Quality of Service for Financial Modeling and Prediction as a Service

Victo

r Chang and Muthu Ramachandran

School of Computing, Creative Technologies and Engineering, Leeds Beckett University, Leeds, U.K.

Keywords: Quality of Service (QoS) for SaaS, Financial Modeling and Prediction as a Service (FMPaaS) QoS,

Performance and Accuracy Test for FMPaaS QoS.

Abstract: This paper describes our proposal for Quality of Service (QoS) for Financial Modeling and Prediction as a

Service (FMPaaS), since a majority of papers does not focus on SaaS level. We focus on two factors for

delivering successful QoS, which are performance and accuracy for FMPaaS. The design process, theories

and models behind the FMPaaS service have been explained. To support our FMPaaS service, two APIs

have been developed to improve on performance and accuracy. Two major experiments have been

illustrated and results show that each API processing can be completed in 2.12 seconds and 100,000

simulations can be completed in an acceptable period of time. Accuracy tests have been performed while

using Facebook as an example. Three points of comparisons between actual and predicted prices have been

undertaken. Results support accuracy since results are between 93.72% and 99.63%.

1 INTRODUCTION

The complexity of large scale financial cloud

computing services that require high speed and high

precision systems grows exponentially. Services of

large scale financial cloud computing and grids are

enormous in recent years. Some of them are used for

weather forecasting, simulation of aircraft and

military services, atmospheric and planet study,

remote sensing, large scale data analysis, aerospace

research, large scale computational fluid dynamic

services, aeronautics and automobile industries, and

financial simulations. More recently, predication

models used by these applications have become

increasingly important (Cantor and Royce, 2014).

As a result, understanding the behavioral aspects of

such systems is important for the design in the

quality of service. Some characteristics of large

scale financial cloud computing services include:

High speed and highly parallel

Real-time

Virtually connected nodes of systems

Grid is an infrastructure for large scale financial

cloud computing and other resources

High precision and accuracy

To manage largely-scale software in the cloud,

software components and also known as service

components are used. The aim is to provide a self-

contained entity that can be adapted to the required

environment quickly and easily. To elaborate this

further, software components design for large scale

financial cloud computing and grids have become

major issues in recent years and in years to come

(Silvestri et al., 2006; Albodour et al., 2012). They

have all claimed the importance of software

components which will dominate large scale

financial cloud computing and grid services.

Albodour et al., (2012) propose a model, Business

Grid Quality of Service (BEQoS), to measure key

metrics and provide added value for commercial and

business Grid applications. They use the GridSim

software to demonstrate their proof-of-concepts with

supporting results to show that reliability and

affordability can be achieved. Silvestri et al., (2006)

assert that the future large scale financial cloud

computing and grid services can be completely built

in a bottom-up fashion using software components

deployed on various locations and interconnected to

form a workflow graph and to re-configure

themselves as and when needed during run-time to

self manage those services that may in need.

In this paper, we propose a QoS requirements

engineering model to assert certain subsets of

activities that must be identified and assessed for a

large scale financial cloud computing and grid

services where the main emphasis has been given to

non-functional requirements that match onto the

characteristics of such Services. In all the

applications and Software as a Service (SaaS),

financial applications require on-demand services

5

Chang V. and Ramachandran M..

Quality of Service for Financial Modeling and Prediction as a Service.

DOI: 10.5220/0005502300050015

In Proceedings of the 2nd International Workshop on Emerging Software as a Service and Analytics (ESaaSA-2015), pages 5-15

ISBN: 978-989-758-110-6

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

that are offered by cloud computing with cost-

benefits. Hence, financial domain has begun to reap

this benefit with emerging financial SaaS such as

FinancialForce developed jointly by SalesForce,

NetSuite, Intacct, and Oracle’s financial SaaS.

According to NetSuite (2014), FinancialForce

helped companies increase their revenues by 95%.

Accenture (2011) reports on financial technology

trends and high performance computing prediction

in the following category:

Leveraging technology to address new & change

in regulations

Reliable and globally harmonized financial

systems

Add value through strategic applications

Harvest benefits from technology

According to Accenture (2011), SaaS should be

simple, efficient, engaging, accessible, clearly

structured, intuitive, and supportive. While keeping

this set of requirements as design criteria, a SaaS

component model and a service architecture should

be designed to support flexibility, scalability, and

adaptability. This paper has proposed an integrated

service-oriented architecture and SaaS component

model for financial domains which provides

required scalability, flexibility and customization

that are at the heart of a financial SaaS.

There are a number of QoS factors that affect

quality of a cloud service. We have proposed a set of

QoS attributes that are keys to success of cloud

services, in particular, Financial Modeling and

Prediction as a Service (FMPaaS) where accuracy

and performance are the key benefits of such

services which has been achieved. To demonstrate

accuracy, two types of the accuracy test were given.

The first type was focused on the overall accuracy

and the second type was focused on three point

selection. One example will be illustrated to support

accuracy for our FMPaaS.

1.1 QoS for Financial Modeling and

Prediction as a Service (FMPaaS)

Cloud is committed to providing everything as a

service and QoS can provide multiple parameters

that are required by financial cloud computing

services. There are a number of QoS metrics to be

considered for FMPaaS. In our previous work

(Chang, 2014), we demonstrated the use of FMPaaS

in business intelligence applications and identified

six important factors. The importance of each factor

can be measured in the scale between 1 and 10. A

complete set of QoS factors that affects FMPaaS are

identified in Figure 1 and some which have been

validated in our earlier project on FMPaaS (Chang,

2014) and are summarized as follows:

Usability: Most of QoS APIs are easy to use

except one API requires further training. The

overall score is 8 because at least 80% of the

tools are easy to use and their manuals are self-

explanatory. The other 20% of the functionalities

require specialized knowledge about financial

modeling to compute complex models.

