E-BUSINESS FOR THE ELECTRICITY RETAIL MARKET

A Business to Client perspective

Victor Santos

ISCAC, Polytechnic Institute of Coimbra, Bencanta Quinta Agrícola, 3040 – 280, Coimbra, Portugal

LCT, University of Coimbra, Pólo II - Pinhal de Marrocos 3030 - 290 Coimbra, Portugal

Edmundo Monteiro

LCT, DEI, University of Coimbra

Pólo II - Pinhal de Marrocos 3030 - 290 Coimbra, Portugal

António Gomes Martins

LGE, DEEC, University of Coimbra

Pólo II - Pinhal de Marrocos 3030 - 290 Coimbra, Portugal

Keywords: Electrical retail, e-Business, B2B, B2C, real time price.

Abstract: In the new deregulated market of the electricity industry the communication and e-Business infrastructure

plays a main role for the efficiency of all the entities present in the electricity sector. From generation to the

final client there are two markets, the wholesale and the retail market. Specific characteristics of the

electricity industry make the communication support a fundamental tool to reflect the changes made by one

of the intervenients in the whole value chain. When prices change at the wholesale market it is necessary to

reflect them at the final consumers. Without a bidirectional and reliable communication systems several

problems could occur, from spikes in the electricity prices that could take retail companies to bankruptcy, to

huge blackouts that happened in Europe and in the United States. The goal of this paper is to present a

model for the electricity retail market. Several studies have been done about the electricity markets, the

grand majority focus their attention on the wholesale market. Our proposal is to analyse the e-Business

communication structure in a Business-to-Client perspective.

1 INTRODUCTION

Deregulation brought the segmentation of the

electricity industry. From generation, passing

through transmission and ending at the distribution

sector, all are separated from each other. During the

nineties several countries have adopted this

structure. Nevertheless, the traditional utility model

still exists. Generation, transmission and distribution

all belongs to the same entity which have a

monopoly or an oligopoly economic structure.

Nowadays in the developed countries customers

become the focus of energy and energy service

providers. This means that generation sells it’s

commodity in the wholesale market to retailers that

distribute to the consumers. Transmission of

electricity is usually done by state regulated entity to

clarify and avoid market influence.

The aim of this work focus on the development

of a electricity retail model that enables market

efficiency growth with the existence of the retailer

entities, and the importance of a Business-to-Client

communication infrastructure to improve better

quality of service to the final client.

There are three different types of clients,

industrial, commercial and domestic, as a

consequence different types of needs and different

types of load profiles. Without the impact of price

oscillation at the final client, it is impossible to

provide profit to the entities of the deregulated

market for new generation systems, maintenance and

to provide a new set of products besides electricity.

150

Santos V., Monteiro E. and Gomes Martins A. (2005).

E-BUSINESS FOR THE ELECTRICITY RETAIL MARKET - A Business to Client perspective.

In Proceedings of the Second International Conference on e-Business and Telecommunication Networks, pages 150-156

DOI: 10.5220/0001423401500156

Copyright

c

SciTePress

Studies developed in several countries, where

electricity deregulation is a fact, where conducted to

characterize the retail clients behaviour

(Cunningham,2001). The analysis of this

information is of main importance to build a retail e-

Business system that answers to clients expectations.

