Implementation of HRMS in Indian Banks

Hemalatha Diwakar and Sushama Chaudhari

National Institute of Bank Management

NIBM Post Office, Kondhwe Khurd

Pune 411 048

Abstract. The Public Sector Banks in India in which the government are ma-

jority shareholders are inducting technology based banking solutions that are

well aligned with their business objectives to achieve business success. In the

process the banks have realized that for technology to be used efficiently an

HRMS in place is mandatory. In this paper, we show why HRMS is crucial for

bank’s progress by presenting the currently existing conventional HR practices

and their drawbacks by using UML diagrams. A case study of a PSB that has

implemented HRMS successfully is described and the benefit the bank has de-

rived is shown by the time-manpower comparison matrix for various HR func-

tions. The issues that PSBs should keep in mind and the strategy that they

should follow for a successful HRMS implementation are presented.

1 Introduction

The onset of technology based Banking solutions, the initiation of financial deregula-

tion, globalization and hence the emergence of new techno-savvy market players in

the Indian banking arena, brought in a sea changes in the Public Sector Banks (PSB)

of India. The PSBs which account for nearly 72% of the Indian banking business,

realized the need for more technology based solutions and therefore opted for central-

ized Banking Solutions that allows the customer to do bank banking rather than

branch banking, a good MIS for better decision making, multiple delivery channels

for round the clock customer service. Each of these PSBs, have more than 1500

branches and over 20,000.employees on an average, spread across the entire country.

A consequence of the introduction of technology and IT enabled business processes

was the large scale re-skilling, training and redeployment of manpower from a branch

centric and geographic centric organization to a bank wide skill and role based or-

ganization.

To support this new model, a centralized Human Resource Management System

(HRMS) is essential for effective decision making in HR as:

• Currently available potpourri of HR packages offer few HR functions such

as payroll, HR inventory and remaining functions are performed manually.

This introduces enormous delays in HR decision making. For instance man-

power planning, staff transfers take more than a month for acquiring relevant

Diwakar H. and Chaudhari S. (2007).

Implementation of HRMS in Indian Banks.

In Proceedings of the 1st International Workshop on Human Resource Information Systems, pages 55-63

DOI: 10.5220/0002430700550063

Copyright

c

SciTePress

data from the entire bank.

• Presently HR data are scattered across multiple organizational units

(PSBs have typically three or four tier organizational structure such as

branches, regional offices, zonal offices and corporate office spread across

the entire country) with a small subset in digital form and the rest in paper

form. This leads to data duplication, inconsistency, lack of integrity, in-

correctness and incompleteness.

• The banks have to review and align their human resources’ competencies

keeping in line with latest advancements in specialized banking areas and

continuous advancement in IT based banking solutions.

• HR Self Service is essential in a lean IT enabled organization for carrying

out HR administration tasks that will relieve HR staff from labor-intensive

tasks and hence permit them to focus more on strategic HR issues. This

will also reduce response time in activities such as leave sanction, Provident

fund based loan sanction etc, by the workflow based transactions.

• Information Technology contributes to man power reduction and hence

banks need to assess manpower availability against requirement, and intro-

duce, manage schemes like voluntary retirements.

It became evident that the PSBs instantly need a centralized HRMS [1] and many

PSBs in India have started working in that direction. Implementation of HRMS sys-

tem is a big challenge to these banks and is also unique in comparison to banks in

other countries considering the geographical spread of the Indian banks, their legacy

systems and the subsequent data migration issues. Collecting additional information

from employees, HR process reengineering, preparing for change management and

training the large workforce along with the selection of appropriate HRMS package,

and subsequent customization are also additional concerns.

In this paper, based on our knowledge of HRMS capabilities [2], [3] and the currently

prevalent HR practices in the banks, we demonstrate how PSBs can benefit by im-

plementing a HRMS as done by a representative PSB. We used structured interviews

for studying the representative bank. The paper is organized in the following way.

Section 3 has a background introduction of a typical PSB, its’ current HR processes

(henceforth referred to as conventional processes), with the most significant ones

described using UML diagrams viz., use case and data flow sequence diagrams.

