RESEARCH OF CREDIT RISK OF COMMERCIAL BANK

PERSONAL LOAN BASED ON ASSOCIATION RULE

Zhang Zenglian

School of Economics and Management, University of Science and Technology Beijing, Beijing, China

Keywords: Commercial bank, Personal loan, Credit risk evaluation, Apriori.

Abstract: Guard against financial risks, reduce bad loans, increase the ability to identity risk of commercial banks, the

key is risk warning. In view of the increasing proportion of personal loans in banking business, it is

particularly important to warning personal loans credit risk. Commercial bank lending itself is a complex

nonlinear system, using general linear theory is difficult to objectively reflect the laws of this, this paper

uses association rule. Personal loan credit index first constructed, and then use apriori algorithm to extract

rules. Results showed that apriori algorithm plays an important role in identifying risk in personal loans.

1 INTRODUCTION

With China's rapid economic development, financial

markets are maturing and mature, the phenomenon

of individuals as financiers to participate in financial

markets has become increasingly common.

Experience from the commercial banks, if we can

properly address the credit risk management and

control, personal loans will be a rewarding business.

Individual loan risk management includes three

aspects: risk assessment (ie assessment of the

applicant's repayment ability and credit repayment to

decide whether to grant the loan), repayment

tracking, breach of contract, in which risk

assessment is essential. At present, relevant

information based on the applicant to rate, but also

the relevant rules need to decide whether to grant

loans. I let historical data of personal loans default,

use Apriori algorithm to extract association rules for

credit risk of personal loans.

For construction of early warning model of credit

risk, current methods are widely used multiple

discriminant analysis (MDA), logistic regression

discriminant analysis, neural network analysis and

other methods. Altman (1968) developed credit risk

Z-score model determined by a number of variables

(Altman et al., 1977), Martin (1977) used Logistic

and the MDA method to predict bank failures

(Martin D., 1977), Ohlson (1980) used Logistic

analysis the relationship between two types of

bankruptcy errors and split points, and achieved

certain results (Ohlson J., 1980). In recent years,

neural network technology as a self-organizing,

parallel processing and fault tolerance, etc., more

and more people's attention, Turban (1996)

discussed the neural network in the bank loan credit

risk management applications (Altman et al., 1994),

most research results showed that neural network

was superior to traditional statistical methods (Dan

and Mark, 2000). In China, represented by Wang

Chunfeng scholars used linear discriminant method,

logistic discriminant analysis and neural network

models and other methods to assess commercial

bank credit risk (Tian Chunyan, 2006). However,

these studies focused on business loans, commercial

banks cannot meet our need for personal loan default

warning.

Based on the above considerations, this paper

uses Apriori algorithm for credit risk analysis of

personal loans in commercial banks. Association

rules for market basket analysis first, this article will

introduce it to the field of risk assessment

information in order to tap the personal loans of

commercial banks, the most significant association

rules, and analyzes the interaction between the

factors.

129

Zenglian Z..

RESEARCH OF CREDIT RISK OF COMMERCIAL BANK PERSONAL LOAN BASED ON ASSOCIATION RULE.

DOI: 10.5220/0003413101290134

In Proceedings of the 13th International Conference on Enterprise Information Systems (ICEIS-2011), pages 129-134

ISBN: 978-989-8425-53-9

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

2 CONSTRUCTION OF

WARNING MODEL FOR

COMMERCIAL BANK

PERSONAL LOAN DEFAULT

RISK

Commercial bank personal loans default risk

warning model is to analyze the characteristics of

individual loans to impact on the probability of

default. Dependent variable is whether the breach of

contract, 1 default, 0 compliance. Default means an

individual cannot repay the loan principal and

interest on due, including subprime loans, doubtful

loans and loss loans. Subprime loan is borrower's

repayment ability apparent problem, totally

dependent on their normal income cannot guarantee

full repayment of loan principal and interest, even if

the guarantee may also cause some loss; Doubtful

loan is borrower cannot full repay the loan principal

and interest, even if the collateral or security, but

also sure to cause greater loss; Loss loan is taking all

possible measures and all necessary legal

procedures, the loan principal and interest is still not

recovered, or can only recover a very small part.

