Determining the Value of Information Security Investments

A Decision Support System

Hannah Louise Davies and Andrew J. C. Blyth

Information Security Research Group, University of South Wales, Pontypridd, U.K.

Keywords: Return on Security Investment, Multi-Attribute Utility Theory, Decision Making under Uncertainty, Multi-

Criteria Decision Making, Information Security Metrics, Decision Making for Information Security.

Abstract: Advances in the technological era are making information security breaches a more common occurrence. A

vital part of ensuring an organisation is well protected from these increasingly complex threats is a suitable

security solution. Suitability of a security solution should not only be measured in terms of goals such as

reducing down time or reducing the risk of a certain threat, but also meet stakeholder and executive goals in

terms of being cost effective. Currently, cost effective is determined by calculating a return on security

investment calculation, where the cost of a solution is evaluated against any savings resulting after

purchasing the solution to determine whether the option is viable. The current implementation of return on

security investment calculations however is often subjective and inaccurate as calculations are performed in

an ad-hoc manner. When there are multiple factors to consider, with uncertain or incomplete values

available, a multi-attribute decision making method that utilises uncertainty is required in order to allow the

decision maker to assess all possible options in the most logical and objective manner, whilst keeping in

mind the goals of the organisation. In this paper we present and evaluate a conceptual, analytical framework

that, with the use of multi-attribute utility theory under uncertainty, is able to model return on security

investment calculations in a novel way. This new calculation is introduced as a Value of Information

Security Investment calculation. The final goal is to create a framework that allows for repeatable,

predictable and mature, calculations that determine the value of an information security investment.

1 INTRODUCTION

Since the global economic crisis of 2008, justifying

a decision to acquire tools, techniques and processes

has become increasingly important. In this

technology era, organisations are faced with building

and maintaining an effective information technology

infrastructure that is not only suited to the

organisations objectives, but conforms to policy,

addresses the alarming increase in information

security threats (Al-Humaigani and Dunn, 2003) and

is cost-effective.

When designing an effective security solution, an

organisation requires a complete Risk Management

framework to identify, measure and manage the

risks present. Assessing the financial aspect of a

security solution is also important and is most

commonly evaluated by performing a return on

investment (ROI) calculation (Pontes et al., 2011).

ROI calculations aim to answer the question as to

which option gives the most value for money

(Sonnenreich, 2006). The problem faced, however,

is that security programs and solutions are often

preventing losses and not delivery profit; hence

calculating a standard ROI is not sufficient.

Applying a security program or solution is expected

to reduce the risks threatening your assets, thus a

return on security investment (ROSI) calculation

should be used to calculate how much loss has been

avoided following the investment (ENISA, 2012).

The standard ROSI methodology involves the

comparison of the monetary value of the investment

and the monetary value of the risk reduction. The

monetary value of the risk reduction can be

estimated by a quantitative risk assessment (ENISA,

2012).

With security threats becoming more

sophisticated and more costly, determining the

acceptable risk level and selection of an optimal cost

effective solution is becoming an increasingly

complex but necessary decision for information

security management. As with all such decisions,

expenditure to protect a system has to be fully

justified in terms of a well-specified objective

(Ioannidis et al., 2010). Another issue that arises

426

Louise Davies H. and J. C. Blyth A..

Determining the Value of Information Security Investments - A Decision Support System.

DOI: 10.5220/0005170704260433

In Proceedings of the International Conference on Knowledge Management and Information Sharing (KMIS-2014), pages 426-433

ISBN: 978-989-758-050-5

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

with calculating ROSI is the lack of data concerning

information security (Levy, 2005). Security breaches

and incidents are still seen as a reason for

embarrassment and few companies are willing or

able to provide actual costs associated with security

breaches (Sonnenreich, 2006). However, whilst the

data itself can be improved in terms of accuracy, it is

in fact the reproducible nature of the calculation that

is important, this reproducible nature arises from a

consistent methodology of calculating and reporting

the cost (Sonnenreich, 2006).

There are multiple factors and numerous

alternatives to consider when such a widely used

methodology as multi-criteria decision-making

(MCDM) is used. MCDM is a collection of

methodologies used to compare, select or rank

multiple alternatives that typically involve

incommensurate attributes (Levy, 2005). MCDM

can fall in to two main categories; 1) decision

making under certainty and 2) decision making

under uncertainty. However, in practice, it is

extremely unlikely to have complete information

about the future (Shah et al., 2007). The values used

in ROSI calculations are subject to uncertainty,

primarily down to the fact that you cannot predict,

with a high level of certainty, the losses caused

when an event may or may not happen

(Sonnenreich, 2006). Consequently, decision-

making under uncertainty is the logical method to

use in order to allow for realistic solutions.

