Promoting Cooperation and Fairness in Self-interested

Multi-Agent Systems

Ted Scully

1

and Michael G. Madden

2

1

Cork Institute of Technology, Cork, Ireland

2

National University of Ireland, Galway, Ireland

Keywords:

Cooperation, Multi-Agent System, Coalitions, Negotiation, Protocol.

Abstract:

The issue of collaboration amongst agents in a multi-agent system (MAS) represents a challenging research

problem. In this paper we focus on a form of cooperation known as coalition formation. The problem we con-

sider is how to facilitate the formation of a coalition in a competitive marketplace, where self-interested agents

must cooperate by forming a coalition in order to complete a task. Agents must reach a consensus on both the

monetary amount to charge for completion of a task as well as the distribution of the required workload. The

problem is further complicated because different subtasks have various degrees of difficulty and each agent is

uncertain of the payment another agent requires for performing specific subtasks. These complexities, cou-

pled with the self-interested nature of agents, can inhibit or even prevent the formation of coalitions in such a

real-world setting. As a solution, an auction-based protocol called ACCORD is proposed. ACCORD manages

real-world complexities by promoting the adoption of cooperative behaviour amongst agents. Through exten-

sive empirical analysis we analyse the ACCORD protocol and demonstrate that cooperative and fair behaviour

is dominant and any agents deviating from this behaviour perform less well over time.

1 INTRODUCTION

Coalition formation is one of the fundamental re-

search problems in multi-agent systems (Wooldridge,

2011). Coalition formation represents an important

means of MAS cooperation, which has associated

benefits such as enabling agents to take advantage of

their complementary capabilities, resources and ex-

pertise.

Multi-agent coalition formation represents a fun-

damental means of MAS cooperation. We consider

the problem of coalition formation in a dynamic real-

world context. The real-world problem domain that

we address consists of a marketplace populated by

self-interested agents, where each agent represents an

individual firm. In this marketplace, a task consisting

of multiple subtasks is proposed to all agents. We as-

sume that no agent is capable of individually perform-

ing an entire task. Therefore, in order to successfully

perform a task, agents must cooperate by forming a

coalition.

Successfully forming a coalition in such an envi-

ronment represents a significant research challenge.

Firstly, an agent must determine the optimal set of

agents with whom to enter into a coalition. Secondly,

if a coalition of agents is to successfully form, its

member agents must reach a consensus on the amount

to charge for completion of the task as well as the dis-

tribution of the required workload.

As we have done in previous work (Scully and

Madden, 2014), we incorporate a number of real-

world difficulties into our problem domain, to ensure

its practical applicability. We assume that agents do

not possess perfect information about one another;

rather, each agent is unsure of the value (monetary

or otherwise) that other agents place on specific sub-

tasks. An emergent difficulty is that agents may ar-

tificially inflate the financial reward they require for

performing a subtask within a coalition.

We incorporate an additional real-world complex-

ity into our problem domain with the assumption that

subtasks may have various levels of difficulty. It is re-

alistic to expect that agents performing the more diffi-

cult subtasks will expect to receive a higher financial

reward. This may lead to an increased level of com-

petition for the more difficult subtasks, which in turn

could lead to a scenario where agents are unable to

reach agreement on the distribution of tasks within a

coalition. We refer to the occurrence of such a sce-

nario as deadlock.

172

Scully, T. and Madden, M.

Promoting Cooperation and Fairness in Self-interested Multi-Agent Systems.

DOI: 10.5220/0005754001720180

In Proceedings of the 8th International Conference on Agents and Artificial Intelligence (ICAART 2016) - Volume 2, pages 172-180

ISBN: 978-989-758-172-4

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

We propose that the occurrence of deadlock and

the artificial inflation of financial rewards can be

avoided if the agents involved were to act in a fair and

cooperative manner. In the context of this work, an

agent exhibits fair behaviour if it honestly calculates

the financial reward for all member agents of a coali-

tion (including itself) on the basis of its personal be-

liefs. An agent is cooperative if it agrees to participate

in any coalition proposal irrespective of the subtask

it is asked to perform, assuming the financial reward

it receives for performing that subtask is adequate.

Cooperation allows us to avoid deadlock as an agent

will participate in a coalition, even though it may not

be optimal from that agent’s perspective. While the

adoption of cooperative and fair behaviour would al-

low agents to successfully form coalitions, the diffi-

culty remains that such agents are self-interested and

have to be motivated to adopt these behaviours.

We progress our previous research (Scully and

Madden, 2014) by considering two variations of the

ACCORD protocol:

1. Public ACCORD, in which each agent is required

to reveal to all others how much it would charge

for each subtask; this is analogous to an open cry

auction

2. Private ACCORD, in which agents do not have to

reveal monetary information; this is analogous to

a sealed bid auction.

2 ACCORD

In this section, we describe the ACCORD(An Auction

Integrated Coalition Formation Protocol For Dynamic

Multi-Agent Environments) protocol, which will en-

able agents to form coalitions while simultaneously

governing agent behaviour by promoting the adoption

of cooperative and fair behaviour. We consider two

variants, Public ACCORD and Private ACCORD.

2.1 Motivation for Two Versions of

ACCORD Protocol

At a fundamental level, the ACCORD protocols are

a type of auction, which are extended specifically for

the purpose of facilitating coalition formation. Before

presenting the ACCORD protocols in detail we con-

sider the issue of information privacy. Should agents

be allowed to retain as much private subtask infor-

mation as possible or should they be required to di-

vulge some of this information to the other agents in

the environment? It is interesting to note that an auc-

tion protocol can be categorised on the basis of its ap-

proach to the issue of information privacy. An auction

can be classified as either an open-cry auction, where

participants divulge private information to the public,

or a sealed-bid auction, where information remains

relatively private and is only shared with the auction-

eer. Consequently, from the perspective of providing

a coalition formation protocol, we propose that both

approaches (public and private) constitute valid solu-

tions depending on the prevailing view of information

privacy. Therefore, we provide two versions of AC-

CORD. One version requires the public revelation of

private monetary information while the other allows

each agent to retain a significant amount of their pri-

vate information.