Compliance refers to a personal debt to maturity,

including the normal loans and interest loans.

Normal loan is the borrower to fulfill contract, there

is not enough reason to doubt the timely and full

repayment of loan principal and interest. The interest

loan is although the borrower has ability to repay the

loan principal and interest currently, but there are

some possible negative impact factors on the

repayment. To understand default standards, the key

is to grasp the core of possibility. Different levels of

inherent loans risk, the repayment probability is

different. The classification of loan risk divided into

the breach of default and undefault by the possibility

of repayment, and in order to reveal the true value of

the loan.

Personal loan risk including: qualification of

unqualified borrowers; borrowers to apply the

information false or non-compliance or not

complete. Personal credit information system is not

perfect now, banks cannot fully assess the

borrower's credit and solvency, the borrower may be

intentional fraud, fraudulent bank loans through

forgery of personal credit information, the bank

suffered financial loss; Risk posed by repayment

ability of borrowers reduce. There are many

personal loans are long-term loans, the borrower’s

repay ability decline is very likely to occur, could be

transformed into the bank's loan risk. Personal loan

default factor is related to characteristics of

individual loans, including age(A), education

level(B), length of service(C), residence(D), family

income(E), loan income ratio(F), credit card debts

(G), other debts(H), sex, the value of fixed assets,

loan term, whether mortgage, the family structure.

Education levels are usually inversely proportional

to the individual loan default, the higher the

education level, the smaller the likelihood of default;

The relationship between age and the default may

change with age; the higher length of service, the

probability of default should be smaller; The longer

the Living, the possibility of default should be

smaller; the higher family income, the probability of

default should be smaller; the higher loans income

ratio, the probability of default should be higher; the

more credit card debts, the higher probability of

default; the higher other debt, the more likelihood of

default; Women prefer stable, less likely to select

default than men; The more value of fixed assets, the

probability of default should be smaller; the longer

the loan period, the greater the likelihood of default;

The higher value of collateral, the smaller likelihood

of default; usually the more stable family structure,

the smaller likelihood of default.

3 APRIORI ALGORITHM OF

ASSOCIATION RULES

Association rules is to identify the data at a time or

things will appear: If item A is a part of the event,

the item B also appears in the probability of event

X%. Association rules with a specific set of

conditions linked to conclusions. Association rules

algorithm to automatically find those visualization

techniques can be found through the association,

such as web nodes, the advantage may exist in the

data associated with any attribute, it tries to find out

the number of rules, each rule can draw a

appropriate conclusions; The disadvantage is that it

can be very large, in an attempt to find model search

space, will cost a long time. It uses a generation-test

method to find the rules - simple rules originally

generated, and was the data set proved to be

effective. Good rules are stored, all the rules are

subject to different constraints, and then be

specialized. Specialization is a condition of

accession to the rules of procedure. These new rules

are then the data proved to be effective, then the

process is repeated to store to find the best or the

most significant rules. Users often a prerequisite for

the number of rules that may make some restrictions.

Or an effective indexing mechanism based on

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

130

information theory based on various technologies,

the existence of many rules is often used to

compress the search space. This process generated

by the map displayed the best rules, but this set of

rules cannot be directly used to predict, because

there are many rules to different conclusions.

Obtained by the association algorithm called

association rule model is not refined.

Let I={i

1

, i

2

, ..., i

m

,} is the set of all items, D for

the services of a project database transaction is a

subset of T(T⊆I). Each transaction has a unique

transaction identifier Tid. Let A be a set composed

by the project, called the item set. Transaction T

contains itemset A, if and only if A⊆T. Minimum

support minsup association rules under which the

user must satisfy the minimum support, it represents

a set of items set in the statistical sense of the need

to meet the minimum. Minimum confidence

minconf association rules required that the user must

meet the minimum confidence, which reflects the

minimum reliability of association rules. Association

rule mining is to find a transaction database D, given

by the user's minimum support minsup and

minimum confidence minconf of association rules. If

the item set support given by the user more than the

minimum support threshold (minsup), the set is said

to frequent itemsets or large item set. Association

rules in two steps: the minimum support threshold

based on data set D, find all the frequent itemsets;

under frequent item sets and minimum confidence

threshold to generate all association rules. There are

many association rule algorithm.