Though there are previous applications of

decision analysis to ROSI problems, the inclusion of

multi-attribute utility theory (MAUT) hasn’t been

applied to its fullest extent. The cases of MAUT

being used are restricted to a small number of

attributes, such as cost and availability (Ioannidis et

al., 2010), (Beautement et al., 2008), or cost,

investment and availability (Beres, Pym and Shiu,

2010) for example. The limited use of MAUT

doesn’t show the full extent to which decision

analysis can be used to support ROSI calculations.

2 RELATED WORK

2.1 Return on Security Investment

Performing an ROSI calculation is a method of

evaluating a security investment prior to making a

decision; it compares the cost of implementing and

procuring a solution to the losses avoided. It is the

misconception of what ROSI demonstrates, in terms

of not necessarily representing a profit, which has

led to its misuse.

Relatively recently, in 2002, Gordon and Loeb

adopted a static optimisation model where the

optimal ratio of investment in Information Security

can be calculated under different assumptions of

expected loss. This model relies on restrictive

assumptions to calculate the optimal ratio and has

sparked much debate regarding whether the

relationship between Information Security

Investment and vulnerability is always a monotonic

function. In 2006, Hausken proposed that

vulnerability be represented as a function, showing

the optimal ratio cannot be supported.

An important issue is that the inputs for ROSI

may be highly subjective, and consequently,

companies that use the same method for calculation

can arrive at extremely varied results due to different

choices made about the inclusion or exclusion of

costs (Sonnenreich, 2006). In addition, estimating

losses from future events brings uncertainty in to the

values used. Even when actuarial tables or insurance

data are used, these values may not be accurate due

to the “ostrich effect” (Sonnenreich, 2006)

experienced when an incident occurs. Another way

to collet data is to base values on competitors

experiences. This could be to investigate losses

incurred by competitors during incidents, or an

uptake in sales within an organisation once a

competitor has experienced an attack. These values

of losses or gains can be added on to the ROSI

analysis (Korostoff, 2003) or values based on

previous experience can also be used. Finally, the

variable most complex to define and evaluate is the

mitigated risk. One method to consider is the use of

past data, determining the expected losses due to

security breaches prior, and subsequent to,

implementing a solution (Arora, Frank and Telang,

2008). The avoided risk or expected benefit is then

the difference between the baseline loss and residual

risk. When using this approach, it must be

recognised that rare events may preclude the use of

past data, when such events occurred sufficiently

long ago that the same conditions no longer apply.

ROSI calculations, as explained above are based

heavily on estimations or perceptions of values –

this makes ROSI more of an approximation and less

accurate. It is the ability to manipulate these

approximations to justify decisions (ENISA, 2012)

that call for ROSI to be improved, in terms of

reproducibility, repeatability and predictability. The

biased perceptions of a decision maker should not

cause differing outputs of the calculations. ROSI

equations should be objective and numerical but due

to insufficient definition or subjective variables, the

calculations become imprecise and subjective

DeterminingtheValueofInformationSecurityInvestments-ADecisionSupportSystem

427

(Rudolph and Schwarz, 2012). Another criticism of

ROSI is that the methods are complex and rely on

soft data to derive hard numbers that are associated

with ROSI. This takes time and therefore simple but

effective methods are preferred in practice

(Holoman and Kuzmeskus, 2012). This research

aims to identify a more suitable method of justifying

Information Security Expenditure by means of an

accurate, reproducible and objective approach in

order to mitigate such criticism.

2.2 Multi-Attribute Utility Theory

Concerning ROSI, most decisions are made in an

environment where the eventual outcomes are

unknown. It is the area of decision making under

uncertainty where the methodology of ROSI and

decision analysis should be performed. Decision

analysis was originally developed to aid a decision-

maker’s evaluation of alternatives whose outcomes

were uncertain (Raïffa and Schlaifer, 1961).

Decision theory provides an approach to modelling

uncertainty in the environment, using probability to

describe the likelihood of uncertain events and using

utility to model the decision-maker’s attitude to risk

(Belton and Stewart, 2002).