The first approach, which we refer to as Public

ACCORD, requires each agent to reveal the mone-

tary amount it would charge for completion of each

subtask that it is interested in performing (see Section

2.3).

While in certain environmentsagents may be will-

ing to reveal private information, it is also reasonable

to assume that in some scenarios agents would pre-

fer not to divulge a full price list to competing agents.

Therefore, our second approach requires an interested

agent to propose a monetary amount to another agent

on the basis of its own private information. We refer

to this protocol as Private ACCORD, which is pre-

sented in more detail in Section 2.4.

2.2 Problem Description

The ACCORD environment contains a set of self-

interested service agents A = {a

1

, a

2

, . . . , a

m

} and an

auctioneer agent. The set S = {s

1

, s

2

, . . . , s

h

} consists

of all valid subtasks that can be performed in this mar-

ket. Any agent a

i

∈ A is capable of performing a cer-

tain set of subtasks S

a

i

, such that S

a

i

⊆ S. In addition,

a

i

maintains a set of private valuations for all possi-

ble subtasks. The function mn() denotes the monetary

valuation that a

i

places on any subtask. For example,

a

i

’s private valuation of subtask s

g

is mn(i, s

g

).

In order to perform a task, a

i

must cooperate with

one or more agents in the form of a coalition. A coali-

tion is represented by the tuple hC, salloc, palloci.

The members of the proposed coalition are contained

in the set C, such that C ⊆ A. In order for a coali-

tion to form successfully, the agents in C must reach

an agreement on the distribution of subtasks and fi-

nances within the coalition. The subtask distribution

is specified by the allocation function salloc(). For

any agent a

i

∈ C, salloc(a

i

) returns the subtask(s)

within the coalition that a

i

is to perform. The finan-

cial distribution is specified by the allocation func-

tion palloc(). Therefore, the monetary amount that a

i

Promoting Cooperation and Fairness in Self-interested Multi-Agent Systems

173

would receive for performing its specified subtask(s)

within the coalition is palloc(a

i

).

2.3 Protocol Description of Public

ACCORD

Public ACCORD can be subdivided into the following

eight stages:

1. Task Submission. A customer submits a task T

consisting of multiple subtasks to the auctioneer,

such that T ⊆ S. Subsequently, the auctioneer will

send notification of T to each agent a

i

.

2. Bidder Participation. Each agent a

i

will inform

the auctioneer of whether or not it is willing to

participate in the protocol. It is logical that a

i

will

participate iff:

∃ s

x

: s

x

∈ S

a

i

∧ s

x

∈ T

In order for a

i

to indicate its willingness to par-

ticipate in the protocol it must submit its offers

to the auctioneer. The subtask and monetary of-

fers from a

i

in relation to T are denoted by the

set B

T

a

i

= {S

T

a

i

, P

T

a

i

}. The set S

T

a

i

= {s

′

1

, s

′

2

, . . . , s

′

q

}

contains the subtasks in T that a

i

is capable of per-

forming.

The set P

T

a

i

contains a

i

’s private monetary valua-

tion for each subtask specified in S

T

a

i

. Therefore,

P

T

a

i

= {mn(i, s

′

1

), . . . mn(i, s

′

q

)}.

3. Auction Commencement. The auctioneer main-

tains a record, B

T

, of the subtask and monetary

capabilities of all agents willing to participate in

the protocol. When the auctioneer receives a re-

ply, B

T

a

i

, from a

i

it adds it to the record B

T

.

Once all replies have been collected the auction-

eer will commence a first-price sealed bid auction

for T. Subsequently, the auctioneer sends notifi-

cation of the auction deadline coupled with B

T

to

each agent a

i

that is willing to participate in the

protocol.

4. Coalition Proposal. Agents participating in the

protocol will propose coalitions to each other in

a peer-to-peer manner. Therefore, an a

i

will ini-

tially perform coalition calculation in order to

determine the optimal coalition proposal CP

a

i

=

hC, salloc, palloci. In order to construct such

a coalition proposal, a

i

must consider both the

monetary demands and subtask capabilities of all

agents. Fortunately, on receipt of B

T

, a

i

is aware

of the subtasks in T that all other agents can per-

form as well as the monetary amount each agent

will charge for completion of these subtasks.

We also assume that a

i

maintains a private estima-

tion of the level of cooperation exhibited by other

agents. It is reasonable to expect that a

i

will incor-

porate these cooperation ratings into its coalition

calculation process. For example, it would be less

likely to include an agent that constantly refuses

all coalition proposals compared to an agent that

regularly demonstrates a high willingness to ac-

cept proposals.

Once a

i

has determined the optimal member

agents C = {a

′

1

, a

′

2

, . . . , a

′

n

} it can construct and

send CP

a

i

to each member agent in C.

5. Proposal Response. An agent a

v

will assess any

coalition proposal CP

a

i

that it receives. It will is-

sue either an accept or reject notice to the propos-

ing agent. ACCORD does not control the means

by which a

v

evaluates a coalition proposal. How-

ever, it is reasonable to assume that a

v

will con-

sider both the subtask(s) and the monetary award

it is offered in CP

a

i

. It is also reasonable to expect

that a

v

will assess the value of participating in a

coalition with the other member agents in C.

6. Coalition Proposal Result. After sending a pro-

posal a

i

must await the replies from the potential

member agents of the coalition. The two possible

outcomes of this stage are:

• The failure to form the proposed coalition CP

a

i

.

