32

Ownership Structure, Corporate Social Responsibility (CSR)

Disclosure and Company’s Financial Performance

Neneng Miskiyah, Hadi Jauhari and Sari Lestari Zainal Ridho

Department of Business Administration, State Polytechnic of Sriwijaya, Palembang, Indonesia

Keywords: Managerial Ownership, Institutional Ownership, Foreign Ownership, Company’s Financial Performance,

CSR Disclosure.

Abstract: This paper is based on an interesting study that examines company's financial performance, focusing on

ownership structure and disclosure of CSR. It is used secondary data taken from companies' annual audited

financial statements for the period 31 December 2012-2017. The population in this study are all mining

companies listed on the IDX (Indonesia Stock Exchange). The sampling method uses purposive sampling

technique. The analysis technique uses multiple regression with application Eviews 6. The results show

partially, managerial ownership has a significant negative effect on CSR Disclosure, institutional ownership

has no significant effect on CSR disclosure, foreign ownership has a positive and significant effect on CSR

disclosure, managerial ownership does not affect performance Corporate finance, institutional ownership has

a significant negative effect on the company's financial performance, foreign ownership has a significant

positive effect on the company's financial performance and CSR disclosure has a significant positive effect

on the company's financial performance.

1 INTRODUCTION

The study of the company's financial performance

and Corporate Social Responsibility disclosure

(hereinafter referred CSR) interesting to be examined,

especially related to the ownership structure, that the

CRS disclosure and financial performance of the

company will be influenced by who is the owner

behind the company. CSR as an effort by the

company to demonstrate corporate social

responsibility as a form of business ethics in building

the company's performance in the future.

In Government Regulation Number 47 the Year

2012 article 3 reads, "The social and environmental

responsibilities as referred to in Article 2 are the

obligation of the Company to carry out its business

activities in the field and/or relating to natural

resources based on the Law" (Government

Regulation, 2012). Mining companies are industries

with the main existence and activities related to

general mining that can provide substantial economic

added value. Some research results show that CSR

disclosure has a positive effect on the company's

financial performance (Amos, et.al, 2016) (Ashraf

and Tariq, 2017) (Awan and Saeed, 2015), because

this CSR disclosure shows a positive signal about the

company's commitment to social and environmental

funds, so that in the long run it is expected to improve

the company's performance. but there are also those

that show CSR disclosures negatively affect the

company's financial performance (Dkhili and Ansi,

2012). Even CSR disclosure does not affect the

company's financial performance (Zaccheaus, et.al,

2014).

In the Agency Theory, it is stated that institutional

shareholders are better able to oversee the company

because of their sufficient resources to carry out such

supervision, according to the statement that

institutional ownership has a positive effect on the

company's financial performance (Charlo, et.al,

2017) (Khamis, et.al, 2015) (Kiamehr, et.al, 2015)

(Maqbool and Zameer, 2018). Some research results

still show differences that institutional ownership

negatively affects the company's financial

performance (Ahmed and Hadi, 2017)

(Andriosopoulus and Yang, 2015) (Zulvina, et.al,

2017).

Managerial ownership is able to have a positive

influence on the company's financial performance.

The percentage of ownership by the manager is

expected to be a motivation to work harder, and

reduce opportunistic behavior of company managers,

30

Miskiyah, N., Jauhari, H. and Ridho, S.

Ownership Structure, Corporate Social Responsibility (CSR) Disclosure and Company’s Financial Performance.

DOI: 10.5220/0009152000002500

In Proceedings of the 2nd Forum in Research, Science, and Technology (FIRST 2018), pages 30-36

ISBN: 978-989-758-574-6; ISSN: 2461-0739

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

but other findings indicate managerial ownership has

a negative influence on the company's financial

performance (Andow and David, 2016), even

managerial ownership does not affect the company's

financial performance (Motta and Uchida, 2018)

(Zondi and Sibanda, 2015).