Multi-attribute utility theory seeks to reduce the

complex problem of assessing a multi-attribute

utility function into one of assessing a series of uni-

dimensional utility functions. These individually

estimated component functions are then brought

together again; the glue is known as value trade-offs

(Zeleny, 1982). The trade-off issue is, in essence,

evaluating how much achievement, in objective 1, is

the decision maker willing to give up to improve

achievement, by some fixed amount, on objective 2

(Keeney and Raïffa, 1976). By determining the

trade-offs that a decision-maker is willing to make,

the optimal solution based on these preferences can

be determined.

An important step in using MAUT is defining the

objectives that an organisation has. There are 4

identified steps to develop and quantify objectives

(Keeney, 1975):

Identify objectives that the organisation

considers important.

Structure the objectives into a hierarchy so

ends and means remain distinct and

redundancies get eliminated.

For clarification, define attributes for

objectives, and then consequences are

measurable.

Develop a utility function to indicate value

trade-offs and reflect different viewpoints

within the organisation.

For the application of MAUT that is being

considered here, an objective may be to reduce the

vulnerability of the organisation to a specific threat

agent. An attribute would then be the number of

incidents in a week/month/year relating to that

specific threat agent. Uncertainty would then be

propagated over the variables with the use of

probabilities.

The basis of MAUT is the use of utility

functions; these can be applied to transform the raw

performance values of the alternatives against

diverse criteria, factual and judgemental, to a

common dimensionless scale (Fülöp, 2005). In

practice, the interval [0,1] is used, where 1 is the

highest utility that can be achieved, and 0 is the

lowest utility that can be achieved. Utility functions

allow for the most preferred alternative to obtain a

higher utility value than less preferred alternatives.

The use of utility functions also allow for more

relevant criteria to contribute more substantially to

the overall utility value than less relevant criteria.

The actual magnitude of the utility is not important,

the utility function serves as a “risk preference

thermometer” that can be used for ranking lotteries

according to the risk preference of an individual

(Howard, 1968). We seek a utility function U(z),

such that alternative a is preferred to alternative b if

and only if the expectation of U(z

a

) is greater than

U(z

b

), that is:

E[U(z

a

)] > E[U(z

b

)] (1)

Where z

a

and z

b

are the random vectors of attribute

values associated with alternatives a and b

respectively. This is the Expected Utility Hypothesis

(Løken, 2007). Establishing the existence of a utility

function is a non-trivial process, even for the single

attribute case. It is within this context that von

Neumann and Morgenstern (1947) first developed

utility theory.

2.2.1 Additive Utility Model

The additive utility function is the best-known form

of multi-attribute utility functions because of its

relative simplicity and application to real world

problems (Raïffa and Schlaifer, 1961). The additive

utility function should be considered firstly as a

possible solution as it is the simplest form of a utility

function. There are a number of conditions that need

to be shown to be satisfied in order for the additive

form of multi-attribute utility model to be valid.

However, when it is not possible to prove all of the

additivity assumptions hold for every case, strong

evidence suggests that even when complete

independence isn’t established, the additive model

KMIS2014-InternationalConferenceonKnowledgeManagementandInformationSharing

428

can still provide close approximations to “pure”

additive utility functions (Yoon and Hwang, 1995).

3 INTRODUCING THE VALUE

OF INFORMATION SECURITY

INVESTMENT AS A CONCEPT

For any organisation, there are a number of

questions relating to Information Security

investments. Organisations are interested in the

amount of investment that should be made, selection

of the measures that should attract investment and

the effectiveness of any potential investments

(Zhang and Li, 2005). All of these questions can be

addressed via the implementation of a decision

support system that utilises multi-attribute utility

theory under uncertainty. Due to the fact that the

“return” of Information Security investments doesn’t

usually come from increased revenues, decreased

costs or other monetary values, this decision support

system avoids the use of the word “return” but rather

determines the value of Information Security

Investments – not just as a monetary value – by

determining the value added to any attributes, such

as process maturity, time saving or peace of mind

for stakeholders. Hence, we introduce an alternative

method for justifying Information security

expenditure in the form of a Value of Information

Security Investment (VISI) Calculation.

3.1 Risk Management Process

ROSI is best incorporated into a full Risk

Management (RM) process, hence, VISI is also best

utilised in a full RM framework. Pontes et al. (2011)

propose a Comprehensive RM framework that

purposely incorporates an ROSI phase. The phases

identified in the RM framework are; plan, risk

appreciation, ROSI, risk treatment, closing. The RM

framework proposed by Pontes et al., 2011 could

therefore be extended to include a VISI calculation

phase in place of ROSI.

