Outlier-based Health Insurance Fraud Detection for U.S. Medicaid

Data

Dallas Thornton

1

, Guido van Capelleveen

1

, Mannes Poel

2

,

Jos van Hillegersberg

2

and Roland M. Mueller

3

1

University of California, San Diego, San Diego Supercomputer Center,

9500 Gilman Dr., MC 0505, La Jolla, CA 92093, U.S.A.

2

University of Twente, Drienerlolaan 5, 7522 NB Enschede, The Netherlands

3

Berlin School of Economics and Law, Badensche Straße 52, 10825 Berlin, Germany

Keywords: Fraud Detection, Medicaid, Healthcare Fraud, Outlier Detection, Anomaly Detection.

Abstract: Fraud, waste, and abuse in the U.S. healthcare system are estimated at $700 billion annually. Predictive

analytics offers government and private payers the opportunity to identify and prevent or recover such

billings. This paper proposes a data-driven method for fraud detection based on comparative research, fraud

cases, and literature review. Unsupervised data mining techniques such as outlier detection are suggested as

effective predictors for fraud. Based on a multi-dimensional data model developed for Medicaid claim data,

specific metrics for dental providers were developed and evaluated in analytical experiments using outlier

detection applied to claim, provider, and patient data in a state Medicaid program. The proposed

methodology enabled successful identification of fraudulent activity, with 12 of the top 17 suspicious

providers (71%) referred to officials for investigation with clearly anomalous and inappropriate activity.

Future research is underway to extend the method to other specialties and enable its use by fraud analysts.

1 INTRODUCTION

Roughly $700 billion of the $2.7 trillion spent on

healthcare in the US is attributable to fraud, waste,

and abuse (Kelley 2009). Healthcare payers deal

with fraudulent practitioners, organized criminal

schemes, and honest providers who make

unintended mistakes while billing for their

legitimate services. Government programs are

particularly susceptible to fraud, as it is harder to

exclude problematic providers than in privately

managed provider networks. Data analysis methods

utilized in other sectors are not yet widely deployed

and utilized in this domain, partially due to the high

level of subject matter knowledge needed to adapt

these techniques to the unique environments in

which they must be deployed. Yet, with up-front

engineering and ongoing adaptations, techniques

such as outlier detection offer a lifeline to programs

struggling to rein in spiraling costs and remain

solvent.

Unsupervised data mining techniques such as

outlier detection are suggested as effective

predictors for fraud. This paper proposes and

evaluates a method for applying outlier detection to

healthcare fraud based on comparative research,

fraud cases, and literature review. Based on a multi-

dimensional data model developed for Medicaid

claim data (Thornton et al. 2013), specific metrics

for dental providers were developed and evaluated in

analytical experiments using outlier detection

applied to claim, provider, and patient data in an

actual state Medicaid program. The proposed

methodology successfully identified fraudulent

activity, with 12 of the top 17 suspicious providers

(71%) referred to officials for investigation with

clearly anomalous and inappropriate activity. The

research methodology of Hevner et al. (2004) was

chosen to guide our work of designing a construct

for fraud detection that should be improved and

adapted based on environmental feedback and an

evolving knowledge base.

2 KNOWLEDGE BASE

Existing literature discusses how electronic fraud

detection could help combat health care fraud by

684

Thornton D., van Capelleveen G., Poel M., van Hillegersberg J. and Mueller R..

Outlier-based Health Insurance Fraud Detection for U.S. Medicaid Data.

DOI: 10.5220/0004986106840694

In Proceedings of the 16th International Conference on Enterprise Information Systems (ISS-2014), pages 684-694

ISBN: 978-989-758-028-4

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

securing the claim input process, checking on

irregularities, and analyzing claim data sets to search

for behavioral indicators of fraud (Aral et al. 2012;

Bolton & Hand 2002; Forgionne et al. 2000; Ortega

et al. 2006). Unfortunately, due largely to the

begrudging acknowledgement of fraud in health

care, the complexity of the claim systems, the size

and distributed storage of claim data and the late and

relatively low funding for fraud detection,

development of electronically fraud detection

systems is lagging industries such as banking and

telecommunications. There is a large base of

statistical methods that are also used in other

industries and could potentially be applied within the

health care industry (Travaille et al. 2011). Some

research reported specific fraud scheme detection

using data mining approaches (Forgionne et al.

2000; Major & Riedinger 2002; Musal 2010; Ng et

al. 2010; Shin et al. 2012), however an outstanding

challenge is to explore other healthcare fields for

potential data mining possibilities and develop a

more applied approach to this problem.

Data mining is gaining more attention by

researchers as a potential tool to find healthcare

fraud more easily (Aral et al. 2012). Most of the

studies consider outlier detection as one of the

primary tools (Weng & Shen 2008). Researchers

have combined multiple methodologies such as

fuzzy logic in medical claims assessment and neural

networks for automatic classification (Travaille et al.

2011). In the early 2000’s, some initial concepts of

data warehousing for data mining purposes in health

care arose (Forgionne et al. 2000). Major and

Riedinger (2002) developed an electronic fraud

detection application to review providers on 27

behavioral heuristics and compare those to similar

providers. A provider score was calculated based on

these heuristics followed by a frontier identification

method to select providers as candidates for

investigation. Another example identified a number

of meaningful rare cases in pathology insurance data

from Australia’s Health Insurance Commission

using an on-line discounting learning algorithm

(Yamanishi et al. 2004). In Taiwan scientists

developed a detection model based on process

mining that systematically identified practices

derived from clinical pathways to detect fraudulent

claims (Yang & Hwang 2006).

