Research on Environmental Accounting Information Disclosure of

Listed Companies in Gansu Province:

Based on Multiple Linear Regression Model

Yuyiqi Shen

1

and Qianyun Hou

2

1

Faculty of Economics and Management Universiti Kebangsaan Malaysia Bandar Baru Bangi, Malaysia

2

School of Accounting Haojing College of Shaanxi University of Science & Technology, Xi'an, China

Keywords: Environmental Accounting Information Disclosure; Operating Capacity; Social Responsibility Report; Media

Attention.

Abstract: In this paper, the environmental accounting information disclosure status of A-share list companies on

Shanghai Stock Exchange and Shenzhen Stock Exchange in Gansu Province from 2017 to 2019 was analyzed.

Then a multiple linear regression model for empirical research was established. The study results show that

the enterprise size, operating capacity, social responsibility report preparation and media attention have

notable influence on the environmental information disclosure of listed companies. Therefore, to facilitate

environmental information disclosure of listed companies, it is essential to expand their size, optimize their

operating capacity, prepare social responsibility reports, and enhance social supervision.

1 INTRODUCTION

The concept of “ecological civilization” was proposed

at the first meeting of the 17th National Congress of

the Communist Party of China (CPC) in 2007. Since

then, the idea of environmental governance in China

has continued to develop and improve. According to

the fifth plenary session of the 19th Central

Committee of the CPC held in 2020, green production

and way of life should be vigorously advocated, and

carbon emissions and total discharge of major

pollutants should be reduced gradually, so as to

continuously improve ecological environment quality

and dramatically enhance the ecological security

protection gradient.

To achieve the above-mentioned goals, enterprises

need to disclose more environmental accounting

information. Related research involves the influencing

factors of disclosure, the characteristics of disclosure

in different industries, and the features of disclosure in

different regions. For instance, Wang R. (2021)

investigated the relationship between the disclosure of

environmental accounting information and financial

constraints, she concluded that management

governance could strengthen the correlation between

the above two factors. Xu X.(2019) studied the

influence and mechanism of green innovation

investment and non-monetary compensation of

management on the interpretation of corporate

environmental accounting information. Chen

D.(2019) found that social responsibility notably

increased the relevance between profitability and the

disclosure quality of accounting information related to

the environment. It was revealed by the study of

Zhang Z.(2018) that political connections enhanced

the impact of the disclosure quality of accounting data

related to the environment on enterprise value. Li

C.(2012) explored the relationship of environmental

accounting information disclosure with regional

economic disparity and enterprise organization

changes.

The industries involved in the relevant studies

include coal industry (Wang S. et al., 2018), air

pollution industry (Li J., 2017), forestry (Liu M. et al.,

2015), logistics industry (Mi Z., 2014), etc. Scholars

have examined the disclosure of accounting data

related to the environment of listed companies in such

provinces as Yunnan Province (Liu K. et al., 2019),

Hunan Province (Luo Q. et al., 2017), Sichuan

Province (Liu J., 2016), Shandong Province (Wang J.

et al., 2012), and Shaanxi Province (Wang X., 2011).

Taken above, current studies in China focus

mainly on influencing factors and different industries.

Regional research is rare, and research in Gansu

Province is lacking.

Shen, Y. and Hou, Q.

Research on Environmental Accounting Information Disclosure of Listed Companies in Gansu Province: Based on Multiple Linear Regression Model.

DOI: 10.5220/0012033000003620

In Proceedings of the 4th International Conference on Economic Management and Model Engineering (ICEMME 2022), pages 355-360

ISBN: 978-989-758-636-1

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

355

Therefore, this research examined the

environmental accounting data disclosure status of A-

share list companies listed on the Shanghai Stock

Exchange and the Shenzhen Stock Exchange in Gansu

Province from 2017 to 2019. A multiple linear

regression model was also developed for empirical

study. This essay seeks to encourage listed companies

in Gansu Province to disclose environmental data. The

study's findings serve as a benchmark for enhancing

China's environmental information disclosure

standards.