If a

i

receives one or more rejections from the

member agents in C the coalition cannot be

formed. It must subsequently inform all agents

inC of the unsuccessful completion of coalition

formation. If adequate time remains before the

auction deadline expires a

i

can recommencethe

coalition proposalstage and attempt to form an-

other coalition.

• The successful formation of the proposed coali-

tion CP

a

i

. If a

i

receives an acceptance from

each of the potential member agents then the

coalition formation process has been success-

ful. It subsequently notifies each member agent

that the proposed coalition has been success-

fully formed.

7. Bid Submission. If a

i

successfully forms the pro-

posed coalition CP

a

i

it will subsequently enter the

coalition as a bid in the auction. Each agent is lim-

ited to submitting a single bid. Therefore, after a

i

has submitted a bid, it can only participate in the

proposal response stage. That is, it can only ac-

cept or reject coalitions proposed by other agents.

Once the auctioneer receivesCP

a

i

, it calculates the

total monetary reward required by the coalition to

perform T as

∑

n

d=1

palloc(a

′

d

). Subsequently, the

ICAART 2016 - 8th International Conference on Agents and Artificial Intelligence

174

auctioneer records this as a sealed-price bid in the

auction.

8. Winner Notification. Once the auction deadline

expires, the auctioneer calculates the lowest mon-

etary bid. The member agents of the correspond-

ing coalition are notified that they have been suc-

cessful in obtaining the contract to collectively

perform T.

2.4 Protocol Description of Private

ACCORD

Private ACCORD facilitates agent-based coalition

formation while also placing emphasis on the reten-

tion of private information. Private ACCORD can be

subdivided into the same eight stages used to illus-

trate Public ACCORD. However, only two of these

stages differ from the formal description of Public

ACCORD. We confine our description of Private AC-

CORD to these two stages.

(2) Bidder Participation. In order for an agent a

i

to

indicate its willingness to participate in the Pri-

vate ACCORD protocol it must submit a list of its

subtask capabilities to the auctioneer. The agent

does not provide it’s private monetary valuation

to the auctioneer.

The subtask capabilities of a

i

for T are denoted by

B

T

a

i

= {S

T

a

i

}. As before, the set

S

T

a

i

= {s

′

1

, s

′

2

, . . . , s

′

q

}

denotes the subtasks that a

i

can perform.

(4) Coalition Proposal. Agents participating in the

protocol will propose coalitions to each other

in a peer-to-peer manner. Each agent a

i

, must

first perform coalition calculation in order to de-

termine its optimal coalition proposal CP

a

i

=

hC, salloc, palloci.

In order to construct such a coalition proposal, a

i

will need to consider both the monetary demands

and subtask capabilities of other agents. On re-

ceipt of B

T

, a

i

is aware of the subtasks in T that

all other agents can perform. However, because

perfect information is not available, a

i

is uncertain

of the monetary amount each agent will require as

payment for performing a given subtask.

Each agent a

i

must maintain a matrix of expected

payments for each subtask for each agent. Ini-

tially a

i

may base the monetary price of a sub-task

to other agents as equal to its own cost for per-

forming that sub-task. However, we also assume

that a

i

has basic learning abilities that allow it to

improve the accuracy of its estimations through

repeated interaction with other agents.

It is also reasonable to assume that a

i

will main-

tain a private estimation of the level of cooper-

ation exhibited by other agents. Therefore, the

cooperation rating of all participating agents is

also considered when performing coalition calcu-

lation.

Once a

i

has determined the optimal member

agents C = {a

′

1

, a

′

2

, . . . , a

′

n

} it can construct and

send CP

a

i

to each member agent in C.

2.5 Motivating Cooperation and

Fairness in the ACCORD Protocols

Cooperation is not an intrinsic attribute of a self-

interested agent. Therefore, for successful coalition

formation to occur, it is necessary to motivate a self-

interested agent to cooperate. The proposed coalition

formation protocols impose the restriction that each

agent can only submit a single bid to the auction for

a task. However, throughout the duration of the auc-

tion, an agent may receive numerous coalition pro-

posals, originating from other agents, for the same

task. Upon receipt of such a proposal an agent has

the opportunity to participate in another coalition by

issuing an acceptance. If the coalition is successfully

formed, the agent increases the probability that it will

be a member of the winning coalition. Therefore, we

hypothesise that a higher probability of success pro-

vides the agents participating in the ACCORD proto-

cols with the motivation to cooperate.

Self-interested agents attempt to maximise their

own profit. Therefore, ACCORD must ensure that

agents are fair and will not artificially inflate their own

financial rewards. Agents are provided with two dis-

incentives against acting selfishly. Firstly, by acting

selfishly, an agent reduces its probability of winning

the auction, since the more an agent inflates its finan-

cial reward the less probable it is that its bid will win

the auction. Secondly, by acting selfishly, an agent

reduces its appeal to others as a potential coalition

partner. When performing coalition calculation it is

logical to assume that an agent will attempt to min-

imise the total price charged by the coalition. There-

fore, selfish agents with inflated monetary require-

ments are less probable to be chosen as coalition part-

ners. Therefore, we hypothesise that a lower proba-

bility of success provides agents participating in the

ACCORD protocols with a disincentive against acting

selfishly.

Promoting Cooperation and Fairness in Self-interested Multi-Agent Systems

175

3 EMPIRICAL EVALUATION

The objective of this empirical evaluation is to un-

dertake a comparative analysis between Public and

Private ACCORD. We have developed a simulation

testbed to evaluate the protocols. Each experiment

measures the performance of agents adopting differ-

ent behaviours in the ACCORD simulation environ-

ment. Section 3.2 presents a brief summary of the

results of Public ACCORD. A more comprehensive

analysis of the Public ACCORD results can be found

in (Scully and Madden, 2014). Section 3.3 and 3.4

assess the impact of adopting uncooperative and self-

ish behaviour in Private ACCORD and contrast this

with the results observed from the Public ACCORD

protocol.