In Canada, researchers used Benford’s Law

Distributions to detect anomalies in claim

reimbursements (Lu & Boritz 2005). Although the

method did find some suspicious behavior, its

potential for fraud identification seemed to be

limited in this case. One of the main reasons is that

Benford’s law uses overly frequently used first-

digits to find fraud. However, this does not

necessarily apply to services with payer-fixed prices.

In Chile, a private health insurance company

built applications of neural networks used to find

medical abuse and fraud (Ortega et al. 2006). The

innovative aspects of the application concerned a

method that could process the claims on a real time

basis. Other examples are the application of

association rule mining to examine billing patterns

within a particular specialist group to detect these

suspicious claims and potential fraudulent

individuals (Shan et al. 2008) or the use of clustering

procedures as well as regression models for

geographical analysis of possible fraud (Musal

2010).

Ng et al. (2010) experimented on detecting non-

compliant consumers (prescription shoppers) in

spatio-temporal health data of Medicare Australia

using multiple metrics that flagged providers.

Although beneficial experimental results were

achieved and the authors consider spatial and

temporal factors to be effective in metrics,

significant benefits concerning the use of spatial-

temporal factors instead of more traditional metrics

could not be verified. The simpler metrics, such as

multiple visits or prescription percentages of

pharmacy visits for drugs of concern, have proved

valuable activity as well. Also Tang et al. (2011)

described the problem of prescription shopping in

their research. They used integrated techniques like

feature selection, clustering, pattern recognition and

outlier detection. Using a threshold on the outlier

score provider groups could be marked as potential

fraudulent.

Iyengar et al. (2013) described a methodology

for identifying and ranking candidate audit targets

from prescription drugs. The researchers developed

a normalized baseline behavioral model for each

prescription area and searched for statistically

significant deviations from that model. For some of

the areas, up to 500 features were used to find

anomalies. For the narcotic analgesics drug class, all

the known cases of fraud were correctly identified

by the model as being very abnormal and excessive.

The research of Thornton et al. (2013) builds

upon Sparrows fraud type classifications and

developed a Medicaid multidimensional data schema

and elaborated on analysis techniques that help to

predict the likelihood of finding fraudulent activities.

A scope and extent of health care fraud was

described by Travaille et al. (2011) that provided an

overview of the electronic fraud detection from other

industries applicable to the health care industry. The

Outlier-basedHealthInsuranceFraudDetectionforU.S.MedicaidData

685

authors advocated the use of statistical methods for

detection fraud and abuse for many of the health

care areas, and gave insight in the multiple fraud

schemes that are used by criminals in health care.

The work of Phua et al. (2010) includes a

comprehensive survey of data mining-based fraud

detection research. He categorizes, compares and

summarizes a decade of research papers about

automated fraud detection.

In general, the papers suggest and justify the

applicability of data mining techniques in detecting

healthcare fraud. Most describe the process of metric

gathering, valuing and validation, and how dynamics

force adaptation within a continuously changing

environment. Most papers have a focus on a specific

health care area, which seems to indicate a non-

homogeneous field for application. In search for

generalizability we look for a common approach that

can be extended and applied flexibly at scale. Our

goal is to apply this methodology on the total set of

Medicaid data, including over 70 million

beneficiaries. Therefore, we need a generic approach

to developing predictors for detection of healthcare

fraud in multiple health specialties.

3 ENVIRONMENT

“Fraud is the intentional deception or

misrepresentation that an individual knows to be

false or does not believe to be true and makes,

knowing that the deception could result in some

unauthorized benefit to himself/herself or some

other person” (Department of Health and Human

Services 1998). In developing our metrics, model,

and overall construct, we bear in mind this definition

and set the goal for identifying provider-based

fraudulent activity. Providers are the initiating actor

for billing healthcare payers, and, as such, quickly

become the nexus for fraud schemes.

When a provider participates in Medicaid, the

provider agrees to reimbursement by the state and

submits claims for payment directly to the state or

managed care entity. States operate claims

processing systems that perform various prepayment

checks and edits to inspect the claim’s legitimacy.

Edits and audits verify information with honest

providers in mind, but they are not designed to detect

fraud schemes of any depth (Sparrow 2000). These

systems simply cannot verify that the service was

provided as claimed, that the diagnosis is correct, or

whether the patient is even aware of the claimed

services.

Health care reimbursement policy varies state to

state and even across different patient populations,

meaning metrics and predictors of fraud in one state

must be adapted to be relevant in the differing

policies of another. In this paper, we focus on a

generalizable model that can be applied across

programs with differing parameters and settings

applied to accommodate for policy and program

differences.

