REPUTATION BASED BUYER STRATEGY FOR SELLER

SELECTION FOR BOTH FREQUENT AND INFREQUENT

PURCHASES

Sandhya Beldona and Costas Tsatsoulis

Department of Electrical Engineering and Computer Science, Information and Telecommunication Technology Center

The University of Kansas, 2335 Irving Hill Road, Lawrence, KS 66045, USA

Keywords: Autonomous agents, Learning, Distributed

, Trust, Reputation, Ecommerce, Electronic Markets.

Abstract: Previous research in the area of buyer agent strategies for

choosing seller agents in ecommerce markets has

focused on frequent purchases. In this paper we present a reputation based buyer agent strategy for choosing

seller agent in a decentralized, open, uncertain, dynamic, and untrusted B2C ecommerce market for frequent

and infrequent purchases. The buyer agent models the reputation of the seller agent after having purchased

goods from it. The buyer agent has certain expectations of quality and the reputation of a seller agent

reflects the seller agent’s ability to provide the product at the buyer agent’s expectation level, and its price

compared to its competitors in the market. The reputation of the seller agents and the price quoted by the

seller agents are used to choose a seller agent to transact with. We compare the performance of our model

with other strategies that have been proposed for this kind of market. Our results indicate that a buyer agent

using our model experiences a slight improvement for frequent purchases and significant improvement for

infrequent purchases.

1 INTRODUCTION

Our work considers decentralized, open, dynamic,

uncertain and untrusted electronic market places

with seller agents and buyer agents. The seller

agents sell products and the quality and the price of

product varies across them. The goal for the buyer

agent (hereafter referred to as the buyer) is to

purchase a product from a seller agent (hereafter

referred to as the seller) who meets its expectations

of quality and service and to purchase it at the

lowest price possible in the market. At the same time

the buyer wants to reduce its chances of interacting

with dishonest and poor quality seller agents. In an

open market, the sellers agents (hereafter referred to

as sellers) and the buyers agents (hereafter referred

to as buyers) can enter and leave the market

anytime. In a dynamic market the players in the

market need not exhibit the same behaviour all the

time; the sellers can vary the price and the quality in

various transactions. Untrusted market implies there

could be dishonest sellers in the market. By

uncertain market we mean that the buyers can gauge

the quality of the product after actually receiving the

product. There could be a onetime transaction

between the buyer and the seller or multiple

transactions between them. There is no limitation on

the number of the sellers and the buyers in the

market. These characteristics are typical of a

traditional commerce market and hence we consider

a similar environment for our electronic market.

It is not possible to pre-program an agent to

ope

rate under these conditions, or to know

beforehand who the best seller for a buyer is, as new

sellers are entering the market, the lowest priced

seller may not necessarily be the best seller, and

sellers could be lying. Agents have to be equipped

with abilities to make the most rational decision

based on all the information that they can gather.

They should be able to learn from their past

experiences.

Recent research has developed intelligent agents

for ecomm

erce applications (A. Chavez & P. Maes,

1996), (A Chavez & D.Dreilinger & R.Guttman &

P. Maes, 1997), (C. Goldman & S. Kraus &

O.Shehory, 2001, p. 166-177), (R.B. Doorenbos &

Etzioni & D. Weld, 1997, p. 39-48), (B. Krulwich,

1996, p. 257-263), (T. Tran, 2003), (T. Tran & R.

84

Beldona S. and Tsatsoulis C. (2007).

REPUTATION BASED BUYER STRATEGY FOR SELLER SELECTION FOR BOTH FREQUENT AND INFREQUENT PURCHASES.

In Proceedings of the Fourth International Conference on Informatics in Control, Automation and Robotics, pages 84-91

DOI: 10.5220/0001618000840091

Copyright

c

SciTePress

Cohen, 2004, Vol. 2, p. 828-835), (J.M. Vidal & E.H

Durfee, 1996, p. 377-384). However, as Tran (T.

Tran, 2003) summarizes, the agents in (R.B.

Doorenbos & Etzioni & D. Weld, 1997, p. 39-48),

(B. Krulwich, 1996, p. 257-263) are not

autonomous, the agents in (A. Chavez & P. Maes,

1996), (A Chavez & D.Dreilinger & R.Guttman &

P. Maes, 1997), (C. Goldman & S. Kraus &

O.Shehory, 2001, p. 166-177), and (R.B. Doorenbos

& Etzioni & D. Weld, 1997, p. 39-48), do not have

learning abilities, the agents in (J.M. Vidal & E.H

Durfee, 1996, p. 377-384). have significant

computational costs, and the agents in (A. Chavez &

P. Maes, 1996), (A Chavez & D.Dreilinger &

R.Guttman & P. Maes, 1997), (C. Goldman & S.

