A PRODUCT LINE OF SOFTWARE REUSE COST MODELS

Mustafa Korkmaz and Ali Mili

College of Computer Science, New Jersey Institute of Technology

Newark NJ 07102-1982

Keyword: Product line tool, a software reuse cost model, ROI functions, quantify

time-to-market gains, non-linear

optimization problem.

Abstract: In past work, we had proposed a software reuse cost model that combines releva

nt stakes and stakeholders

in an integrated ROI-based model. In this paper we extend our earlier work in two directions: conceptually,

by capturing aspects of the model that were heretofore unaccounted for; practically, by proposing a product

line that supports a wide range of cost modeling applications.

1 INTRODUCTION: AN

INTEGRATED COST MODEL

In (Mili et al, 2000), (Mili et al, 2001); Mili et al had

proposed a software reuse cost model that has the

following characteristics:

• It

recognizes four stakeholders in the software

reuse lifecycle, who are: component engineers,

domain engineers, application engineers, and

corporate manager.

• It recognizes decisions that each stakeholder

m

ust make in order to support a sustainable

reuse activity: the component engineer’s

decision to develop for reuse; the domain

engineer’s decision to initiate a domain analysis

activity; the application engineer’s decision to

avail herself of reusable assets; the corporate

manager’s decision to sustain a reuse based

development process.

• It m

odels each stakeholder’s decision as an

investment decision, which is quantified by

means of ROI functions.