4 METHOD FOR APPLYING

OUTLIER DETECTION TO

HEALTHCARE FRAUD

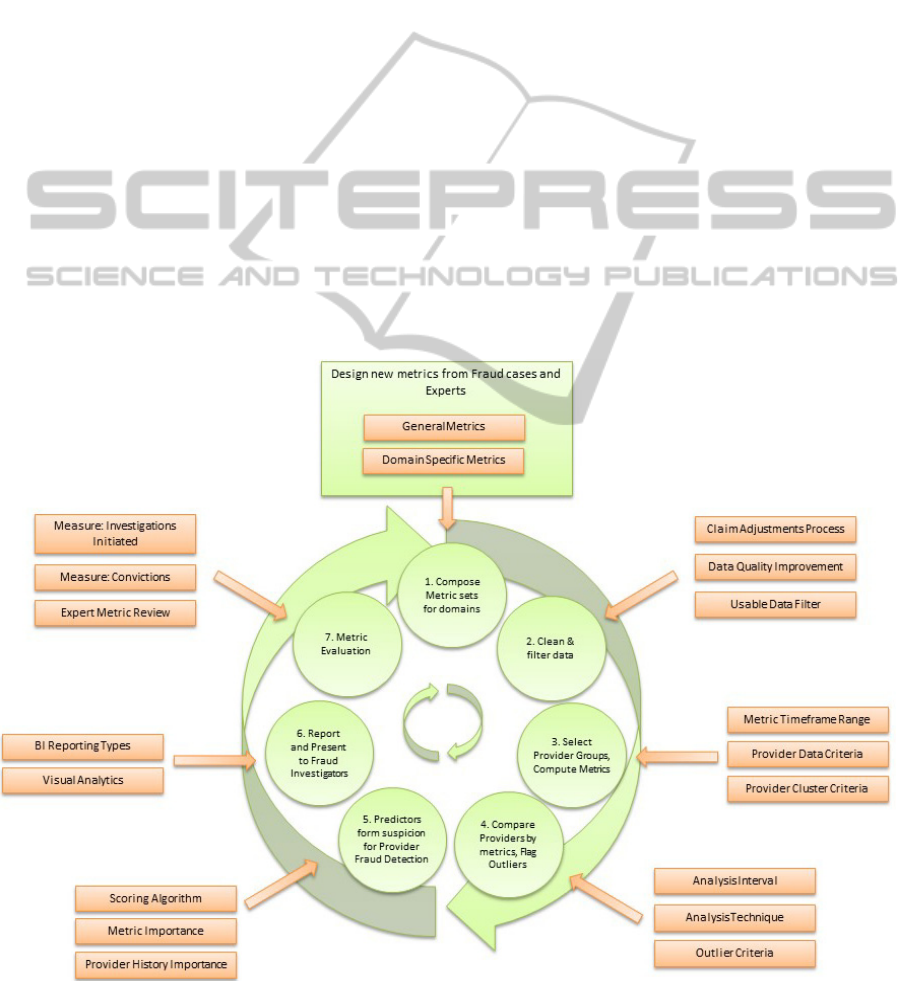

To best address the need for iterative metric review,

adjustment processing, and iterative weighting

modifications, we have developed an iterative

process for applying outlier detection to healthcare

fraud, shown in Figure 1. In the subsequent

subsections, we will describe each phase of this

process.

4.1 Compose Metric Sets for Domains

Metrics can be derived and designed in multiple

ways: through case analysis, by literature review, by

study of attributes in the data model, or by

cooperation with businesses of an industrial sector.

Although a case study may be an instrument that

helps to create a set of metrics, evaluation of the

metrics by means of experts and flagging results is

an absolute necessity. The set of metrics chosen in

this paper consists of metrics based on analyzed

cases from the FBI (U.S. Federal Bureau of

Investigation 2013), metrics developed through

discussions with healthcare fraud experts, and

metrics found in existing literature (Musal 2010; Ng

et al. 2010; Shin et al. 2012; Tang et al. 2011; U.S.

Government Accountability Office 2012). To

understand the process of fraud metric extraction we

illustrate two examples of fraud cases that helped to

design identifying metrics.

First, in a recent fraud case in New Jersey, a

physician and owner of a home-based physician

services firm for seniors plead guilty for charging

lengthy visits to elderly patients that they did not

receive (District of New Jersey U.S. Attorneys

Office 2013). The physician in dispute received at

least half a million dollars and was eventually

detected because he became the highest billing home

care provider among over 24,000 doctors in New

Jersey from January 1, 2008 through October 14,

2011. Intentional over-billing for services, also

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

686

known as up-coding, is a typical behavior that can be

detected using metrics. Derived from this case was

the ‘visit length’ metric. The comparison of peers

based on the proportion of each visit length could

identify such fraud. The assumption is that criminal

providers may claim a higher proportion of lengthy

patient visits than their peers.

Second, a Texas doctor owned a community

medical center and falsely represented office visits

and diagnostic test that were medically unnecessary

from February 2010 until February 2011 (District of

Texas U.S. Attorneys Office 2013). In exchange for

submitting to diagnostic tests, patients at the clinic

were prescribed controlled substances, incentivizing

the patient to return for follow-up visits. The creation

of fictitious symptoms provided the doctor reason to

prescribe the narcotics and provided plausible

rationale for ordering more tests. An indication for

this type of fraud can potentially be found in the

referral rate. Despite their apparent deteriorating

condition, patients in this case would rarely be

referred to an outside specialist, as this would

obviously reveal that they are healthy. It might also

be found in the amount and/or types of specific tests

the doctors would prescribe to their patients as

compared to peer physicians. A third telling metric

could be patient retention and frequency of visits.

Although most general physicians have returning

patients, when a large proportion of patients return

too often, this would seem quite suspicious and stand

out as compared to peers.

Metric identification is a complex task that

requires the knowledge of both, the health care

domain and statistical theory. In the metric design

process, it requires more than analysis of fraud cases

to find fraud indicators. A group of outliers will

normally consist of some outliers based on statistical

deviation, just by chance, which cannot be filtered

within a single metric. Only when fraudulent

providers will take a more deviant position in the

group of outliers, normal providers may shift to the

non-outlying group, leaving the ‘bad guys’

separated. However, there are always providers that

will be classified as outliers, although they are not

fraudulent, due to the fact that their practice actually

differs too much from the closest comparable peer

group. Filtering this non-fraudulent provider or

moving them to alternate peer groups can be done,

but it is difficult to impossible without significant

understanding of the domain.

Figure 1: Method for Applying Outlier Detection to Healthcare Fraud.