Kraus & O.Shehory, 2001, p. 166-177), (R.B.

Doorenbos & Etzioni & D. Weld, 1997, p. 39-48),

(B. Krulwich, 1996, p. 257-263), (J.M. Vidal & E.H

Durfee, 1996, p. 377-384) do not have the ability to

deal with deceptive agents. Tran and Cohen’s (T.

Tran & R. Cohen, 2004, Vol. 2, p. 828-835) , (T.

Tran, 2003) work addressed these shortcomings by

developing a strategy for the buying agents using

reinforcement learning and reputation modelling of

the sellers. However their model builds reputation

slowly and the buyer has to interact with a seller

several times before the seller is considered

reputable. This model works well where the buyer

has to make repeated transactions with the sellers

during frequent purchases. The performance of this

model deteriorates for infrequent purchases as the

buyer has to purchase several times from a seller

before making its decision about the seller. When

the buyer is purchasing a product on an infrequent

basis it needs to quickly identify reputed sellers.

We present reputation based modelling of a

seller by the buyer which can work for frequent as

well as infrequent purchases in a B2C ecommerce

market. We compared the performance of the buying

agents using our model, reinforcement learning

(J.M. Vidal & E.H Durfee, 1996, p. 377-384) and

reputation based reinforcement learning (T. Tran &

R. Cohen, 2004, Vol. 2, p. 828-835), (T. Tran,

2003). Our results show that the buying agents

using our model improved their performance slightly

for frequent purchases and showed a significant

improvement for infrequent purchases, making our

approach better suitable for all kinds of buyers.

2 METHODOLOGY

We consider decentralized, open, dynamic, uncertain

and untrusted electronic market places with buyers

sellers. The buyers’ model the sellers’ reputation

based on their direct interactions with them. The

buyer has certain expectations of quality and the

reputation of a seller reflects the seller’s ability to

provide the product at the buyer’s expectation level,

and its price compared to its competitors in the

market. The buyer’s goal is to purchase from a

seller who will maximize its valuation of the

product, which is a function of the price and quality

of the product. At the same time it wants to avoid

interaction with dishonest or poor quality sellers in

the market. The reputation of the seller is used to

weed out dishonest or poor quality sellers.

In this paper we use the following notation:

Subscript represents the agent computing the rating.

Superscript represents the agent about whom the

rating is being computed. The information in the

parenthesis in the superscript is the kind of rating

being computed. For example, every time the buyer

b purchases a product from the seller s , it computes

a direct trust (di) rating T

b

s(di)

of the seller s by buyer

b. The trust rating of seller s by buyer b is computed

as shown in equation 1.

⎪

⎪

⎪

⎪

⎩

⎪

⎪

⎪

⎪

⎨

⎧

<

⎟

⎟

⎠

⎞

⎜

⎜

⎝

⎛

−

−

−

<≥

≥≥

⎟

⎟

⎠

⎞

⎜

⎜

⎝

⎛

−

−

=

)(

)(

)(

min

minmax

min

exp

min

exp

min

maxexp

)(

cqqif

pp

pp

q

q

bppandqqif

q

q

appandqqif

p

pp

q

q

T

act

actact

avgactact

act

avgactact

avgact

act

dis

b

(1)

where q

act

is the actual quality of the product

delivered by the seller s, q

exp

is the desired expected

quality and q

min

is the minimum quality expected by

the buyer b. p

act

is the price paid by the buyer b to

purchase the product from the seller s. p

min

is the

minimum price quote, p

max

is the maximum price

quote received and p

avg

is the average of the price

quotes received by the buyer for this product.

The trust rating should be proportional to the

degree the quality delivered by the seller meets the

buyer’s expectations and the price paid to purchase

the product. If there are two sellers, s1 and s2, who

can meet the buyer’s expectation for the quality of

the product, and s1’s price is lower than s2, then s1

should get a higher rating than s2. Similar to (T.

Tran, 2003) and (T. Tran & R. Cohen, 2004, Vol. 2,

p. 828-835) , we make the common assumption that

it costs more to produce a higher quality product. So

when considering the price charged by a seller, if the

seller meets the buyer’s minimum expectation for

quality, and if the price is greater than the average

price quoted, then the difference between the seller’s

price and the average price quoted is weighed

REPUTATION BASED BUYER STRATEGY FOR SELLER SELECTION FOR BOTH FREQUENT AND

INFREQUENT PURCHASES

85

against the maximum price quoted for that product

(part (a) of the equation). On the other hand if the

price of the seller is below the average price (which

can happen if the other sellers are trying to

maximize their profits or there are too many low

quality sellers) then the rating for this seller is

computed based on its quality alone (part (b) of the

equation). If the seller’s quality does not meet the

buyer’s expectation then the difference of seller’s

price and the minimum price quoted is compared to

the difference between the maximum and the

minimum price quoted to penalize the seller more

severely (part (c) of the equation).

