Effect of Companies That Do and Do Not Perform Income Smoothing

on Automotive Sector Company Value

Febrianty

1

and Ria Kumala

1

1

Accounting Study Program, Polytechnic of Palcomtech, Basuki Rahmat Street Numb.05, Palembang, Indonesia

Keywords : Perform, income, company value

Abstract: The purpose of this study was to determine the effect of companies that do and do not perform income

smoothing on the value of the company specifically in the Automotive Sector company in the Indonesia Stock

Exchange with the period of 2012-2017. The method used in this study was quantitative descriptive analysis,

namely: calculate income smoothing using the Eckel index method and calculating company value, Price

Earning Ratio (PER) and Price Book Value (PBV). The results show that in this sector, 2 of 6 companies that

were proven to perform income smoothing with the Eckel index calculation value below 1, namely AUTO

and INDS. There were 4 of the 6 companies that had overvalue above the criteria of PER analysis, the four

companies were ASII, AUTO, INDS, and NIPS. There were 4 companies from 6 companies that had

overvalue above the criteria from PBV analysis, the four companies were ASII, AUTO, NIPS, and SMSM.

Companies that had proven to have income smoothing such as AUTO and INDS on average had good PBV

value. Companies that performed income smoothing tend to increase the value of the company in terms of

Price Book Value ratio except for INDS, in PBV calculations the INDS company had a bad value because it

was below the industrial standard. Companies that had proven to have income smoothing such as AUTO and

INDS on average had good PER value.

1 INTRODUCTION

Demand for automotive needs makes the automotive

sector players increasingly improve the performance

of their companies in order to also increase corporate

profits. Because the parameters of the financial

statements used in measuring the performance of the

company's management are profit, management will

do various ways to provide "positive information

accounting". One of them is income smoothing.

Income smoothing is performed by increasing profit

if profit tends to be low and vice versa if profit tends

to be high, then management will decrease its profit

(Budiasih, 2009). The phenomenon of tight

competition is a strong trigger for the management of

the company to show the best performance because it

will have an impact on the market value of the

company and also affect the interests or decisions of

investors. Finally, it will affect the availability and

amount of funds that can be utilized as well as the

Cost of Capital (COC) that must be borne by the

company.

Income smoothing is a detriment to investors,

because investors will not get accurate information

about profits in order to evaluate the rate of return

from the portfolio. The action of income smoothing

results in the disclosure of financial statements to be

inadequate (Dwiatmini and Nurkholis, 2001). This

phenomenon is a negative impact of information

asymmetry in agency theory concepts. The act of

income smoothing is a general or rational action

(Jatiningrum, 2000). The practice of income

smoothing is also a common phenomenon as a

management effort in order to reduce reported

earnings fluctuations (Narsa, et al., 2003). The actions

of income smoothing are also a means of

management to reduce fluctuations in income

reporting and manipulate pseudo (accounting)

variables or by conducting real transactions

(Brayshaw and Eldin, 1989). For management, it is

often not necessary to report the maximum profit of

company, even the management is more likely to

report the company profits that are considered normal

for some periods (Samlawi and Sudibyo, 2000).

Febrianty, . and Kumala, R.

Effect of Companies That Do and Do Not Perform Income Smoothing on Automotive Sector Company Value.

DOI: 10.5220/0009152700002500

In Proceedings of the 2nd Forum in Research, Science, and Technology (FIRST 2018), pages 75-80

ISBN: 978-989-758-574-6; ISSN: 2461-0739

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

75

Companies that are indicated often perform

income smoothing actions, such as companies in the

Automotive, Textile and Garment sectors, Property

and Real Estate, Manufacturing and Banking.

Automotive companies, one of the companies that are

strongly indicated, often perform income smoothing.

The cause of the automotive sector companies often

perform income smoothing because the level of

competition in that industry is very tight, besides that

the automotive sector is a business with bright and

profitable prospects. This is supported by increasingly

advanced technological advances and the increasing

need for automotive products for the community

(Hery, 2015).

Profit as a benchmark for the success of the

company because of the achievement of profits,

companies can make investors more interested in

investing in the automotive sector. The drop in sales

experienced by several companies in the automotive

sector made the company have to experience a decline

in profits and even tended to suffer some losses. The

decline in profits and losses experienced by some

companies that look extreme will greatly affect the

value of the company which results in reduced

investor interest in investing. Data on automotive

companies profit/loss in 2014-2016 on the Indonesia

Stock Exchange can be seen from Table 1.