Performance: Performance on QoS is good.

Computation takes a short time to get results.

The score is 8.

Security: QoS needs third party software and is

not a model with a high level of security. Basic

authentication and authorization can still be

achieved. As a result, the score is 4.

Computational accuracy: Computational QoS

results are accurate. Some banks have used QoS

to calculate pricing and risks, and are close to the

actual values. But QoS requires have accurate

input values before getting the final results. This

level of dependency is a limitation to prevent it

to score 10. The overall score is 8.

Portability: QoS is highly portable in most of the

systems. All operating systems and

computational devices can run QoS applications.

The overall score is 9.

Scalability: QoS tools are highly scalable. It can

run on a single processor desktop, or clusters of

high-end servers. Input variables can be highly

adaptable to a wide range of values.

These scores for QoS are based on the results of

expert reviews of eleven experts. Follow-up

improvements are required to support the QoS

model.

Figure 1: QoS Metrics to Measure.

ESaaSA2015-WorkshoponEmergingSoftwareasaServiceandAnalytics

6

In addition to these well know parameters to

measure QoS, we have also defined a clear model

and equation to measure QoS in terms of satisfaction

of services on the fly. We highlight important factors

essential for QoS success, with more emphasis paid

on performance and accuracy. Referring to Figure 1,

a list of QoS parameters are used in our work to

evaluate service quality. We highlight important

factors essential for QoS success, with more

emphasis paid on performance and accuracy.

1.2 Our Approach in QoS for Financial

Modeling and Prediction as a

Service (FMPaaS)

In review of all the six factors influencing QoS, we

have already demonstrated the importance of

security in our papers (Ramachandran and Chang,

2014)

. In this paper, we will elaborate on these

factors, in particular performance and accuracy. The

reasons are as follows. First, literature presented in

Section 1.1 does not provide details in accuracy.

While SaaS is essential to sectors such as finance

and medicine which require an extremely high level

of accuracy, any errors or glitch may cause

damaging impacts. If FMPaaS calculates incorrect

results such as advising investors to buy a particular

stock with millions of pounds, or a reliable stock at a

particular instance with millions of pounds, they can

bear the consequence. This means that the emphasis

in QoS accuracy is essential for Cloud Computing.

Second, there is an increased demand to offer

accurate predictive services, since the inaccurate

results may cause financial loss, loss of company

reputation, loss of consumer confidence. This is a

type of QoS that have not been presented in the

research computing community. For example, if

they lose out million of pounds due to the

misleading predictive results from similar FMPaaS

services, it may result in bankruptcy (Lehman

Brothers), loss of reputation (UBS) and loss of

investors apart from the direct loss of money.

Similarly, simulations related to human bodies such

as brain, heart and vital organs are important to

determine the most likely scenarios for patients

receiving treatments for several years.

With regard to FMPaaS, one of our contributions

to QoS is the notion of service satisfaction index

which can be in-built as part of a service

specification. FMPaaS index allows users evaluate

services based on their merits in real scenarios and

also supports service reusability, a key benefit of

service computing. In reviewing all factors

contributing to QoS success, we focus more on

accuracy and performance to ensure that our

FMPaaS can provide as correct and swift as possible

for investors. We emphasize on the software design

approach for FMPaaS QoS and use one example to

illustrate our proof-of-concepts.

2 INANCIAL MODELING AND

PREDICTION AS A SERVICE

QoS

This section describes the system design for

Financial Modeling and Prediction as a Service

(FMPaaS) QoS, which is essential in a few

disciplines. For example, e-government applications

require open, flexible, interoperable, collaborative

and integrated architecture to provide services.

These services can be made available as stand alone,

integrated, componentized, web based service

component, composite service (a set of

interconnected services), virtualized services (cloud

based), and dynamically re-configurable services.

This vision is similar to the Open Group’s (2009)

Service Integration Maturity Model (OSIMM),

which provides:

A process roadmap for attaining key practices

with metrics

Seven levels of maturity to improve

A quantitative model for assessing current

practices and to improve with recommended

practices

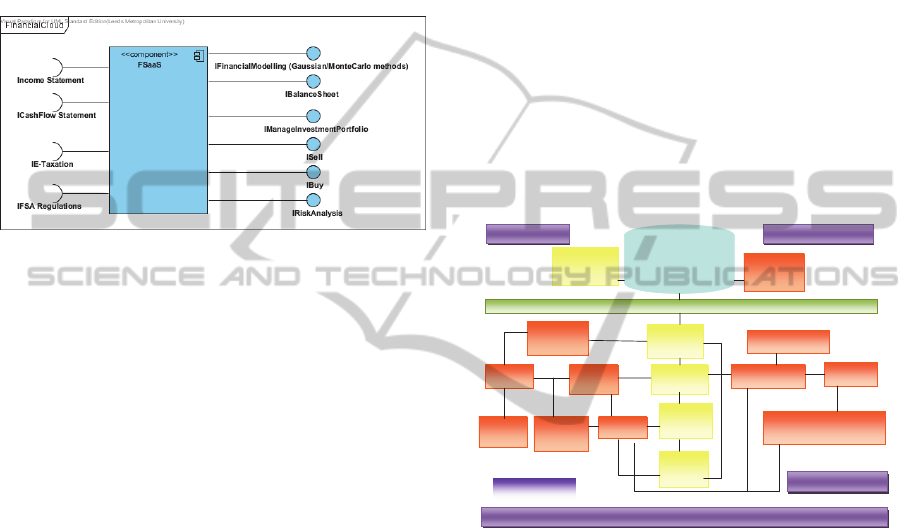

As mentioned earlier section, service components

are useful to manage system complexity and reuse of

services during autonomous service composition.