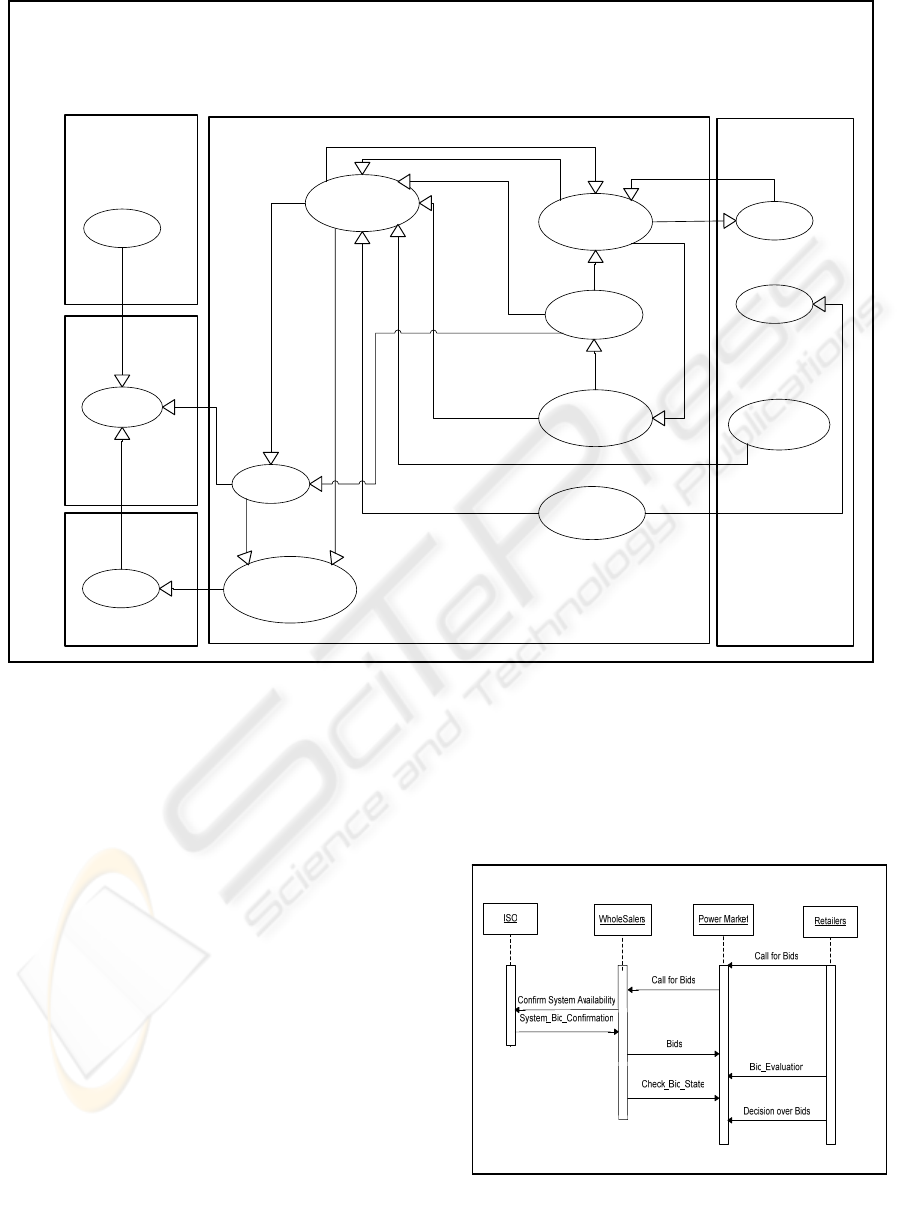

To model the electricity retailer reality we used a

UML representation The UML e-Business model of

the electrical retail company is presented in Fig. 2

identifying all its components, requirements and

interactions.

In this paper an e-Business model of the

electrical company is presented, and as demonstrated

will improve customer response, company

efficiency, and time-to-market response at the

wholesale market where is crucial to trade well for a

better sell.

This paper is organized as follows. In section 2 three

market models are presented and analysed. In

section 3, the UML retailer B2C model is presented.

A discussion of the model proposed is done in

section 4. Requirements for security in this kind of

markets are evaluated in section 5. The conclusions

and future developments are at the paper end in

section 6.

