AUCTION BASED SYSTEM FOR ELECTRONIC COMMERCE

TRANSACTION

A. R. Dani

+

, V. P. Gulati

+

+ Institute for Development and Research in Banking Technology, Hyderabad, India

Arun K. Pujari*

* Department of Computer Science, University of Hyderabad, Hyderabad, India

Keywords: Forward auctions, reverse auctions, assignment constraints, capacity

constraints

Abstract: Auctions provide efficient price discovery mechanism for sellers. Auctions are being used for sale of variety

of objects. In last few years auction based protocols are widely used in electronic commerce. Auction based

systems have been developed for electronic procurement. In this paper we propose system for electronic

commerce transactions, which can support electronic procurement as well as help enterprises to sale items.

We also consider assignment constraints those may be required in different commercial transactions. In this

paper we consider forward and reverse auctions. We formulate the problem as mixed integer programming

problem. Then we propose an algorithm to obtain optimum solution and compute pay-off.

1 INTRODUCTION

An auction is basically a bidding mechanism which

is describ

ed by set of rules. These rules specify how

the winner is determined, from the set of competing

bids and how much winner has to pay. Auctions

have been in use for many years. They are used for

sale of variety of objects. These objects range from

bonds of public utilities to perishable items like

flowers. Governments of different countries use

auction mechanism to sale long-term securities and

treasury bonds, to raise funds to meet the borrowing

needs of government. Similar mechanisms are used

by public sector utilities to sale their bonds and raise

money. The process of procurement using

competitive bidding is another form of auction. In

this case the bidders compete for right to sell their

products or services. The private and state owned

enterprises use different types of bidding

mechanisms for procurement of variety of products

like computer stationery and this practice is fairly

wide spread.

It is also being used to dispose of waste and

scrap m

aterials

. The rights to use material resources

from public property such as mining rights, off-

shore oil leases, have been sold by means of

auctions in different countries. Communication

companies use to similar mechanisms for bandwidth

allocation. In real life large number of transactions

are carried out using different types of auction

mechanisms. Auctions are helpful to seller, as they

help them to avoid the risk of determining the price

of an object. Auctions provide mechanism, where

the price is determined by others rather than seller

himself. However seller can decide whether to

accept the bids received. Auctions are used mainly

for following three reasons

• Au

ction helps in obtaining/revealing information

abou

t buyer’s valuations

• Actions are also helpful dishonest dealing between

bu

yers and sellers

• They provide Speed of sale

Trad

itionally auctions like ascending price or

Engli

sh, descending price or Dutch, or Sealed bid

auctions were earlier used in different economic

transactions. Emergence of Internet based electronic

markets in last years has contributed significantly to

growth of different types of auction transactions.

This has resulted in significant increase in number of

transactions that are being carried out using different

types of auction mechanisms on Internet. Present

day electronic auctions support novel applications

like electronic procurement, bidding on air ticket etc.

Different companies use electronic bidding to get

market determined prices of their goods. Internet

based auction companies such as ebay, ubid carry

16

R. Dani A., P. Gulati V. and K. Pujari A. (2005).

AUCTION BASED SYSTEM FOR ELECTRONIC COMMERCE TRANSACTION.

In Proceedings of the Seventh International Conference on Enterprise Information Systems, pages 16-23

DOI: 10.5220/0002529800160023

Copyright

c

SciTePress

out large number of auctions. Internet based auction

companies have implemented many different types

of auction mechanisms, apart from traditional

auctions like English, Dutch, Sealed Bid. Auction

based protocols have been widely used in electronic

commerce. Auction mechanisms are widely used in

electronic commerce for carrying out negotiations.

One of the most important use of this mechanism

is to facilitate the transfer of assets from public to

private hands. This has been a common phenomenon

in different countries in last two decades as a result

of economic liberalization. Governments in

countries like Britain and Scandinavia have uses

auctions to privatize transportation systems. In

former Soviet Union and Easter Europe countries

auctions have been used to sale public owned

industrial enterprises. Auctions are being used for

many years to acquire rights of use of natural

resources. Such types of auctions, where

government grants access rights to use natural

resources or transfers the ownership of its

enterprises can be considered as examples of

forward and reverse auctions. When government is

transferring public owned enterprise, it may be

interested in seeing that ownership is distributed

appropriately and no one person or enterprise gets

ownership beyond certain percentage.

While granting access to natural resource it may

be interested to see that no one person or private

enterprise acquires complete control. This can give

rise to different types of constraints, while

determining the winner. In this paper we consider a

scenario of forward and reverse auctions under

constraints. The main contribution of this paper is

the development of algorithm which can minimize

procurement cost for enterprises as well as maximize

the cost selling. Then design of system for electronic

procurement and selling has been presented. Our

algorithm also takes into account different types of

constraints. We also compute Vickrey-Clake-

Grooves (Vickrey, 1961), (Clarke, 1971) (Gooves,

1973) (VCG) payments for buyers and sellers. This

ensures that our mechanism is strategy proof and

efficient. The rest of the paper is organized as

follows, in section 2, we present an example of the

problem with different types of constraints and

related work. In section 3, we discuss the problem

formulation, design aspect of our system and our

algorithm. In section 4 we discuss experimental

results. In section 5, system implementation is

discussed. We conclude in section 6.

