The Research of Probability of Informed Trading under Short-Sell

Constraints

Jingxia Xu

1, 2, a*

, Susheng Wang

3, b

, Jijin Geng

2, c

and Yun Xiong

4, d

1

School of Urban Planning and Design, Peking University, Nanshan District, Shenzhen, Guangdong, 518000, China

2

Shenzhen Land and Real Estate Exchange Center, Futian District, Shenzhen, Guangdong, 518000, China

3

Finance Department, South University of Science and Technology, Nanshan District, Shenzhen, Guangdong, 518000, China

4

Ping An Bank Co., Ltd, Shenzhen, Guangdong, 518000, China

Keywords: Short-Sell Constraints, Probability of Informed Trading, Trading Spread.

Abstract: The probability of informed trading is an important indicator for regulators supervising market order. Classic

models of the probability of informed trading allow traders short unlimited with private information.

However, it has short-sell constraints in China's stock market at present, which would make the measurement

deviation occurs if directly apply classic models to China's stock market. Under this condition, this research

adds two short-sell constraint parameters to the classic model, named SC-TPIN model, to measure the

probability of informed trading of stocks with bad event. By selecting eligible stocks as the sample stocks,

this research estimates the probability of informed trading and relevant parameters of those stocks before and

after the disclosure day, and analyze and summarize the time characteristics and microscopic characteristics

of these parameters. This research proves that the SC-TPIN model is consistent with the order flow

information, and the parameters and probability of informed trading estimated by the SC-TPIN model are in

line with the actual situation of sample stocks. Compared with the TPIN model, the SC-TPIN model has

strong explanatory power in explaining the same time series spreads and strong predictive power in

forecasting future spreads in China’s stock market. Therefore, the SC-TPIN model is valid.

1 INTRODUCTION

The supervision on the insider trading caused by bad

events is somewhat weakness in China’s stock market

at present. We consult insider trading events handled

by China Securities Regulatory Commission, and

find that these insider trading cases are mainly caused

by good events, rarely relate to bad events. Since

2011, there are only 4 insider trading cases caused by

bad events, meanwhile, there is no bad insider trading

case relate to underlying stocks of margin trading,

which show that the regulation of insider trading

caused by bad events should be improved. Insider

trading is part of informed trading, and the regulation

on informed trading can effectively prevent insider

trading events to occur. The probability of informed

trading model is a feasible method to infer informed

trading and observe the dynamic change of

probability of informed trading. There are short-sell

constraints in China’s stock market at present.

Effectively calculating stocks’ probability of

informed trading under China's current market

condition, screening stocks with higher probability of

informed trading, and hosting supervision on such

stocks, could provide a feasible direction for

regulating insider trading caused by bad events in

China's stock market.

The informed trading measurement model which

accepted widely is EKOP model proposed by Easley

(1996) (Easley, 1996), known as the classical EKOP

model. The EKOP model reflects the situation of

informed trading through the imbalance of orders,

that is, the order arrival rate of informed traders and

uninformed traders are different due to the differ of

their private information. Although the model is

found by observing the rules of the market maker, its

principle can also be applied to the order driven

market. For example, Yang et al. (2004) assumes that

there is a hidden market maker who makes deal with

informed and uninformed investors through

submitting limit orders, and they applied the EKOP

model directly to the Shanghai Stock Exchange

(Yang, 2004). Many scholars have improved the

model in order to correctly estimate the probability of

Xu, J., Wang, S., Geng, J. and Xiong, Y.

The Research of Probability of Informed Trading under Short-Sell Constraints.

DOI: 10.5220/0011731700003607

In Proceedings of the 1st International Conference on Public Management, Digital Economy and Internet Technology (ICPDI 2022), pages 137-144

ISBN: 978-989-758-620-0

Copyright

c

2023 by SCITEPRESS – Science and Technology Publications, Lda. Under CC license (CC BY-NC-ND 4.0)

137

informed trading under various trading rules. such as

Qin Lei (2005) (Lei, 2005) had research on the New

York Stock Exchange and found that the buy and sell

order arrival rate of uninformed traders are different,

so they introduced the TPIN model by setting the buy

and sell order arrival rate of uninformed traders with

different parameters based on the classic EKOP

model. The model is rational and reasonable through

deduction and demonstration, and is used by more

and more scholars. Duarte and Young (2009)

proposed a modified PIN model. They added the

market order flow shock in the classical EKOP

model, which make the correlation of buy and sell

orders implied in the model positive, in order to better

match the actual data (Duarte, 2009).