3.1 Experimental Methodology

Each experiment is run on 10 randomly generated

datasets. A dataset is comprised of 50 tasks, which are

auctioned in sequential order. Each task consists of 8

subtasks, chosen randomly from a set of 20 possible

subtasks. The duration of each auction is 4 minutes.

If two bids of equal value are submitted, a winner is

chosen randomly.

We referred to deadlock a situation where a subset

of agents, attempting to form a coalition, are unable

to reach agreement due to a high level of competition

for performing specific subtasks. There may be one or

more subtasks that multiple agents are capable of per-

forming and they are unable to find a resolution. We

simulate such an environment by ensuring that each

agent is capable of performing a large number of the

possible subtasks. For each new dataset a population

of 20 service agents is generated. Each agent is capa-

ble of performing 8 subtasks. By allowing each agent

to perform 8 out of the possible 20 subtasks, a high

level of competition and consequently deadlock regu-

larly occurs in our simulation environment.

The monetary amount each agent will charge for

subtask completion must also be generated. For each

subtask s

z

∈ S (where S is the set of all possible

subtasks), we have randomly selected a mean cost,

V

s

z

, with a uniform distribution between 10 and 99.

To simulate uncertainty of information, each agent

chooses the monetary amount it will charge for com-

pletion of s

z

by using a Normal distribution with a

standard deviation of 2 and a mean equal to V

s

z

.

For each of the 10 datasets generated, the perfor-

mance of 4 differing behaviour types (described later)

is contrasted. Within the simulated marketplace of 20

agents, each agent will exhibit 1 of the 4 behaviours

(5 agents for each behaviour). The subtask capabil-

ities are also represented equally amongst agents ex-

hibiting differing behaviours. This allows us to com-

pare the performance of different behaviour types in

an unbiased manner.

The result of a single experiment is arrived at

by combining the results obtained from 10 randomly

generated datasets. After each task in a dataset is auc-

tioned, the accummulated financial reward obtained

by each agent type is recorded. Therefore, the results

of a single experiment are derived by summing the

accumulated financial reward received by each agent

type across the 10 datasets.

We characterise each agent with a function accept-

ing two parameters, λ(α, β). The level of coopera-

tion exhibited by an agent is denoted by α, such that

0 ≤ α ≤ 1, α ∈ R. The level of selfishness displayed

by an agent is defined by β, such that 0 ≤ β ≤ 4, β ∈ Z.

A fair coalition proposal offers an agent an ade-

quate financial reward for performing a specific sub-

task. An adequate financial reward is greater than or

equal to the true reward the agent would expect to

receive for performing the subtask. If an agent re-

ceives a fair coalition proposal, it must subsequently

decide whether it will cooperate and join the proposed

coalition. It bases this decision on its value of α.

The parameter α represents the minimum fraction of

the most financially rewarding subtask that an agent

is willing to accept. For example, consider the task

Tr(A, D), which consists of the sub-tasks Sr(A, B),

Sr(B,C) and Sr(C, D). Assume that agent t

1

with an

α value of 0.5 expects a monetary reward of 15 units

for performing Sr(A, B) and 40 units for performing

Sr(C, D). Therefore, its α value dictates that it will

not accept a coaliton proposal that offers less than 20

(0.5 ∗ 40). Higher values of α imply lower coopera-

tion. If t

1

in our above example had an α value of

0.8 then it would only accept a coalition proposal that

offered it greater than or equal to 32 (0.8∗ 40).

An agent can exhibit selfish behaviour by artifi-

cially inflating its own financial rewards. The value

of β signifies the amount by which an agent increases

its financial reward. For example, assume the agent

t

1

with β = 0 expects a financial reward of 40 units

for performing Sr(C, D). If the configuration of t

1

is

changed so that it has β = 1 it would now expect a

financial reward of 41 units for performing Sr(C, D).

Agents with β = 0 exhibit fair behaviour because they

do not artificially inflate their own financial rewards.

3.2 Fair and Cooperative Behaviour in

Public ACCORD

We initially present the effect of different levels of

selfishness (β) in Public ACCORD. We perform 4

ICAART 2016 - 8th International Conference on Agents and Artificial Intelligence

176

0

20

40

60

80

100

120

5 10 15 20 25 30 35 40 45 50

Normalised Financial Reward (%)

Number of Tasks

Coop Fair λ(0, 0)

Coop Selfish λ(0, 1)

Coop Selfish λ(0, 2)

Coop Selfish λ(0, 3)

Coop Selfish λ(0, 4)