2 HYPOTHESIS

The influencing factors studied in this paper are

external and internal factors of enterprises. Internal

factors include the company size, operating capacity

and social responsibility report preparation. The

external factor is media attention.

2.1 Company Size

The company size (SIZE) is an indicator of operating

performance of the company. Companies with a large

size are generally in the mature period of their life

cycle. They have a relatively perfect operation and

management mode, and are more inclined to disclose

environmental accounting information to improve

their image and attract investors. M.Vogt et al. (2017)

analyzed the relationship of the size of 97 companies

and environmental accounting information disclosure,

the results suggested that the company size affected

the disclosure of environmental accounting

information. In this study, the company size is

represented by total assets. A company with more total

assets has a larger size, and receives more attention

from the government and society. Enterprises with

more total assets tend to disclose more enterprise

information.

H1: The size of listed companies is positively

related to the environmental accounting

information disclosure level

2.2 Operating Capacity

The operating capacity (OC) reflects the utilization

rate of various assets of the company. A high

utilization rate implies that the company has high

profitability, and can efficiently use its assets and

quickly convert the assets into actual revenue. The

company is able to implement environmental

protection measures, so it is motivated to disclose

more environmental accounting data to the outside

world. In the study of Wang X. et al. (2014), it was

found that the operating capacity was intimately

related to the environmental accounting data

disclosure level. In this paper, the operating capacity

is denoted by the total assets turnover ratio.

H2: The operating capacity of listed companies

is positively related to the environmental

accounting information disclosure level.

2.3 Social Responsibility Report

When an enterprise prepares a social responsibility

report, the quality of its environmental data disclosure

will be higher. X. Du (2018) analyzed related data of

listed companies in the energy industry. The research

results showed that the quality of environmental

accounting data given by independent reports was

better than that disclosed by the annual report of the

company. Therefore, social responsibility report

preparation (SRR) is chosen as one of the independent

variables.

H3: Social responsibility report preparation of

listed companies is positively correlated with the

environmental accounting information disclosure

level.

2.4 Media Attention

The more media attention a company receives, the

more pressure it is under to disclose environmental

data. The higher the quality of environmental

information sharing, the more comprehensive the

information disclosed by the enterprise. According to

R. Gamerschlag et al. (2011), media attention

influenced the level of information disclosed in

environmental accounting. Hence, media attention

(VISIBILITY) is taken as one of the independent

variables.

H4: Media attention of listed companies is

positively related to the environmental accounting

information disclosure level.

3 RESEARCH DESIGN

3.1 Environmental Accounting

Information Disclosure Index

The environmental accounting information disclosure

level is reflected by environmental accounting

information disclosure indexes (EDI) in this paper.

After analyzing the collected data, it was found that a

majority of the listed companies in Gansu Province

disclosed environmental accounting information in

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

356

annual reports and social responsibility reports. All

companies studied in this paper did not prepare social

responsibility reports.

Based on the current situation of listed companies

in Gansu Province, quantitative and qualitative

methods are used to score the companies tested in this

paper according to indexes in Table 1. There are ten

quantitative and qualitative indexes in the table, and

the total score is 20 points.

