Environmental Disclosure

From the Accounting to the Report Perspective

Francisco Carreira

1

, Ana Damião

1

, Rute Abreu

2

and Fátima David

2

1

Setúbal Polytechnic Institute, Campus do IPS, Estefanilha, 2914-503 Setúbal, Portugal

2

Guarda Polytechnic Institute, Av. Dr. Francisco Sá Carneiro, 50, 6300-559 Guarda, Portugal

Keywords: Environmental Index, Disclosure, Accounting, Reporting.

Abstract: This paper focus on the environmental disclosure (ED) promoted by firms, due to the strong demand for

information and identification of the relevant data that pursuit the new legal requirements. The methodology

is separate, by one side, on the theoretical framework based on the disclosure of environmental information

(EI) and the true and fair view based on the accounting perspective. Indeed, the paper provides an

understanding of the Patten (2002), Clarkson et al. (2008) and Monteiro (2007) researches. And, by the

other side, the empirical analysis, at longitudinal and exploratory level, measures the degree of disclosure of

the environmental information based on the report perspective. The authors present an Environmental

Disclosure Index (EDI) and discuss the increase of the environmental reporting (ER) over the time and

disclosure level of items published in the firms’ annual reports listed on the Lisbon Euronext Stock Market,

during the period of 2007-2009.

1 INTRODUCTION

Environmental information (EI) must help the

society and firms to recognize the impact on the

environment of business decisions (Milne and

Patten, 2001; Kuk et al., 2005). Information systems

as Carlson et al., (2001) argue: “By making use of

current business information technology, such as

Internet-accessible tools, and industrial

environmental management tools, standards, policies

and legislation an information system for EI

management has been designed”. The constant need

of information from the EI system help managers to

identify environmental risks, structure of costs and

investments which need a challenge to be faced by

firms. The environment could not be defended only

by strictly economic results (Mendes, 2007). Indeed,

environmental accounting and its reporting are,

mostly, made by a voluntary character, especially

when they concern the natural environment. The

requirements of environmental standards, issued by

International Organization for Standardization (ISO)

have been the basis to many researches on

environmental responsibility. To meet these

demands (Fernando et al., 2010) the corporate

annual report (AR) and accounting information

system have been considered as one of the important

information systems to communicate with firms’

stakeholders. From the literature, Gray and Collison

(2002) says that the concept of sustainable

development appears to challenge or defy different

measures within the financial accounting economic-

based model, which are nowadays the main factors

of corporate success. According to this concept

economic development and the natural

environment’s protection are jointly treated and not

apart (Barros, 2008). The methodology used is: first,

as a qualitative research to understand the meaning

that firms and managers have pointed out to the

environmental disclosure (ED): how people make

sense of their world and the experiences they have in

it (Merriam, 2009); and second, as a quantitative

research to identify concepts, comparable metrics

and make statistical treatments to classify as relevant

management or accounting as a major challenge

(van Dijk et al., 2014). First, authors discuss the

literature review on the disclosure of EI; Second,

authors present an empirical analysis, which

describes the research methodology, the sample

used, the data collection process and the hypotheses

tested, as well as, the results obtained. Third, authors

present the conclusions, limitations and proposals

for future research.

496

Carreira F., Damião A., Abreu R. and David F..

Environmental Disclosure - From the Accounting to the Report Perspective.

DOI: 10.5220/0004973604960501

In Proceedings of the 16th International Conference on Enterprise Information Systems (ICEIS-2014), pages 496-501

ISBN: 978-989-758-029-1

Copyright

c

2014 SCITEPRESS (Science and Technology Publications, Lda.)

2 ENVIRONMENTAL

DISCLOSURE

The disclosure of EI is based on the document

analysis as it is been promoted by Bowen (2009).

Several studies show concerns about sustainability

reporting, such as: Gray (2002, 2006), Gray and

Collison (2002), Sahay (2004), Byrch et al. (2007).

