TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES

UTILIZATION

A Case Study of Saudi Arabia

Fahad Algarni, Y. Cheung and Vincent Cheng-Siong Lee

Clyton School of Information Technology, Monash University, Wellington Road, 3800, Melbourne, Australia

Keywords: Utilization, eMarketplace, Saudi Arabia, Online shopping.

Abstract: Many aspects of ICT such as use of smart cards, use of mobile phones and the internet have become

integrated into business operations today, becoming indispensable aspects of organizations. Recent

developments have seen the introduction of eMarketplaces which are virtual spaces where businesses and

consumers can interact and exchange goods and services. Whilst utilisation of eMarketplaces in many

regions of the world such as, North America, Europe and Asia are increasing, its adoption and utilization in

Saudi Arabia has been very slow. The aim of this paper was to investigate the current lack of utilisation of

eMarketplaces in Saudi Arabia. A comparison was made between utilisation of eMarketplaces in Saudi

Arabia and other parts of the world. Statistical data collected shows that utilisation of eMarketplaces in

Saudi Arabia is the lowest. Possible explanations were identified as weak ICT infrastructure in the country,

weak technological culture, undeveloped complementary services and lack of investment by the

government. Several strategies that can be used to address this problem are identified. An explanatory

model of eMarketplaces utilization is proposed in this paper with suggestions for further work in this area.

1 INTRODUCTION

The growth of information and communication

technology (herein referred to as ICT) in recent

years has affected many aspects of human life. This

technology has changed the way people

communicate, the way business is conducted as well

as the way people live in contemporary society. It is

an undeniable fact that ICT has an indispensable role

in society. In fact, ICT is the main enabling

technology for eMarketplaces activities.

Businesses have adopted ICT through various

strategies. These range from the simple use of email

to communicate with suppliers, consumers, other

businesses and other stakeholders to the use of

buying and selling on the internet. In addition,

consumers can share resources to gain complete

advantage. Most businesses are connected to each

other via the internet today, and those that are not

find it hard to operate without this elite business

model.

ICT is lower priced than conventional

communication models such as telephony and

postage. Businesses can also access and relay

information on a real time basis. This means that the

business can access current information to make

strategic decisions using this information.

For instance, eMarketplace is one aspect of ICT

that the Saudi Arabian government (herein referred

to as SA) is currently focusing on or should be

focusing on. Aleid, Rogerson, Fairweather and Ben

(2009) are of the view that one major aspect of

improving ICT in this country is the development of

a feasible infrastructure that can be used to control

and support it. This is given the fact that

infrastructure has been identified as one of the major

factors that affect the adoption and development of

ICT in any country (Steinbrook, 2009).

Another indicator of ICT consumption in most

countries around the world is the internet coverage

rate (Amit and Zott 2001). A high rate of internet

coverage in a country points to a correspondingly

high rate of ICT consumption. According to Amit

and Zott (2001), internet coverage is an indication of

the segment of the population that can easily access

the internet and the services therein. In SA, this

internet coverage rate is very low, and this translates

into low utilisation of eMarketplaces. According to

the Saudi Telecom Co. (herein referred to as STC,

63

Algarni F., Cheung Y. and Cheng-Siong Lee V..

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia.

DOI: 10.5220/0003495300630075

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 63-75

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

which is one of the major players in the ICT sector

in SA), the portion of Saudi residents who can

access the internet is approximately 3-4 percent (Sait

2002), and this has increased to 25 percent by 2006

(Eraqi, 2006). Given that not all internet users were

accessing eMarketplaces; the low rate of access to

eMarketplaces is significantly lower compared to

other nations around the world such as the United

States of America (Vandana 2010). Furthermore,

about 75 percent of these internet users in the

country were male (Sait 2002). This is due to the

fact that majority of businesses in this country are

owned and operated by men many of whom are aged

35 years and below, an indication that the younger

population are embracing technology more than the

older generation (Holz 2008).

Overall, the low level of eMarketplace utilisation

in the kingdom of SA can be appreciated when

several aspects such as accessibility to the internet

are compared with those of other developed nations.

For example, the United Nations Conference on

Trade and Development (herein referred to as

UNCTAD), is of the view that most internet hosts

are found in the United States of America and

Europe, some of the most developed nations in the

world. In fact, 89 percent of all internet hosts in the

world are found in these two regions (UNCTAD,

2003). Subsequently, the rate of eMarketplaces

access in these countries is also high.

1.1 The Need to Increase Utilization

of eMarketplaces

An eMarketplace is an emerging phenomenon in the

sphere of eCommerce. The definition of

eMarketplace given by Cyberindigo (2010) is the

one that will be used for the purpose of this paper.

An eMarket, according to Cyberindigo (2010), can

be conceptualized as a “virtual space” (1) used by

consumers and sellers to exchange goods and

services and carry out other business transactions.

Activities that take place in an eMarket are not

different from those in the conventional physical

market. There is exchange of information, buying or

selling goods, services are also exchanged. The

major difference between the eMarket and the

conventional market, and perhaps the only

difference, is the fact that the eMarket exists in

virtual space, over the internet. This is as opposed to

the conventional market where the buyer and the

seller have to establish physical contact.

Having looked at e-market as a concept, it is now

appropriate to expand it further and look at an

eMarketplace. Cyberindigo (2010) defines it as a

“virtual online exchange” (1), a place where

businesses register as either buyers or sellers. After

registering as such, the businesses can now

communicate with their suppliers, clients and other

stakeholders over the internet (Cyberindigo 2010).

Business operations such as negotiations, buying and

selling are also conducted through this

eMarketplace.

There are several services that are offered by

eMarketplaces. These include creation of an

electronic catalogue detailing the services and goods

offered by the business and their prices, structuring

of diverse business proposals, business negotiations

and such other services (Bakos, 1998). The

provision of these services depends on the demands

of the consumers and the sellers.

Adoption of eMarketplaces and utilisation of

services therein is not a uniform phenomenon. It is

dependent upon social factors such as culture,

location and economy. For example, the number of

people who use eMarketplaces today is higher than

that in earlier years. The rate of adoption in

developed nations such as United States of America,

Netherlands, South Korea and Australia is also

higher than that in developing nations such as Africa

and southern America (Nielson 2010).

Customers who use eMarketplaces in SA stand

to benefit by having the ability to shop at any time of

the day and at any day of the week (Sait 2002).

Unlike conventional physical market places that are

governed by business operating houses,

eMarketplaces are always connected to users.

Customers also have the benefit of accessing a large

assortment of goods and services from which they

can select what they want. This is especially so

given the fact that businesses find it more

convenient and low priced to advertise on

eMarketplaces, and as such, customers are exposed

to a huge variety of goods and services. Customers

can also operate from home or from the office,

without the need to travel. What they need is just a

computer and access to the internet. At the same

time, there will be less pollution due to reduction of

vehicles on the roads as well as other environment

related issues.

The aim of this study is to analyse the utilisation

of eMarketplaces in SA. We will look at various

aspects of this phenomenon, including the factors

influencing the adoption, challenges faced by

eMarketplaces in this country amongst other things.