Next , the case study of a PSB that has implemented HRMS is described and the

time–cost comparison matrix of the conventional versus HRMS for the processes

stated in section 3 is presented, to show the marked benefits the banks can accrue by

such implementation. With a mention of the experiences and derived benefits of a

HRMS implementation in this PSB, the paper concludes with a mention on the strat-

egy the banks should consider for such successful implementations.

56

2 Background

The Public Sector Banks in India, twenty of them in number, started banking with the

business motto of “neighborhood banking”. Almost all the villages in India have a

branch of any of these banks. In the 90s, the main branches of these banks that gener-

ate maximum business were totally automated but not networked, with the rural

branches remaining manual. The open economy and deregulation brought in new

techno savvy market players. These banks started with a centralized banking system,

a “customer centric business model” with banking domain experts as their core busi-

ness team, posed a great challenge to the PSBs. The PSBs which still hold 72% of

the total assets of scheduled commercial banks in India, started massive technical

investments towards the implementations of multiple service delivery channels, bank

wide network and Core Banking Solutions.

In the process of change, these banks realized the need for intelligently managing the

Human resources that they have, for which they needed a centralized Information

system, as they currently have a potpourri of HR systems with some fully automated

, a few semi automated and the most of the remaining fully manual. These banks

typically have independent Payroll, basic HR information, terminal benefits systems

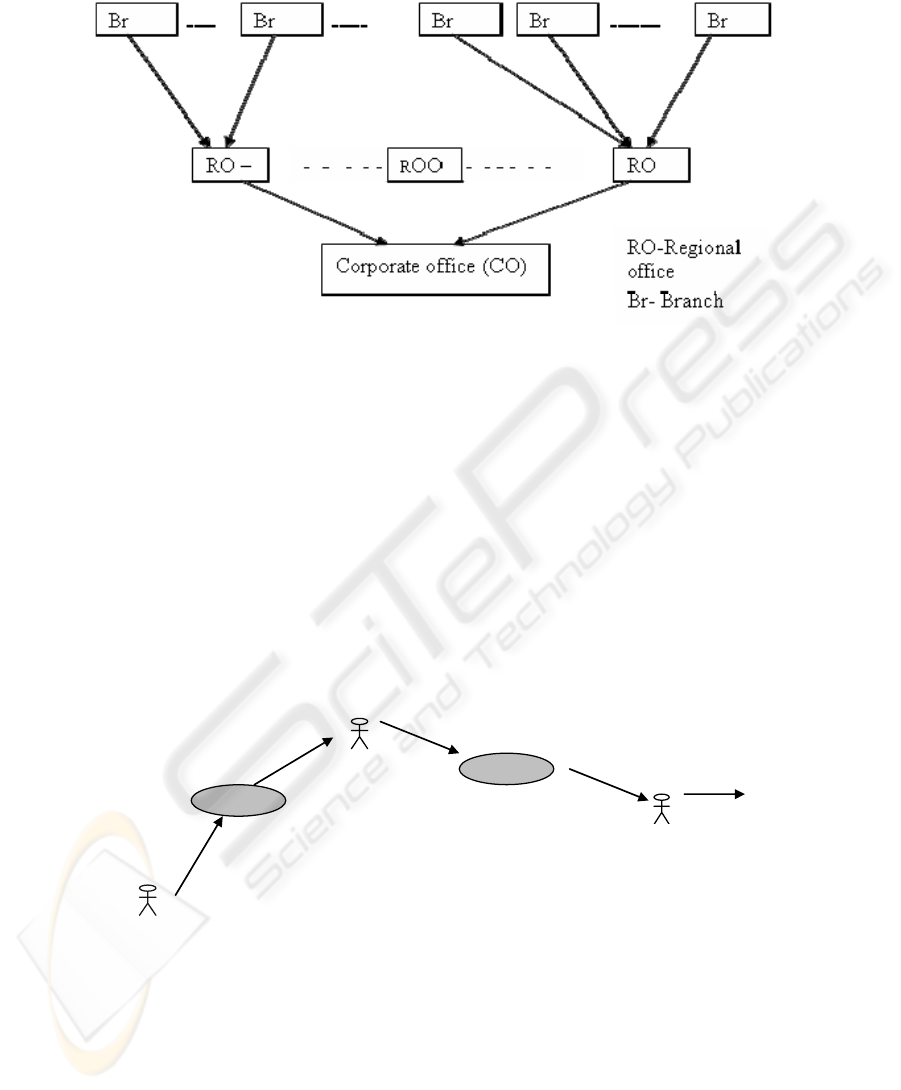

that are computerized with a lot of data duplication. The PSBs typically have a three