2 RELATED WORK AND

MOTIVATING EXAMPLE

In this paper we consider the problem of single item

multi unit auction problem under different types of

constraints. We basically consider two scenarios. In

first case there is a single seller having quantity q of

an item to sell and there are n buyers. This type of

auction is usually called as forward auction. In the

second case, we consider a scenario, where there is

one buyer and who requires quantity q of certain

item and there are n sellers who can supply these

items. This type of scenario is called as reverse

auction. These types of auction problems have been

studied recently (Kothari, 2003). An approximately-

strategy proof and tractable multi unit auction

mechanism for single good multi unit allocation

problem has been presented in (Kothari, 2003). The

problem has been modeled as generalization of

classical 0/1 knapsack problem and a fully

polynomial time approximation scheme for reverse

and forward auction variations has been presented.

In this formulation capacity constraints, where buyer

or seller can express upper bounds on their

respective requirements are considered.

However in certain cases in addition to capacity

constraints, we can have constraints on number of

items that can be sold to one buyer or which can be

purchased from a single buyer. We consider an

example of Initial Public Offering (IPO) of a

government owned enterprise to illustrate this. In

IPO government invites competitive bids from

different individuals and private enterprises, for

privatization. Suppose that government wishes to

decrease its ownership in an enterprise from 100%

to say 49%. This is done by means of IPO of its

shares, wherein government invites competitive bids

from individuals and others. Even though

individuals or private enterprises may indicate their

capacity or willingness to buy certain number of

shares, it may not be feasible as per policies of

government. The enterprises may be divided in

number of categories and the there can be different

restrictions This scenario has been shown in Table 1.

A government wishes to sale say, one million shares

by means of IPO. Suppose that the bids submitted by

different companies are as given in Table 1.

AUCTION BASED SYSTEM FOR ELECTRONIC COMMERCE TRANSACTION

17

The third and fourth columns show capacity

constraints of different enterprises. The restrictions

as per rules governing IPO, are shown in fifth

column. These restrictions impose certain

constraints. However these constraints are not much

different from usual capacity constraints. This may

result in change upper bounds and lower bounds in

some cases. It can be seen that upper bound on

shares that can be sold to an enterprise, is much

smaller in respect of enterprises 1, 2 and 5 and is

much higher in case of enterprises 3 and 4. So upper

bound on capacity constraints of these enterprises

will differ. However there can be constraints like

total number of shares that can be sold to a particular

group. We illustrate these constraints in next table

in reverse auctions. In reverse auction also there can

be similar constraints e.g. An enterprise has

requirement of 10000 meters of clothes. As per

government policies, it is required to acquire certain

percentage from certain types of sellers (e.g. a small

scale enterprises run by group of women etc.). The

different quotes received by it are given in Table 2.

As per government policy, the enterprise must

acquire half of its requirement for enterprises (1) and

(4), which are small scale enterprises, run by group

of persons from weaker sections of society. It can

acquire remaining requirement from other two

enterprises. These constraints are basically on group

of sellers. Even though each seller has capacity

constraints, the group constraints will apply on a

group of sellers (1,4) and (2,3). These constraints

differ slightly from usual capacity constraints. We

formulate this problem as mixed integer

programming problem, which can handle

assignment constraints indicated above. Then we

present an algorithm, which obtains optimum

solution and then computes pay-off based on VCG

mechanism. A detailed survey of auction

mechanisms can be found in (Wolfstter, 1996). A

multi attribute auction system, for electronic

procurement has been studied in (Bichler, 1999).

Table 1 : Sale of 1 Million shares by IPO

Enter-

prise

Price

Min.

Demand

Max.

Demand

Govt.

restriction as

% of Tot.

No. of

Shares (1

Mn)

1 100 2 Lakhs 5 Lakhs 15%

2 105 5 Lakhs 8 Lakhs 30%

3 110 5 Lakhs 1 Million 30%

4 102 1 Lakhs 1 Million 20%

5 100

10 Thous-

and

1 Lakh 5%

Table 2 : Quotations Received

Enterprise Price ( per Ton) Maximum Supply

1 105 3000

2 101 10000

3 102 6000

4 103 4000

In multi attribute auctions winner determination is

based on more than one attributes unlike in

traditional English or Dutch auctions, where price is

the only attribute. An application of auction theory

in electronic procurement has also been studied in

(Eso, 2001), it also gives near optimal solution to bid

evaluation problem of the buyer. A procurement

process which minimizes the cost using auctions has

been proposed in (Kalgnanam, 2001). Another type

of auction known as Combinatorial Auctions where

seller wishes to sell a combination of goods and

buyers bid on one or more goods, has been studied

recently (Rothkopf, 1998), (Sandholm, 1999).

Double Auctions is another widely used auction

mechanism and has been used in different stock

exchange markets like (National Stock Exchange of

India) and many other stock exchanges worldwide.

