RESEARCH ON THE COST MANAGEMENT MODE

OF CHINESE REAL ESTATE ENTERPRISES

Jianyin Luo and Yufei Li

Beijing UFIDA Co., Ltd, No. 68 Road Beiqing, 100094, Haidian District, China

Keywords: Real estate enterprises, Cost management, Mode research.

Abstract: The real estate industry is now going through a painful period. Many far-sighted companies are hence

grasping this opportunity firmly to strengthen their internal organs. One important way of internal

improvement is cost management. Based on the empirical researches on leading real estate firms (Vanke,

China Sea, Pearl River, and Country Garden) over many years, this paper integrates effective cost

management modes for China’s real estate industry. Every mode introduced in this paper is developed into

the following part: Enterprise Characteristics; Mode Characteristics; Mode Advantages; Mode

Disadvantages; Applicable Enterprises, etc.

1 INTRODUCTION

The real estate industry is now going through a

painful period. Many far-sighted companies are

hence grasping this opportunity firmly to strengthen

their internal organs. One important way of internal

improvement is cost management. Based on the

empirical researches on leading real estate firms

(Vanke, China Sea, Pearl River, and Country

Garden) over many years, this paper integrates

effective cost management modes for China’s real

estate industry. Every mode introduced in this paper

is developed into the following part: Enterprise

Characteristics; Mode Characteristics; Mode

Advantages; Mode Disadvantages; Applicable

Enterprises etc.

2 RESEARCH ON VANKA’S

COST MANAGEMENT MODE

2.1 Enterprise Characteristics

Typical enterprises of this mode include Vanka,

Wanda, Excellence Group, and Eontime. They

always focus on real estate development and

management while outsource other core activities

such as design and construction.

2.2 Mode Characteristics

The mode characteristics of Vanke could be

concluded as giving priority to macro cost control,

while giving consideration to the progress and

quality of a project.

A target cost management system which sets a

corresponding target cost for every project is

established. This system benefits the overall

process of project development.

Dynamic cost accounting. Dynamic costs are

computed in the following situations: making a

contract, changing certificates, settling a

contract, paying for a contract, and non-

contractual expenditures. By adopting dynamic

cost accounting, the latest happening in the

project could be reflected in time.

Cost management work is done according to

standard operating procedure.

The method of cost accounting is consistent

with its principle. However, it is not required

that cost accounting be extraordinarily accurate.

Overall situation consciousness is emphasized

because cost is not only the responsibility of

Cost Department.

Focus on the control of total cost.

Under the framework of total cost,

responsibility costs are assigned to specific

departments’ specific activities according to

their separate division of labour.

Correspondingly, supervising and inspecting

345

Luo J. and Li Y..

RESEARCH ON THE COST MANAGEMENT MODE OF CHINESE REAL ESTATE ENTERPRISES.

DOI: 10.5220/0003610203450350

In Proceedings of the 13th International Conference on Enterprise Information Systems (BIS-2011), pages 345-350

ISBN: 978-989-8425-54-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

system, together with performance evaluation

system is then deployed to reduce the costs of

every division, and enables every division to

exert subjective initiative.

Major materials are purchased via tender offer

and adopt a JIT approach.

Cost-effective analysis is adopted to decide

whether a cost could improve the value of a

product. If can, the cost is spent effectively and

otherwise it is ineffectively. By using the cost-

effective analysis, the company could avoid

every possible ineffective cost and spend their

money where it counts.

Aggregate all the data of developing projects

into a cost pool. Data of excellently managed

projects could be set as standards to conduct a

feasibility study for new projects or guide the

development process of new projects.

