TRADING FOREIGN CURRENCY USING ARTIFICIAL NEURAL

NETWORK STRATEGIES

Bruce Vanstone and Gavin Finnie

School of IT, Faculty of Business, Bond University, Gold Coast, Australia

Keywords: Financial trading, Foreign currency, Artificial neural networks.

Abstract: The foreign exchange (FX) markets represent an enormous opportunity for traders. These markets have

huge liquidity, trade 24 hours a day (except weekends), and allow the use of leverage. This paper takes a

simple FX trading strategy and shows how to substantially improve it, using a neural network methodology

originally developed by Vanstone & Finnie for creating and enhancing stockmarket trading systems. This

result demonstrates the important role neural networks have to play within complex and noisy

environments, such as that provided by the intraday FX markets.

1 INTRODUCTION

The FX markets are designed to assist international

trade and investment, by allowing participants to

easily convert one currency into another at an agreed

rate. Although this is the primary purpose of the FX

markets, they also provide an outstanding

opportunity for currency speculators.

The FX markets currently have a daily turnover

of approximately $4 trillion (BIS, 2010). They trade

24 hours a day (except weekends) around the globe,

with focus shifting between different geographical

regions in accordance with the business hours of

those regions.

FX markets are particularly attractive to short-

term speculators due to their high liquidity, their use

of leverage, and their low transaction costs. Further,

there are a number of software products which allow

high-frequency and intraday traders to trade the

markets algorithmically. This allows these traders to

exploit price changes in very small timeframes.

This paper focuses on an existing methodology

for creating and enhancing trading strategies both

with and without soft computing, developed by

Vanstone & Finnie (Vanstone and Finnie, 2009).

Using this methodology, we create a neural network

to enhance a simple FX intraday breakout trading

strategy. The original strategy and the ANN

enhanced version are comprehensively benchmarked

both in and out-of-sample, and the superiority of the

ANN enhanced version is demonstrated.

2 REVIEW OF LITERATURE

Traditional financial models have difficulty

explaining the gap between financial theory and

practice. In theory, exchange rate determination is

based on rational expectations and efficient markets,

with publicly available information being the major

influence on longer term price structures. However,

this view leaves no role for the behavior of traders to

influence market prices.

From a market microstructure point of view,

research has found that trading is an important factor

in the price formation process (Love and Payne,

2009), and a number of trading behaviours such as

‘herd behaviour’ and ‘over(under)-reaction’ have

been documented (see, for example: (Kirman, 1995),

(Carpenter and Wang, 2007), (Serban, 2010)). At

short time horizons, there remains no well accepted

model of exchange rate determination.

According to the Bank for International

Settlements (BIS, 2010), the FX ‘spot’ market size is

approximately $1.5 trillion and has a high turnover

largely due to more active trading. This suggests that

as much as 37.5% of the FX markets are being

actively traded in the shorter term, even though there

is no well accepted model of short term exchange

rate determination.

In practice, most traders rely on Technical

Analysis to make trading decisions. Technical

Analysis provides a framework based on price, price

movements, and price patterns. Research shows that

163

Vanstone B. and Finnie G..

TRADING FOREIGN CURRENCY USING ARTIFICIAL NEURAL NETWORK STRATEGIES.

DOI: 10.5220/0003679601630167

In Proceedings of the International Conference on Neural Computation Theory and Applications (NCTA-2011), pages 163-167

ISBN: 978-989-8425-84-3

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

nearly all traders in the FX markets use technical

analysis, particularly for trading in the shorter

timeframes (Cross, 1998); (Menkhoff and Taylor,

2007).

As the majority of traders in the shorter term FX

markets are employing algorithmic trading models,

and most base their decision frameworks on

Technical Analysis, it is appropriate to select a

strategy which selects trading opportunities solely

based on price movement. For this reason, a simple

price based strategy is used in this paper.

Breakout trading is one simple method short

term traders use to capture profits in the FX market.

Essentially, breakout traders wait for price to break

above some previously defined threshold and they

use this breakout as the signal to enter a trade.

Although many good opportunities are signaled

by breakout rules, a large number of breakouts

quickly fail. The difficulty for traders is to assess

which breakouts are likely to continue, and which

are likely to fail. This is a forecasting function, and

is ideally suited to an Artificial Neural Network

(ANN).

ANNs have long been used within the trading

and investment community to assist with making

decisions in complex, non-linear, and noisy

environments. A comprehensive review of the ways

that ANNs have assisted traders build profitable

trading models is available in Vanstone et al

(Vanstone and Tan, 2003).