The key challenge is to design a service component

that supports service characteristics discussed

earlier. A service component can be defined as a self

autonomous service which provides two sets of

services: provider business services and required

business services. The provider business service

(often shown with a lollypop notation and the

naming convention starts with I) is a set of services

offered to other services to compose where as the

required business services (often shown as a semi-

arc notation) are a set of services that are required by

this service in order to compose successfully. In this

work, we have proposed a component model for

FMPaaS applications as shown in Figure 2, which

the required services include Income statement,

ICashFlow statement, Ie-taxation, IFSA regulations.

IFSA provides interface service integration for

Financial Authority regulations. Ay investment

QualityofServiceforFinancialModelingandPredictionasaService

7

service providers can integrate their work to this

FMPaaS service component model, which is

adaptable to regular updates in regulations. By doing

so, FMPaaS can provide scalability and flexibility

for financial analysts. These services can be made

available as stand alone, integrated, componentized,

web based service component, composite service (a

set of interconnected services), virtualized services

(cloud based), and dynamically re-configurable

services.

Figure 2: FMPaaS Service Component Model.

The next step in the design process is to design

service-oriented cloud architecture for FMPaaS

where all aspects of the corporate financial service

are integrated and composed based a set of SLA and

governance. The architecture presented in this paper

is based on a critical review and analysis of a

number of existing architectures for FMPaaS

applications. Further to this, the SOA based

architecture consists of four distinct levels of

abstraction layers which are connected and

communicated by messages through a core

communication channel known as a service bus or a

central bus. These layers are: 1) a business layer

with a dedicated set of services; 2) an orchestration

layer with a set of services where new services can

be composed; 3) an FMPaaS layer that supports

integration of services, government departments and

local governments, and 4) an e-business layer that

supports new businesses and integration of data. The

SOA based architecture for FMPaaS services, then

ensures that it achieves the expected service-oriented

design factors such as customization, cost-

effectiveness, availability, etc. The service-oriented

FMPaaS architecture is shown in Figure 3.

Referring to Figure 3, at the business and

orchestration layers provide high level service

composition based on new business perspective and

policies (both political and economical factors).

Mostly, the customization and the new business

needs arise from these two key variables. The sub-

systems such as registration control, security control,

integrated services for FMPaaS applications control,

and communications channels help to achieve

customization at a higher level of abstraction

without affecting underlying business logic services.

These are communicated and connected to layers

below using a concept of service bus known as

FMPaaS secured service bus. The layer below the

business layer provides services for various FMPaaS

departments, and external suppliers (E-Business

layer). Software components for large scale financial

cloud computing services require a detailed analysis

of the domain and its boundary in order to define a

collection of components for large scale financial

cloud computing services that are highly reusable

and scalable. A good SaaS design should introduce a

domain analysis process which allows us to define a

set of common definitions, domain classification,

domain boundaries, domain models, design artifacts,

and design guidelines that are based on those

domain criteria.

Finance &

Budget

Integration

Systems

Integration

Manager

Investments Portfolio

Management

Tax &

Accounting

Security &

Portal Mgnt

Financial

Projects

Integration

Stakeholders

Financial

Modelling

FSA Policy

Regulations

Service

Integration

Management

Government

Investments

Government

Projects

Integration

E-Financial Services

(e-invest, e-buy, e-sell, e-balanc e-

sheet, e-financial models, etc)

Investment

Companies

Integration

Integration Layer

Registration,

Authentication &

Security Control

Service

Communication

Channels

Secured FSaaS Service Bus

Integrated Financial

Institutions & Investments

Business Layer Orchestration Layer

FSaaSServicesLayer

Infrastructure Layer

Figure 3: Service-oriented Architecture for FMPaaS.

3 MODELS AND THEORIES

BEHIND FMPaaS

The current work on QoS (Lee et al, 2009;

Mukhopadhyay, 2012; Shehu et al., 2014) have

proposed a number of frameworks and are useful in

its own merits. However, they only have an

emphasis on other non-functional attributes and then

claim non-functional attributes as QoS parameters.

Similar to Albodour et al., (2012), our proposed

model is to provide commercial uses for research

institutes, financials services and general public who

are involved or interested in stock market analysis.

The main difference between our work and

Albodour et al. (2012) is that we use our own

development of work. We have developed a

comprehensive approach based on the development

ESaaSA2015-WorkshoponEmergingSoftwareasaServiceandAnalytics

8

of FMPaaS extended from our current work, which

aims to distinguish QoS attributes clearly; helps to

identify them from requirements to model financial

cloud and then validate services against those

attributes. These include the followings:

1. Based on the reputable models – the chosen

model is the Heston Model (which includes the

Wiener process and the Stochastic Volatility) and

the Visualization APIs to compute the best

pricing and risks for different scenarios.

2. Accuracy to compute and track volatility –

FMPaaS can track the movement of volatility

and help investors make a better judgment for

investment when prices are high and volatility is

low. Our FMPaaS can compute pricing and risk

values to several decimal places and also

calculate its mean, lower and upper range to get

our results as accurate as possible.

3. Performance – all calculations should be

completed within seconds to ensure all services

can be delivered in an acceptable time frame.

3.1 Models Used for FMPaaS

Models behind FMPaaS are essential for the

calculation, processing and presentation of financial

computation in the Cloud. Our previous work

explains all the associated models, including the

choice of the models, their associated formulas, how

they can be used in the development of FMPaaS. In

summary, models include (Chang, 2014):

1. Heston Model

2. Wiener Process

3. CIR (Cox, Ingersoll and Ross) Model

4. Runge–Kutta method (RKM)

The use of all the models for FMPaaS can match

accuracy and optimize the performance. The

summary of their descriptions is as follows.

