MUTUAL INTERDEPENDENCE OF STOCK MARKETS

BASED ON SUPPORT VECTOR MACHINE

Minghao Zhu and Jie Li

School of Economics and Management, Beijing Jiaotong University, Beijing, China

Keywords: Stock index, Mutual prediction, Nonlinear dependence, Support Vector Machine.

Abstract: China's market economy continues to advance, which makes the transparency of information of stock

market increasing, the information between the stock market flows faster, a variety of interactions between

the stocks increasingly significant. In this paper, support vector machine method is used to study the stock

market in the nonlinear discontinuous time series, through the establishment of different support vector

machine model, respectively to predict for the Shanghai A shares index, the Shenzhen A share index, the

Shanghai B share index and Shenzhen B share index, analyze their absolute error and relative error, it was

found there is a strong nonlinear interdependence in the same stock market and a strong dependence of

different securities markets, the Shanghai index has a larger effect compare to the Shenzhen index slightly.

1 INTRODUCTION

By studying the interaction between the predictive

ability of stock to analyze the interdependence of the

stock market, stock prediction is the use of mutual

support vector machines for the training data using

different indexes to predict changes in other stock

indices open space and trends, through analysis the

error between models to study the predicted

relationship between stock index, which can analyze

the dependence between the stock market, mainly to

describe the mutual coordination of the stock index

between the various elements of the situation is good

or bad, to measure the phase transition

characteristics and laws between the two indexes.

According to the basic principles of coordination

theory, the coordination degree determines which

sequence and structure the system will reach when it

comes to a critical region or the trend from

disorderly to orderly.

The main methods of researches between stocks

are stock co-integration (Daimin, 2002; Yu et al.,

2004; Guang and Yang, 2010; Xiyu and Yufang,

2004) and prediction

(Pi-e and Yanhua, 2000; Ping

et al., 2003; Xing et al., 2001; Yuchuan and

Zuoquan, 2007). Co-integration analysis is used to

study relationship and co-integration of the stock

index, futures, options, mutual stock fluctuations and

so on, by the methods of ADF, Johansen, Granger

Test, but all of these methods cannot describe the

nonlinear characteristics. There is a lot of studying

on a short-term or long-term prediction of a stock

index, but less about mutual prediction. Support

Vector Machine (SVM) theory is based on statistical

learning theory, and the approximately realize of the

minimization structural risk, the effective prediction

of stock index by the method of SVM regression

prediction gives powerful message about the overall

change in the stock market, which makes sense for

index prediction. The mutual authentication and

prediction of different stock index as the training

data gives us a new method to understand the

relevance and synergy of securities market change.

China's stock market is still in "weak efficient

market", which is not a simple linear and orderly

market; it is the financial market with complex

nonlinear characteristics. Not only investors is

irrationality with overreaction occurs or lack of

reflect, but also the market is often unstable. With

the internal features of nonlinear, discontinuous, the

time-series of the stock market and SVM methods

have similar characteristics. The paper establishes

SVM neural network model, with the Shanghai A

Share Index and Shenzhen A Share Index as the

training data, then it analyzes other indexes

(including the Shanghai A Shares Index and

Shenzhen A Shares Index) for regression predict. By

analyzing the predicted results and the forecast error,

we study the correlation and collaboration between

218

Zhu M. and Li J..

MUTUAL INTERDEPENDENCE OF STOCK MARKETS BASED ON SUPPORT VECTOR MACHINE.

DOI: 10.5220/0003552702180221

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 218-221

ISBN: 978-989-8425-54-6

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

different indexes.

2 MANUSCRIPT PREPARATION

2.1 Basic Principles

Support Vector Machine (Cortes and Vapnik, 1995)