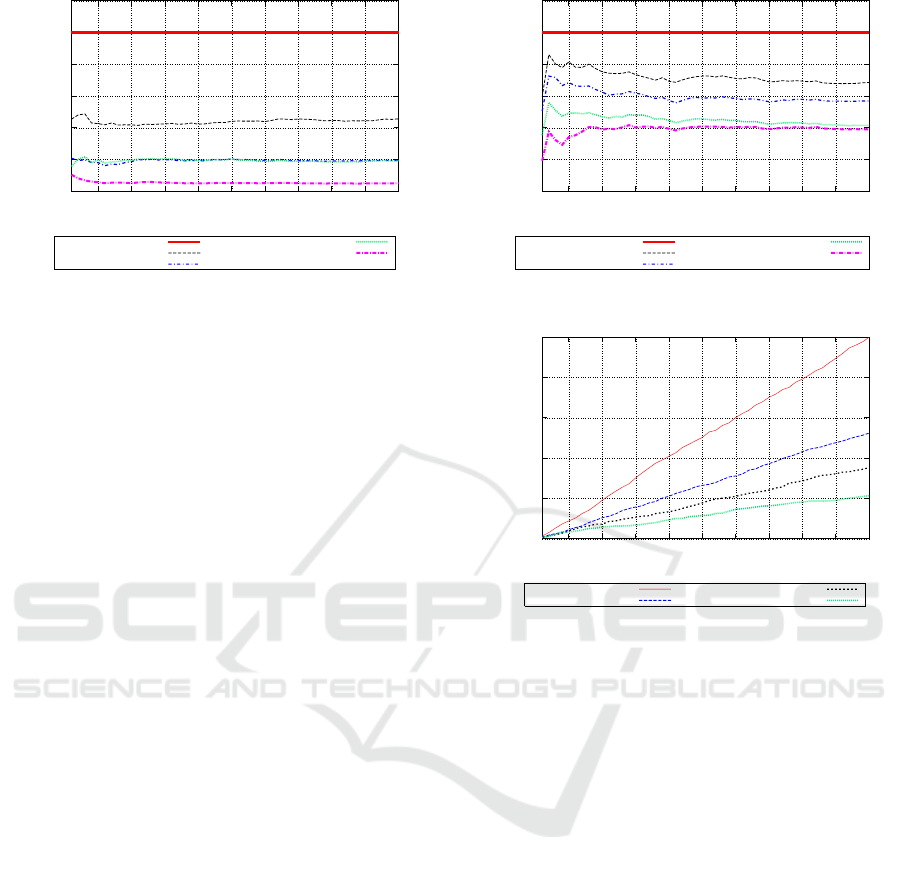

Figure 1: Overview of Fair (β = 0) and Selfish (β > 0) Be-

haviour for Public ACCORD.

experiments that contrast the performance of fair

(β = 0) and selfish (β > 0) agents. In Experiment 1

we contrast the performance of selfish agents where

β = 1 with fair agents (β = 0). The 4 agent types

that populate the marketplace are Cooperative Fair

(λ(0, 0)), Cooperative Selfish (λ(0, 1)), Uncoopera-

tive Fair (λ(1, 0)) and UncooperativeSelfish (λ(1, 1)).

The details for Experiments 2 — 4 are the same,

except that selfish agents use β = 2 in Experiment 2,

β = 3 in Experiment 3 and β = 4 in Experiment 4.

An overview of the results obtained by coopera-

tive agents in the Experiments 1 — 4 are presented

in Figure 1. The performance of the Cooperative

Fair λ(0, 0) agent type over Experiments 1 — 4 is

normalised as 100%. Figure 1 measures the perfor-

mance of the Cooperative Selfish agent types (λ(0, 1),

λ(0, 2), λ(0, 3), λ(0, 4)) in the Experiments 1-4 as a

percentage of the performance of the CooperativeFair

agent type. The Cooperative Fair λ(0, 0) agent type

exhibits the best performance. It is evident that an in-

crease in the value of β corresponds to a decrease in

performance.

To investigate the effect of different levels of co-

operation (α), Experiments 5 — 8 are performed.

The objective of these experiments is to contrast the

performance of cooperative (α = 0) and uncoopera-

tive (0 < α ≤ 1) agents. In Experiment 5, we ex-

amine the performance of uncooperative agents that

use α = 0.25 with cooperative agents (α = 0). The

4 agent types that populate the marketplace for Ex-

periment 5 are Cooperative Fair λ(0, 0), Cooperative

Selfish λ(0, 2), Uncooperative Fair λ(0.25, 0) and Un-

cooperative Selfish λ(0.25, 2). The details for Exper-

iments 6 — 8 are the same, except that uncooperative

agents use α = 0.5 in Experiment 6, α = 0.75 in Ex-

periment 7 and α = 1 in Experiment 8.

Figure 2 contains an overview of the results ob-

tained by fair agents in the Experiments 5 — 8. As

a fair agent reduces its value of α it experiences a

0

20

40

60

80

100

120

5 10 15 20 25 30 35 40 45 50

Normalised Financial Reward (%)

Number of Tasks

Coop Fair λ(0, 0)

Uncoop Fair λ(0.25, 0)

Uncoop Fair λ(0.50, 0)

Uncoop Fair λ(0.75, 0)

Uncoop Fair λ(1, 0)

Figure 2: Overview of Cooperative (α = 0) and Uncooper-

ative (0 < α ≤ 1) Behaviour for Public ACCORD.

0

20

40

60

80

100

5 10 15 20 25 30 35 40 45 50

Cumulative Financial Reward (%)

Number of Tasks

Coop Fair λ(0, 0)

Coop Selfish λ(0, 1)

Uncoop Fair λ(1, 0)

Uncoop Selfish λ(1, 1)