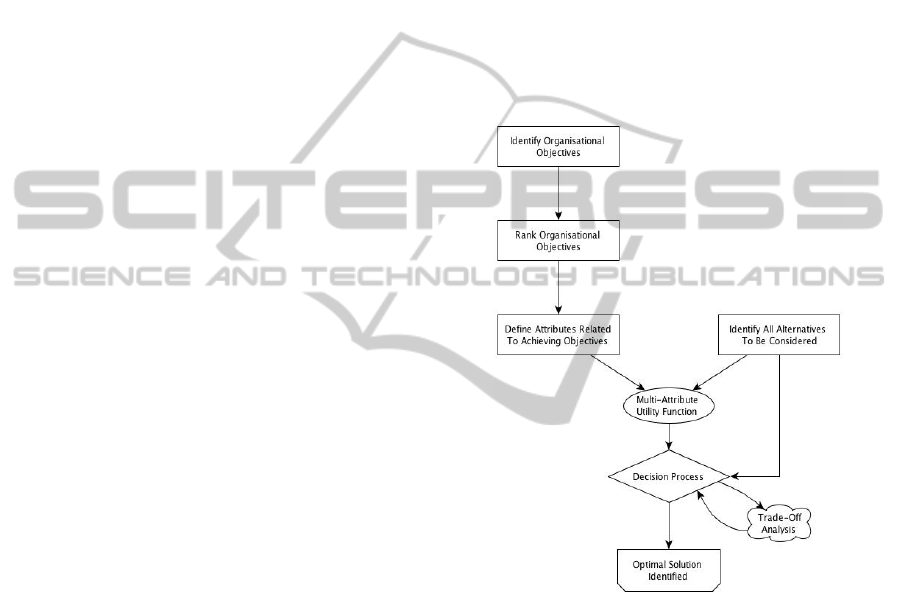

3.2 Proposed Architecture

The main underlying concept of the proposed

solution is to produce a decision support model that

is able to evaluate multiple attributes, multiple

alternatives, ROSI calculations and trade-offs under

uncertainty to identify an optimal security solution

for any particular organisation. The purpose of this

approach is to create a standard method for

calculating VISI and making an informed decision

based upon these VISIC results.

Multi-attribute utility theory will initially form

the analytical core of this system. The multi-attribute

utility model will be fed with data that defines the

objectives of the organisation, the attributes to be

considered in the decision process and the

alternatives. If the number of attributes is denoted as

n and the number of alternatives denoted by m, then

the proposed architecture is designed to be able to

consider n attributes across m alternatives. This

approach allows more sophisticated methods of

dealing with the uncertainty present in VISI

calculations. The initial proposed architecture is

shown in Figure 1.

Figure 1: Initial Proposed Architecture.

3.3 Proposed Validation

In order to validate the decision support model that

is being proposed, a series of realistic and

appropriate case studies need to be considered. The

case studies also need to be reliable and able to

replicate real world behaviour and decisions. The

case studies will be hypothetical, although these will

be validated by the use of industry experts. The case

studies will initially start with a simple, small

decision problem to demonstrate that the solution is

viable. The model complexity will then be increased

to demonstrate applicability of the solution to real

world problems that are currently being encountered.

Yin (2009), characterises case study research as an

empirical inquiry that:

DeterminingtheValueofInformationSecurityInvestments-ADecisionSupportSystem

429

Investigates a contemporary phenomenon

within its real life context; when

The boundaries between phenomenon and

context are not clearly evident.

As the VISI calculation is extremely complex,

comprising of alternatives, objectives, attributes and

their interrelationships, a case study design was

warranted. As stated by Yin (2009), case studies

have at least four different applications, perhaps

most importantly, the explanation of causal links in

the VISI calculation, and to provide enlightenment

to situations in which the VISI calculation being

evaluated has no clear, single set of outcomes. The

case study approach also allows for the use of data

from multiple sources.

3.4 Initial Case Study

This hypothetical case study looks at a medium

sized organisation that is concerned about the safe

use of its sensitive data. As the insider threat is still

identified as a serious threat for organisations

(Pricewaterhouse Cooper, 2014), this case study will

consider the threat agent to be an insider with direct

access to the system and the alternatives available to

be preventive measures that will deter or prevent the

insider from extracting sensitive data. The

psychological reasons for insiders acting maliciously

towards a present or previous employer are outside

the scope of this paper.

