RESEARCH ON THE RELATIONSHIP OF BANK INDUSTRY’S

STOCK PRICE AND TRADING VOLUME WITH PANEL DATA

MODEL

Weidong Li and Lizhai Jia

School of Economics and Management, Beiijing Jiaotong University, Beijing, China

Keywords: Panel data, Fixed effects regression model, Stock, Price, Volume.

Abstract: Panel data becomes the main data vector with the development of the information technology. The panel

model has been applied to many fields such as economics, management and science. In the panel fixed

effects regression model, explanatory variable is a constant but the interception changes according to the

individuals. Relationship between trading volume and price of stock is not only a way to understand the

structure of financial market, but also an effective way to study the arbitrage opportunities and effectiveness

of market. In this paper, we take the stock of banking industry as an example, using the fixed effects

regression model to analyse the relationship between quantity and price of the stock. It is concluded that the

volume fluctuation of stock has significant influence on the price of the stock. As each additional unit of

volume of banking stocks is increased, stock prices will increase by 0.003377 units. It shows that the stock

market trading volume is the internal driving force of stock price. Trading volume directly reflects the

relation of supply and demand in stock market, and to some extent, it determines the trend of the price

changes. At last it is found the panel fixed effects model is an effective tool to analyze the relation between

trading volume and price of stock.

1 INTRODUCTION

As social economics is becoming increasingly

complex, panel data turns to be more popular. There

is a limitation to solve the financial and economic

problems by using simple application of section data

and time series data. Panel data is the combination

of cross-section data and time series data. As a

statistical model, it is widely used in financial and

economics fields. Panel data provides researchers

with a large number of data points. It increases the

degree of freedom and at the same time it reduces

the collinearity about the explanatory variables. It

can overcome the defects of the cross-section model

and time series model. It can characterize the

heterogeneity of cross-sectional data and make its

economics significance better. It is beneficial to

study the dynamic problem and construct and test

behaviour model which is much more complex.

Recently, stock prices and volume trading in

financial market attract people’s attention, because

the relationship between volume and price is not

only a way to understand the structure of financial

markets, but also an effective way to study the

arbitrage opportunities and the important means of

market. People also think that stock trading volume

is the internal driving force, because it directly

reflects the situation of the stock market's supply and

demand. To some degree, it decides the direction of

price changing. In Modern financial theory, as any

factor on the impact of the stock market can be

reflected in market behaviour. So stock trading

volume and stock prices become basic variables to

describe the benefits and risks.

2 LITERATURE REVIEW

There are many studies about the relation between of

stock price and trading volume by scholars, some

representative researches are as follows:

At first, the Granger causality test of the stock

price and trading volume are discussed. Yiling Chen,

Fengming Song

[1]

(2002), Chenwei Wang,

Chongfeng Wu

[2]

(2002), Jiatao Bian, Suo

Jiang

[3]

(2008) and so on selected the data after the

595

Li W. and Jia L..

RESEARCH ON THE RELATIONSHIP OF BANK INDUSTRY’S STOCK PRICE AND TRADING VOLUME WITH PANEL DATA MODEL.

DOI: 10.5220/0003595905950599

In Proceedings of the 13th International Conference on Enterprise Information Systems (PMSS-2011), pages 595-599

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

split share structure reform. They used cointegration,

ECM, Granger causality test and impulse response

function to make a comprehensive in-depth study of

the relationship between the stock prices and trading

volume. They conclude that stock trading volume

changes bring more influences on the changes of

stock prices, while the changes of stock price bring

less influence on stock trading volume changes.

Secondly, GARCH model are used to study the

relation between stock price and trading volume.

According to the theory of MDH, Lamoureux and

Lastrapes (1990) took the trading volume as an

exogenous variable into the GARCH model wave

equation to test the relationship between trading

volume and price volatility. Yanhui Wang, Kaitao

Wang

[4]

(2005)characterized the volatility of stock

returns and verified the impact of trading volume on

volatility persistence with GARCH model. Based on

mixture distribution model, Bin Yang

[5]

(2005) used

the extended GARCH model to explain the volatility

persistence impact of the trading volume on the

stock price. Shuangcheng Li, Hongxia Wang

[6]

made

an empirical study on the relationship between the

Chinese stock market volume and price and non-

symmetrical component GARCH-M model.

Thirdly, other methods are used to analyse the

relation between stock price and trading volume.

Zhengming Qian, Penghui Guo

[7]

, Feng He,

Zongcheng Zhang

[8]

and Fuyu Feng

[9]

used quantile

regression to analyse the relation between stock

price and trading volume. With the theory of

plasticity and elasticity in the field of physics, Aimei

Zhai, Xuefeng Wang

[10]

study the inflect of plasticity

and elasticity those happened in stock price changes

and the stock price volatility that is driven by stock

volume by means of the simulation.

