Effect of Financial Distress and Firm Size to Firm’s Intrinsic Value

and Profitability as Intervening Variable on Property and

Real Estate Sector

Anthony Hardinal Sijabat

1

, Khaira Amalia Fachrudin

2

1

Master of Property Management and Valuation Program, Universitas Sumatera Utara, Jl. dr. Mansur Kampus USU,

Medan, Indonesia

2

Faculty of Economics and Business, Universitas Sumatera Utara, Medan, Indonesia

Keywords: Financial Distress, Firm Size, Firm Intrinsic Value, Profitability, Free Cash Flow to Firm, Valuation,

Property and Real Estate Sector.

Abstract: The intrinsic value of a firm is the fair value of all future net cash flows resulted from a business. The

purpose of this research is to examine the effect of financial distress and firm size on profitability; the effect

of financial distress, firm size, and profitability on intrinsic value of firm; and the indirect effect of financial

distress and firm size on intrinsic value of firm by profitability as intervening variable. The population of

the research was the companies in property and real estate sector listed in BEI (Indonesia Stock Exchange).

The statistics method which used to test hypotheses is path analysis. The result show that financial distress

had a negative and significant influence on profitability, firm size had a positive and insignificant influence

on profitability, financial distress had a negative and insignificant influence on intrinsic value, firm size and

profitability had a positive and significant influence on intrinsic value, profitability could mediate the

correlation of financial distress with intrinsic value of firm, and profitability could not mediate the

correlation of firm size with intrinsic value of firm.

1 INTRODUCTION

The main purpose of the establishment of a company

is to maximize the welfare of shareholders and other

stakeholders by increasing the value of the company.

The value of the company is very important because

of the high value of the company which will be

followed by a high prosperity shareholders

(Brigham, 2010).

The intrinsic value of the company is also known

as fair value, which is the total present value of net

cash flow. The intrinsic value can be measured by

free cash flow to firm (FCFF) are projected to obtain

the present value of net cash flow of the company by

the method of discounted cash flow models (DCF

model). DCF model is one method that can be used

to conduct an assessment to obtain the fair value of

the company so that the value can be compared with

the market value, where the value of the market in

question is the value that is formed from the number

of outstanding shares at the market price of shares

offered

One of the factors that affect the value of a

company or can be controlled is the profitability of

the company. The company's profitability is a

measure of the achievements of the company arising

from the management decision-making process,

because it has a relationship of capital utilization

effectiveness, efficiency and profitability of activity

performance (Fidhayatin, 2012). Financial

performance can be achieved by the company within

a certain period is a healthy picture or failure of a

company. In addition to providing a profit for the

owners of capital or investor, healthy companies can

also demonstrate the ability to repay the debt in a

timely manner.

The size of the company is also a factor that can

determine the performance of the company

(Sambharakreshna, 2010). It can be seen from the

company's ability to generate profits, because the

larger the company, the greater the company's ability

to cope with financial problems and the company's

ability to generate high returns because it is

supported by adequate resources, especially the

Hardinal Sijabat, A. and Amalia Fachrudin, K.

Effect of Financial Distress and Firm Size to Firm’s Intrinsic Value and Profitability as Intervening Variable on Property and Real Estate Sector.

DOI: 10.5220/0009897300002480

In Proceedings of the International Conference on Natural Resources and Sustainable Development (ICNRSD 2018), pages 45-51

ISBN: 978-989-758-543-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

45

company's assets so great that the obstacles

companies such as adequate equipment and the like

can be resolved. According to Djongkang and Rita

(2014) financial distress is a situation where the

company suffered a loss or operating cash flow is

not sufficient to meet the needs of the company's

liabilities. Furthermore, of the losses will lead to

capital deficiency due to impairment of retained

earnings are used to pay dividends, and total equity

as a whole will be deficient. The condition indicates

a company is experiencing financial difficulties

(financial distress) which in the end if the company

is not able to get out of the above conditions, then

the company would be insolvent.

