Price based Unit Commitment with Wind Generation and Market

Clearing Price Variations

Vaidyanath Ramachandran

1

, Junbiao Han

2

, Sarika Khushalani Solanki

3

and Jignesh Solanki

3

1

Alstom Grid, Bellevue, WA, U.S.A.

2

ABB Inc., Raleigh, NC, U.S.A.

3

Department of Electrical Engineering, West Virginia University, Morgantown, WV 26505, U.S.A.

Keywords: Market Clearing Price, Auction, Wind Integration and Intermittency, Price based Unit Commitment, Dynamic

Programming.

Abstract: Bidding plays an important role for Gencos (Generation Companies) participating in competitive electricity

markets with the objective of maximizing profit. The characteristics of generators and price uncertainty need

to be considered while formulating bidding strategies as they have a direct impact on expected profit. The

rapid development of wind technology leads to an increasing share of wind power in the market and should

be considered for calculating the Market Clearing Price (MCP). In this paper, the effects of wind intermittency

on MCP variations of the wind farm generators are considered for the price based unit commitment strategy

of the Genco. Simulations are performed on an IEEE 30-bus test system with wind farm that indicate

significant corrections in day ahead forecasted PBUC (Price Based Unit Commitment) schedule and real time

dispatch schedule of the Genco for optimal bidding.

1 INTRODUCTION

The electric industry throughout the world is

undergoing a significant transformation from a

vertically integrated framework to a distributed,

deregulated and competitive structure consisting of

independent generation, transmission and distribution

entities. In doing so, the net cost of electricity has

been reduced due to increased competition between

the market entities. The reliable and efficient

operation of this new grid structure is ensured by an

independent body known as the ISO (Independent

System Operator). The ISO establishes rules for

energy and ancillary services markets, manages the

system in a fair and non-discriminatory manner and

shields the markets from risks and accumulation of

market power with a single entity. In order to achieve

these goals, the ISO supports different market models

namely the PoolCo, Bilateral contracts and Hybrid

models. The PoolCo market model is defined as a

centralized marketplace that clears the market for

power buyers and sellers. Electric power

sellers/buyers submit bids to the pool and each bid

contains information on how much power, at which

prices, in which area, at what time, a market

participant is willing to buy or sell. The PoolCo

market model is achieved by the Power Exchange

(PX) that is integral to the ISO’s operation. The PX

functions as an independent, non-government and

non-profit entity that conducts the auction for

electricity trades in the market. The PX calculates the

Market-Clearing Price (MCP) based on the highest

price bid in the market.

In such a competitive market, Genco (Generation

Company) sells electricity to the PX from which large

customers such as Discos (Distribution Company)

and aggregators may purchase electricity to meet their

needs. Along with real power, Gencos also trade

reactive power and operating reserves. For successful

bidding in the market, Gencos need innovative

strategies to determine their optimal bid to maximize

revenue and profit targets. Generation schedules

covering a range of 24 hours to 1 week ahead

achieved through unit commitment, help in

formulating optimal bids for a competitive Genco.

In the deregulated power market, a particular type

of unit commitment is used by the Genco to optimize

generation resources in order to maximize its profit,

called the Price Based Unit Commitment (PBUC). In

PBUC, satisfying load is no longer an obligation and

the objective is of maximizing the profit from trading

energy and Ancillary Services (AS) in the market.

The distinct feature of PBUC is that the market price

217

Ramachandran V., Han J., Khushalani Solanki S. and Solanki J..

Price based Unit Commitment with Wind Generation and Market Clearing Price Variations.

DOI: 10.5220/0005442002170225

In Proceedings of the 4th International Conference on Smart Cities and Green ICT Systems (SMARTGREENS-2015), pages 217-225

ISBN: 978-989-758-105-2

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

reflects on all market transactions indicating market

price as the only signal that enforces a unit’s ON/OFF

status and generation dispatch. In day-ahead market

Genco runs PBUC based on forecasted energy and

ancillary services price, and price uncertainty needs

to be considered as it has a direct impact on the

expected profit. Several approaches have been used

to solve the PBUC problem viz. Linear/Non-

Linear/Dynamic Programming and other meta-

heuristic techniques (Senjyu, 2003- Mantawy, 1997).

The PBUC problem has been approached using

Lagrangian Relaxation (LR) and Dynamic

Programming in (Pokharel, 2005). A tradeoff

between LR and Mixed Integer Programming to solve

the PBUC is presented in (Li, 2005). A hybrid

technique involving LR and evolutionary

programming has been used in (Attaviriyanupap,

2003). Intelligent techniques like multi-agent and

particle swarm optimization for solving PBUC are

presented in (Xiaohui, 2005-Yu, 2004).