This model makes the assumption that the buyer

b expects the highest quality and in the best case q

act

can be equal to q

exp

and it costs more to produce

higher quality products. From the above equations it

can been seen that T

b

s(di)

ranges from [-1, 1]. In the

best case, b gets the expected quality at the lowest

price and T

b

s(dimax)

= 1. In the worst case q

act

= 0 and

b

pays the maximum price quoted and T

b

s(dimin)

= -

1.

If the buyer has not interacted with the seller

then T

b

s(di)

= 0 for that seller and such a seller is

referred to as a new seller.

Whenever the buyer b is evaluating a list of

sellers for purchase decisions it computes T

b

s(diavg)

,

the average rating for each seller s from its past

interactions. T

b

s(diavg)

is computed as the weighted

mean of its past n recent interactions.

∑

=

=

n

i

dis

ibi

diavgs

b

Tw

W

T

1

)(

)(

)(

1

(2)

where

icur

cur

i

tt

t

w

−

=

(3)

∑

=

=

n

i

i

wW

1

(4)

where T

b(i)

s(di)

is the rating computed for a direct

interaction using equation 1.Subscript i in

parenthesis indicates the i

th

interaction. w

i

is the

importance of the rating in computing the average.

Recent ratings should have more importance. Hence

the weight of a rating is inversely proportional to the

difference between the time a transaction happened t

i

to the current time t

cur

.

The buyer has threshold values θ and ω for the

direct trust ratings to indicate its satisfaction or

dissatisfaction with the seller respectively. The

threshold values θ and ω are set by the buyer and

θ > ω and θ and ω

are in the range [-1, 1]. The

buyer chooses sellers whose average direct trust

rating is greater than or equal to θ and considers

them to be reputable, does not choose sellers whose

average direct trust rating is less than or equal to ω

and considers them to be disreputable. It is unsure

about sellers whose average direct trust ratings are

between ω and θ and will consider them again only

if there are no reputable or new sellers to consider.

From the list of sellers who have submitted price

bids, reputable sellers whose T

b

s(diavg)

is above the

satisfaction threshold θ are identified as potential

sellers. The buyer includes new sellers into the list

of potential sellers to be able to quickly identify a

good seller.

The buyer’s valuation function for the product is

a function of the price a seller is currently quoting

and the quality that has been delivered in the past .

For a seller with whom the buyer has interacted

before, the quality is the average of the quality

delivered in the past interactions. For a seller with

whom the buyer has not interacted directly, the

quality is set to the expected quality. From the list of

potential sellers, the buyer chooses a seller who

maximizes its product valuation function.

3 RELATED WORK

We compare our model to (T. Tran, 2003), (T. Tran

& R. Cohen, 2004, Vol. 2, p. 828-835) and (J.M.

Vidal & E.H Durfee, 1996, p. 377-384) as their and

our work consider a similar market environment

with autonomous buying agents who learn to

identify seller agents to transact with. (J.M. Vidal &

E.H Durfee, 1996, p. 377-384) use reinforcement

learning strategy and (T. Tran, 2003) and (T. Tran &

R. Cohen, 2004, Vol. 2, p. 828-835) use

reinforcement learning with reputation modelling of

sellers. Our model provides a different method of

computing reputation and does not use

reinforcement learning strategy.

Vidal and Durfee’s (J.M. Vidal & E.H Durfee,

1996, p. 377-384) economic model consists of seller

and buyer agents. The buyer has a valuation

function for each good it wishes to buy which is a

function of the price and quality. The buyer’s goal is

to maximize its value for the transaction. Agents are

divided into different classes based on their

modelling capabilities. 0-level agents base their

actions on inputs and rewards received, and are not

aware that other agents are out there. 1-level agents

are aware that there are other agents out there, and

they make their predictions based on the previous

ICINCO 2007 - International Conference on Informatics in Control, Automation and Robotics

86

actions of other agents. 2-level agents model the

beliefs and intentions of other agents. 0-level agents

use reinforcement learning. The buyer has a

function f for each good that returns the value that

the buyer expects to get by purchasing the good at

price p. This expected value function is learned

using reinforcement learning as f= f + α(v - f) where

α is the learning rate, initially set to 1 and reduced

slowly to minimum value. The buyer picks a seller

that maximizes its expected value function f. Our

market model is extended into a more general one by

having sellers offer different qualities and by the

existence of dishonest sellers in the market. The

buyers use the reputation of the sellers to avoid

dishonest sellers and reduce their risks of purchasing

low quality goods. The reputation of the sellers is

learned based on direct interactions.