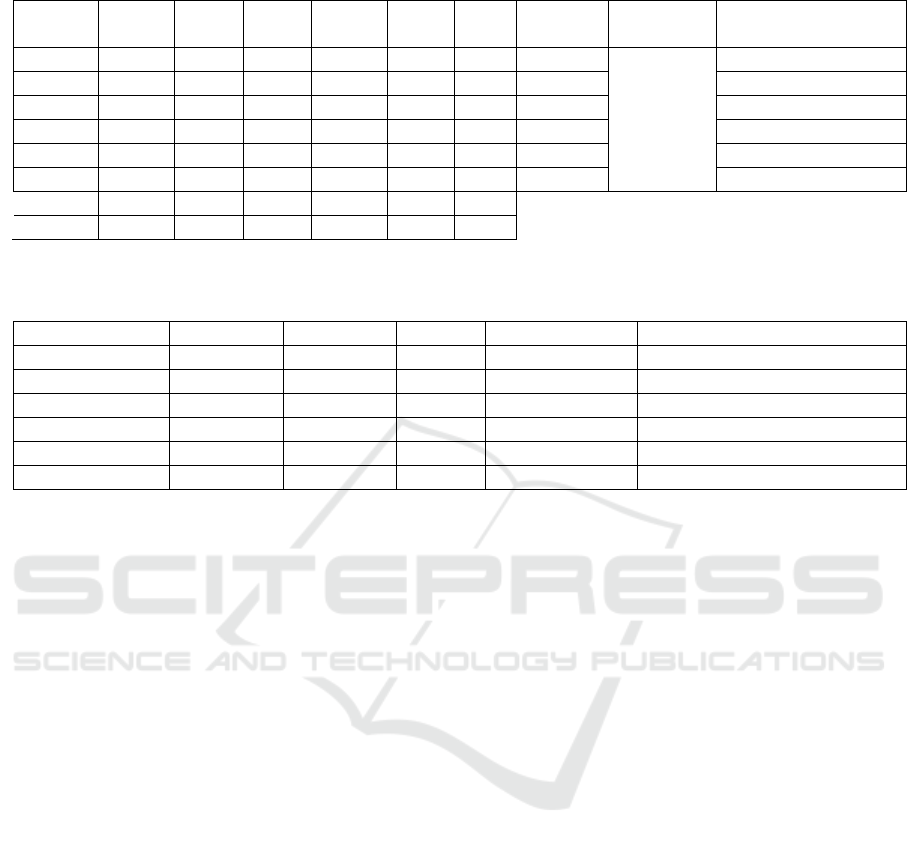

Table 1: Automotive companies profit data 2014-2016 (in rupiah)

Code 2014 2015 2016

ASII 22.125.000.000.000 15.613.000.000.000 18.302.000.000.000

AUTO 956.409.000.000 322.701.000.000 483.421.000.000

BRAM 222.409.138.000 176.030.484.000 312.194.148.000

GDYR 38.384.584.000 (1.553.692.000) 23.185.750.000

GJTL 269.868.000.000 (313.326.000.000) 626.561.000.000

IMAS (67.093.347.900) (22.489.430.531) (312.881.005.784)

INDS 127.657.349.869 1.933.819.152 49.556.367.334

LPIN (4.130.648.465) (18.173.655.308) 64.037.459.813

MASA 6.622.210.000 (376.027.022.000) (93.830.926.000)

NIPS 50.134.988.000 30.671.339.000 65.683.137.000

PRAS 11.340.527.608 6.437.333.237 (2.690.964.318)

SMSM 421.467.000.000 461.307.000.000 502.192.000.000

Source: www.idx.com

The 12 companies incorporated in the automotive

industry on the IDX in 2018, only 6 companies that

have positive profits from year to year are seen from

the company's financial statements. Companies that

always have positive profits from year to year have the

potential for management to take income smoothing.

Income smoothing is absolutely necessary if the

company wants to increase the value of the company.

Previous research that showed the link between

income smoothing and firm value (PBV and PER)

conducted by Zuhriya and Wahidahwati on income

smoothing and the factors that influence

manufacturing companies on the IDX. The results

showed that PBV did not have a positive effect on

profits (Wasilah, 2012). Another research conducted

by Rahmawantari, examined the effect of profitability,

financial risk and price earnings ratio (PER) on

income smoothing in the plantation industry which is

listed on the Indonesia Stock Exchange. The results

showed that PER had a positive influence and

significance on the practice of income smoothing

(Rahmawantari, 2012).