2 MARKET MODELS

The electricity retailer is the unified entity of the e-

Business structure that could improve benefits to

both sides, generation and final clients. The e-

Business can be supported by an e-market entity

based on a web platform. At the B2B side the

retailer acquires the electricity to sell, by bidding on

a power market or by establishing bilateral contracts

with the wholesalers. This paper is focused on the

B2C side of the e-Business retail model. Consumers

will be encouraged to renew the metering structure

of the electricity business. Smart meters with web

access are the resort of the last mille to implement,

allowing a bidirectional communication structure

that will permit the access to billing and services,

structures all based on a web platform. Considering

the web as an open space with multiple market

scenarios, what will be the best scenario, most

efficient, bringing win-win relations? Three different

types of markets are possible to analyse assuming

that all clients have a real time price tariff as shown

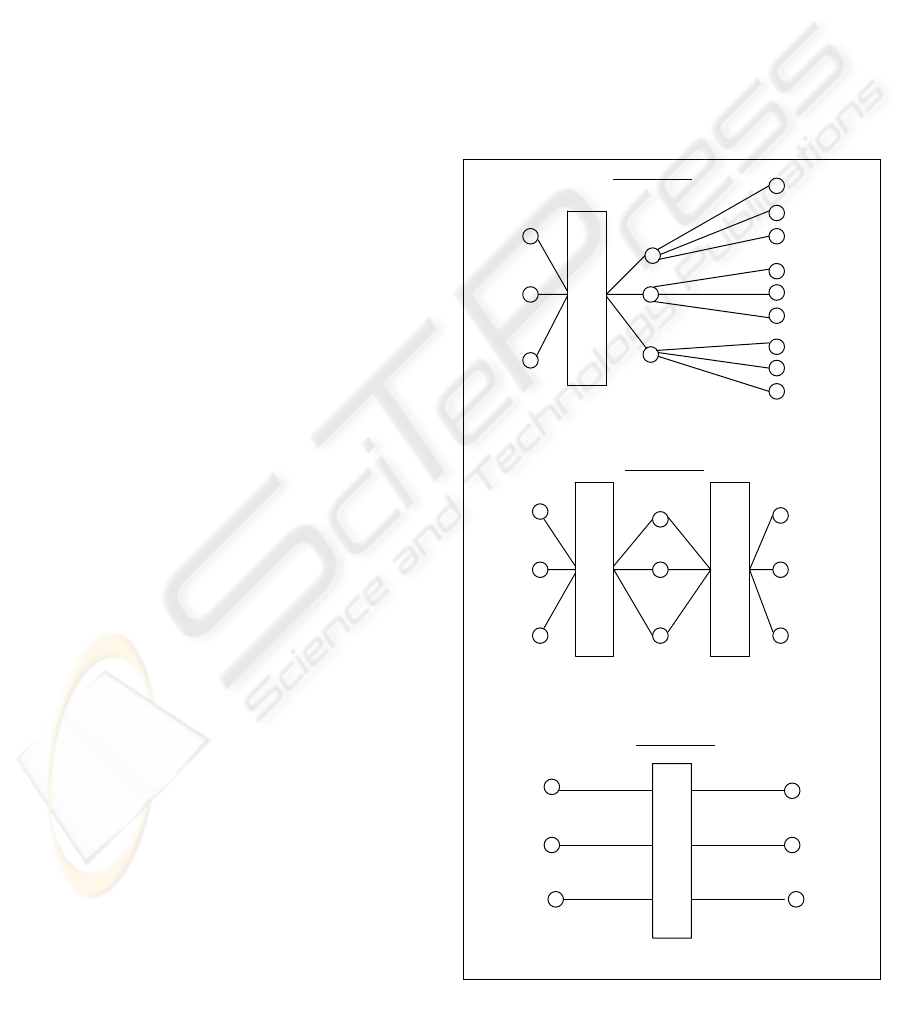

in Fig. 1.

In the first case we have a retailer for a group of

clients, where any client could choose his retailer,

this structure is used in the countries where

deregulation has arrived, it doesn’t allow a dynamic

change between suppliers.

The second model proposed, allows a dynamic

retailer multi-choice. In fact what is proposed is a

B2C web market for the electricity retailer. This web

structure have several advantages for both sides of

the business, clients could get the best price, retailers

don’t have to support the huge variation on price at

wholesale market, where prices could increase more

than 100% in one day. Nevertheless it must be

defined a time restriction for a change of retailer.

This is done to protect retailers investments and

discourage unfair clients who won’t pay theirs bills

and are always

changing from supplier, issue that is

focus below in the electricity retail market structure

security.

Retailers

Wholesalers

Clients

W

1

C

1r1

W

n

W

2

Hypothesis 1

Retailers

Wholesalers Clients

W

1

C

1

W

n

W

2

C

2

C

n

Hypothesis 2

Wholesalers Clients

W

1

C

1

W

n

W

2

C

2

C

n

Hypothesis 3

R

1

R

2

Rn

R

n

R

1

R

2

C

2r1

C

3r1

C

1r2

C

2r2

C

3r2

C

1rn

C

2rn

C

3rn

.

.

.

B2C

Market

.

.

.

.

.

.

.

.

.

.

.

.

B2B

Market

B2B

Market

B2B

Market

Figure 1: Hypotheses for a B2C retail market

E-BUSINESS FOR THE ELECTRICITY RETAIL MARKET-A Business to Client perspective

151

The third hypothesis is an answer to how important

is the retailer presence in this type of market, by

assuming his overtaking on the electricity

wholesaler market. Let’s suppose that the final

clients with real time price could have a direct

access to the wholesale market, what is a fact in

same traditional outlets markets (O´Sheassy, 2003).