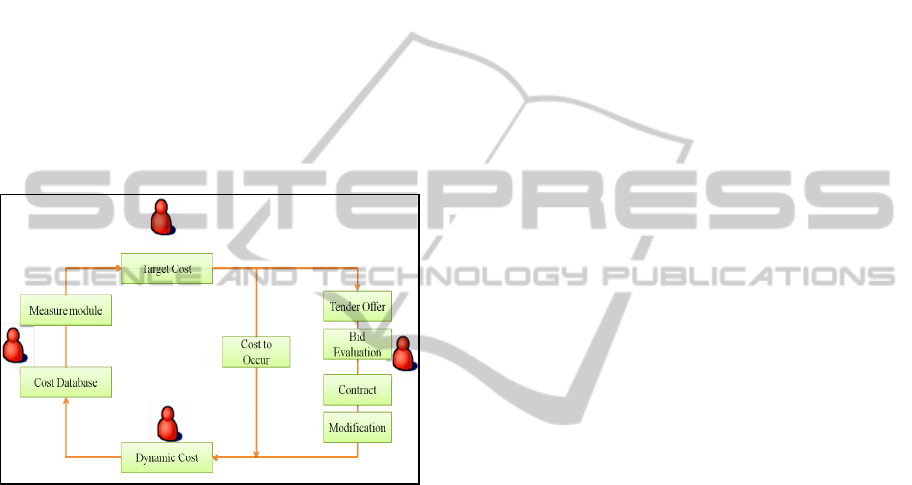

Figure 1: How a closed loop for cost management is

formed.

2.3 Mode Advantages

A closed loop of cost management is

established, which promotes the cost

management level to improve. (Figure 1)

Is beneficial for the macro-control of the

overall group. The group could formulate

uniform rules which are executed strictly in the

development process of projects.

Meanwhile, combined with some professional

real estate information analysis tools such as

UFIDA, a fast copy effect could be realized by

solidifying the group’s rules and defining

relative guidelines on project management in

the software. Therefore, software could be used

to help enterprises to guide their behaviours.

The establishment of a cost pool makes the

feasibility study on new projects faster and

more effective.

2.4 Mode Disadvantages

This mode of cost accounting lacks precision, thus

limits the range of cost control.

2.5 Applicable Enterprises

The Vanke cost management mode could be applied

to pure real estate enterprises without affiliated

construction enterprises or enterprises that lack

actual construction experiences.

3 RESEARCH ON CHINA SEA’S

COST MANAGEMENT MODE

3.1 Enterprise Characteristics

Typical enterprises such as China Sea, Tiantai, etc.

adopt this cost management mode to focus more on

the management of real estate development. These

enterprises are all transformed from construction

companies so they are good at construction

management.

3.2 Mode Characteristics

This mode is characterized by an elaborate system

on cost management and control, specific as follows.

A unified budget management system for the

overall group is established to control the whole

process of project development. This system

sets up corresponding budgets for every

specific item according to the categories and

standards for budgets.

Budgets are assigned to specific departments’

specific activities according to their separate

division of labour. Correspondingly,

supervising and inspecting system, together

with performance evaluation system is then

deployed to reduce the costs of every division,

and enables every division to exert subjective

initiative.

Budget control concerns the following aspects:

making a contract, changing certificates,

settling a contract, paying for a contract, and

non-contractual expenditures

Annual capital plan and monthly capital plan

are drawn up by project and functional

department. Approved capital plans strictly

control the payment flow of projects.

Budget control is as detailed as to every

department and every item.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

346

Budget pre-warning. This system supports an

early warning for the execution of budget

control. For example, if an early warning mode

is pre set, as long as a user overruns his or her

principle project by 80%, the early warning

would prompt out.

Bill of quantities is need when concluding a

contract.

Project schedule is formulated according to bill

of quantities and tasks. Periodically, actual

accomplished work amount will be confirmed.

Besides, the bill of quantities will also be

referred to when paying for a project.

Comprehensive material management. Strategic

cooperative partnership with major suppliers is

established to reduce purchasing costs

drastically. Material requisition list is required

when employing materials. For oversupplied

materials, deductions are applied using

progressive rates or excess progressive rates,

and deduction threshold as well as mark-up

percentage is set to guarantee the maximum use

of materials.

3.3 Mode Advantages

A complex and volatile project management

process can be changed into a controllable

process by establishment management, task

decomposition, contract management, progress

confirmation, and payment flow.

By using budget management, capital plan and

tender offer management, the company could

integrate limited resources so as to improve the

effective utilization rate of resources.

In the process of the project, by utilizing

investment estimation management, project

cost management and dynamic cost projection,

the company could timely evaluate the input-

output relationship about the project.