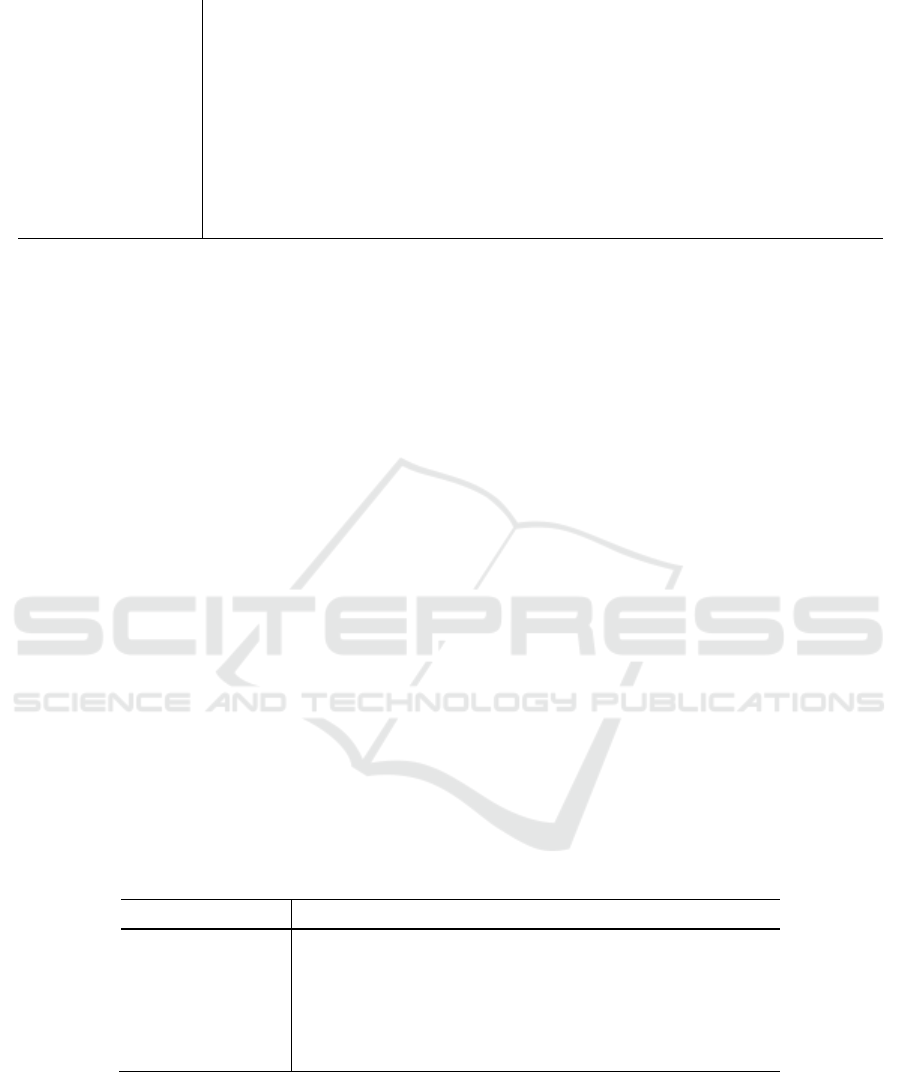

Table 1: Environmental Accounting Information Disclosure Index.

Disclosed Item

Maximum score

Scoring rule

Key pollution monitoring unit 2 points

No description: 0

points;

Description in words: 1

point;

Description in words

and quantity: 2 points;

Highest score: 2 points.

Environmental protection measures achieve the

goal stipulated in government policies

2 points

Environmental management system or

environmental protection concept

2 points

Environmental protection honors or awards 2 points

Environmental protection education and

training

2 points

Expenses for afforestation and sewage

discharge

2 points

Three wastes, energy conservation and

emission reduction

2 points

Pollution control 2 points

Environmental protection input 2 points

Environmental liability 2 points

3.2 Sample Selection and Data Source

In this article, A-share listed companies on Shanghai

Stock Exchange and Shenzhen Stock Exchange A

shares in Gansu Province were taken as reference

samples. After removing specially processed samples

and samples with incomplete data, 26 companies were

included, and their annual reports and social

responsibility reports from 2017 to 2019 were studied.

All annual reports and social responsibility reports

of the companies included were originated from

official websites of Shanghai Stock Exchange and

Shenzhen Stock Exchange. Total assets, total assets

turnover ratio and other financial data of the

companies were downloaded from CSMAR database.

A part of media attention data came from China

Securities Journal, the statutory disclosure newspaper

designated by China Securities Regulatory

Commission for information disclosure of listed

companies. The other part was from authoritative

(financial) newspapers and periodicals (e.g.,

ShangHai Securities News and Securities Times) and

manually collated network news. Data were processed

by Excel and StataSE15.

3.3 Variables

Based on the above theoretical analysis,

environmental information disclosure indexes of

listed companies were taken as dependent variables.