Research conducted by Pasaribu, et al, examined

the effect of accounting conservatism, managerial

ownership, dividend policy, company size, leverage,

price earnings ratio, price to book value and earnings

per share on profit management (a study of

manufacturing companies on the IDX 2008-2013).

The results of the study found that there was a

significant influence on the variables of managerial

ownership, leverage, and Price Earning Ratio (PER).

While the variables of accounting conservatism,

dividend policy, company size, Price to Book Value

(PBV) and Earning Per Share (EPS) had no

significant effect on profit management (Prayudi and

Daud, 2013). This study aims to present the effects of

the automotive public sector companies actions that

do and or do not make income smoothing on their

corporate values based on industry standards, where

simple detection and analysis can be used by

FIRST 2018 - 2nd Forum in Research, Science, and Technology (FIRST) – International Conference

76

investors. The income smoothing calculation uses the

Eckel Index.

2 METHODOLOGY

2.1 Type and Source of Data

The types and sources of data used in this study were

secondary data obtained from the financial statements

and annual reports of the automotive sector

companies from 2012 to 2017 (www.idx.com).

2.2 Population and Sample

This study used a population of automotive sector

companies on the IDX during the period 2012 to

2017. The number of research population was 12

companies. However, only six companies were

selected as samples, because only 6 companies had

positive profits from year to year. The sample

technique which is used is purposive sampling.

Purposive sampling is a data source sampling

technique with certain considerations (Sugiyono,

2017).

The criteria used in determining the sample of this

study are as follows:

1. The automotive sector company is listed on the

IDX for the period 2012-2017.

2. The Company has issued and published annual

financial statements in a row from 2012 to 2017.

3. Automotive companies that have positive profits

from year to year during 2012-2017.

After selecting a sample based on the above

criteria, the company selected as a sample was 6

companies, as follows:

Table 2: List of sample of automotive sector companies listed on the IDX

No Company Name Code

1 Astra International Tbk ASII

2 Astra Otoparts Tbk AUTO

3 Indo Kordsa Tbk BRAM

4 Indospring Tbk INDS

5 Nipress Tbk NIPS

6 Selamat Sempurna Tbk SMSM

Source: www.idx.com

2.3 Analysis Technique

The data analysis technique which is used is

quantitative descriptive analysis. The quantitative

descriptive analysis is a research method based on the

philosophy of positivism used to examine a particular

population or sample, data collection using research

instruments, data analysis is quantitative/statistical

with the aim of testing predetermined hypotheses

(Sugiyono, 2017).

Quantitative descriptive analysis techniques used

in this study are as follows:

Calculate income smoothing using Eckel Index

method, where Eckel Index is used to indicate

companies that do income smoothing or not (Warsidi,

2014).

Calculate company value as follows:

a. Price Earning Ratio (PER)

The PER ratio reflects the market's appreciation

of the company's ability to generate profits

(Widyaningdyah, 2010).

b. Price Book Value (PBV)

Price Book Value (PBV) is a ratio that describes

how much the market valuing the book value of

shares of a company (Husnan and Pudjiastuti,

2012).

3 RESULT AND DISCUSSION

Eckel index analysis on the automotive sector

companies in IDX for the period 2012-2017 can be

seen from Table 3.

Effect of Companies That Do and Do Not Perform Income Smoothing on Automotive Sector Company Value

77

Table 3: Eckel index of automotive sector companies in IDX 2012-2017

Code CV∆I CV∆S IS Description

ASII 9.55 2.23 4.29

N

o

t

Income smootin

g

AUTO -2.97 0.94 -3.16 Income smootin

g

BRAM 2.44 1.61 1.52

N

o

t

income smootin

g

INDS -54.14 1.45 -37.40 Income smootin

g

N

IPS 4.22 0.95 4.44

N

o

t

income smootin

g

SMSM 0.40 0.40 1.00

N

o

t

Income smootin

g

Source: Processed by author, 2018

AUTO and INDS empirically based on Eckel

index analysis proved to have income smoothing.