From the review of the literature about relation

between stock price and trading volume, we can see

that although there are a lot study of the relationship

between trading volume and price of the stock, those

are mainly based on time series analysis, most of

which are the causation-based models and GARCH

models. There are many space for the analysis of the

relation between trading volume and price of the

stock with panel data models.

3 PANEL FIXED EFFECTIVE

MODEL

Time-series data or section data is one-dimensional

data. Panel data is the two-dimensional cross-section

data obtained in time and space, which is named as

time-series and cross-sectional data.

Panel data is defined by variable y about n

objects observed t periods obtained a two-

dimensional structure of the date,

it

y ,

1, 2, ,im=

,

1, 2, ,tn=

Because panel data includes changes in cross-

sectional data, panel data analysis needs to consider

the differences between each individual. We suppose

that individual differences between the regression

models are mainly reflected in the constant term, it

forms a simple prototype model of panel data

analysis

1

n

it ki kit it

k

y

xu

β

=

=+

(1)

Here,

1, 2, ,im= shows there are

m

individuals;

1, 2, ,tn=

, means there are

n

time points;

1, 2,ks=

, indicates there are

s

explanatory

variables;

s

it

x

means the value of explanatory

variable

s

we observe individual

i

at time

t

.

s

i

β

is a

parameter to be estimated, and

it

u is a random error.

In Linear regression of panel data, different

interfaces and different time series cause different

intercepts. But the slope coefficients are the same,

we name this model as fixed effective model. It is as

follows:

1

s

it i ki kit it

k

yxu

αβ

=

=+ +

,

1, 2, ,im=

,

1, 2, ,tn=

,

1, 2,ks=

(2)

The estimator of parameters

i

α

is the residual of the

individual observed value. It is

ˆ

iii

yx

α

β

=−

.

According to the least squares,

ˆ

β

is an estimator

of

β

. Based on parameter estimator of the fixed

effects model, the residual sum(RSS) of the fixed

effective models have different terms of constants.

2

11

ˆ

ˆ

()

mn

it i it

it

RSS y x

α

==

=−−

β

(3)

As the same, the residual sum of the fixed effective

models have the same terms of constants.

**2

11

ˆ

ˆ

()

mn

it it

it

RSS y x

∗

α

==

=−−

β

(4)

If the error term of the fixed effective model

it

u is a

normal distribution

2

(0, )

u

N

σ

, using different panel

data model

RSS and

*

RSS , F statistic can be

constructed.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

596

[]

*

()/(1)

~( 1, 1)

/(1)

RSS RSS m

Fm mn m k

RSS mn m k

−−

−−−+

−− −

(5)

The premise of Hausman test is that the model

contains random effect. It relates to the explanatory

variables. Therefore, the null hypothesis

0

H

: in the

assumption of random effects and explanatory,

variables are not related, internal estimator (for the

virtual variable model) and the estimator that

obtained from GLS are consistent, but internal

estimator is not effective. Alternative hypothesis

1

H

:

in the assumption of random, effects and

explanatory variables are related, and GLS is no

longer consistent, except for the internal estimator.

Thus in the original assumption, the gap of

absolute value of

ˆ

w

β

and

ˆ

GLS

β

should not be large, so

it should be reduced by increasing the sample size,

which gradually approaches to 0.

Hausman analyzed the statistics of test with this

statistical feature

()()

1

ˆ

ˆ

ˆ

ˆ

'

wGLS wGLS

W

β

ββ ββ

−

=− −∑

(6)

Here

β

∑

and ∑ are different. The discrepancy

between the matrix covariance of two estimators

(Hausman's basic conclusion is that the discrepancy

between valid estimator and non-effective

estimator,

()

ˆˆ

wGLS

ββ

− ) equals to 0, so

()

ˆ

ˆˆˆ

w GLS w GLS

Var Var Var

β

ββ β β

=−=−∑

(7)

Hausman test is widely used to test the rationality of

the selected panel data model.

4 APPLICATION OF THE PANEL

FIXED EFFECTIVE MODEL IN

STOCK ANALYSIS

Taking banking stock as an example, we use fixed

effective model to analyse the relation with trading

volume and stock price. The banking stocks data is

from the GW stock software. We select the opening

price, closing price and trading volume data from

June 30, 2010 to Dec 31, 2010 as research objects.

As Anxin Trust closed market and the Agricultural

Bank of China and China Everbright Bank listed

later, the research data does not contain these three

stocks. This data includes shares of other 16 banking

stocks. This article uses the Eviews software to

analyse. Closing stock price is expressed by p, and

trading volume is expressed by q. In order to

exclude the impact of dimension to the model, at the

beginning of the study, the data are standardized.

Then the results of data analysis are as follows:

Table 1: The fixed effects of stock trading volume on the

stock price.