Three alternatives available to the organisation

are identified. These include off the shelf software to

prevent unauthorised storage devices being

connected to the network, implementation of a

tracking software that track activity and raise alerts

to suspicious activity and finally the use of database

monitoring software to monitor access to certain

restricted data by insiders.

The organisation is concerned with the following

attributes that it will use to evaluate the decision.

These attributes are cost, lifetime and maturity. As

can be seen, these attributes are measured in

different units and are defined in monetary and time

units as well as a scale. These incommensurate

attributes are just one issue that is met when trying

to perform a VISI calculation to justify information

security expenditure.

This case study will use an additive utility

function U. This form of multi-attribute utility

theory includes individual utility functions U

i

for

each attribute x

j

, usually scaled from 0 to 1 that

reflect the decision-makers trade-offs among the

attributes.

U(x

1

,x

2

,x

3

) =

w

1

U

1

(x

1

)+w

2

U

2

(x

2

)+w

3

U

3

(x

3

)

(2)

Where

w

1

+ w

2

+ w

3

= 1 (3)

Weights may be specified directly, or found

using a swing-weight procedure. Individual utility

functions are assessed using the range of attribute

values across the alternatives being considered in the

decision problem.

In this example, the cost has a unit of GBP, the

lifetime is the expected number of years that the

product will last or be useful and the maturity is a

value given by a third party organisation.

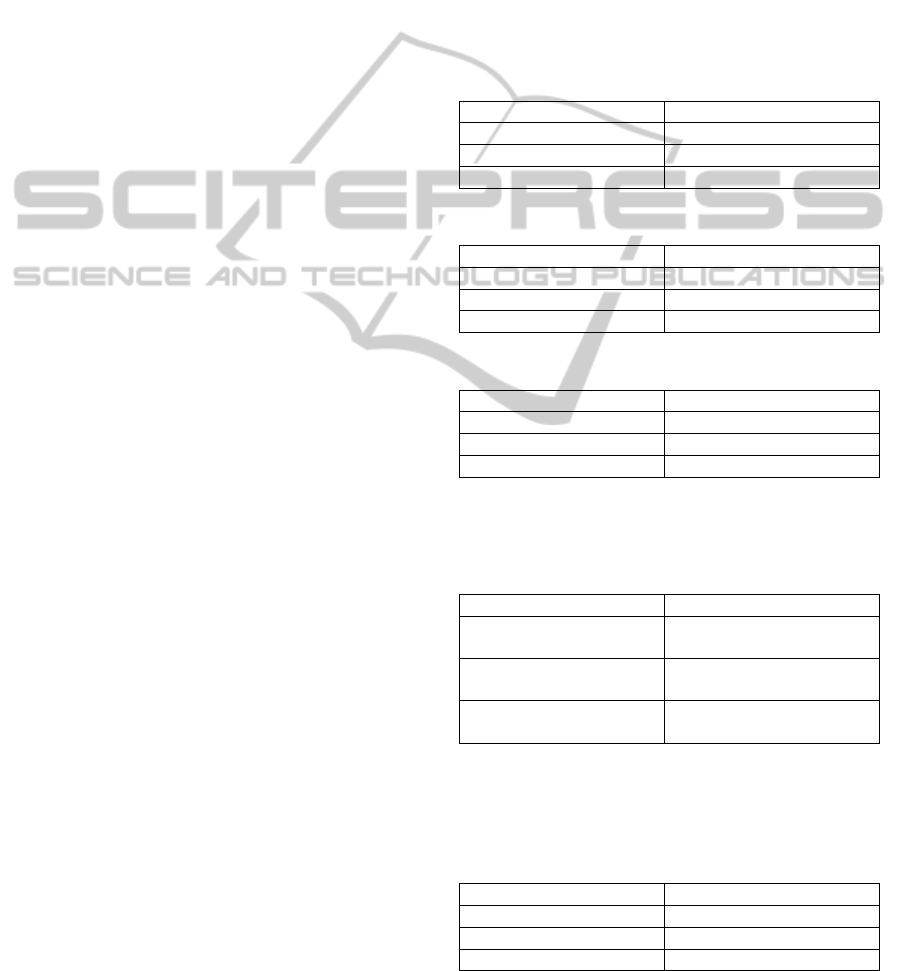

Table 1: Decision Attributes and Alternative 1.