Income smoothing which performed by AUTO and

INDS can be seen from the results of the Eckel index

which is < 1. Income smoothing for AUTO and INDS

has an impact on the stable value of corporate profits

that can spur investors to be more interested in

investing, but for stakeholders who do income

smoothing can be detrimental to stakeholders because

there are differences in recognition of company

profits. Whereas ASII, BRAM, NIPS and SMSM

empirically based on Eckel index analysis proved not

to do income smoothing in the observation period of

2012-2017. Income smoothing that is not carried out

by these companies can be seen from the results of the

Eckel index that is > 1. Companies that do not make

income smoothing tend to have a better profit value

so that they do not need to reduce reported profit

fluctuations, manipulate variables (accounting) or by

making real transactions. The results of the analysis

of company value using PER can be seen from table

4.

Table 4: PER performance of automotive sector companies

Code 2012 2013 2014 2015 2016 2017 Average Industrial

Standar

d

Description

ASII 15.83 14.17 15.66 16.81 22.13 17.81 17.07

15.00

Overvalue

AUTO 13.55 16.44 23.20 24.24 23.56 18.07 19.85 Overvalue

BRAM 8.32 17.17 13.03 14.61 11.55 15.23 13.32

Undervalue

INDS 7.10 7.65 8.29 243.06 10.68 7.25 47.34 Overvalue

NIPS 80.08 3.10 14.44 20.60 8.81 23.03 25.01 Overvalue

SMSM 15.59 16.12 16.23 16.03 3.12 53.96 20.17 Overvalue

Max 80.08 17.17 23.20 243.06 23.56 53.96

Min 7.10 3.10 8.29 16.03 3.12 7.25

Source: processed by author, 2018

Price earning ratio analysis in terms of the

comparison of stock prices and profits from shares in

the company. Based on PER calculations for

automotive sector companies listed on the IDX, in

2012-2017 on average only ASII, AUTO, INDS and

NIPS had average values above the PER standard.

The three companies, in general, can be said to be of

good value because the company is able to show a

consistent value above the standard Price Earning

Ratio criteria.

BRAM and SMSM on average had sub-standard

criteria. The BRAM, although on average had a value

below the criteria of good value, in 2013 and 2015

BRAM had a good corporate value above the

standard 15.00. The results of the analysis of

company value by using a price book value (PBV)

can be seen from table 5.

Based on the calculation of PBV in the automotive

sector companies in 2012-2017 it can be seen that on

average only 4 companies from 6 companies that

were overvalued (high value) including ASII, AUTO,

NIPS and SMSM. The highest value in 2012-2017

was obtained by the NIPS in 2013 with a PBV value

of 10.76 and the lowest value obtained by the INDS

in 2015 with a PBV value of 0.12.

The recapitulation results of the effect of income

smoothing which related to PER and PBV can be seen

from table 6.

FIRST 2018 - 2nd Forum in Research, Science, and Technology (FIRST) – International Conference

78

Table 5: PBV performance of automotive sector companies

Code 2012 2013 2014 2015 2016 2017 Average

Industrial

Standard

Description

ASII 2.00 2.59 2.50 1.92 2.39 2.15 2.26

1 time

Overvalue

AUTO 2.90 1.84 2.00 0.76 0.94 0.92 1.56 Overvalue

BRAM 0.92 0.51 1.01 0.79 1.13 1.16 0.92 Undervalue

INDS 1.16 0.80 0.57 0.12 0.26 0.39 0.55 Undervalue

N

IPS 0.35 10.76 1.26 1.04 0.69 0.93 2.50 Overvalue

SMSM 0.44 4.94 5.97 4.76 0.89 4.10 3.52 Overvalue

MAX 2.90 10.76 5.97 4.76 2.39 4.10

MIN 0.44 0.51 0.57 0.12 0.26 0.39

Source: processed by author, 2018

Table 6: The Effect of Income Smoothing Which Related to PER and PBV Performance

Code IS PER PBV Performance Description

ASII 4.29 17.07 2.26 Goo

d

Inappropriate

AUTO -3.16 19.85 1.56 Goo

d

Appropriate

BRAM 1.52 13.32 0.92 Ba

d

Appropriate

INDS -37.40 47.34 0.55 Ba

d

Inappropriate

N

IPS 4.44 25.01 2.50 Goo

d

Inappropriate

SMSM 1.00 20.17 3.02 Goo

d

Inappropriate

Source: processed by author, 2018

Based on Table 6, it can be seen that companies

that performed income smoothing actions such as

AUTO have firm value based on Price Earning Ratio

and Price Book Value that were well above industrial

standard (overvalued), with a PER value of 17.07 and

a PBV value of 2.26. Other companies that did not

perform income smoothing such as ASII, NIPS, and

SMSM had company value based on Price Earning

Ratio and Price Book Value that were well above

industrial standard (overvalued), namely with PER

value of ASII was 17.07, NIPS of 25.01 and SMSM

of 20.17.

