THE IMPACT OF THE CONCENTRATION RATE OF THE

INTERNATIONAL CONTAINER LINER MARKET ON CHINESE

CONTAINER FREIGHT INDEX

Cui Li, Zhou Yong Sheng and He Mingke

School of Business, Beijing Technology and Business University, 33 Fucheng Road, Beijing, P.R. China

Keywords: Container liner market, Market concentration rate, CCFI.

Abstract: At the beginning of the 21st century, a wave of company merging was stirred up in the global container

liner market. The relationship between market concentration and China container freight index (CCFI) was

analyzed through economic theory from the year 2000 to 2005 when container liner freighting industry

reached the high point of the merging wave. It was found that the increasing market share of the top 20

shippers did not affect CCFI to some extent. But the high degree of monopoly had impaired the fairness of

shipping market and also affected the free competition of Chinese shipping market. Some policy

suggestions were given to deal with the potential mergers.

1 INTRODUCTION

In recent years, the role of independent carriers in

shipping market has become more and more

important along with as the containerization and

globalization of liner transport. The wave of merger

and consortium was raised by the large liner

corporations all over the world which made the

market concentration of container market

continuously rises. Three important merger cases

around 2005 resulted in the capacity of the top

twenty liner corporations increase to 82.5 percent.

Although this figure fluctuated in 2006, it was 79.92

percent in 2009, only decreasing a little. But the

latest data show that the year growth rate of the

capacity of the top twenty liner corporations is 14

percent. So it may be a signal for a new round of

merger and consortium.

As a major international trading nation, China

has contributed a lot to international container liner

shipping since the trade volume continuously

increases for the past few years. Meanwhile, it

makes Asia-Pacific area a market which is fought

for most furiously by the large container liner

corporations in the process of merger and

consortium. Comparatively speaking, the merger and

consortium may influence Chinese container

transport market. We studied the relationship

between the market concentration of the global

container liner market and China container freight

index and proposed some suggestions to deal with

the new round of potential merger.

2 MARKET CONCENTRATION

OF THE GLOBAL CONTAINER

LINER MARKET

Market concentration is the comparative scale

structure possessed or controlled by buyers or sellers

in a certain specific industry or market. It can be

measured by absolute concentration, relative

concentration and Herfindahl-Hirschman Index.

2.1 Market Absolute Concentration

Rate

The market concentration rate discussed in this

paper is referred to the comparative scale structure

possessed or controlled by freight capacity providers

who are the actual carriers and denoted by the

market absolute concentration rate CRm, i.e. the

sum of market shares of the top m corporations in

the global container liner industry. The

concentration status from 1997 to 2009 is shown in

Table 1.

611

Li C., Yong Sheng Z. and Mingke H..

THE IMPACT OF THE CONCENTRATION RATE OF THE INTERNATIONAL CONTAINER LINER MARKET ON CHINESE CONTAINER FREIGHT

INDEX.

DOI: 10.5220/0003597906110616

In Proceedings of the 13th International Conference on Enterprise Information Systems (PMSS-2011), pages 611-616

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

Table 1: Market Concentration Rates of International

Container Liner Shipping Market from 1997 to 2009.

Year CR4 CR8 CR16 CR20

1997 17.04% 30.25% 45.67% 50.69%

2000 22.97% 34.49% 50.10% 50.69%

2001 28.50% 43.70% 63.00% 69.90%

2002 30.40% 45.50% 65.40% 72.00%

2003 31.10% 46.20% 66.60% 74.10%

2004 30.90% 46.80% 68.00% 76.20%

2005 37.10% 51.60% 72.10% 79.40%

2006 38.30% 53.50% 74.80% 80.90%

2007 39.80% 56.42% 79.20% 85.40%

2008 39.17% 55.05% 77.20% 82.90%

2009 41.16% 53.39% 72.98% 79.92%

From Table 1 we can see that the market

concentration rate CR20 of international container

liner shipping market changed from 50.69 percent in

2000 to 79.92 percent in 2009. The index increased

rapidly during 2000 to 2007 and dropped from 2008

subject to the economic crisis. But totally it can still

be made out that big and small liner companies were

constantly conducting merge and integration since

2000.

2.2 Herfindahl-Hirschman Index

Although the absolute market concentration rate can

reflect the market share of the largest corporation in

the market, it cannot sufficiently reflect the internal

scale structure within the largest corporation.

Herfindahl- Hirschman Index emerged at the right

moment. It is the sum of squares of all the

corporations’ market shares, denoted by the equation

as following.