Tran and Tran and Cohen develop learning

algorithms for buying and selling agents in an open,

dynamic, uncertain and untrusted economic market

(T. Tran, 2003) and (T. Tran & R. Cohen, 2004, Vol.

2, p. 828-835)

. They use Vidal and Durfee’s (J.M.

Vidal & E.H Durfee, 1996, p. 377-384)

0-level

buying and selling agents. The buying and selling

agents use reinforcement learning to maximize their

utilities. They enhance the buying agents with

reputation modelling capabilities, where buyers

model the reputation of the sellers. The reputation

value varies from -1 to 1. A seller is considered

reputable if the reputation is above a threshold value.

The seller is considered disreputable if the reputation

value falls below another threshold value. Sellers

with reputation values in between the two thresholds

are neither reputable nor disreputable. The buyer

chooses to purchase from a seller from the list of

reputable sellers. If no reputable sellers are

available, then a seller from the list of non

disreputable sellers is chosen. Initially a seller’s

reputation is set to 0. The seller’s reputation is

updated based on whether the seller meets the

demanded product value. If the seller meets or

exceeds the demanded product value then the seller

is considered cooperative and its reputation is

incremented. If the seller fails to meet the demanded

product value then the seller is considered

uncooperative and its reputation is decremented.

This model builds reputation slowly. So the buyer

has to interact with a seller several times before the

reputation of the seller crosses the threshold value.

This model works well where the buyer has to make

repeated transactions with the sellers, but a buyer

cannot utilize this model when making infrequent

purchases.

4 EXPERIMENTS AND RESULTS

For our experiments we developed a multi-agent

based simulation of an electronic market with

autonomous buying agents, selling agents, and a

matchmaker. The sellers upon entering the market

register with a matchmaker (

D. Kuokka & L. Harada

, 1995) regarding the products that they can supply.

When a buyer wants to purchase a product, it obtains

a registered list of sellers selling this product from

the matchmaker and sends a message to each of the

sellers in the list to submit their bids for the product

p. The sellers who are interested in getting the

contract submit a bid which includes the price. The

buyer waits for a certain amount of time for

responses and then evaluates the bids received to

choose a seller to purchase from.

The following parameters were set. The quality q

sold across the sellers ranges from [10, 50] and

varies in units of 1. The buyer expects a minimum

quality of 40(q

min

=40). The price of a product for an

honest seller is pr = q ± 10%q. Like Tran (T. Tran,

2003) we make the assumption that it costs more to

produce high quality goods. We also make the

reasonable assumption that the seller may offer a

discount to attract the buyers in the market or raise

its price slightly to increase its profits. Hence the

price of the product is set to be in the range of 90%

-110% of the quality for an honest buyer. A

dishonest buyer on the other hand may charge higher

prices. The buyer’s valuation of the product is a

function of the quality and the price and for our

simulation we set it as 3 * quality – price. The

buyer’s valuation function reflects the gain, a buyer

makes from having purchased a product from a

seller. Each time a buyer purchases a product from a

seller its product valuation is computed and we

consider this as the buyer’s gain for having

purchased from that seller.

We compared the performances of four buyers .

1. F&NFBuyer: - This buying agent uses the buying

strategy as described in our model. The buyer’s

desired expected quality is q

exp

= 50. The

acceptable quality for a buyer is from [40, 50].

The non acceptable quality is from [10-39]. The

maximum price p

max

quoted by honest seller

would be 55 and the minimum price p

min

quoted

would be 9. The average price p

avg

would be 32.

The threshold values θ for a seller to be

considered reputable and ω for a seller to be

considered disreputable values can be computed

as follows:

The buyer is expecting at least a quality of 40.

In the worst case it can get this at the highest

REPUTATION BASED BUYER STRATEGY FOR SELLER SELECTION FOR BOTH FREQUENT AND

INFREQUENT PURCHASES

87

5. Inconsistent: - Each seller offers a quality in the

range [10-50]. The price is between 90-110% of

the quality they are selling.

price that can be charged by a honest seller which

would be 44. From equation 1(a) the trust rating

for that seller would be

6. Dishonest: - This category of sellers in their first

sale to a buyer offer acceptable quality q [40-50]

charging a price pr= q ± 10%q. In their

subsequent sales to that buyer they reduce the

quality q to be in the range [10-25]. However

their price still remains high. Price pr= q1 ±

10%q1 where q1 is in the range [40 -50].