Apriori algorithm can only handle character

variables and outcome variables. Because of its only

character attributes, you can use a subset of

intelligent technology to accelerate the search speed.

It provides five methods for rules choice, using a

complex index of programs to effectively handle

large data sets. In the implementation of the node

before the field type must be fully instantiated. It can

keep the number of rules there is no specific limit,

can handle up to 32 premises in the rules. Apriori

algorithm uses hierarchical order of the search loop

method (also called the search step by step iterative

method) produces frequent itemsets, which uses

frequent k-item set to explore generate (k+1)-

itemsets. First, find out the length of one of the

frequent itemsets, denoted L1, L1 is used to generate

frequent 2-collection of itemsets L2, and used to

generate frequent 3-itemsets L3, and so the cycle

continues, until you could not find new frequent k-

itemsets. Lk need to scan the database to find each

one. Obtained using the following formula to

calculate the confidence of association rules.

Which, support_count(A∪B) that contains the

transaction itemsets A∪B number of records,

support_count(A) is the set A contains the item

number of records of transactions. Rules of frequent

item sets generated by the algorithm described as

follows:

for all frequent k itemset l

k

,

k≥

2 do begin

H1={l

k

in the rules after the pieces, after the pieces

of rule that only one item};

Call ap_genrules(l

k

,H1);

end;

Procedure ap_genrules(l

k

:frequent itemsets, Hm: m

projects of pieces after collection)

if(k>m+1) then begin

Hm+1=apriori_gen(Hm)

for all hm+1∈H

m+1

do begin

conf=support(l

k

)/support(l

k

-h

m+1

);

if(conf≥minconf) then

output rules l

k

-hm+1→hm+1 with confidence=conf

and support=support(l

k

);

For the existence of a large number of frequent

patterns, long-closed mode or the value of the

minimum support is small, Apriori algorithm will

face the following deficiencies: algorithm will spend

a large overhead to deal with particularly large

number of candidate sets; multiple scans the

transaction database, requires a lot of I/O load.