Apart from innovative bidding strategies, Gencos

have adopted distributed generation resources such as

wind farms to their portfolio; to supplement

coal/natural gas fired generation and meet green

generation mandates thereby maximizing profits.

Wind farms present an innovative and clean

technology, but their output is intermittent. Wind

farms are capital-intensive but have lower operating

costs than fossil-fuel plants. Although wind power

offers many possible benefits, it has many potential

challenges to participate competitively in the current

restructured electric industry (Fabbri, 2005-Milligan,

2005). These challenges can be broadly classified into

four categories.

• Network: The network constraints include

geographical locations of wind farms and the

capacity of the line/cable infrastructure to

extract power at medium and high voltages from

remote wind farms.

• Availability: For a Genco with wind generation,

wind power availability forecast is very

essential as it has direct impact on the system

performance and stability. A combination of

simulation statistical and weather based

techniques to predict the quantity of intermittent

wind power are presented in (Sideratos, 2007)

and (Kariniotakis, 2006). The impacts of wind

power variability on system operating costs are

not negligible (DeMeo, 2005).

• Operation: Large penetration of wind farms

introduce significant operational difficulties like

reverse power flow, voltage fluctuations and

harmonics depending on size and voltage.

• Pricing: The uncertainty in wind availability

has a direct impact on its pricing which depends

on the nature of wind intermittency. Under this

scenario, the MCP varies and some approaches

to calculate MCP are presented in (Zeineldin,

2009- Singh, 2008). There are different

approaches to handle the wind uncertainties in

competitive electricity market: probabilistic,

stochastic and fuzzy systems. Fuzzy sets have

been successfully applied to power system

operation and planning to simulate uncertainties

(Martin, 2015, Sharma, 2014 and Ting, 2013).

Earlier works have focused on the formulation of

the PBUC problem and different optimization

techniques to solve it. Several other works have

addressed the challenges faced by Gencos owning

intermittent energy resources. However, there is not

much contribution made towards investigating the

effects of wind intermittency on the PBUC schedules

of a Genco.

A novel approach to PBUC has been presented in

this paper by calculating MCP under varying wind

conditions. The relationship between wind

intermittency and MCP is used to determine a revised

PBUC strategy for a Genco owning wind farms, so as

to maximize profits. The paper is organized as

follows: Section II proposes the MCP formulation

with wind integration. The existing methods for

calculating MCP (pay-as-bid market clearing rules,

single price market clearing rules and single auction

market) and the proposed method (optimal power

flow based) for MCP calculations with wind

integration are described. Section III presents the

PBUC problem formulation and dynamic

programming for obtaining the optimal unit

commitment schedule. LR method with dynamic

programming is used to solve the PBUC problem in

this paper. Section IV provides the test system

information and results. The IEEE 30 bus system

comprising of two Gencos consisting of six

generating units G1-G6 and two additional windfarm

units is used as the test system. A 24-hour varying

output from the two windfarms simulates the

intermittency and volatility of wind power. PBUC

strategies are developed for the six generating units

under different conditions such as a) No wind power

b) With rated wind power c) Low wind volatility d)

High wind volatility and e) Brief wind intermittency.

The resulting effects of wind intermittency on MCP

and the PBUC strategies of Gencos are discussed.

Section V concludes the discussion.

SMARTGREENS2015-4thInternationalConferenceonSmartCitiesandGreenICTSystems

218

NOMENCLATURE

p Price of electricity in $/kWh.

Slope of the linear supply curve.

Slope of the linear demand curve.

N Number of generating units.

D Total demand of the system.

j Index for unit.

Price Axis Intercept of the Demand curve.

C Total Generation Cost

F Total profit of the Genco

Power output of generator i.

(

)

Cost function of generator i.

Incremental cost at bus i.

Uniform electricity market price.

P (j, i) Generation of unit j at time i.

R (j, i) Spinning reserve of unit j at time i.

N (j, i) Non-spinning reserve of unit j at time i.

RP (j, i) Energy price at the instant i.

RR (j, i) Spin price at the instant i.

RN (j, i) Non-Spin price at the instant i.

(

)

Minimum ON time of unit j.

(

)

Minimum OFF time of unit j.

(

,)

Time duration for which unit j has been ON

at time i.

(

,)

Time duration for which unit j has been OFF

at time i.

UR (j) Ramp up limit of unit j.

DR (j) Ramp down limit of unit j.

L (t, ON) Lagrangian function at time i for ON status.

∗

(t,

ON)

Optimal cumulative Lagrangian at hour i for

the ON status.

∗

(t,

OFF)

Optimal cumulative Lagrangian at hour i for

the OFF status.

,

Start-up cost for unit j at time i.