Some studies suggest that firms with large total

assets will be more likely to be able to generate

higher profit levels (Sembiring, 2008). Profit may

indicate the company's performance. The greater the

profit, the better the performance of the company

and good corporate performance will certainly

increase the value of the company. This is reflected

in the results of research Gill and Obradovich (2012)

which states that the size of the company and

significant positive effect on firm value

However, financial distress are proxied by the

model financial soundness of companies indicate

different things, Pi or the results of the score against

financial distress which if the probability of reaching

the number 1 means that the company has entered

the status of the financial difficulties of the most

severe, whereas when it reaches 0 means the

company no financial difficulties. Therefore, by

increasing the level of the financial difficulties

facing the company will have a negative impact on

profitability of the company.

Increasing profitability means that the company's

prospects in the future rated increasing as well,

which means that the better the company's value in

the eyes of investors. If the company's ability to

generate income increases, the share price will also

increase. Improved share price reflects the company

good value for investors.

Based on the above, the proposed hypothesis is

as follows:

H1

: There is the effect of financial distress and firm

size on profitability

H2

: There is the effect of financial distress, firm

size and profitability of the company's intrinsic

value

H3 : There is the indirect effect financial distress

and firm size to the company's intrinsic

value through profitability as an intervening

variable.

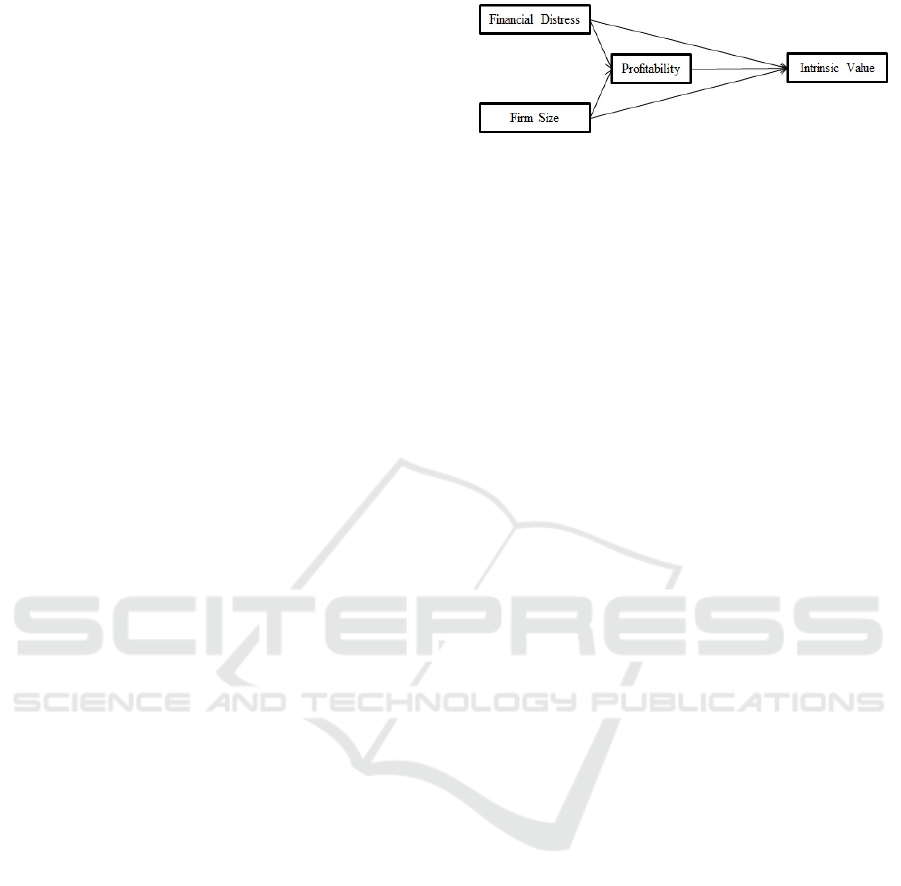

Figure 1: Conceptual framework showing the linkage

between financial distress, firm size, profitability, and the

company's intrinsic value.