The data from the experiments was collected

over 100 simulations. In each simulation, each

buying agent conducted 500 transactions. In each

transaction they purchased product p by querying the

seller list from the matchmaker, obtain price quotes

from different sellers and utilize their buying

strategy to choose a seller. We compared the

performances of the various buying agents on the

following parameters.

581.0

55

3244

50

40

=

⎟

⎠

⎞

⎜

⎝

⎛

−

−

(5)

so we set θ = 0.58. For new sellers the trust

rating is set to 0. These buyers should not come

under the category of disreputable sellers. So we

set the threshold value for a seller to be

considered unacceptable as -0.1. So ω=-0.1

2. Tran Buyer: - This buying agent uses the buying

strategy as described in Tran and Cohen [8]. The

threshold for seller to be considered reputable is

set to 0.5 and for seller to be considered

disreputable is set to -0.9 as described in their

work.

3. RL Buyer:- This buying agent uses a

reinforcement learning strategy as described for

0-level buying agent in Vidal and Durfee [9].

• How long it took them to learn to identify high

quality low priced sellers. We want the buying

agents to identify high quality sellers offering low

prices as soon as possible. If the buyer is able to

identify high quality sellers quickly then the same

strategy can be used when making infrequent

purchases.

4. Random Buyer:- This buying agent chooses a

buyer randomly.

We populated the market with 12 sellers

belonging to one of the six categories with the price

and quality properties as shown (two agents per

category):

• The average gain as the number of purchases of

product p is increased. If the average is

consistently high means that the buyer is

interacting with high quality sellers offering low

prices most often. If the average gain is high

earlier on implies that the buyer has identified

high quality low price sellers quickly.