tier or four tier organization structure - Branches-Regional office(RO)-Zonal office

(ZO)-Corporate office(CO) as shown in the figure 1. The ROs and CO have HR de-

partments. .All the above said HR systems are installed in their regional offices and

also in the corporate Office, as HR functions such as computing salary, leave applica-

tion are carried out only in the ROs. So the relevant data pertaining to all the employ-

ees of the branches falling under a particular regional office are stored only in that

regional office. It is interesting to note that in the PSBs, when an employee is re-

cruited he/she is assigned a home Regional Office to which he/she belongs. Mostly

the transfers are among the branches under his/her home region except in cases such

as, transfers on special request or management posting , or if the employee is in the

top executive cadre. In such cases, his/her entire records are moved from the last

posted RO to the current posted RO or CO depending on the placement. The point to

note is that different aspects of an employee data are stored in the branch, regional

office (RO) and corporate office (CO) and hence the entire employee data is not

available in one place and also is available as a mix of digital and paper form.

As data forms the core base for HR decision making, it is clear that from the way the

data is available, the time taken to make HR related decisions varies greatly. It could

take the bank from 15 days to two months, irrespective of whether it is regarding an

individual employee such as sanctioning of loan from Provident Fund or the entire

bank such as finding law graduates in the bank. Also many of these HR activities

needed information flow back and forth in the entire 3 tier hierarchy where the com-

munications are carried out purely using postal/ courier service, the delay is immi-

nent. Additionally, the data in all the organizational units are not current, complete

and correct .Hence the banks realized the immediate need for an HRMS that will

allow workflow based transaction processing and instant decision making in above

said cases.

57

Fig.1. Organization structure of a typical PSB with three tier architecture.