The review of literature is used to contextualise the

current study within the wider field of

eMarketplaces and eCommerce in SA and in

extension, in the world.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

64

The structure of this paper is as follows: Section

2 reviews related literature that exists in the field of

eMarketplaces. In Section 3, we discuss issues and

challenges of Saudi Arabian eMarketplaces adoption

supported by a collection of statistical data. An

explanatory model of factors influencing the

utilization of eMarketplaces in SA is presented in

Section 4. Finally, in Section 5 we conclude our

findings and suggestions for future work.

2 LITERATURE REVIEW

The main aim of this analysis is to identify

knowledge lacuna that exists in the field and how the

gaps can be filled. The literature review will also

contextualise the current study within the larger field

of ICT and e-business.

2.1 Categories of eMarketplaces

Barratt and Rosdahl (2002) are of the view that

businesses, especially the emerging and established

small and medium scale enterprises, stands to

benefit from the adoption of eMarketplaces in their

operations. The benefits range from reduced

operation costs, efficiency and increase in volume of

sales among others.

However, Barratt and Rosdahl (2002) caution

that the benefits accrued by the business enterprise

will depend on the suitability of the type of

eMarketplace that the business selects and the

compatibility of this eMarketplace with the business

model and structure used by the organisation. This is

given the fact that there are several types of

eMarketplaces to be found in contemporary

ecommerce field.

Before embarking on an analysis of the various

eMarketplaces available in today’s web market, it is

important to note that a particular eMarketplace or

site can be operated in various ways. There are those

that are operated by third parties who have invested

in the eMarketplace and wish to make a return on

their investment (Alemayehu 2007). These investors

make returns by providing value adding services to

the sellers or the buyers accessing the market. These

services may include creation of electronic

catalogues and such others. Fees charged by owners

of these markets are used to make returns on the

investment made. Other markets are maintained on a

cost recovery basis by associations and other bodies

found within a particular field. For example, the

pharmaceuticals’ body in the kingdom of SA may

create an eMarketplace aimed at elevating the

visibility of their members. However returns made

from the operations of the site are not used to make

profits; rather, the eMarketplace is operated on a

non-profit basis, and the returns are only used to

recover the costs of maintaining the eMarketplaces.

Regardless of the type of operator maintaining

the eMarketplace, it is notable that the main aim is to

bring together interested parties for the sake of

conducting business. For example, the eMarketplace

created and managed by the pharmaceuticals’ body

in SA as indicated above may aim at bringing

together the sellers and buyers of the products in the

market.

As stated earlier, many types of eMarketplaces

exist in today’s virtual space. The distinction

between these eMarketplaces is made on the basis of

the business model that is adopted. Various

categories emanate from the kind of operations that

maintain the market as well as the motivation or aim

of maintaining that particular eMarketplace.

The following are some of the categories of

eMarketplaces identified by many scholars in this

field:

2.1.1 Independent eMarketplace

According to Pucihar and Podlogar (2005), this type

of eMarketplace is usually operated by a third party

who is running it just like any other business venture

aimed at making economic returns to the investor.

This kind of eMarketplace can be conceptualised as

a business to business online pedestal aimed at

making transactions between sellers and buyers

easy. The eMarketplace is accessible both to the

buyers and the sellers in a given industry, given that

these eMarketplaces are usually industry specific

(Pucihar and Podlogar 2005).

This kind of an eMarketplace requires buyers

and sellers interested in the services to register with

it. After the registration, they can access

advertisements and business quotations in that

particular industry (Pucihar and Podlogar 2005).

As stated previously, the aim of the operator of

such a platform is to make profits. As such, some

payments are to be made by those accessing the

market. This is no different from the revenues paid

to the authorities by a business operating within a

given physical market. The only difference is that

the charges made to the eMarketplace operators may

be lower priced than those made to the authorities in

the case of a physical market place.

2.1.2 Buyer Oriented eMarketplace

As the name implies, this type of eMarketplace is

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia

65

usually formed and maintained by a conglomeration

of buyers or consumers in a particular industry

(Kamel 2009). The major aim for such a platform is

to develop an efficient and conducive buying

environment for the consumers (Kamel 2009). For

example, the consumers and potential buyers are

able to achieve the best deals from the sellers, and as

a result, participation in such a platform reduces the

operation costs for the buyers. For example, a

consortium of construction industry operators may

create an eMarketplace to access the best equipment

to buy or hire for their work.

However, it is important to note that it is not only

the buyers that can access and use a buyer oriented

eMarketplace. Zhuo and Xinhe (2004) are of the

opinion that a buyer oriented eMarketplace can also

be used by sellers in a particular industry for their

own benefit. For example, the buyers can access

these eMarketplaces and place advertisements on

them. This is advantageous given that the sellers will

be able to reach out to a set of specific and target

audience in one go. On the other hand, buyers on

such an eMarketplace can make saving by perusing

the catalogues advertised and selecting the best

deals. As such, both sellers and buyers also benefit

from these eMarketplaces.

2.1.3 Supplier Oriented eMarketplace

This is a forum that is created and operated by a

consortium of sellers or suppliers in a given

industry. Mutlaq and Rasheed (2009) also refer to

this type of eMarketplace as a “supplier directory”

(p. 34). The aim of the eMarketplace, and that of the

sellers participating in it, is to create an efficient

sales conduit that has the ability to reach a large

number of consumers on the internet (Mutlaq and

Rasheed 2009).

Buyers can also access these eMarketplaces, just

like sellers can access buyer oriented market places.

The buyer can search these eMarketplaces on the

internet by the service of product that is being sold

(Zhuo and Xinhe 2004). The buyers can benefit from

these platforms by accessing information on sellers

in the industry and regions that they are interested in

where they may lack knowledge or experience. As

far as the sellers are concerned, they are able to

increase their volume of sales by enhancing their

visibility to the buyers who access such

eMarketplaces (Aleid et al 2009).

2.1.4 Vertical and Horizontal eMarketplace

This kind of eMarketplace can be conceptualised in

terms of the vertical up and down businesses in a

given market (Aleid et al 2009). Such businesses

benefit by cutting back their supply chain costs and

other distribution expenses incurred for the

suppliers.

A horizontal eMarketplace is one which takes

place when both the seller and the buyer are at the

same level. This is for example when two business

organisations with equal financial power, operating

within the same industry exchange goods on the

virtual market. An example is when a vehicle

manufacturer sells some spare parts to another

vehicle manufacturer in the country or outside the

country.

On the other hand, vertical eMarketplace takes

place when two parties occupying different levels in

the market exchange goods and services on the

virtual space. For example when a motor vehicle

supplier sells its products to a fast food company

online. Another example is when a motor vehicle

manufacturer sells its products directly to the

consumer in the virtual market. The manufacturer

and the consumer are at different levels in the supply

chain, and their interaction can be viewed as a

vertical one.

Unlike other eMarketplaces discussed earlier,

here suppliers and consumers from different markets

and localities are brought together (Aleid et al 2009).

An eMarketplace of this kind can also be used by

consumers to buy an assortment of products that

may not be related, such as office stationery and

furniture.

2.2 The eMarketplaces in the Middle

East Region: A Case Study of Saudi

Arabia

Globalization of financial markets and other sectors

have resulted in stiff competition particularly in the

banking sectors of the Middle East and its regions.

SA has a stable economy compared to other

countries as it is dominated by the oil sector that has

35% of the Gross Domestic Period. Even though the

rate of eMarketplace utilisation in this country is

low, evidence supports that the adoption of this

technology and ecommerce are emerging trends in

trade in SA (Aleid et al 2009). This field has the

potential to assist business operators in SA in facing

competition both nationally and internationally.