,

Shutdown cost for unit j at time i.

2 MARKET CLEARING PRICE

FORMULATION

The most common method for MCP formulation for

PBUC is based on electricity auction. Most of the

earlier works treat wind farms as conventional

generators that are paid according to the hourly

market price. However, this method is not valid for a

Genco with wind resources to bid into the market as

the wind intermittency and price variation are not

taken into effect while formulating MCP. Existing

and proposed methods for MCP formulation are

described in detail and the corresponding changes in

PBUC schedules of the GENCO are analyzed.

2.1 Existing MCP Formulation based

on Electricity Auction

The important aspects of pricing for electricity

auction, which are generally used in real-time

markets, are listed below:

• Discriminatory/ pay-as-bid market clearing rules:

Under this rule, every participant pays or is paid

at the price of winning bid. In this system, the

bidding is made by predicting the cut-off price and

not on marginal cost. It may happen such that

some of the Gencos having lower energy cost may

bid above the cut-off price and some high cost

firms would win the bid and the customers have

to pay more to obtain the high cost energy. The

cost of generation would, therefore, be above the

market clearing cost. Pay-as-bid system can

increase the total cost of generating electricity and

will therefore be less efficient.

• Uniform/ single price market clearing rules: This

rule is more efficient and commonly used. After

receiving bids, ISO aggregates the supply bids

into a supply curve (S) and aggregates the demand

bids into a demand curve (D) and clears the

market by determining the clearing price. The

sellers and buyers receive the same clearing price,

even if they bid less than this clearing price. The

theory behind such a bidding system is that all

bids to sell electricity would be priced at the

marginal cost of that electricity. In an electricity

auction, market clearing price is formulated as the

lowest price obtained at the point of intersection

of aggregated supply and demand curves. At this

price, both the winning generation and demand

bids are satisfied and would provide enough

electricity to satisfy all purchase bids.

• For single auction market, demand bid is not

available, the load is assumed to be fixed and only

Gencos are participating in the bidding. This

auction formulation starts with the energy

generated by bidder j, represented as

E

(

p

)

=

p

m

(1)

The total combined generation can be calculated by,

(

)

=

()=

1

(2)

The MCP,

∗

can be calculated from,

E

(

∗

)

=

(3)

∗

=

∑

1

(4)

If the capacity limits are considered, then the

combined supply curve can be represented as,

()=

1

,

≤≤

0, ≤

,

≤

(5)

PricebasedUnitCommitmentwithWindGenerationandMarketClearingPriceVariations

219

2.2. Developed MCP Formulation with

Wind based on Optimal Power

Flow

With proper pricing mechanism for MCP

determination, the efficiency of the market can be

improved. In this paper an MCP formulation is

developed to handle the uncertainty in wind

availability. The basic concept used for this

formulation is that the MCP with and without the

wind availability is different. A time series based

Optimal Power Flow (OPF) which considers

fluctuating wind farm output as and when available is

developed. The solution of the optimal power flow

determines the new MCP for each instant, which

reflects the wind availability for the corresponding

instant.

The objective of the standard OPF for an ISO is to

maximize social welfare. For a 24-hour period, load

and wind generation are varying in each time interval,

and the optimization problem can be formulated as

=

(

)

+

(

)

(6)

(

)

=

+

+

(7)

Solving this OPF yields the highest value of the bus

incremental cost which is now set as the new MCP.

Thus,

≥

∀∈1,2…,

(8)

The new MCP, defined by, incorporates the wind

generators in the market clearing process. This takes

into effect the nature of wind intermittency and its

impacts.

3 PRICE BASED UNIT

COMMITMENT

3.1 Problem Formulation

The objective of PBUC is to maximize the profit (i.e.

revenue minus cost) subject to all prevailing

constraints. For unit j at time i, the objective function

is given as:

{(−

∗

−

∗

−

∗

)+(

+

+

)}

∗

+{

−

∗

+(

)}∗(1−

)

(9)

The first part of the equation represents the profit

when the unit is ON and the second part represents

the profit when the unit is OFF. Here, profit

represents revenue from the non-spinning reserve

sales minus production costs and the cost of any

energy purchases. Similarly, profit from bilateral

contracts would also be included. The objective

function for the total time period is

=

(

,

)

(10)

The system constraints can be expressed by (11)-

(17).

Unit ON

−min

,

−

−

≤0

(11)

≤

≤

(12)

≤

≤

(13)

≤

+

+

≤

(14)

Unit OFF

=0

(15)

=0

(16)

≤

≤

(17)

These constraints represent the special

requirements of the Genco like the minimum and

maximum generation, ramp rates, quick start and

minimum ON–OFF time constraints. The minimum

ON time and OFF time constraints are to be

implemented in the dynamic programming routine.