3 Conventional HR Practices

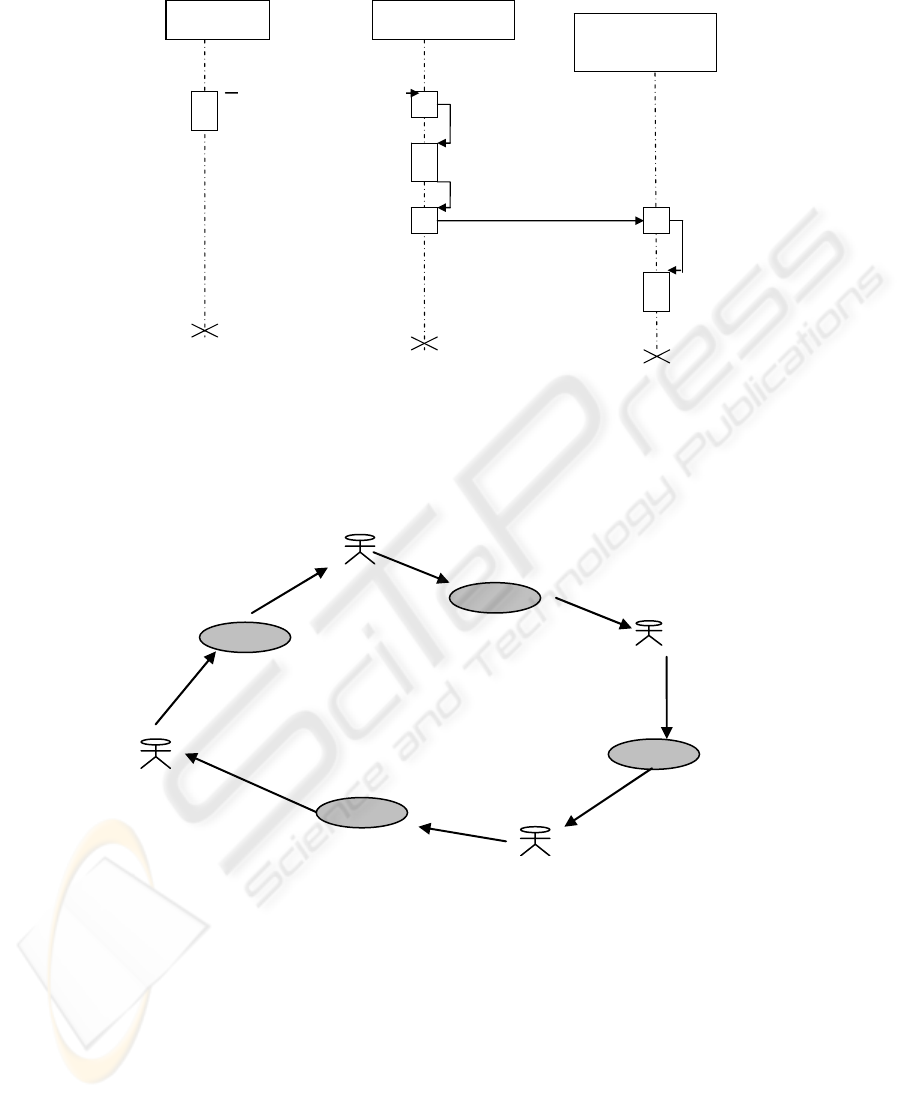

Some of the HR activities which are crucial yet time consuming in the conventional

legacy (current for most of the banks) scenario are presented using UML diagrams [4]

through use cases and sequence diagrams.

Man Power Planning. A typical example is finding out the lawyers in the bank to

strengthen its legal department by inducting more personnel. In such a scenario the

bank has to spend, more than a month to collect this information from the entire bank

as this kind of data is not part of any of their currently existing computerised HR

systems. The use case and the sequence diagrams of the same are presented below:-

Fig. 2. Use case diagram for Manpower planning.

Branch

R/O HR

dept

Send man

power data

for

consolidatio

n at RO

Send man

power data

for

consolidatio

n at CO

CO HR

D

ept

Man

power

report

58

Fig. 3. Sequence diagram for manpower planning.