Zhuo and Xinhe (2004) opine that those

businesses and individuals in SA who access and

utilise eMarketplaces do so in response to various

economic factors. In the case of a business enterprise

using eMarketplace to market its products, the main

aim and motivation behind this may be the need to

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

66

sustain its competitive advantage in the market by

expanding its market and increasing its sales

volume. On the other hand, consumers just like

those from any other countries in the world, may be

looking for the best deals in the market.

eMarketplaces have many benefits both to the

businesses and consumers in SA. According to

Alemayehu (2007), the telecommunications

expenses for businesses are significantly reduced.

This cuts back on the inventory overheads for these

businesses. For example, by making use of

eMarketplaces, businesses do not need to print

marketing brochures and posting them to the clients.

The businesses do not necessarily have to engage in

other modes of marketing campaigns such as

advertising on print media.

A number of issues to be considered when using

eMarketplace include how fit is the industry,

management of and ownership of the eMarketplace

with its finances, costs of E-marketing and technical

issues among other factors. Information systems that

are used in the eMarketplace should have similar

features for easy access of transactions. The leading

business-to-business eMarketplaces i.e tourism

industries in the Middle East have enhanced its

promotion by facilitating services to attract more

customers in the eMarketplaces (Buhalis, 2007).

Gulf oil and gas portal is a specialised government

owned eMarketplace for oil services in the Middle

East and its regions. RAK was established as a trade

online exhibition for business transactions that have

features to promote one-product and market goods

and services in the Internet. The current utilization

of eMarketplaces in some of the Middle East regions

including the following countries: SA, UAE, Jordan

and Kuwait mainly depend on the internet

penetration as it assists the growth of eMarketplaces

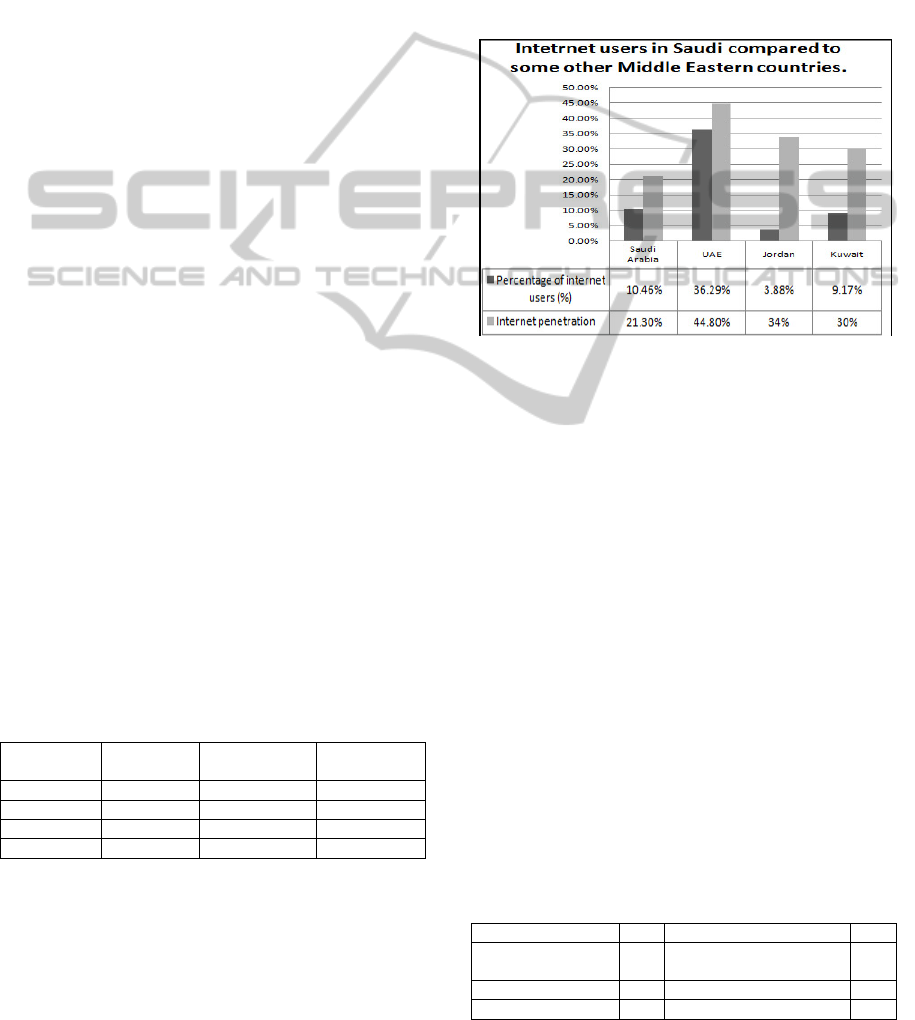

consumption (Eraqi, 2006). Table 1 shows statistical

comparison on that internet users and penetration

Table 1: Number of internet users in some of the Middle

Eastern countries, Adapted from: (Eraqi, 2006).

Populations in

million

Country

Percentage of

internet users (%)

Internet

penetration

24.29 SA 10.46% 21.3%

2.48 UAE 36.29% 44.8%

5.46 Jordan 3.88% 34%

2.18 Kuwait 9.17% 30%

Table1 shows the number of internet users in SA

compared to UAE, Jordan and Kuwait. These

countries are all located in the Middle Eastern region

as mentioned previously. Considering that not all of

internet users are interested in utilizing the

eMarketplaces (Jalal and Maskati, 2010), this

presents the fact that there is still a big gap between

Middle Eastern countries including SA and other

developed nations. However, despite low utilization

of eMarketplaces in the Middle East region,

government support in those countries is growing

compared to other countries in the world. Developed

countries such as, USA, Netherlands and South

Korea have higher percentage of internet users and

internet penetration and consequently they have

higher average of eMarketplaces utilization (Jalal

and Maskati, 2010).

Figure 1: Comparisons between the number of internet

users in some of the Middle Eastern countries, Source

(Eraqi, 2006).

Figure 1 further illustrates the number of internet

users, utilization averages for several nations of the

Middle East including SA, and their utilization

averages. Despite the fact that the United Arab

Emirates and SA have a higher average number of

internet users than Kuwait and Jordan, the

percentage is still considered low compared to the

developed countries. In addition, eMarketplaces in

the Middle East region especially for both SA and

UAE have more business-to-business activities of

eCommerce than the business to customer

eCommerce following the past decade’s commerce

analysis (Ferguson and Yen, 2006). Thus, the

utilization rate of eMarketplaces in SA requires

further improvement. This includes identifying

factors affecting customer satisfaction in regards to

eMarketplaces activities.

Table 2: The current and intended percentage of

eMarketplaces adoption in the Middle Eastern region,

Source: (Adam & Deans, 2008).

Current status % Intended status %

Countries adopting

eMarketplaces

16 Countries adopting

eMarketplaces

48

No plans 61 No plans 42

uncertain 5 Uncertain 17

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia

67

Table 2 shows the current and intended status of

eMarketplaces adoption. The current status of

eCommerce generally in Middle East indicates that

the many countries amounting to 61% have no plans

to adopt eCommerce with only 16% of the countries

using eCommerce. This low percentage of adoption

can significantly affect the eMarketplaces utilization

as it is a prime and major component of eCommerce.