3.1.1 The Heston Model

The Heston Model has a close relationship with

Black-Scholes model, since it relaxes the constant

volatility assumption in the classical Black-Scholes

model by incorporating an instantaneous short term

variance process (Albrecher et al., 2006). In other

words, the Heston Model can be used in a more

flexible way and is not as theoretical-oriented as the

classical Black-Scholes model does. In addition,

there are both the Wiener process and the CIR

process related to the Heston Model. Heston Model

has been explained in our previous work and it can

still be very useful for undertaking business

intelligence services and prediction of financial

modeling (Chang, 2014).

3.1.2 The Heston Model

The Wiener process is a stochastic process with

independent and stationary increments, which means

the motion of a point whose consecutive

displacements are independent and random with

each other. The Wiener process has Lévy

characterization has continuous martingale with W0

= 0 and quadratic variation [Wt, Wt] = t. This

implies that Wt2−t is a martingale (Cox et al., 1985;

Kloeden and Platen, 1999). The basic Heston model

assumes that S

t

, the price of the asset, is determined

by a stochastic process (Cox et al., 1985; Kloeden

and Platen, 1999). The Heston Model has a CIR

process involved, which is a Markov process with

continuous paths defined by the following stochastic

differential equation (SDE). The variable include

Wiener process (i.e., random walks) with correlation

ρ dt. The parameters in the Heston model for

providing input in the computation in Section 4

represent the following:

μ is the rate of return of the asset.

θ is the long variance, or long run average price

variance; as t tends to infinity, the expected value

of ν

t

tends to θ.

κ is the rate at which ν

t

reverts to θ.

ξ is the volatility of the volatility; as the name

suggests, this determines the variance of ν

t

.

3.1.3 The CIR Model

The CIR process is used to model stochastic

volatility in the Heston model, which aims to resolve

a shortcoming of the Black–Scholes model which

corresponds to the fact that the implied volatility

does tend to vary with respect to strike price and

expiry. By assuming that the volatility of the

underlying price is a stochastic process rather than a

constant, stochastic volatility can make it possible to

model derivatives more accurately (Cox et al., 1985;

Wilmott and Wilmott, 2006).

3.1.4 The Runge-Kutta Method

The Runge–Kutta method (RKM) is a technique for

the approximate numerical solution of a stochastic

differential equation (SDE) (Hull and White, 1987;

Wilmott, 2006). RKM can be used to generalize the

ordinary differential equation to SDE. To elaborate

further, the Ito diffusion X satisfying the following

Ito stochastic differential equation (Hull and White,

QualityofServiceforFinancialModelingandPredictionasaService

9

1987;

Wilmott and Wilmott, 2006). Details of

formulations can be referred to Chang (2014).

3.2 Methods for FMPaaS Calibration

This section describes methods for FMPaaS

calibration, which is used in a way that a known

observation of the dependent variables is used to

predict a corresponding explanatory variable. The

root-mean square error (RMSE) and Moving

Window (MW) are identified as the methods to

perform FMPaaS calibration.

3.2.1 The Root-Mean Square Error

The Root-Mean Square Error (RMSE) is used to

measure of the differences between values predicted

by a model or an estimator and the values actually

observed. RMSE also determines the goodness of fit

of the Heston Model presented by Cox et al. (1985)

and Hull and White (1987).

n

XX

RMSE

n

i

idelmoiobs

1

2

,,

)(

(1)

where n is the number of quoted options, X

obs

is

observed values and X

model

is modelled values at

time/place i. The parameters required for RMSE

include (ν

0,

κ, θ, ξ , ρ) used for calibration and ν

0

is

the instantaneous variance at the starting point.

Referring to formula (2), the rate of return of the

asset can be calculated by multiplying κ and

difference between θ and ν

0.

3.2.2 The Moving Window

The Moving Window (MW) estimate is a suitable

model in the use of VIX options, which are provided

daily to track market values of volatility. MV can be

computed as the mean of variance of the stock price

process over the time series window that moves

forward in time. MW is used to compute the

forecasted movement in the Heston Model.

3.2.3 Average Absolute Percentage Error

(APE) and Aggregated Relative

Percentage Error (ARPE)

The average absolute percentage error (APE) of the

mean price and aggregated relative percentage error

(ARPE) are additional formulas for calibration to

construct the best fit in financial computation, and

thus improves the accuracy and performance of the

calculations (Wilmott, 2006; Kloeden, and Platen,

2012; Guillaume and Schoutens, 2012). A limitation

with APE is that it may cause a problem. A few of

the series with a very high APE might distort a

comparison between the average APE of time series

fitted with one method compared to the average

APE when using another method. To overcome this

limitation, another model, aggregated relative

percentage error (ARPE) is used.

3.3 Services on Offer

This section explains two types of services on offer

for FMPaaS QoS. The architecture adopts the

private cloud at the University of London

Computing Centre (ULCC) data center and

Southampton clusters, where the processing took

place in ULCC. Two types of services are as

follows.

Heston Volatility and Pricing as a Service

(HVPaaS): The request started and completed at

Southampton clusters, including the processing

of the HVPaaS. The objective is to track

volatility and pricing simultaneously since both

can change significantly during the volatile

period. The metrics are provided by the

respective inputs of Heston model except

volatility, which is provided by VIX.

Business Analytics as a Service (BAaaS): After

analyzing the numerical computation of volatility

and pricing, the next step is to compute them as a

Business Analytic. This makes the analysis much

easier and the stakeholders can understand. After

the processing of HVPaaS completed in

Southampton, results are sent to ULCC in

London, where both sites can process BAaaS.