They can be represented as

(

,

)

−

(

)

∗

−

≥0 (18)

(

,

)

−

(

,

)

∗

−

≥0 (19)

The minimum ON–OFF time constraints result in

an expanded state transition diagram for the dynamic

programming problem. The ramp up and ramp down

constraints of the system can be represented as

−

≤() (20)

−

≤() (21)

The forward stage of dynamic programming is

used to find the optimal cumulative value at every

hour for each state described by (22) and (23) while

the backward search is used to find out the optimal

commitment trajectory.

∗

(

,

)

={

∗

(

−1,

)

,

∗

(

−1,

)

+(,)}+(,)

(22)

∗

(,) = {

∗

(−1,)+(,),

∗

(

−1,)}+(,)

(23)

SMARTGREENS2015-4thInternationalConferenceonSmartCitiesandGreenICTSystems

220

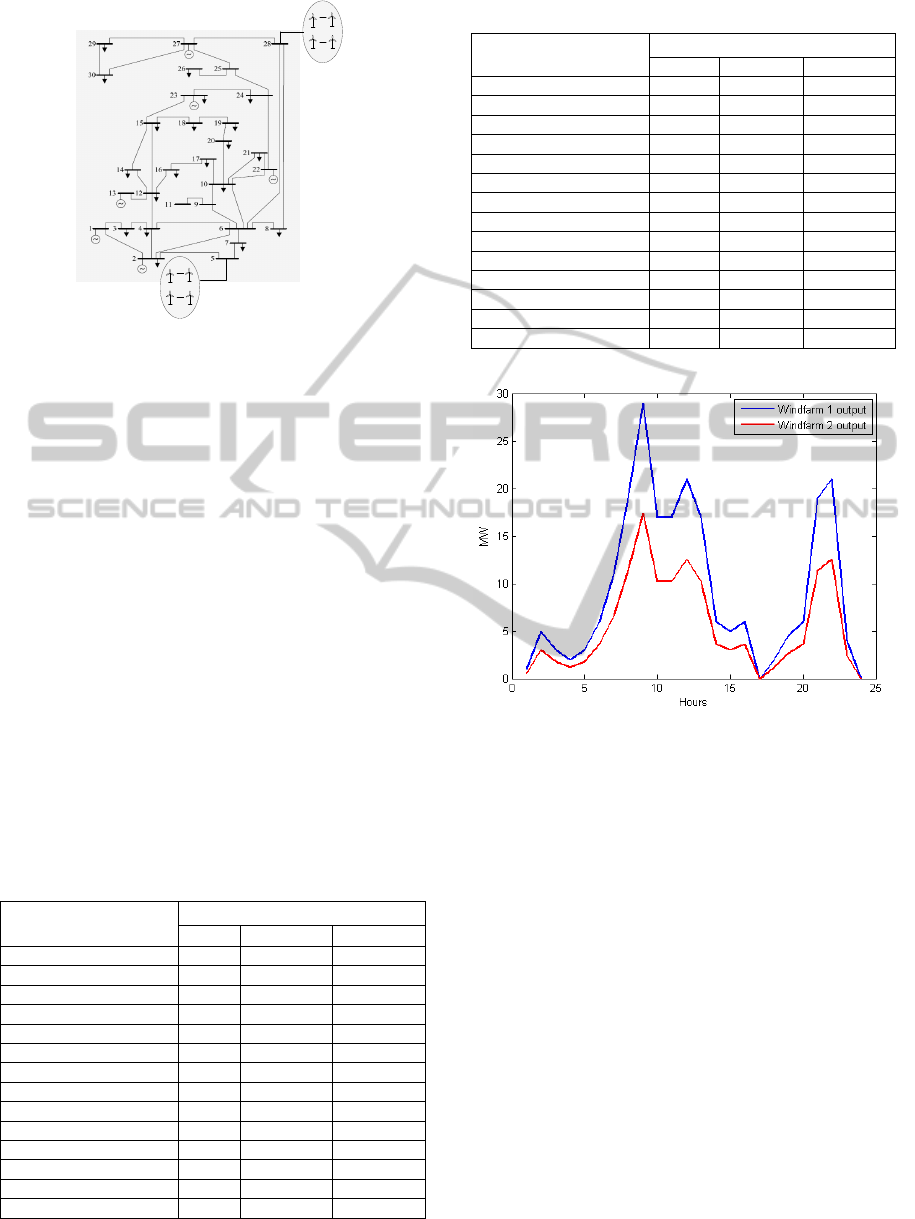

Figure 1: IEEE 30 bus Test System with Wind Farm.