• It

accounts for the way in which cost

information flows between the four investment

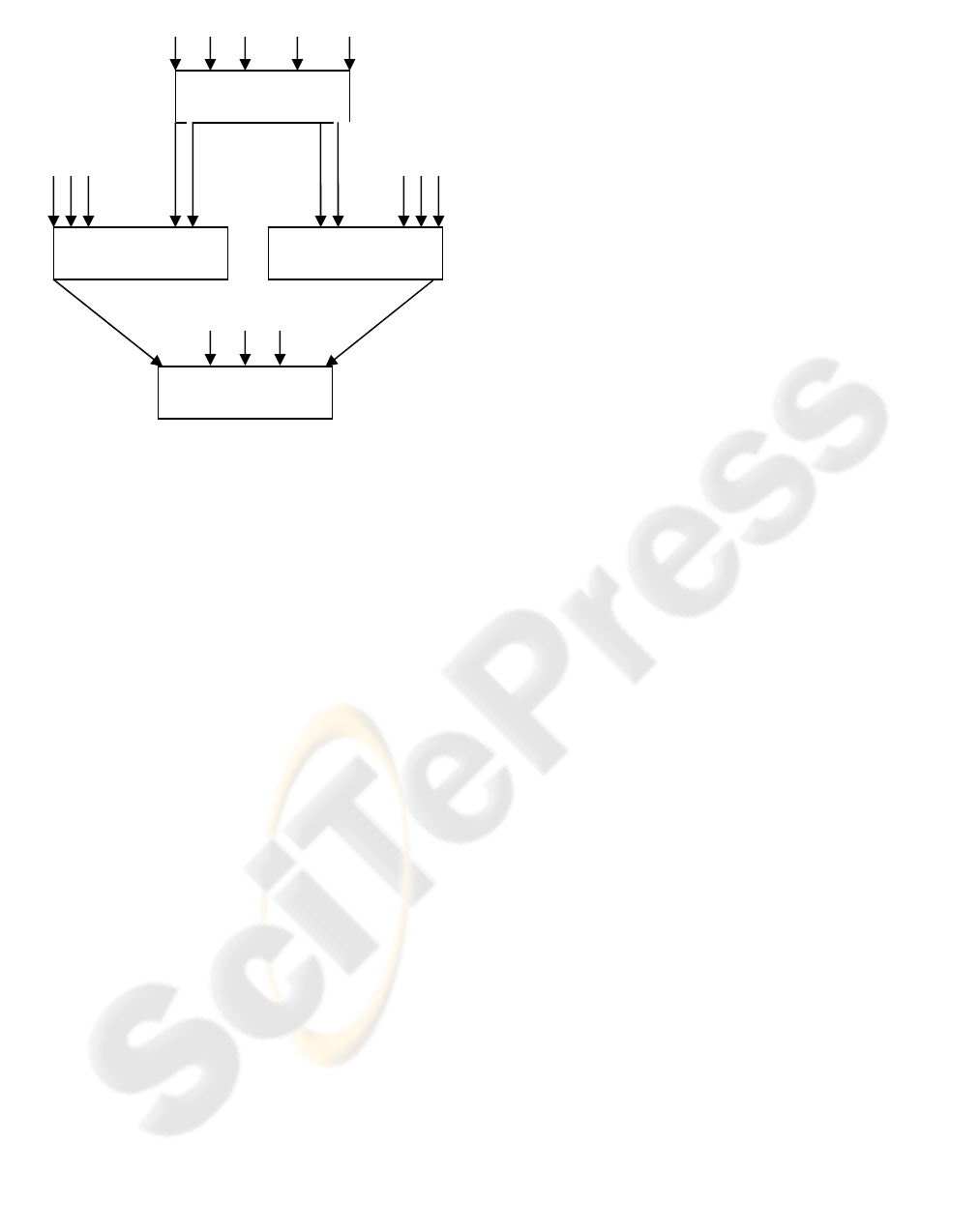

cycles. Figure 1 shows summarily how cost

factors are propagated from one investment

cycle to another.

In (Mili et al, 2000), (Mili et al, 2001); Mili et al

had di

scussed in what sense and to what extent the

proposed model encompasses (or does not

encompass) existing software reuse cost models.

Also, in (Chmiel et al, 2000), Chmiel et al discuss

how this cost models affords us the ability to

regulate the practice of reuse, not through

preaching/ lecturing/ arms-twisting, but rather

through a carefully tuned incentive and reward

structure, that consists in the following steps:

• Elu

cidate the equations that quantify the return

on investment of each of the four relevant

investment cycles.

• Identify controllable factors in

the cost models

of each cycle.

• Fi

ne tune the controllable factors so that all four

ROI functions take positive values (or values

that exceed some threshold).

• Link stakeholder rewards to

their respective

return on investments.

In this short paper, we briefly discuss extensions of

th

is model, by considering in turn conceptual

extensions and practical extensions:

• Co

nceptual Extensions: We augment the

existing model in two ways: first, while the

current model captures quality gains and

productivity gains of reuse, it fails to quantify

time-to-market gains. Second, while the

current model aims to fine tune controllable

factors so as to make all ROI positive, we

propose to maximize the corporate ROI under

the constraint that all four ROI’s are positive

(or greater than some threshold). Depending on

what factors we want to control, this produces a

linear or non-linear optimization problem.

• Pract

ical Extensions: We have developed a

product line of software reuse cost estimation

tools, using core ideas of the proposed cost

model and exploring how these can be adapted

to specific organizational requirements.

We discuss these extensions in the sequel.

264

Korkmaz M. and Mili A. (2007).

A PRODUCT LINE OF SOFTWARE REUSE COST MODELS.

In Proceedings of the Second International Conference on Software and Data Technologies - SE, pages 264-269

Copyright

c

SciTePress

Figure 1: Cost Factor Propagation.

2 CONCEPTUAL EXTENSIONS

2.1 Optimizing Corporate ROI

We consider the cost structure shown in Figure 1.

Each ROI cycle is defined by five cost factors,

which are

• IC: the initial investment cycle,

• Y: the length of the investment cycle (e.g. 3

years, or 5 years, etc).

• d: the discount rate (e.g. 0.15).

• B(y), the benefits gained at year y, for 1≤y≤Y.

• C(y), the costs expended at year y, for 1≤y≤Y.

As a simplifying assumption, it is fair to assume that

parameters d and Y are defined organization wide as

part of the organization’s strategy, and are the same

for all stakeholders. We briefly define the

remaining factors for all stakeholders. For

component engineering, the investment cost is the

cost of development for reuse; the subsequent yearly

benefit is the benefit gained from component sales,

and the costs are the costs of maintenance of the

component. For domain engineering the investment

cost is the cost of domain analysis, the benefits and

costs of subsequent years is the sum of costs and

benefits of all the components that are part of the

domain. For Application engineering, the benefit at

year 0 is the productivity gain, and the benefit at

subsequent years is the quality gains (which we

quantify by savings in maintenance costs). At the

corporate level, investment costs are the costs of the

reuse infrastructure, the benefits at subsequent years

are the cumulative benefits of application

engineering, and the costs of subsequent years are

the cumulative costs of domain engineering. Domain

engineering benefits and application engineering

costs cancel each other at the corporate level, if we

assume that component trade happens internally (i.e.

domain engineering provides reusable assets only to

application. Engineering, and application

engineering acquires assets only from domain

engineering).