Outlier-basedHealthInsuranceFraudDetectionforU.S.MedicaidData

687

The set of metrics does not necessarily have to be

large; on the contrary, often 25 to 30 features are

sufficient. If hundreds of metrics have to be

designed, the absolute amount of outliers is increased

as well, which eventually will result in all providers

displaying outlying behavior for some metrics.

Metric identification is dependent on fraud experts

and is an iterative process to find a set of metrics that

works effectively. For our case study, we initially

developed over 100 behavioral metrics. This list was

subsequently refined to fifteen that could be applied

to a relatively homogenous provider pool in the

dental domain, feasible for implementation within

our research case constraints.

4.2 Clean and Filter Data

This phase creates a workable set of data for the

analysis. This consists of cleaning the data set and

selecting only the relevant data of those providers to

be analyzed.

The first task relates to data quality, which has to

be estimated in order to determine the precision of

computations. Where data quality may be reduced by

multiple influences, three main concerns are

addressed. First, merging multiple databases of

information about common entities is frequently

encountered in large commercial and government

organizations (Hernández & Stolfo 1998). Second,

there is also the problem of entered data quality.

Health insurance data is subject to quality problems

in various ways. Data entry is often done by hand,

which is shown to be inaccurate in about 4.4% in

cases on personal information, and even higher

percentages when abstracting data (Colin et al.

1994). Third is the use of inaccurate data. Claims are

often incorrectly submitted and adjusted afterwards.

These claims should be removed if possible. Data

cleansing is highly suggested prior to analysis. Data

cleansing will process the data in order to detect and

correct (or remove) corrupt or inaccurate records

from the record set, table, or database.

After cleaning, filtering is required—the task of

selecting only that data which can be used for

analysis. All data containing missing values that

cause the inability to calculate metrics, should be

removed or estimated with imputation. Claims that

are voided from the system will be filtered out from

the data set used for analysis. The result set of claim

transaction data should meet the ISO 8000 data

quality criteria, as far as possible, before continuing

the analysis.

4.3 Select Provider Groups, Compute

Metrics

Providers should be similar so that it is meaningful

to compare their behavior. The main problem is that

the more homogeneous a providers group is,

comparison may be better delineate true outliers,

however, the sample size of providers will decrease

as well. Three questions arise. Is there a minimum

sufficing data quantity that should qualify a provider

for the metric? For example, a provider with only 2

claims per month should probably be excluded.

What is the minimum provider sample size

acceptable to delineate outliers with reasonable

certainty? A group of only 5 providers will likely not

produce trustworthy comparisons. What provider

characteristics can be used to group similar provider

populations suitable for comparisons? Apart from

operating within the same domain or sub-domain,

other provider characteristics may influence the

analysis, such as the provider size or volume of

patients. If a cluster analysis is done to detect such

differences, the cluster criteria would help identify

these different groups.

To apply metrics in analysis, calculations of those

are performed and stored. The data time frame over

which the metric is calculated must be defined. In

our experiment we took a snapshot of provider

behavior for each metric in a time frame.

4.4 Compare Providers by Metric, Flag

Outliers

The analysis interval, the frequency to compute the

metrics and perform the analysis, should be defined.

A reasonable approach in our environment, in which

new data is loaded monthly, is to calculate the

metrics on a monthly basis. We defined

requirements for the computational resources and for

the subject matter experts.

Next, the appropriate analysis techniques and/or

outlier detection methods should be used for each of

the metrics. Examples of analysis techniques used in

our experiment were univariate analysis, multivariate

analysis, time-series analysis, and box-plot analysis.

The following outlier detection methods were used:

deviation from regression model, deviation clusters,

single deviations from clusters, trend deviations, and

peak deviations, making use of both non-parametric

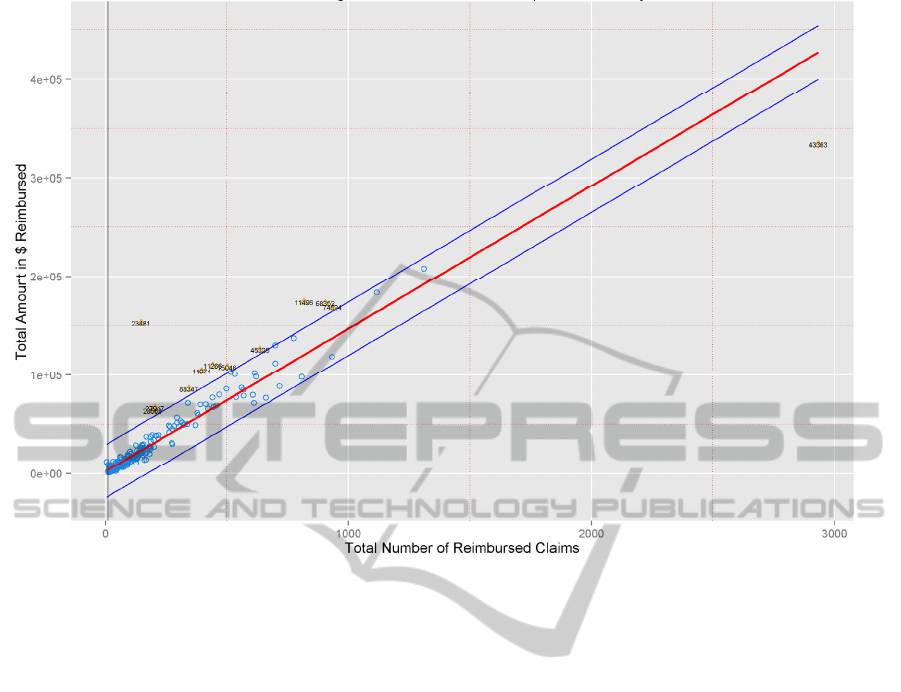

and parametric deviations. In the figures 2–5 we will

show some examples of the different analyses.