No matter the classic EKOP model, nor the TPIN

model, they both don’t involve short-selling

constraints, and default that trader can short freely.

While in China's stock market, naked short is

forbidden, and traders could short only when they

reach a certain threshold, which restrict lots of traders

to short. Therefore, if we want to calculate the

probability of informed trading accurately, we should

choose models involving short-sale constraint

variables. Yuan et al. (2011) (Yuan, 2011) divide the

short-sale constraint into four types, and divide

traders into full short selling, restricted short selling,

prohibited short selling, and selling, and set

parameters for those traders respectively. Parameters

of this model are too many, and some traders may sell

and short sell at the same time, which may lead to

repeating calculations. Wang, Guo et al (2013, 2013)

(Guo, 2013; Wang, 2013) introduced a short-sale

constraint factor

θ

into the classical EKOP model,

with

10 <<

θ

, then the model became

)2)1(/()1(

ε

θ

δ

δ

α

μ

θ

δ

δ

α

μ

++−+−=PIN

. Due to

10 <<

θ

, the PIN value calculated by this model is

less than the PIN value calculated by the EKOP

model. When good news come, informed traders

would buy stocks, and in this case there is no short

selling restrictions, but because

0≠

θ

and

1≠

θ

, the

PIN value estimated by the model would not match

with actual situation.

Considering the status quo of short-sell

constraints in China’s stock market, we build the SC-

TPIN model through adding two short-sell constraint

parameters to the TPIN model and deducing the

model equation by using the decision tree. Then we

illustrate step by step that our SC-TPIN model is

suitable for current China’s stock market by order

information flow derivation, estimation results

analysing, explanatory power and predictive power

verification to the information asymmetry proxy

indicator. We prove that our SC-TPIN model is more

effective in estimating stocks’ probability of

informed trading in China's stock market compared

with TPIN model, which provide a reference for

measuring probability of informed trading of stocks

caused by bad events in China's stock market.

The contents of this paper are as follows: the

second part is the model construction, we construct

our SC-TPIN model and deduce its order information

flow. The third part is the empirical results analysing,

we analyse the distribution of SCTPIN value and

parameters from the perspective of time and micro

characteristics. The fourth part is the model validity

verify, we analyse the sensitivity of short-selling

constraint parameters, and verify the explanatory

power and predictive power of SCTPIN value to the

trading spread. The fifth part is the conclusion.

2 MODEL CONSTRUCTION

China's securities market sets different restrictions on

financing trading and short selling, and investors

react different to good news and bad news (Xie,

2015). In order to make the model correctly reflect

the actual market situation, we only take into account

the calculation of the probability of informed trading

of stocks with bad events happened in this paper.

Based on the TPIN model proposed by Qin Lei

(2005) (Lei, 2005), we add short-sell constraint

parameters into the TPIN model, and get our

probability of informed trading model which could be

used under short-sell constraint condition, denoted as

Short-sale Constraint TPIN model (SC-TPIN model).

This model is mainly used to calculate the probability

of informed trading of stocks with bad events under

the condition of short-sell constraint. The value of the

probability of informed trading estimated by the SC-

TPIN model is recorded as SCTPIN value.

2.1 TPIN Model

There are three kinds of information state in the stock

market: good news, bad news and no news. At the

beginning of each trading day, information events are

independently distributed and occur with probability

α

, and the information is only mastered by informed

traders. The probability that the information is bad

news is

δ

, while that good news is

δ

-1

. Assuming

that the buy and sell order arrival rate of uninformed

traders in one day submit to the Poisson distribution

with parameter of

b

ε

and

s

ε

respectively. When the

information arrives, the order arrival rate of informed

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

138

traders submits to the Poisson distribution with

parameter of

μ

.