It is also widely being used in commodity exchanges

such as (Multi Commodity Stock Exchange of India)

and other similar exchanges. Stocks are homogenous

goods, and buyers do not have preferences over a

designated stock. Apart from this we are not aware

of any work done in developing algorithms to

generate optimum solution in case of constraints or

exploring other approaches to solve the problem

especially in case of forward and reverse auctions.

3 SYSTEM DESCRIPTION AND

PROBLEM FORMULATION

We basically consider two scenarios- A forward

auction, where there is a single seller having

quantity q of an item to sell and there are n buyers,

and a reverse auction, where there is one buyer who

requires quantity q of certain item and there are n

sellers who can supply these items. We first

introduce the relevant concepts. One of the

important features of our system is the algorithm

which obtains the optimum solution i.e. minimum

procurement cost or the highest cost of sale under

different types of assignment constraints. This

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

18

algorithm always generates the optimum solution

with polynomial time complexity. Another feature of

our implementation is an algorithm, which generates

the pay off for each participant. We compute VCG

pay–off which ensures the properties like efficiency.

It also ensures that truthful bidding is the dominant

strategy.

A bid in the forward auction (an ask in reverse

auction) describes the details of the items, its

quantity and price that the buyer is willing to pay.

Without loss of generality we assume that there are n

buyers (sellers). Additionally buyer (seller) can

describe capacity constraints. A buyer (seller) can

also use the marginal decreasing piecewise bidding

language used in (Kothari, 2003). This allows buyer

to specify the quantity range and price that buyer is

willing to pay as ([10,5),5) instead of single quantity

price pair. It is also an ordered list of attribute

names and values. Let there be a set of n bids, B

1

,

B

2

,…, B

n

. Each B

i

(Ai) is of the following type:

B

i

= ( (at

1

, v

1

), (at

2

, v

2

),…, (at

k

, v

k

)),

where at

j

denotes the j

th

attribute and

v

j

is the value

of the attribute.

The attributes describe different characteristics

of the items. Each attribute assumes the values from

the set of specified domains. For instance, the price

attribute will have values from set of positive real

numbers. The price and quantity are two attributes

of asks and bids. If buyer (seller) uses marginal

decreasing piecewise bidding language, then at

i

can

be a semi closed interval, which is open at one end.

Each buyer (seller) can specify m such intervals and

price pair. In this case we select only one point (on

an interval) for each buyer.

Our system is implemented as a web based

system which can be configured to be implemented

by third party auctioneers as well as enterprises. It

has got a parameterized policy module using which

levels of security, scheduling, type of auctions etc.

can be defined. Three different implementation

levels of security are provided in the system. In the

first level authentication by means of User-Id and

Password is provided. Once the user is successfully

authenticated, it uses Secure Socket Layer (SSL)

protocol for sending any message.

In the second level combination of User-Id,

Password and Public Key Cryptography is provided.

In this level it uses Public Key Infrastructure (PKI)

for implementing security. Each participant (i.e.

buyers, sellers, auctioneers) can optionally have a

key pair. The public key must be deposited with the

specified trusted third party (TTP). In this level use

of public key cryptography is optional. In the third

level the use of public key cryptography is

mandatory. In this case all the participants must

have key pair. In this implementation a bid or ask is

acceptable only if it is digitally signed by the sender

(i.e. buyer, seller or auctioneer). These levels help to

provide different levels of security in the system.

The level of security can be selected depending upon

the value of items. The auctioneer can enforce use

of public key cryptography in case of high value

items.

Another feature of our system is that its design

based on of Event-Condition-Action (ECA) rules.

Specific ECA rules can then be bound to different

events for versatile exception handling. Number of

different types of exceptions and events have been

defined in the system.

Events of different types can occur in this system

occur because of actions of different parties. The

action by buyer of submission of a bid will cause

occurrence of event like “Bid Arrived”. This event

will trigger activity like “Bid Validations”. This

activity will validate the bid. In case the bid is

invalid i.e. some of the attributes of bid violate some

constraints “Invalid Bid” exception will be raised,

sending appropriate notification to sender. In case

bid is valid an event “Bid Accepted” will occur.

There can be two types of events database events

and negotiation events. Events in the system like

“Bid Arrived” will be caused by actions of buyers.

When the event like “Acceptance Closure” occur, it

will automatically trigger of the algorithm to

generate optimum solution.

This system can be configured as sealed bid or

open depending upon the type of auction. In case of

sealed bid option bids (asks) will be submitted in

encrypted format and will be decrypted only after

the auction has closed. In this case it will not be

possible for the buyers (sellers) to see the bids (asks)

submitted by others. The system can also be

configured to accept more than one bid or ask from a

buyer or seller. However sender must specify which

bid or ask is final. If the information is not specified

then the last submitted bid (ask) is treated as final.

The complete cycle of stages in our system is as

follows:

(1) User Registration: The system requires that each

participant must register with system, before it

can be used. The user details are captured in

this phase.