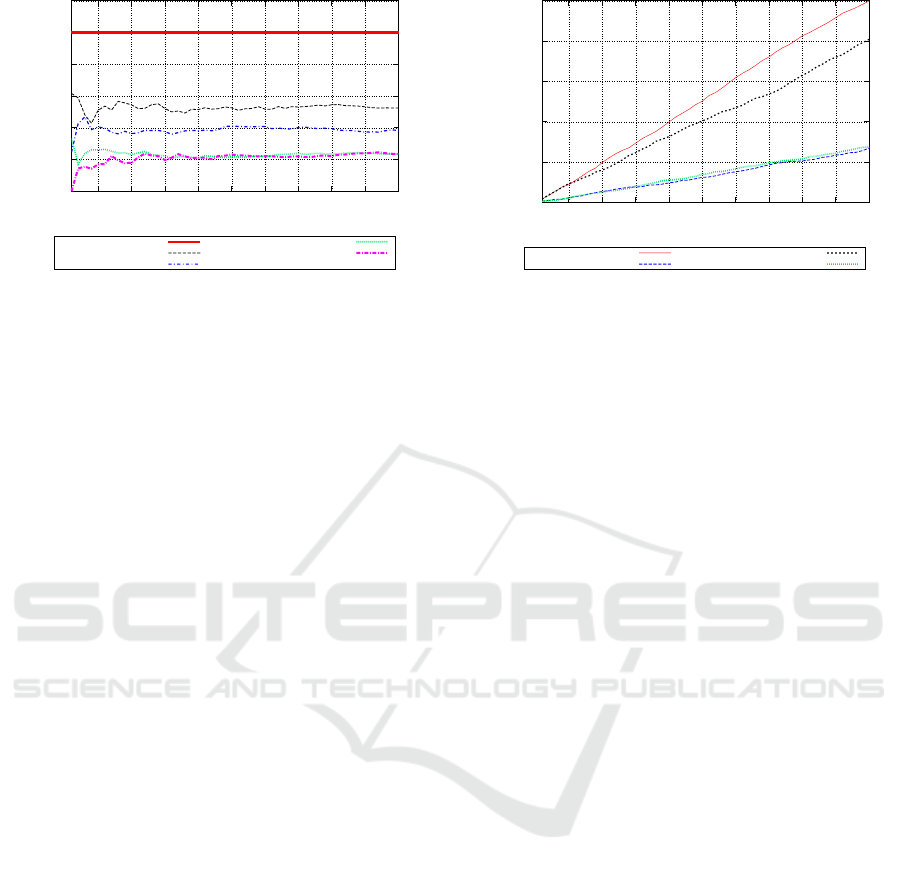

Figure 3: Comparing Performance of Fair (β = 0) and Self-

ish (β = 1) Behaviour for Private ACCORD.

corresponding degradation in performance. This re-

sult demonstrates the dominance‘of cooperative be-

haviour (α = 0) in Public ACCORD.

3.3 Fair/Selfish Behaviour in Private

ACCORD

The experiments undertaken in this section investi-

gate the effect of different levels of selfish behaviour

(β) amongst agents participating in Private ACCORD.

Experiments 9 — 12 are executed in the Private AC-

CORD environment. As in Section 3.2 these exper-

iments contrast the performance of fair (β = 0) and

selfish (β > 0) agents. The agent population setup for

Experiments 9 — 12 is the same as the setup used for

Experiments 1 — 4 respectively. For example, selfish

agents use β = 1 in Experiment 9, β = 2 in Experi-

ment 10, β = 3 in Experiment 11 and β = 4 in Exper-

iment 12.

The results obtained from Experiment 9 are de-

picted in Figure 3. The Cooperative Fair (λ(0, 0))

agent type significantly outperforms all other agent

types. The cooperative fair agents outperforms all

other agent types in the Experiments 10-12. These ex-

Promoting Cooperation and Fairness in Self-interested Multi-Agent Systems

177

0

20

40

60

80

100

120

5 10 15 20 25 30 35 40 45 50

Normalised Financial Reward (%)

Number of Tasks

Coop Fair λ(0, 0)

Coop Selfish λ(0, 1)

Coop Selfish λ(0, 2)

Coop Selfish λ(0, 3)

Coop Selfish λ(0, 4)

Figure 4: Overview of Fair (β = 0) and Selfish (1 ≤ β ≤ 4)

Behaviour for Private ACCORD.

periments also show a reduction in the performanceof

the selfish agent types as the value of β is increased.

Figure 4 presents an overview of the results ob-

tained by cooperative agents in Experiments 9 — 12.

The results confirm that the performance of an agent

type decreases as it increases its value of β. It is also

interesting to compare the overview of selfish varia-

tion in Private ACCORD (Figure 4 ) with that of self-

ish variation in Public ACCORD (Figure 1). The self-

ish agent types in Private ACCORD outperform their

equivalent agents in Public ACCORD, confirming that

selfish behaviour is more severely punished in Public

ACCORD than in Private ACCORD. It can also be ob-

served that the initial period of instability experienced

by agents in Figure 1 is also present in Figure 4. How-

ever, not only is the duration of the instability experi-

enced in Figure 4 longer than that experienced in Fig-

ure 1 but the degree of variance present is also more

severe. This period of instability is attributed to the

learning process that each agent must undergo. That

is, each agent must learn about the other agents with

whom they share the market-place. However, in Pub-

lic ACCORD each agent is already aware of the price

other agents require for performing specific subtasks.

Therefore, an agent need only learn about the level

of cooperation exhibited by other agents. However,

agents participating in Private ACCORD are unaware

of the financial demands of other agents and conse-

quently face a more complicated and time consuming

learning task. This is reflected in the increased insta-

bility present in Figure 4.

3.4 Cooperative/Uncooperative

Behaviour in Private ACCORD

In order to assess the impact of varying levels of un-

cooperative behaviour in Private ACCORD, 4 experi-

ments (numbered 13 — 16) are performed. The agent

population setup for these experiments is the same

0

20

40

60

80

100

5 10 15 20 25 30 35 40 45 50

Cumulative Financial Reward (%)

Number of Tasks

Coop Fair λ(0, 0)

Coop Selfish λ(0, 2)

Uncoop Fair λ(0.25, 0)

Uncoop Selfish λ(0.25, 2)

Figure 5: Comparing Performance of Cooperative (α = 0)

and Uncooperative (α = 0.25) Behaviour for Private AC-

CORD.

as for Experiments 5 — 8. The only difference is

that Experiments 13 — 16 are run on the Private AC-

CORD simulation environment instead of the Public

ACCORD environment. Uncooperative agents use,

α = 0.25 in Experiment 13, α = 0.5 in Experiment

14, α = 0.75 in Experiment 15 and α = 1 in Experi-

ment 16.