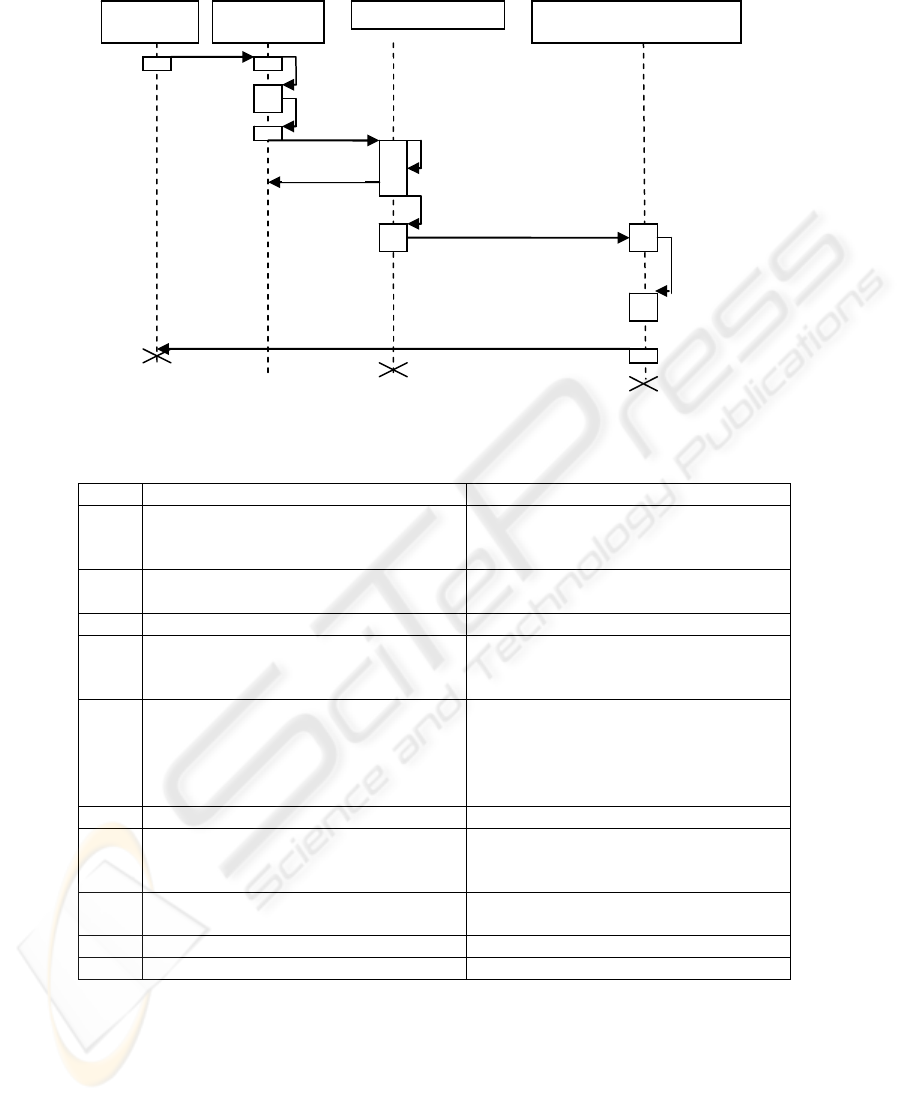

Provident Fund Loans and Other Loans. Employees applying for loan against

provident fund or any other loan submit a loan application form and it takes a mini-

mum of 15 days as the system is purely manual ( paper form) and the communication

medium is used postal courier service.

Fig. 4. Use case diagram for loan sanction for employee.

The other significant HR functions which more or less take similar data flow paths

as the two examples given above are presented in Table 1. From these details, it is

evident that the current HR system scenario in the banks is not on par with the tech-

nology sophistication the banks have gone for. Hence it has become mandatory for

the banks to opt for a Human Resource Management System to reap the full benefits

of technology induction.

: Branch : Regional Office

:Corporate

Office

Send manpower

profile

Consolidate data

from all its

branches

Send manpower

profile

Consolidate

Data from all

its ROs

Employee

Accountant in

the branch

Submit loan

request form

Send to RO

after

verification

Send to

HO after

verificati

on

Check for loan

sanction

HO

(

Trustees

)

Remittance or reject

59

Fig. 5: Sequence diagram for loan sanction.

Table 1. HR functions, data flows in the conventional legacy HR system.

No HR function name Process steps

1 Compensation

- Salary

Branch to RO

2 Conveyance reimbursement

Branch to RO

3 Terminal benefits From RO to Corporate office

4 Leave management

To know the leave status of the em-

ployee

Record room. Long queues, heavy de-

lays , errors

5 Training administration The staff training colleges used to send

the training calendar to regional offices

and await nominations.

6 Appraisal and Performance Fully paper based branch to RO to CO

7 Employee access to system (self service)

Income tax forecasting , Medical bills,

other benefits

All paper based requests , branch to RO ,

some times to CO

8 Management of Transfer and Postings Fully manual, collecting data from

branch to RO and then to HO

9 Promotions Collecting data from branch to RO to CO

10 career planning, Succession Planning Nil

4 HRMS Implementation - Case Study

Employee

: Re

g

ional Office

:

Corporate Office (Trustee)

