THE INFORMATION SYSTEM OF BANK UNDER

THE E-COMMERCE ENVIRONMENT

Lili Zhu

School of Economics and Management, Beijing Jiaotong University

No.3 Shang yuan Vallage, Haidian District, Beijing, China

Keywords: E-commerce, Information System, Bank.

Abstract: This paper based on the analysis of the E-commerce demanding for the banks and the operating

environment, investigates the effects of electronic commerce on the marketing campaigns of banks. The

final result is as follows: to set up electronic commerce systems, communication between information

system of banks and each entity is essentially necessary. Moreover, banks need to improve the inner

requirements for EC and create the better supporting environment to develop E-commerce. In addition, to

establish bank information system under the E-commerce, the key point, however, is to put emphasis on the

set-up between internet network system and open-ended but integrated information system of banks.

1 INTRODUCTION

With the development of information technology

and E-commerce, the traditional framework of

information system is challenged. With the

introduction of E-commerce, banks are facing the

environment transfer from traditional circuit to

present marketing open-ended. Moreover, the

corresponding enterprise information management

framework is also developed from traditional closing

MIS type into related marketing E-commerce type.

To survive and acquire the competitive advantages,

banks have to take information and network

technology as bases, rebuild business process and

redesign information system.

2 REQUIREMENTS OF BANK’S

INFORMATION SYSTEM

FOR E-COMMERCE

E-commerce cannot exist without the information

system, it itself is the application of new information

technologies; which is bound to expand and develop

the information systems. Information system also

fails its adherence to the original framework; it is

obliged to include e-commerce so as to make a new

face based on the original system. Thus, the e-

commerce and information systems are penetrated

and connected, forming the most competitive

integral part of business in the information age. E-

commerce usually refers as commercial activities

that business is promoted via the network and

advanced digital media technologies among the

various entities (production enterprises, commercial

enterprises, financial institutions, government

agencies, individual consumers and so on). To put it

simply, e-commerce is one kind of effective and

efficient commercial activity through the use of

network and information technology. Generally, to

develop e-commerce, banks need to address four

main core issues: information flow, capital flow,

logistics and security. Information flow is the

biggest advantage of e-commerce. It can be quickly

passed through the transport information of network

technology. In compassion, the traditional business

of information communication takes a lot of time

and effort, resulting in high transaction costs. Cash

flow is a challenge to E-commerce; we need online

banking and electronic money settlement to deal

with business. Logistic flow can be divided into two

categories, one is logistics of digital products that

can be done through the network, and the other one

is non-digital that cannot be resolved by information

technology. Security is the bottleneck of e-

commerce development. E-commerce is difficult to

extensively be developed if we cannot solve security

issues. Therefore, bank’s information system

construction must make a smooth flow of real-time

554

Zhu L..

THE INFORMATION SYSTEM OF BANK UNDER THE E-COMMERCE ENVIRONMENT.

DOI: 10.5220/0003610505540558

In Proceedings of the 13th International Conference on Enterprise Information Systems (IAST-2011), pages 554-558

ISBN: 978-989-8425-55-3

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

transmission for business information, capital flow

and logistics. In addition, the safety of specific

business activities is especially necessary.

Specific requirements:

The exchange of information needs to be

achieved rapidly and extensionally among

the within and the outside of the entity, the

internal equipment sector and the different

levels.

The real-time subsystem must be included to

achieve the cash flow of the transmission in

the enterprise information systems.

The ancient security features should be

achieved to ensure the security of e-

commerce activities.

3 OPERATING ENVIROMENT

OF BANKS FOR ELEC TRONIC

COMMERCE

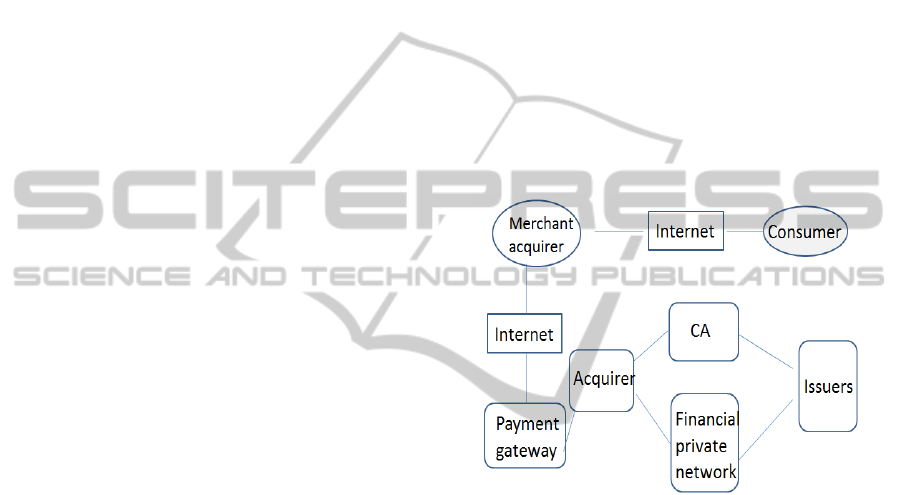

E-commerce relates with customers,cardholders,

banks and various aspects. Special Network is a

necessity among different banks. E-commerce is

done on the Internet. Financial private network

communicates with payment gateways though

network. Therefore, payment gateways of pay

internets take a security work here.