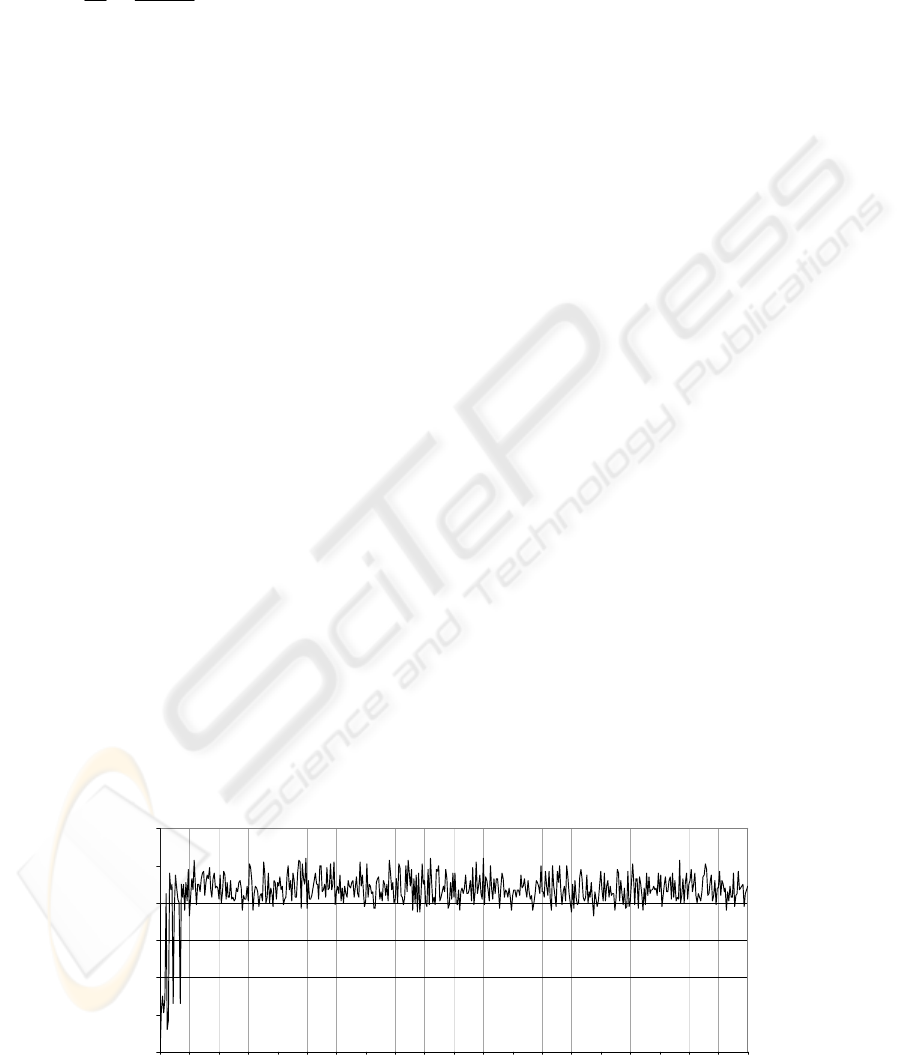

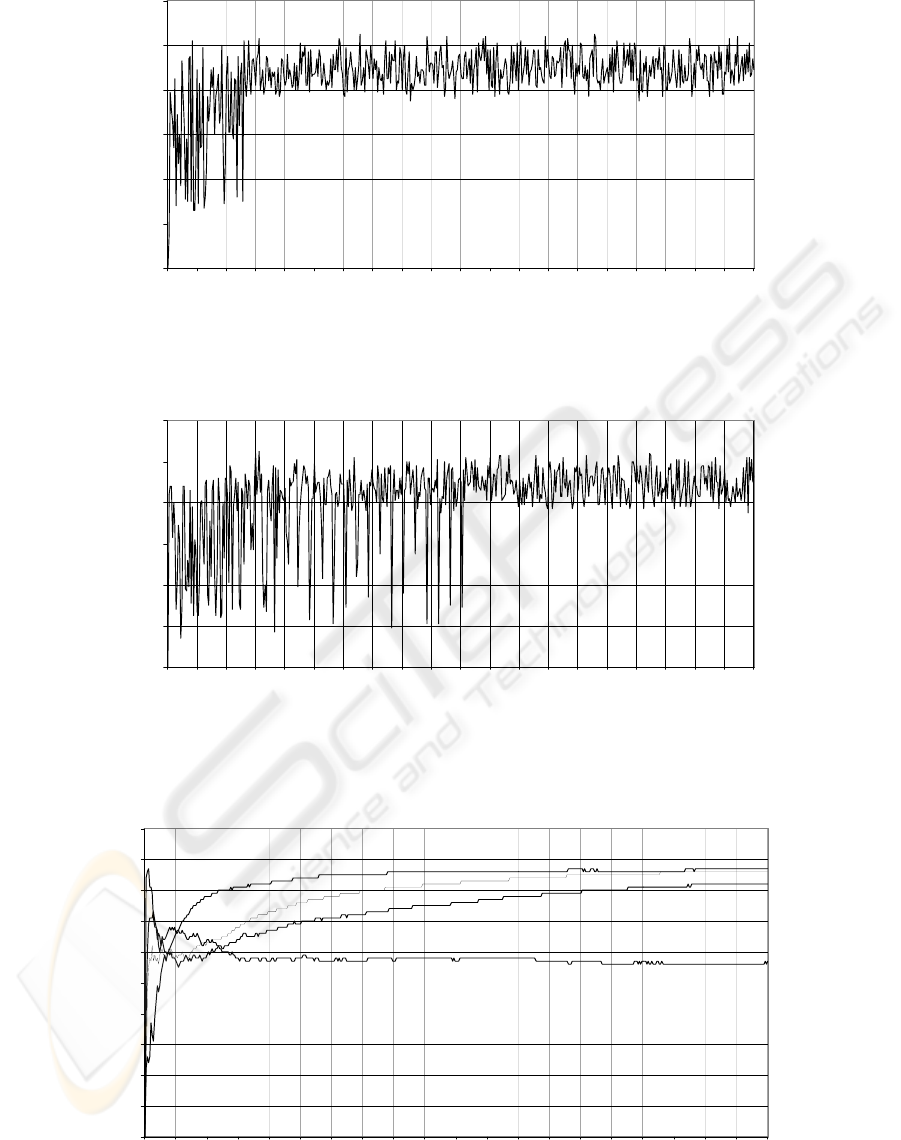

Figures 1-3 show the gain versus transactions for

each type of buyer (because of space considerations

we are not showing the plot of the gain vs. a random

buyer, since the gain simply constantly fluctuates):

1. Honest Acceptable (HA): - Each seller offers a

quality in the range [40-50]. The price is between

90-110% of the quality they are selling.

2. Honest Not Acceptable (HNA): - Each seller

offers a quality in the range[10-39]. Their price is

between 90 -110% of the quality they are selling.

3. Overpriced Acceptable (OPA):- Each seller offers

a quality in the range [40-50]. The price is

between 111-200% of the quality they are selling.

4. Overpriced Not Acceptable (OPNA): - Each seller

offers a quality in the range [10-39]. Their price is

between 111-200% of the quality they are selling.

0

20

40

60

80

100

120

0 50 100 150 200 250 300 350 400 450 500

Transaction

Gai

n

Figure 1: Gain Vs Transaction for a F&NF Buyer.

ICINCO 2007 - International Conference on Informatics in Control, Automation and Robotics

88

0

20

40

60

80

100

120

0 50 100 150 200 250 300 350 400 450 500

Transactions

Ga in

Figure 2: Gain Vs Transaction for a Tran Buyer.