Verification check for

validity

If OK, Send forward

Verification

Accountant

Loan

r

equest

Verify

&forward

Remittance

/reject

Re

j

ect

60

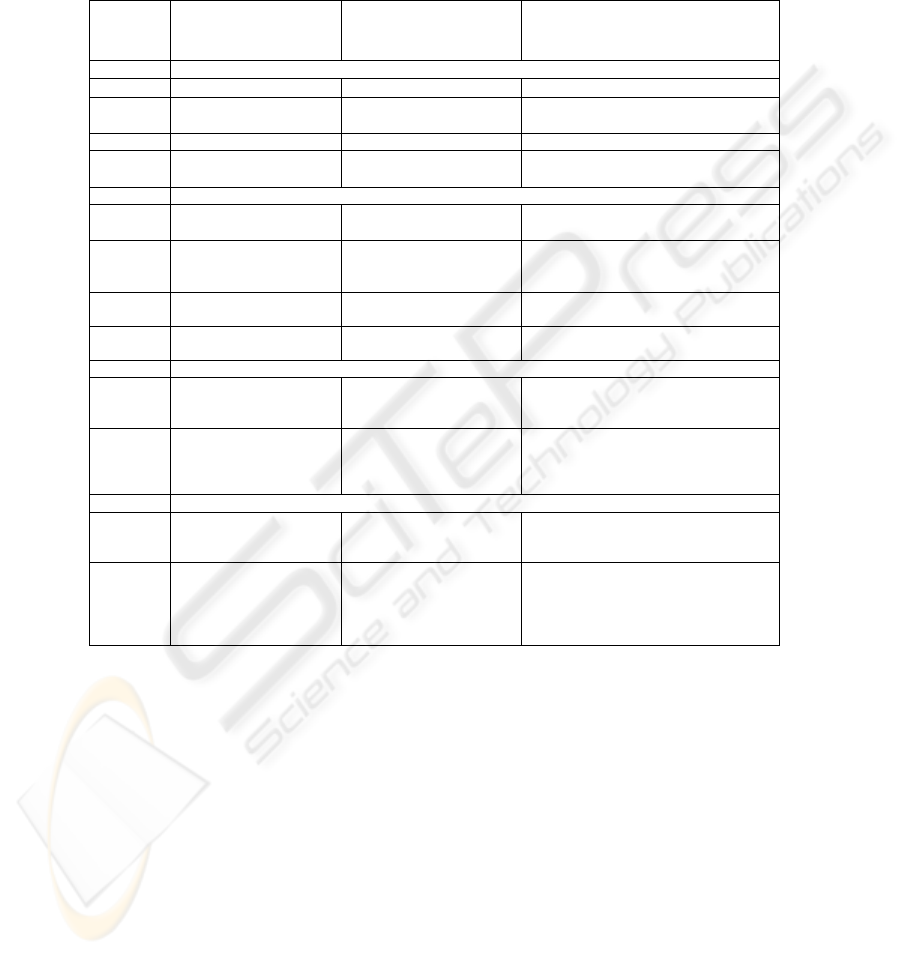

After studying the features of HRMS it emerged that the same HR functions quoted in

the section 3 will be carried out in less time and also results in considerable man

power reduction in HR department. The implementation of HRMS in the Union

Bank of India, the pioneer in HRMS implementation in Indian Banks, substantiated

the same. The Union Bank of India, [5] a hundred years old bank with manpower of

25,000, having more than 2000 branches, has gone for centralized Banking solutions

and has been implementing Oracle’s PeopleSoft Enterprise Human Capital Manage-

ment package[6],[7] since the last few years.

Structured interviews were conducted to study the various facets of HRMS imple-

mentation. Senior Managers in HR department, Project team members and select

users of Union Bank of India constituted the sample. Interviews were structured

around key HR subsystems such as Manpower Planning, Training, Employee ser-

vices, Compensation and Performance evaluation etc. The focus was to understand

how data related to each of these HR systems is managed and used after HRMS im-

plementation. On an average, an hour was spent per person. In Table 2, Union Bank

of India’s HR functions in the conventional legacy HR systems against the present

HRMS are compared in terms of man power reductions in HR department and re-

sponse time.

It is evident that the bank has utilised HRMS very effectively for HR self service and

other decision support activities..The Union Bank of India derived the benefits such

as, improved Employee morale, greater transparency due to its HRMS global service

rules, faster decision making (PF loan, leave etc), centralized HR database that is

instantly accessible to all its ROs and Corporate office and most importantly reduc-

tion in staff looking after salary and funds function (from 60 to 20).