2 METHOD

The population of this research is company property

and real estate sectors listed in Indonesia Stock

Exchange in 2016. The population is 49 companies.

The target population is a company that does not

have a negative net income and has a complete data

relating to the variables used in the study, ie 37

companies. All companies in the target population

was observed (sample saturated). Data is sourced

from the company's financial statements are audited

downloaded from the website of Indonesia Stock

Exchange, namely www.idx.co.id. The focus of

research is in real estate companies and real estate.

The data used is secondary data that is historical

cross section. Research in the form of ex post facto

research, because the data is sourced from the

issuer's financial statements have been published and

are used without change. Research is causality, the

research wants to find an explanation in the form of

causality (cause-effect) between some of the

variables that are developed in the management

(Ferdinand, 2006). The hypothesis presented is a

hypothesis of causality. Analysis of the data will

result in a general conclusion. Data was analyzed

using path analysis. This analysis is used because

there is a possible relationship between the variables

in the model is linear. The confidence level used is

95%, which means that the alpha is 5%.

Structural equations to test the first hypothesis:

Y1 = X1X1 + ρY1 ρY1X2X2 + Є1 (1)

Y1 = endogenous variables Profitability

X1 = exogenous variables Financial Distress

X2 = exogenous variables Firm Size

ρY1X1 = path coefficients X1 to Y1

ρY1X2 = path coefficient of X2 to Y1

Є1 = coefficient error 1 path variables

Structural equation for testing the second

hypothesis:

ICNRSD 2018 - International Conference on Natural Resources and Sustainable Development

46

ΡY2X1X1 + Y2 = Y1 + ρY2X2X2 +

ρY2Y1 Є2

(2)

Y2 = endogenous variables Company Value

Y1 = endogenous variables Profitability

X1 = exogenous variables Financial Distress

X2 = exogenous variables Firm Size

ρY2X1 = path coefficients X1 to Y2

ρY2X2 = path coefficient X2 to Y2

ρY2Y1 = path coefficient Y1 to Y2

Є2 = coefficient error 2 path variables

The indirect effect calculations for testing the

third hypothesis:

The indirect effect (indirect effect) X1 to Y2

through Y1 = ρY1X1 x ρY2Y1

The indirect effect (indirect effect) X2 to Y2

through Y1 = ρY1X2 x ρY2Y1

The research variables and operational

definitions:

Y1 is the company's performance in this case is

measured by Return on Assets (ROA) formula:

ROA =

(1)

(3)

Y2 Intrinsic value can be measured by the free

cash flow to firm (FCFF) are projected to obtain

the present value of net cash flow of the

company by the method of discounted cash flow

models (DCF model). Damodaran (1997) FCFF

formulate as follows:

FCFF = EBIT (1-tax) (1-Reinvestment

Rate)

(4)

On the Discounted Cash Flow method (DCF)

model, the present value of the overall results of the

projection and the terminal value at a discount rate,

is the company's intrinsic value.

X1 is a possibility of companies experiencing

financial distress. To calculate the risk of

financial distress of the company can use the

methods of financial soundness (Fachrudin,

2008) formula:

Pi =

. . , ,

(5)

X2 is a measure of the company. The size of the

company can be measured by the natural

logarithm (natural log) of the total assets (Naiker

et al., 2008).

3 RESULTS AND DISCUSSIONS

The results will be discussed in three subsections,

they are testing the first hypothesis, the second

hypothesis, and the third hypothesis.

3.1 First Hypothesis Testing

3.1.1 Testing Classical Assumptions

1. Residual Normality Test

Kolmogorov-Smirnov test statistic p-value shows

0197 (> 0.05), indicating that the residual

normality assumption has been fulfilled

2. Test Multicolinearity

Tolerance value of each variable is 0921, which

is greater than 0.1. VIF value of 1.085, which is

smaller than 10. This shows that there is no

multi-kolonieritas.