0

20

40

60

80

100

120

0 50 100 150 200 250 300 350 400 450 500

Transactions

Gai

n

Figure 3 : Gain Vs Transaction for a RL Buyer.

Random Buyer

F&NF Buyer

Tran Buyer

RL Buyer

0

10

20

30

40

50

60

70

80

90

100

0 50 100 150 200 250 300 350 400 450 500

Purchases

Avg Gain

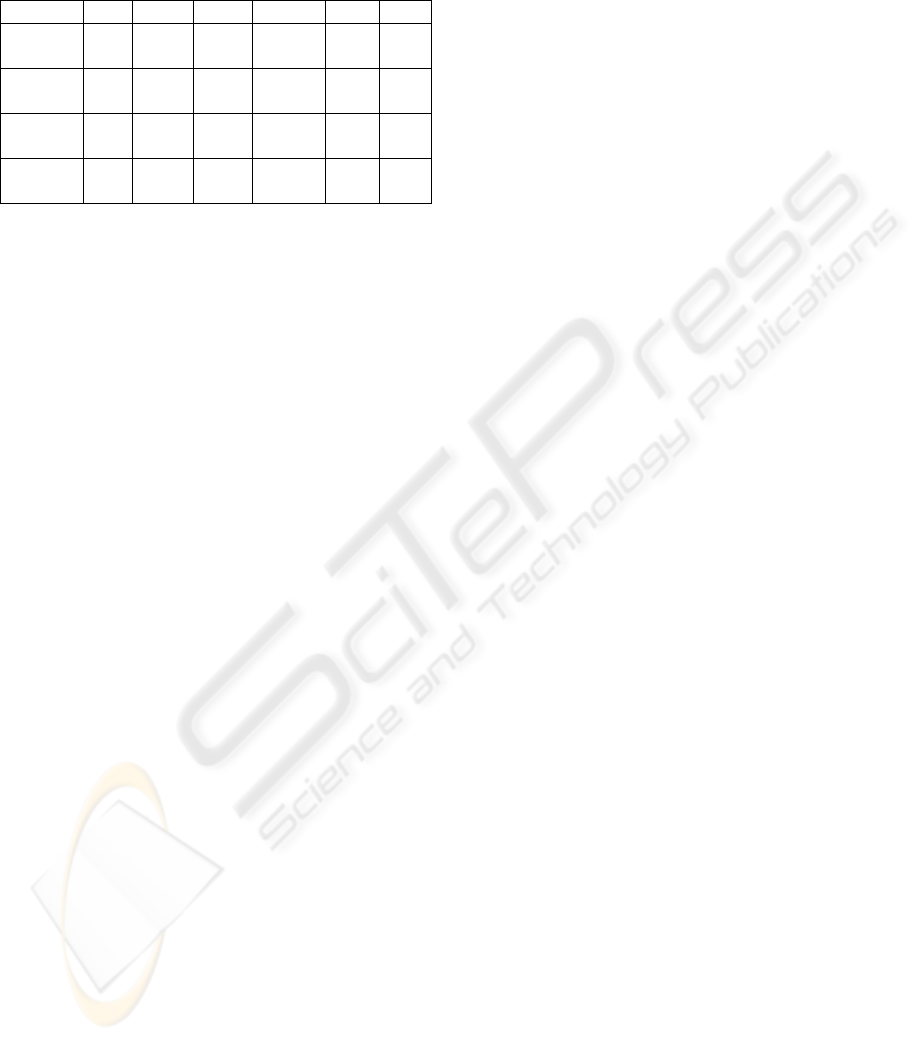

Figure 4: Average Gain versus Number of Purchases for different buyers.

REPUTATION BASED BUYER STRATEGY FOR SELLER SELECTION FOR BOTH FREQUENT AND

INFREQUENT PURCHASES

89

Table1 shows the number of purchases made by a

buyer from each seller type.

Table 1: Buyer seller interaction.