Component

Engineering

Application

Engineering

Domain

Engineering

Corporate

Management

d Y IC B(y) C(y)

d Y IC B(y) C(y) IC Y d

C(y) d Y IC B(y)

C(y) B(y)

Using these factors, we can quantify the return on

investment of the various cycles using any number

of formulas, including (Favaro, 1996): Net Present

Value (NPV), Return on Investment (ROI),

Profitability Index (PI), Average Rate of Return

(ARR), Average Return on Book Value (ARBV),

Internal Rate of Return (IRR), and Payback Value

(PB). We denote the return on investment function

(computed by whichever formula) by

,,,,

RADC

ROIROIROIROI

for (respectively) the component, domain,

application, or corporate investment cycle. We

formulate the require- ment of optimizing corporate

ROI in the following terms:

.

,

,

),(

ε

ε

ε

>

>

>

A

D

C

R

ROI

ROI

ROI

ROIMax

Depending on the formula selected for ROI, and on

the controllable factors that we are prepared to alter,

this produces a linear optimization problem or a

non-linear optimization problem. One possible

controllable factor that we have considered in this

study is the price of reusable assets. Normally, the

acquisition of reusable assets by the application

engineering team from the domain engineering

team, gives raise to a credit on the DE account and a

charge on the AE account. We have found that, to

be perfectly fair in distributing the benefits of reuse

between DE and AE, we ought to set the price of

reusable assets at about half their custom

development cost. In case where one of the ROI

values turns out to be negative, shifting this price in

the appropriate direction may ensure that all ROI’s

are positive. Other controllable factors are possible

as well.

2.2 Quantifying Time to Market

Composing an application from reusable assets

affords is productivity gains (in terms of saved

development effort), quality gains (in terms of

higher reliability/ availability and lower

A PRODUCT LINE OF SOFTWARE REUSE COST MODELS

265

maintenance costs) and time to market gains (in

terms of shorter production time). Hence for the

sake of completeness, the ROI of application

engineering ought to include time to market gains,

in addition to productivity gains and quality gains.

A survey of economics research has yielded little in

terms of quantitative models for the gains achieved

by going to market ahead of time. Broadly

speaking, there are two factors that must be

quantified: 1) the amount of sales achieved during

the period separating the early time to market (with

reuse) and the later time to market (without reuse);

2) the market share gained by getting to the

marketplace earlier than competing applications.