There are some commodities where this happens but

the client is forced to acquire great amounts of the

product of his interest, in this case electricity.

Because it (electricity) is a continuous function in

time and couldn’t be stored, this must be done by a

bilateral contract, where all the parameters, like

prices, quantities, date and time periods are

previously settled. Besides that the final client could

not have the benefits of real time tariffs if he

overtakes the retailer. In addition to that fact,

electricity retailers could also have the distribution

structure to support which in that case a rent must be

established for the distribution lines if the final client

buys directly in the electricity wholesaler market.

After the choice of the market model it’s

important to deepen the electricity retail model to

understand what modules he must have for is

internal business run, and what connections he has to

establish with the wholesalers and on the other side

with their costumers. For an e-Business development

we should to distinguish two sides of the same

business, the B2Band the B2C sides. Their

interactions are of great importance not only for the

retailer but also to their clients. The good deals done

at the B2B market are reflected on the B2C services

availability.

3 B2C INFRASTRUCTURE

In this section it is presented a UML model of the

electricity retailer. The interaction between this

model and the external entities are analysed in sub-

section 3.2 e-Business transactions. Ending this

section the security requirements of the model

analysed is discussed.

3.1 Electricity retail model

Fig. 2 shows an e-Business model for the electricity

retailer and the connections with the other entities.

Besides the wholesalers and the final clients, as

could be seen there is also an Independent System

Operator – ISO which coordinates the electricity

physical structure. From country to country, this

entity can have different levels of intervention in the

market. He (the ISO) could operate only the physical

structure or also the financial market, regulating the

transactions schedule in time. Electricity can be

traded in different periods of time ranged from

fifteen minutes to several months later, before

empowering the lines. The ISO acts like a regulator

of the commodity and also of the financial systems.

Following in the UML model several modules

are presented. The energy management use case, a

crucial module in the retail business, makes the

analysis of all the impact decisions. They are made

after the evaluation of the saving measures that can

be taken to avoid new purchases and a rigorous

definition of the quantities to buy.

At the clients load management use case, the

loads are elected for automatic cut off or rearm.

The client’s consumptions are the business

beginning, read by the power meter and sent to the

automatic meter reading use case. Every service to

the final client, besides electricity distribution and

sells, are processed at the financial services use case.

On the other hand, the bids at the wholesale

power market are done after the information passed

from the forecast consumption use case to the

energy management module. Bids are executed by

the retailer market management use case.

In the next section the transactions to the outside

of the retailer model are analyse.

3.2 e-Business transactions

In the traditional electricity industry the company

has to support generation, transmission and

distribution costs besides maintenance. The

company profit is granted by contracts that are made

by the distribution sector with their clients.

Deregulation brought the segmentation of the

electricity industry, all parts from generation to

distribution where separated and new markets where

created. Retailers buy electricity from the

wholesalers which is then sold to the final clients.