Figure 2 shows the regression analysis between

the total dollar amount reimbursed by Medicaid to a

provider, and the number of reimbursed claims. The

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

688

Figure 2: Regression of Reimbursement pre Beneficiary.

red line is the fitted linear model through the data

points. The blue lines represent the 2.33 sigma’s

deviation from the logical model. Provider 23481,

plotted in the left top corner, was one of the

providers that attracted attention, because of its

severe outlying behavior, and would be an

interesting candidate for further analysis to find the

cause of higher average of this provider on

reimbursements.

Outliers influence sample means and deviations

and therefore could mask themselves. This ‘masking

effect’ could be reduced by robust estimation

procedures (Rousseeuw & van Zomeren 1990).

However, we did not use these unmasking

procedures in this study.

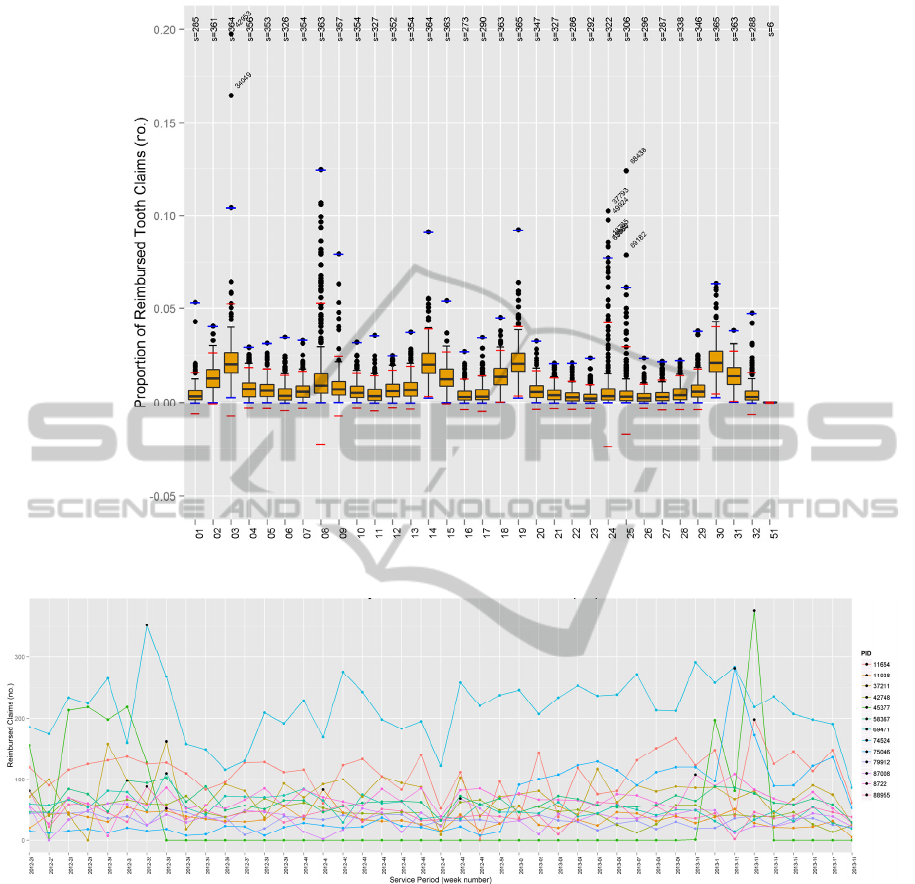

Figure 3 shows the boxplot outlier analysis by

tooth code. Roughly 1–32 are adult teeth. The

assumption is that providers that constantly perform

treatments on the same tooth are interesting.

Previous fraud cases mentioned examples of

providers that claimed exact copies of procedures for

different patients, to receive more reimbursements.

These copies will be visible when we look at the

tooth code, for example.

Another type of fraud that might reveal from this

analysis is the recursive treatment on a tooth. If a

provider fills it with amalgam, repeats it with a

correctional procedure, but finally pulls it and puts a

replacement, many procedures were performed on

the same tooth. Sometimes this happens because of

misdiagnoses, estimation errors, or coincidence. We

took provider 42953 that almost claimed 20% of its

procedures on code 03, about a 140 procedures. To

compare, the second most billed tooth of this

provider appeared 27 times, all other teeth below 10.

The procedures are spread over multiple patients, in

general one or two per patient. Most of the

procedures have code D0120, a periodic oral

evaluation on an established patient. The procedures

are nicely spread over the whole year, around 12 per

month.

Figure 4 shows the time series of a group of

providers with outlying peaks. Those providers with

a constant flow of claim submissions were compared

to see if sudden increases in claim numbers could be

found. The black dots represent the outlying peak

that has been identified. One interesting finding is

the green line (42748). The provider is not claiming

for patients and suddenly around week 13, he claims

over 300 patients per week. Simple explanations

might be the use of multiple Medicaid provider IDs,

or a wrong registration of specialty, namely the

provider corresponds to a mobile dental practice.

Outlier-basedHealthInsuranceFraudDetectionforU.S.MedicaidData

689

Figure 3: Tooth Code Analysis.

Figure 4: Peak Analysis: Time Series with Outliers of Reimbursed Claims.

