Research on the Relationship between the Total Factor Productivity

of Each Industry and Its Influence Factors in China

Wang Lihui

School of Statistics and Mathematics, Zhejiang Gongshang University, No.18 Xuezheng Steet,

Xiasha Higher Education Zone, Hangzhou City, P.R. China

wlh310033@163.com

Keywords: Total Factor Productivty, Industry, Financial Deepening.

Abstract: In order to study the influence factors of the total factor productivity and the relationship between these

factors and the total factor productivity, this paper analyzed such aspects as the financial deepening,

education development, energy consumption, opening to the outside world. The relationship between these

factors and total factor productivity of each industry was studied by using the vector error correction model

(VEC) in this paper on the basis of the existing literature research. The conclusion is that the financial

deepening has a long-term role in promoting technology progress of the secondary industry and the tertiary

industry. The innovation of this paper is that it distinguished among three industries to study the total factor

productivity.

1 INTRODUCTION

Burak R. Uras et al., (2014) studied the quantitative

relevance of the cross-sectional dispersion of

corporate

financial structure in explaining the intra-

industry allocation ef

ficiency of productive factors.

Chadwick C. Curtis et al., (2015) studied on the

impact of economic reforms on China’s growth in

total factor productivity. Xingle Long et al., (2015)

compared total productivity and eco-efficiency in

China’s cement manufactures from 2005 to 2010.

Many scholars have studied the total factor

productivity from different perspectives (Thomas

Scherngell et al., 2014; Maria Gabriela Ladu and

Marta Meleddu, 2014; Shuiping Zhang, 2014; Yen-

Chun Chou et al., 2014; Zibin Zhang, and Jianliang

Ye, 2015).

Based on the existing literature research, this

paper studies the influencing factors of the total

factor productivity and the relationship between

these factors and the total factor productivity of the

three industries in china from 1952 to 2013.

2 MODEL, INDEX AND DATA

Solow residual method which was proposed by

Robert M. Solow is the method widely used of

calculation of total factor productivity. It is

established under the condition of constant return to

scale. The calculation formula is as follows:

t

t

Y

TFP

K

L

(1)

Y

refers to the total industrial output value,

represented by actual GDP, which is deflated by

GDP deflator.

K

and

L

refers to the input of

capital and labor. Capital

K

are caculated by use

of the method of the perpetual inventory. The

calculation formula is as follows.

tttt IKK

)1(1

(2)

K refers to the capital stock,

Refers to depreciation

rate,

I refers to investment.

and

refer to the output elasticity of capital

and labor respectively. In this paper, the elastic

coefficient applied the coefficient measured by

the “Quantitative Calculation Method on the

Role of Scientific and Technological Progress in

Economic Growth” issued by the State Planning

Commission of China in 1992. That is, the

capital elasticity coefficient is 0.35, the

corresponding labor elasticity coefficient is 0.65.

Taking logarithm of TFP, this paper get LNPTFP

as the index of the total factor productivity of the

primary industry, and get LNSTFP as the index

448

448

Lihui W.

Research on the Relationship between the Total Factor Productivity of Each Industry and Its Influence Factors in China.

DOI: 10.5220/0006028304480451

In Proceedings of the Information Science and Management Engineering III (ISME 2015), pages 448-451