Attribute Alternative 1

Cost £3000

Lifetime 3 years

Maturity Low

Table 2: Decision Attributes and Alternative 2.

Attribute Alternative 2

Cost £9000

Lifetime 5 years

Maturity High

Table 3: Decision Attributes and Alternative 3.

Attribute Alternative 3

Cost £6000

Lifetime 5 years

Maturity Medium

The individual utility for each attribute shall be

assessed in the following way:

Table 4: Individual Utilities for each attribute.

Attribute

Cost U(£3000) = 1, U(£9000) =

0, linear

Lifetime U(3 years) = 0, U(5 years)

= 1, linear

Maturity U(Low) = 0, U(Medium)

= 0.6, U(High) = 1

These assessments for each attribute will allow

for the individual utility for each alternative to be

found below in Tables 5-7.

Table 5: Individual Utility for Alternative 1.

Attribute Alternative 1

Cost 1.0

Lifetime 0.0

Maturity 0.0

KMIS2014-InternationalConferenceonKnowledgeManagementandInformationSharing

430

Table 6: Individual Utility for Alternative 2.

Attribute Alternative 2

Cost 0.0

Lifetime 1.0

Maturity 1.0

Table 7: Individual Utility for Alternative 3.

Attribute Alternative 3

Cost 0.5

Lifetime 1.0

Maturity 0.6

The trade-offs assessment is more difficult to

make. One method is to assess weight ratios. In this

example, the decision maker identifies that cost is

twice as important as lifetime. This may be

interpreted to mean that the change in overall

satisfaction corresponding to a change in cost from

£9000 to £3000 is twice the change in overall

satisfaction relating to a change in lifetime from 5

years to 3 years. Similarly, for maturity, the

decision-maker may judge that the £6000 decrease

in cost is 1 and half times as satisfying as a change

from a high to low rating. These ratios are used to

identify the weights for each attribute in Table 8.

Table 8: Weight Assessments.

Weights

Cost 0.462

Lifetime 0.231

Maturity 0.307

These weights are then used to identify the

overall utility value for each alternative. These are

shown in Table 9 below.

Table 9: Overall Utilities.

Alternatives Utility Value

1 0.462

2 0.538

3 0.6462

Hence, the maximum utility is that of alternative

3. Hence, the approach that should be adopted is that

of the database monitoring software. In order to

assess the VISI calculation of this decision, we first

need to identify the cost to the organisation of not

choosing any of these solutions. This is vital to

ensure that the amount of expenditure is below the

potential losses. The organisation suspects that if a

large-scale breach were to occur that the cost would

exceed £20,000, in the lowest case the cost of the

incident is estimated at £10,000. This shows that

even the minimum cost is higher than that of the

expenditure. When evaluating the expenditure over

the lifetime of the product we see that the expected

losses are still much higher than that of the

expenditure required for alternative 3.

This relatively simple, initial case study shows

the viability of using multi-attribute utility theory to

assess information security expenditure decisions.

So far, the decision has been investigated in terms of

just the attributes cost, lifetime and maturity.

However, information security decisions for

expenditure need further justification. We propose

this comes in the form of a VISI calculation. The

purpose of the VISI calculation is to show the value

of the expenditure. The cost to the organisation if a

major incident occurs is £20,000. The organisation

also identifies the probability of a major incident

occurring to be 0.05 and the probability of a minor

incident occurring to be 0.2. In order to identify the

VISI for each alternative, we need to evaluate the

savings and costs in order to identify the best

possible solution. For alternative 1, the savings are

potentially £17,000; alternative 2 provides a

potential saving of £11,000; alternative 3 provides a

potential saving of £14,000. This should also be

included in the utility theory process, however the

uncertainty present in reality of these potential losses

doesn’t allow for a linear utility function. We

identify the decision-maker to be risk averse and

hence the utility function now will be concave

shaped. In the case of a risk seeking decision-maker,

the utility function would be convex shaped.

We define VISI as follows:

VISI = ∅

(4)

Where ∅ represents the breach probability, S

represents the potential savings and I represents the

investment cost of the alternative. This cost should

be considered in a singular unit of time, which is

annually, monthly or weekly for example.

Including this VISI value in to the utility theory

process as another attribute further validates the

expenditure being considered. We are trying to

achieve the highest VISI and hence, the highest

value will be assigned the value of 1, and the lowest

the value of 0 for the assessment of each alternative.