The assumption that the parties involved in the

company will try to maximize the company's

financial performance, is not always fulfilled. The

foreign ownership negatively affects the company's

financial performance (Alfaro and Chen, 2012)

(Andriosopoulus and Yang, 2015), while foreign

ownership has a positive effect on the company's

financial performance (Jusoh, 2016) (King and

Santor, 2008) (Prochazka, 2017).

CSR programs are expected to improve the

company's financial performance because investors

tend to invest in companies that are fully committed

to implementing CSR activities. Institutional

ownership has a positive effect on CSR disclosure.

Foreign ownership negatively affects CSR disclosure

(Zulvina, et.al, 2017), states that foreign ownership

does not affect CSR disclosure (Zainal, 2017).

However that institutional ownership has a positive

effect on CSR disclosure (Chang and Zhang, 2015)

(Swandari and Sadikin, 2016), while managerial

ownership has a positive effect on CSR disclosure

(Laksmi and Kamila, 2018). Contrary to the results of

the research that managerial ownership does not

affect CSR disclosure (Ilmi et.al, 2017).

The ownership structure shows the form of

agency problems in a company and can affect CSR

disclosure and the company's financial performance,

both giving a negative and positive influence on the

future development of the company. This has become

an important subject of this study which will discuss

the influence of ownership structure both managerial

ownership, institutional ownership and foreign

ownership of CSR disclosure and its implications for

the company's financial performance. Various

empirical studies have been conducted and show

varied results due to the differences in the object of

study, the period of study, and the analytical methods

used by the researchers, therefore the purpose of this

article is to better understand the diversity of

ownership structures (managerial ownership,

institutional ownership, foreign ownership).

Towards CSR Disclosure and the company's financial

performance, this study contributes empirically to test

and examine whether there is a partial effect of

managerial ownership, institutional ownership and

foreign ownership on CSR Disclosure and whether

there is a partial influence of managerial ownership,

institutional ownership, foreign ownership and CSR

Disclosure towards the company's financial

performance. The results of the analysis of this study

will have implications for the management of the

company regarding the importance of CSR disclosure

related to improving the performance of the company

and the involvement of managerial ownership,

institutional ownership, and foreign ownership can

increase the company's concern for the environment

around the mine and spur the company's financial

performance.

2 LITERATURE REVIEW AND

HYPOTHESES

DEVELOPMENT

2.1 Effect of Managerial Ownership,

Institutional Ownership and

Foreign Ownership on CSR

Disclosure

Agency issues that often occur between principals

and agents indicate the greater pressure faced by

companies to disclose more information in their

annual reports. The managerial ownership has a

positive effect on CSR disclosure (Laksmi and

Kamila, 2018), contrary to the statement of

managerial ownership does not affect CSR disclosure

(Ilmi, et.al, 2017). This is because the percentage of

managerial ownership is very small compared to

ownership by institutions and the public because

companies are open, that is, ownership of shares can

be owned by parties outside the company. The owner

will demand management to reconsider CSR

disclosure if disclosure of social responsibility can

reduce the achievement of the company's financial

performance. The institutional ownership has a

positive effect on CSR disclosure (Chang and Zhang,

2015) (Swandari and Sadikin, 2016). The entry of

foreign ownership in the company, will have an

impact on the progress of technology and more

efficient use of resources, foreign parties are also

more concerned with the environmental conditions

around the company and are committed to complying

with applicable laws and regulations.

The hypotheses tested in this study are:

H1: Managerial ownership has a significant effect on

CSR Disclosure

H2: Institutional ownership has a significant effect on

CSR Disclosure

H3: Foreign ownership has a significant effect on

CSR Disclosure

Ownership Structure, Corporate Social Responsibility (CSR) Disclosure and Company’s Financial Performance