Retailer business is well suited to be supported by an

e-Business structure, where a B2B relation is

established between the wholesalers and the retailer,

on the other side a B2C platform is the retailer

solution to improve their competence and services to

the final costumers. Information and communication

technologies are essential for optimal performance

of a retailer. Retailers acquire electricity in two

ways, by a bilateral contract with

ICETE 2005 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

152

Energy Management

WholeSalers

Accounting Management

Clients Acounting

Management

Retail Market

Management

Clients Load

Management

Consumption

Forecast

Automatic Meter

Reading

ISO

WholeSalers

Power Meter

Loads

Financial Services

Retailer

Clients

Realised Values

Values Needed

Load Control

Service Values

Metering control

Read Values

Traded values

Offers

Power Market

Values

Supply Changes

Sells/Purchases Data

Sales values

Values to analyse

Wholesalers

Meter Read Values

Values Request

Estimated Values

Metering request

System

Operator

Market

Power Market

Management

Bids

Billing

Bilateral

Contracts

the wholesalers or at the wholesale market

posting bids in an auction (Bower, 1999). As

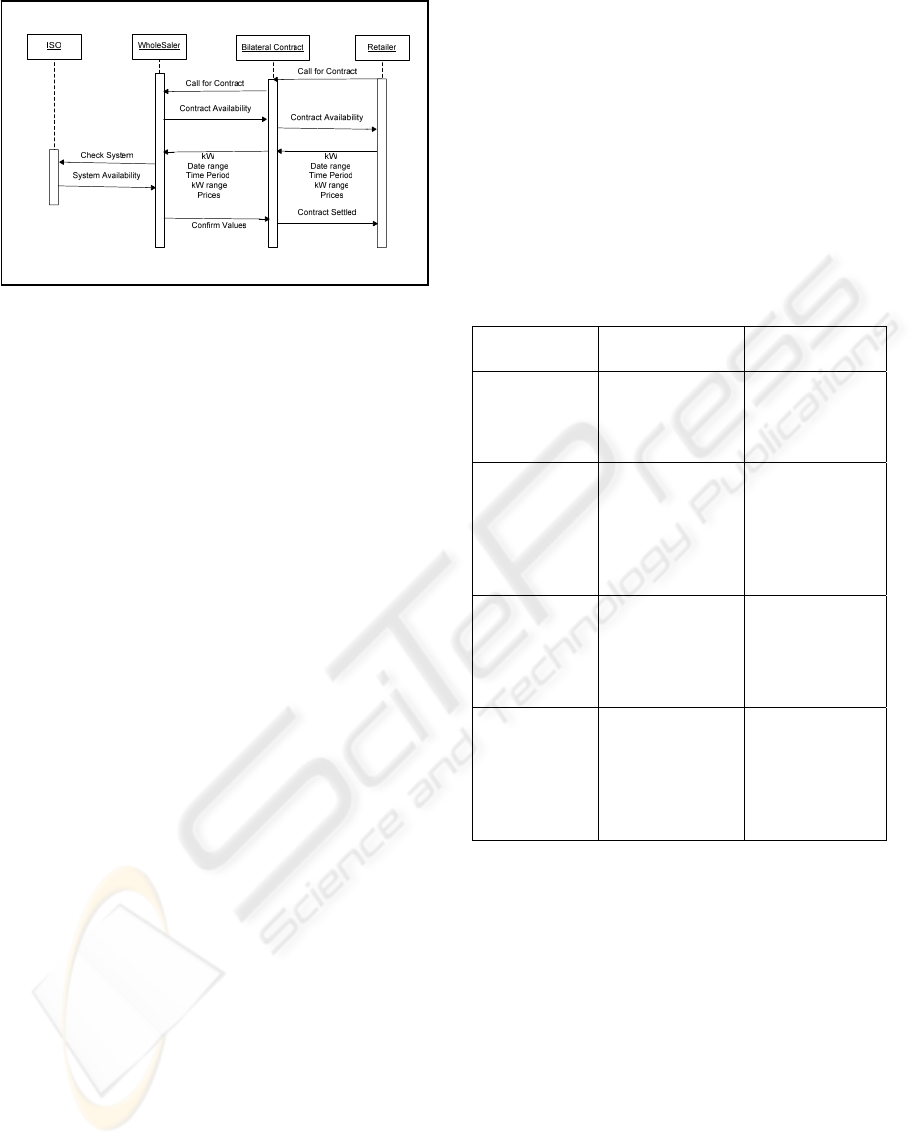

presented in Fig. 3 and Fig. 4 the UML sequential

diagrams intends to give a timely perception of the

two forms for the retailer get his commodity

Usually at the power market a reverse auction is

coordinated by the market operator, trying to match

the retailer’s bids with the wholesaler’s offers. As

could be seen in Fig. 3, even in the market where the

Independent System Operator is apart from the

market operator the trades have to be confirmed by

him, usually the day before, because physical

constraints could occur.

Bilateral contracts could have several forms, to

name a few, contracts of fixed price, fixed

quantities, indexed, floating, etc. Nevertheless there

are same parameters and operations that are common

to all. At first, all contracts are settled between two

entities, independent from the system operator.

Prices, quantities, dates and period of time, are the

usual variables. It is possible to join to the contracts

same services for load management, or same

different variables like the temperature or oil price

(Lafferty, 2001). Besides the fact that the contracts

agreements are not revealed, the common

parameters above mentioned, must be sent to

Independent System Operator before the quantities

agreed enter in the power system.

Figure 3: Electricity Power Market

Figure 2: UML model of the electricity retaile

r

syste

m

E-BUSINESS FOR THE ELECTRICITY RETAIL MARKET-A Business to Client perspective

153

To the retailer and his client point of view,

consumption analysis is relevant information. It

helps the costumer to identify his load profile and

behaviour, and gives to the retailer important

information for energy management services (Gaw,

1998).