2

1

1

1

m

i

i

m

i

i

HHI

S

S

=

=

⎧

=

⎪

⎪

⎨

⎪

=

⎪

⎩

∑

∑

The value of HHI is usually multiplied by 10000,

therefore between 10000/m and 10000. The higher

the value of HHI that the higher of market

concentration rate. This index is very sensitive to the

market share variation of the larger scale

corporations and the comparative adjustment of

scale structure of larger corporations.

We calculated the values of HHI of the

international container liner shipping market from

2000 to 2009 according to the market shares

correspondingly. The market shares of all the

corporations in the market are needed to calculate

HHI while the market shares of many small shipping

corporations cannot be achieved. The market shares

which cannot be achieved are very small and

influence total HHI very little after being squared.

Therefore, we used the market shares of the top 20

corporations in the international container liner

shipping market to calculate HHI. The values of

HHI of the international container liner shipping

market from 2000 to 20009 are shown as Table 2.

Table 2: HHI of the International Container Liner

Shipping Market from 2000 to 2009.

Year 2000 2001 2002 2003 2004

HHI

20

222.82 351.97 375.22 394.41 410.56

Year 2005 2006 2007 2008 2009

HHI

20

576.74 573.21 605.79 583.61 609.72

The HHI of the international container liner

shipping market has been on the rise from 2000,

especially in 2005 after P&O Nedlloyd Ltd. was

acquired by the A. P. Moller-Maersk Group

(Maersk). So the acquisition of Maersk influenced

the structure of the international container liner

shipping market strongly.

3 THE RELATIONSHIP

BETWEEN CONCENTRATION

RATE AND CHINA

CONTAINER FREIGHT INDEX

3.1 China Container Freight Index

Chinese foreign trade especially the export trade has

developed rapidly since the reform and open policy

was implemented. But in foreign trade especially the

export trade Chinese corporations usually use FOB

trade terms, i.e. buyers are responsible for booking

shipping space while buyers usually choose the liner

shipping corporations of their own countries or

international famous corporations such as Maersk

Sealand and Mediterranean Shipping Company.

Therefore, the wave of merger and restructuring of

international large liner companies certainly will

impact on Chinese trade transportation market

especially the export trade transportation market.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

612

China Container Freight Index, CCFI for short, is

formed by Shanghai Shipping Exchange every

Friday based on the export container freight price on

Jan 1st 1998. The base is designated as 1000.