The results obtained from Experiment 13 are de-

picted in Figure 5. As with the previous experi-

ments the Cooperative Fair (λ(0, 0)) agent type out-

performs all other agent types. It is interesting to con-

trast the results of this experiment with those obtained

from the equivalent experiment (Experiment 5) per-

formed on the Public ACCORD simulation environ-

ment. The uncooperative agent types (λ(0.25, 0) and

λ(0.25, 2)) perform better when participating in Pri-

vate ACCORD (Experiment 13) than they do in Pub-

lic ACCORD (Experiment 5). This indicates that un-

cooperative behaviour is less advantageous in Public

ACCORD than it is in Private ACCORD.

The results of experiments 14 — 16 reveal that the

cooperative fair agents remain dominant, while also

showing a gradual degradation in the performance of

the the uncooperative agents as they increase their

value of of α.

An overview of the results obtained by fair agents

in the Experiments 13 — 16 are presented in Figure

6. On examination of Figure 6 it is apparent that a sig-

nificant period of instability occurs at the commence-

ment of each of the experiments. The Cooperative

Fair (λ(0, 0)) agent type is outperformedbriefly by the

Uncooperative Fair (λ(0.25, 0)) agent type at the be-

ginning of Experiment 13. The performance of each

agent type stabilises over the duration of the experi-

ment. While the initial instability in Figure 6 is an

undesirable attribute of Private ACCORD, it is still

necessary in order for each agent to learn about the

other agents in the market-place and identify potential

ICAART 2016 - 8th International Conference on Agents and Artificial Intelligence

178

0

20

40

60

80

100

120

5 10 15 20 25 30 35 40 45 50

Normalised Financial Reward (%)

Number of Tasks

Coop Fair λ(0, 0)

Uncoop Fair λ(0.25, 0)

Uncoop Fair λ(0.50, 0)

Uncoop Fair λ(0.75, 0)

Uncoop Fair λ(1, 0)

Figure 6: Overview of Cooperative (α = 0) and Uncooper-

ative (0 < α ≤ 1) Behaviour for Private ACCORD.

partners. Apart from initially being outperformed the

Cooperative Fair (λ(0, 0)) agent type still proves to be

dominant. The instability present in Figure 6 is more

severe than that present in Figure 2, which presents an

overview of uncooperative behaviour in Public AC-

CORD. This is consistent with our previous observa-

tion that Private ACCORD experiences greater initial

instability than Public ACCORD (Section 3.3).

It is also interesting to compare the instability that

occurs in Figure 6 and in Figure 4, which presents an

overview of selfish behaviour in Private ACCORD.

The instability present in Figure 4 is visibly less se-

vere than that encountered in Figure 6. This indicates

that learning to identify uncooperative agents repre-

sents a more difficult task than learning to identify

selfish agents. This is to be expected because of the

inherent inconsistency of uncooperative behaviour.

While a selfish agent behaves selfishly all the time,

uncooperative agents may only exhibit uncooperative

behaviour occasionally (an agent with α = 0.25 may

rarely adopt uncooperative behaviour).

As expected, Figure 6 demonstrates that as an

agent increases its level of uncooperative behaviour

its performance degrades. By comparing the results

of Figure 6 and Figure 2, which assesses the impact

of uncooperative behaviour in Public ACCORD, we

can conclude that agents adopting uncooperative be-

haviour achieve a higher level of performance when

participating in Private ACCORD than they do in

Public ACCORD. This confirms that uncooperative

behaviour is less severely punished in Private AC-

CORD than in Public ACCORD.

4 RELATED RESEARCH

A important research objective in multi-agent systems

is to enable self-interested agents to successfully form

coalitions. A coalition of agents can jointly perform

a complex task, which the individual member agents

would be unable to complete in isolation (Ye et al.,

2013). Coalition formation research in MAS’s can be

broadly classified into either macroscopic or micro-

scopic coalition formation(Vassileva et al., 2002).

The macroscopic approach examines the entire

agent population and research work in this area has

focused on the development of techniques to calcu-

late the optimal coalition structure, which is the di-

vision of all agents in the environment into exhaus-

tive and disjoint coalitions (Sen and Dutta, 2000),

(Bachrach et al., 2013), (Rahwan and Ramchurn,

2009), (Iwasaki et al., 2013), (Dan et al., 2012), (Xu

et al., 2013). This work typically assumes any given

coalition has a fixed determinable value, which is uni-

versally known by all agents (Sandholm and Lesser,

1997). This assumption conflicts with one of the real-

world difficulties we incorporated into our problem

domain, namely, that agents may maintain differing

values for any subtasks, which also means they may

have differing values for any coalition.

In the microscopic approach to coalition forma-

tion each agent will reason about the process of form-

ing a coalition based on its personal information and

its perspective of the system. The work in this area

can be divided into cooperative and self-interested

multi-agent environments. Significant research at-

tention has been focused on the development of dis-

tributed coalition formation protocols for cooperative

agent environments (Toˇsi´c and Ordonez, 2012), (Ye

et al., 2013), (Smirnov and Sheremetov, 2012).

Microscopic coalition formation has also been

studied in the context of hedonic games. In such an

environment self-interested agent achieve a specific

level of satisfaction based on the coalition they join.

A number of distributed protocols have been proposed

to facilitate coalition formation in such environments

(Ghaffarizadeh and Allan, 2013), (Aziz et al., 2011),

(Genin and Aknine, 2011). A solution to a hedonic

game is the exhaustive decomposition of all agents in

an environment into coalitions.

Research has been carried out on the topic of

coalition formation in self-interested buyers markets.

One such example is the development of coalition for-

mation protocols that enable buyers, interested in pur-

chasing the same or similar products, to form coali-

tions (Tsvetovat and Sycara, 2000) (Shehory, 2000).

These protocols facilitate coalition formation, how-

ever the market that they address differs significantly

from that considered in this paper as the agents are

not in direct competition with one another.