31

2.2 Effect of Managerial Ownership,

Institutional Ownership, Foreign

Ownership and CSR Disclosure on

the Company's Financial

Performance

The emergence of agency conflicts because principals

and agents have the same interests trying to maximize

their respective utilities, resulting in management

cheating and unethical behavior so that it can harm

shareholders. For this reason, it is necessary to have a

control mechanism that can align the differences of

interests between principals and agents. The greater

the ownership of management, the less the tendency

of management to optimize the use of resources

(Jensen and Meckling, 1976). Furthermore,

institutional ownership, as an effective party to

monitor the company.that the greater the institutional

ownership (Charlo, et.al, 2017), the greater the drive

to optimize the company's performance (Maqbool

and Zameer, 2018). Signaling theory where a

company can improve the company's financial

performance through its reporting by sending signals

through its annual report. Disclosure of company

activities related to CSR is one way to send positive

signals to stakeholders and the market regarding the

company's prospects in the future that the company

provides guarantees for the survival of the company

in the future. Prospective investors in making

investment decisions will consider CSR carried out

by the company. Hasan, et.al (2018) show that CSR

disclosure has a significant positive effect on the

company's financial performance that the higher the

level of disclosure CSR carried out, the higher the

company's financial performance.

The hypotheses in this study are:

H4: Managerial ownership affects the company's

financial performance

H5: Institutional ownership affects the company's

financial performance

H6: Foreign ownership affects the company's

financial performance

H7: CSR Disclosure affects the company's

financial performance

3 RESEARCH METHODOLOGY

The type of this research is causality research, there

is a causal relationship between exogenous

(independen variables), namely variables that affect

endogenous variables (bound), namely variables that

are affected. Using secondary data taken from the

audited annual report 31 December 2012-2017

period, the annual report obtained through the corner

of the Sriwijaya State Polytechnic Indonesia Stock

Exchange (BEI) and from the website www.idx.co.id.

The population of this study was all mining

companies listed on the Indonesia Stock Exchange in

2012-2017 totaling 41 companies consisting of 22

coal companies, 7 listed companies of Metals & Gas,

10 listed companies of Metals & Minerals, 2 issuers

of Batu-Batuan. The research sample obtained 72

companies using purposive sampling technique,

namely, companies that publish financial statements

every year, do not experience losses and have

complete data. Then there are two equations, namely

as follows:

CSRDit = α + β1 MNGRit + β2 INSTit + β3FORNit

+ εit (1)

ROAit = α + β1 CSRDit + β2MNGRit + β3 INSTit

+ β4 FORNit + εit (2)

Where ROAit is company financial performance that

occurs in period t, CSRDit is CSR disclosure

company i that occurs in period t, MNGRit is

company managerial ownership that occurs in period

t, INSTit is company institutional ownership that

occurs in period t, FORNit is foreign ownership of

company i that occurs in period t, α is constants, β1 ...

β4 is the intercept state, ε is an error term.