which is proposed by Vapnik firstly, establishes a

separating hyper plane as a decision surface to

maximize interval edge between the positive cases

and the counter cases, , its learning strategy is a

structural risk minimization principle (minimize the

expected risk, and also minimize the empirical risk

and confidence interval). Practical issues will be

converted by a nonlinear transformation to high-

dimensional feature space; in the high-dimensional

space it constructs linear decision function to realize

the nonlinear decision function of the original

spaces. The key of SVM learning algorithm is the

concept of inner product kernel between the support

vector x (i) and the input control vector x. SVM is

composed with small subset which is extracted from

the training data by the algorithm. SVM neural

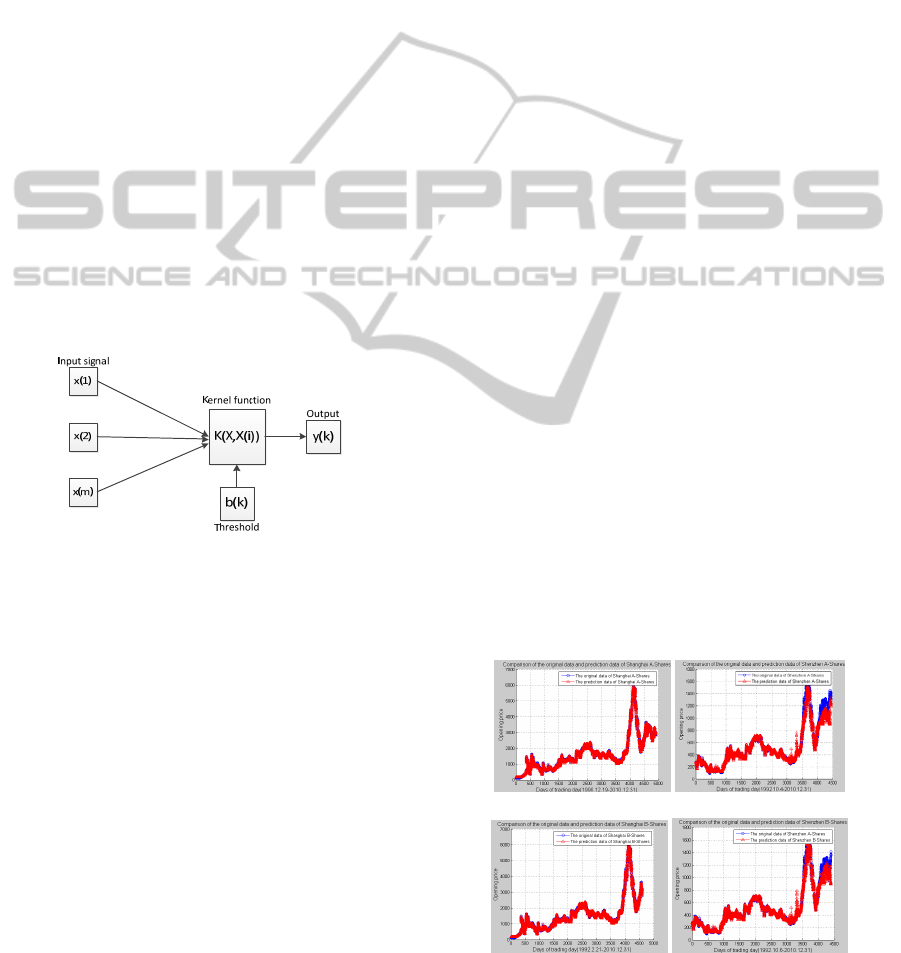

network system is shown in Figure 1.

Figure1: SVM neural network system.

The method of Kernel Function avoids the

specific form of nonlinear mapping, so that the field

of linear learning achievements can be naturally

extended to non-linear learning areas, with the

kernel function instead of the linear term of linear

equations, it can make the original linear algorithm

"nonlinear", which can do linear regression. The

class of Kernel Function mainly includes linear

kernel, polynomial kernel function, radial basis

function and the two-sensor kernel function.

2.2 First Section

(1) Data selection: Select the opening index, the

closing index, total volume, total turnover, the

highest index, the lowest index of a stock index

trading day (as the penultimate trading day) as

independent variables, and the opening index of the

corresponding trading day ( from the second date) as

the dependent variable.

(2) Data normalization: Using the mapminmax

function of Matlab, it normalizes, of the independent

variables and dependent variable respectively.

(3) Parameters selection: it optimizes the penalty

parameters c and kernel function parameters g of

SVM by genetic algorithm.

(4) Training and prediction: it uses the best

parameters c and g to train SVM model, and uses

different index to do regression prediction for

studying the regression results and errors.

3 EMPIRICAL STUDY

In this paper, the research object includes the

Shanghai A Share Index from December 19, 1990 to

December 31, 2010, the Shenzhen A Share Index

from October 4, 1992 to December 31, 2010, the

Shanghai B Share Index from February 21, 1992 to

December 31, and the Shenzhen B Share Index from

October 6, 1992 to December 31, 2010, it remove

unreasonable data and select the opening index, the

closing index, total volume, total turnover, the

highest index, the lowest index as major indicators,

it uses different stock index as the training data to

study the mutual predictability and interoperability

of them.

3.1 Mutual Predictability of the

Shanghai A Share Index and Other

Share Indexes

The Shanghai A share index is the training data in

model 1, it respectively predicts the Shanghai A

share index, Shenzhen A share index, Shanghai B

share index, Shenzhen B share index, it comes to

c = 67.6781, g = 25.5882 through training.

(1) (2)

(3) (4)

Figure 2: Comparisons of the original data and prediction

data in Model 1.

MUTUAL INTERDEPENDENCE OF STOCK MARKETS BASED ON SUPPORT VECTOR MACHINE

219

(1) (2)

(3) (4)

Figure 3: Relative error in Model 1.

For each share index, it use Shanghai A share

index SVM neural network forecasting model to

predict. Figure 2 shows the results of the regression

prediction and the original data of the Shanghai A

share index, Shenzhen A share index, Shanghai B

share index, Shenzhen B share index, Figure 3

shows the relative error of each index, it can be seen

that Shanghai A share index has the mean square

error of 3.0629e-005, the correlation coefficient of

99.898%; Shenzhen A share index has the mean

square error of 0.00142668, the correlation

coefficient of 97.9941%; Shanghai B share index

has the mean square error of 3.13279e-005

correlation coefficient of 99.8898%; Shenzhen B

share index has the mean square error of

0.000907803, the correlation coefficient of

98.4753% by calculating. It shows that the

predictability between Shanghai A share index and

B share index is strong, investors in Shanghai Stock

Exchange have the same expectations between A

share and B share, they have strong nonlinear

interdependence. The Shanghai A share index,

Shenzhen A share index and Shenzhen B share

index also can mutual predict with a certain degree

of interdependence, but week than The Shanghai A

share index and The Shanghai B share index. The

degree of interdependence between Shenzhen Stock

Exchange and Shanghai Stock Exchange is

relatively low, investors always focused on a

particular stock investment in the same exchange

market; it has poor coordination between different

markets.