By using the high-frequency transaction data, we

can estimate parameters above from the maximum

likelihood estimation bellow:

!!

)(e

)-1(

!

)(

!

e

!!

e

-1),(

)(

)(

S

S

e

B

S

e

BS

e

B

SBL

S

s

B

b

S

s

B

bs

B

b

sb

sbsb

εμε

δα

μεε

αδ

εε

αθ

εμε

μεεεε

+

+

+

+=

+

+

)(

(1)

Then we can get the value of TPIN

)(

αμεεαμ

++=

sb

TPIN

(2)

2.2 Short-Sale Constraint TPIN Model

(SC-TPIN Model)

The TPIN model assumes that when informed traders

learn the information of one stock arrives, they can

trade according with their private information

without cost and restriction. However, if there are

short-sale constraints in the market, or even lack of

short mechanism, it would prevent informed traders

to short, and change the distribution of market

information.

At present, China's stock market has the following

short-sale constraints: only underlying stocks of

margin trading are allowed to be shorted; naked short

selling is not allowed; the cost of short selling is

higher, only investors who meet a certain threshold

are allowed to short, and the securities lending

amount of those investors is also limited by their

credit and margin line. In this case, uninformed

traders usually behave as liquidity traders or noise

traders. Short restriction and high threshold of margin

trading will prevent uninformed traders to short,

while informed traders will choose to short only when

they have strong sign that the price is going to fall.

Therefore, margin trading distinguishes informed and

uninformed traders to some extent.

According to the TPIN model, we still assume

that the information arrive rate is

α

, and the

information is only mastered by informed traders.

The probability that the information is bad news is

δ

, while that good news is

δ

-1

. The buy and sell

order arrival rate of uninformed traders on one day

submit to the Poisson distribution with parameter of

b

ε

and

s

ε

respectively. When the information arrives,

under the unlimited shorting status, the order arrival

rate of informed traders submits to the Poisson

distribution with parameter of

μ

. We assume that the

proportion of informed traders who hold the target

stock is

h

,

10 ≤≤ h

, and informed traders prefer to

sell their holding first. The proportion of informed

traders who short the target stock is

k

, and

10 ≤≤ k

.

So when the bad news of one stock arrives, informed

traders who hold the target stock will take sale or

short sell strategy, this part of informed traders is

h

,

the proportion of informed traders who don’t hold the

target stock but short it is

kh)-1(

, while the

proportion of informed traders who do not hold the

target stock and cannot short it because of short-sell

constraints is

)1)(1( kh −−

.

Other assumptions of this model are consistent

with other probability of informed trading models

without short-selling constraints. The transaction

process can be described by the decision tree of figure

1.

Figure 1: The decision tree existing short-sell constraints.

Information

event occurs

Bad news

Sell arrival rate

Buy arrival rate

Sell arrival rate

Buy arrival rate

Sell arrival rate

Buy arrival rate

Information event doesn’t

occur

Good news

Once per day

The Research of Probability of Informed Trading under Short-Sell Constraints

139

After introduce parameters of h and k, the order

arrival rate of informed traders is

)1())1((

δ

α

μ

α

μδ

−+−+ khh

And the order arrival rate of uninformed traders is

sbsbsbsb

ε

ε

ε

ε

α

ε

ε

δ

α

ε

ε

α

δ

+=+−++−++ )))((1())(1()(

Thus the probability of informed trading is

sb

sb

khh

khh

khh

khh

PIN

εεδδαμ

δδαμ

εεδαμαμδ

δαμαμδ

++++

++

=

++++

++

=

]-1))-1(([

]-1))-1(([

)-1())-1((

)-1())-1((

(3)

The maximum likelihood estimation is adopted to

estimate unknown parameters in the SC-TPIN model.

In this case, the likelihood estimation function of

parameter

T

sb

kh ),,,,,(

μεεδαθ

=

is

!!

)(e

)-1(

!