.However, the future intended status is that more

countries will implement and adapt eCommerce

while the countries with no plans were being

reduced at the rate of 48% and 42% respectively.

Thus the future of the eMarketplaces in the Middle

Eastern region including SA can be improved by

finding and tackling challenges that are facing its

diffusion.

3 ISSUES AND CHALLENGES OF

SAUDI ARABIA

eMARKETPLACES ADOPTION

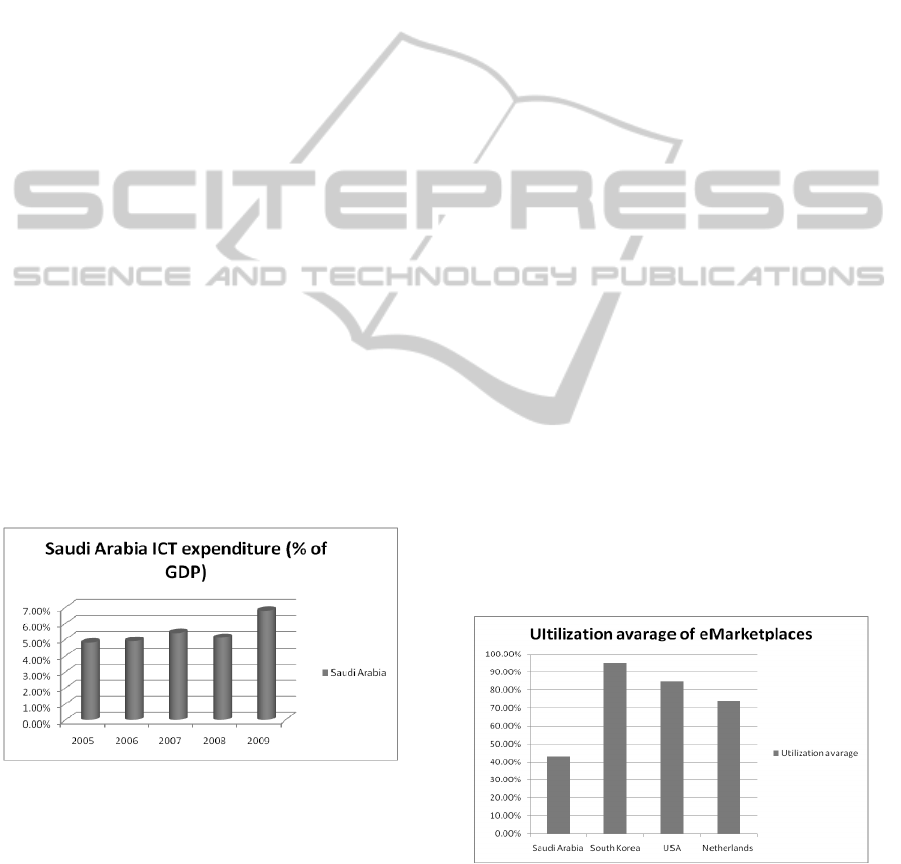

3.1 Overview

A survey carried out in 2008 by the Arabs Advisors

Group, showed that buyers in SA spent about 3.28

billion dollars doing online transactions in the year

2007(Al-Hawari 2008). The government of this

country also invested significantly towards the

utilisation of eMarketplaces in this country. Figure 2

depicts this spending from 2005-2009:

Figure 2: The Saudi government spending on ICT in SA,

Source: TheWorldBankGroup, 2010a).

Additionally, the rise in internet consumption as

compared to previous years has been attributed to

the rise in the population size in this country. For

example, by the year 2005, population size has

increased to about 23.4 million (Solbi and Mayhew

2005). Moreover, despite the fact that growth of

internet usage in SA has reached 27.1% in

2009(CDSI, 2010), the proportion is still considered

low. A study conducted by Mutlaq and Rasheed

(2009) found that there are several threats facing the

adoption of ICT in SA. For example, they found that

infrastructure issues such as low and slow

connectivity, lack of or inadequate investment in the

sector and lack of appropriate human resource are

some of the hindrances to ICT for businesses here. It

should be noted that any hurdle facing adoption of

ICT in businesses means that eMarketplaces are also

affected, given that the latter rely on ICT

infrastructure and accessibility

3.2 Lack of Utilisation of

eMarketplaces in SA:

Possible Explanations

The following are some of the possible explanations

to low utilisation of eMarketplaces in SA:

3.2.1 Security Issues

According to the study conducted by Mutlaq and

Rasheed (2009), 70 percent of consumers in the

kingdom of SA are of the view that security is their

major concern when it comes to buying or selling

online. This is especially so given the fact that to

buy from the eMarketplace, personal details such as

names and account details are needed. Of major

concern is the disclosing of credit card details to

eMarketplaces sellers.

The level of concern that the people in this

country have as far as the security of the internet is

concerned is clearly indicated by a comparison

between the utilisation of eMarketplaces in this

country and in other developed countries such as the

USA. Figure 3 depicts this comparison:

Figure 3: Comparison of the utilization average of

eMarketplaces between SA and some of the developed

nations, Adapted from: (Nielson, 2010).

Alemayehu (2007) puts this concern down to the

conservative nature of people from this region. They

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

68

are of the view that consumers are naturally adverse

to anything new that may destabilise their existence.

While this may not exactly be true, it is also a major

concern to many people in SA that the rate of

eMarketplace utilisation in this country is very low.

However, Alemayehu (2007) believes that

security concerns can be addressed by ensuring that

safety measures such as secure sockets layer are

implemented. This way, consumers can exchange

data between their systems and that of the supplier in

a secure manner. This makes the customers

confident, and they can use the services without fear

of their details been accessed by unauthorised

parties.

Strong encryption servers which cannot be easily

hacked can also be used to ensure the information

and data on eMarketplaces in SA is secure (Aleid et

al., 2009). Security also can build consumers’ trust

(

Hoffman et al., 1999).

3.2.2 Undeveloped Complementary Services

For eMarketplace to flourish there is a need for

supporting services and technologies to be

developed. This is for example training of

businesses’ members of staff and the population in

general and equipping them with IT skills, which is

an important prerequisite for eMarketplaces. This

has not taken place in SA. Kamel (2009) is of the

view that only 35 percent of the population in SA

have the skills needed to utilise the internet. Low

utilisation of the internet means that eMarketplaces

are also under utilised (Ariba, 2000).