3. Test Heteroscedasticity

Glejser test found that the significant value of t

test is greater than 5% alpha which indicates that

the data is free from the problem of

heteroscedasticity.

3.1.2 Goodness of Fit Assessment Model

1. The coefficient of determination is worth 0.117

which means that the ability of the model to

explain variations in profitability variable was

11.7%, while the remaining 88.3% is explained

by other variables not included in the model.

2. Test f

Significant test F is 0.036. Values smaller than

5% alpha indicates that the model used is

feasible and can be used for further analysis.

3. Test t

Financial Distress have a negative effect and

significant (p-value is worth 0.013) toward

Profitability. While the Firm Size have a positive

effect but not significant (p-value is worth 0.923)

toward Profitability.

Effect of Financial Distress and Firm Size to Firm’s Intrinsic Value and Profitability as Intervening Variable on Property and Real Estate

Sector

47

Table 1: Path Model 1.

Coefficients

Model

Unstandardized

Coefficients

Standardized

Coefficients

T Sig.

B

Std.

Erro

r

Beta

1 (Constant) .060 .190 .316 .754

Financial

Distress

-.154 .059 -.425 -2623 .013

Firm Size .001 .007 .016 .097 .923

a. Dependent

Variable:

Profitabilit

y

The mathematical equation of path model 1:

Y1 = -0,425X1 + 0.016X2 (6)

3.1.3 Influence of Financial Distress and

Firm Size on Profitability

In the first hypothesis testing found that the financial

distress a negative effect and significant towards

profitability. The size of the company does not affect

the performance of the company.

The findings suggest that if other things being

equal, an increase in the risk of financial distress by

1% percent will reduce profitability, in this case is

the ratio of earnings after tax to total assets,

amounted to 15.4%. This is not out of the capital

structure as well as the determining factors of

financial distress itself, which is dominated by the

capital structure of debt are particularly vulnerable

to the crisis and very likely increasing financial

difficulties for any gains. The decline in profitability

as a result of the larger companies are at risk of

experiencing financial difficulties.

These research discovered that the average

probability of financial distress is 0.12 to 0.19

standard deviation. This high amount indicates that

the company is not in financial difficulty so that

there is a possibility that careful management in the

composition of its capital structure and maximize

existing assets to become the company's net profit,

due to the influence of financial distress to

profitability is negative.

Firm size does not affect the profitability of the

company. This indicates that company size is not a

guarantee that the company will have a good

performance. Epi (2017) also found that there is no

effect of firm size on firm performance. But

Fachrudin (2011) found that the size of the

company's positive effect on performance.

3.2 Second Hypothesis Testing

3.2.1 Testing Classical Assumptions

1. Residual Normality Test

Kolmogorov-Smirnov test statistic shows that p-

value 0.067 (> 0.05), indicating that the residual

normality assumption has been fulfilled

2. Test Multicolinearity

Tolerance value of financial distress variables,

firm size and profitabily respectively, are 0.766,

0.921, 0.823, greater than 0.1. VIF respectively

1,085 1,305 1,215, which is less than 10. This

shows that there is no multicollinearity.

3. Test Heteroscedasticity

Glejser test found that the significant value of t

test is greater than 5% alpha which indicates that

the data is free from the problem of

heteroscedasticity.

3.2.2 Goodness of Fit Assessment Model

1. The coefficient of determination is worth 0.422

which means that the ability of the model to

explain variations in the company's intrinsic

value variable is equal to 42.2%, while the

remaining 57.8% is explained by other variables

not included in the model.

2. Test f

Significant test f is 0.000. Values smaller than

5% alpha indicates that the model used is

feasible and can be used for further analysis.

3. Test t

Financial Distress have a negative effect but not

significant (p-value is worth 0.613) toward the

company's intrinsic value. Firm Size have a

positive and significant effect (p-value is worth

0.000) toward the company's intrinsic value.