4 SIMULATION AND RESULTS

The IEEE 30 bus test system is used to simulate

power market operation and the system configuration

is shown in Figure 1. The system consists of two

Gencos- Genco I and Genco II respectively. Genco I

consists of three non-wind generators –units G1, G2

and G3 connected at buses 1, 2 and 13 respectively.

Genco II also consists of three non-wind generators –

units G4, G5 and G6 connected at buses 22, 23 and

27 respectively. Genco I consists of a wind farm unit

G7 with capacity of 59.4 MW at bus 5 and Genco II

consists of a wind farm with capacity of 35.6 MW at

bus 28. Generator data is listed in Tables I (A) and I

(B). The intermittency and volatility of the wind

power and time varying loads for a 24 hour period

were considered in this study. Figure 2 shows

forecasted wind farm output for 24 hours for both the

wind farms considered in this paper.

Table 1 (A): Genco I - Generator Data and Constraints.

Parameter Genco I

G1 G2 G3

Unit Type Coal Coal Oil

Pmin (MW) 15 15 10

Pmax(MW) 80 80 50

Ramp Rate(MW/h) 40 40 30

Quick Start (MW) 10 10 1

Minimum ON time (h) 2 2 2

Minimum OFF time 2 2 2

Initial State ON ON ON

Initial Hour (h) 4 4 4

Fuel Price ($/MBtu) 2 2 2

Startup (MBtu) 60 60 30

Cost Coeff. a ($/MWh

2

) 0 0 0

Cost Coeff. b ($/MWh) 25 24.75 26

Cost Coeff. c ($/h) 0.02 0.0175 0.0250

Table 1 (B): Genco II - Generator Data and Constraints.

Parameter Genco II

G4 G5 G6

Unit Type Coal Coal Oil

Pmin (MW) 10 5 10

Pmax(MW) 50 30 55

Ramp Rate(MW/h) 30 15 30

Quick Start (MW) 5 5 1

Minimum ON time (h) 2 2 2

Minimum OFF time 1 1 1

Initial State OFF OFF OFF

Initial Hour (h) 2 2 2

Fuel Price ($/MBtu) 2 2 2

Startup (MBtu) 10 10 10

Cost Coeff. a ($/MWh

2

) 0 0 0

Cost Coeff. b ($/MWh) 24 26 25.25

Cost Coeff. c ($/h) 0.0625 0.025 0.0083

Figure 2: Forecasted Wind farm output.

4.1 MCP Determination using OPF

A 24 hour optimal power flow solution is run for the

system with the forecasted wind farm output. In the

event of wind power availability, dispatching

generators should reduce their outputs to

accommodate the wind power in the energy market.

Figure 3 shows that the presence of wind generation

decreases the incremental cost of the online

generators and thereby decreases the MCP. Wind

energy, thus has a positive impact on customer

benefit. With the new MCP, the PBUC program

determines the optimal commitment schedule of the

generators. To integrate the effects of uncertainty in

wind availability, three wind scenarios were

considered. Scenario I assumes low volatility in wind

power for the forecasted wind output shown in Figure

3.

PricebasedUnitCommitmentwithWindGenerationandMarketClearingPriceVariations

221

Figure 3: Variation of Market Clearing Price with Wind

Integration.

Table 2: 24 HOUR Wind Farm Data.

Wind

Power

Wind

Farm1

MW

Wind

Power

S-1

MW

Wind

Power

S-2

MW

Wind

Power

S-3

MW

Wind

Power

Wind

Farm2

MW

Wind

Power

S-1

MW

Wind

Power

S-2

MW

Wind

Power

S-3

MW

1 0.886 0.85 1 0.6 0.531 0.51 0.6

5 4.55 4.25 5 3 2.73 2.55 3

3 2.67 2.55 3 1.8 1.602 1.53 1.8

2 2 1.7 2 1.2 1.2 1.02 1.2

3 3.07 2.55 3 1.8 1.842 1.53 1.8

6 6.082 5.1 6 3.6 3.649 3.06 3.6

11 10.12 9.35 11 6.6 6.077 5.61 6.6

19 18.97 16.15 19 11.4 11.38 9.69 11.4

29 27.50 24.65 29 17.4 16.50 14.79 17.4

17 17.60 14.45 17 10.2 10.56 8.67 10.2

17 16.23 14.45 17 10.2 9.738 8.67 10.2

21 20.33 17.85 21 12.6 12.20 10.71 12.6

17 17.21 14.45 17 10.2 10.33 8.67 10.2

6 5.565 5.1 6 3.6 3.339 3.06 3.6

5 5.385 4.25 5 3 3.231 2.55 3

6 5.97 5.1 0 3.6 3.582 3.06 0

0 0 0 0 0 0 0 0

2 0 0 0 1.2 0 0 0

4.5 4.2 3.825 0 2.7 2.52 2.295 0

6 6.72 5.1 6 3.6 4.032 3.06 3.6

19 22.16 16.15 19 11.4 13.29 9.69 11.4

21 21.97 17.85 21 12.6 13.18 10.71 12.6

4 3.91 3.4 4 2.4 2.34 2.04 2.4

0 0 0 0 0 0 0 0

Scenario II represents high volatility which follows a

normal distribution with a standard deviation of 15%.