4 RESULT AND DISCUSSION

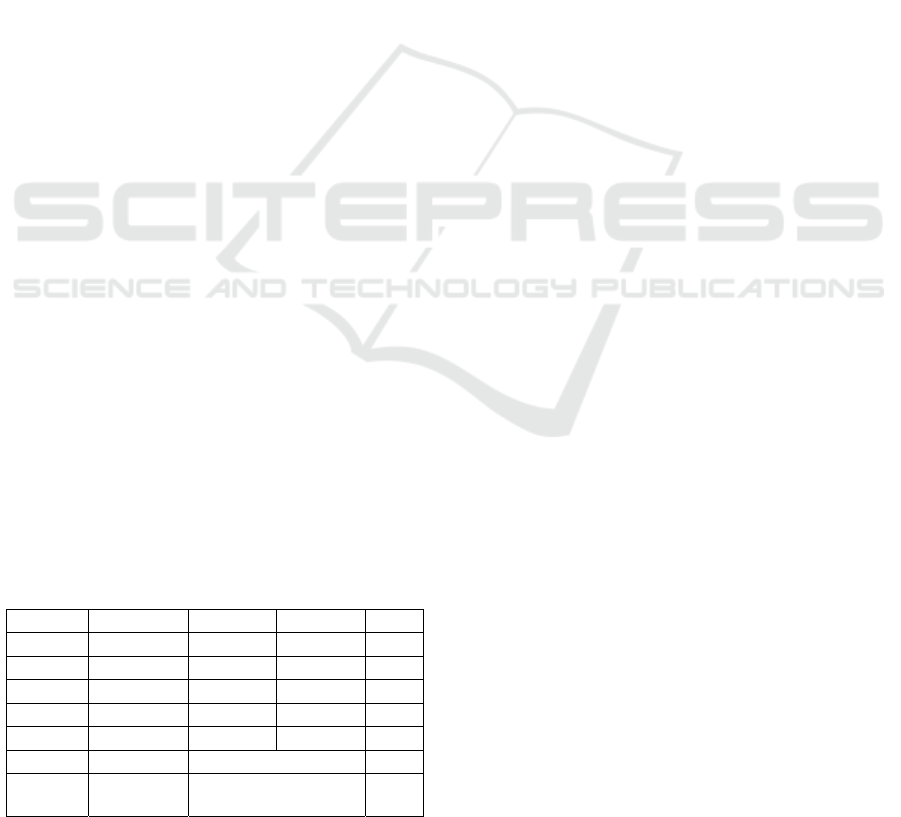

Descriptive statistics for the variables of this study are

shown in Table 1 below. It can be seen that the

financial performance of mining companies is owned

by PT Indo Tambang Raya Megah Tbk in 2012, while

PT Surya Esa Perkasa Tbk is the lowest company

with 0.003% in 2017. The highest CSR Disclosure

financial performance was carried out by PT Bukit

Asam (Persero) Tbk in 2012 which amounted to

87.20, and the lowest implementation of CSR was

owned by PT Baramulti Sukses sarana Tbk which

was 17.90. The average company that discloses CSR

is 0.507 or 50.7%, this shows that the company has

implemented the program and knows the benefits of

disclosing CSR, the company has been able to adjust

the activities of the company to the environment and

norms of the local community.

FIRST 2018 - 2nd Forum in Research, Science, and Technology (FIRST) – International Conference

32

Table 1: Descriptive statistics of research variables.

ROA CSRD MNGR INST FORN

Mean 8.09 0.51 26.34 34.91 26.59

Maximu

m

28.97 0.87 97.53 100.00 100.00

Minimu

m

0.003 0.18 0.00 0.00 0.00

Std. Dev. 6.33 0.18 33.05 32.12 29.58

Jarque-Bera 11.02 2.56 9.84 7.09 9.02

Observations 72 72 72 72 72

From Table 1 above, it can be seen that the

financial performance of mining companies is owned

by PT Indo Tambang Raya Megah Tbk in 2012, while

PT Surya Esa Perkasa Tbk is the lowest company

with 0.003% in 2017. The highest CSR Disclosure

financial performance was carried out by PT Bukit

Asam (Persero) Tbk in 2012 which amounted to

87.00, and the lowest implementation of CSR was

owned by PT Baramulti Sukses SaranaTbk which was

18.00. The average company that discloses CSR is

0.51 or 51%, this shows that the company has

implemented the program and knows the benefits of

disclosing CSR, the company has been able to adjust

the activities of the company to the environment and

norms of the local community.

Furthermore, the determination of the best model

on the data panel is done by using the chow test

(Common Fixed effects effect Vs) and Hausman

(random Vs fixed) test.

Table 2: Chow test results

Effect test

Test F

Statistics

P

Value

fixed effect

model

1 Cross-section F 33.067 0,00 Accepted

2 Cross-section F 30.684 0.036 Accepted

The Hausman test was then carried out to find out

whether models 1 and 2 of the panel data followed a

fixed effect model or random effect model.

Table 3: Hausman test results.

Effect test

Test

Statistics χ

2

P

Value

random effect

model

Cross-section

random

1.487 0.685 accepted

Cross-section

random

0.655 0.341 accepted

Based on Table 3 it can be concluded that models

1 and 2 are more appropriate to use random effect

models when compared with fixed effect models.

Table 4 shows the estimation results for model 1

(random effect model).

Table 4: Estimation of model 1 (random effect model).

Variable Coefficient Std. Error t-Statistic Prob.