The potential savings and cost of the solution

elements require a pre-determined set of values to

include. By providing a set of values to include in

this process, the calculation will be repeatable and

reproducible as well as comparable across

departments and organisations.

The savings and costs to be included are:

Monetary losses due to downtime.

Monetary losses due to loss of business.

DeterminingtheValueofInformationSecurityInvestments-ADecisionSupportSystem

431

Losses in terms of productivity of employees.

Cost of software, hardware, maintenance and

licencing costs.

Training costs.

This list of savings is currently under review and

will be extended and adapted as required.

4 CONCLUSIONS

This paper has demonstrated that the current state of

the art methods in ROSI calculations for information

security possess deficiencies in producing

repeatable, predictable and reproducible results. Due

to the rapid increase in the number of breaches

organisations now encounter, protecting an

organisation is an important aspect. This solution

should not only meet the criteria in terms of

protection of assets and critical systems but should

also be viewed as cost-effective to stakeholders and

executives.

The expansion of ROI calculations to security is

not viable, due to the nature of security solutions

preventing losses and not generating profit, thus a

specific ROI calculation for security needs to be

used. Due to inaccurate data and inconsistent

methods of calculating and reporting losses, many

ROSI calculations are estimations at best, and only

provide insight when the methodologies are kept

constant – by a single organisation for example. The

current best practice methods are simple

calculations, however these calculations are unable

to deal with hard to define and complex metrics.

This paper presents a multi-attribute utility theory

method instead of using ROSI calculations. This

method allows for decision-making under

uncertainty to be carried out in a logical way even

when considering multiple objectives, attributes and

alternatives. This consistent methodology allows for

repeatable and predictable results that are

reproducible when supplied with the organisational

data and method. This proposed, novel solution is

defined as a Value of Information Security

Investment calculation.

This paper presents the initial solution

framework and an initial case study. The idea of the

initial case study is to show the viability, and ease of

the VISI calculation.

Future work with the VISI calculation will

involve refinement of the calculation method and the

application to more complex, real world decision-

making problems that are encountered in large,

security or government organisations. Also, the RM

framework needs to be expanded to include the VISI

calculation to provide organisations with a complete

picture of their information security position.

Sensitivity analysis also needs to be carried out on

VISI calculations, both coarse and fine, for

sensitivity to large and small changes to the ratios

identified, in order to investigate how these changes

affect the identified solution in terms of the overall

utility.

ACKNOWLEDGEMENTS

This work has been partly funded by ESII, contract

number 3000134902/TIN/21.

REFERENCES

Al-Humaigani, M., and D.B. Dunn. 2003. “A Model of

Return on Investment for Information Systems

Security.” In Circuits and Systems, 2003 IEEE 46th

Midwest Symposium on, 1:483 –485 Vol. 1.

doi:10.1109/MWSCAS.2003.1562323.

Arora, Ashish, Steven Frank, and Rahul Telang. 2008.

“Estimating Benefits from Investing in Secure

Software Development.” Build Security In.

Beautement, A., et al., 2009. “Modelling the Human and

Technological Costs and Benefits of USB Memory

Stick Security.” In Managing Information Risk and the

Economics of Security, edited by M. Eric Johnson,

141–63. Springer US.

Belton, Valerie, and Theodor J. Stewart. 2002. Multiple

Criteria Decision Analysis: An Integrated Approach.

Springer.

Beres, Yolanta, David Pym, and Simon Shiu. 2010.

“Decision Support for Systems Security Investment.”

Manuscript, HP Labs.

European Network and Information Security Agency

(ENISA). 2012. “Introduction to Return on Security

Investment : Helping CERTs Assessing the Cost of

(lack Of) Security.”

Fülöp, János. 2005. Introduction to Decision Making

Methods. Laboratory of Operations Research and

Decision Systems. Computer and Automation

Institute, Hungarian Academy of Sciences.

Gordon, Lawrence A., and Martin P. Loeb. 2002. “The

Economics of Information Security Investment.”

ACM Trans. Inf. Syst. Secur. 5 (4): 438–57.

doi:10.1145/581271.581274.

Hausken, Kjell. 2006. “Returns to Information Security

Investment: The Effect of Alternative Information

Security Breach Functions on Optimal Investment and

Sensitivity to Vulnerability.” Information Systems

Frontiers 8 (5): 338–49. doi:10.1007/s10796-006-

9011-6.