3 METHODOLOGY

The most heavily traded currency in FX markets is

the EURUSD pair (Euro dollar, quoted in US

Dollars), which accounts for approximately 28% of

the spot market (BIS, 2010), and data for this pair is

used in the paper. Given the incredible turnover and

importance of this currency pair, it should be one of

the most ‘efficient’ securities in existence.

The software used to conduct the testing of

trading strategies, and the creation of the neural

networks is Wealth-Lab Developer 6 (2011).

For the neural network part of this study, the data

is divided into two partitions: data from 01/01/2000

up to and including 31/12/2005 (in-sample) is used

for training the networks, which are then tested over

the period 01/01/2006 to 30/04/2011 (out-of-

sample).

A primary difficulty with breakout strategies is

determining which breakouts are likely to be

sustained and hence lead to a profitable outcome, as

compared to those which quickly fail and lead to an

unprofitable outcome. This is the specific issue that

the ANNs in this paper are designed to address.

As this paper is focused on high-frequency

currency trading, the system developed is designed

to be run in the 1-hourly timeframe, and aims to hold

trades open for up to 12 hours. For the simple

breakout system, the rule to buy (sell) is price

closing above (below) the high (low) of the last 8

hours.

Creation of ANNs to enhance simple breakout

trading systems involves the selection of ANN

inputs, outputs and various architecture choices.

Each of these areas is discussed in more detail

below.

3.1 Selection of Inputs

As the final trading system is to be run in a high-

frequency format, the primary choice of variables

are those produced directly from price data, namely,

Technical Variables. Among this group, support has

been found for Moving Averages of various lengths

(Preen, 2010); (Dewachter, 2001); (Levich and

Thomas, 1993); (Schulmeister, 2008)), MACD

((Preen, 2010)) and Stochastics (Preen, 2010).

These variables are ideal for use within a neural

network as they are easily calculated, and react

immediately to changes in price. The values of these

variables are sampled every hour.

The three input variables chosen and their

formula are:

1. EMA(Period)

EMA = ( K x ( C - EMA

1

) ) + EMA

1

(1)

where

C = Current Price,

EMA

1

= Previous EMA value,

K = 2 / ( 1 + period )

2. MACD

MACD = EMA(12) – EMA(26) (2)

3. Stochastic(K,N)

Stochastic = SMA(StochK, N) (3)

where

N = the smoothing period,

SMA = Simple Moving Average,

StochK = (C-L(K)) / (H(K)-L(K))*100,

C = closing price,

L(K), H(K) = the lowest low (highest high) in

K periods

NCTA 2011 - International Conference on Neural Computation Theory and Applications

164

The statistical properties of these inputs is shown

in Table 1.

Table 1: Statistical Properties of Input Variables.

Variable Min Max Mean StdDev

EMA 99.70 100.49 100.07 0.09

MACD -0.44 0.58 0.06 0.13

Stochastic 34.96 99.48 79.48 11.19

3.2 Selection of Outputs

The neural networks built in this study were

designed to produce an output signal, whose strength

was proportional to expected returns over the

forward 12-hourly timeframe. In essence, the

stronger the signal from the neural network the

greater the expectation of a successful trading

outcome within the next 12 hours. Signal strength

was normalized between 0 and 100.

The target is initially calculated as the maximum

percentage price change over the next 12 hours,

computed for every element (i) in the input series as:

(Highest(close

(i+12)

…Close

(i)

)-Close

(i)

) * 100 / Close

(i)

(4)

This allows the neural network to focus on the

relationship between the input technical variables,

and the expected forward price change. When the

value of the forward price change is positive, the

neural network target is set to 100, otherwise it is set

to 0.

3.3 Architecture Choices

In accordance with the design methodology of

Vanstone & Finnie (Vanstone and Finnie, 2009), a

number of hidden node architectures need to be

created, and each one is benchmarked against the in-

sample data.

The initial ANN is created and benchmarked

with SQRT(n) hidden nodes, where n is the number

of input variables. The number of hidden nodes is

then increased by one for each new architecture

created, until in-sample testing reveals which

architecture has the most suitable in-sample metrics.

A number of metrics are available for this purpose,

in this paper, the architectures are benchmarked

using the absolute profit per hour method. This

method assumes unlimited capital, takes every trade

signalled, and measures how much average profit is

added by each trade over its lifetime.

4 RESULTS

In the in-sample data, there were 2809 rows selected

for training (one row for each occurrence of the

price closing above the previous 8 hour highs).

Table 2 benchmarks the basic trading characteristics

of these rows. These figures are for trading 5

standard contracts ($100,000 euro), and include

typical transaction costs (2011).