3.1 Process

Courses of dealing:

The consumer (cardholder) issued a purchase

request to the merchants

Merchants sent consumer's payment

instructions to the merchant acquirer.

Acquirer sent the authorization information

back to acquirer through the payment gateway

after getting the authorization from issuers

(consumer’s opening bank) through the

financial private network.

Merchant acquirer sent feedback information

to consumers after getting the authorization. If

payment and authorization didn’t finish at the

same time, the merchant acquirer need to send

a request to the acquirer through the payment

gateway to transfer the amount of the

transaction to the merchant's account.

Banks complete their settlements by the inter-

bank payment system.

3.2 Two Basic Elements

Banks develop e-commerce relies on two basic

elements:

Develop the internal demand of the enterprise

for promoting EC.

Support the external environment of the

development of e-commerce, such as the sound

laws and regulations, system (the legality of

digital signatures, the validity of electronic

documents, the appropriate tax incentives of e-

commerce, etc.), sound norms and standards

(the normative of security payments, etc.), safe

and reliable authentication system, a strong

network environment ( including public and

private networks), and the efficient and secure

payment systems. The network topology

diagram, as shown:

Figure 1: E-commerce’s network topology.

4 E-COMMERCE IMPACT

TO MARKETING ACTIVITIES

OF BANK

With the development of enterprise information and

business activities, an extensive e-commerce

become more and more important in the economic

life, it will become the inevitable choice of

individuals and enterprises, in particular, enterprises

will be the biggest beneficiaries. E-Commerce

provides the opportunity to take part in global

competition, increased marketing opportunities,

reduce trading costs and improve trade efficiency for

banks, e-commerce will have a tremendous and

profound impact on bank’s marketing activities.

THE INFORMATION SYSTEM OF BANK UNDER THE E-COMMERCE ENVIRONMENT

555

4.1 Electronic Commerce’s Impact

on Business

E-commerce thoroughly changed the method of

operation of the bank’s business .E-commerce

enables the transfers of information flow, capital

flow and part of the information logistics to network,

so that the network become the main space of

economic activities and create the new growth point,

and gradually completed the transition from the

industrial economy to new economy ( Network

Economy).

4.2 E-commerce’s Impact on Bank’s

Market

E-commerce shorten the distance between banks

and customers. Through the establishment of an

electronic store or the website's home page,

customers are allowed to transfer their business

needs directly and quickly converted to the

production order.

4.3 E-commerce’s Impact

on Production

E-commerce’s the largest impact of the bank’s

marketing activities is reflected on the production

area. Mainly as follows:

Reduce procurement costs.

Reduce business inventory.

Increase their trading opportunities.

4.4 E-commerce’s Impact on Bank’s

Management

E-commerce promote the implementation of

information resources management. Banks adopt

effective methods of information resources

management, and use the advantages of e-business

information to improve bank’s management level,

thus greatly reducing friction, and increasing

efficiency. Timely and accurate exchange of

information make the contract management more

orderly, allocation of resources become more

rational, and marketing decisions turn to more

scientific. Multinational organizations’ global

business and cross-border management become

possible by the establishment of e-commerce

system.

4.5 E-commerce’s Impacts on Bank’s

Organizations

The development of electronic commerce will result

in the organizational structure of banks violently,

prompting banks to accelerate the pace of change

and restructuring. With the development of

electronic commerce, the old boundaries between

the various units of the bank will be broken and re-

combination of a team which provide services for

customers directly. The Closed pyramid structure

will turn into a new network-type organization

which is more convenient to communicate with each

other and learn from each other. E-commerce will

create a large number of virtual enterprise, besides,

enterprise’s organizational and its management are

required to relocate.

4.6 E-commerce’s Impact on Bank

Professionals

The impacts of e-commerce to bank’s marketing

activities above will enable banks to adapt to

profound changes. To meet the requirements of

business change in the information age, human

resources will become the focus of competition. The

decision-makers of the bank will become younger,

high-quality, interdisciplinary and cross-cultural

Business, financial, information management,

computer networks and other professionals, will

become the minion under the e-commerce

environment.

5 SEVERAL PROBLEMS

IN THE IMPLEMENTATION

OF THE NEW BANKING

INFORMATION SYSTEM

UNDER THE E-COMMERCE

ENVIRONMENMT

Banks in the overall strategy should be designed to

adapt to each other by considering the establishment

and development of e-business goals, business

systems and organizational structure.Trying to be

value-oriented and efficient, and create a stronger

competitive advantage on the enterprise value chain

to improve competitiveness and strategic image of

the bank. In order to adapt science and technology’s

rapidly changing, business strategy must be changed

, and to be flexible and agile, all should face the

global market and oriented to the customer

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

556

satisfaction. Under the e-commerce environment, the

following two issues worthy of drawing attention in

the implementation of new bank management

information system.