The goal of standardizing project management

work, optimizing management procedures, and

realizing overall control could be attained with

the help of information tools. The level of

project management could be therefore

improved because information is more

visualized, procedures are more transparent,

and motions are more standardized.

Coordinate and manage overall project

resources from a group’s view. These resources

include financial resources, human capital

resources, supplier resources, project

development management experiences and so

on.

Scale duplication of project development

management.

3.4 Mode Disadvantages

Among all the cost management modes in real estate

enterprises, this mode characterized by an elaborate

system has the highest requirement for professional

cost management. Apart from the necessary cost

analysis skills, project skills and financial skills for

development enterprises, construction techniques are

also needed.

3.5 Applicable Enterprises

This mode could be applied to real estate enterprises

with higher level of project management experience

and construction experience.

4 RESEARCH ON PEARL

RIVER’S COST

MANAGEMENT MODE

4.1 Enterprise Characteristics

Typical enterprises such as Pearl River would prefer

this cost management mode, which focuses more on

real estate development and management, and

contracted their construction work to affiliated

construction companies.

4.2 Mode Characteristics

This mode is characterized by a moderate flexible

target cost control system. This system emphasizes

on the details of a project, especially the control of

certificate changes.

A target cost management system is

established. Meanwhile, in order to reduce the

period for a project, construction work is doing

while budgets are still making.

Dynamic cost accounting. Dynamic costs are

computed in the following situations: making a

contract, changing certificates, settling a

contract, paying for a contract, and non-

contractual expenditures. By adopting dynamic

cost accounting, the latest happening in the

project could be reflected in time. Besides,

company can frequently check whether it is

beyond the target cost.

The principles concerning the distribution of

costs among different regions/time include: a.

RESEARCH ON THE COST MANAGEMENT MODE OF CHINESE REAL ESTATE ENTERPRISES

347

Benefit Principle, which allocates costs

according to benefits; b. Equal Principle, which

allocates costs equally among all the regions; c.

Territorial Principle, which allocates costs to

where the project is located. (Table 1)

Since Pearl River is listed in Hong Kong, it

accepts various methods of cost apportionment,

such as Chinese accounting rules, Performance

Requirement for Hong Kong Listed Companies

etc.). This is beneficial for different purposes of

management. (Table 1)

Table 1: Examples of various cost distribution principles

under different accounting rules.

Projects

Internal

Control

Assessment

Chinese

Account-ing

Rules

Performance

Requirement

for Hong

Kong Listed

Companies

“Municipal

Planning

Road

Project”

Benefit

Principle

Benefit

Principle

Territorial

Principle

A quota system (benchmark price) is

introduced according to the types of products.

Generally, products from the same regions are

applied with the same quota. Quota added by

indicative data could quickly result in an

initial version of target costs, which is

beneficial for a quick feasibility research

decision.

Regional companies employ a capital demand

plan based on their actual demand for

operation and management. This capital plan

includes annual capital plan and monthly

capital plan.

(For example, an annual capital plan is formulated

according to the following procedures: Every

November, the company would draft next year’s

capital plan based on the market forecast, sales

targets and project progress. The Project Sales and

Planning Department would put forward next year’s

sales plan, other operating revenue plan, selling

expenses budget and operating expenses budget. The

Financial Department would predict next year’s

sales revenue actual collection plan. The Project (or

Regional) Development Department proposes the

capital demand plan; The Project Engineering

Department comes up with next year’s progress plan

and capital demand plan. The Project Office raises

next year’s administrative expenses budget. When

drafting out corresponding plans and budgets, each

department should communicate adequately and

reach consensus with regional functional

departments. Approved by company’s general

manager, all these budgets and plans could become

the basis for the Financial Department to formulate

the “Annual Capital Plan”. )

Approval authority is strictly controlled in case

that out-of-control risk breaks out.

Every month, the quantities of work are

evaluated in a simplified way. Pearl River

estimates the overall quantities one at a time,

while Vanke and China Sea aggregates every

specific project’s quantities in to the overall

quantities.

Project Development Life Cycle is relatively

flexible. For example, projects planned to be

completed in first phase may be postponed

many times. Besides, two or more projects

could be combined into one phase to complete.

4.3 Mode Advantages

This mode forms a stratified central

management of information resources for

headquarter, regional companies, and project

companies.