4 ASSOCIATION RULES IN

COMMERCIAL BANK CREDIT

EVALUATION OF PERSONAL

LOANS

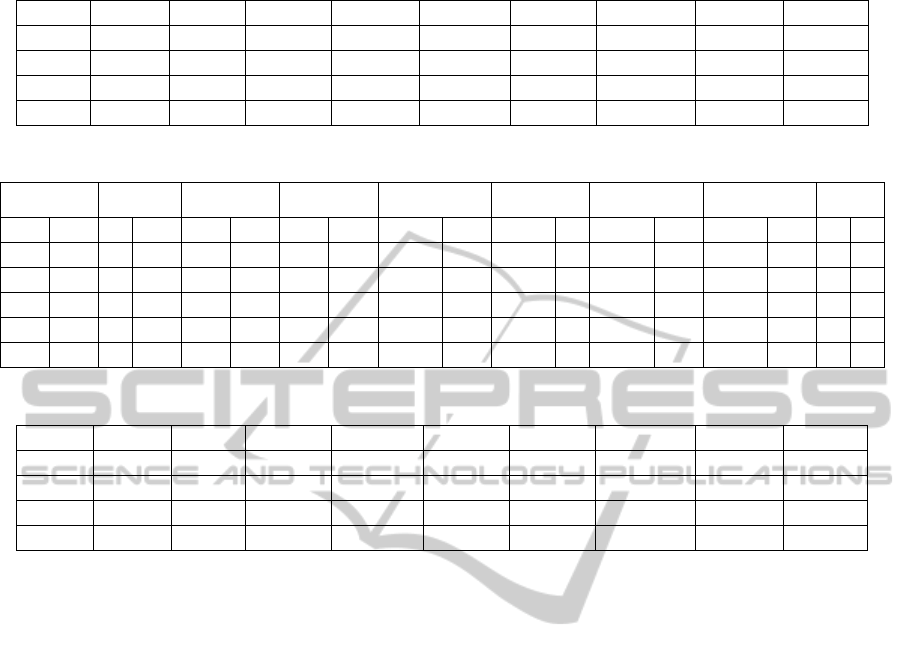

Data from a commercial bank committed to reducing

the loan default rate data, including 700 former

customers of the financial and demographic

information. Credit personal loans will target

variable I, the A to H as explanatory variables, its

use Clementin 12.0 Apriori algorithm of association

rules. Part of the original data in Table 1, the Apriori

algorithm can only handle character variables and

outcome variables, the first of the original discrete

data, discrete criteria in Table 2, the discrete part of

the data in Table 3. By Clementin 12.0 after the

discrete data of the Apriori algorithm, so that the

independent variables in the foregoing paragraph,

the dependent variable for the latter, 10% minimum

support, minimum confidence of 80%, resulting in

the 39 association rules in Table 4.

RESEARCH OF CREDIT RISK OF COMMERCIAL BANK PERSONAL LOAN BASED ON ASSOCIATION RULE

131

Table 1: Original data of part commercial banks credit personal loans.

Records age ed employ address income debtinc creddebt othdebt default

1 27 1 0 1 16.00 1.70 0.18 0.09 0

2 24 1 2 1 21.00 0.60 0.03 0.10 0

… … … … … … … … … …

700 30 1 0 11 17.00 3.70 0.45 0.18 1

Table 2: Discretization criteria of commercial banks credit risk data of personal loan.

age ed employ address income debtinc creddebt othdebt defau

20-25 A1 Pr B1 0 C1 0 D1 1.3-1.9 E1 0.1-1.9 F1 0.01-0.99 G1 0.05-0.99 H1 U I1

26-29 A2 Hi B2 1-3 C2 1-3 D2 2.0-2.9 E2 2.0-3.9 F2 1.00-1.99 G2 1.00-1.99 H2 D I2

30-35 A3 U B3 4-6 C3 4-6 D3 3.0-3.9 E3 4.0-6.9 F3 2.00-2.99 G3 2.00-2.99 H3

36-39 A4 P B4 7-10 C4 7-10 D4 4.0-5.9 E4 7.0-9.9 F4 3.00-4.99 G4 3.00-4.99 H4

40-49 A5 11-15 C5 11-15 D5 6.0-9.9 E5 10.0-15.9 F5 5.00-9.99 G5 5.00-9.99 H5

50-56 A6 16-33 C6 16-34 D6 10.0-44.6 E6 16.0-41.3 F6 10-20.56 G6 10-20.56 H6

Table 3: Part of discrete data of commercial banks credit personal loans.