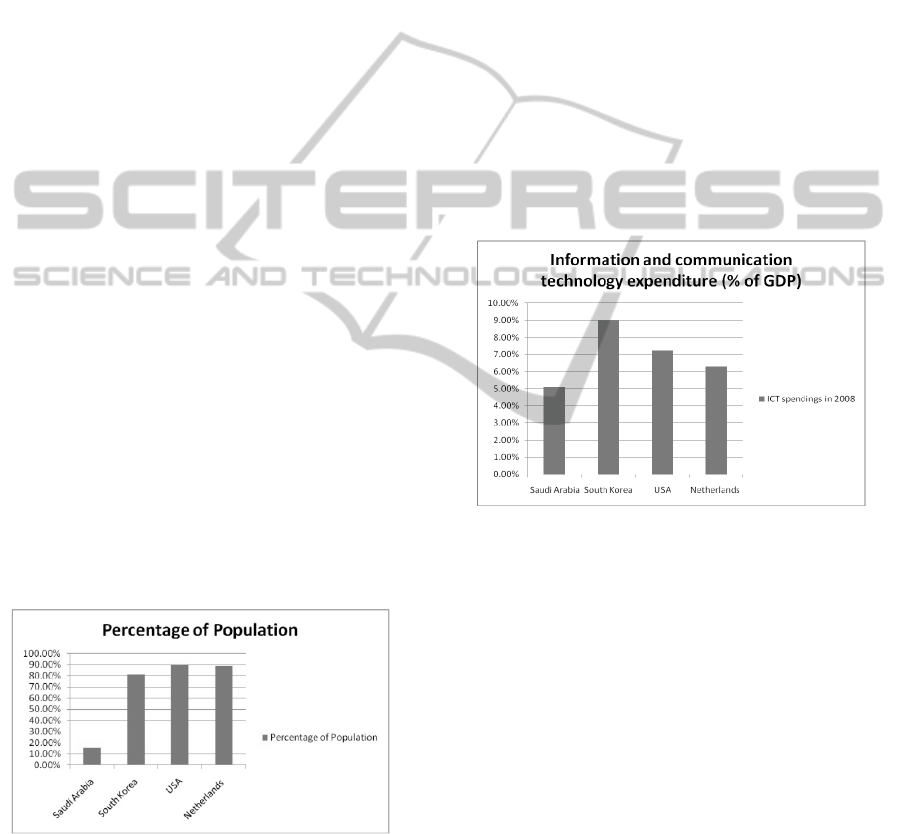

Figure 4 compares the internet coverage between

SA and other developed nations such as USA and

South Korea:

Figure 4: Comparison of ICT usage average of population

in SA, USA, Netherlands and South Korea, Source:

(Nielson, 2010).

It is important to note that the rate of internet

coverage in the country is an indication of the rate of

development of other complementary services such

as the availability of computers.

The challenge of underdeveloped complementary

services can be addressed by having the government

and other stakeholders invest more in ICT. For

example, buying more computers for schools and

other initiatives, like making teaching of IT skills

mandatory to all school going children.

3.2.3 Weak Infrastructure

An effective and strong eMarketplace needs an

equally efficient and strong infrastructure. However,

in SA, ICT infrastructure is not as effective as it

should be. Compared to spending on eMarketplaces

by other countries in the world, this can be due to

the low rate of investing in this sector by the Saudi

government and other stakeholders in the private

sector. Figure 5 represents a comparison of the

portion of GDP that was spent on ICT in SA and in

the previous mentioned developed countries in the

year 2008:

Figure 5: GDP comparison spending by governments of

SA and some other developed nations on ICT, Adapted

from: TheWorldBankGroup, 2010a).

As seen from the figure, spending of the Saudi

Arabian government in ICT was only 5% of GDP

compared to 9% of the South Korean expenditures.

Consequently, spending on eMarketplaces was less

than 5% as ICT spending includes non-

eMarketplaces operations.

At the same time, infrastructure such as secure

servers and internet coverage are also lacking. This

makes it hard for the people to access the internet

and eMarketplaces.

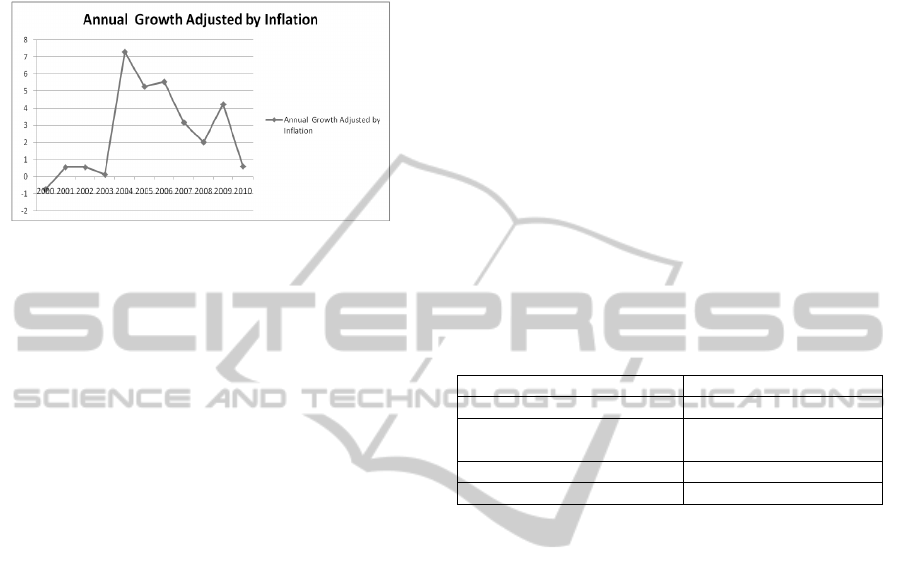

3.2.3.1 Impact of Strong eMarketplaces

Infrastructures on the Economy

Growth of Saudi Arabia

The kingdom of SA has a large potential for

utilisation of eMarketplaces. This is given the fact

that the economy of this country is one of the largest

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia

69

in the Arab world. The economy has also

experienced significant growth in the past few years.

Figure 6 depicts the growth of this economy in the

past ten years:

Figure 6: Economy growth in the past ten years in SA,

Source: TheWorldBankGroup, 2010b).

This means that if the government and other

stakeholders in this country invest more in this

sector, then the eMarketplaces in this country have

the potential to contribute significantly to the growth

of the economy.

3.2.4 Reliability of eMarketplaces

Reliability in eMarketplaces typically means

dependability. In research context, the word reliable

also means the probability of a failure free system

that consumers can rely on (Lyu, 1996) , however

that is not the precise meaning. Having a reliable

measure or observation in a research perspective can

be confused simply with the thought of a valid

measure. Therefore, describing reliability measure

in eMarketplaces has to be defined precisely in order

to gain and understand clearly its context.

Assessing reliability in eMarketplaces, (as a part

of e-business processes) is still a difficult and time

consuming task (Anderson et al., 2005). However,

reliability could also mean consistency. An

eMarketplace is considered reliable if it provides us

the same results in different cases assuming that the

eMarketplace we are assessing is consistent. Thus,

consistency is highly required for all facts that

contribute positively in measuring reliability.

Factors like connectivity(Zhang et al., 2009) where

the eMarketplaces are connected at all times and

also consumers have the ability to access it together

with accuracy (Auer and Biffl, 2004)and(Yang et al.,

2005) means eMarketplaces have the ability to

perform precisely, are trustworthy and dependable

for all consumers in at all stages of the eMarkeplace

processes (Kohlas et al., 2006).

A study conducted by McKnight et al(2002)

shows that, internal consistency reliability is

considered as an important factor that raises the trust

of online consumers. In addition, they explained that

eCommerce consumers measure eMarketplaces not

in broad terms, but in terms of precise attributes.

Trusting attitude can also enhance reliability of

eMarketplaces even in the preliminary stage.

3.2.4.1 Types of Reliability

Reliability is a major consideration when analyzing

the application and success of eMarketplaces. As a

result there are several ways in which reliability of

eMarketplaces can be ascertained.

There are several reliability identities which are

used in the study of eMarketplaces. As shown in

Table 3. The information is crucial in the

formulation of policies as well as to ensure the

overall success of eMarketplaces (Daniels &

Harrington 2006)

and

(Brombacher et al., 2005).