This service is regarded as the case of a complete

FMPaaS QoS.

Application Programming Interfaces (APIs) are used

to illustrate how to use these two services. In

BAaaS, it has two APIs as follows.

1. FinancialData API – this allows the BIaaS

Cloud to obtain financial data from Google

Finance and have all the major stock market

data, particularly the US and UK stock exchange

data.

2. TradingChart API – this allows the financial

data to be presented in the trading chart format

similar to the visualization services offered by

London Stock Exchange and Thomson Reuters.

Additional functions can allow analysts to use

the MW model to compute forecasted

movement. “TradingChart” is the API to

demonstrate both models (Heston and Financial

ESaaSA2015-WorkshoponEmergingSoftwareasaServiceandAnalytics

10

data) can work together to deliver an integrated

service. Results of the experiments will be

presented in Section 4.

3.4 Measurement of FMPaaS QoS

This section describes the measurement of FMPaaS

QoS, which aims to demonstrate the significance of

performance and accuracy. In terms of performance,

the execution time for all APIs should be recorded to

check their completion time is within seconds.

Experiments involved with multi-core and multi-

node processing are included to illustrate the

performance issue. To demonstrate accuracy, an

approach is to compare the predicted result from the

FMPaaS QoS with the actual results generated by

the market such as the New York Stock Exchange or

London Stock Exchange. The end results of these

APIs, particularly the TradingChart API (the last one

of all FMPaaS services), can correspond to the

predicted results of the FMPaaS analysis. The actual

results can be imported directly from Google

Finance. The difference between the actual and

predicted results can correspond to the percentage of

accuracy. The objective is to maintain all differences

within 5% difference to ensure a high quality of

accuracy to be achieved.

4 ACCURACY TESTS AND

RESULTS OF PERFORMING

FMPaaS QoS SIMULATIONS

This section describes the accuracy tests of the

selected stocks listed on the New York Stock

Exchange. Some of these selected stocks are the

continuation of our previous study which analyzed

stocks between mid-May 2012 and early July 2013.

Hence, we will analyze the stocks between early

July 2013 and mid-May 2014. Additionally, some of

the new selected stocks such as Citi and GE are used

to analyze the accuracy of FMPaaS results. Our

previous work has shown the stocks of Facebook,

Apple, IBM and Microsoft between mid-May 2012

and end of June 2013 and these four stocks are used

again for FMPaaS analysis.

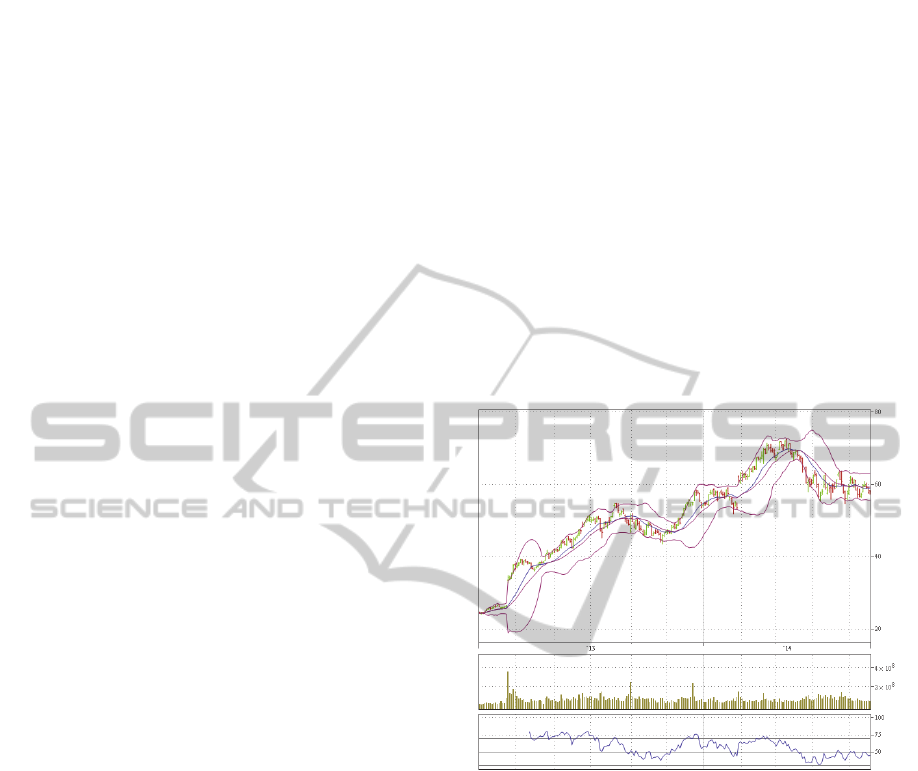

4.1 The Overview of the FMPaaS

This section presents the overview of the FMPaaS,

including the end results of the analysis shown in

Figure 4. The first section of Figure 4 is the main

area of FMPaaS QoS, where the y-axis shows the

price and the x-axis shows the time scale. There are

upper and lower lines, which are predicted indexes

based on the stock values every ten minutes ago. As

explained in our previous work, both upper and

lower limits offer 95% of confidence interval (CI)

for the predictive modeling. The purple line in the

middle is the baseline based on the prediction. The

blue line in the middle is the predicted value line

based on the values given 10 minutes ago and

without using the 95% CI approach. The second

section represents the trading volume. The third

section represents the relative strength index, which

means how active the stock movement is compared

to 50 as the baseline. In this case, we are only

concerned about the first section, the accuracy and

performance of the actual and predicted index

movements.