Records age ed employ address income debtinc creddebt othdebt default

1 A2 B1 C1 D3 E1 F1 G1 H1 I1

2 A2 B1 C1 D2 E1 F1 G1 H1 I1

… … … … … … … … … …

700 A4 B2 C1 D5 E3 F1 G1 H1 I2

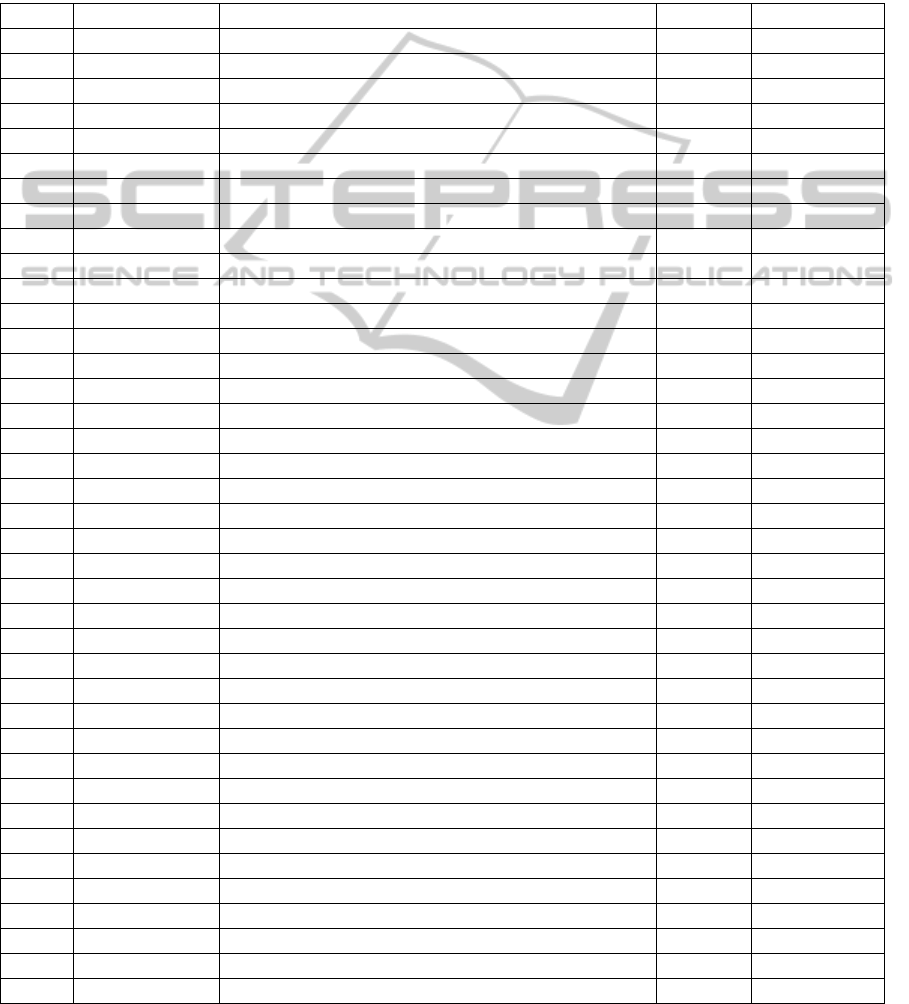

(1) Age has greater impact on credit risk. Rules 1

to 5 by the rules shows that, with age, increase the

solvency of individual credit risk reduction. 4 shows

the 36-39 rule, the customer, with 81.98% degree of

confidence that it will not default on their loans. We

can see from the rule 5, 40-49-years-old client, a

80.84% degree of confidence that it will not default

on their loans. If it is older, and credit card loans is

very low (rule 1), a higher level of confidence is not

in arrears (94.52%).

(2) Education had little influence on credit risk.

Shows that by the rules 6, middle and the following

culture, and credit card loans is very small (less than

100 yuan) customers are 85.31% confidence level

will not default on their loans. This is as expected,

generally considered higher education, the better the

credit. But the data shows that low levels of

education, other debts or credit card loans with little

or less seniority or length of residence, the client's

credit better. This suggests that bank lending, it does

not have to select the highly educated customers.

(3) Years of service have a greater impact on credit

risk. Rules 7-14 shows that with the length of

service growth, increased personal solvency, credit

risk reduction. Rule 9 shows that length of service

among the customers in the 16-33, with 84.48%

degree of confidence that it will not default; shows

by rule 12, length of service among the customers in

the 11-15, with 91.23% confidence level that the Not

in arrears; by the rule 13 shows, length of service

between customers in 7-10, with 81.25% degree of

confidence that it will not default. If the relatively

long length of service, and low levels of education

or credit card loans is very low, no higher degree of

confidence in arrears.

(4) Residence has greater impact on credit risk.

Showing by rule 15-19, as the residence of growth,

increased personal solvency, credit risk reduction.