)])-1(([

!

e

!!

e

-1),(

)(

)])-1(([

S

e

B

S

khhe

B

S

e

B

SBL

S

s

B

b

S

s

khh

B

b

S

s

B

b

sb

sb

sb

εμε

δα

μεε

αδ

εε

αθ

εμε

μεε

εε

+

+

++

+=

+

++

)(

(4)

Easley (2008) indicated that, the daily trading data

contains important information about the order

arrival rate of informed traders and uninformed

traders (Easley, 2008). We set

T

T

as the total

number of trades per day, then the expected value of

the total trades is

][TTE

, which is the sum of the

Poisson arrival rate of informed traders and

uninformed traders.

The arrival rate of the buy order is

bbbb

BE

εδαμεαμεδααδε

+=+++= )-1()-1())(-1(][

the arrival rate of the sale order is

s

SSS

khh

khhSE

εαμδ

εαεδαμεαδ

++=

++++=

))-1((

)-1()-1()])-1(([][

and the expected value of the total trades is

sb

sb

khh

khhTTE

εεδδαμ

εεδαμαμδ

++−+−+=

++−+−+=

]1))1(([

)1())1((][

The expected value of the trade imbalance

BSK -=

, when

sb

ε

ε

=

A more informative quantity is the absolute value

of the trade imbalance. The first-order term of this

expectation relates directly to the arrival of the

informed trades

]-1))-1(([

)-1())-1((][

δδαμ

δαμαμδ

++=

++=

khh

khhKE

The expect balance order

K

T

T

-

is

=)-( KTTE

sb

ε

ε

+

It is clear from the above equation that, after

h

and

k

are introduced, the unbalanced order

K

include the arrival information of informed traders,

while the balance order

K

T

T

-

contains the arrival

information of uninformed traders, which is

consistent with Easley (2008) (Easley, 2008).

The calculation of PIN value needs to know the

trade direction. The most commonly used method to

judge the trade direction is the method proposed by

Lee and Ready (1991) (Lee, 1991). However, the

accuracy of this method has always been questioned

by scholars. Some scholars believe that the inaccurate

judgment of the trade direction will lead to the

underestimation of PIN. Therefore, in order to reduce

the unnecessary errors in the calculation process, we

use the high frequency data with trade direction to

conduct our empirical test.

3 MODEL VA L I D I T Y TEST

3.1 Samples and Data

Due to the China’s stock market crash in June, 2015

(Wu, 2016), stocks price illegitimately limited up and

limited down affected by other external factors,

during which the transaction data were at abnormal

level. Therefore, we abandon samples during that

period, and limit our sample time interval from 2011

to 2014. Learning from Karpoff (2010) (Karpoff,

2010) and considering the reliability of event source,

we selected those two types of bad news: (1) Listed

companies which had poor performance in the annual

report during 2012 and 2014. (2) Listed companies

which was punished by CSRC during Jan, 2012 and

March, 2015 due to the following reasons: short-term

trading, illegal disclosure, major accident and

connected transaction.

Because time points of the selected events are

dispersed, we use the multi-object asynchronous

event study method in this paper. By taking the

disclosure day as the benchmark, and recording it as

the event date, this is, the day 0, we set the estimation

window start from 100 days to 11 days before the

event day, denoted as [-100, -11]. The event window

is 10 days before and after the event day, denoted as

[-10, 10]. This is to say, sample stocks must have 100

consecutive trading days before the event day and 10

consecutive trading days after the event day. In order

to ensure the validity of the data and eliminate

abnormal samples, we also eliminated the ST, PT

stocks, and finally got 208 stocks, of which there are

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

140

67 stocks chose from type (1), and 141 stocks chose

from type (2).

We choose our sample stocks from Shenzhen A-

share market and Shanghai A-share market, and get

our microscopic characteristics data from CSMAR

database and RESSET database, and get our high-

frequency trading data from Giant Financial

Platform.

We break the tick-by-tick transaction data into 5-

minute data. The reasons are: on the one hand, private

information integrating into the data needs trading for

a certain time, the 5-minute data accumulates the

information containing in the tick-by-tick data. On

the other hand, the computation amount required by

the tick-by-tick data is too large, and it is easy to

overflow during the parameter estimation process,

resulting in false value.