Figure 4: The full FMPaaS result showing Facebook stock

prices, volume and relative strength between 2 July, 2013

and 16 May 2014

4.2 Performance Test: The

Experiments with APIs

As explained in Section 3.3, development of APIs is

essential for FMPaaS to measure the effectiveness of

QoS. Our previous work also demonstrates the use

of two APIs, “FinancialData” and “TradingChart”,

which display the outputs of FMPaaS based on the

calculation and computation of formulas presented

in Section 3. The outputs measure the following two

items:

The status of the return, which are the prices of

the assets at the times that sales are intended;

Volatility, which represent the variable market

risk associated with the sale or buy activities.

Experiments with these two APIs are important

QualityofServiceforFinancialModelingandPredictionasaService

11

since they will determine the performance of

generating results and accuracy of the results

received. To present the results of experiments, the

hardware specifications are described in Section

4.2.1. Steps and processes involved with two

experiments are then presented in Section 4.2.2 and

4.2.3 respectively.

4.2.1 Infrastructure Used for Experiments

University of London Computer Center (ULCC) was

used for the experiments. ULCC has advanced

Cloud and parallel computing infrastructure and

network attached storage (NAS) service. It has

CPUs totalling 30 GHz, 60 GB of RAM and 12 TB

of disk space for experiments. Fiber optic network

offering the 10 Gb network speed was used for

experiments. The network was connected to the first

private clouds based at Greenwich, which has a total

of 9 GHz CPU and 20 GB RAM. The infrastructure

at ULCC is also connected to the second private

cloud based at the University of Southampton,

which have 6.0 GHz and 16 GB RAM in place.

There is the third private cloud based at the author’s

venue at Southampton, which has the capability is

24.2 GHz CPU and 32 GB RAM. All the three

private clouds located in Greenwich and two places

at Southampton have been connected to ULCC

through the fast fiber optic networking and the

VMWare infrastructure. Before experiments took

place, preliminary work had been tested and all the

outputs could be successfully computed. The

distance between different private clouds did not

make a difference in the execution time during the

preliminary phase of the experiments.

4.2.2 Execution Time for a Single API

Processing

This section presents results of processing each API

in two settings. The first experiment was undertaken

between the two private clouds at Southampton. The

second experiment was undertaken while utilizing

both the Southampton and ULCC clouds. In other

words, results should be sent to ULCC for

processing and returned back to Southampton. The

execution time is the total time of processing

mathematical modeling on the APIs on the server

and response time to the client. The first experiment

was expected to take less time due to the shorter

distance. All experiments were conducted five times

with the mean values taken as the execution time

and the standard deviation was the difference

between the highest and lowest values. The results

of API experiments were presented in Table 1.

Table 1: The execution time for each API or process in the

local environment (p < 0.005).

API or process

Southampton

execution time

(sec) and standard

deviations

ULCC: execution

time (sec) and

standard deviations

FinancialData 2.04 (0.10) 2.12 (0.12)

TradingChart 1.11 (0.03) 1.19 (0.06)

4.2.3 Execution Time for 100,000

Simulations of API Processing

Results in Section 4.2.2 show the average execution

time of one simulation per API processing. To test

the performance, the large-scale simulations are

required (Guillaume and Schoutens, 2012). Our

FMPaaS can offer up to 100,000 simulations per

service to test the scenarios that if there are 100,000

service requests happen every second, whether our

FMPaaS can still provide services smoothly without

degrading the service. The aim of this experiment is

to demonstrate that our FMPaaS can support

100,000 service requests and achieve a good

execution time. Availability was 100% at the time

that those experiments were taken, with the network

and VMs working in excellent conditions. All the

experiments were taken five times with the mean

values taken as the execution time and the standard

deviation was the difference between the highest and

lowest values. Results are presented in Table 2.

100,000 simulations on the API could be completed

in 200,645 seconds, or 55 hours, 44 minutes and 5

seconds.

Table 2: The execution time for 100,000 simulations of

API processing in the ULCC (p < 0.005).

API or process

Southampton

execution time

(sec)

and standard

deviations

ULCC: execution

time (sec) and

standard deviations

FinancialData 200432 (488) 200645 (499)

TradingChart 110135 (417) 110348 (429)

All the standard deviations are below 0.5% of the

average execution time for all six APIs. The aim for

this experiment is to demonstrate that in the event of

having 100,000 requests from users in real-time,

how the FMPaaS can respond to all the processing.

Results also show that FMPaaS can cope with

100,000 requests.