C 0.571 0.056 10.119 0.000

MNGR -0.001 0.001 -2.856 0.006

INST 0.001 0.001 1.042 0.301

FORN 0.002 0.001 -1.918 0.050

R-squared 0.124 F-statistic 3.206

Adjusted R-

square

d

0.085 Prob(F-statistic) 0.029

The coefficient of determination with the adjusted

R square value of 0.085 means that the variability of

the dependent variable that can be explained by the

independent variable is 8.5% and the remaining

91.5% is explained by other variables not included in

this research model. The managerial ownership has a

significant negative effect on CSR disclosure, which

has a negative regression coefficient of -0.001

and a financial performance significance (prob) of

0.006 smaller than α = 0.05, which means that

hypotheses 1 is accepted.

This means that managerial ownership has a

significant effect on CSR disclosure in the direction

of a negative relationship at a 95% confidence level.

The negative influence shows that the greater the

percentage of managerial ownership will reduce CSR

disclosure and vice versa. The results of this study

support the phenomenon in Indonesia, the majority

ownership of public companies is owned by certain

parties or families, this certainly causes the

dominance of decisions in the company in the hands

of management.

Regarding CSR disclosure, most companies do not

support social activities because according to them

they will spend a considerable amount of money.

Contrary that managerial ownership has a positive

effect on CSR disclosure (Laksmi and Kamila, 2018)

and the stated that managerial ownership does not

affect CSR disclosure (Ilmi, et.al, 2017).

Institutional ownership does not have a significant

effect on CSR disclosure. with a negative regression

coefficient of 0.0005 and financial performance

significance (prob) of 0.301 greater than α = 0.05,

which means hypotheses 2 is rejected. The absence of

the influence of institutional ownership on the

company's financial performance shows that from an

average ownership percentage of 34.9%, it has not

been able to oversee the company to implement CSR

programs and disclose CSR data that has been carried

out by the company. This study provides evidence that

institutional ownership has not been able to encourage

company management to commit to disclosing the

company's social activities optimally. Institutional

Ownership Structure, Corporate Social Responsibility (CSR) Disclosure and Company’s Financial Performance

33

ownership has not been sufficiently influential in

monitoring management performance and

encouraging increased supervision including

disclosure of CSR by company management.The

results of this study are in line with previous

researchers that institutional ownership does not affect

the company's financial performance (Herdjiono and

Sari, 2017) (Hykaj, 2016) (Motta and Uchida, 2018).

The results of this study do not support Agency theory,

and the statement that institutional ownership has a

positive effect on the disclosure of social

responsibility (Swandari and Sadikin, 2016).

Foreign ownership has a significant positive

effect on CSR disclosure with a regression coefficient

of 0.002 and a financial performance significance

(prob) of 0.050 smaller than α = 0.05, which means

that hypotheses 3 is accepted. The positive influence

shows that the greater the percentage of foreign

ownership will increase CSR disclosure and vice

versa. This research supports Stakeholders' theory

that the role of foreign owners in business activities

of the company has been able to monitor and monitor

CSR activities. The results of this study indicate that

there is a significant positive influence of foreign

ownership on CSR disclosure because companies

whose shares are owned by foreign parties are more

concerned with the environmental conditions of the

company and have a commitment to comply with the

applicable regulations in the company's operational

area. This finding shows that foreign ownership is a

party that is concerned with disclosure of CSR,

foreign ownership in companies in Indonesia already

cares about critical issues of environmental and social

issues that must be disclosed in annual reports and

sustainability reports. Thus it can be concluded that

the percentage of foreign ownership in a company can

affect the disclosure of social responsibility carried

out by the company. But these findings differ that

foreign ownership does not affect social

responsibility disclosure (Zainal, 2017).

The following Table 5 shows the results of the

regression model 2 (Random effect model).

Table 5: Estimation of model 2 (random effect model).

Variable Coefficient Std. Error t-Statistic Prob.