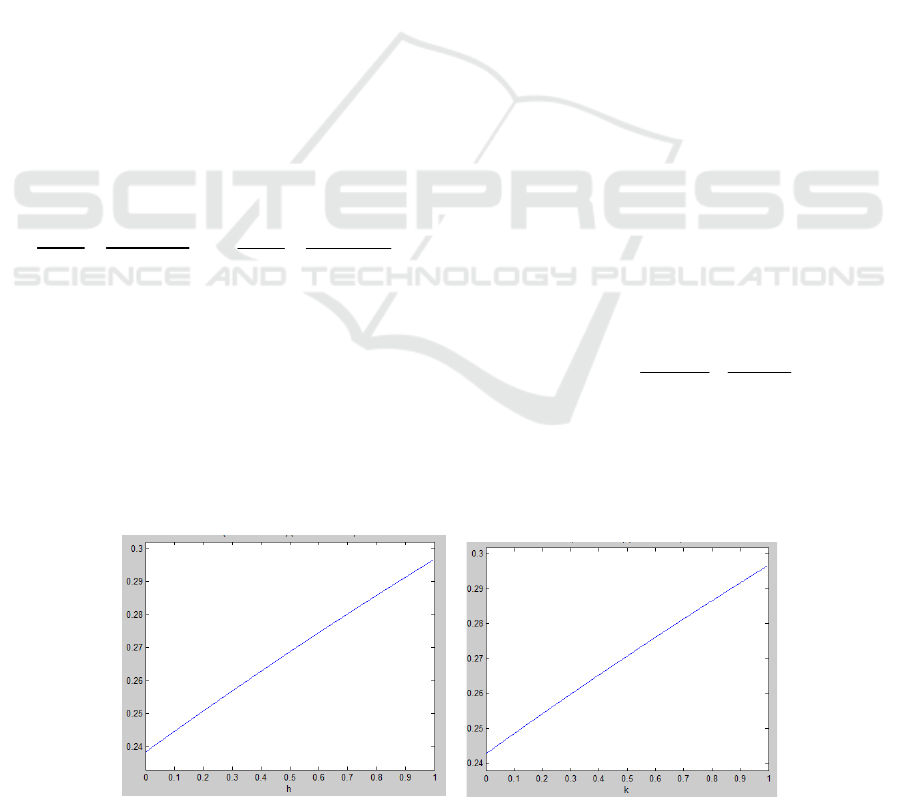

3.2 Parameters Sensitivity Analysis

We add two new parameters h and k in our SC-TPIN

model. In order to clarify the relationship between the

two parameters and SCTPIN, we make the following

sensitivity analysis: Firstly, we find the partial

derivative of PIN respect to h and k respectively by

formula derivation, to analyse the relationship

between PIN with h and k at [0, 1]. The partial

derivative of PIN respect to h and k are as follow:

2

)( BAh

AC

h

PIN

+

=

∂

∂

2

)( FDk

DC

k

PIN

+

=

∂

∂

Where

)1( kA

−=

α

μδ

,

sb

kB

ε

ε

α

μδ

α

μ

α

μδ

++−+=

,

sb

C

ε

ε

+=

,

)1( hD

−=

α

μδ

,

sb

hF

ε

ε

α

μδ

α

μ

α

μδ

++−+=

, and

A, B, C, D, and F are all greater than or equal to 0.

We can see that when h and k changes at [0, 1],

0/ >∂∂ hPIN

, and

0/ >∂∂ kPIN

, so PIN is the

increasing function of h and k respectively, and PIN

get its maximum and minimum when

1=h

(

1=k

)

and

0=h

(

0=k

). We use the figure to display the

change of SCTPIN when h and k change at [0, 1]

intuitively. As shown by figure 2.

The horizontal axis in figure 2 represent the

values of h and k at [0, 1], and the vertical axis

represents the change of SCTPIN. After we fixe other

values, the relationship between h and PIN presents

the form of inverse proportional function, when h

changes at [0, 1], the value of the PIN presents

positive and approximate linear form in figure 2, this

is, PIN is a strictly increasing function when h

changes at [0, 1]. The relationship between k and PIN

is approximately the same as that of h.