Table 3: Types of Reliability.

Reliability Identity Essence

Inter observer reliability Scope of eMarketplace

Examining re-examining

reliability

Desired results

Parallel figures reliability Diversity role

Inner consistency reliability Consistency and depth

Inter-Observer Reliability plays a significant role

in the whole aspect of determining the scope of

eMarketplace in a given area. This term suggests the

analysis of how viewers of different calibres

perceive a particular eMarketplace based on the

belief that several opinions can provide better

understanding to a given concept. Under normal

circumstances, there cannot be the same evaluations

by different observers. Thus, with the use of inter

observer reliability; there will be different

evaluations of the same aspects. This seeks to

analyze and derive meaningful interpretations from

the conflicting perceptions.

The marketing strategy may also be hindered by

the distribution of the product (Knolmayer, Martens

& Zeier, 2002). As a company launches into

extensive marketing strategy, it should also have in

place a strong distribution channel to support its

marketing strategy. With the expansion of

eMarketplaces utilization, local products are gaining

popularity on the international market. Customers

may be disappointed if the company cannot

efficiently supply them with the products/services.

Examining-Re-examining reliability can provide

feedback on actual outcomes to improve the

processes. Companies can apply this type of

reliability for same group of customers during

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

70

different periods of time. Results obtained from

previous examinations can assist companies to

further enhance their eMarketplaces services.

Parallel figures reliability evaluates necessary

information for eMarketplaces measurement by

setting different tests for different participants at the

same period of time. For instance, a company that

provides eMarketplace services may wish to develop

a large set of questions for testing the reliability of

its software. Using different sets of questions, the

company chooses the most consistent results of one

set for evaluation (Beizer, 2002).

Through inner consistency reliability it is

possible for the eMarketplaces providers to

determine its consistency viability for decision

making. As consistency plays a significant role in

assisting the consideration of eMarketplaces

(Lockett and Brown, 2006). This type of reliability

evaluates in depth the consistency of eMarketplaces

by testing different sets of questions of the same

construct. For example, a company may wish to set

altered questions to test the consistency of a specific

function for their eMarketplace. Results then

compared to each other for their ability to provide

consistently proper outcomes. Through this it

becomes possible to understand whether the

eMarketplace is viable or not. As consistency is a

key factor in the whole process of evaluating

eMarketplaces (Grudzewski, 2008).

Hence, applying all types of reliability

mentioned previously can significantly improve the

reliability and efficiency of eMarketplaces thereby

increasing their utilization. This is ideal for SA to

exploit these techniques for further developments in

the field of eMarketplaces.

3.2.5 Regulatory Requirements

of eMarketplaces

When the internet came into the kingdom of SA, it

brought a new challenge to the government. The

government did not want to create a situation where

the new technologies interfered with the cultural

beliefs of the country. Thus eMarketplace regulatory

mechanisms stem from two main forces, i.e. the

eGovernment and cultural values of the country

provide an environment of checks and balances

within the eMarketplaces environment.

Initially eMarketplaces activities had no formal

regulations. As widely believed, regulations were

expected to distract the growth of the markets.

However, it resulted in many notable legal disputes

and security concerns worldwide. Armed with this

information the Saudi government decided to put in

place measures to control trading in eMarketplaces.

It started with the government’s adoption of

technology by introducing the eGovernment. This

initiative sent a strong message to the community at

large. ICT is now being continually embraced in

hospitals, schools and other businesses. For instance,

SA colleges are now using and sharing open source

courses (Lewin, 2009).

The eGovernment, which was established

following a royal directive in March 2003, has put in

place measures for regulation of eMarketplaces in

the region. In addition, the Ministry of Finance

recently implemented what was called the Saudi

Project for Electronic Data Interchange (SaudiEDI).

The main aim of this initiative was the securing of

speed and transparency in the business environment

of eMarketplaces. The SaudiEDI applies both to

import and export services on the trade market. The

SaudiEDI implies that there will be electronic

interchange of information of the consignment, the

delivery papers, as well as the other main items of

information in the context of import and export.

These procedures involve different agencies which

include customs department, shipping agents,

clearing agents, and even general ports department

(World Summit on IT, 2005). This has an overall

effect of creating a safe environment for trade for the

private sector, the international community as well

as the citizens.

Cultural issues have also been a factor that has

largely contributed to the regulation of the

eMarketplaces. Predominantly, SA is a Muslim

kingdom. Muslims in SA are obligated to implement

Sheria law in all aspects concerning their lives. From

a purely commercial perspective, Islam Sheria law

has provided its faithful with guidelines. These

guidelines are not to be ignored and neither are they

to be infringed. Bringing to attention this affects the

eMarketplaces as reference has to be made to what

the Sheria law has to say concerning it first before it

can be accepted (Edward, 2008).

Since the advent of the eMarketplaces, one of the

biggest concerns for the government was whether it

contravened the teachings of the Quran. The Sheria

law has laid down procedures and regulations for

businesses. It has is unique terminologies which can

not be ignored in a trading environment, for

example, processes for the contract of sale, the

meeting place and absentee purchases. As the Quran

teaches that a purchase should not be initiated by

two parties in one place and then later wrapped up in

a totally different place. This presented very unique

problems (and largely contributed to the laxity of the

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia

71

people to adopt the eMarketplaces) to the utilization

of eMarketplaces in SA (Alzaagy, 2007).

The Monarch of SA established a committee by a

royal decree to look into the eCommerce details and

if it could be seamlessly adopted in the context of

the Sheria law. It was later realized that the Sheria

law was in fact friendly to E-commerce. Convincing

the staunch Muslims of this fact is what has been a

white elephant for the committee (World Summit on

IT, 2005). However, in the case of E-markets there

was a need of further scrutiny by Muslim kadhis or

jurists to establish the accepted practices in the

Quran.

As the Kadhis and Muslim Jurists examined the

Sheria Law in the light of eMarketplaces, it was

discovered that the door has been left open. It

indicates that eMarketplaces activities can be ruled

upon by the most suitable and convenient approach.

This precipitated into the gradual entrance of

eMarketplaces into the region.

Generally, it can be said that the government has

recognized the importance of the ICTs and began

embracing the emerging trends in a bid to be abreast

with the rest of the world. The government envisions

a strategic plan for 2020 in the 7th development plan

to have fully embraced the necessary ICTs.

Nationally, precedence has been set by the

government’s ambitious e-government project. The

national policy document for ICT was also adopted

by the ministers. This document envisages the

development of ICTs with the needed mechanisms

that will be used in meeting this objective. In line

with this, the Saudi Computing Association has been

mandated with the task of preparing a national IT

plan. The government wants to make sure it is at par

with the rest of the world as far as technological

advancement is concerned.

There is a direct relationship between the

government regulations and the cultural/religious

customs of the Saudis. The main reason for this is

the fact that SA is predominantly a Muslim kingdom

and like every other Muslim nation, the laws that

govern the land are the Muslim laws otherwise

called the Sheria law. For instance when the internet

came to SA in 1998, it was with the presence of

control mechanisms by the government to ensure

that unwanted content was filtered out. This was to

make sure that the internet was not used to violate

the teaching of the Islam faith and the cultural

believes of the Saudi Nationals. It was a balance that

would allow the people to enjoy the benefits of the

internet including eMarketplaces while at the same

time be protected from the malpractices of the

internet.