In Scenario III, the intermittency of wind power is

considered during hours 17-20, when the wind power

drops to zero. The simulated scenarios for both the

wind farms are in Table 2.

4.2 Dispatch with Forecasted Wind

Power

With forecasted wind power in Table 2, PBUC

determines the dispatch of the non-wind units as

detailed in Table 3. For Genco I, PBUC determines

units G1, G2 and G3 to be “ON” for hours 1-24 for

all scenarios to maximize profit with the initial state

of all units being “ON”.

Table 3: PBUC Plans For Generators.

Scenario Hours (0-24)

Forecasted

Schedule

without Wind

Genco I Unit G1 1111111111111111111111111

Unit G2 1111111111111111111111111

Unit G3 1111111111111111111111111

Genco II Unit G4 0111111111111111111111111

Unit G5 0111111111111111111111111

Unit G6 0111111111111111111111111

Forecasted

Schedule with

Wind

Genco I Unit G1 1111111111111111111111111

Unit G2 1111111111111111111111111

Unit G3 1111111111111111111111111

Genco II Unit G4 0111111111111111111111111

Unit G5 0111111111111111111111111

Unit G6 0111111111111111111111111

Scenario 1

Low Wind

Volatility

Genco I Unit G1 1111111111111111111111111

Unit G2 1111111111111111111111111

Unit G3 1111111111111111111111111

Genco II Unit G4 0111111111111111111111111

Unit G5 0111111000000000000000000

Unit G6 0111111111111111111111111

Scenario 2 High

Wind Volatility

Genco I Unit G1 1111111111111111111111111

Unit G2 1111111111111111111111111

Unit G3 1111111111111111111111111

Genco II Unit G4 0111111111111111111111111

Unit G5 0111111000000000000000000

Unit G6 0111111111111111111111111

Scenario 3 Brief

Wind

Intermittency

Genco I Unit G1 1111111111111111111111111

Unit G2 1111111111111111111111111

Unit G3 1111111111111111111111111

Genco II Unit G4 0111111111111111111111111

Unit G5 0111111111111111111111111

Unit G6 0111111111111111111111111

Figure 4(a): Bidding Strategy of the Genco I with and

without wind.

SMARTGREENS2015-4thInternationalConferenceonSmartCitiesandGreenICTSystems

222

Figure 4(b): Bidding Strategy of the Genco II with and

without wind.

For Genco II, the initial state of all units is “OFF”

and PBUC determines the units G4 and G6 to be

“ON” for hours 1-24 for all scenarios to maximize

profit. Unit G5 turns off from hours 7-24 for scenarios

I and II. With the availability of wind power, both

Genco I and Genco II bid more in the market as

shown in Figures 4(a) and 4(b). The ancillary services

bid for both the cases remains same because all the

units of Genco I and Genco II remain “ON” for hours

1-24, therefore not capable of providing non-spinning

reserve. These energy bids with wind are assumed to

be contracted by the Genco to the power pool in the

day ahead market.

Figure 5(a): Bidding Strategy for Genco I in Scenario I.

Figure 5(b): Bidding Strategy for Genco II in Scenario I.

4.3 Scenario I:

Dispatch with Low Wind Volatility

Scenario I, considers low volatility in forecasted wind

power. This challenges the Gencos as changes in the

expected wind power may require a re-dispatch from

the non-wind generators. The PBUC solution for this

scenario in Table 3 shows the commitments of units

G1, G2 and G3, G4 and G6 are same as the forecast

while unit G5 turns off for hours 7-24 to maximize

profits.

Figures 5(a) and 5(b) show the committed

dispatch and the actual dispatch for Genco I and

Genco II in Scenario I. It is noticed that, due to low

wind volatility, the Genco I is able to satisfy its

contract for hours 1-24. For Genco II, there is

decrease in the dispatch from committed value for

hours 7-24 as unit G5 turns “OFF”. The other units,

namely G4 and G6 do not have enough ramping and

quick start capabilities to increase the dispatch to

committed value. The units with faster ramp rate G4

and G6 have a quick start of only 5 MW and 1 MW

respectively. For hours 1-24, the ancillary services

contract is satisfied by the Genco I. For Genco II there

is an increase in the ancillary services dispatch from

hours 7-24 as the “OFF” unit G5 provides non-

spinning reserve.