ISBN: 978-989-758-163-2

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

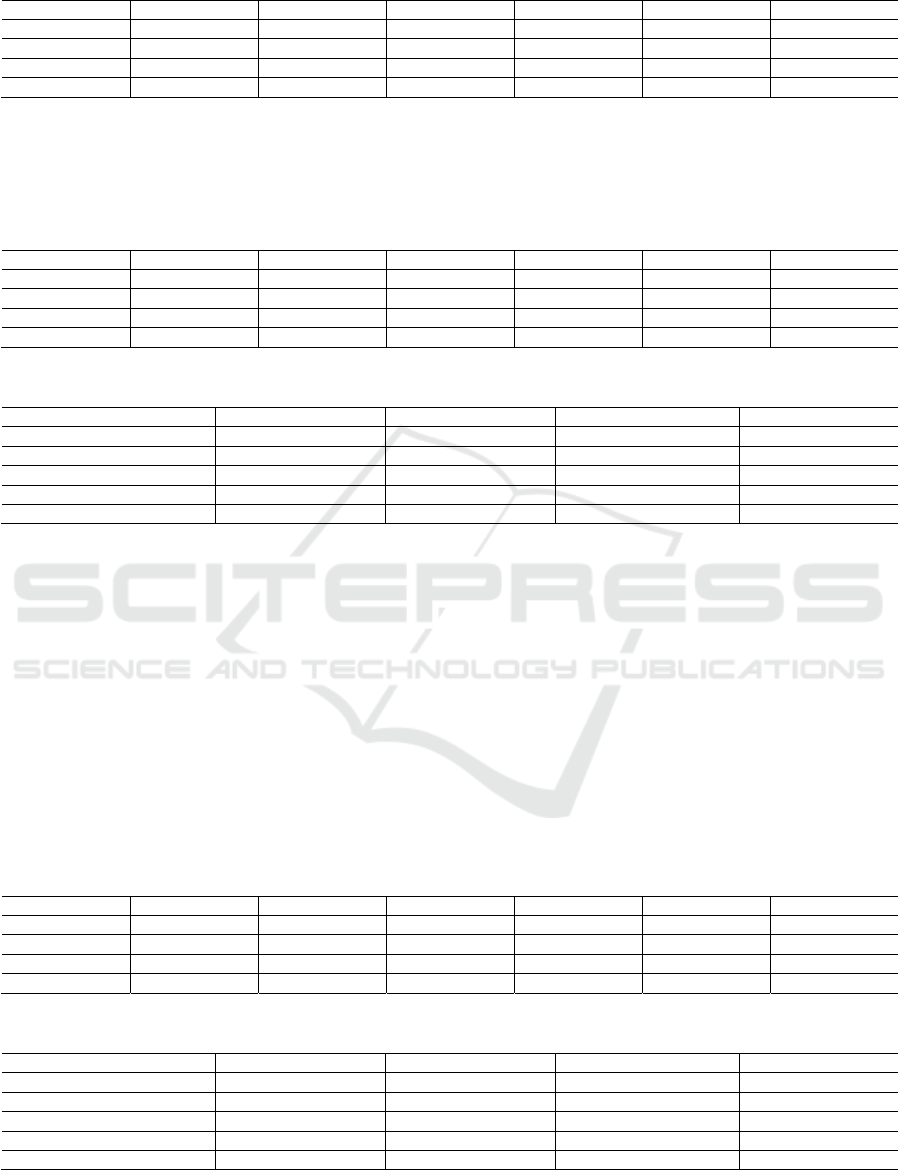

Table 1: Variable Stationary test.

Test sequence

Testform

(C,T,K)

ADF test statistic

The critical value of each significant level

Test result

1% 5% 10%

LNM (C,T,0) -1.969621 -4.115684 -3.485218 -3.170793 Unstatationary

DLNM (C,N,0) -9.531509*** -3.544063 -2.910860 -2.593090 Stationary

LNEDU (C,T,1) -2.604001 -4.118444 -3.486509 -3.171541 Unstatationary

DLNEDU (N,N,1) -4.215640*** -2.604746 -1.946447 -1.613238 Stationary

LNEU (N,N,8) 6.253966 -2.609324 -1.947119 -1.612867 Unstatationary

DLNEU (C,N,1) -4.505033*** -3.546099 -2.911730 -2.593551 Stationary

LNTIE (C,T,1) -2.465281 -4.118444 -3.486509 -3.171541 Unstatationary

DLNTIE (C,N,0) -5.097995*** -3.544063 -2.910860 -2.593090 Stationary

LNPTFP (C,T,0) -2.159173 -4.115684 -3.485218 -3.170793 Unstatationary

DLNPTFP (C,N,0) -6.071282*** -3.544063 -2.910860 -2.593090 Stationary

LNSTFP (C,T,1) -2.550908 -4.118444 -3.486509 -3.171541 Unstatationary

DLNSTFP (C,N,1) -9.040902*** -3.546099 -2.911730 -2.593551 Stationary

LNTTFP (C,T,0) -1.269348 -4.115684 -3.485218 -3.170793 Unstatationary

DLNTTFP (C,T,0) -6.711633*** -4.118444 -3.486509 -3.171541 Stationary

of the total factor of the secondary industry,

LNTTFP as the index of the total factor productivity

of the tertiary industry.

Taking logarithm of each index, the financial

deepening (LNM), education development

(LNEDU), energy onsumption (LNEU) and opening

to the outside world (LNTIE) are the influencing

factors of technological progress.

Data in this paper are derived from the CSMAR

database, the website of the Nationgal Bureau of

Statistics of the People’s Republic of China and the

New China 60 Years Statistical Data Compilation.

3 EMPIRICAL ANALYSIS

3.1 Stationary Test

Before the construction of VAR model, it is

necessary to carry out unit root test. Unit root test is

the sequence of the stationary test. In this paper, the

ADF method is used to test the total factor

productivity and its influencing factors. The test

results are shown in Table 1. All the variables are 1

stage single integration, therefore can be tested by

the cointegration test method.