3.3 Model Validity Verification

Bid-ask spread is a common method used to measure

the information asymmetry between informed and

uninformed traders (O'hara, 2007). Reference to the

method used by Easley (1996) (Easley, 1996) and Qin

Lei (2005) (Lei, 2005), we verify the contribution our

SC-TPIN model in explaining asymmetric

information by measuring the explanatory power of

SCTPIN to the spread, which also can verify the

rationality of our SC-TPIN model apply to China's

stock market. Because China's stock market is the

order-driven market, it lacks corresponding bid-ask

spread data. Based on the availability of data and

acceptance of calculation method by scholars, we

choose the trading spread with volume suggested by

Stoll (2000) (Stoll, 2000) to calculate stocks’ spread.

The equation of the trading spread with volume

TSW

is as follows:

−

=

=

=

=

=

m

1j

m

1j

s

i

n

1i

n

1i

B

i

P

P

S

i

s

i

B

i

B

i

Q

Q

Q

Q

TSW

(5)

Where

B

i

P

and

S

j

P

are the price of the

i

th buy

and sell in unit time respectively,

B

i

Q

and

S

i

Q

are

corresponding volume respectively. The unit time is

Figure 2: The sensitivity analysis of h and k.

The Research of Probability of Informed Trading under Short-Sell Constraints

141

Table 1: Regression results for equation (6).

Independent variable Opening spread Closing spread Average spread

VSCTPIN

0.001817

(5.0499)***

0.001027

(5.6804)***

0.000825

(3.3543)***

VTPIN

0.001524

(4.1844)***

0.000115

(0.6280)

0.001002

(4.0258)***

VOL

0.001948

(3.0735)**

-0.000229

(-0.7192)

-0.001182

(-2.7288)**

R- squared 0.170043 0.084857 0.108927

Note: when the significance level is

α

=0.1, Z = 1.645; when

α

=0.05, Z = 1.96; when

α

=0.01, z=2.33; when

α

=0.001, Z = 3.29.

5 minute.

For the trading spread, we follow the method used

by Easley (1996) (Easley, 1996) and Qin Lei (2005)

(Lei, 2005), and select the opening spread, closing

spread and average spread as the dependent variable

respectively. After removing missing and invalid

data, we get the 5 minute opening spread (excluding

the call auction data), the 5 minute closing spread

(excluding the call auction data) and the average

spread (the average value of 5 minute spread per

trading day) of 187 sample stocks.

3.3.1 The Explanatory Power of SCTPINs

Consistent with Easley (1996) (Easley, 1996) and Qin

Lei (2005) (Lei, 2005), we use the panel regression

(6) to test the explanatory power of SCTPINs:

tititititi

VOLVTPINVSCTPIN

,,3,2,10,

ε

β

β

β

β

++++=Σ

(6)

Here

ti,

is the spread, VSCTPIN is the product

of SCTPIN and stock price, VTPIN is the product of

TPIN and stock price, VOL is the trading volume

defined as the product of stock price and share

volume,

ε

is the residual, and

]1,10[ −−∈t

. Existing

researches show that the probability of informed

trading has a positive effect on the spread, and VOL

has a negative effect on the spread (Li, 2010), so the

expected coefficient of VOL is negative. As

competing measures of information asymmetry,

VTPIN and VSCTPIN are expected to have positive

coefficients. If one of the two measures completely

subsumes the other in explaining spread, then we

expect to see a significant positive coefficient for the

dominant measure and an insignificant one for the

other. The regression results of equation (6) are

shown in Table 1, and the brackets are the values of

t-statistic.

As can be seen from Table 1, the regression

coefficient of VOL is significant when explaining the

opening spread and the average spread, and the

regression coefficient is negative when explaining the

average spread. The coefficient is negative when

explaining the closing spread, but it is not significant.

The coefficient of VTPIN is significant in explaining

the opening spread and the average spread, but it

can’t explain the closing spread. VSCTPIN has

significant explanatory power for all three spreads,

and its regression coefficients are all positive,

especially when explain the opening spread and the

closing spread, the coefficients of VSCTPIN are

larger than that of VTPIN. Since the sample mean of

VSCTPIN is larger than VTPIN, the overall

explanatory power of VSCTPIN is higher than that of

VTPIN (Lei, 2005).