The most important parameter to be chosen for

in-sample testing is the signal threshold, that is, what

level of forecast strength is enough to encourage the

trader to open a position. This is a figure which

needs to be chosen with respect to the individuals

own risk appetite, and trading requirements. A low

threshold will generate many signals, whilst a higher

threshold will generate fewer. Setting the threshold

too high will mean that trades will be signalled only

rarely, too low and the traders’ capital will be

quickly invested, removing the opportunity to take

higher forecast positions as and when they occur. As

the ANN forecast is allowed to range between 0 and

100, a value of 50 is chosen. This choice is strictly

arbitrary, and represents an attempt to match the

quality of the trading signals generated to an

individual’s unique risk appetite. Whilst a more

‘scientific’ method could be used to determine the

optimum threshold, it is unlikely that the one fixed

value threshold would be ‘best’ for different traders.

As traders are individuals working under tightly

managed risk conditions, it seems important to allow

the flexibility to balance the risk within the signal

generating process to the specific risk a trader

wishes to adopt. This is not a decision which can be

taken in isolation from the rest of the trading

activities in which the individual is involved.

Table 2: In-sample benchmarks.

Strategy

Profit per

hour

Win %

Avg. Profit

per Trade

Hours trade

open

Simple

Breakout

$5.87 39.98% $137.83 23.41

ANN – 2

hidden

nodes

$22.39 52.44 % $269.24 12.03

ANN – 3

hidden

nodes

$20.82 53.03 % $189.68 9.11

As described in the empirical methodology, it is

necessary to choose which ANN is the ‘best’, and

this ANN will be taken forward to out-of-sample

testing. It is for this reason that the trader must

choose the in-sample benchmarking metrics with

TRADING FOREIGN CURRENCY USING ARTIFICIAL NEURAL NETWORK STRATEGIES

165

care. If the ANN is properly trained, then it should

continue to exhibit similar qualities out-of-sample to

those which it already displays in-sample.

From the above table, it is clear that ANN – 2

hidden nodes should be selected, as it extracts the

highest amount of profit per hour. Note that this will

not necessarily make it the best ANN for a trading

system. Extracting good profits in a short time

period is only a desirable trait if there are enough

opportunities being presented to ensure the traders

capital is working efficiently.

The testing so far covered in-sample data

previously seen by the ANN, and is a valid

indication of how the ANN can be expected to

perform in the future. In effect, the in-sample

metrics provide a framework of the trading model

this ANN should produce.

Table 3 shows the effect of testing on the out-of-

sample data, and includes the effects of the global

financial crisis. As such, these out-of-sample figures

provide an unusual opportunity to see how this

neural network trading system behaved out-of-

sample under extremely challenging conditions.

Table 3: Out-of-sample benchmarks.