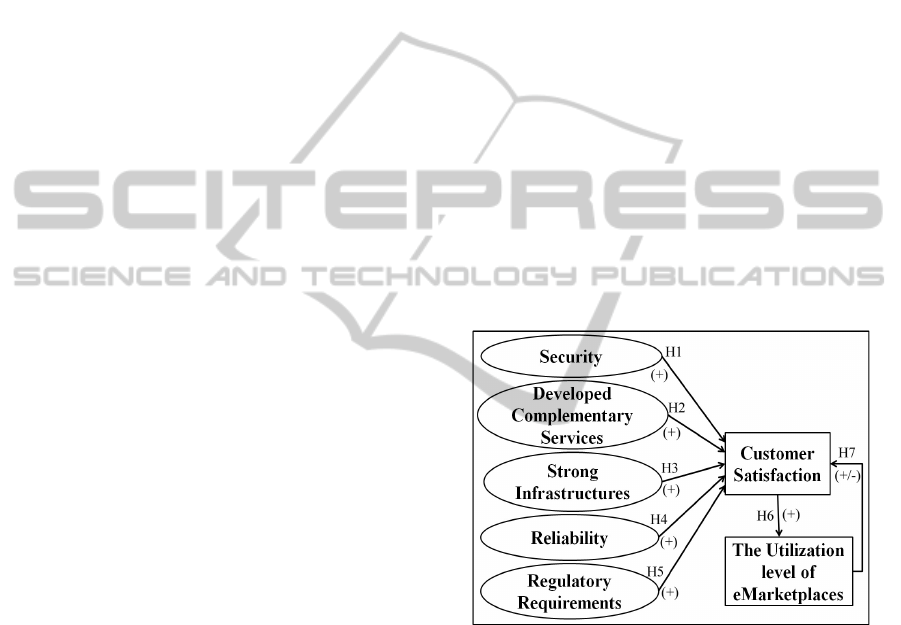

4 PROPOSED EXPLANATORY

MODEL

A number of influencing factors for eMarketplaces

utilisation are identified in this paper. Security being

the first and biggest concern of online shoppers has a

significant role to increase the current utilization rate

in SA (Mutlaq and Rasheed 2009). In addition,

reliability of eMarketplaces can raise the confidence

of eMarketplaces users (McKnight et al,2002). Thus,

these two factors require attention and further

investigations to gradually impact positively on the

utilization of eMarketplaces for Saudis.

Other factors shown such as strong

infrastructure, regulatory and complementary

services need to be highly considered by the

government to assist further development of

eMarketplaces in SA.

Based on the previous section the following

model is proposed to clarify the relationship between

all five factors. These factors can be applied to

identify the most appropriate eMarketplaces type

that suits Saudis:

Figure 7: Factors influencing the utilization of

eMarketplaces.

Figure 7 further demonstrates the significance of

the relationship between the previously mentioned

factors in order to obtain higher utilization level of

eMarketplaces in SA. Higher utilization of

eMarketplaces can benefit both companies and

individuals. Consumers can comfortably shop and

obtain their purchases with efficient transactions as

mentioned earlier. Companies in the other hand can

avoid lagging behind competition with foreign

companies that have implemented their

eMarketplaces effectively. It also assists companies

to reduce transaction costs, improve audit of

capability and advance the relationship between

buyer and supplier of eMarketplaces (Howard et al.,

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

72

2006).

Thus further work involves addressing the following

questions:

Q1: Do current eMarketplaces have sufficient

security that assure confidence of online consumers?

Q2: How could developed complementary services

contribute to increasing the current utilization of

eMarketplaces in SA?

Q3: Does government funding for the

eMarketplaces infrastructure meet the required

levels in SA?

Q4: How can eMarketplaces’ reliability be

increased/maintained within SA?

Q5: How can the government of SA regulate

eMarketplaces appropriately?

Q6: How does customer satisfaction impact on the

utilization level of eMarketplaces in SA?

Q7: What type of relationship exists between the

utilization level of eMarketplaces in SA and

customer satisfaction of the eMarketplaces?

Hence, future studies could identify more factors

affecting the current utilization of eMarketplaces in

SA and its surrounding neighbours of the Middle

Eastern region. Further research can help in testing

the following hypothesises derived from figure 7:

H1. An advanced security system can develop

appropriate satisfaction for customers and therefore

increases the utilization of eMarketplaces in SA.

H2. Developed Complementary services of

eMarketplaces can increase the level of utilization of

eMarketplaces in SA.

H3. Stronger infrastructures can lead to higher

levels of customer satisfaction on eMarketplaces in

SA.

H4. Reliability of eMarketplaces can increase

customers’ satisfaction of eMarketplaces in SA.

H5. Abiding Regulatory requirements can influence

the utilization of eMarketplaces in SA.

H6. Customer satisfaction can enhance the

utilization of eMarketplaces in SA.

H7. The utilization of eMarketplaces in SA can be

increased/decreased in accordance with the increase

in customer satisfaction.

5 CONCLUSIONS & FUTURE

WORK

Current lack of utilisation of eMarketplaces in SA is

due to a number of factors i.e. weak infrastructures

and shortage of resources such as human resource.

The internet coverage in SA was found to be lower

than that in other developed countries such as the

United States of America, Netherlands and South

Korea.

These challenges affect the adoption of

eMarketplaces in this country. This is despite the

fact that the kingdom of SA is the economic nerve

centre of the Islamic world and has the largest

economy in the region, standing at approximately

160 billion dollars as of 2009. This means that there

is a large potential for eMarketplaces in this region,

a potential that can be exploited to further the

economic pursuits of this country.

Future comparative research could target these

areas to gain comparative national results. In

addition, measuring behaviours of users of

eMarketplaces can be desirable for future studies. In

order to determine the most appropriate evaluation

strategy for assessing our model, data collection

including web-based surveys, mail questionnaires

and personal interviews will be focused on the

development and improvement of the Saudis’

utilization of eMarketplaces.

REFERENCES

Adam, S. and Deans, K. R., 2008. Web qual: an e-

commerce audit, fib Australian world wide web

conference (pp. 2-5), Southern Cross University,

Hypermedia References, HREFI, Australia.

Aleid, F., Rogerson, S., Fairweather, N., and Ben, N.,

2009. Factors Affecting Consumers Adoption of

Ecommerce in Saudi Arabia from a Consumers’

Perspective. [Online]. Available: http://hdl.handle.net/

2086/4020. [08 November 2010].

Alemayehu, H. G., 2007. B2B eMarketplaces: How to

succeed. Business Strategy Review, 12(3): 20-28.

Alzaagy, A., (2007). The Islamic Concept of Meeting

Place and its Application in e-Commerce. 1(1) p. 45.

Al-Hawari, M., Al-Yamani, H., and Izwawa, B., 2008.

Small Businesses’ Decision to have Website: Saudi

Arabia Case Study. [Online]. Available:

http://www.waset.org/journals/waset/v37/v37-55.pdf.

[25 November 2010].

Amit, R., and Zott, C., 2001. Value creation in e-business.

Strategic Management Journal, 22(6-7): 493-520.

Anderson, B., Hansen, J., Lowry, P. & Summers, S., 2005.

Model checking for design and assurance of e-

Business processes. Decision Support Systems, 39,

333-344.