(2) Auction Notification: Once the users are

registered with the system they can notify the

auction. The details of auctions like item

description, type, security level required etc. are

submitted by the users to the system. This

indicates the start of auction. An auction can be

initiated by a buyer or a seller. Optionally it is

also possible to submit the reservation price.

(3) Bid/Ask Submission: Once the auction is

notified the bids and asks can be submitted by

the registered users. At this time price and

quantity details are required to be submitted. In

AUCTION BASED SYSTEM FOR ELECTRONIC COMMERCE TRANSACTION

19

some cases asks and bids are required to be

digitally signed by the sender. Multiple asks and

bids can be submitted by any buyer or seller,

however only one of these bids or asks will be

considered. It can be the last submitted bid/ask

or any one of the submitted as indicated by the

buyer.

(4) Closure: The bids and asks can be accepted for

only fixed period of time. After this period asks

or bids cannot be accepted. At the end of

closing period the auction is cleared.

(5) Clearing and Pay-off: Once the acceptance of

bids (asks) is closed, the optimization problem

is constructed from the received bids and asks.

Then the optimum solution is obtained. After

finding out optimal solution, system generates

the pay-off of each buyer and seller.

(6) Notification: After generation of optimum

solution, VCG pay-off for each buyer and seller

is generated. In this phase each buyer and seller

is notified about the result of auction and his

pay-off.

At present the system is not linked with banking

system to execute payments. In the next phase it will

be linked with banking system, so that payments can

also be effected automatically. In the following

paras we describe and state our algorithm for finding

optimum solution.

Our algorithm is based on branch and bound

method. At each stage it finds out maximum

possible improvement. At any given price,

maximum improvement is possible only by selecting

maximum quantity that can be available at that price.

Our algorithm is based on this and works as follows:

(1) We start with the highest (lowest) available

price.

(2) Determine the maximum quantity that is

available at that price after taking into account

all the constraints. If there are two bids (asks)

with same price then we combine them.

(3) Save the value of buyer’s (seller’s) contribution

in separate table.

(4) Repeat above two steps till requirement is

completely fulfilled.

(5) Then determine VCG Payoff for each buyer

(seller).

Let A be the list of asks and B be the list of bids.

The algorithms are as follows:

Algorithm (1) forwauct /* Main Algorithm */

1. Sort all bids on descending order of price within

same price sort on descending order of quantity

2. While (there is an unmarked bid or unfulfilled

demand) repeat steps 3thru 7

3. Find out maximum quantity available for price

p

i

after capacity constraints on buyers

and other

constraints

4. Calculate and save the buyer’s contribution

5. Calculate the value of objective function

6. Mark the bid

7. Add quantity to demand_fulfilled

Algorithm (2) revauct /* Main Algorithm */

1. Sort all asks ascending order of price within

same price sort on descending order of quantity

2. While (there is an unmarked ask or unfulfilled

supply) repeat steps 3thru 7

3. Find out maximum quantity available for price

p

i

after capacity constraints on sellers

and other

constraints

4. Calculate and save the seller’s contribution

5. Calculate the value of objective function

6. Mark the ask

7. Add quantity to supply_fulfilled

Example: The working of the algorithm is illustrated

in the following simple example. There are four asks

and five bids. The capacity and other constraints are

shown in maximum demand and supply column.

Bid Price

Qty

Avl.

Max.

Possi

ble

Tot.

Price

Ask

Price

Ask

Qty

Qty.

Req Cost

1 45 5 3 135 12 5 50

2 40 8 5 200 12 4 60

3356 6 210 08480

4 30 6 4 180 8 4 100

5258 8 200

33 925

The output of our algorithm shown in column 4

(forward auction) and last column for reverse

auction.