The company size, operating capacity, social

responsibility report preparation and media attention

were taken as independent variables. (Table 2)

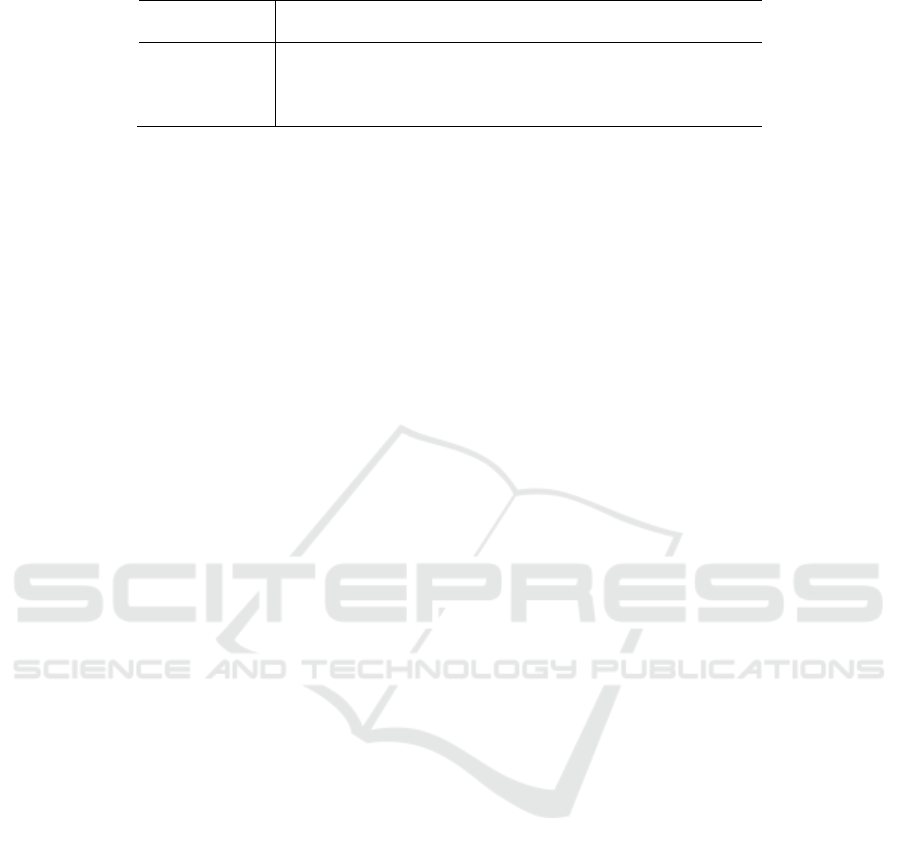

Table 2: Variables Design.

Variable type

Variable

symbol

Variable title computing method Expected symbol

Dependent variable EDI

Environmental

accounting information

disclosure index

Scores of environmental

information disclosure

indexes

Independent variables

SIZE Company size

Total assets (taking the

natural logarithm)

+

OC

Operating capability

Total assets turnover

ratio

+

Research on Environmental Accounting Information Disclosure of Listed Companies in Gansu Province: Based on Multiple Linear

Regression Model

357

SRR

Social responsibility

report

1 for having released

social responsibility

reports; 0 for no social

responsibility report

+

VISIBIL-

ITY

Media attention

The number of news

about the included

companies in securities

publications and Internet

news (taking the natural

logarithm)

+

3.4 Model Construction

A multiple linear regression model was established to

analyze the data:

EDI = a0 +a1SIZE +a2OC +a3SRR +

a4VISIBILITY+ e

Where EDI denotes environmental accounting

information disclosure indexes, a0 is a constant term,

a1-a4 are regression coefficients, e is a constant error

term, SIZE, OC, SRR, and VISIBILITY are

independent variables.

4 EMPIRICAL RESULTS

4.1 Descriptive Statistics

In Table 3, the average value of Environmental

Accounting Information Disclosure Index (EDI) is

0.201, the minimum value is 0, the maximum value is

0.55, and the standard deviation is 0.184. It can be

seen that some companies did not disclose the

situation. This indicates that the overall disclosure

level of the companies in the sample is low.