Another provider that lighted up on this figure was

provider 75046. Questionable is the sudden peak in

week 12 of 2013. The number of claims rises from

around a 100 claims per week, to almost 300. After

analysis on a service code level we found suspicious

claims. Many children that visited the clinic that

week received exactly the same treatments, only on

different teeth. The combination of codes to reappear

so frequently can’t almost be a coincidence and

should definitely be further investigated.

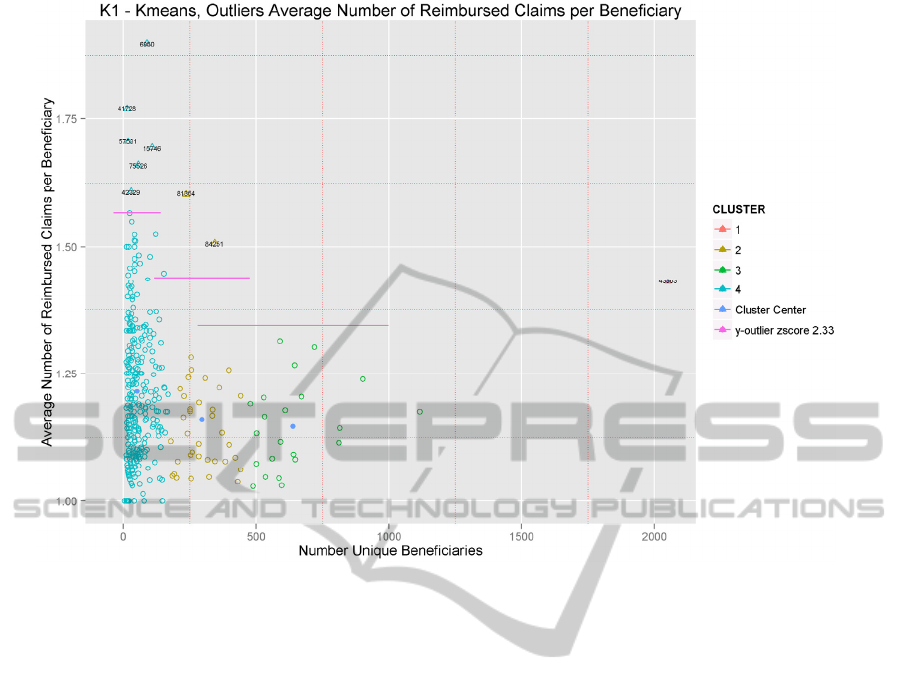

Figure 5 shows the combination of multivariate

clustering and outlier detection. All data points

exceeding the pink line represent 2.33 sigma’s

deviation in the extreme y direction from the cluster

mean. Marked outliers thus have a considerable high

average of reimbursed claims per beneficiary.

Several reasons are possible for this phenomenon;

not all related to fraud. There could be strict

examination intervals to provide the best care, where

many people will see the dentist on a regular basis,

although this is costly. The maximization of the

reimbursement under Medicaid could be another

reason for a high average. Looking at provider 6950,

an analysis at the claim level was done. We found

that the high claiming behavior was caused by the

decoupling of services over multiple claims. When

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

690

Figure 5: Multivariate Clustering and Outlier Analysis.

patient, service date, and treating dentists were

identical, services were just send in as two claims.

Does the provider decouple the claims to try to hide

something, or is it an administrative error?

4.5 Predictors Form Suspicion for

Provider Fraud Detection

An important aspect is how to report an anomaly and

how to relate it to indication of fraud. Once an

outlier criterion has been exceeded by a provider, we

raise a flag for the provider in that period. A flag is

the identification of an anomaly detected by the data

mining algorithm. Scoring is the formula of the

individual predictors for fraud detection based on the

individual results of each of the outliers in provider

analysis. The proposed scoring is a way of stacking

suspicion. A single provider analytic will flag some

honest providers. The assumption of using scoring to

find the most interesting providers to investigate for

fraud is that it will find those providers that are

frequent outliers on multiple predictors.

4.6 Report and Present to Fraud

Investigators

Fraud investigators need flexible reporting. In our

view, there is no specific pre-defined way for

reporting the data. A combination of dashboards and

interactive multidimensional processing is therefore

recommended. On the dashboard level we provide

high level information on providers, by presenting

the provider metric results, alerts on those providers

that score deviant from others or on their history.

Within comparative analysis, we enable

investigators to drill down to the root of a claim to

learn how deviations might have occurred and to

collect the set of claims that needs further

investigations. A list of alerts and their scores might

be a starting point for investigators to begin their

analysis.

4.7 Metric Evaluation

Evaluation of predictor effectiveness is required to

make decisions for analyses and further metric

developments. Measuring “success” is a difficult

process since fraud is not established as fraud until

after a litigation. Given the years of time lag,

measuring convictions as justification for resource

allocation and input for iterative improvement is

suboptimal. Measuring investigations and audits

initiated by fraud experts after internal review is

certainly timelier and may be sufficiently reliable. If

Outlier-basedHealthInsuranceFraudDetectionforU.S.MedicaidData

691

fraud investigation initiations are chosen as

evaluation statistics, we may use the formulas of

precision and recall to calculate the effectiveness of

the method. A downside is that fraud investigations

might be systematically wrong initiated distorting

the effectiveness measurements. Fraud convictions

might eventually provide the contrary evidence,

however, we believe that fraud experts are capable

of interpreting these measurements meaningfully.

Thresholds, or configuration of the outlier detection

algorithms influence the classification of data points

as outliers. Restrictive outlier groups may minimize

the number of potential fraud, while less restrained

classification lead to false positives. The trade-off

may be measured in terms of precision and recall

(Aggarwal 2013).

