗

a

E

da

,

E

∗

a

∈ [E

∗

min,a

,1],

E

`

gt

∈ [0,E

`

max

].

(10)

The demand market (presented below) has the

property to always allocate the demanded amount to

the buying SO (i.e. those with E

x

> 0) while satisfy-

ing partly or totally the selling SO: that is the amount

to be sold is |

e

E

x

| ≤ |E

x

| if E

x

< 0. Hence, for both

SO, the optimization (10) is solved before entering the

market. Then, for the selling SO, optimization (10) is

solved again after the allocation of the market, with

the extra constraint that for that SO with E

x

=

e

E

x

.

6 MODELING THE DEMAND

MARKET

At the start of each hour, the two scheduling operators

report to the market their willingness to either sell or

buy energy. Three cases can arise:

Buying and Selling Scheduling Operator.

Scheduling operator 1 wants to buy E

1

x

> 0 amount

of energy while scheduling operator 2 wants to sell

E

2

x

< 0. Thus scheduling operator 2 submits a two

dimensional selling bid of the form hE

2

x

,P

2

x

i. The

market computes prices P

A

and P

B

according to:

P

A

= P

2

x

× min

E

1

x

|E

2

x

|

,1

+ P

m

gt

max

0,E

1

x

− |E

2

x

|

,

P

B

= P

m

gt

(E

1

x

).

The buyer gets the amount E

1

x

of energy (as ex-

pected) and is charged P

1

x

= min{P

A

,P

B

}. If P

B

< P

A

,

then the seller gets

e

P

x

2

= 0 and the market gas turbine

receives P

B

. Otherwise, the selling scheduling opera-

tor sells the amount of energy

f

E

2

x

= min

E

1

x

|E

2

x

|

,1

×E

2

x

at total price

f

P

2

x

= min(

E

1

x

|E

2

x

|

,1) × P

2

x

.

Buying Scheduling Operators Only. Let the buy-

ing scheduling operators report their demand E

1

x

and

E

2

x

. The market fetches the total demand of E

1

x

+

E

2

x

from the market based gas turbine at a price of

P

m,gt

(E

1

x

+ E

2

x

) and the buyers are charged a payment

proportional to the energy they requested for.

Selling Scheduling Operators Only. When both

scheduling operators try to sell, then no energy trans-

action takes place in the market. Thus both the

scheduling operators receive a payment of 0.

7 IMPLEMENTATION

Each scheduling operator plans each hour ahead and

thus saves itself from producing any unused amount

of energy. At each hour of simulation, the schedul-

ing operator gets information on expected amount of

production from the windmill. Information is fed into

the Equation (9) to give out the answers of how much

local gas turbine should produce and also how much

to buy or sell to the market.

Then, the reseller and aggregator attached with a

scheduling operator reports its demand for that hour.