This mode unifies each piece’s accounting

system and operating procedures, so that the

group management could conduct a real-time

data inquiry to strengthen their supervisory

force.

This mode enhances company’s capital

management, enabling it to reflect real-time

capital account information to control the

payment flow.

The adoption of the quota system is beneficial

for new projects’ feasibility research.

4.4 Mode Disadvantages

Due to the lag behind between target cost and actual

business, this mode has the disadvantage of limited

target cost control force.

4.5 Applicable Enterprises

This mode could be applied to real estate enterprises

with moderate flexibility.

5 RESEARCH ON COUNTRY

GARDEN’S COST

MANAGEMENT MODE

5.1 Enterprise Characteristics

Typical enterprises such as Country Garden would

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

348

prefer this cost management mode, which focuses

more on real estate development and management.

Meanwhile, this mode covers all the cycles in real

estate development, including design, construction,

decoration, gardening, hotel, school, tourism and so

on.

5.2 Mode Characteristics

This mode is characterized by a unified capital

management and material supply concentration

system.

Low land price with large-scale investment

strategy. Companies using this mode always

choose second-tier and third-tier cities as their

base areas, with an average land price of RMB

174 per square meter. Correspondingly, the

ratio of land cost to average sales revenue is

maintained at 7 to 8 percent.

Design cost is controlled. Take Country

Garden as an example, it owns a special design

institute with hundreds of houses. For example,

they have as many as 100 classic town houses.

Taken into consideration local climate and

custom, their design covers all types of houses.

Their blue prints contains sufficient

information such as the location of a switch

which enables the client to touch more

comfortably, or the most reasonable wide of a

gap between a door and a wall, and also how a

ceramic tile could be paved. All these means

that Country Garden could simply enter into

construction procedures just according to their

blueprints with few adjustments or even no

adjustments.

Materials supply management is centralized.

Bulk commodities are bought through Group

purchasing centre to reduce material costs.

Low cost results in high turnover rate. Project

price is normally half than other comparable

projects, average daily batch sales rate is as

high as 78%, and average annual stockpile rate

is only 2.5%.

Low sales price also effectively reduces sales

expenses. In the first half year of 2007,

settlement revenue is increased by 48% while

sales expenses only increased 45%, and

marketing expenses only increased 36%.

The business chain of Country Garden is

perfectly integrated. Not only product design,

but also building construction, estate

management and hotel management are all well

considered. These large buildings always take

up more than thousands of acres, which could

significantly reduce purchasing cost and realize

a large-scale duplication.

The centralized management of capital enables

the company to monitor the movement of

money more effectively. By utilizing

information tools, the company could check its

capital situation cross banks and cross

departments could know the real-time balances

of its accounts, could have fast control over

every subsidiary’s capital flow, and could also

monitor major capital movements so as to

automatically supervise abnormal situation.

These functions enable the company to form an

overall management of capital.

5.3 Mode Advantages

The Country Garden Mode covers all the

possible cycles in real estate development,

including project orientation, house design,

construction and building material, decoration,

marketing and estate management. Profits

from every link in the value chain are seized

to reduce costs and improve development

speed.

Fast duplicating and scaled manufacturing are

realized through this mode.

5.4 Mode Disadvantages

Since this mode covers every connecting and

interacting cycle in the real estate development, it is

rather challenging for a company to manage and

control.

5.5 Applicable Enterprises

This mode would be very suitable for enterprises

that have business on all the process of real estate

development.

6 CONCLUSIONS

With the increasing competition among companies

and the current economic situation, real estate

companies should adopt scientific cost management

approaches to improve their cost management

quality. Additionally, they should take advantage of

cost management methods to bring benefits and

effectiveness to themselves. Only by this way, can

real estate enterprises successfully go through the

current crisis and enjoy a healthy sustainable long-

term development.

RESEARCH ON THE COST MANAGEMENT MODE OF CHINESE REAL ESTATE ENTERPRISES

349

REFERENCES

Zhongwei Wang, 2006. Cost optimization control for real

estate development project. Development and

Construction.

Zhenhua Chen, 2006. Discussion on how Chinese real

estate enterprises could shape their core

competitiveness. Science and Technology of Overseas

Building Materials.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

350