5.1 Bank’s Computer Network System

Bank’s computer network system includes an

internal network system (Intranet), external network

system (Extranet) and the intelligent network

management system. Intranet and Extranet are used

to organize internal or external internet, the

intelligent network management system can manage

the network resources to ensure the security of

enterprise information resources and achieve the

automation of the operation of the enterprise Web

site management and maintenance.

Intranet / Extranet can connect all departments of

the bank in real-time and improve management’s

efficiency and the rate of feedback. Create a NIS

system which comprehensive involved in

production, supply and production, operation,

management and several other major aspects and

improve the quality and efficiency of management

not only is the measures to establish internal

management, but also is the key to the electronic

commerce.

5.2 The building of Bank's Open

Integrated Information System

The rapid development of computer networks and e-

commerce technology has brought great

opportunities and challenges to the business model

of traditional business organizations, they are

changing almost every aspect of business. At

present, many companies are establishing their own

e-commerce systems. Therefore, we must implement

the integration of the e-commerce and information

system in order to form an open integrated

information system.

Through the internal network system, we can

combine management data with external data, and

combine bank’s e-commerce systems EC,

management information systems MIS, decision

support system DSS, OA office automation systems

together. We can integrate the data warehousing,

data mining technology to from product marketing,

business development, new product development,

production planning, product processing to other

aspects of information resources, and apply them in

deeply, forming a new sound information system in

finally. Bank’s new information system finish a low-

cost, immediate and direct data transmission and

sharing through the bank’s intranet and extrane

which are based on browser .According to market

demand, we can make the production planning,

material supply arrangements, organization of

production and processing together for all

departments within the bank and the bank's joint

ventures which are on supply chain.

Because of the information within the enterprise

and all partners are transparent, so in the process of

the plan’s development and implementing, the plan

can be adjusted according to actual conditions, to

ensure the program’s effectiveness. Currently,

bank’s integrated information system is a closed

automated system, we need to translate them into

information systems which are based on unified

chain of web, in order to achieve the effective

coordination operations with all partners in the

supply chain.

Complete integrated information system should

include all internal and external customers and

market-related information, it not only includes the

production task information, equipment information,

management information, quality information, stock

information, material and financial information, etc,

but also including suppliers, customers and market

information.

For businesses, there will be no information be

devided as inside information and outside

information, but only as a link of the corporate’s

information chain. The application of new

information system, is not only a technical

implementation of the process, but also a process of

management’s restructuring and technical

knowledge’ innovation. To enhance the competitive

advantage in supply chain management, it’s

necessary to reform the entire supply chain and

restructure the organization.

6 CONCLUSIONS

The information system of enterprise is related to the

E-commerce’s which established on the

communication of each entity. To set up electronic

commerce systems, communication between

information system of banks and each entity is

essentially necessary. Moreover,banks need to

improve the inner requirements for EC and create

the better supporting environment to develop E-

commerce.The E-commerce would influence banks

on aspects of Economics, Marketing, Production,

Management, Organization, Talents, etc.

In addition, to establish bank information system

under the E-commerce, the key point, however; is to

THE INFORMATION SYSTEM OF BANK UNDER THE E-COMMERCE ENVIRONMENT

557

put emphasis on the set-up between internet network

system and open-ended but integrated information

system of banks.

ACKNOWLEDGEMENTS

This research was supported by the Students’

innovative experimental projects of Beijing Jiaotong

University in 2010 (Number 1040006).

REFERENCES

Delone, William H,Mcleam, Ephraim R. Information

Systems Success: The Quest for the Dependent

Variable. Information Systems Research, 1992,pp.60-

95

Raymond McLeod. Management Information System

(Eighth Edition). Prentice Hall, Inc.2002, pp.238-256.

Deng Jiangao, Min Wang. Fuzzy Integrated Evaluation of

E-commerce Information System. ISCSCT 2008,

pp.513-516

Katz Z., Tibbles C.J., “Research on Business Intelligence

System's Data Architecture”, International Journal of

Advanced Manufacturing Technology, Vol. 25, May

2005

John Ward, Pat Griffiths, “Strategic Planning for

Informations Systems.”New York: John Wlicy &

Sons Press, 1997, pp.53–54.

D. K. Kwon, Research on Credibility e-Commerce System

Architecture” IEEE Trans. Circuits. Syst. Video

Techonol. 2007

Papalilo E., Freisleben B., “Towards a flexible trust model

for grid envrimoments”, Grid services engineering and

management, Proceedings Lecture Notes in Compute

Science, vol.3270, pp.94-106, 2004.

K. C. Laudon, and J. P. Laudon, “Management

Information System:organization and technology in

the networked enterprise.” London: Prentice Hall,

2000, pp. 122–125.

N. F. Doherty,“The Relative Success of Alternative

Approaches to Strategic Information Systems

Planning: an empirical analysis, “Journal of Strategic

Information Systems”, 1999 (8) , pp.44–48.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

558