3.2 Primary Industry VAR Model

Through test, the LNPTFP and other variables are

not cointegrated relationship. Therefore, the VAR

model is constructed to analyze the relationship

among the difference of the LNPTFP and that of

other variables.

According to the test of table 2, the optimal lag

period of the VAR model is selected as 1 stage. Not

significant variables are removed, and the test results

of VAR model are shown in the formula (3). The

number in the parentheses is the standard error and

the T statistics in the brackets.

3.3 Secondary Industry VEC Model

The test of LNSTFP and other variables are co-

integrated relationship. Therefore, the VEC model is

constructed to analyze the relationship among the

LNSTFP and other variables.

According to the test of table 3, the optimal lag

period of the VEC model is selected as 2 stage, that

is 3 stage minus 1 stage because of cointegration

constraint. Cointegration test results are shown in

Table 4. According to the trace statistics, there is

cointegration relationship among the variables. Not

significant variables are removed, and the test results

of VEC model are shown in the formula (4) and

formula (5).

3.4 Tertiary Industry VEC Model

The test of LNTTFP and other variables are co-

integrated relationship. Therefore, the VEC model is

constructed to analyze the relationship among the

LNTTFP and other variables.

According to the test of table 5, the optimal lag

period of the VEC model is selected as 1 stage, that

is 2 stage minus 1 stage because of cointegration

constraint. According to the trace statistics, there are

cointegration relationship among the variables. Not

significant variables are removed, and the test results

of VAR model are shown in the formula (6) and

formula (7).

Research on the Relationship between the Total Factor Productivity of Each Industry and Its Influence Factors in China

449

Research on the Relationship between the Total Factor Productivity of Each Industry and Its Influence Factors in China

449

Table 2: Variable lag length test.

Lag LogL LR FPE AIC SC HQ

0 180.3035 NA 1.63e-09 -6.044948 -5.867324 -5.975760

1 235.8736 99.64287* 5.70e-10* -7.099088* -6.033342* -6.683959*

2 254.5886 30.33134 7.22e-10 -6.882367 -4.928499 -6.121296

3 273.0901 26.79518 9.50e-10 -6.658279 -3.816288 -5.551266

110.287 0.139

(0.091) (0.073)

[ 3.172] [1.894]

tt tDLNPTFP DLNEU DLNTIE

(3)

Table 3: Variable lag length test.

Lag LogL LR FPE AIC SC HQ

0 -151.0157 NA 0.000136 5.288668 5.464730 5.357396

1 197.8435 626.7640 2.33e-09 -5.689609 -4.633234* -5.277243

2 246.9987 79.98143 1.05e-09 -6.508432 -4.571744 -5.752427

3 285.5240 56.15553* 6.95e-10* -6.966916* -4.149917 -5.867274*

Table 4: Johansen cointegration test result of LNSTFP、LNM、LNEDU、LNEU and LNTIE.

Hypothesized No. Of CE(s) Trace Statistic 0.05 critical value Max-Eigen Statistic 0.05 critical value

None* 76.92855* 69.81889 31.50815 33.87687

At most 1 45.42040 47.85613 17.61823 27.58434

At most 2 27.80217 29.79707 15.61677 21.13162

At most 3 12.18540 15.49471 12.17002 14.26460

At most 4 0.015378 3.841466 0.015378 3.841466

11 21

21 2 1

0.211 0.273 0.519 0.397

(0.082) (0.122) (0.120) (0.135)

[ 2.580] [ 2.248] [ 4.316] [ 2.946]

0.121 0.583 0.493 0.162 0.067

(0.062) (0.

tt t t t

ttt t

DLNSTFP ECM DLNSTFP DLNSTFP DLNM

DLNEDU DLNEU DLNEU DLNTIE

167) (0.154) (0.101) (0.022)

[ 1.962] [3.489] [ 3.203] [1.603] [3.083]

(4)

11 1 1 10.366 0.200 0.171 0.280 5.192

(0.137) (0.055) (0.115) (0.111)

[ 2.670] [ 3.614] [ 1.488] [2.514]

tt t t tLNSTFP LNM LNEDU LNEU LNTIE

(5)

Table 5: Variable lag length test.

Lag LogL LR FPE AIC SC HQ

0 -168.8526 NA 0.000249 5.893307 6.069370 5.962035

1 231.6231 719.4987 7.43e-10 -6.834683 -5.778308* -6.422317

2 273.8622 68.72796* 4.22e-10* -7.419057 -5.482370 -6.663053*

3 299.0095 36.65545 4.40e-10 -7.424052* -4.607052 -6.324410

Table 6: Johansen cointegration test result of LNTTFP、LNM、LNEDU、LNEU and LNTIE.