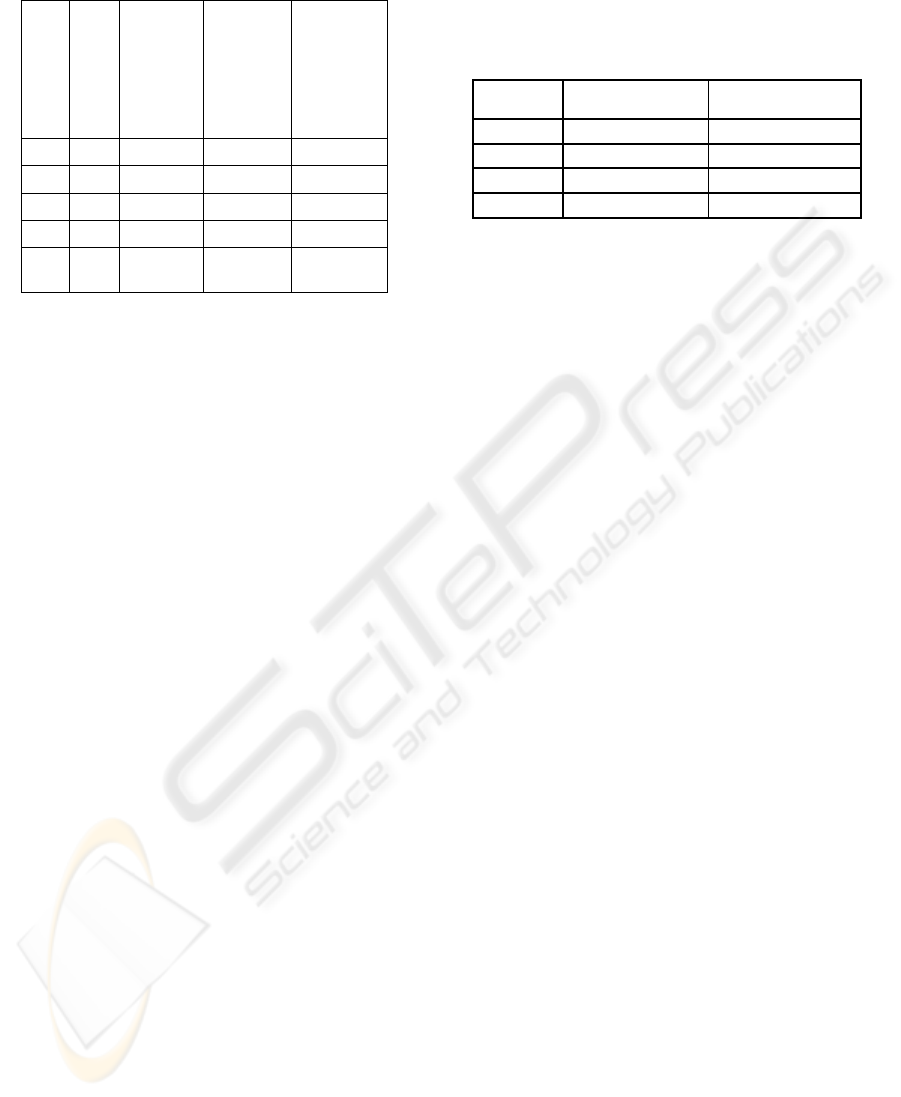

4 EXPERIMENTAL RESULTS

The algorithm has been implemented in C++. The

data sets of asks and bids of different sizes were

generated randomly. Each data set consisted of

number of asks with ask price, quantity, ask size, bid

size, bid price and bid quantity. Size of data sets

varied from 5 to 1500. The results were compared

with unconditional optimum solution and some

solutions obtained with the help of MATLAB

package. It can also be seen that time complexity of

our algorithm is always polynomial. The Figure 1

indicates the comparative performance of proposed

solution against algorithm proposed in (Kothari,

10

15

2

25

Solution Exam

p

le

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

20

2003). The maximum (minimum) quantity at any

price can be obtained by scanning at most n asks and

bids each time. Apart from this sorting is the hardest

part. Since sorting time complexity is of the order of

O(nlogn), the time complexity of this algorithm is

O(n

2

) + O(nlogn) in worst case, which compares

favorably with the time complexity order O(n3)

presented in(Kothari,2003). Additionally VCG pay-

off gets computed in linear time complexity.