HA

HNA OPA

OPNA INC DIS

Rsk

Buyer

488

2 2 2 2 4

Tran

Buyer

451 7 23 5 8 6

RL

Buyer

420 16 15 13 17 16

Random

Buyer

86 88 82 83 69 92

Acceptable quality sellers can offer qualities

anywhere between 40-50. The lowest gain from

purchasing from a honest seller offering at the

lowest end of good quality range and charging its

highest price is 76 (3*40 – 44). When the gain from

purchasing from a seller is 76 and above, it means

the buyer is purchasing from a high quality low

priced seller. From figures 1-3 it can be seen that

F&NF Buyer, Tran Buyer and RL Buyer learn

although at different rates to identify high quality

low priced sellers. After having learned, they

consistently interact with high quality low priced

sellers. This is confirmed by the fact that highest

number of purchases are made from honest

acceptable sellers as shown in table 1. Random

Buyers never learn and that is to be expected as they

are choosing sellers randomly. F&NF Buyer learns

to identify high quality low priced sellers very

quickly in about 15 transactions or purchases. Tran

Buyers take about 60 transactions to learn and RL

Buyer learns in about 250 transactions. If the buyers

were to purchase the product infrequently then the

F&NF Buyer strategy would work better than the

RL Buyer or Tran Buyer strategy as it requires the

least number of transactions to learn.

Figure 4 shows the average gain versus the

number of purchases for different buyers.

In the beginning, average gains are fluctuating as

the buyers employing a non-random strategy are

learning and Random Buyer is choosing sellers

randomly. F&NF Buyer is the quickest to learn and

its average gain raises sharply earlier on compared

to the other two learning agents. As RL Buyer takes

a long time to learn, its average gain at the end is

still lower than the F&NF or Tran Buyer. Since

Random Buyer purchases randomly from various

types of sellers, its average is consistently the

lowest. In the first half of the figure 4 it can be seen

that when the purchases are fewer, the average gain

for the F&NF Buyer, once its learning phase is

completed, is higher than the other buying agents.

So, if the buyers were to purchase the product

infrequently, then the F&NF Buyer strategy works

better than the RL or Tran Buyer strategy. As the

number of purchases increases, F&NF Buyer still

has the highest average gain with the Tran Buyer’s

average gain coming very close to it at very high

number of purchases.

5 CONCLUSIONS AND FUTURE

WORK

We presented a model for a buyer to maintain the

seller reputation and strategy for buyers to choose

sellers in a decentralized, open, dynamic, uncertain

and untrusted multi-agent based electronic markets.

The buyer agent computes a seller agent’s reputation

based on its ability to meet its expectations of

product, service, quality and price as compared to its

competitors. We show that a buying agent utilizing

our model of maintaining seller reputation and

buying strategy does better than buying agents

employing strategies proposed previously for

frequent as well as for infrequent purchases. For

future work we are looking at how the performance

of buying agent can be improved for extremely

infrequent purchases.

REFERENCES

A. Chavez, and P. Maes, 1996, Kasbah: An Agent

Marketplace for Buying and SellingGoods. In

Proceedings of the 1

st

Int. Conf. on the Practical

Application of Intelligent Agents and Multi-Agent

Technology, London.

A Chavez, D. Dreilinger, R. Guttman. And P. Maes,

1997, A real-Life Experiment in Creating an Agent

Marketplace, In Proceedings of the Second

International Conference on the Practical Application

of Intelligent Agents and Multi-Agent Technology.

C. Goldman, S. Kraus and O. Shehory, 2001, Equilibria

strategies: for selecting sellers and satisfying buyers

,

Lecture Notes in Artificial Intelligence, Vol. 2182, M.

Klusch and F. Zambonelli (Eds.), Springer, 166-177.

R.B Doorenbos, Etzioni, and D. Weld, 1997, A Scalable

Comparison-Shopping Agent for the World Wide

Web, In Proceedings of the First International

Conference on Autonomous Agents, 39-48.

B. Krulwich, 1996, The bargainfinder agent:comparision

price shopping on the Internet, Bots, and other

Internet Beasties, J. Williams, editor, 257-263,

Macmillan Computer Publishing.

ICINCO 2007 - International Conference on Informatics in Control, Automation and Robotics

90

D. Kuokka and L. Harada, 1995, Supporting Information

Retrieval via Matchmaking, Working Notes of the

AAAI Spring Symposium on Information Gathering

from Heterogeneous, Distributed Environments.

T. Tran, 2003, Reputation-oriented Reinforcement

Learning Strategies for Economically-motivated

Agents in Electronic Market Environment, Ph.D.

Dissertation, University of Waterloo.

T. Tran and R. Cohen, 2004, Improving User Satisfaction

in Agent-Based Electronic Marketplaces by

Reputation Modeling and Adjustable Product Quality,

Proc. of the Third Int. Joint Conf. on Autonomous

Agents and Multi Agent Systems (AAMAS-04), Volume

2, 828-835.

J.M. Vidal and E.H. Durfee, 1996, The impact of Nested

Agent Models in an Information Economy, Proc. of

the Second Int. Conf. on Multi-Agent Systems, 377-

384.

REPUTATION BASED BUYER STRATEGY FOR SELLER SELECTION FOR BOTH FREQUENT AND

INFREQUENT PURCHASES

91