Figure 6(a): Bidding Strategy for Genco I in Scenario II.

Figure 6(b): Bidding Strategy for Genco II in Scenario II.

PricebasedUnitCommitmentwithWindGenerationandMarketClearingPriceVariations

223

4.4 Scenario II:

Dispatch with High Wind Volatility

Scenario II, considers high volatility in forecasted

wind power. The PBUC solution for this scenario in

Table 3 shows the commitments of units G1, G2 and

G3, G4 and G6 are same as the forecast while the

PBUC schedule turns the unit G5 “OFF” for hours 7-

24. Figures 6(a) and 6(b) show the committed

dispatch and the actual dispatch for Genco I and

Genco II in Scenario II. From hours 1-6 Genco I is

still able to maintain the committed value because the

higher capacity units G1 and G2 are able to ramp up

to meet the volatility. It is noticed that, due to the high

volatility of the wind, Genco I violates its contract for

hours 6-23.

Similarly, highly volatile wind generation results

in Genco II violating its contract with the power pool

for hours 7-24 as shown in Figure 6(b) due to

insufficient ramping and quick start capabilities of

units G4 and G6, with the unit G5 turned “OFF”. For

hours 1-24, the ancillary services contract is satisfied

by Genco I. For Genco II there is an increase in the

ancillary services dispatch from hours 7-24 as the

“OFF” unit G5 provides non-spinning reserve.

4.5 Scenario III:

Dispatch with Wind Intermittency

Scenario III, considers a brief intermittency in

forecasted wind power. The PBUC solution for this

scenario in Table 3 determines the commitments of

all the units to be same as the forecasted commitment

to maximize profit.

Figures 7(a) and 7(b) show that the Genco I

satisfies the contract during wind intermittency in

hours 17-20 by ramping up units G1 and G2. It is

evident that in this scenario, the ramp and quick start

constraints of G1 and G2 are such that brief wind

intermittency can be met by Genco I and satisfy the

contracted value. For Genco II, it is evident that the

ramp up and quick start capabilities of units G4, G5

and G6 are insufficient to meet the wind intermittency

in hours 17-20 thereby resulting in the violation of

contract. Ancillary services like spinning and non-

spinning reserve can be met by both Gencos, without

violation of this contract due to brief periods of wind

intermittency. From the three scenarios, it is evident

that, Genco I with units having higher ramping and

quick start capabilities is able to meet the contract to

the power pool during periods of low volatility and

brief wind intermittency. Genco II is observed to

violate its contract during these scenarios. For highly

volatile wind conditions, both the Gencos fail to

Figure 7(a): Bidding Strategy for Genco I in Scenario III.

Figure 7(b): Bidding Strategy for Genco II in Scenario III.

satisfy the contract in the hours with high wind

volatility.

The results obtained in this paper compare well with

existing literature and provides avenues for future

research in the area of PBUC strategies for Gencos

owning wind farms. In this paper, it has been shown

that the presence of wind generation has a positive

impact on the electricity prices and leads to reduction

of MCP and incremental cost of generators. This

confirms with the detailed MCP studies conducted in

in (Sinha, 2008), which state that the accurate wind

power prediction and the resulting MCP calculations

can result in greater savings for customers and

additional revenue for Gencos. It is also demonstrated

in this paper that under conditions of low wind

volatility and brief wind intermittency, the Gencos

will be able to meet their contracts to the power pool

if they have sufficient quick start generating units.

Under highly volatile wind conditions, the Gencos

may fail to meet their power contracts. Wind power

can also play a vital role in satisfying the ancillary

services contracts to the power market. These results

reinforces the studies conducted in (Sinha, 2008) and

(Ting, 2013), which prove that uncertainty in wind

production is the major factor for Gencos to compete

with conventional power producers in the market. In

case of non-availability of wind power, Gencos must

be ready to supply complete load to be sustainable

and recover costs.

SMARTGREENS2015-4thInternationalConferenceonSmartCitiesandGreenICTSystems

224

5 CONCLUSIONS

A novel approach to PBUC by considering the effects

of wind intermittency and market price variations is

presented in this paper. The results indicate that the

profit of the Genco is largely dependent on the wind

intermittency and volatility. The results for the 30 bus

system show that the physical limitations of the units

such as ramping and quick start are crucial for

accommodating the volatility of the wind power. In a

wind based power system a tradeoff between security

and economy must be achieved such that the security

of the system is maintained while the operational cost

is minimized. Another option for accommodating

wind power volatility is to allocate additional hourly

reserves or utilize battery storage. The problem with

this option is that the security of the power system

may not be guaranteed since the system may not have

enough ramping capabilities in real time and the

battery may be bound by physical constraints.