3.2 Mutual Predictability of the

Shenzhen A Share Index and Other

Share Indexes

The Shenzhen A share index is the training data in

model 2, it respectively predicts the Shenzhen A

share index, Shenzhen B share index, Shanghai A

share index, Shanghai B share index , it comes to

c = 2.48966, g = 75.2551 through training.

(1) (2)

(3) (4)

Figure 4: Comparisons of the original data and prediction

data in Model 2.

(1) (2)

(3) (4)

Figure 5: Relative error in Model 2.

For each share index, it use Shenzhen A share

index SVM neural network forecasting model to

predict. Figure 4 shows the results of the regression

prediction and the original data of the Shenzhen A

share index, Shenzhen B share index, Shanghai A

share index, Shanghai B share index. Figure 5 shows

the relative error of each index, it can be seen that

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

220

Shenzhen A share index has the mean square error

of 2.82236e-005, the correlation coefficient of

99.9429%; Shenzhen B share index has the mean

square error of 1.42277 e-004, the correlation

coefficient of 99.7345%; Shanghai A share index

has the mean square error of 0.00186936, the

correlation coefficient of 93.9273%; Shanghai B

share index has the mean square error of 0.00173146

correlation coefficient of 93.9391% by calculating.

It shows that the Shenzhen A share index and

Shenzhen B share index have strong mutual

predictability, it has a strong nonlinear

interdependence, but less than index in the Shanghai

Stock Exchange, the Shenzhen B share index is

more affected by Shenzhen A share index. Mutual

prediction between the Shanghai A share index

Shenzhen A shares and B share index is week than

indexes in the same stock market, but they also have

some interdependence, the results of the previous

model is verified by model 2, consistent with the

actual situation.

4 CONCLUSIONS

With the gradual development of socialist market

economy, investors gradually obtain a reasonable

expectation by historical data and portfolio analysis,

so that investment is increasingly rational, and any

changes in a stock market information will affect

other securities market, cooperatively of stock

markets becomes the more and more stronger. In the

paper, it establishes two SVM neural network

regression prediction model to analyze mutual

predictability and cooperatively of Shanghai A

shares, Shanghai B shares, Shenzhen A shares and

Shenzhen B Share Index, we know that two indices

in a same stock exchange have a strong nonlinear

interdependence, the index of the various exchanges

also have a certain dependence, Shanghai Stock

Exchange affect Shenzhen Stock Exchange

relatively larger.

ACKNOWLEDGEMENTS

This paper was supported by “the Fundamental

Research Funds for the Central Universities

(2011YJS028)”.

REFERENCES

Shi Daimin. Research of Co-integration for the Stock

Index Fluctuation of Shanghai and Shenzhen Stock

Markets [J], Quantitative And Technical Economics,

2002, 19 (9) _3.

Wei-Bin Yu, Ying Fan, Yi-Ming Wei, etc. The co-

integration Analysis of the Brent Futures Market [J].

Application Of Statistics And Management, 2004, 23

(5) _7.

Qin Wei Guang, Rei-Cheng Yang. Study on Linkage

between Chinas Stock Market Index and Main Index

for International Stock Market: Based on Co-

integration Analysis [J]. Technology Economics, 2010,

29 (11).

Cheng Xiyu, Chen Yufang. Non-linear Co-integration

Analysis on Dowjones Index and Nasdaq Index [J].

Systems Engineering--Theory & Practice, 2004, 24

(7)_5.

Zheng Pi-e, Ma Yanhua. Rbf Neural Network-Based

Stocks Market Modeling And Forecasting [J]. Journal

Of Tianjin University, 2000, 33 (4) 4.

Chen Ping, Wang Chengzhen, Zhou Jun and so on.

Prediction and Analysis for the Index of Shanghai

Stock Exchange by SAS System on Monthly Data [J].

Systems Engineering-Theory & Practice, 2003, 23

(6)_7.

Chen Xing, Meng Weidong, Yan Taihua and so on.

Forecasting Stock Market Quotations via Fuzzy

Neural Network Based on TS Model [J]. Systems

Engineering - Theory & Practice, 2001, 21 (2)_7.

Zhang Yuchuan, Zhang Zuoquan. Application of Support

Vector Machines in Stock Price Predicting [J]. Journal

Of Beijing Jiaotong University, 2007, 31 (6)_4.

Corinna Cortes and V. Vapnik, "Support-Vector

Networks, Machine Learning, 20, 1995

MUTUAL INTERDEPENDENCE OF STOCK MARKETS BASED ON SUPPORT VECTOR MACHINE

221