Rule 17 shows that, when the residence time in

between 16-34 years, with 87.61% degree of

confidence that it will not default; by rule 18 shows,

when the residence time in between 7-10 years, with

85.42% of the degree of confidence that it will not

default. If you live a relatively long period, and the

low level of education or credit card loans is very

low, there are substantial grounds for believing that

it will not default.

(5) Income has greater impact on credit risk. Rules

20-24 show that, as income levels increase,

individuals enhance the solvency and credit risk

reduction. Rule 23 shows that, when the income of

0.06-0.099 million, 81.55% degree of confidence

that it will not default; year income 0.03-0.039

million, 81.25% degree of confidence that it will not

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

132

default. If the income is relatively large, and the low

level of education or credit card loans is very low,

there are substantial grounds for believing that it will

not default.

(6) Loan income ratio has greater impact on credit

risk. We can see by rules 25-31, loan income is

relatively low, less pressure on individuals to pay,

credit risk reduction. Rule 27 shows, when the loans

than in the 2-3.9 times revenue, 88% confidence

level that it does not default; by rule 29 shows, when

the loans than in the 4-6.9 times revenue, with

84.85% confidence level I believe it will not default;

by rule 31 shows, when the loans than in the 7-9.9

times revenue, with 80.65% degree of confidence

that it will not default.

Table 4: Association rules generated by Apriori algorithm.

Rules After items Before items Support Confidence

1 default = I1 age = A5 and creddebt = G1 10.43 94.52

2 default = I1 age = A5 and ed = B1 11.71 89.02

3 default = I1 age = A3 and creddebt = G1 13.57 86.32

4 default = I1 age = A4 15.86 81.98

5 default = I1 age = A5 23.86 80.84

6 default = I1 ed = B1 and creddebt = G1 30.14 85.31

7 default = I1 employ = C6 and ed = B1 10.14 92.96

8 default = I1 employ = C4 and creddebt = G1 12.86 92.22

9 default = I1 employ = C6 16.29 91.23

10 default = I1 employ = C5 and ed = B1 10.29 87.5

11 default = I1 employ = C3 and creddebt = G1 10.71 85.33

12 default = I1 employ = C5 16.57 84.48

13 default = I1 employ = C4 20.57 81.25

14 default = I1 employ = C4 and ed = B1 11.43 81.25

15 default = I1 address = D4 and ed = B1 11.29 91.14

16 default = I1 address = D4 and creddebt = G1 11.29 88.61

17 default = I1 address = D6 16.14 87.61

18 default = I1 address = D4 20.57 85.42

19 default = I1 address = D3 and creddebt = G1 10.71 81.33

20 default = I1 income = E3 and creddebt = G1 11.29 89.87

21 default = I1 income = E2 and ed = B1 and creddebt = G1 11.43 83.75

22 default = I1 income = E4 and ed = B1 10.43 82.19

23 default = I1 income = E5 14.71 81.55

24 default = I1 income = E3 18.29 81.25

25 default = I1 debtinc = F3 and ed = B1 12.71 91.01

26 default = I1 debtinc = F3 and ed = B1 and creddebt = G1 11.0 90.91

27 default = I1 debtinc = F2 10.71 88.0

28 default = I1 debtinc = F4 and ed = B1 10.14 85.92

29 default = I1 debtinc = F3 23.57 84.85

30 default = I1 debtinc = F3 and creddebt = G1 19.71 84.06

31 default = I1 debtinc = F4 17.71 80.65

32 default = I1 creddebt = G1 54.43 81.89

33 default = I1 othdebt = H2 and ed = B1 and creddebt = G1 10.43 87.67

34 default = I1 othdebt = H1 and ed = B1 and creddebt = G1 11.57 85.19

35 default = I1 othdebt = H1 and creddebt = G1 20.43 83.22

36 default = I1 othdebt = H2 and ed = B1 15.29 83.18

37 default = I1 othdebt = H1 and income = E2 10.14 83.10

38 default = I1 othdebt = H2 and creddebt = G1 17.71 83.06

39 default = I1 othdebt = H3 and ed = B1 10.71 80.0

RESEARCH OF CREDIT RISK OF COMMERCIAL BANK PERSONAL LOAN BASED ON ASSOCIATION RULE

133

If the loan is relatively low income and lower

education level, or credit card loans is very low,

there are substantial grounds for believing that it will

not default.