As for the simulation, web service is used to relay

the information to the scheduling operator. Once the

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

354

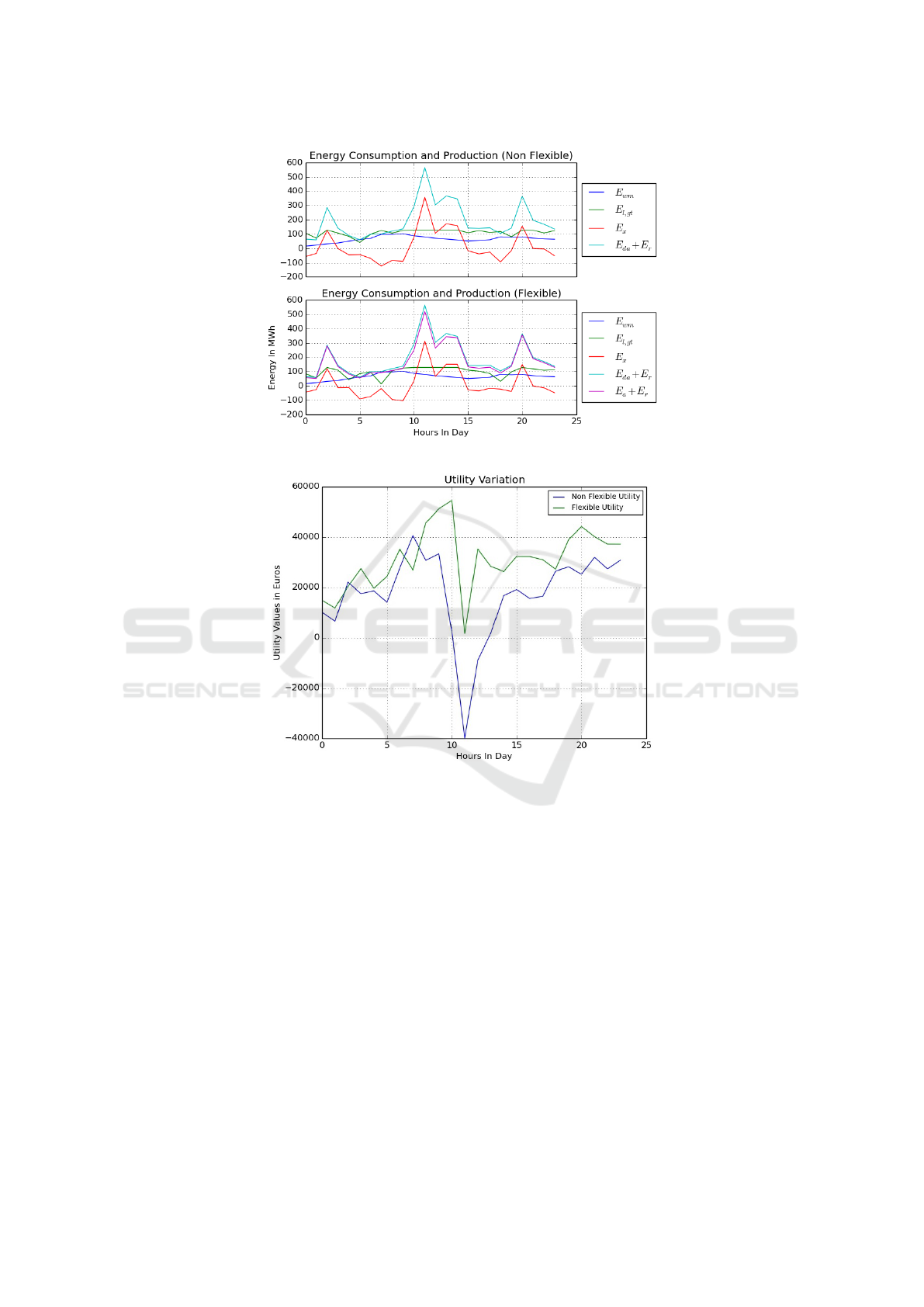

Figure 2: Energy Production and Consumption Comparison.

Figure 3: Utility Value Comparison.

market plays its role, the scheduling operators adjusts

their production and consumption.

The simulation was implemented in Python 3.4

using Flask API on commodity hardware. Each ac-

tor was assigned a server port address and communi-

cation between different actors was carried via HTTP

protocol. The results were later converted into graphs

for visualization using matplotlib.

8 RESULTS AND DISCUSSION

Results can be divided into two parts, the first task

being to find tariff T

r

of each coalition. The second

task is to understand the impact of flexibility on the

smart grid model in terms of profit made.

8.1 Finding Tariff

In order for the optimization to work, we have to set

the tariff for distributors such as aggregators and re-

sellers. Initially, random prices were chosen to see

how the system behaved. It was observed that on set-

ting the tariff too high, the aggregators started behav-

ing like resellers. On lowering the tariff, the schedul-

ing operator on behalf of its coalition made immense

losses. Then, we tried to find the best tariff for each

hour for which there were no losses nor profit for

the scheduling operator, assuming aggregators to be

resellers as well. The average tariff was then cal-

culated over a year. For Scheduling Operator 1 and

Scheduling Operator 2, as given in the model, the tar-

iff came as 300e/MWh and 320e/MWh respectively.

To make the model simple, we have assumed that the

tariffs are time invariant.

Economical Analysis of Flexibility in Micro Grids

355

8.2 Impact of Flexibility

To understand the impact of flexibility, a similar situa-

tion with non flexible operator in one case and flexible

operators on the other must be compared. Here study

has been mainly focused with respect to two parame-

ters namely energy consumption and production and

utility variation. A randomly sampled result has been

put to display.