5 SYSTEM IMPLEMENTATION

The auction system for purchase a

nd sale

elps

elps users to

transactions which minimizes the procurement cost

and maximizes cost of selling based above algorithm

has been implemented. The system can handle

forward as well as reverse auctions and is

configurable. An enterprise can configure the system

for forward or reverse auctions and once it is

configured buyers can submit bids and sellers can

submit asks. Then our algorithm computes optimum

solution based on submitted asks and bids. The

optimum solution will be either minimum

procurement cost or maximum cost of sale. Then it

also computes VCG pay-off of each buyer and

seller. As VCG implementation has different

properties like efficiency, strategy-proof ness, our

implementation has also these properties. It ensures

that no buyer or seller can gain by untruthful

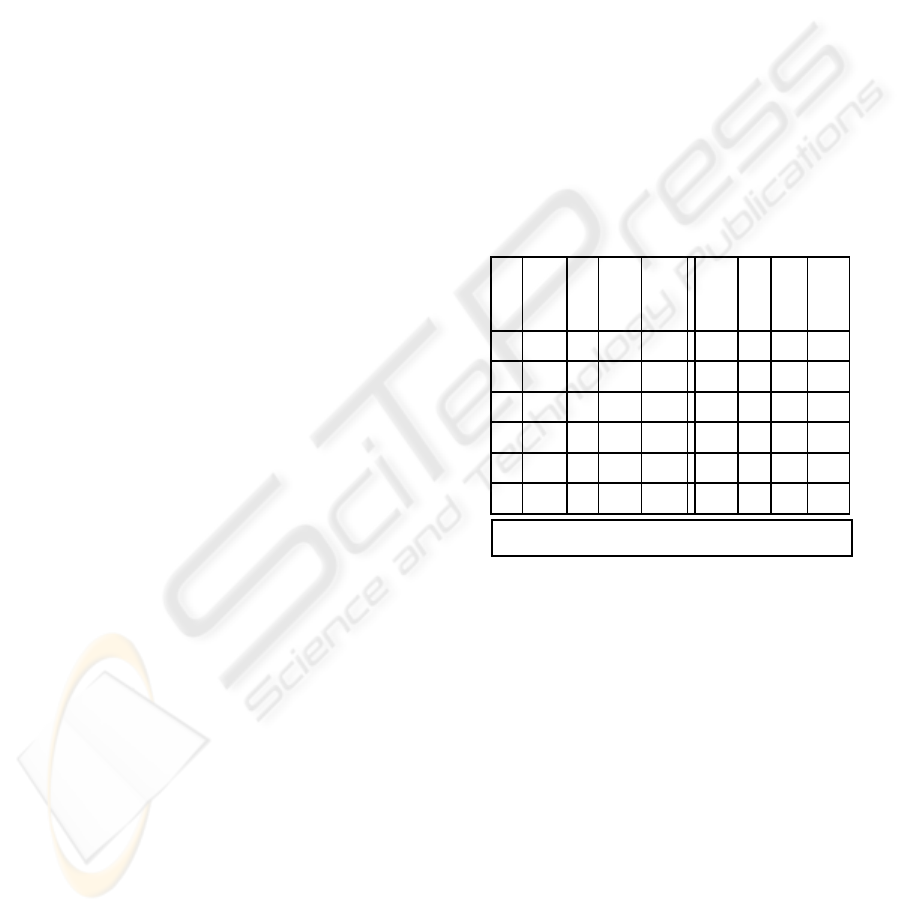

bidding. The UML State Chart Diagram of Figure 2

captures different states of our auction based system.

The UML activity diagram is shown in Figure 3.

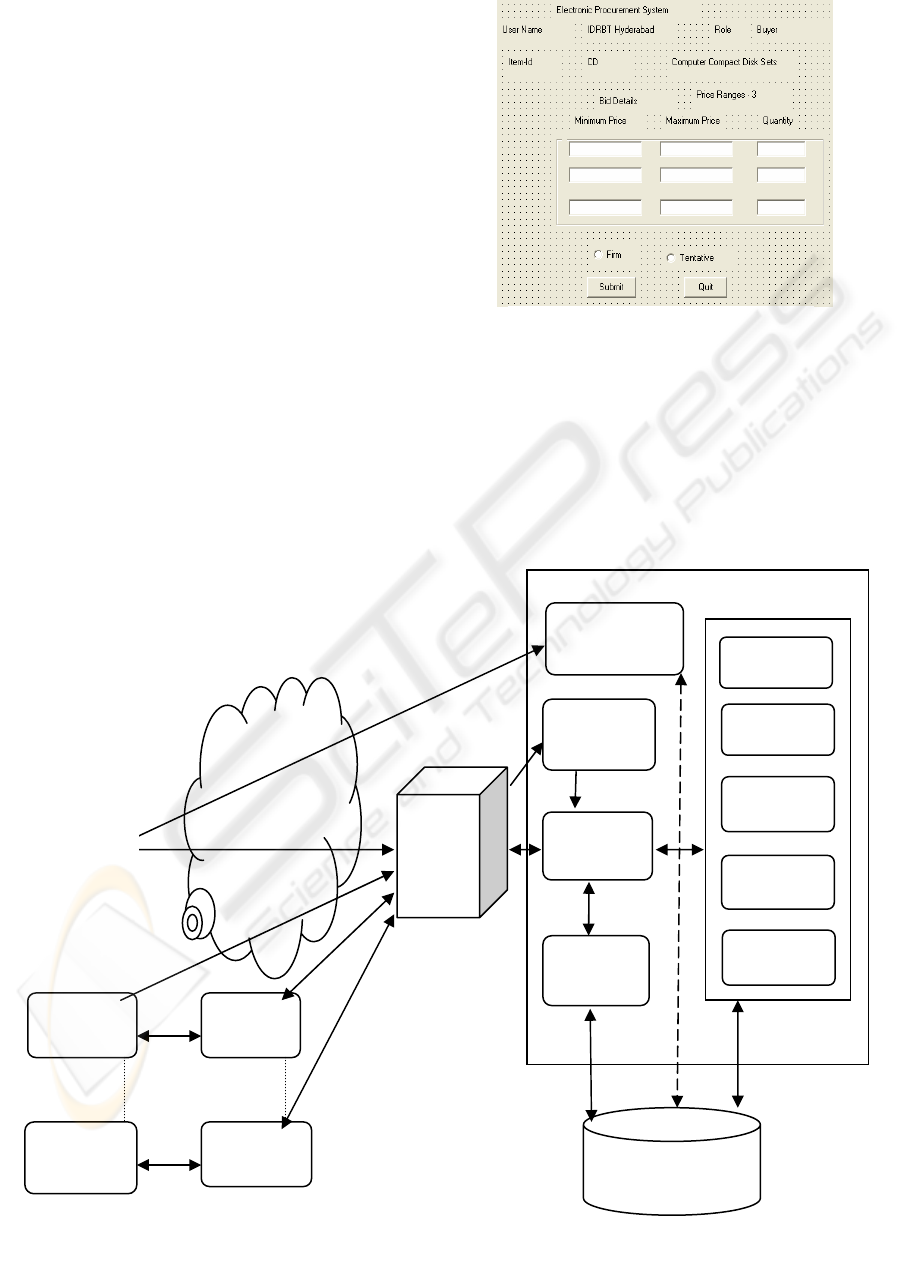

The different modules in the system are

User Registration Module: This module h

buyers and sellers to register with the system. The

details of the users are captured here. The users can

also submit their respective public keys to the

system using this module. The users can also update

their respective details. A web interface has been

created for submitting the user details.