The different types of tariffs that could be

implemented aren’t all supported by the old power

meters, but open new possibilities for retailer

aggregated services. Real time tariffs are only

available for consumers with smart meters and

costumers that could have an online communication

channel with the retailer. Table 1 presents the four

types of tariffs usually available. It is relevant to

explain the difference between these four tariffs. Flat

tariff is the traditional one. The estimation is based

and time blinded, without any variable

improvement. It is not possible to adapt for the

power market.

On the contrary, Time of Use represents the

natural evolution of the traditional power meter here

we have a internal clock to distinguished the

different periods of a 24 hours day. This way,

allows a transfer of the client’s loads from peak

periods to off peak periods. The price change in a 24

hours day, higher prices naturally at peak periods.

With the evolution of the power metering, the

automatic meter reading have is main support in a

communication channel. Real Time Price tariff

appears and have a direct connection to prices

established at the power market (Reed, 2000). The

power smart meters responds to inputs readings from

the retail centre. This static memory device has

internal algorithms programmed to react to market

prices oscillation. Besides the direct connection of

the Real Time Price tariff, this type is out of phase in

time with the wholesale power market.

Dynamic Tariff is the model that in a more

realistic way represents a real time pricing tariff

varying in periods of half or hour day during the 24

hours of a day. Smart meters could have real time

price changes, the communication structure must be

bidirectional and have additional algorithms for

price adjustment.

To better understand the communication

requirements of a retailer, we will analyse the

communication process of a client with dynamic

pricing tariff. At the first sight, the retailer only

needs to communicate once a day, sending the price

structure for the next day. A more efficient

alternative is to develop a dynamic price web server

for this type of clients. This way costumer could

access the prices list from the retail web server any

time they want.

Type of Tariff Price Costumers

Requirements

Flat Estimation

based. Local

meter reading.

Traditional

meter

TOU - Time

of Use

Prices varying

during a 24

hours day where

fixed intervals of

time.

Traditional

meter with an

internal clock

time periods in

a 24 h day.

RTP - Real

Time Price

Consumer prices

with a direct

connection to

prices at the

power market.

Smart meters

that responds to

inputs readings

from the retail

centre.

DP - Dynamic

Pricing

Prices varying in

periods of half or

hour day during

the 24 hours of

day.

Smart meters

with

bidirectional

communication

.

Suppose the same client is participating in a

load-reduction program, the retailer might want to

know the load reduction as it occurs, in which case

the communication from the customer’s meter to the

retailer needs to be either much more frequent or

based on a system that permits the retailer to poll the

customer’s meter at any time. This second approach

requires a meter with multiple communication ports

that can send dynamic-pricing and load-reduction

programs. The metering communication system

needs to move data and instructions between the

customer and its retailer, and perhaps automatic-

control systems will be needed to answer to time-

varying prices. The answer to these situations brings

us to reflect what should be the better structure to

support these requirements. An e-Business structure

Fi

g

ure 4: Bilateral Contracts

Table 1: Types of Tariffs

ICETE 2005 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

154

is no doubt, but what type of structure could better

improve this B2C platform.

The answer stills in the model presented in the

second hypothesis of the market model in section 2,

Fig.1 supported by the UML specific model

presented in fig. 2 the electricity retail model. This is

also supported by the Baligh-Richartz effect where

the reduction of number of contacts improves trade

efficiency and reduces its associated costs as shown

in (Wigand, 2003). Mediation overtakes the

incompatibilities between the buyers and the sellers

and focuses the attention on the transaction.

3.3 Security requirements

Any kind of web transaction to be successful must

be secure, surveys indicate the most important factor

that influences an online purchase is the security of

that transaction (Malek, 2004).

An issue of great importance is the security of

the B2C market, from both sides, the access to the

market and the information exchanged are

significant values to preserve. On the contrary to

other electronic markets the break of the security

market not only affects the information but also an

huge amount of resources in a directly or indirectly

way. An intruder that violates the system could

unbalance the market values, and as a consequence

the electrical system is affected as all the framework

that support it. Brownouts and blackouts can occur

affecting all the population served by that market.

The structure presented must answer to the basics

security parameters, authentication, confidentiality,

integrity, non-repudiation in all the online

transactions exchanged in this market.

Specifically the first step from the point of view

of the market operator is to be sure that the markets

participants are who they said to be, to do so an

authentication process must be required.