Profitability is positive and significant (p-value is

worth 0.029).

ICNRSD 2018 - International Conference on Natural Resources and Sustainable Development

48

Table 2: Path Model 2.

Coefficients

Model

Unstandardized

Coefficients

Standardized

Coefficients

T Sig.

B Std. Erro

r

Beta

1

(Constant) -69344,16

7

17215.22

0

-4028 .000

Financial

Distress

-

2984.334

5840.556 -.077 -.511 .613

Firm Size 2548.205 595 012 .591 4283 .000

Profitability

35596.35

6

15539.24

6

.334 2,291 .029

a. Dependent

Variable:

Intrinsic Value

The mathematical equation of path model 2:

Y2 = -0.077X1 + 0.591X2 + 0.334Y1 (7)

3.2.3 Influence of Financial Distress, Firm

Size and Profitability of the

Company's Intrinsic Value

In the second hypothesis testing found that the

financial distress does not affect the company's

intrinsic value. Firm Size and significant positive

effect on the company's intrinsic value. Profitability

have a positive and significant impact.

Financial distress does not affect the company's

intrinsic value. This suggests that financial distress

was not a reflection of the company has an intrinsic

value that is positive or negative, but only as a

reflection on the quality of management to manage

the assets of the company. This is not in line with

research by Choy et al. (2011) where his research

shows that the higher the risk of the company is

experiencing financial difficulties, the value of

companies represented by the stock price will

decrease. The results of this study concluded that

financial distress do not significantly affect the value

of the company because the company's value is

calculated by using the income approach that

method of calculation is more focused to the

prospect of revenue streams economically owned by

the company while the financial distress summarily

rather the ratio of debt and income divided by total

asset so it is difficult to connect with the company's

intrinsic value. Unlike the case with previous studies

using PBV or stock prices as a proxy for the value of

the company through the investor perception of the

company is so significant effect.

Statistical test results showed that the Firm Size

positive effect on the company's intrinsic value,

meaning that the larger the size of the company,

increasing the company's value. The larger the

company's assets, generally will increasingly attract

investors to own shares of the company. Company

with great assets is generally a leading company in

the sector. Large companies can easily access to the

capital markets. Ease of access to the capital markets

means that companies have the flexibility and ability

to obtain funds, for ease of accessibility to the

capital markets and its ability to raise more funds.

The ease their captured by investors as a positive

signal and a good prospect that size could have a

positive influence on firm value. This is in line with

research by Maheswari (2016) where his research

shows that the larger the company, as measured by

the logarithm of the total assets of the company have

the value of the companies represented by PBV will

increase. This is because the larger the total assets of

the company which owned the greater the prospects

of economic revenue stream that would be obtained

in the future.

These reserach found that an increase in the

company's profitability significantly improve the

company's intrinsic value. Profitability is a picture of

the performance of the company, for investors, in

using its assets efficiently and effectively in

generating profits. The ability of property companies

to generate huge profits in the future will be able to

increase cash flow of companies that have an impact

on increase the intrinsic value of the company, it is

because of a positive relationship between the flow

of net cash flows of companies with profitability.

This is in line with research by Khumairoh (2017)

which found a significant positive relationship

between profitability and value of companies in

which the company is able to produce high profits

can be a positive signal to investors about the

company's performance was good.

3.3 Third Hypothesis Testing

The indirect effect of financial distress and Firm size

of the intrinsic value of the company through the

company's performance as an intervening variable

can be seen below:

Indirect effect (indirect effect) X1 to Y2 through

Y1 = -0.425 x 0.334 = -0.142

Indirect effect (indirect effect) X2 to Y2 through

Y1 = 0.016 x 0.334 = 0.005

Statistical test results in Table 2 above shows

that the profitability of a significant effect on the

alpha 5% of the company's intrinsic value (p-value

0.029). Therefore, the indirect effect of financial

distress and firm size of the company's intrinsic

Effect of Financial Distress and Firm Size to Firm’s Intrinsic Value and Profitability as Intervening Variable on Property and Real Estate

Sector

49

value as calculated above is also a significant

possibility.