The data of SIZE is obtained by taking the natural

logarithm of the total assets. The mean value of SIZE

is 22.36, the minimum value is 19.11, the maximum

value is 24.61 and the standard deviation is 1.15. It

shows that the assets of the listed companies in Gansu

Province are in good condition, the number of

enterprises with large assets is more, and the scale of

these enterprises is relatively stable, and the difference

is small.

The value of OC in the table is the total asset

turnover of the enterprise. The average value of total

asset turnover is 0.483, the minimum value is 0.063,

the maximum value is 1.337, and the standard

deviation is 0.316. It shows that the operating capacity

of listed companies in Gansu Province is different, and

most of them are not high.

The maximum value of SRR is 1, the minimum

value is 0, and the average value is 0.192, indicating

that few companies in the sample prepare social

responsibility reports.

The average of VISIBILITY is 5.189, the

minimum is 2.833, the maximum is 7.88, and the

standard deviation is 0.96. This indicates that almost

all enterprises are concerned by the media.

Table 3: Descriptive Statistical Analysis.

Variables N mean sd min max

EDI 78 0.201 0.184 0 0.550

SIZE 78 22.36 1.153 19.11 24.61

OC 78 0.483 0.316 0.063 1.337

SRR 78 0.192 0.397 0 1

VISIBILITY 78 5.189 0.960 2.833 7.880

4.2 Regression Analysis

The data in Table 4 are obtained by using multiple

linear regression model, and the correlation

coefficients of the four independent variables are all

greater than 0. Therefore, it can be concluded that the

four influencing factors of company size, operating

capacity, social responsibility report preparation and

media attention are positively correlated with the

environmental accounting information disclosure

index.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

358

Table 4: Data from Regression Analysis.

EDI Coef.

Std.

Err.

t P>t

[95%

Conf.

Interval]

SIZE 0.027 0.016 1.670 0.100 -0.005 0.059

OC 0.143 0.062 2.310 0.024 0.020 0.267

SRR 0.194 0.043 4.540 0.000 0.109 0.279

VISIBILITY 0.037 0.018 2.050 0.044 0.001 0.072

5 CONCLUSIONS

In this paper, 2017-2019 annual reports of 26 listed

companies in Gansu Province are analyzed to figure

out the current situation and influencing factors of

their environmental information disclosure. The

results reveal that all the 26 companies do not prepare

environmental reports. Besides, less information is

disclosed on environmental protection input, and

qualitative descriptions are excessive. A larger

company size, stronger operating capacity, social

responsibility report preparation and higher media

attention will promote the disclosure of more

environmental accounting information.

Several measures can be taken to improve the

disclosure quality of accounting data related to the

environment of listed companies in Gansu Province.

First, operation management of the company should

be strengthened, especially the management of

enterprise procurement, production and processing,

sales and payment collection. Meanwhile, reasonable

personnel and post allocation enables competent

employees to undertake more important work.

Second, listed companies should actively prepare

social responsibility reports or environmental reports,

and be conscious and willing to increase

environmental awareness. Environmental information

is generally disclosed through two ways: independent

environmental reports and traditional financial

reports. The latter way is commonly used in most

listed companies in Gansu Province, but financial

reports cannot highlight the importance of

environmental data disclosure. Therefore, listed

companies, no matter what types, should prepare

social responsibility reports or environmental reports

on environmental issues to fully explain the

environmental accounting information. Third,

accounting firms are encouraged to audit

environmental reports and should be open to public

and media scrutiny. Public opinion pressure will force

enterprises to assume social responsibility for survival

and development, and to cultivate the habit of

disclosing environmental information. As a result,

extensive environmental information disclosure will

be carried out among enterprises.

REFERENCES

Chen D., “Social responsibility, profitability and

environmental accounting information disclosure,”

Commun. Finance Account., no. 21, pp. 25–29, 2019.

Kong D., Liu S., and Ying Q., “The role of media in

corporate behavior: stirring up evil or boosting the

flames?,” J. Manag. World, no. 7, pp. 145–162, 2013.