Ariba. N. M., 2000. B2B marketplaces in the new

economy. [Online]. Available: http://www.ariba.com/

com_plat/white_paperform.cfm. (8 November 2010).

Auer, M. & Biffl, S., 2004. Increasing the accuracy and

reliability of analogy-based cost estimation with

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia

73

extensive project feature dimension weighting. IEEE,

147-155.

Bakos, Y., 1998. The emerging role of electronic

marketplaces on the internet. Communications of the

ACM, 41(8): 35-42.

Barratt, M. and Rosdahl, K., 2002. Exploring business-to-

business marketsites. European Journal of Purchasing

& Supply Management, 8(2):111-122.

Bates, T., 2005. Analysis of young, small firms that have

closed: Delineating successful from unsuccessful

closures. Journal of Business Venturing, 20(3): 343-

358.

Beizer, B., 2002. Software testing techniques, Dreamtech

Press.

Brombacher, A., Sander, P., Sonnemans, P. & Rouvroye,

J., 2005. Managing product reliability in business

processes under pressure'. Reliability Engineering &

System Safety, 88, 137-146.

Buhalis, D., 2007. E Tourism: information technology for

strategic management. Prentice Hall, London.

CDSI, 2010. Saudi Arabia Social and Demographic

Statistics. In: Information, D. O. S. A. Kingdom of

Saudi Arabia. [Online]. Available: http://www.cdsi.

gov.sa/english/DemStats. [18 November 2010].

Cyberindigo, 2010. EMarketplaces. [Online]. Available:

http://www.cyberindigo.net/articles/emarketplaces.htm

. [8 November 2010].

Edward, M., (2008) Rim To Let Saudi to Monitor

Blackberry Data. [Online] (Updated August 7, 2010)

available at: http://news.cnet.com/8301-1035_3-

20012988-94.html (Accessed on 25th December

2010).

Eraqi, M., 2006. IT as a means for enhancing competitive

advantage. Anatolia-Ankara-International Journal Of

Tourism And Hospitality Research-, 17, 25.

Ferguson, C. W. & Yen, D. C., 2006. A regional approach

to e-commerce global expansion. International

Journal of Electronic Business, 4, 99-114.

Grudzewski, W., Hejduc, I., Sankowska, A. &

Wantuchowicz, M., 2008. Trust Management in

Virtual Work Environments: A Human Factors

Perspective, CRC Press.

Harrington, J. & Daniels, P., 2006. Knowledge-based

services, internationalization and regional develop-

ment, Ashgate Pub Co.

Hoffman, D. L., Novak, T. P., and Peralta, M, A., 1999.

Building consumer trust online, Communications of

the ACM, 42(4): 80-85, UK.

Holz, M. K., 2008. Ecommerce in the Arab countries.

New York: Free Press.

Howard, M., Vidgen, R. & Powell, P., 2006. Automotive

e-hubs: Exploring motivations and barriers to

collaboration and interaction. The Journal of Strategic

Information Systems, 15, 51-75.

Jalal, A. & Maskati, M. A., 2010. Insight of Online

Shopping Trend: An Empirical Study with relevance

to Bahrain. Global Journal of Enterprise Information

System, 2.

Kamel, S., 2009. Electronic business in developing

countries: Opportunities and challenges. London: Idea

Group Inc.

Knolmayer, G., Mertens, P. & Zeier, A., 2002. Supply

chain management based on SAP systems: order

management in manufacturing companies, Springer

Verlag.

Kohlas, R., Jonczy, J. & Hafnni, R., 2006. Towards a

precise semantics for authenticity and trust. ACM

, 1-9.

Lewin, T. 2009. In a digital future, textbooks are history.

The New York Times, 9.

Lockett, N. & Brown, D. H., 2006. Aggregation and the

Role of Trusted Third Parties in SME E-Business

Engagement. International Small Business Journal,

24, 379.

Lyu, M., 1996. Handbook of 9software reliability

engineering, McGraw-Hill, Inc. Hightstown, NJ, USA.

McKnight, D., Choudhury, V. & Kacmar, C., 2002. The

impact of initial consumer trust on intentions to

transact with a web site: a trust building model.

Journal of Strategic Information Systems, 11, 297-323.

Mutlaq, A. O. and Rasheed, M. A., 2009. e-Commerce

Adoption in Saudi Arabia: An Evaluation of

Commercial Organisations’ Web Sites. King Saudi

University.[Online]. Available: http://faculty.ksu.edu.

sa/DrRasheed/My%20Publications/Saudi_Websites.pd

f. [8 January 2011].

Nielsen, A., 2010. Global Trends in online shopping: a

global Neilsen consumer report. Message post to:

http://hk.nielsen.com/documents/Q12010OnlineShopp

ingTrendsReport.pdf. [10 November 2010].

Pohjola, M., 2003. The adoption and diffusion of ICT

across countries: Patterns and determinants. The new

economy handbook, 77-100.

Pucihar, A. and Podlogar, M., 2005. e-Marketplace

adoption success factors: Challenges and opportunities

for a small developing country. Princeton: Princeton

University Press.

Sait, S. M., 2002. IT in Saudi Arabia: Status & Trends.

[Online]. Available: http://faculty.kfupm.edu.sa/

coe/sadiq/richfiles/rich/ppt/morocco.ppt. [8 November

2010].

Solbi, A. & Mayhew, P., 2005. Measuring E-Readiness

Assessment in Saudi Organisations Preliminary

Results From A Survey Study. Citeseer, 10-12.

Steinbrook, Y. E., 2009. Ecommerce in developed nations:

A case study of Asian economies. International

Journal of Management and Enterprise Development,

13(4): 82-88.

THEWORLDBANKGROUP, 2010. Information and

communication technology expenditure [Online].

Available: http://data.worldbank.org/indicator. (Acces-

sed November 29, 2010).

THEWORLDBANKGROUP, 2010b. World Development

Indicators [Online]. Available: http://data.worldbank.

org/data-catalog/world-development-indicators. (Ac-

cessed November 14, 2010).

United Nations Conference on Trade and Development

(UNCTAD), 2003. e-Commerce in Developed

Countries Continues on Strong Growth Path. [Online].

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

74

Available: http://www.unctad.org/templates/webflyer.

asp?docid=4253&intItemID=2261&lang=1. [8 Novem

ber 2010].

Vandana, M. N., 2010. ICT and SME’s in developed

nations. European Journal of Purchasing & Supply

Management, 3(8), 27-33.

World Summit on Information Technology (2005)

Information and telecommunication technology in

Saudi Arabia. Proceedings of the World Summit on

Information Technology of 2005. P.6-15.

Yang, Z., Cai, S., Zhou, Z. & Zhou, N., 2005.

Development and validation of an instrument to

measure user perceived service quality of information

presenting web portals. Information & Management,

42, 575-589.

Zhang, X., Jia, L., Dong, H., Wang, Z., Wang, K. & Qin,

Y., 2009. Analysis and Evaluation of Connectivity

Reliability for Dynamic Transportation Network.

Seoul IEEE, 353-356.

Zhuo, J. and Xinhe, J., 2004. Analysis of eMarketplace for

the textile industry in China. International Journal of

Management and Enterprise Development, 4(3): 337-

353.

TOWARDS AN EXPLANATORY MODEL OF eMARKETPLACES UTILIZATION - A Case Study of Saudi Arabia

75