3.3.1 The Indirect Effect of Financial

Distress and Firm Size of the Intrinsic

Value of the Company through

Profitability as an Intervening

Variable

Known to directly influence financial distress given

the intrinsic value of the company amounted to -

0.077 while the indirect effect of financial distress

through the profitability of the company's intrinsic

value is obtained by multiplying the beta financial

distress to profitability with a beta value of the

profitability of the company's intrinsic value,

namely: -0.425 x 0.334 = -0.14195 total effect given

the financial distress of the intrinsic value of the

company is a direct influence plus the indirect effect

is -0.077 + -0.14195 = -0.21895 based on the above

calculation is known that value of direct influence of

-0.077 and the indirect influence of -0.14195, which

means that value of indirect negative effect greater

than the negative value of the direct effect, these

results shows that financial distress to profitability

have a significant effect towards company’s intrinsic

value.

These means that with the increase in

profitability or ability company makes a profit is

able to influence financial distress in improving the

company's intrinsic value. Profitability in this case

ROA indirectly caused a negative effect on the

company's intrinsic value calculated by the free cash

flow to the firm does not regard the depreciation

element, but the profitability is calculated by taking

the element of depreciation accounting profit.

This study is in line with Tamarani (2015) that

profitability is able to mediate between size of

company's influence on the value of the company.

Results of recent research in this study were able

to mediate the profitability of firm size effect on the

company's intrinsic value. Known to directly

influence a given firm size the intrinsic value of the

company for 0.591 while the indirect effect of firm

size through the profitability of company's intrinsic

value is obtained by multiplying beta firm size to

profitability with a beta value of profitability of

company's intrinsic value is: 0.016 x 0.334 = 0.005

then total effect of a given firm size of intrinsic

value of company is a direct influence coupled with

indirect effect that is 0.591 + 0.005 = 0.571 based on

a above calculation known that value of the direct

influence of 0.591 and indirect influence by 0.

This means that with the increase in profitability

or ability company makes a profit does not affect the

size of the company in improving the company's

intrinsic value. This study is in line with Pratama

(2016) that profitability is not capable of mediating

influence between size of company to value of the

company.

4 CONCLUSIONS

This study found a negative effect on the

profitability of the company's financial distress. The

risk of financial distress or financial difficulties can

affect the performance of company due to

negligence of management in managing its capital

structure and quality will be assets that also applies

vice versa if management able to manage its capital

structure well in the sense according to the needs of

the company and also in improving the quality assets

that company will have risk of financial distress can

be reduced and therefore the smaller the risk of

financial distress, firm performance will certainly be

better considering the company is able to

productively and efficiently to the assets the

company had.

The risk of financial distress do not affect value

of company where company is experiencing a high

risk of financial distress or not at all can affect value

of company. Firm size has a positive effect on firm

value. The greater total assets of company, the

greater the value of the company. Back again this

indicates that firm size as measured on total assets

on logarithm can be managed by a company well

because basically the higher the assets are likely to

increase in operating expenses will these assets, but

in this study the greater the assets, the higher the

value of the company so can be said to be capable

management with a maximum of managing their

assets to enhance corporate value. Profitability

positive and significant effect on firm value. It is

characterized by the higher level of profitability of

the company's ability to take advantage of all its

assets to obtain optimum profit superbly.

The intrinsic value of the company, the

profitability of financial distress is able to mediate

relation to the intrinsic value of the company and

firm size is able to directly influence the intrinsic

value of the company without having to first go

through profitability. It can be concluded that the

direct effect of financial distress of the company's

intrinsic value is smaller than the indirect effect

through profitability and firm size of the intrinsic

ICNRSD 2018 - International Conference on Natural Resources and Sustainable Development

50

value is greater than the indirect effect through

profitability.