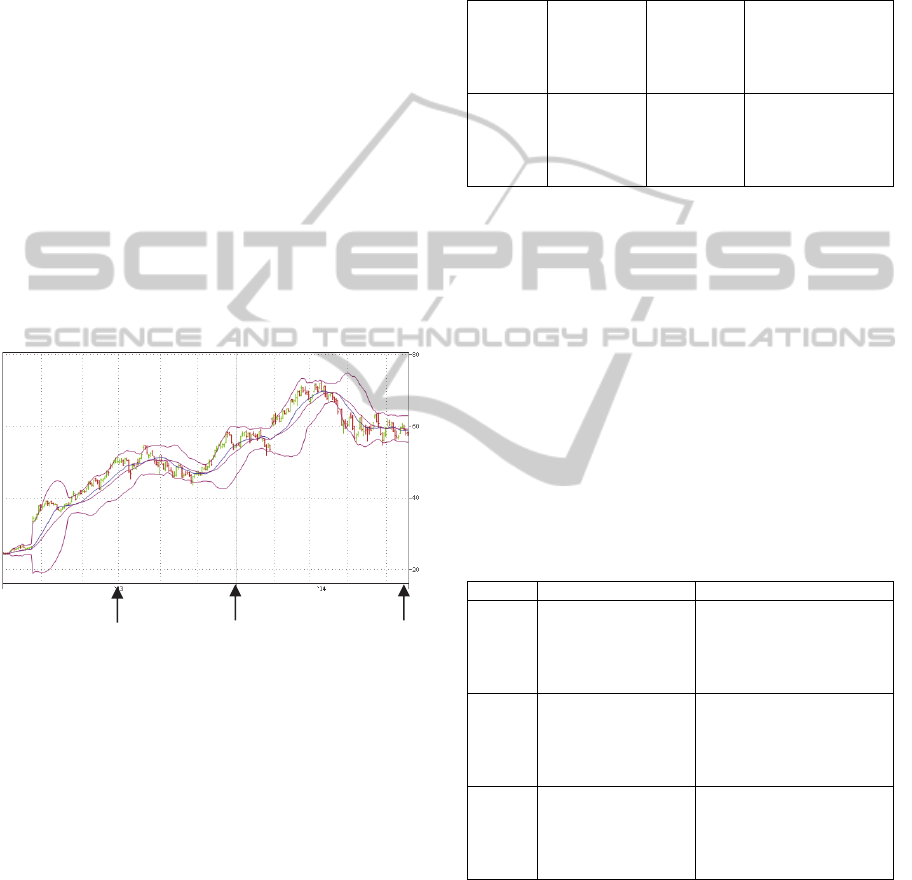

4.3 Accuracy Test

This section describes the accuracy test by using

Facebook as an example to illustrate. The focus is to

ESaaSA2015-WorkshoponEmergingSoftwareasaServiceandAnalytics

12

demonstrate accuracy and performance of using

FMPaaS analysis. The execution time of performing

this FMPaaS test is 3.15 seconds, which correspond

to the sum of processing “FinancialData” and

“Tradingchart” APIs. We identify three major points

where the predicted asset prices would be compared

directly with the actual prices. The reason was that

since price values could change all the times,

identifying the points for comparison was useful.

Additionally, this can ensure prediction to be more

focused on the end of the trading activities since

they could receive more investors’ attention.

Two types of accuracy tests are presented. The

first test is focused on the overall level of accuracy,

whether all the actual values fall into the upper and

lower predicted values within the range of 95%

confidence interval (CI). The second test is based on

three selection points where the trading activities are

at the end of the quarterly business review, or at

three obvious points in the FMPaaS result. In Figure

5, points 1, 2 and 3 are chosen due to the location of

these points to be checked and noticed easily.

Figure 5: The FMPaaS result showing Facebook stock

prices between 2 July, 2013 and 16 May 2014.

Table 3 shows the results of the overall accuracy

test. We count the number of datapoints falling

outside the 95% CI divided by the total number of

datapoints. The results show that about 97% of the

actual datapoints, or actual values of Facebook index

movements, fall within the 95% CI predictive range.

Among those 3% falling outside the predicted range,

there is one spot with a red arrow. This happened

because Facebook was reported to have more profits

than their analysts’ forecasted results. However, the

market had the mixed reactions in the first few days,

which resulted in numerous selling and buying

activities. Those who bought thought that Facebook

would have a better value at some point. Those who

sold thought that it was a time to get their

investment back. This explains why our forecasted

values slightly deviate from the actual values.

Additional calibration can be used to compute the

forecast price values and volatility for the three

points, where the results can then be used to

compare with the actual values for the accuracy.

Table 3: The test of the overall accuracy for Facebook.

Items

Falling

within 95%

CI lines

Percentage

falling

outside

95% CI

lines

Significant spots

falling outside 95%

CI lines

Actual

values

Yes. 97%

of actual

values are

within the

range.

About 3%

Profits were more

than their predicted

results between

2013/2014

forecast.

To determine the accuracy test, asset prices of

the predicted values (input values by Heston model

and VIX and computed by models in Section 3) are

directly compared with the actual values. See Table

4 for results. Asset prices computed by the predicted

value are close to their respective actual values in

points 1, 2 and 3, ranging between 93.72% and

99.63% accuracy. Points 2 and 3 have extremely

high accuracy and point 1 has an acceptable level of

accuracy. The likely reason is that the asset price

prior reaching point 1 was on the way up to one and

a half months and it was less predictable to forecast

the asset price values on the way up in point 1.

Table 4: The test of the three selection point accuracy for

Facebook.

Items Actual value Predicted value

Point 1

Asset price = 50.15;

volatility = 1.20;

implied volatility =

0.45; time = 0.3

Asset price = 47.00;

volatility = 1.20; implied

volatility = 0.45; time =

0.3. 93.72% same as the

actual value

Point 2

Asset price = 53.30;

volatility = 0.5;

implied volatility =

0.45; time = 0.6

Asset price = 53.70;

volatility = 0.5; implied

volatility = 0.45; time =

0.6. 99.26% close to actual

value

Point 3

Asset price = 59.01;

volatility = 0.5;

implied volatility =

0.35; time = 1.15

Asset price = 59.23;

volatility = 0.5; implied

volatility = 0.35; time =

1.15. 99.63% same as the

actual value

4.4 Discussion

The benefits of adopting FMPaaS are as follows.

First, FMPaaS have focused on improving the

accuracy for the financial modeling and prediction

as demonstrated in the test results. This can also

provide new and alternative services for forecasting

and investment analysis. Second, FMPaaS can

point 1

point 2

point 3

QualityofServiceforFinancialModelingandPredictionasaService

13

provide positive impact to the stakeholders and

potential investors to understand the market

performance, volatility, trading volume and likely

predicted movements of their chosen stocks. These

two aspects of contributions will help the

stakeholders, potential investors and research

community to understand the market much better.