C -8.925 2.941 -3.034 0.003

CSRD 32.871 4.227 7.776 0.000

MNGR -0.020 0.024 -0.839 0.405

INST -0.036 0.013 -2.774 0.007

FORN 0.079 0.026 3.089 0.003

R-squared

0.369

F-statistic

9.833

Adjusted

R-s

q

uare

d

0.332

Prob(F-statistic)

0.000

Based on the results of Table 5, the determination

coefficient shows adjusted R square of 0.369 meaning

that the variability of the dependent variable that can

be explained by the independent variable is 36.99%

and the remaining 63.01% is explained by other

variables not included in this research model. CSR

disclosure has a significant effect on the company's

financial performance, which has a positive

regression coefficient of 32,871 and a significant

financial performance (prob) of 0,000 smaller than α

= 0.05 which means that hypotheses 4 is accepted.

This means that CSR disclosure has a significant

effect on the company's financial performance with a

positive relationship direction at a 95% confidence

level.

The results of this study support that CSR

disclosure has a significant positive effect on the

company's financial performance (Amos, et.al, 2016)

(Ashraf, et.al, 2017) (Hasan, et.al, 2018). This study

shows that there is already a high level of corporate

awareness to care for the environment, especially in

the area around the mine, so that the public is also

interested in buying the company's products and

services so that it will increase the profits earned and

in the end, will contribute to the increase in the

company's financial performance. The positive effect

of CSR disclosure on financial performance means

that when a company discloses a company's social

activities, in the short term the company must spend

social costs but there will be value (positive image)

that the company will obtain in the future so that the

product consumption will increase company, and

increase profits in the future.The results of this study

contradict (Dkhili and Ansi, 2012), that CSR

disclosure has a significant negative effect on the

company's financial performance and the CSR

disclosure does not affect the company's financial

performance (Zaccheaus, et.al, 2014).

Managerial ownership does not have a significant

effect on the company's financial performance,

indicated by negative regression coefficient of 0.0200

and financial performance significance (prob) of

0.404 greater than α = 0.05, which means that

hypotheses 5 is rejected. The results of this study are

in accordance (Zondi and Sibanda, 2015).Managerial

ownership has no significant effect on the company's

financial performance (Motta and Uchida, 2018), and

does not support the findings that mention managerial

ownership has a negative influence on the company's

financial performance (Andow and David, 2016).

This finding shows that mining companies that

have an average percentage of managerial ownership

of 26.33% have not been able to make managers

focus and commit themselves to the company's main

FIRST 2018 - 2nd Forum in Research, Science, and Technology (FIRST) – International Conference

34

objectives, meaning that there are still conflicts of

interest between managers and shareholders. This is

also suspected because the proportion of managerial

ownership is still very low, so managerial ownership

ability to help meet the interests of managers and

owners to improve company performance has not

been effective. The company management does not

feel that they have ownership and responsibility to the

company because not all profits can be enjoyed by the

management, this clearly causes the management to

be less motivated to work optimally so as not to affect

the company's financial performance.

Institutional ownership has a significant negative

effect on the company's financial performance,

indicated by negative regression coefficients of

0.0361 and financial performance significance (prob)

of 0.007 smaller than α = 0.05, which means

hypotheses 6 is accepted. This means that

institutional ownership has a significant negative

effect on the company's financial performance with a

negative relationship direction at a 95% confidence

level. There is a negative influence, according to the

researchers' assumptions, institutional ownership

does have a high enough number of shares (34.90%)

so that institutions will tend to act in their own

interests at the expense of the interests of other

shareholders and will create imbalances in

determining the direction of company policy in fact it

is more beneficial to the majority shareholders,

namely the institution and will ultimately reduce the

company's financial performance.

The results of this study support that institutional

ownership negatively affects the company's financial

performance (Ahmed and Hadi, 2017)

(Andriosopoulos and Yang, 2015). But contrary to

where institutional ownership has a positive influence

on the company's financial performance (Charlo,

et.al, 2017) (Khamis, et.al, 2015) (Kiamehr, et.al,

2015) (Maqbool and Zameer, 2018).