Strategy Profit per hour Win %

Avg. Profit

per Trade

Hours trade

open

Simple

Breakout

$5.33 39.11 % $113.81 21.37

ANN – 2

hidden

nodes

$ 21.77 51.72 % $226.09 10.39

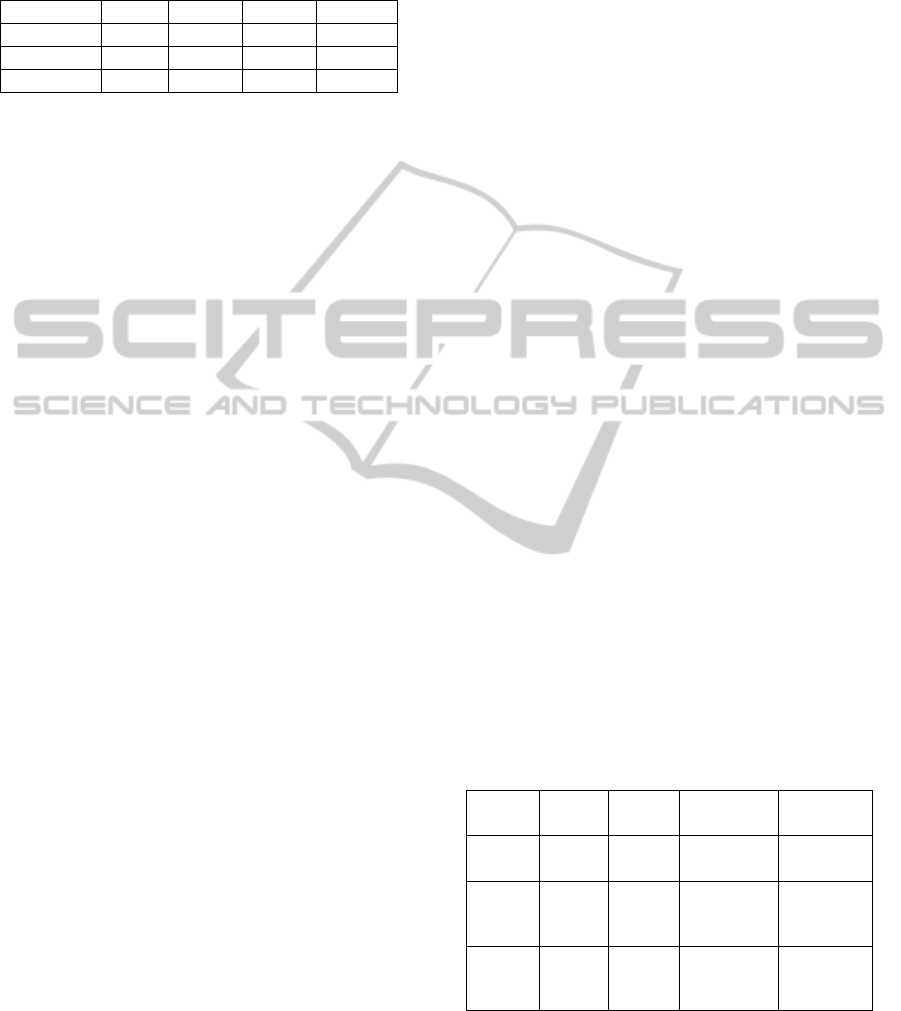

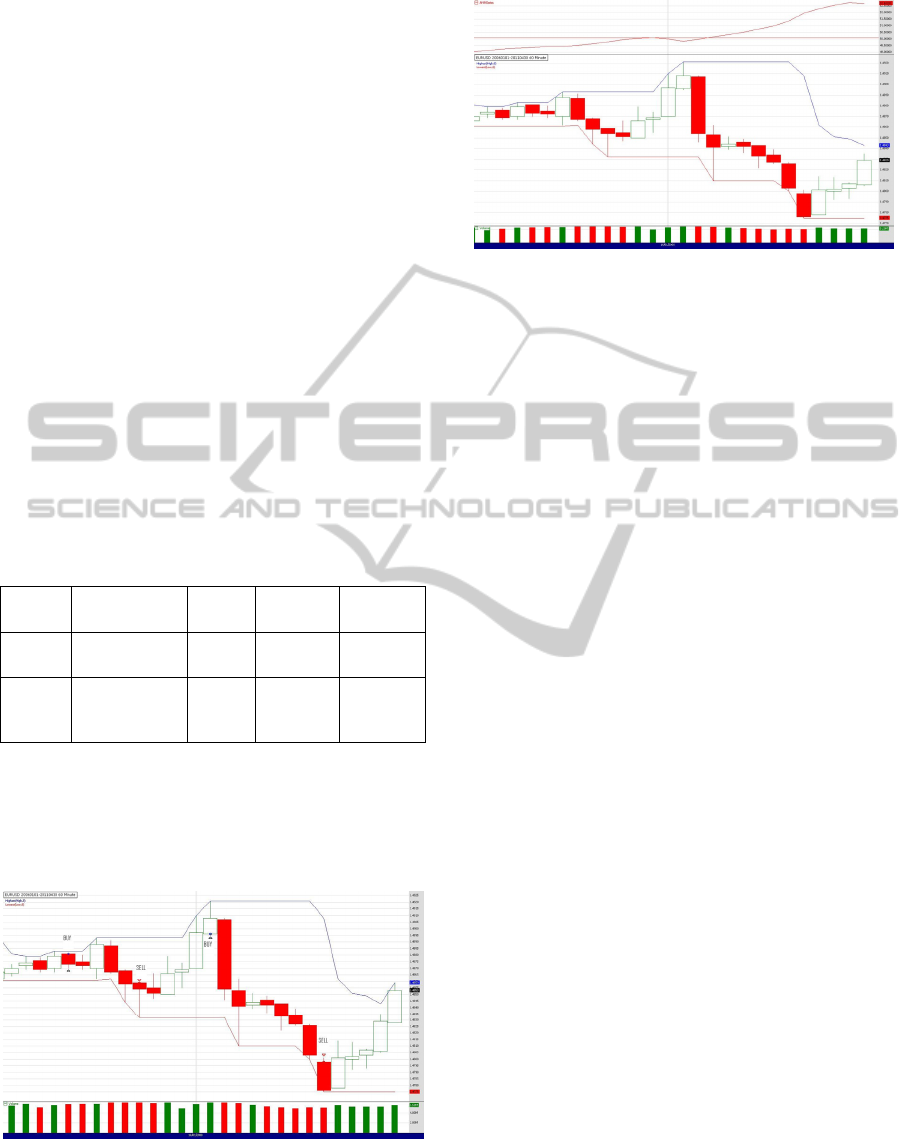

Figures 1 and 2 both show the same trading

timeframe. Figure 1 shows the trades the initial

strategy took, whilst figure 2 shows the ANN

enhanced strategy avoiding these trades due to the

signal threshold being below 50.