The benefits offered by FMPaaS are relevant to the

themes of Emerging Software as a Service and

Analytics to allow the community to know an

improved and better Cloud SaaS services being

validated and illustrated with reported contributions.

The next phase of challenges is to improve the

overall level of accuracy from 95% to 98% and

above; improve the point accuracy as close as to

99.99% and raise three points of evaluation and

testing to six points to ensure there is a greater

coverage of accuracy tests.

5 CONCLUSION AND FUTURE

WORK

A large number of QoS papers focus on the

hardware infrastructure and Service Level

Agreement with the lack of explanation and further

development for SaaS. We explain the motivation

and significance of QoS for FMPaaS, which is our

main service for finance and business intelligence.

Six factors for delivering FMPaaS QoS have been

illustrated, where the emphasis for this paper is on

performance and accuracy. We first start with the

design process and methodology for FMPaaS, and

then explain the theories behind FMPaaS. APIs are

provided in the FMPaaS, where “FinancialData” and

“TradingChart” are the two APIs that have been

developed and then used in the experiments for

performance tests. Two types of experiments were

conducted. First, each API was tested five times top

get the mean execution time to generate outputs. All

execution time was completed within 2.12 seconds.

Second, large scale of 100,000 simulations was

performed to test whether APIs can provide real-

time services. Results show that 100,000 simulations

on the API could be completed in 200,645 seconds,

or 55 hours, 44 minutes and 5 seconds with a low

percentage of standard deviations. Accuracy had

been conducted to test the differences between the

predicted and actual values. Three points of

comparisons for Facebook stock were used for

accuracy test since they represented the end of all

transaction activities. Results show that accuracy

tests had between 93.72% and 99.72% of accuracy

while comparing the actual and predicted values of

the asset prices of Facebook stock. Our future work

will include the improvement of our performance

and accuracy tests. We will also use more companies

to illustrate that our FMPaaS can provide better

services and accuracy while comparing the actual

and predicted values of asset prices.

REFERENCES

Accenture, 2011, Accenture Financial Trends slides,

http://www.slideshare.net/fullscreen/ramblingman/acc

enture-financial-saa-s-external-presentation-final/3,

accessed on April 2014.

Albodour, R., James, A., N. Yaacob, 2012, High level

QoS-driven model for grid applications in a simulated

environment. Future Generation Computer Systems,

28(7), 1133-1144.

Albrecher, H., Mayer, P., Schoutens, W., and Tistaert, J.,

2006, The Little Heston Trap, Technical paper,

September.

Cantor, M. and Royce, W., 2014, Economic Governance

of Software Delivery, IEEE Software, 31(1).

Chang, V., 2014. The business intelligence as a service in

the cloud. Future Generation Computer Systems, 37,

512-534.

Cox, J.C., Ingersoll J.E. & Ross, S.A. 1985, A Theory of

the Term Structure of Interest Rates, Econometrica 53:

385-408.

Durrett, R., 2000, Probability: theory and examples, 4th

edition. Cambridge University Press, ISBN 0-521-

76539-0.

Guillaume F., and Schoutens, W., 2012, Calibration risk:

Illustrating the impact of calibration risk under the

Heston model, Review of Derivatives Research,

15:57–79.

Hull, J., and White, A., 1987, The Pricing of Options on

Assets with Stochastic Volatilities, The Journal of

Finance, 42(2).

Lee, J. Y., Lee, J. W., Cheun D. W. & Kim S. D., 2009,

QoS A Quality Model for Evaluating Software-as-a-

Service in Cloud Computing, the Seventh ACIS

International Conference on Software Engineering

Research, Management and Applications.

Kloeden, P.E, Platen, E., 1999, Numerical Solution of

Stochastic Differential Equations. Berlin: Springer.

ISBN 3-540-54062-8.

Mukhopadhyay, D., Chathly, F. J., Jadhav, N. N., 2012,

QoS Based Framework for Effective Web Services in

Cloud Computing, Journal of Software Engineering

and Applications, 5, 952-960.

NetSuite, 2014, white paper and software, product

http://www.netsuite.co.uk/portal/uk/seo-landing-

page/accounting-2/main.shtml?gclid=CLK9k5q-

37sCFTHLtAodikoAzw, accessed on April.

Open Group, OSIMM, 2009, from https://

www2.opengroup.org/ogsys/jsp/publications/Publicati

onDetails.jsp?publicationid=12450, Retrieved Oct

2013.

ESaaSA2015-WorkshoponEmergingSoftwareasaServiceandAnalytics

14

Ramachandran, M., Chang, V., 2014 Cloud Security

proposed and demonstrated by Cloud Computing

Adoption Framework, the first international workshop

on Emerging Software as a Service and Analytics,

Barcelona, Spain, 03 - 05 April.

Schulze, B., Coulson, G., Nandkumar, R., Henderson, R.,

2006, Special Issue: Middleware for Grid Computing:

A ‘possible future’, Concurrency and computation:

practice and experience, 10.1002/cpe.1132, Wiley.

Shehu, U., Epiphaniou, G., Safdar, G. A., 2014, A Survey

of QoS-aware Web Service Composition Techniques,

International Journal of Computer Applications (0975

– 8887), 89(2), March.

Silvestri, F. et al., 2006, Toward a search architecture for

software components, Journal of Concurrency and

Computation: Practice and Experience: 18:1317-

1331.

Wilmott, P., 2006, Paul Wilmott on quantitative finance,

Wiley (2nd ed.), ISBN 0470018704.

QualityofServiceforFinancialModelingandPredictionasaService

15