Foreign ownership has a significant positive

effect on the company's financial performance,

indicated by a negative regression coefficient of

0.079 and financial performance significance (prob)

of 0.002 smaller than α = 0.05, which means that

hypotheses 7 is accepted. The results of this study

support that foreign ownership has a significant

positive effect on performance (Jusoh, 2016) (King

and Santor, 2008) (Prochazka, 2017). Foreign

ownership in mining companies has a large influence

in making company decisions to increase / decrease

company profits which ultimately can improve the

company's financial performance. Foreign owners are

able to aspire to the interests of the owner if there is

an adverse management policy due to a conflict of

interest between management and the owner. Foreign

ownership is also able to oversee the company's

performance by conducting direct supervision of

management. The results of this study do not support

that foreign ownership negatively affects the

company's financial performance (Alfaro and Chen,

2012) (Andriosopoulos and Yang, 2015).

5 CONCLUSIONS

Partially, managerial ownership has a significant

negative effect on CSR Disclosure, institutional

ownership has no significant effect on CSR

Disclosure, foreign ownership has a significant

positive effect on CSR Disclosure, managerial

ownership does not affect the company's financial

performance, institutional ownership has a significant

negative effect on the company's financial

performance Foreign ownership has a significant

positive effect on the company's financial

performance and CSR Disclosure has a significant

positive effect on the company's financial

performance.

Simultaneously, Managerial Ownership,

Institutional Ownership, Foreign Ownership and CSR

Disclosure had a significant effect on the company's

financial performance with Rsquare's contribution to

the contribution of 36.99% and the remaining 63.01%

explained by other variables not included in this

research model.

REFERENCES

Ahmed, N., & Hadi, O. A. 2017. Impact Of Ownership

Structure on Firm Performance In The MENA Region:

An Empirical Study. Accounting and Finance

Research, 6(3), 105.

Alfaro, L., & Chen, M. X. 2012. Surviving The Global

Financial Crisis: Foreign Ownership And

Establishment Performance. American Economic

Journal: Economic Policy, 4(3), 30-55.

Amos, B., Ibrahim, G., Nasidi, M., & Ibrahim, K. Y. 2016.

The Impact of Institutional Ownership Structure On

Earnings Quality of Listed Food/Beverages And

Tobacco Firms In Nigeria. Researchers World, 7(1),

20.

Andow, H. A., & David, B. M. 2016. Ownership Structure

And The Financial Performance Of Listed

Conglomerate Firms In Nigeria. The Business &

Management Review, 7(3), 231.

Andriosopoulos, D., & Yang, S. 2015. The Impact Of

Institutional Investors On Mergers And Acquisitions In

Ownership Structure, Corporate Social Responsibility (CSR) Disclosure and Company’s Financial Performance

35

The United Kingdom. Journal Of Banking &

Finance, 50, 547-561.

Ashraf, M., Khan, B., & Tariq, R. 2017. Corporate Social

Responsibility Impact On Financial Performance Of

Bank’s: Evidence From Asian Countries. International

Journal Of Academic Research In Business And Social

Sciences, 7(4), 618-632.

Awan, A. G., &Saeed, S. 2015. Impact Of CSR On Firms’

Financial Performance: A Case Study Of Ghee And

Fertilizer Industry In Southern Punjab-

Pakistan. European Journal Of Business And

Management, 7(7), 375-384.

Chang, K., & Zhang, L. (2015). The Effects Of Corporate

Ownership Structure On Environmental Information

Disclosure-Empirical Evidence From Unbalanced

Penal Data In Heavy-Pollution Industries In

China. WSEAS Transactions on Systems And

Control, 10, 405-414.

Charlo, M. J., Moya, I., & Munoz, A. M. 2017. Financial

Performance Of Socially Responsible Firms: The

Short-And Long-Term Impact. Sustainability, 9(9),

1622.

Dkhili, H., & Ansi, H. (2012). The Link Between Corporate

Social Responsibility and Financial Performance: The

Case of The Tunisian Firm. Journal of Organizational

Knowledge Management, 2012, 1.

Government Regulation Number 47 of 2012 concerning

Social and Environmental Responsibilities of Limited

Liability Companies

Hasan, I., Kobeissi, N., Liu, L., & Wang, H. 2018.

Corporate Social Responsibility And Firm Financial

Performance: The Mediating Role of

Productivity. Journal of Business Ethics, 149(3), 671-

688.