According to the weekly data released by Shanghai

Shipping Exchange, the annual average data of

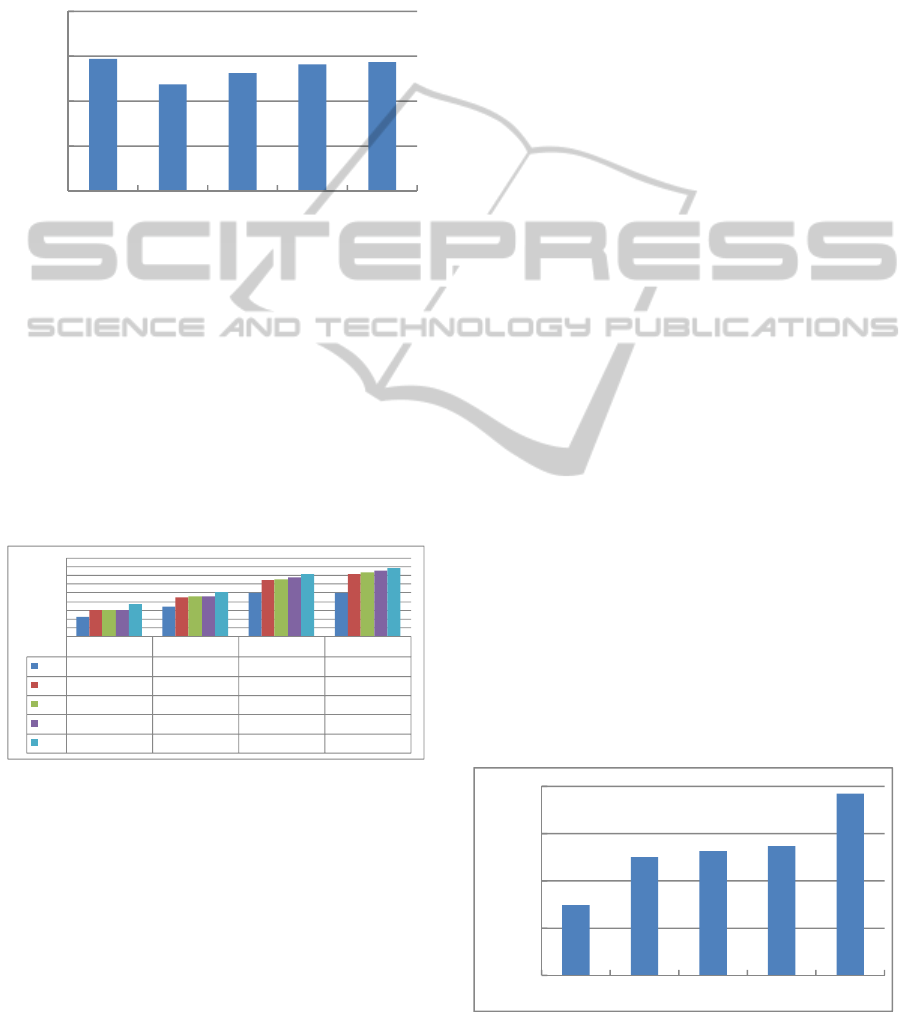

CCFI from 2000 to 2005 is compared by Figure 1.

Figure 1: Annual Average of CCFI from 2000 to 2005

From Figure 1 it can be seen that CCFI dropped

drastically from 2000 to 2002 but have risen since

2002, not larger than the value in 2000.

3.2 CCFI and CRm of the

International Container Liner

Shipping Market

The market concentration rates of container liner

market from 2000 to 2005 are shown by Figure 3.

Figure 2: The Market Concentration Rates of Container

Liner Market from 2000 to 2005.

From Figure 2 it is can be seen that the

concentration rates of container liner market went

steadily upward from 2000 to 2005 except for a little

decrease in 2004. Integrated the values of CR8,

CR16 and CR20, we can also draw the conclusion

that the concentration rates of container liner market

tends to grow from 2000 to 2005.

Without regard to the influence of other factors

such as social economic situation, trade volume and

fuel prices and ignoring the yearly variation of

CCFI, here we think the big variation of CCFI is

caused only by the concentration rate of container

liner market. Then the situation of container liner

market is fit for the theory of industrial organization

i.e. SCP paradigm except for the abnormal condition

in 2000.

The market concentration rate was low while the

freight price was high in 2000. The reasons may be

as following.

1) When CR8 is less than 45 percent in container

liner market and the whole industry is in the period

of atom type, increase of market concentration will

cause CCFI fall because the freight price of

container liner market is determined by cost plus

pricing. During the period when the market

concentration increase within a certain extent,

scaling up and reasonable integration of major

corporations certainly cause their operations cost

drop for the natural monopoly industry. So the price

based on cost will drop undoubtedly.

2) When CR8 is no less than 45 percent in

container liner market and the whole industry is in

the period of medium/low concentrated oligopolistic

type, increase of market concentration will cause

freight price increase because the numbers of

corporations in the market reduces and the market

share of major shipping corporations increases so

that they have stronger monopoly power and more

ability to affect the price. Regarding to the influence

of monopoly power of monopoly corporations based

on the cost plus pricing, then the price in the

shipping market was led to increase.

3.3 CCFI and HHI of the International

Container Liner Market

The values of HHI of Container Liner Market from

2000 to 2005 are shown by Figure 3.

Figure 3: HHI of Container Liner Market from 2000 to

2005.

1176

950

1048

1126

1147

0

400

800

1200

1600

2000 2002 2003 2004 2005

CCFI

CR4 CR8 CR16 CR20

2000

22.97% 34.49% 50.10% 50.69%

2002

30.40% 45.50% 65.40% 72.00%

2003

31.10% 46.20% 66.60% 74.10%

2004

30.90% 46.80% 68.00% 76.20%

2005

37.10% 51.60% 72.10% 79.40%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

222,82

375,22

394,41

410,56

576,74

0

150

300

450

600

2000 2002 2003 2004 2005

HHI

THE IMPACT OF THE CONCENTRATION RATE OF THE INTERNATIONAL CONTAINER LINER MARKET ON

CHINESE CONTAINER FREIGHT INDEX

613

Comparing Figure 4 and Figure 2, we can draw

the conclusion similar to the analysis of CRm that

the values of HHI from 2000 to 2002 shows the

concentration rate of the shipping market increased

rapidly while the shipping price dropped greatly. As

the concentration rate of the shipping market

increased from 2002 to 2004 the shipping price also

increased, fitting for the SCP paradigm.