5 EVALUATION: MEDICAID

DENTAL PROVIDERS CASE

STUDY

We performed a case study in which dental claims

were analyzed on 14 different metrics. The seven

stages to develop a successful fraud detection tool

were followed and one iterative cycle was

completed. A study on dental fraud has not been

reported so far in literature, although it represents a

large part of the Medicaid healthcare expenses.

Dentistry is also a large and homogeneous group of

providers that fit the criteria for the developed

methodology well. An attempt was made in

selecting metrics fitting within multiple known

categories where fraud could be found.

5.1 Data, Metrics, and Parameters

For the case study, 11 months of Medicaid records

from July 2012 until May 2013 were used for

analysis, containing about 650.000 dental claims.

The start date was the first of April 2013. To

enhance peer group homogeneity, we chose to take

only regular dental providers without any specialty

as our provider group. Before calculation, data was

processed for adjustments and cleaned for entries

containing incorrect data such as null values, zero

dollar payments, adjustments without original

claims, and future servicing dates.

The metrics were computed using Oracle SQL

Procedures and stored in database tables. Using the

R language, scripts were developed to calculate and

compare providers. The analyses developed in R

made use of built-in functionality extended with

statistical packages such a ’ggplot2’ and ’cluster’

required for functions such as fitting rule-based

models, k-means algorithms, and boxplots. The

application made use of a parameter file to configure

the analysis by example set data filter criteria, outlier

criteria, write back capabilities, and presentation

characteristics.

The minimum requirements for analysis varied

over the different types of analyses, as some metrics

required larger data sets to achieve significant

results. The baseline for a provider to be taken for

analysis was set to a minimum of either 10 unique

beneficiaries or $10,000 reimbursed per month.

Some of the predictors, such as the procedure code

analysis, required a minimum service amount per

year.

In the regression analysis, a deviation of 2.33

sigma from the underlying regression model was

considered to be an outlier. In the univariate analysis

we took the highest cluster, those providers that

scored as a group the highest for the specific metric.

In the multivariate analysis, using k-means

clustering, outliers were defined by the outlier

criteria, single data points deviating more than 2.33

sigma in y direction from its belonging cluster, or

outlier cluster if smaller than 5 items. Clusters were

formed using the k-means algorithm, set to 10

iterations. In the box-plots, the interquartile ranges

defined the outlier criteria, configured for each

metric separately.

As described in the methodology, a scoring

mechanism is suggested for pointing out the most

interesting cases to investigate. The scoring

algorithm would make use of the number of flags,

the importance value that has been assigned to a flag,

and partly of the provider flagging history. In this

study, the history was ignored due to the limited

length of the data set, and, as an initial full cycle,

flags for each of the metrics were equally weighted

to evaluate their impact and relevance.

5.2 Results

Beginning with a data set of over 500 dental

providers, the set was narrowed to roughly 360

providers through selection criteria. After

performing the analysis, only 35 providers raised 2

or more of the potential 14 predictive flags. 17

providers raised 3 or more flags. We focused on

these 17 providers to evaluate the potential efficacy

of the approach.

We interviewed qualified healthcare fraud subject

matter experts to evaluate the claims of and the

raised flags by these 17 providers. While some of the

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

692

flags could be understood as acceptable given the

types of services rendered or due to the provider’s

operating environment, there was a preponderance of

evidence suggesting that at least 12 of these 17

providers (71%) with three or more flags should be

immediately referred for audit and potentially to law

enforcement.

6 CONCLUSIONS AND FUTURE

RESEARCH

We structure our design science contribution

according to the Hevner et al. (2004) framework and

address a relevant problem in healthcare fraud

detection. This paper offers an artifact and a

description of a method for applying outlier

detection to healthcare fraud along with an

evaluation of this model in practice to a state-wide

database of actual healthcare claims with over 500

providers. The model is evaluated by applying it in

practice to actual healthcare data and having experts

review the results of the analysis. The paper

contributes to the literature by providing a roadmap

for future applications of outlier detection in

healthcare and potentially other corollary domains.

We used the domain context of Medicaid and

discussed considerations for its use in different data

contexts. We communicated the model to

stakeholders, including applying the overall process

and specific scoring methods in practice.

Through this research, we learned many insights

about antifraud efforts. Extensive healthcare subject

matter expertise is required to design analysis

techniques and interpret their results. Identifying 17

out of 360 (5%) primary dental providers for further

investigation, of which 12 of 17 (71%) have been

evaluated and deemed appropriate for formal

investigation can be considered a successful

outcome. As compared with prior comparative

success rates of roughly 10% (Major & Riedinger

2002), we see great opportunity in building upon this

model in various ways. Future research will dive

deeper, including evaluating specific outlier

techniques relevant to different types of healthcare

fraud, and look more broadly at methods and models

for storing and preserving the scoring metadata and

provenance information to allow for more automated

scoring, model adaptability, and reconstruction. With

this research we hope to both advance the state of the

art in healthcare fraud detection and prevention, as

well as materially assist tax payers and law

enforcement in confronting this important societal

challenge.

REFERENCES

Aggarwal, C. C., 2013. Outlier analysis, New York:

Springer.

Aral, K. D. et al., 2012. A prescription fraud detection

model. Computer Methods and Programs in

Biomedicine, 106(1), pp.37–46.

Bolton, R. J. & Hand, D. J., 2002. Statistical fraud

detection: A review. Statistical Science, 17(3),

pp.235–255.

Colin, C. et al., 1994. Data quality in a DRG-based

information system. International Journal for Quality

in Health Care, 6(3), pp.275–280.

Department of Health and Human Services, 1998.

Medicare A/B Reference Manual - Chapter 21 -

Benefit Integrity and Program Safeguard Contractors.