The plots in Figure 2 show the need of flexibility

in the hours of high demand. It is justified since it is

not wise to trouble the customers all the time as that

might lead to undesirable circumstances. For exam-

ple, in the 11

th

hour, there was an imminent need for

flexibility after the local gas turbine reached its maxi-

mum operating point. The plots in Figure 3 show the

variation of utility/profit in both cases. It can be ob-

served that at the time of flexibility, the non flexible

operator incurred a loss while the flexible one made a

profit, no matter how meager it is. From an econom-

ical standpoint, flexibility resulted in a better utility

than being non flexible keeping the other parameters

constant.

9 CONCLUSION

In this paper, though we have kept the mathematical

modeling simple, the impact of flexibility at aggrega-

tor level have been quite prominent. The naive way of

finding an optimal tariff, seemed effective in showing

flexibility. More importantly, the system showed flex-

ibility only in times of high demand, automatically

modeling the comfort level of the consumers. Find-

ing out the optimal tariff for the system is worth re-

searching as it is one of the critical parameter for the

system to show flexibility. Instead of keeping it con-

stant throughout the day, it can made to vary along

different hours of the day. There is lack of strategies

in the paper, by virtue of which a scheduling operator

can model others. Possible scopes of experimenting

lies in formulation of the flexibility function and com-

pensation function for the aggregator. The interaction

between the scheduling operators via the market can

be thought of as an auction mechanism. Herein lies

the future scope of game theory into modeling the ex-

pectation function for the scheduling operators along

with bidding strategies. With more than two schedul-

ing operators in the market, the grid dynamics will be

interesting to observe.

REFERENCES

Albadi, M. H. and El-Saadany, E. (2007). Demand response

in electricity markets: An overview. In IEEE power

engineering society general meeting, volume 2007,

pages 1–5.

Chen, C., Kishore, S., and Snyder, L. V. (2011). An innova-

tive RTP-based residential power scheduling scheme

for smart grids. In IEEE International Conference on

Acoustics, Speech and Signal Processing (ICASSP),

pages 5956–5959.

Fadlullah, Z. M., Nozaki, Y., Takeuchi, A., and Kato, N.

(2011). A survey of game theoretic approaches in

smart grid. In IEEE International Conference on Wire-

less Communications and Signal Processing (WCSP),

pages 1–4.

Gkatzikis, L., Koutsopoulos, I., and Salonidis, T. (2013).

The role of aggregators in smart grid demand response

markets. IEEE Journal on Selected Areas in Commu-

nications, 31(7):1247–1257.

Maity, I. and Rao, S. (2010). Simulation and pricing mecha-

nism analysis of a solar-powered electrical microgrid.

Systems Journal, 4(3):275–284.

Mohsenian-Rad, A.-H., Wong, V. W., Jatskevich, J., and

Schober, R. (2010a). Optimal and autonomous

incentive-based energy consumption scheduling algo-

rithm for smart grid. In Innovative Smart Grid Tech-

nologies (ISGT), 2010, pages 1–6. IEEE.

Mohsenian-Rad, A.-H., Wong, V. W., Jatskevich, J.,

Schober, R., and Leon-Garcia, A. (2010b). Au-

tonomous demand-side management based on game-

theoretic energy consumption scheduling for the fu-

ture smart grid. IEEE Transactions on Smart Grid,

1(3):320–331.

Momoh, J. et al. (2009). Smart grid design for efficient

and flexible power networks operation and control. In

IEEE/PES Power Systems Conference and Exposition

(PSCE), pages 1–8.

Nguyen, P. H., Kling, W. L., and Ribeiro, P. F. (2013). A

game theory strategy to integrate distributed agent-

based functions in smart grids. IEEE Transactions on

Smart Grid, 4(1):568–576.

Roche, R. (2012). Algorithmes et architectures multi-

agents pour la gestion de l’

´

energie dans les r

´

eseaux

´

electriques intelligents. Application aux centrales

`

a

turbines

`

a gaz et

`

a l’effacement diffus r

´

esidentiel.

PhD thesis, Universit

´

e de Technologie de Belfort-

Montb

´

eliard, Institut de Recherche sur les Trans-

ports, l’Energie et la Soci

´

et

´

e / Laboratoire Syst

`

emes

et Transports.

Saad, W., Han, Z., Poor, H. V., and Bas¸ar, T. (2012). Game-

theoretic methods for the smart grid: An overview

of microgrid systems, demand-side management, and

smart grid communications. Signal Processing Mag-

azine, IEEE, 29(5):86–105.

SMARTGREENS 2016 - 5th International Conference on Smart Cities and Green ICT Systems

356