4 THE RELATIONSHIP

BETWEEN CONCENTRATION

RATES AND THE MODIFIED

CCFI

The market concentration is not the only factor that

influences the liner shipping market in the reality.

The relationship between supply and demand is the

key factor affecting market price.

The most influential factor of the demand in the

container liner shipping market is still international

trade volume which is affected by many factors

including the global economic development and

changes. In the rising period of global economy the

international trade is prosperous so that the shipping

market grows prosperously. Seasonality is another

major factor influencing the international trade

volume. In China, the period from July to October is

the boom of trade because of the suitable climate for

production and working. So the situation of the

shipping market is comparatively better. Moreover,

the factors impacting on the international trade

volume and further on the shipping market contain

trade barrier, intellectual property protection and

appreciation of the RMB, etc.

Major influential factors of the supply in the

container liner shipping market include global fuel

price and technology level besides the market

concentration we have mentioned. Particularly the

effect of fuel price should not be underestimated.

For example, the hurricane of the Mexico Gulf

severely damaged the production of petroleum in

2005 and brought about huge panic to petroleum

market. The price of crude oil futures once surged to

70 dollars for one barrel. It influenced the shipping

market greatly.

Therefore, we cannot simply compare the trend

of CCFI and the concentration rate of the container

liner shipping market in order to study the effect of

the concentration rate on CCFI. We need to

eliminate the other major influential factors of CCFI

and then compare it to the concentration rate of the

container liner shipping market.

The primary factor influencing CCFI is global

economic factors. The lowest points are around the

first period in 1998 and the 51st period in 2002

when the global economy was in trough while the

rising periods of CCFI including the 26th to 31st

periods in 2000 and the 61st period in 2003 were the

times when the global economy took a turn for the

better. And from Figure 1 we can see that CCFI had

obvious seasonality in a year. So eliminating the

large fluctuation brought by the great depression and

excessive booming of an economic cycle and the

periodic wave brought by the seasonal factor, we get

to know that CCFI tended to drop for a long term.

After eliminating the economic cycle, seasonal

cycle and other instable factors, we think the

decreasing trend of CCFI was influenced only by the

global fuel price and the concentration rate of the

international liner market. The trend of global fuel

price can be reflected by Singapore high sulfur fuel

oil which is presented by Figure 4.

Figure 4: The Trend of Price of Singapore High Sulfur

Fuel Oil from 2000 to 2005.

From Figure 4 it can be seen that the general

trend of Singapore HSFO was increasing from 2000

to 2005. The increasing fuel price would necessarily

result in the increase of the liner shipping cost and

the price. But CCFI presented a decreasing trend for

a long term. This phenomenon illustrates that the

trend of CCFI was caused by the concentration rate

of the international liner market. So we can find out

the relationship between the concentration market

and CCFI. CCFI decreased as the concentration rate

CRm increased. That is to say, the merger and

reorganization of the international liner corporations

led to the drop of CCFI. This conclusion contradicts

to the theory of industrial organization. The

contradiction can be explained by the following.

The resource integration and technology

improvement brought by the mergers made the cost

of liner shipping corporations lower. For the years of

0

200

400

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

614

2004 and 2005, although the market concentration

rate CR4 was close to 40 percent and CR8 close to

80 percent the whole industry was not affected by

the major corporations. When the merger and

reconstructing constantly happened the shipping

capacity and resources could be integrated better and

preferable technology be applied widely. The cost of

container liner shipping industry was reduced and

then resulted in the decrease of the price in the

whole shipping market. But this cannot reject the

situation that the monopoly of liner shipping

corporations grows as the concentration rate

increases further and the price in the shipping

market increase again.

The decline and perish of liner society made the

power of industry market weaker. The liner society

played a monopoly role in the shipping market since

the 1870s through many policies such as common

freight rates, unified operations arrangement and

united service to make the shipping liners a huge

cartel. The market concentration rate was much

higher than that calculated by the market shares of

the corporations in the market because of the

existence of the liner society. In the 1970s the power

of the liner society began to decline but still affected

some ship routes especially the Far East route. In the

end of the last century the decline of liner society

was intensified. The European Community

abolished 4056/86 regulation providing immunity of

anti-monopoly for the liner society on Sep.25 2006

so that ended the special status of the liner society

from the legislation point. During the period of

perishing, the monopoly power was weakened

constantly and the market concentration rate

contributed by the liner society also decreased.

Therefore, it can explain the reversing change of the

concentration rate and the price in the liner market.