While the PBV value of ASII value was 2.26,

NIPS was 2.50 and SMSM was 3.02. INDS which

performed income smoothing had a PER value that

was well above the industry standard (overvalued) of

47.34 but had a PBV value below the industrial

standard (undervalued) which was 0.55.

Conditions in the INDS indicated that companies

that make income smoothing will not necessarily

increase the value of the company, especially the

measurement of company value using price book

value. Companies that were proven not to perform

income smoothing such as BRAM, had a company

value based on bad Price Earning Ratio and Price

Book Value because they were below the industrial

standard (undervalued), with a PER value of 13.32

and a PBV value of 0.92.

4 CONCLUSION

The conclusion of this study is that there were 2 of 6

companies that were proven to perform income

smoothing with the Eckel index calculation value

below 1, namely AUTO and INDS. There were 4 of

the 6 companies that had overvalue above the criteria

of PER analysis, the four companies were ASII,

AUTO, INDS, and NIPS. There were 4 companies

from 6 companies that had overvalue above the

criteria from PBV analysis, the four companies were

ASII, AUTO, NIPS, and SMSM.

Companies that had proven to have income

smoothing such as AUTO and INDS on average had

good PBV value. Companies that performed income

smoothing tend to increase the value of the company

in terms of Price Book Value ratio except for INDS,

in PBV calculations the INDS company had a bad

value because it was below the industrial standard.

Companies that had proven to have income

smoothing such as AUTO and INDS on average had

good PER value.

REFERENCES

Budiasih, I. 2009. Affecting Factors of Income Smoothing

Practices. J. Bus. Account., vol. 4, no. 1, pp. 44–50.

Effect of Companies That Do and Do Not Perform Income Smoothing on Automotive Sector Company Value

79

Dwiatmini, S. and Nurkholis. 2001. Analysis of Market

Reactions to Profit Information: Cases of Income

Smoothing Practice in Companies Listed on the Jakarta

Stock Exchange. TEMA, vol. 2, no. 1.

Jatiningrum. 2000. Analysis of the Influential Factors on

the Net Income / Profit Alignment of Companies Listed

on the JSE’. Bus. Account. J., vol. 2, no. 2, pp. 145–

155.

Narsa, I. M., et al. 2003. Affecting Factors on Profit

Alignment During the Monetary Crisis in Companies

Listed on the Surabaya Stock Exchange. Economic

Magazine, pp. 128–145.

Brayshaw, R. and Eldin, A. E. K. 1989. The Smoothing

Hypothesis and The Role of Exchange Differences. J.

Business, Financ. Account., vol. 16, no. 5, pp. 621–633.

Samlawi, A. and Sudibyo, B. 2000. Analysis of Profit

Smoothing Behavior Based on Company Performance

in the Market. Natl. Account. Symp., vol. 3.

Hery. 2015. Analysis of Financial Statements, 1st ed.

Center For Academic Publishing Service.

“www.idx.com.” .

F. & Wasilah. 2012. Cost accounting, 3rd ed. Jakarta:

Salemba Empat.

Rahmawantari. 2012. Analysis of Financial Ratio on

Banking Companies Financial Distress Listed on the

Indonesia Stock Exchange 2008-2013. Syariah Pap.

Account., vol. FEB UMS.

Prayudi, D. and Daud, R. 2013. The Effect of Profitability,

Financial Risk, Corporate Value and Ownership

Structure on Income Smoothing Practices in

Manufacturing Companies Listed on the Indonesia

Stock Exchange. JEMASI., vol. 9, no. 2.

Sugiyono. 2017. Methods of Qualitative Quantitative

Research and R & D. Bandung: Alfabeta.

Warsidi. 2014. Understanding of General Economics.

Jakarta: PT. Gramedia Umum Jakarta.

Widyaningdyah, A. U. 2010. Analysis of Influential Factors

on Earnings Management of Go Public Companies in

Indonesia. J. Akunt. dan Keuang. Indones., vol. 3, no.

2.

Husnan and Pudjiastuti. 2012. Fundamentals of Financial

Management Yogyakarta: UPP YKPN.

FIRST 2018 - 2nd Forum in Research, Science, and Technology (FIRST) – International Conference

80