Li C., “Regional Economic Difference, Enterprise

Organizational Change, Environmental Accounting

Information Disclosure: Empirical Data from the

Polluting Enterprises of Shanghai in 2009,” Audit

Econ. Res., vol. 27, no. 1, pp. 68–78, 2012.

Li J., “Environmental regulation, quality of environmental

accounting information disclosure and market reaction

-- Empirical Evidence from the air pollution industry,”

Finance Account. Mon., no. 20, pp. 32–38, 2017.

Liu M., Li Y., Wu Y., and Zhang C., “Research on

environmental accounting information disclosure of

Forestry Listed Companies in China,” Agric. Econ.

Probl., vol. 36, no. 1, pp. 66-72+111, 2015.

Liu K., Wu Y., and Mou S., “An empirical study on

environmental accounting information disclosure of

Listed Companies -- a case study of Yunnan Province,”

Friends Account., no. 3, pp. 123–126, 2019.

Liu J., “The Analysis of the Status Quo and Restraining

Factors of Information Disclosure in Environmental

Accounting of Listed Companies——Based on the

Evidence of the Listed Companies in Sichuan

Province,” Reform Econ. Syst., no. 4, pp. 121–126,

2016.

Luo Q. and Zhang D., “Research on environmental

accounting information disclosure of Listed Companies

in heavy pollution industry -- a case study of Hunan

Province,” Commun. Finance Account., no. 25, pp. 9–

12, 2017.

M. Vogt, N. Hein, F. Silva-da Rosa, and L. Degenhart,

“Relationship between determinant factors of

disclosureof information on environmental impacts of

Brazilian companies,” Estud. Gerenciales, vol. 33, no.

142, pp. 24–38, 2017.

Mi Z. and Xie R., “Research on environmental accounting

information disclosure of listed companies -- Based on

the current situation of environmental accounting

information disclosure in logistics industry,” Friends

Account., no. 29, pp. 11–14, 2014.

R. Gamerschlag, K. Möller, and F. Verbeeten,

“Determinants of voluntary CSR disclosure: empirical

Research on Environmental Accounting Information Disclosure of Listed Companies in Gansu Province: Based on Multiple Linear

Regression Model

359

evidence from Germany,” Rev. Manag. Sci., vol. 5, no.

2, pp. 233–262, 2011.

Wang R., “Management governance, environmental

accounting information disclosure and financing

constraints,” Commun. Finance Account., no. 03, pp.

73–76, 2021.

Wang S., Shang L., and Xi L., “Research on the problems

and Countermeasures of environmental accounting

information disclosure in Coal Enterprises,” Friends

Account., no. 9, pp. 48–52, 2018.

Wang J., Kou J., and Zhang X., “Research on

environmental accounting information disclosure in

heavy pollution industry -- a case study of Listed

Companies in Shandong Province,” Friends Account.,

no. 31, pp. 107–109, 2012.

Wang X., Wang H., and Li B., “A study on the effect

domain of environmental accounting information

disclosure of Listed Companies -- a case study of Listed

Companies in Shaanxi Province,” Mod. Econ. Sci., vol.

33, no. 4, pp. 115-123+128, 2011.

Wang X., Wang H., and Luo J., “An empirical study on

environmental accounting information disclosure of

enterprises under Low-carbon Economy -- empirical

data from the surveyed enterprises in Shaanxi

Province,” Commun. Finance Account., no. 24, pp. 13–

16, 2014.

X. Du, “A tale of two segmented markets in China: The

informative value of corporate environmental

information disclosure for foreign investors,” Int. J.

Account., vol. 53, no. 2, pp. 136–159, 2018.

Xu X., “Management did not expect monetary

compensation, green innovation investment and

enterprise environmental accounting information

disclosure,” Commun. Finance Account., no. 27, pp.

48–52, 2019.

Zhang Z., “Political Connection, Disclosure Quality of

Environmental Accounting Information and Enterprise

Value,” Commun. Finance Account., no. 36, pp. 47–51,

2018.

ICEMME 2022 - The International Conference on Economic Management and Model Engineering

360