Whereas the first factor could perhaps be quantified,

the second factor is much harder to quantify, and its

impact is much longer lasting. We have tentatively

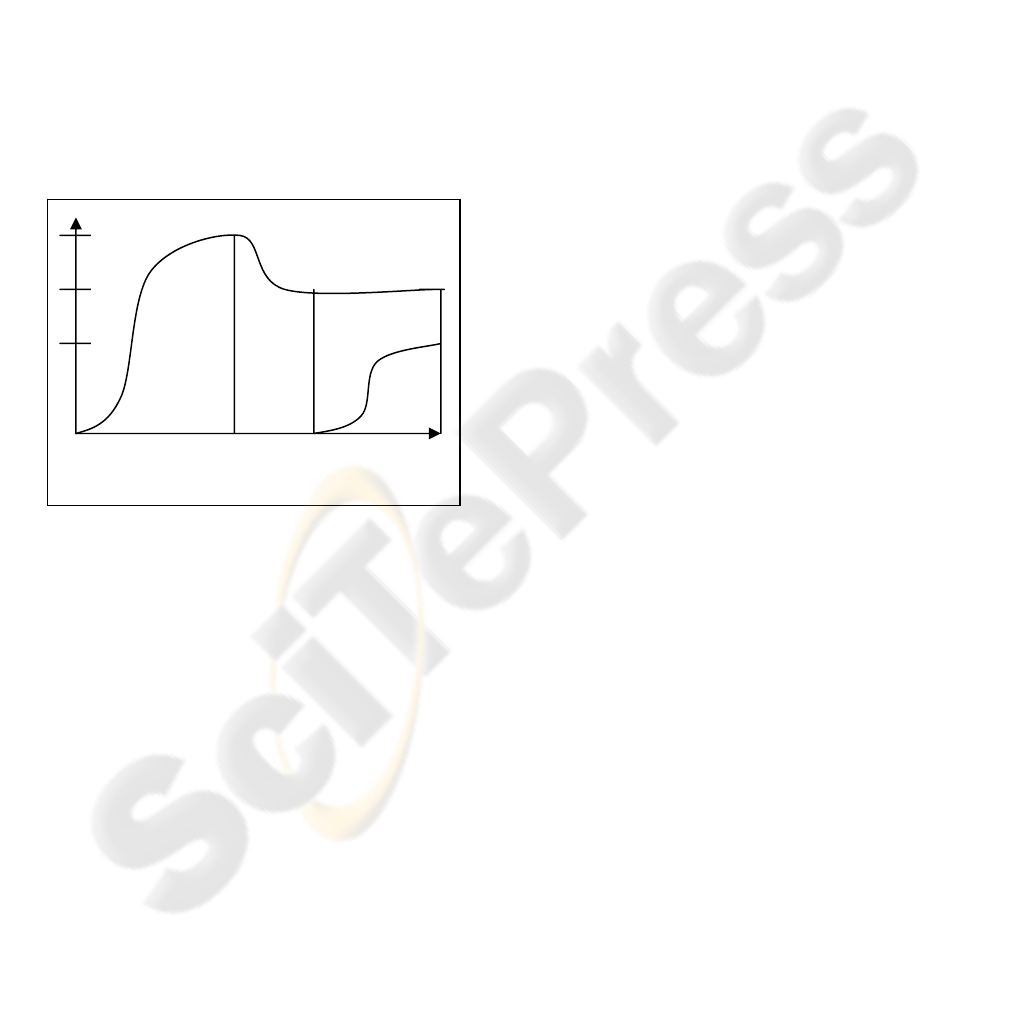

modeled it by the curve shown in Figure 2.

Figure 2: Evolution of Market Share.

To analyze the impact of time to market on market

share, we consider two scenarios: a scenario where a

product is brought to market at time t0, and a

scenario where a product is brought to market at

time t2. Also, we imagine that a competitor arrives

on the market at a time t1 between t0 and t2. The

surface between the two curves represents the lost

sales that can be blamed on delayed time to market.

On the time (horizontal) axis, we can let t0 be 0, we

can estimate t2 using COCOMO-like schedule

equations and let Y be the investment cycle length;

the only unknown is t1, for which we can choose an

average value. On the vertical axis, none of the three

factors (m, n, k) is known or has a default value.

We can estimate m by expert judgment (how many

copies of this application do we estimate to sell per

unit of time?); we can assign heuristic values to n

and k (e.g. 2/3, 1/3). Validation of this model and

associated heuristics is under way.

3 PRACTICAL EXTENSIONS

We envision an automated tool that helps the

various stakeholders to estimate/ compute return on

investments, as well as to record, archive and track

costs and benefits of relevant activities. However,

due to the wide variability of possible user needs,

we resolve to develop this tool not as a single

product, but rather as a product line. Also, we have

resolved to use Weiss and Lai’s domain engineering

methodology, called FAST (Weiss et al, 1999).

3.1 Domain Scope

Broadly speaking, the purpose of our proposed

product line is to provide cost tracking and

estimating tools for a variety of clients, who may

have distinct specific needs. The purpose of an

application within our proposed product line is

multi-fold:

m

n

k

t0 t1 t2 Y

• Cost Tracking/ Archiving. Because return on

investment cycles are long term cycles, that

range over several years, it is impossible to

estimate costs without maintaining long term

cost information. The first function that we

envision for applications in our product line is

to maintain a database of cost factors,

pertaining to all four investment cycles, and

entered by appropriate parties among the four

stakeholders.