Var Coef. t-Stat P

C 12.00 316.97 0.000

q 0.0034 5.93 0.000

From the results, we can see that in the bank

forum the marginal effects of the stock trading

volume on the stock price are the same, it is

0.003377, which means each additional unit of

volume increasing promotes stock prices up by

0.003377 units. However, the prices of banking

stock are affected by the fundamental value, which

is significantly differently, just as following Table 2.

Table 2: The fundamental value of bank shares.

Bank shares Value

Shenzhen Development Bank A 18.75

Bank of Beijing 13.28

Bank of Nanjing 6.45

SPD Bank 1.57

China Merchants Bank 1.45

Bank of Communications 0.54

Bank of Ningbo 0.51

Huaxia Bank -0.42

Industrial Bank -0.96

Shan Guotou A -1.31

AJ Stock -2.54

ICBC -6.34

China Minsheng Bank -6.98

BOC -7.34

CCB -7.95

China CITIC Bank -8.71

RESEARCH ON THE RELATIONSHIP OF BANK INDUSTRY'S STOCK PRICE AND TRADING VOLUME WITH

PANEL DATA MODEL

597

The stock with the highest fundamental value is

Shenzhen Development Bank, which is almost three

times of the Bank of Nanjing, followed by the Bank

of Beijing, whose fundamental value is up to 13.3.

But some state-owned commercial banks such as

ICBC, CCB and BOC shares, whose fundamental

values are negative. There are more than half of the

bank's stocks’ fundamental values are negative, most

of which are state-controlled banks. This shows that

overall of the state-controlled banks is worse than

foreign-funded banks and the local banks those have

geographical advantages and operating

characteristics. Therefore, the state-controlled banks

should find out the reasons and take measures,

explore their advantages, accelerate development to

improve the operating conditions. From the results

of the data we can obtain the model. The model of

Shenzhen Development Bank A is

p

=18.7540+0.003377q

(8)

The model has passed the t test and F test, and its

goodness of fit is to 0.9795, which indicates that the

model is effective. We can get the other bank stocks’

trading volume and price models for the same

reason.

Modify Hausman test procedures with Eviews

software. The program results are as follows.

Table 3: Hausman test for fixed versus random effects.

Chi-sqr(1) 524.66

p-value 0.000

Table 3 shows that, Hausman test reject the null

hypothesis, so the panel fixed effective model is

reasonable.