Notification Module: This module h

notify about the auction. An auction can be initiated

by a buyer or a seller. A web-based interface has

been defined using which users can specify the

different parameters. The users can specify the

details like whether auction is open or sealed bid, the

period for which the auction will remain open, type

of auction, constraints and reservation price etc.

Once the auction details are submitted this module

notifies different buyers and sellers about it. This

module also informs users about various activities

and status of auctions. Once auctions are notified

buyers and sellers can submit respective bids and

Comparision of Algorithms

0

5000

10000

15000

20000

25000

30000

5

2

0

35

50

65

80

9

5

11

0

No. of Bids

No. of Asks scannced / bid

Proposed algorithm

Existing algorithm

Figure 1: Comparative Performance

N

otifie

d

Bid/Ask

S

Re

g

istere

d

ubmitted

Data

Validated

Acceptance

Closed

Optimum allocation

Payoff Generation

Rejected

Figure 2: State Chart diagram

Register User Notify Users

A

ccept Bids

Is Data Valid?

Y/N

Generate optimum

and Asks

Allocation

Is Period Over ?

Co

Y/N

mpute Pay

Off

Notify Result

Figure 3: Activity diagram

AUCTION BASED SYSTEM FOR ELECTRONIC COMMERCE TRANSACTION

21

asks. It also notifies the result of auction and payoff

of each buyer and seller.

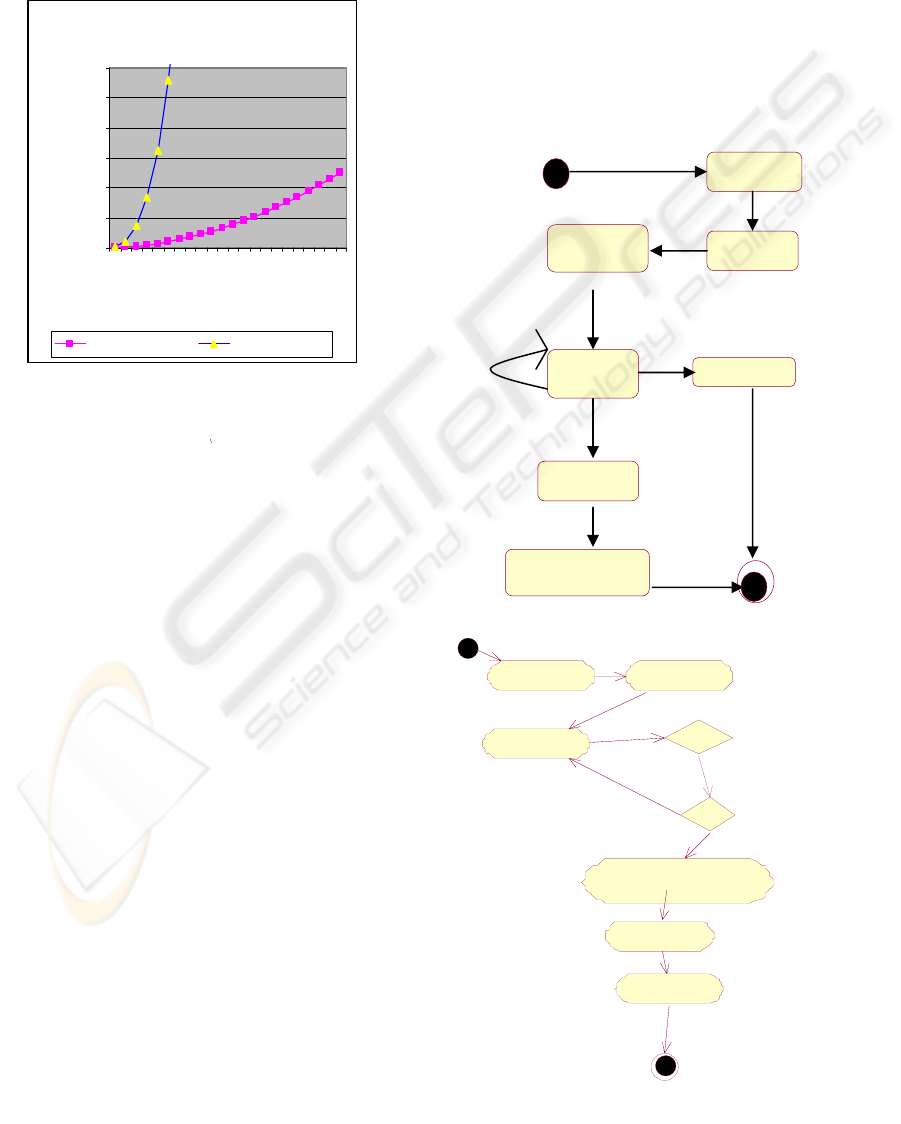

Figure 5: Auction Screen

Bid/Ask Submission: This interface helps buyers

and sellers to submit their respective bids and asks.