3.3.2 The Predictive Power of SCTPINs

In order to test whether the SCTPINs is more

informative than other measures of information

asymmetry, we run the following panel regression to

compare the predictive power of these measures for

predicting the spread of the next trading day.

1,6,5,4

,3,2,101,

+

+

++++

+++=Σ

tititi

titititi

MERVOLOIMB

VOLVTPINVSCTPIN

εβββ

ββββ

(7)

1, +

ti

refers to the next day's trading spread,

VSCTPIN is the product of SCTPIN and stock price,

VTPIN is the product of TPIN and stock price, VOL

is the trading volume defined as the product of stock

price and share volume, OIMB is the order imbalance

or absolute net order flow in number of trades, as the

events we selected are the bad events, the OIMB here

equal to daily sell trades minus daily buy trades. ME

is the market value of equity, and RVOL is the

volatility of returns. Chordia et al. (2002) argue that

order imbalances reduce liquidity, so the predicted

sign for absolute order imbalance is positive

(Chordia, 2002), that is, the coefficients of

VSCTPIN, VTPIN, and OIMB should be positive.

Stocks with large market cap generally have good

liquidity, so the coefficient of ME is expected to be

negative. Inventory theory holds that stocks with

large earning volatility tend to have large spread

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

142

Table 2: The regression results of equation (7).

Independent variable Opening spread Closing spread Average spread

VSCTPIN

0.002189

(

6.066

)

***

0.000839

(

4.6845

)

***

0.000964

(

3.9971

)

***

VTPIN

0.001442

(3.9179)***

0.000278

(1.5303)

0.000927

(3.7821)***

VOL

0.003491

(

4.5418

)

***

0.000218

(

0.5720

)

-0.000907

(

-1.7655

)

*

RVOL 0.037095

(

1.1571

)

-0.030371

(

-1.9084

)

*

0.026972

(

1.2584

)

OMBI 6.90E-09

(0.5175)

-2.84E-09

(-0.4296)

-4.16E-09

(-0.4671)

ME -0.002089

(-2.3631)**

-0.000563

(-1.2839)

-0.000895

(-1.5147)

squaredR −

0.200612 0.081735 0.120732

Note: when the significance level is

α

=0.1, Z = 1.645; when

α

=0.05, Z = 1.96; when

α

=0.01, z=2.33; when

α

=0.001, Z = 3.29.

(Lei,.2005), so the expected sign for RVOL is

positive. The regression results of equation (7) are

shown in table 2

As can be seen from table 2, the regression

coefficients of VSCTPIN are all positive and

significant when explaining the opening spread, the

average spread, and the closing spread, indicating that

VSCTPIN has significant explanatory power for all

three spreads of one day after. VTPIN has significant

explanatory power for the opening spread and the

average spread, but its explanatory power for the

closing spread is 0. Meanwhile, the regression

coefficients of VTPIN are smaller than that of

VSCTPIN. VOL has significant explanatory power

for the opening spread and the average spread, but the

coefficient is negative only when explaining the

average spread. For other variables, only the

coefficient of RVOL and ME are significant when

explaining the closing spread and the opening spread

respectively. So we believe that SCTPIN is a better

and more robust measure in predicting future spreads,

even after controlling for other competing measures

of information asymmetry.

From the results above, we can see that, compared

with TPIN, SCTPIN has strong explanatory power in

explaining the same time series spreads and strong

predictive power in forecasting future spreads,

indicating that our SCTPIN model has strong power

in explaining the information asymmetry in China’s

stock market, so our SC-TPIN model is effective.

4 CONCLUSIONS

The classic models of the probability of informed

trading set no limitation on short selling based on

private information, while it has short-sell constraints

in present China’s stock market, which could result

in measurement deviation when applying the classic

models to China's stock market directly. In this paper,

we develop a SC-TPIN model by incorporating two

short-sell constraint variables into the classical

model, and select eligible sample stocks to verify it.