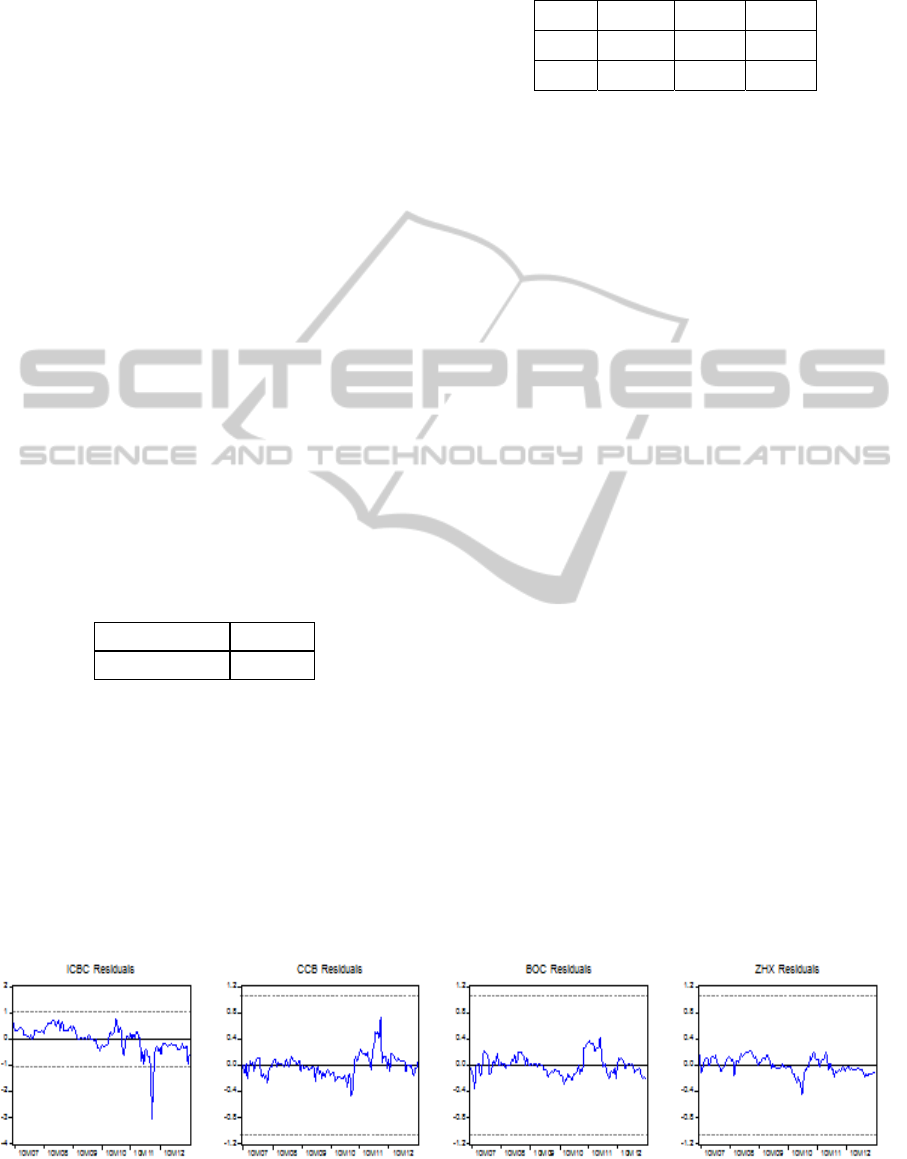

Observing the residuals of the regression model,

it is found they are white noise residuals. Take the

model residuals of ICBC, CCB, BOC and CITIC

Bank as examples.

From the Observation we can find that the

residual series fluctuations in the value of 0, and it is

white noise sequence, which proves the validity of

the model.

Table 4: The fixed effects of the stock price on the stock

trading volume.

Var Coe t-Stat P

C -6.30 -0.63 0.53

P 4.85 5.93 0

The volume of stock does have impact on stock

prices. Then, what impact would stock price have on

the volume of stock transactions? Data analysis

results are as Table 4.

According to the data results in Table 4, each

additional unit of volume increasing promotes stock

prices up by 4.85 units. The model has passed the t

test and F test and its goodness of fit is to 0.4321,

which shows that the extent explanation by stock

prices on the amount of stock transactions is

43.21%. The fitness of the model is not so good. It

shows that stock price can not explain the change of

stock volume effectively.

5 CONCLUSIONS

The above results show that in China’s banking

industry, the fundamental values of different kinds

of bank shares are different. The fundamental value

level of the overall of state-controlled banks is lower

than that of foreign-funded banks and local banks.

As each additional unit of volume of banking stocks

increases, stock prices will increase by 0.003377

units, it has great impact on stock prices. It can be

concluded that the stock market trading volume is

the internal driving force of stock price. Trading

volume directly reflects the relation of supply and

demand in stock market, and to some extent, it

determines the trend of the price changes. At the

same time, it can be found that the panel fixed

effects model is an effective tool to analyze the

relation between trading volume and price of stock.

Figure 1: ICBC, CCB (CCB), BOC, CITIC Bank model residuals.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

598

REFERENCES

Yiling Chen, Fengming Song. The Empirical Study of

Chinese Stock Market Price Changes and Trading

Volume [J].Management Sciences. 2002 (06).

Jiatao Bian, Suo Jiang. The Study of Shanghai Stock

Diyrx - Based on the EG Two-step Method and the

Impulse Response Function [J]. Trade. 2008 (8):93-

95.

Yanhui Wang, Kaitao Wang. Stock Trading Volume,

Return of the Correlation Analysis [J]. Systems

Engineering. 2005 (1).

Chenwei Wang, Chongfeng Wu. Study on Linear and

Non-linear Causality Relationship between Chinese

Stock Market Prices and Volume[J]. Management

Sciences. 2002, 5(4):7-12.

Bin Yang. The Empirical Research of the Relationships

among Shanghai A share Trading Volume, Return

Rate and the Mobility of Transition-based on Mixed

Distribution Model[J]. Statistics and Decision.

2005(8).

Shuangcheng Li, Hongxia Wang. The Empirical Study on

Chinese Stock Market Diyrx [J]. Mathematics in

Practice and Theory. 2008(12).

Zhengming Qian, Penghui Guo .The Quantile Regression

Analysis of Shanghai stock Diyrx [J]. Quantitative &

Technical Economics Research, 2007(10).

Feng He, Zongcheng Zhang. The Comparison between

Chinese Futures Market and Stock Market Diyrx

based on the Study of Quantile Regression[J].

Institute of Financial. 2009(3).

Fuyu Feng. Analysis of the Diyrx of China Stock Market

Analysis based on Quantile Regression [J]. Economics

Business and Management. 2008(6).

Aimei Zhai, Xuefeng Wang. Research of Plastic and

Elastic about Diyrx [J]. Financial Theory and

Practice. 2010(2).

RESEARCH ON THE RELATIONSHIP OF BANK INDUSTRY'S STOCK PRICE AND TRADING VOLUME WITH

PANEL DATA MODEL

599