The buyers and sellers can specify capacity

constraints using this module. It allows multiple

submission till closing time. It helps users to specify

their firm bid or ask. It allows the users to digitally

sign their respective bid or ask. It can also ensure

that each message is encrypted if required.

Validation Module: This module validates the data

submitted by users. Each bid or ask is validated.

Only bids and asks are considered for further

processing. If bid or ask is invalid then

corresponding message is returned. It validates the

user details and the auction details. If the submitted

details are invalid then the data is rejected.

Optimization Module: This module first formulates

the optimization problem depending upon the

options, attributes and constraints specified. It then

implements the algorithm described in section 3 of

the paper. It finds out optimum procurement cost or

cost of sale. This is one of the main important

feature of our system.

Scheduler Module: This module schedules various

activities in the system. Once the auction is

submitted it schedules activities like auction

notification, closure of bid and ask acceptance,

clearing of market etc.

Configuration Module: It helps enterprises to

configure the auction system. Different parameters

like security level, period, type etc, can be

configured based on user requirements. It also helps

in User Administration.

Auction System

Enterprise

Application

Enterprise

Application

Internet

Enterprise

Application

Enterprise

Application

Auction

Server

Database

Security

Module

Pay off

Module

User

Registration

Scheduler

Module

Configuration

Module

Optimization

Module

Validation

Module

Bid / Ask

Submission

Notification

Module

Buyer /

Seller

Figure 6: Auction System Architecture

ICEIS 2005 - SOFTWARE AGENTS AND INTERNET COMPUTING

22

Payoff Module: It computes the payoff of each

buyer and seller. It computes VCG Pay-off by fast

computation. This module can also backtrack and

generate the solution, even if one of the participant

backs off.

Security Module: This module provides the

security components in the system. It provides

services for storage of public keys. It has modules

for encryption, decryption and digital signing.

The screen shot our system is shown in figure 5 and

architecture in figure 6.

6 CONCLUSION AND FUTURE

WORK

In this paper we have presented the design of an

auction-based system, which can handle assignment

constraints. The two types of auctions considered

here are forward auction and reverse auctions.This

system can handle different types of assignment

constraints in addition to capacity constraints. Its

two main components are the optimization

algorithm, which generates optimum solution to

problem of minimizing procurement cost or cost of

sale, considering different types of assignment

constraints and pay-off algorithm. This can help

enterprises to procure and sell items. It is also

helpful in carrying out IPOs for sale of share of any

enterprise. They can specify the assignment

constraints of different types, so the problem is

handled more general settings. The algorithm can

also handle unconstrained cases. Our system also

ensures that the truthful bidding is the dominant

strategy. The future work includes extending this

work to solve the problem where quantity is not

constrained to be integer. Another extension will be

interfacing the system with the existing systems of

different enterprises and adding payment

component. One of the extension will be to provide

secure payment capabilities by incorporating one or

more banks in the system.

REFERENCES

Bichler Martin, Kaukal Marion, Segev Marion, 1999.

Multi Attribute Auctions for Electronic Procurement,

In the proceedings of First IBM IAC Workshop on

Internet Based Negotiation Technologies, Yorktown

Heights, NY, Marz.

Clarke E. H., 1971.

Multi Part Pricing of Public Goods,

Public Choice, 11:17-33.

Eso M., Ghosh S., Kalagnanam J.,Ladanyi L., 2001.

Bid

evaluation in procurement auctions with piece-wise

linear supply curves

, IBM Research Report RC 22219

Grooves T., 1973.

Incentives in Teams, Econometrica,

41:617-631.

Kalgnanam Jayant R., Lee Ho. S., 2001.

Minimizing

Procurement Costs for Strategic Sourcing

, IBM White

Paper

Kothari Anshul, Parkes David C., Suri Subhash, 2003.

Approximately Strategyproof and Tractable Multi-

Unit Auctions

. Proceedings of 4

th

ACM Conference on

Electronic Commerce, Pages 166-175.

Multi Commodity Stock Exchange of India,

www.mcxindia.com

National Stock Exchange of India, www.nse-india.com

Rothkopf, M.H., Pekec A., Harstad R.M., 1998.

Computationally Manageable Combinatorial

Auctions, Management Science

, 44(8), 1131-1147.

Sandholm T., 1999.

An Algorithm for Optimal Winner

Determination in Combinatorial Auction

, In

proceedings of IJCAI 1999, Morgan Kaufmann

Vickey W., 1961.

Counter Speculation, Auctions and

Competitive Sealed Tenders

, Journal of Finance, 16:8-

37.

Wolfstter E., 1996.

Auctions: An Introduction, Journal of

Economic Surveys, 10(4): 367-420

AUCTION BASED SYSTEM FOR ELECTRONIC COMMERCE TRANSACTION

23