The bank attributed its success to top management’s support in keeping the project

team same throughout its entire HRMS implementation cycle and giving highest

priority for collecting its employee data , cleaning the existing data before migration ,

deploying personnel Officers as HR administrators for prompt updation of data. The

bank faced challenges while collecting additional employee information, cleaning the

existing employee data, assessment of hardware requirements and also resistance

from employees to use the new workflow based system Even then with a change

management in place and incessant support from the top management made the Un-

ion Bank of India see the light.

5 Implementation Strategy and Conclusion

In order to have a smooth implementation of a HRMS, the Public Sector Banks can

follow the strategy of engaging a single project management team for the entire dura-

tion of the project; identify its requirements in HRMS, considering its business objec-

tives and prioritise the modules the order in which it wants to implement; identify

what data it already has, where and in what form, how old it is and then check for its

correctness and identify other data requirements and collect from the employees;

Select the product that is web enabled, has workflow mechanisms, uses multi tier

architecture and also widely used package, as it will be well supported ; Simultane-

ously carry out Human Process Reengineering (HPR), rework with package for cus-

61

tomisation as. the HPR may bring in changes in the organization structure as well and

hence prepare a change management and training program for the entire bank; Finally

data migration relates issues.

Table 2. Time, manpower comparison of HR functions in conventional systems against

HRMS.

No HR function name Time delay/man power

involved

in conventional system

Time delays/man power

Involved in HRMS

A MANPOWER PLANNING

1 Man power planning More than a month Instant.

2 Management of Transfer

and Postings

Two months Computerized system for transfers

deciding and takes less time

3 Promotions Two months Under implementation

4 career planning, Succes-

sion Planning

Nil Online system for career planning (under

implementation)

B COMPENSATION & BENEFITS

1 Loan (PF loan) 15 days Online form filling and workflow, hence

within 24 hrs.

2 Compensation

Salary

Normally a week or more

;With 15 employees from

HR dept

Two to three days with only two em-

ployees in HR department carrying out

this activity

3 Conveyance reimburse-

ment,

Two months Two to three days

4 Terminal benefits 25 persons from HR

department

Now only 15 persons

C TRAINING ,DEVELOPMENT AND PERFORMANCE EVALUATION

1 Training administration A fortnight to a month of

delay

Availability of online training calendar.

Nomination and intimation with no time

delay; selected employee record updated

2 Appraisal and Perform-

ance

Nearly two months Online self appraisal form submission,

instantaneous review by superiors ,

employee record updated reflecting the

review

D EMPLOYEE SERVICES

1 Leave management

To know the leave status

of the employee

Long queues, heavy delays

, errors

Immediate, Online submissions of leave

application, workflow system , status

known after the superior’s decision

2 Employee access to

system (self service)

No self service, paper based

form for any information.

Provident Fund statements

were given once in six

months

Leave requests, loans, income tax fore-

casting , medical bill settlement, benefits

all on self-service, PF records online

availability

In this paper the need for HRMS in PSBs is emphasised and the benefits they can

achieve are brought out by presenting a successful implementation of HRMS in a

PSB Keeping in mind the manpower, size and geographical spread of Indian banks,

an online user friendly HRMS package will greatly help them in utilizing their tech-

nology based banking solutions to attain their business goals..

62

References

1. Rampton, Glenn M ., Turnbull, J. Ian., Doran , J. Allen, : Human Resource Management

Systems: A Practical Approach, Carswell Legal Publications,, (1999).

2. Meade, James G.:The Human Resources Software Handbook: Evaluating Technology

Solutions for Your Organization, Pfeiffer publications, Wiley imprint, CA,(2002).

3. Doran Al :E-work Architect:How HR leads the way using the internet,Futura Publishing

,Texas(2001)

4. Rumbaugh, James, Jacobson, Ivar Booch; Grady :The Unified Modeling Language User

Guide ,Addison-Wesley ,New York (2005)

5. www.unionbankofindia.co.in

6. www.oracle.com/customers/snapshots/union-bank-of-india-case-study.pdf

7. Adam T : PeopleSoft HRMS Reporting, Prentice Hall , New Jersey(2000).

63