• Cost Estimation/ Prediction. The purpose of

this function is to estimate the return on

investment of the four stakeholders, on the

basis of archived cost information. This

function also supports what-if analyses,

whereby stakeholders can vary some

controllable factors (pertaining, for example, to

corporate strategy, incentive/ reward policies,

etc) to assess their impact on ROI estimates.

We also envision, although we have not

implemented it yet, a capability whereby we

derive controllable factors that optimize the

corporate ROI while keeping all ROI’s positive.

• Post Mortem Analysis. Whereas cost

estimation/ prediction assesses costs and

benefits using estimated cost factors, this

function can revisit calculations using actual

cost factors. For example, cost estimation uses

COCOMO (Boehm, 1981), (Boehm et al, 1995)

equations to estimate development costs (which

are then adjusted using reuse specific constants

to reflect development for reuse and

development with reuse (Poulin, 1997)), and

uses estimated reuse frequency figures to

ICSOFT 2007 - International Conference on Software and Data Technologies

266

estimate benefits. In the post-mortem analysis,

estimated are replaced by actuals, and the

economic merits of individual investment

cycles can be assessed accurately.

3.2 Commonalities and Variabilities

Commonalities among applications of our proposed

domain are well defined. The features discussed in

section 3.1 represent functional commonalities, and

the features discussed in section 1 (how the cost

model is structured as a set of nested investment

cycles, how costs are propagated from one model to

another, etc) represent structural commonalities.

Hence we focus our attention in this section on

dimensions of variability, which are listed below:

• The set of available ROI Functions. The client

organization may choose any subset of the ROI

functions that we have listed in section 1. The

choice of these functions may be dependent on

how the organization makes its investment

decisions. This decision had to be made at

application engineering time, rather than run-

time, because it affects the format of output

screens.

• Database Support. The client organization may

choose any of two candidate database systems,

namely SQL or Oracle. This decision has to be

made at application engineering time rather

than run-time, because it involves different

access routines and data formats, hence

different software packages.

• Reuse Organization. We have identified several

candidate reuse organizations, that may affect

the cost equations and the mechanisms of how

costs are charged or credited in an organization.

These include (Fichman, 2001): the library

model, the curator model, the product centered

model, the expert services model, and the reuse

factory model. The client organization may

select an organizational model among these,

and we adjust the equations accordingly.

• COCOMO Model. The client organization may

choose one of three versions of the COCOMO

model: Basic COCOMO (Boehm, 1981);

Intermediate COCOMO (Boehm, 1981) or

COCOMO II (Boehm

et al, 1995). This

decision has to be made at application

engineering time rather than run-time because it

affects data entry routines, as well as

calculations.

• Parameter Adjustment. The client organization

may decide whether cost estimation constants

are adjusted automatically, in light of archived

cost data, or only manually, from authorized

stakeholders. This decision has to be taken at

application engineering time rather than run-

time because it involves different control

processes within the application.

• Procurement Channels. The client organization

may choose a procurement channel whereby the

application engineering team gets components

only from the domain engineering team, and the

DE team provides components only to the AE

team; alternatively, it may allow external

procurement and external sales. This choice

involves different cost equations, and must be

implemented at application engineering time.

• Access Rights. The client organization may

choose different policies regarding the

management of the parameters of the cost

estimations (such as default values, investment

parameters, incentive structures, etc). One

policy could be that all these are under the

exclusive purview of corporate management; a

more flexible policy could delegate each set of

parameters to the stakeholder that knows best,

or has the greatest stake in each. This involves

complex variability in access rights.

• Optimization Parameters. If the user organiza-

tion chooses to implement the optimization

option, whereby the system can compute values

for the controllable factors that maximize

corporate ROI under constraints, then a number

of non trivial parameters must be fixed, which

pertain to the ROI formulas that have been

selected in the first variability (above) as well

as the controllable factors that have been

selected for the organization.