(7) Credit card lending is inversely proportional to

credit risk. Rule 32 shows, credit card loans of less

than 100 yuan, a 81.89% degree of confidence that it

will not default.

(8) Other debts have greater impact on credit risk.

we can see by rules 33-39, the less other liabilities,

credit risk is smaller. When other less debt, and

credit card debt low level of education or less, the

customer usually does not breach of contract.

5 CONCLUSIONS

Unrefined 39 rules by a representative of association

rules modeling the rules found in the node, which

contains the rules extracted from the data

information, these rules are not designed to directly

predict, but to provide useful information on bank

loans . We can see by these rules, the older (more

than 30 years of age), length of service longer, living

longer lives, higher income, low income loans,

credit cards, small loans, other debt a few customers

are high-quality customers. Limited to the index

system of loans and the lack of sample data, this

paper considers only the impact of individual loan

default the main factors. Limited to the index system

of loans and the lack of sample data, this paper

considers only the impact of individual loan default

the main factors. In reality, the credit rating personal

loans banks will also be required to consider some

other factors, such as use of the loans and so on, to

get more objective results. Commercial banks should

be based on their own circumstances, such as market

positioning, risk tolerance and other factors of risk

and establishing early warning model to their own

circumstances, to update the sample database, on the

one hand can provide a more accurate assessment of

the borrower's credit risk, on the other hand can also

be integrated master The Bank's operating status, for

subsequent development banks, the overall planning

and layout to provide information support.

In order to guard against default risk of personal

loans, banks need to spare "three investigations

work", effort to reduce losses caused by information

asymmetry. Asymmetric information easily lead to

adverse selection and moral hazard, therefore, to do

"loans before, loads middle, loans after" three

examinations work, effectively reducing the

information asymmetry caused by the credit default

risk. Investigation stage of the loan, to strengthen the

borrower's eligibility review to ensure the

qualifications of the borrower of the main provisions

of commercial banks; Meanwhile, according to the

borrower to submit proof of income, books, tax

return and other materials, combined with its

occupation, job security and other information on

the solvency of the borrower income and

comprehensive analysis and use of personal credit

information database accurately The borrower's

overall credit evaluation. Strengthen dynamic

monitoring, early warning. Customer's credit rating

is a dynamic change with a variety of factors,

dynamic monitoring of these factors can not only

advance warning, it is important to have sufficient

time to seek countermeasures.

REFERENCES

Altman E. I. et al. Zeta analysis: Anew model to identify

bankruptcy risk of corporations[J]. Journal of Banking

and Finance, 1977, 1(1):29-54.

Martin D., Early warning of bank failure: A logit

regression approach[J]. Journal of Banking and

Finance,

1977, 1(3):249-276.

Ohlson J., Financial ratios and the probabilistic prediction

of bankruptcy [J]. Journal of Accounting Research,

1980, 18(1):109-131.

Altman E. I., Marco G., Varettl F., Corporate distress

diagnosis: Comparisons using linear discriminant

analysis and neural networks [J]. Journal of Banking

and Finance, 1994,18(3):505-529.

Dan M. C. & Mark G. R., A comparative analysis of

current credit risk models [J]. Journal of Banking and

Finance 2000, 24(1): 59-117.

Zhang. On the personal loan business in the commercial

banking risk prevention [J]. Financial Development,

2008 (8).

Tian Chunyan and so on. Bank loan approval personal

knowledge of the rule base refinement [J].

Management, 2006 (9).

Xue Feng. Rough Sets - neural network system in the

commercial bank loan classification application [J].

Systems Engineering Theory & Practice, 2008 (1).

Xie Bangchang. Clementine data mining application

practices [M]. Beijing: Mechanical Industry Press,

2008.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

134