REFERENCES

Brigham and Houston., 2010. Fundamental of Financial

Management, Salemba Empat.

Choy S.L.W., Munusamy J., Chelliah S., Mandari A.,

2011. Review of Economics & Finance, 85 / 99

Damodaran, A., 1997. Corporate Finance Theory and

Practice. Newyork.

Djongkang F, Rita., 2014. Altman z-score : Mendeteksi

Financial Distress. Jurnal Akutansi 1 (1) 247 / 255.

Epi Y., 2017. Pengaruh Ukuran Perusahaan, Struktur

Kepemilikan Manajerial dan Manajemen Laba

terhadap Kinerja Perusahaan Property dan Real Estate

yang terdaftar pada Bursa Efek Indonesia. Riset dan

Jurnal Akuntansi 1 (1)

Fachrudin KA., 2008. Kesulitan Keuangan dan Personal.

USU Press. Medan.

Fachrudin KA., 2011. Analisis Pengaruh Struktur Modal,

Ukuran Perusahaan, dan Agency Cost Terhadap

Kinerja Perusahaan. Jurnal Akutansi dan Keuangan

13 (1) 37 / 46

Ferdinand A., 2006. Metode Penelitian Manajemen. Edisi

Kedua,. Universitas Diponegoro. Semarang.

Fidhayatin, Dewi., 2012. Analisis Nilai Perusahaan,

Kinerja Perusahaan dan Kesempatan Bertumbuh

Perusahaan terhadap Return Saham pada Perusahaan

Manufaktur yang Listing di Bei. Jurnal Ilmu dan Riset

Akutansi 2 (2) 203/214

Gill, Amarjit, Obradovich, John., 2012. The Impact of

Corporate Governance and Financial Leverage on the

Value of American Firms. International Research

Journal of Finance and Economics 91 1450 / 2887

Khumairoh, Nawang K., 2017. Pengaruh Leverage,

Profitabilitas dan Ukuran Perusahaan terhadap Nilai

Perusahaan. Jurnal Syariah Paper Accounting

Maheswari., 2016. Pengaruh Tingkat Kesehatan Bank dan

Ukuran Bank terhadap Nilai Perusahaan. Jurnal

Akutansi Universitas Udayana 16 (2) 1319 /- 1346

Naiker, Vic, Farshid Navissi, VG Sridharan., 2008. The

Agency Cost Effects of Unionization on Firm Value.

Journal of Management Accounting Research 20, pp.

133 / 152.

Pratama IGB, Wiksuana IGB., 2016. Pengaruh

Kepemilikan Institusional dan Leverage terhadap

Nilai Perusahaan. E-Jurnal Manajemen 5 (2) 1338-

1367.

Sambharakreshna, Yudhanta., 2010. Pengaruh Size of

Firm, Growth dan Profitabilitas Terhadap Struktur

Modal Perusahaan. Jurnal Akutansi, Manajemen

Bisnis dan Sektor Publik 6 (2) 197-216

Sembiring S., 2008. Pengaruh Ukuran Perusahaan dan

Kebijakan Pendanaan terhadap Kinerja Keuangan

pada Perusahaan Bisnis Properti di Bursa Efek

Jakarta. Thesis Universitas Sumatera Utara

Tamarani L., 2015. Pengaruh Good Corporate

Governance Indeks dan Financial Distress terhadap

Nilai Perusahaan dengan Kinerja Perusahaan sebagai

Variabel Intervening (Studi Pada Perusahaan

Manufaktur yang Terdaftar di Bursa Efek Indonesia

(BEI) Periode 2009-2012). Jurnal Online Mahasiswa

Fakultas Ekonomi 2 (1)

Effect of Financial Distress and Firm Size to Firm’s Intrinsic Value and Profitability as Intervening Variable on Property and Real Estate

Sector

51