Some of these dimensions of variability are fairly

straightforward and can easily be supported at

application engineering time; others are fairly

complex

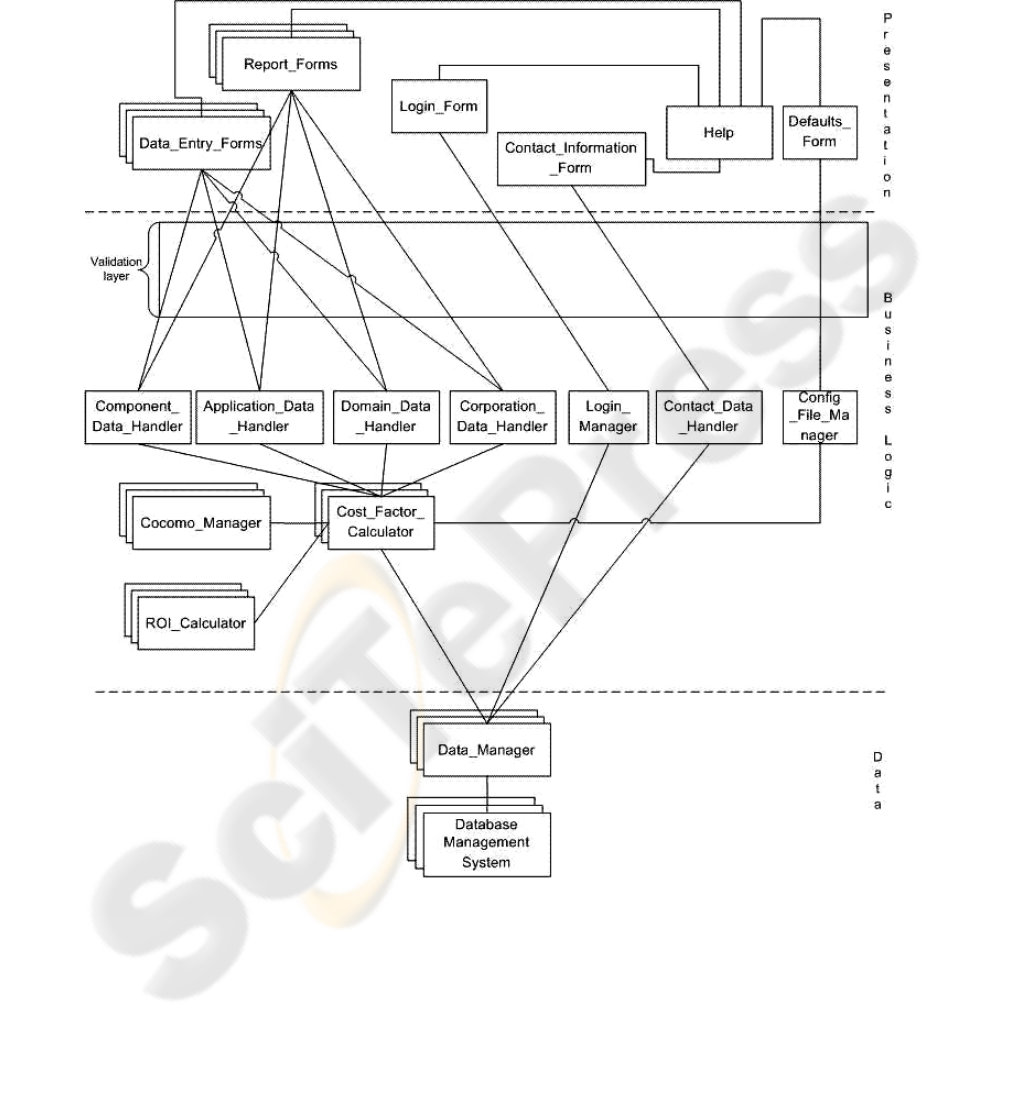

3.3 Reference Architecture

The choice of a reference architecture is perhaps the

most critical decision in the lifecycle of a product

line, as it determines the ease, and the costs of the

application engineering phase, as well as the quality

of produced applications. Decisions taken about

software architectures are usually driven by non

functional attributes, such as required reliability,

security, performance, safety, throughput, response

time, availability, etc.

Because this is reference architecture, another

requirement comes into play that must be added to

these considerations: The architecture must support

A PRODUCT LINE OF SOFTWARE REUSE COST MODELS

267

the application engineering activity by mapping

each dimension of variability into a pre-planned,

pre-verified, set of steps that must be taken to

implement the user’s selection along that dimension

of variability. In this work, we have adopted a

simple way to support variabilities, which is to map

each dimension of variability to a component of the

architecture. The proposed architecture is given in

Figure 3.