KMIS2014-InternationalConferenceonKnowledgeManagementandInformationSharing

432

Holoman, Kathy, and Aaron Kuzmeskus. 2012. The

Evolution of Return on Security Investment (ROSI).

White Paper WP-SEC-SECURITY ROSI-A4.BU.N.

EN.01.2012.0.01.CC. Schneider Electric.

Howard, R.A. 1968. “The Foundations of Decision

Analysis.” IEEE Transactions on Systems Science and

Cybernetics 4 (3): 211 –219. doi:10.1109/TSSC.1968.

300115.

Ioannidis, C. et al., 2009. “Investments and Trade-Offs in

the Economics of Information Security.” In Financial

Cryptography and Data Security, edited by Roger

Dingledine and Philippe Golle, 148–66. Lecture Notes

in Computer Science 5628. Springer Berlin

Heidelberg.

Keeney, Ralph L., and Howard Raïffa. 1976. Decisions

with Multiple Objectives: Preferences and Value

Tradeoffs. Wiley.

Keeney, Ralph L, and Howard Raiffa. 1993. Decisions

with Multiple Objectives : Preferences and Value

Tradeoffs. Cambridge [England]; New York, NY,

USA: Cambridge University Press.

Keeney, Ralph Lyons. 1975. Examining Corporate Policy

Using Multiattribute Utility Analysis. IIASA.

Korostoff, Kathryn. 2003. “The ROI of Network

Security.” Network World. http://www.networkworld.

com/techinsider/2003/0825techinsiderroi.html.

Levy, Jason. 2005. “Multiple Criteria Decision Making

and Decision Support Systems for Flood Risk

Management.” Stochastic Environmental Research

and Risk Assessment 19 (6): 438–47. doi:10.1007/

s00477-005-0009-2.

Løken, Espen. 2007. “Use of Multicriteria Decision

Analysis Methods for Energy Planning Problems.”

Renewable and Sustainable Energy Reviews 11 (7):

1584–95. doi:10.1016/j.rser.2005.11.005.

Pontes, Elvis, Adilson E., Anderson A. A. Silva, and

Sergio T. 2011. “A Comprehensive Risk Management

Framework for Approaching the Return on Security

Investment (ROSI).” In Risk Management in

Environment, Production and Economy, edited by

Matteo Savino. InTech. http://www.intechopen.com/

books/risk-management-in-environment-production-

and-economy/a-comprehensive-risk-management-

framework-for-approaching-the-return-on-security-

investment-rosi-.

Pricewaterhouse Cooper. 2014. “2014 Information

Security Breaches Survey.” PwC.

Raïffa, Howard, and Robert Schlaifer. 1961. Applied

Statistical Decision Theory. Division of Research,

Graduate School of Business Adminitration, Harvard

University.

Rudolph, Manuel, and Reinhard Schwarz. 2012. “A

Critical Survey of Security Indicator Approaches.” In

2012 Seventh International Conference on

Availability, Reliability and Security (ARES), 291 –

300. doi:10.1109/ARES.2012.10.

Shah., N.H., R.M. Gor, and H. Soni. 2007. Operations

Research. PHI Learning Pvt. Ltd.

Sonnenreich, W. 2006. “Return on Security Investment

(ROSI): A Practical Quantitative Model.” Journal of

Research and Practice in Information Technology 38

(1).

Von Neumann, J, and O Morgenstern. 1947. Theory of

Games and Linear Programming. 2nd Edition. New

York: Wiley.

Yin, Robert K. 2009. Case Study Research: Design and

Methods. 4th ed. Applied Social Research Methods, v.

5. Los Angeles, Calif: Sage Publications.

Yoon, K. Paul, and Ching-Lai Hwang. 1995. Multiple

Attribute Decision Making: An Introduction. SAGE.

Zeleny, Milan. 1982. Multiple Criteria Decision Making.

New York [etc.]: McGraw-Hill.

Zhang, Jin-Ping, and Shou-Mei Li. 2005. “Portfolio

Selection With Quadratic Utility Function Under

Fuzzy Environment.” In Proceedings of 2005

International Conference on Machine Learning and

Cybernetics August 18-21, 2005, Ramada Hotel,

Guangzhou, China, 2529–33. Piscataway, NJ: IEEE.

DeterminingtheValueofInformationSecurityInvestments-ADecisionSupportSystem

433