5 POLICY SUGGESTIONS

In order to deal with a new wave of merger possibly

emerging at all times, Chinese government should

take some measures to impose restrictions on them

and ensure the fair competition in the market so as

not to waste social resources. Meanwhile, the

domestic shippers can be protected and the profit

space can be preserved. The specific policies include

three aspects as following.

1) To adopt CIF or CFR and the similar trade

terms in the export trade. It is estimated that 80

percent to 90 percent of the trade volume use FOB

trade terms with which the foreign purchasers

appoint freighters. The export trade plays a leading

role in Chinese international trade. Therefore, the

power of the shipping corporations like Maersk

possessing large market share in China will be

strengthened further thus influence the freedom of

Chinese shipping market if we do not change the

situation of using FOB trade terms in the export

trade.

2) To support domestic shipping corporations.

The fundamental goal of restricting the monopoly

power is to increase market competition in order to

make market resources allocation optimized. So we

need to support domestic shipping corporations to

contend against the major international corporations

and forming the situation of multiple pillars

confrontation to optimize resources according to the

theory oligarch competition.

3) To formulate anti-monopoly policies. The

government should draft anti-monopoly policies

correspondingly to realize macro control and ensure

well-organized operations of Chinese shipping

market.

6 CONCLUSIONS

The following conclusions about the influence of

shipping market mergers on Chinese export

container market can be drawn through the study in

this paper.

In recent years the market concentration of the

international container liner shipping market has

continuously risen as the merger and consortium of

the large international liners happened.

CCFI appeared increasing gradually between

2000 and 2005, excepting for a little decrease in

2002. But after economic cycle and seasonality

eliminated, CCFI tended to decrease for a long term.

The mergers of international liner shipping

corporations influenced Chinese export container

shipping price in two ways. Firstly, the mergers

made the market concentration rate of Chinese liner

market rise and the monopoly power of international

liners in Chinese shipping market strengthened.

Secondly, the mergers made scale economy play a

part in reducing the shipping cost with more

effective technologies and management methods.

For the administrator s and regulators of Chinese

shipping market should make relevant policies to

ensure the market develop healthily and well-

THE IMPACT OF THE CONCENTRATION RATE OF THE INTERNATIONAL CONTAINER LINER MARKET ON

CHINESE CONTAINER FREIGHT INDEX

615

organized. The policies include encouraging to adopt

CIF or CFR and the similar trade terms in the export

trade, supporting domestic shipping corporations

and formulating anti-monopoly policies.

The merger of international shipping

corporations especially the liner shipping

corporations is in no sense dreadful or panicky. It is

an edged sword with the bad edge to form market

monopoly and the good edge of scale effect. Only if

the administrators of the industry utilize policies

well to supervise and guide can the merger of

shipping corporations play its good function and

avoid its shortcomings.

REFERENCES

Cheng L. J., Su H. Q., 2005.Trend analysis of shipping

price in China s international container liner transport

market, Journal of Shanghai Maritime University,

Vol.26, No.4, pp.73-77.

Huang S. Q., 2004. Analyses on Market Concentration in

Container Liner Shipping, World Shipping, Vol. 27,

No.5, pp.26-27.

Huang Z., Zhu R.J., 2006. An analysis of the global

container shipping market, Shipping Economy Trade,

No.5.

Li M.Z., Ke X. Q., 2004. Industry Organization Theory,

Tsinghua University Press. Beijing.

Li N., Zhong M., Liu J. C., 2006. The algorithm and

empirical analysis of the concentration rate of

international container liner shipping market, Shipping

Management, No.12, pp.10-13.

Liu H. Y., Qi S. J., Liu C., 2008. Forecasting the trend of

the merger of international container liner

corporations, China Water Transport, Vol.8, No.11,

pp.48-49.

The capacity of the top 20 liner companies increased 14

percent in 2010, 2010. http://auto.chinaports.org/

News_info.htm?id=135952, 2011-1-7/2011-2-10

Wang X. P., 2008. The merger trend of the global shipping

market and the countermeasures of Chinese liner

industry, Containerization, No.7, pp.11-13.

Zhu Y. Q., 2007. Degree of monopoly of Chinese

Container Liner Shipping market, Journal of Ocean

University (Social Science Edition), No.1, pp.17-22.

Zhu Y .Q., Zhang Q., 2006. Study of the Monopoly Extent

of Container Liner Shipping in Chinese Market,

Journal of SSSRI, Vol.29, No.2, pp.137-142.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

616