ACKNOWLEDGEMENTS

The authors would like to acknowledge partial

funding support from NSF#1351201 CAREER grant,

NSF# 1232168 for this research work. The authors

also would like to thank NETL RUA Grid

Technologies Collaborative team.

REFERENCES

Senjyu, T., Yamashiro, H., et. al., 2003. Fast solution

technique for large-scale unit commitment problem

using genetic algorithm. Proceedings of IEE

Generation, Transmission and Distribution , Vol. 150,

Issue 6, pp. 753-760.

Mantawy, A.H., Abdel-Magid, Y.L. and Selim, S.Z., 1997.

A new genetic algorithm approach for unit

commitment. Proceedings of the International

Conference on Genetic Algorithms in Engineering

Systems, pp.215-220.

Pokharel, B.K., Shrestha, G.B., et. al., S. E., 2005. Price

based unit commitment for Gencos in deregulated

markets. Proceeding of the IEEE Power Engineering

Society GM, pp. 2159-2164.

Li, T., and Shahidehpour, M., 2005. Price based unit

commitment: A case of Lagrangian relaxation versus

mixed integer programming. IEEE Tran. on Power

Systems, Vol. 20, No. 4.

Attaviriyanupap, P., Kita, H., Tanaka, E., and Hasegawa, J.,

2003. A hybrid LR-EP for solving new profit based UC

problem under competitive environment. IEEE

Transactions on Power Systems, Vol. 18, No. 1, pp:

229-237.

Xiaohui, Y., Yanbin, Y., Cheng, W. and Xiaopan, Z., 2005.

An improved PSO approach for profit based unit

commitment in electricity market. IEEE/PES

Transmission and Distribution conference &

Exhibition: Asia and Pacific, Dalian, China.

Yu, J., Zhou, J., Wu, W. and Yang, J., 2004. Solution of the

profit-based unit commitment problem by using the

multi agent system. Proceedings of the 5

th

World

Congress on Intelligent Control and Automation,

Hangzhou, China.

Fabbri, A., GomezSanRoman, T., et. al., 2005. Assessment

of the Cost Associated With Wind Generation

Prediction Errors in a Liberalized Electricity Market.

IEEE Transactions on Power Systems, Vol. 20, No. 3,

pp: 1440- 1446.

Milligan, M., Porter, K., 2005. Determining the capacity

value of wind: A survey of methods and

implementation. Proceedings of Wind Power, Denver.

Sideratos, G., Hatziargyriou, N.D., 2007. An advanced

statistical method for wind power forecasting. IEEE

Transactions on Power Systems, Vol. 22, No. 1.

Kariniotakis, G., Waldl, I.H.P., et. al., 2006. Next

generation forecasting tools for the optimal

management. Proceedings of the International

Conference on Probabilistic Methods Applied to Power

Systems, pp. 1-6.

DeMeo, E., A., Grant, W., Milligan, M., R., Schuerger, M.,

J., 2005. Wind plant integration: Cost, status & issues,”

IEEE Power and Energy Magazine, Vol. 3, No. 6, pp:

38–46.

Zeineldin, H.H.; El-Fouly, T.H.M.; El-Saadany, E.F.;

Salama, M.M.A., 2009. Impact of wind farm

integration on electricity. Renewable Power

Generation, IET, Vol.3, No.1.

Sinha, A., Basu, A.K., Lahiri, R.N., Chowdhury, S.,

Chowdhury, S.P., Crossley, P.A., 2008. Setting of

market clearing price (MCP) in microgrid power

scenario. Proceedings of the IEEE Power and Energy

Society General Meeting - Conversion and Delivery of

Electrical Energy in the 21st Century.

Singh, S.N., Erlich, I., 2008. Strategies for Wind Power

Trading in Competitive Electricity Markets. IEEE

Transactions on Energy Conversion, Vol. 23, No. 1.

Martin, S., Smeers Y. and Aguado J.A., 2015. A Stochastic

Two Settlement Equilibrium Model for Electricity

Markets With Wind Generation. IEEE Transactions on

Power Systems, Vol. 30, No. 1, pp. 233-245.

Sharma, K.C., Bhakar, R. and Padhy, N.P., 2014. Stochastic

cournot model for wind power trading in electricity

markets. IEEE PES General Meeting, pp.1-5.

Ting Dai and Wei Qiao, 2013. Trading Wind Power in a

Competitive Electricity Market Using Stochastic

Programing and Game Theory. IEEE Transactions on

Sustainable Energy, Vol. 4, No. 3, pp. 805-815.

PricebasedUnitCommitmentwithWindGenerationandMarketClearingPriceVariations

225