Promoting Cooperation and Fairness in Self-interested Multi-Agent Systems

179

5 CONCLUSIONS

This paper has introduced Public and Private AC-

CORD to facilitate the process of coalition forma-

tion in dynamic real-world environments. In order

to evaluate these protocols we developed a simula-

tion testbed that was used to contrast the performance

of agents adopting different behaviours. The results

demonstrate that cooperative and fair behaviour is

dominant in our empiricial environment. This solves

the problem of artificial inflation of financial rewards

and provided a mechanism of forming coalitions that

would not suffer from deadlock.

It was also found that deviant behaviour (uncoop-

erative or selfish behaviour) was more severely pun-

ished in Public ACCORD. It was also observed that an

initial period of instability was experienced in both

Public and Private ACCORD, which corresponds to

the duration of the agent learning process. Because

Public ACCORD requires the revelation of private in-

formation, the initial instability it experienced was not

as severe as that experienced in Private ACCORD.

There is wide range of possible research avenues

for the ACCORD protocols. An undesirable property

of these protocols is the presence of an initial period

of instability. This has been attributed to the learning

process that each agent must undergo. Such instabil-

ity could potentially be exploited by uncooperative or

selfish agents. Sen & Dutta encounter a similar prob-

lem with their method of reciprocative-based cooper-

ation and effectively employed a reputation mecha-

nism as a solution. An interesting area of future work

would be to incorporate a similar reputation mecha-

nism into the ACCORD protocols. It would also be

worthwhile to observe the level of instability that oc-

curs in Public and Private ACCORD for large agent

populations. For example, is it possible that the pe-

riod of instability will increase inline with the size of

the agent population?

REFERENCES

Aziz, H., Brandt, F., and Seedig, H. (2011). Stable partitions

in additively separable hedonic games. Autonomous

Agents and Multiagent Systems, 1:183–190.

Bachrach, Y., Kohli, P., Kolmogorov, V., and Zadimoghad-

dam, M. (2013). Optimal Coalition Structure Genera-

tion in Cooperative Graph Games Finding the Optimal

Coalitional Structure. In Twenty-Seventh AAAI Con-

ference on Artificial Intelligence, pages 81–87.

Dan, W., Cai, Y., Zhou, L., and Wang, J. (2012). A Co-

operative Communication Scheme Based on Coalition

Formation Game in Clustered Wireless Sensor Net-

works. IEEE Transactions on Wireless Communica-

tions,, 11(3):1190 – 1200.

Genin, T. and Aknine, S. (2011). Constraining Self-

Interested Agents to Guarantee Pareto Optimal-

ity in Multiagent Coalition Formation Problem.

IEEE/WIC/ACM International Conferences on Web

Intelligence and Intelligent Agent Technology, pages

369–372.

Ghaffarizadeh, A. and Allan, V. (2013). History Based

Coaliton Formation in Hedonic Conext Using Trust.

International Journal of Artificial Intelligence & Ap-

plications, 4(4):1–8.

Iwasaki, A., Ueda, S., and Yokoo, M. (2013). Finding the

Core for Coalition Structure Utilizing Dual Solution.

IEEE/WIC/ACM International Joint Conferences on

Web Intelligence (WI) and Intelligent Agent Technolo-

gies (IAT), pages 114–121.

Rahwan, T. and Ramchurn, S. (2009). An anytime algo-

rithm for optimal coalition structure generation. Jour-

nal of Artificial Intelligence, 34:521–567.

Sandholm, T. and Lesser, V. (1997). Coalitions Among

Computationally Bounded Agents. Artificial Intelli-

gence: Special Issue on Economic Principles of Multi-

Agent Systems, 94:99–137.

Scully, T. and Madden, M. (2014). Facilitating Multi-

Agent Coalition Formation through Cooperation in

Self-Interested Environments. In Proceedings of Eu-

ropean Conference on Multi-Agent Systems. Springer.

Sen, S. and Dutta, P. (2000). Searching for optimal coalition

structures. Proceedings Fourth International Confer-

ence on MultiAgent Systems, pages 287–292.

Shehory, O. (2000). Coalition Formation for Large-Scale

Electronic Markets. In Proceedings of the Fourth In-

ternational Conference on MultiAgent Systems, pages

167–174. IEEE Computer Society.

Smirnov, A. and Sheremetov, L. (2012). Models of coali-

tion formation among cooperative agents: The current

state and prospects of research. Scientific and Techni-

cal Information Processing, 39(5):283–292.

Toˇsi´c, P. and Ordonez, C. (2012). Distributed protocols

for multi-agent coalition formation: a negotiation per-

spective. Active Media Technology, pages 93–102.

Tsvetovat, M. and Sycara, K. (2000). Customer Coalitions

in the Electronic Marketplace. In Fourth International

Conference on Autonomous Agents, pages 263–274.

Vassileva, J., Breban, S., and Horsch, M. (2002). Agent

Reasoning Mechanism for Long-Term Coalitions

Based on Decision Making and Trust. Computational

Intelligence, 18(4):583–595.

Wooldridge, M. (2011). Computational aspects of cooper-

ative game theory. Agent and Multi-Agent Systems:

Technologies and Applications, 6682.

Xu, B., Zhang, R., and Yu, J. (2013). Improved

Multi-objective Evolutionary Algorithm for Multi-

agent Coalition Formation. Journal of Software,

8(12):2991–2995.

Ye, D., Zhang, M., and Sutanto, D. (2013). Self-Adaptation-

Based Dynamic Coalition Formation in a Distributed

Agent Network: A Mechanism and a Brief Survey.

Parallel and Distributed Systems, 24(5):1042–1051.

ICAART 2016 - 8th International Conference on Agents and Artificial Intelligence

180