3.4 Variability Mappings

We have adopted a policy whereby each dimension

of variability that we offer is mapped to a specific

component of the reference architecture.

Specifically,

• ROI Functions. Once a client organization has

chosen a set of ROI functions, we modify the

ROI Calculator (Figure 2.3) and, perhaps

secondarily, the Report Forms component.

• Database Support. Once a client organization

has chosen a DBMS, we modify the Data

Manager to adapt to the selected system.

• Reuse Organization. As we envision it now, the

selection of the reuse organization affects the

Cost Factor Calculator; this component derives

the cost factors IC, d,

y

,

B(y)

, C(y), for the

appropriate cycle, and feeds them to the ROI

Calculator.

• COCOMO Model. The COCOMO Manager

component is modified according to the

selection of the client organization.

• Parameter Adjustment. The equations that are

used by the Cost Factor Calculator depend on a

host of constants that are derived from industry

experience

(Poulin, 1997). If the client

organization wishes, we can have these

constants adjusted in light of calculations made

by the tool; this is handled by the Configuration

File Manager.

• Procurement Channels. The choice of

procurement channels affects the calculation of

cost factors C(y) and B(y) for application

engineering and domain engineering. This

choice affects the Cost Factor Calculator.

• Access Rights. The selection of a policy of

parameter management affects the management

of access rights implemented by component

Login Manager.

• Optimization Parameters. This dimension of

variability is something of an exception, as we

could not encapsulate it into a single

architectural component, and changing the

architecture to map it into a single component

would be costly in terms of its impact on other

variabilities. As it stands now, this variability

affects the Cost Factor Calculator, the

Corporation Data Handler, and the

Configuration File Manager.

4 SUMMARY AND

CONCLUSIONS

In this paper, we have extended our past work on

modeling software reuse costs in two directions.

Conceptually, by integrating a quantification of time

to market gains into the ROI of application

engineering; and by adding a capability that allows

the model to fine tune controllable factors so as

maximize the corporate ROI while keeping all

stakeholder ROI’s positive (or greater than a

predefined threshold). We have also considered a

practical extension, which consists of developing a

product line of software reuse cost estimation tools,

which support a wide range of variability in user

requirements. Most of the functionality discussed in

this paper is currently operational, and can be

demonstrated, including the ability to produce

applications to specific requirements. To this effect,

we have developed an Application Generation

Environment, similar to the environment that Weiss

and Lai produce in (Weiss et al, 1999) for the

floating weather station. This environment takes

prespecified variability parameters and

automatically generates code according to the

parameter values.

REFERENCES

B. Boehm, 1981. Software Engineering Economics.

Prentice Hall, Englewood Cliffs, NJ.

B. Boehm, B. Clark, E. Horowitz, C. Westland, R.

Madachy, and R. Selby, September 1995. Cost models

for future software lifecycle processes: COCOMO 2.0.

Annals of Software Engineering, 1:57–94.

S. F. Chmiel and A. Mili, October 2000. Estimating

software reuse costs. In Fifteenth International Forum

on COCOMO and Software Cost Estimation, Los

Angeles, CA. University of Southern California.

J. Favaro, April 1996. A comparison of approaches to

reuse investment analysis. In Proceedings, Fourth

International Conference on Software Reuse, pages

136–145, Orlando, FL.

A. Mili, S. F. Chmiel, R. Gottumukkala, and L. Zhang,

June 2000. An integrated cost model for software

reuse. In Proceedings, International Conference on

ICSOFT 2007 - International Conference on Software and Data Technologies

268

J. Poulin, 1997. Measuring Software Reuse: Principles,

Practices and Economic Models. Addison Wesley.

Software Engineering, pages 157–166, Limerick,

Ireland. IEEE Computer Society Press.

D. M. Weiss and C. T. R. Lai, 1999. Software Product

Line Engineering. Addison Wesley.

A. Mili, S. F. Chmiel, R. Gottumukkala, and L. Zhang, 11,

2001. Managing software reuse economics: An

integrated roibased model. Annals of Software

Engineering.

Robert G. Fichman, Apr 27, 2001. Incentive Compatibility

and systematic software reuse, Journal of Systems and

Software, New York

Figure 3: Reference Architecture.

A PRODUCT LINE OF SOFTWARE REUSE COST MODELS

269