Herdjiono, I., & Sari, I. M. 2017. The Effect of Corporate

Governance on the Performance of a Company.Some

Empirical Findings from Indonesia. Journal of

Management and Business Administration, 25(1), 33-

52.

Hykaj, K. 2016. Corporate Governance, Institutional

Ownership, And Their Effects on Financial

Performance. European Scientific Journal,

ESJ, 12(25).

Ilmi, M., Kustono, A. S., & Sayekti, Y. 2017. Effect Of

Good Corporate Governance, Corporate Social

Responsibility Disclosure And Managerial Ownership

To The Corporate Value With Financial Performance

As Intervening Variables: Case On Indonesia Stock

Exchange. International Journal of Social Science And

Business, 1(2), 75-88.

Jensen, M. C. and Meckling, W. 1976. Theory of the Firm:

Managerial Behavior, Agency Costs, and Ownership

Structure. Journal of Financial Economics, October,

1976, 3(4): 305-360.

Jusoh, M. A,.2016. Foreign Ownership And Firm

Performance: Evidence From Malaysia. Asian Journal

Of Accounting And Governance, 6, 49-54.

Khamis, R., Hamdan, A. M., & Elali, W. 2015. The

Relationship Between Ownership Structure

Dimensions And Corporate Performance: Evidence

From Bahrain. Australasian Accounting, Business And

Finance Journal, 9(4), 38-56.

Kiamehr, M., Asa'diMoghaddam, A., Alipour, S., & Hajeb,

H. R. 2015. Examining The Impact of Institutional

Ownership on Monitoring Cost: The Case of Iranian

Firms Listed on Tehran Stock Exchange. International

Journal of Academic Research In Accounting, Finance

And Management Sciences, 5(4), 22-30.

King, M. R., &Santor, E. 2008. Trading Places: Impact of

Foreign Ownership Changes on Canadian

Firms. Journal of Banking And Finance, 32(11), 2423-

2432.

Laksmi, A. C., & Kamila, Z. 2018. The Effect Of Good

Corporate Governance And Earnings Management To

Corporate Social Responsibility Disclosure. Academy

Of Accounting & Financial Studies Journal, 22(1).

Maqbool, S., & Zameer, M. N. 2018. Corporate Social

Responsibility And Financial Performance: An

Empirical Analysis of Indian Banks. Future Business

Journal, 4(1), 84-93

Motta, E. M., & Uchida, K. 2018. Institutional investors,

corporate social responsibility,and stock price

performance. Journal of the Japanese and

International Economies, 47, 91-102.

Prochazka, D. 2017. The Impact Of Ownership And Other

Corporate Characteristics on Performance of V4

Firm. Journal Of International Studies, 10(2), 204-218.

Swandari, F., &Sadikin, A. 2016. The Effect of Ownership

Structure, Profitability, Leverage, And Firm Size on

Corporate Social Responsibility (CSR). Binus Business

Review, 7(3), 315-320.

Zaccheaus, S. A., Oluwagbemiga, O. Z., & Olugbeng, O.

M. 2014. Effects Of Corporate Social Responsibility

Performance (CSR) On Stock Prices: Empirical Study

Of Listed Manufacturing Firm In Nigeria. Journal Of

Business And Management, 16(8), 112-117.

Zainal, D. 2017. Quality of Corporate Social Responsibility

Reporting (CSRR): The Influence of Ownership

Structure And Company Character. Asian Journal Of

Accounting Perspectives, 16-35.

Zulvina,Fitri.,Desi Zulvina, Yani Zulvina, Makhdalena.

2017. Ownership Structure, Independent

Commissioner, and Corporate Social

Responsibility.Research Journal of Finance and

Accounting www.iiste.org ISSN 2222-1697 (Paper)

ISSN 2222-2847 (Online) Vol.8, No.22, 2017

Zondi, S., & Sibanda, M. 2015. Managerial Ownership And

Firm Performance On Selected Jse Listed

Firms. Corporate Ownership & Control, 23

FIRST 2018 - 2nd Forum in Research, Science, and Technology (FIRST) – International Conference

36