Figure 1: Example trades from initial system.

Figure 2: ANN enhanced system avoids these losing

trades.

5 CONCLUSIONS

The ANN based trading system has performed

remarkably robustly, as the out-of-sample

performance is remarkably close to the in-sample

performance, leading to the conclusion that the ANN

is not curve-fit, and should continue to perform well

into the future.

Unfortunately, there are no well accepted models

of exchange rate determination over shorter term

horizons, so it is not feasible to compare the result to

other commonly accepted shorter term trading

models, as there are none. In many ways, this lack of

viable, accepted shorter term models is an indication

of the difficulty of shorter term trading.

6 FUTURE WORK

This paper has demonstrated the process of creating

a neural network to support a high-frequency foreign

currency trading system. As it currently stands, this

trading system only signals when to take long

positions. Trading short is also quite common in the

FX markets, as it allows traders to trade against a

currency when they wish. Future work for this

system is to develop a neural network to support

short side breakout trading.

The choice of the length of the breakout

parameter is fixed (and arbitrary). It is expected that

a parameter that is dynamic would be of further

benefit, and this is also further work for this style of

trading.

Further, the variables used as inputs to the neural

network are by no means comprehensive within the

domain of technical analysis, and a more detailed

review of likely variables of influence needs to be

NCTA 2011 - International Conference on Neural Computation Theory and Applications

166

conducted within the chosen instruments and

timeframes.

Finally, there are a number of other instruments,

particularly other highly liquid currencies and index

futures, which appear to lend themselves to this style

of short-term trading. Further work would be to

extend this work across these other securities.

REFERENCES

(2011). from (Interactive Brokers Commissions)

http://www.interactivebrokers.com/en/p.php?f=commi

ssion.

(2011). "Wealth-Lab." from www.wealth-lab.com.

BIS (2010) "Triennial Central Bank Survey: Foreign

exchange and derivatives market activity in April

2010: Preliminary Results." September 2010, Bank for

International Settlements, Monetary and Economic

Department, 1-21.

Carpenter, A. and J. Wang, (2007). "Herding and the

information content of trades in the Australian dollar

market." Pacific-Basin Finance Journal 15(2): 173-

194.

Cross, S. Y., (1998). All about...The Foreign Exchange

Market in the United States, Federal Reserve Bank of

New York.

Dewachter, H., (2001). "Can Markov switching models

replicate chartists profits in the foreign exchange

market?" Journal of International Money and Finance

20: 25-41.

Kirman, A., (1995) "The behaviour of the foreign

exchange market." Bank of England Quarterly

Bulletin.

Levich, R. M. and L. R. Thomas, (1993). "The merits of

active currency risk management: Evidence from

international bond portfolios." Financial Analysts

Journal 49(5): 63-70.

Love, R. and R. Payne, (2009). "Macroeconomic news,

order flows, and exchange rates." Journal of Financial

and Quantitative Analysis 43(2): 467-488.

Menkhoff, L. and M. P. Taylor, (2007). "The Obstinate

Passion of Foreign Exchange Professionals: Technical

Analysis." Journal of Economic Literature 45(4): 936-

972.

Preen, R., Ed., (2010). Identifying Trade Entry and Exit

Timing Using Mathematical Technical Indicators in

XCS Lecture Notes in Computer Science.

Schulmeister, S. (2008). "Components of the profitability

of technical currency trading." Applied Financial

Economics 11: 917-930.

Serban, A. F., (2010). "Combining mean reversion and

momentum trading strategies in foreign exchange

markets." Journal of Banking and Finance 34(11):

2720-2727.

Vanstone, B. and G. Finnie, (2009). "An Empirical

Methodology for developing Stockmarket Trading

Systems using Artificial Neural Networks." Expert

Systems with Applications 36: 6668-6680.

Vanstone, B. and C. N. W. Tan, (2003). A Survey of the

Application of Soft Computing to Investment and

Financial Trading. 8th Australian & New Zealand

Intelligent Information Systems Conference (ANZIIS

2003), Sydney.

TRADING FOREIGN CURRENCY USING ARTIFICIAL NEURAL NETWORK STRATEGIES

167