By parametric characteristics analysis, order flow

information analysis, and explanatory and predictive

power test in explaining trading spreads, we prove

that our SC-TPIN model is valid, and can better

estimate the probability of informed trading of stocks

with bad events in China’s stock market.

By analyzing the time characteristics of the results

of our SC-TPIN model, we found that stocks with

high pre-event PIN value have significantly higher

PIN value before the event day than that after the

event day, while stocks with low pre-event PIN value

have no significant difference before and after the

event day, indicating that stocks with higher PIN

value are more likely to be informed traded before

bad news disclosure.

Through analyzing the microscopic

characteristics of the results of our SC-TPIN model,

we find that stocks with high institutional ownership,

low turnover, small market cap, small securities

lending scale and low price characteristics have

higher probability of informed trading, and informed

traders tends to short stocks with large volume and

low institutional ownership when bad event arrives.

In addition, compared with TPIN model, our SC-

TPIN model has stronger explanatory power in

explaining the same time series spread and stronger

predictive power in forecasting future spread.

Our model can be used to provide reference for

securities regulators investigating insider trading

timely, and it can also provide a relatively reliable

way for uninformed traders avoiding stocks with bad

The Research of Probability of Informed Trading under Short-Sell Constraints

143

events. However, our model does not consider the

interaction between different types of traders, which

could be suggested as the research direction in future.

ACKNOWLEDGMENT

This research is the achievement of Shenzhen

Humanities and Social Sciences Key Research Base.

REFERENCES

Chordia T, Roll R, Subrahmanyam A. Order imbalance,

liquidity, and market returns. Journal of Financial

Economics 2002, 65: 111–130.

Duarte J, Young L. Why is PIN priced? Journal of Financial

Economics, 2009, 91(2): 119-138.

Easley D, Kiefer N, O'Hara M, Paperman J B. Liquidity,

Information, and Infrequently Traded Stocks. Journal of

Finance, 1996, 51(4):1405-1436.

Easley D, Engle R F, O'Hara M, Wu L. Time-Varying

Arrival Rates of Informed and Uninformed Trades.

Journal of Financial Economics, 2008, 6(2): 171-207.

Guo H, Wang C F, Fang Z M. Influence of Information

Asymmetry on Liquidity in View of Short-sale

Constraint in A-share’s Market. Journal of Xidian

University (Social Science Edition), 2013, 23(2): 47-54.

Karpoff J M, Lou X X. Short Sellers and Financial

Misconduct. The Journal of Finance, 2010, 65(5): 1879-

1973.

Lei Q, Wu G J. Time-varying Informed and Uninformed

Trading Activities. Journal of Financial Markets, 2005,

8: 153-181.

Lee C, Ready M J. Inferring Trade Direction from Intraday

Data. The Journal of Finance, 1991, 46(2): 733-746.

Li G C, Liu S C, Qiu W H. The probability of informed

trading in continuous order driven market: A new

method. Journal of Management Sciences in China,

2010, 13(10): 8-20.

O'Hara M. Market microstructure theory. Blackwell

Publishers, London, 1997:

Stoll H. Presidential address: friction. Journal of Finance,

2000, (4): 1479-1514.

Wang C F, Guo H, Fang Z M. Research on update of A-

share’s trade arrival rate and innovation digestion in the

perspective of high-frequency data. Management

Review, 2013, 25(8): 32-38.

Wu X Q. Stock Market Crisis: Structural Defects and

Regulatory Reform. Finance & trade economics, 2016,

(1): 22-32.

Xie H B, Fan K K, Zhou M. A study on the difference

between the reactions of Chinese stock market to good

and bad news. System Engineering Theory and

Practice, 2015, 35(7): 1777-1783.

Yang Z S, Yao S Y. An Empirical Study on the Spread and

Information Based Trading of the Shanghai Stock

Exchange. Journal of Financial Research, 2004, (4): 45-

56.

Yuan H Y. Short selling Mechanism and Operation

Performance of China’s Securities Market. Economic

Science Press, 2011: 38-39.

ICPDI 2022 - International Conference on Public Management, Digital Economy and Internet Technology

144