Available at: https://http://www.novitas- solutions.

com/refman/chapter-21.html [Accessed February 21,

2013].

District of New Jersey U.S. Attorneys Office, 2013. South

Jersey Doctor Admits Making Half-a-Million Dollars

in Fraud Scheme Involving Home Health Care for

Elderly Patients. Available at: http://www.fbi.gov/

newark/press-releases/2013/south-jersey-doctor-

admits-making-half-a-million-dollars-in-fraud-

scheme-involving-home-health-care-for-elderly-

patients [Accessed March 28, 2013].

District of Texas U.S. Attorneys Office, 2013. Physician

Pleads Guilty to Role in Health Care Fraud

Conspiracy. Available at: http://www.fbi.gov/dallas/

press-releases/2013/physician-pleads-guilty-to-role-in-

health-care-fraud-conspiracy [Accessed March 1,

2013].

Forgionne, G. A., Gangopadhyay, A. & Adya, M., 2000.

An intelligent data mining system to detect healthcare

fraud. In Healthcare information systems: challenges

of the new millennium. Hershey PA: IGI Global, pp.

148–169.

Hernández, M. A. & Stolfo, S. J., 1998. Real-world data is

dirty: Data cleansing and the merge/purge problem.

Data mining and knowledge discovery, 2(1), pp.9–37.

Hevner, A. R. et al., 2004. Design Science in Information

Systems Research. MIS Quarterly, 28(1), pp.75–105.

Iyengar, V. S., Hermiz, K. B. & Natarajan, R., 2013.

Computer-aided auditing of prescription drug claims.

Health Care Management Science, (July), pp.1–12.

Kelley, R. R., 2009. Where can $700 billion in waste be

cut annually from the US healthcare system? Ann

Arbor, MI: Thomson Reuters, TR-7261 10/09 LW.

Lu, F. & Boritz, J. E., 2005. Detecting fraud in health

insurance data: Learning to model incomplete

Benford’s law distributions. In Machine Learning:

ECML 2005. Springer, pp. 633–640.

Major, J. A. & Riedinger, D. R., 2002. EFD: A Hybrid

Knowledge/Statistical-Based System for the Detection

Outlier-basedHealthInsuranceFraudDetectionforU.S.MedicaidData

693

of Fraud. Journal of Risk and Insurance, 69(3),

pp.309–324.

Musal, R. M., 2010. Two models to investigate Medicare

fraud within unsupervised databases. Expert Systems

with Applications, 37(12), pp.8628–8633.

Ng, K. S. et al., 2010. Detecting Non-compliant

Consumers in Spatio-Temporal Health Data: A Case

Study from Medicare Australia. In Data Mining

Workshops (ICDMW), 2010 IEEE International

Conference on. pp. 613–622.

Ortega, P. A., Figueroa, C. J. & Ruz, G. A., 2006. A

Medical Claim Fraud/Abuse Detection System based

on Data Mining: A Case Study in Chile. In

Proceedings of the 2006 International Conference on

Data Mining. DMIN. Las Vegas, Nevada, USA:

CSREA Press, pp. 224–231.

Phua, C. et al., 2010. A comprehensive survey of data

mining-based fraud detection research. arXiv preprint

arXiv:1009.6119.

Rousseeuw, P. J. & van Zomeren, B. C., 1990. Unmasking

Multivariate Outliers and Leverage Points. Journal of

the American Statistical Association, 85(411), pp.633–

639.

Shan, Y. et al., 2008. Mining Medical Specialist Billing

Patterns for Health Service Management. In

Proceedings of the 7th Australasian Data Mining

Conference - Volume 87. AusDM ’08. Darlinghurst,

Australia, Australia: Australian Computer Society,

Inc., pp. 105–110.

Shin, H. et al., 2012. A scoring model to detect abusive

billing patterns in health insurance claims. Expert

Systems with Applications, 39(8), pp.7441–7450.

Sparrow, M. K., 2000. License To Steal: How Fraud

bleeds america’s health care system Updated.,

Boulder: Westview Press.

Tang, M. et al., 2011. Unsupervised fraud detection in

Medicare Australia. In Proceedings of the Ninth

Australasian Data Mining Conference-Volume 121.

pp. 103–110.

Thornton, D. et al., 2013. Predicting Healthcare Fraud in

Medicaid: A Multidimensional Data Model and

Analysis Techniques for Fraud Detection. Procedia

Technology, 9, pp.1252–1264.

Travaille, P. et al., 2011. Electronic Fraud Detection in the

US Medicaid Healthcare Program: Lessons Learned

from other Industries.

U.S. Federal Bureau of Investigation, 2013. FBI news

blog. Available at: http://www.fbi.gov/news/

news_blog [Accessed April 18, 2013].

U.S. Government Accountability Office, 2012. Medicare

Fraud Prevention: CMS has Implemented a Predictive

Analytics System, but Needs to Define Measures to

Determine its Effectiveness. Available at:

http://www.gao.gov/products/GAO-13-104 [Accessed

March 28, 2013].

Weng, X. & Shen, J., 2008. Detecting outlier samples in

multivariate time series dataset. Knowledge-Based

Systems, 21(8), pp.807–812.

Yamanishi, K. et al., 2004. On-line unsupervised outlier

detection using finite mixtures with discounting

learning algorithms. Data Mining and Knowledge

Discovery, 8(3), pp.275–300.

Yang, W.-S. & Hwang, S.-Y., 2006. A process-mining

framework for the detection of healthcare fraud and

abuse. Expert Systems with Applications, 31(1),

pp.56–68.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

694