Hypothesized No. Of CE(s) Trace Statistic 0.05 critical value Max-Eigen Statistic 0.05 critical value

None* 78.38199* 69.81889 29.58991 33.87687

At most 1* 48.79208* 47.85613 19.45679 27.58434

At most 2 29.33529 29.79703 14.33239 21.13162

At most 3 15.00290 15.49471 12.73030 14.26460

At most 4 2.272598 3.841466 2.272598 3.841466

ISME 2015 - Information Science and Management Engineering III

450

ISME 2015 - International Conference on Information System and Management Engineering

450

1110.209 0.244 0.130

(0.043) (0.112) (0.090)

[ 4.871] [2.185] [1.444]

tt t tDLNTTFP ECM DLNTTFP DLNEU

(6)

11 1 10.533 0.572 0.168 1.634

(0.146) (0.129) (0.119)

[ 3.779] [4.441] [1.413]

tt t tLNTTFP LNM LNEU LNTIE

(7)

4 CONCLUSIONS

From the perspective of industrial production

efficiency, the opening to the outside world helps to

promote the primary industrial technology progress.

Energy consumption and the primary industrial

technology progress have a negative relationship,

and the production of high energy consumption is

not conducive to technological progress of the

primary industry. The impacts of financial

deepening and educational development on

technological progress of the primary industry are

not significant. Energy consumption is helpful to

promote the technological progress of the secondary

industry. Financial deepening and improving the

level of education have a long-term role in

promoting the technology progress of the secondary

industry. Opening up to the outside world helps to

promote the technological progress of the secondary

industry in the short term, but in the long run is a

reverse change relationship. In the long run, the

financial deepening is helpful to promote the

technological progress of the tertiary industry.

Energy consumption in the short term is conducive

to the technological progress of the tertiary industry,

from the long-term view is not conducive to

technological progress. The level of education has

no significant effect on the technological progress of

the tertiary industry. From a long time to see the

relationship between the opening up and the

technological progress of the tertiary industry is the

reverse.

Therefore, policy should further deepen the role

of finance in the economy, and strive to play a role

of financial in promoting the technology

development. To promote the development of

education, and strive to promote the role of

education in the promotion of technological progress.

In energy consumption, energy consumption

although promote the technology progress of the

secondary industry, it is not conducive to the

primary industrial technological progress, and from

the long-term view is not conducive to the

technological progress of the tertiary industry.

Therefore, in the energy consumption we should be

rational use of resources, play the role of energy in

the economy, change the way of economic growth,

encourage intensive production, and promote

technological progress. In opening up, we should

improve the export of high value-added products,

and use international trade to promote technological

progress.

REFERENCES

Burak R. Uras, 2014. “Corporate fi nancial structure,

misallocation and total factor Productivity ”. Journal

of Banking & Financ. Vol. 39, pp. 177-191.

Chadwick C. Curtis, 2015. “Economic reforms and the

evolution of China’s total factor productivity”. Review

of Economic Dynamics.

Xingle Long, Xicang Zhao and Faxin Cheng, 2015. “The

comparison analysis of total factor productivity and

eco-efficiency in China's cement manufactures”.

Energy Policy. Vol. 81, pp. 61-66.

Thomas Scherngell, Martin Borowiecki and Yuanjia Hu,

2014. “Effects of knowledge capital on total factor

productivity in China: A spatial econometric

perspective”. China Economic Review. Vol. 29, pp.

82-94.

Maria Gabriela Ladu and Marta Meleddu, 2014. “Is there

any relationship between energy and TFP (total factor

productivity)? A panel cointegration approach for

Italian regions”. Energy. Vol. 75, pp. 560-567.

Shuiping Zhang, 2014. “Evaluating the method of total

factor productivity growth and analysis of its

influencing factors during the economic transitional

period in China”. Journal of Cleaner Production.

Yen-Chun Chou, Howard Hao-Chun Chuang and

Benjamin B.M. Shao, 2014. “The impacts of

information technology on total factor productivity: A

look at externalities and innovations”. International

Journal of Production Economics.Volume 158, pp.

290-299.

Zibin Zhang and Jianliang Ye, 2015. “Decomposition of

environmental total factor productivity growth using

hyperbolic distance functions: A panel data analysis

for China”. Energy Economics.Volume 47, pp. 87-97.

Research on the Relationship between the Total Factor Productivity of Each Industry and Its Influence Factors in China

451

Research on the Relationship between the Total Factor Productivity of Each Industry and Its Influence Factors in China

451