After this process the market operator must have

means to ensure the confidentiality of the

information exchanged. An encrypted end-to-end

method will increase the reliability of the security

system.

Non-repudiation is a grant that ensures the

responsibility of all market participants, and

consequently push them to take measures for their

security systems.

If besides the above measures an attack succeed

the market security system must have means of

recovery.

Besides the generic security issues there are

some specific of this type of market. As said above it

is allowed that clients could change between

electricity providers but it is necessary to prevent

unfair jumps between retailers without the financial

situation resolved. Each time a new contract is

settled, the verification must be granted by the ISO,

certifying the availability of these new contract

parameters for the physical structure of the electrical

system.

4 DISCUSSION

As we analysed above, retailers are necessary in any

type of electricity market structure and in the near

future their presence will be more essential. The

natural evolution of the electricity industry and

Internet technologies will bring a electricity web

retailer market for costumers with dynamic tariffs. It

makes sense they will have such a market, where the

client could choose between different type of

electricity prices, bundle of products and services.

Price is usually a main parameter to make a choice,

but there are other services that retailers could

associate over the electricity they provide and the

necessary metering. Other types of energy are

common to be bundle like fuel and gas, remote

control of interrupted loads, remote energy audits,

advising and giving support to new and efficient

equipment are some of the services that an

electricity retailer could offer. In fact Great Britain is

starting an electricity client retail market with

several competitors (about 38), from the client side

more than 100.000 per week change from suppliers

(Heath, 2004). Market efficiency is also supported

by retailer web auctions where savings range from 3

to 8% (Wigand, 2003).

5 CONCLUSION

The paper proposed a new electricity retail market

model, on a B2C web platform to clients with

dynamic price. In this model, a client could choose

between retailers (and the associated products and

services) that belong to this e-market. Besides

metering, billing, and remote tariffs control, retailers

provide remote services like energy audits, energy

management programs.

Price spikes at the wholesale market where the

cause of many brownouts and blackouts. In the first

phase of deregulation, prices at the final client

change once or twice a year. Retailers have to

support financially these oscillations. The model

proposed makes possible to solve this problem and

E-BUSINESS FOR THE ELECTRICITY RETAIL MARKET-A Business to Client perspective

155

creates efficient answers in the market. This way it’s

possible to better control demand and it’s resources.

The wholesales markets are trading for some

time and already tested, while retail e-markets are

only making the first steps. The Web is the right

platform for these markets, as for retailer e-

procurements programs. Some issues are raised for

futures improvements in retailer models, such as the

clients segmentation, could be stratified in several

ways, by power, by consumption, by economic

sector. Usually three types are at the top of this

hierarchy, industrial, commercial and domestic

clients. As the influence of on-line auctions grows,

customers are more likely to learn about the

potential savings that can be reaped through

aggregated purchasing via a centralized, low-cost

procurement channel.

We could talk in a second generation of

deregulation where market concentrate an

international electricity retail purchasing system,

which intention is to save money and electricity to

both sides of this web market, retailer and the final

costumer, as said before a win-win relation.

Efficiency is achieved by the competition among

retailers to keep and acquiring costumers. As a result

of this market web structure operational and product

costs are reduced.

REFERENCES

Bower, John, 1999, A Model-Based Comparison of Pool

and Bilateral Market Mechanisms for Electricity

Trading, Energy Markets Group, London Business

School

Cunningham, Paul R. 2001, Buying Energy in a

Deregulated Market, EnergyUserNews.

Gaw, David, 1998, Scalable, Integrated, Real-time Energy

Management Requirements and System Architecture,

Coactive Networks, Inc.

Heath, 2004, E-Business On-line retail energy

marketplaces take off in Britain - Platts Research &

Consulting

Lafferty, R.2001, Demand Responsiveness in Electricity

Markets, Office of markets, tariffs and rates.

Malek, Manu 2004, E-Business Security, Stevens Institute

of Tecnology.

Reed, L. William, 2000, Competitive Electricity Markets

and Innovative Technologies: Hourly Pricing Can

Pave the Way for the Introduction of Technology and

Innovation.

O´Sheassy, Michael, 2003, Demand Response: Not Just

Rhetoric, It can Truly Be the Silver Bullet, The

Electricity Journal.

ICETE 2005 - GLOBAL COMMUNICATION INFORMATION SYSTEMS AND SERVICES

156