Although, ED is already a widespread tendency in

large and small and medium firms, it does not

address these issues on their AR (Sahay, 2004; Chan

and Welford, 2005). Indeed, it constitutes a

challenge to firms whose current environmental

focus are presented on monetary terms (Lamberton,

2005; Cho and Patten, 2007). Another example are

the corporate AR that, usally, disclose their “good”

business practices that ensure the sustainability of

the business in order to contribute to the

maximization of shareholder value, but nothing

related to the “bad” business practices of the

environment (Chan and Welford, 2005). But, there is

a danger of transmitting a false image of firms’

reports, emphasizing those that are managed

positively (Lamberton, 2005; DeVilliers and van

Staden, 2006). Niskala and Pretes (1995) say that

there are evidence about environmental reporting

(ER) to be subjective, because the ED can change

due to the voluntary basis. Neyland (2007) argues

that these informations give more transparency to

AR. Other example of disclosure could be the

publication of standards by National Entities or

Standard Setting Bodies in different countries about

environmental responsibility. In Portugal there is a

Accounting and Financial Reporting Standards 26 -

Environmental Issues (CNC, 2009), that prescribes

the accounting treatment for EI in terms of

recognition, measurement and disclosure. However,

entities with securities listed on regulated markets of

the member States of the European Union (EU) and

with consolidated accounts, do not apply this

standard. In these cases, the application of the

International Accounting Standards issued by the

International Accounting Standards Board (IASB) is

mandatory, since January 2005 (CNC, 2005).

Undeniably, Monteiro (2007) has identified some

factors that explain the ED practices in large firms

that operate in Portugal. Main factors could be

significantly associated with the prominence of ED

among the firms included in the sample, in order to

ascertain as to the existence of a significant (positive

or negative) relationship between ER and financial

performance. These concepts and ER seems to

identify several variables based on financial

accounting and as currently business success factors

(Gray, 2002). As van Dick et al. (2014) defends “the

most important challenge to sourcing environmental

data is not always data collection per se, but often

rather that collected data are too unlike,

insufficiently described, and notmachine readable

and therefore cannot (easily) be used in national

accounts and reports”. So, this research seeks to

analyse the ED on behalf of good practices

promoted by the firms listed on the Euronext Stock

Market which it will be associated with other

variables from the firms’ AR disclosures.

3 EMPIRICAL RESEARCH

There is a theoretical assumption that the disclosure

on environmental and social issues has a potential

impact on the companies’ economic and financial,

environmental and social performances (Gray,

2006), because it is thought that sustainability

reporting might improve corporate behavior. Many

authors have been analysed the firms’ AR (Niskala

and Pretes, 1995; Patten, 2002; DeVilliers and van

Staden, 2006; Cho and Patten, 2007). Al-Tuwaijri et

al. (2004) show that the relationships between ED,

environmental performance and economic

performance relates these three aspects, two by two.

Regarding the relationship between social and ED

and financial performance, conclusions have not

been entirely clear (Gray, 2006). There are many

reasons for this inconclusiveness, i.e., users of

financial information, and stakeholders of firms that

may or may not recognize the added value of the

environmental and social nature disclosures. One of

the main issues that firms must disclosure to their

stakeholders is the AR (DeVilliers and van Staden,

2006). This has been the main data source for most

empirical studies on the ED (Barros, 2008). The

methodology used in most cases is the content

analysis and it aims to assess as to whether a

significant, positive or negative, relation between the

ED matters and some corporate factors, considered

as part of the economic and financial performance,

may be established. In this research it was necessary

to study the population of the listed firms on the

Lisbon Euronext Stock Market, during 2007-2009.

In depuration process, the research concentrates

mainly in the firms that belong to the PSI-20 Index.

However, the final sample is not represented by 20

firms, reported to a certain date. Indeed, this study

considers 24 firms that remained throughout that

period as well as those that entered, continuing to

consider the data of those that were excluded from

the index under review. After the sample

EnvironmentalDisclosure-FromtheAccountingtotheReportPerspective

497

identification, we consulted the public avaliable

information, through the websites of each firm and

identify the industry sectors. In the qualitative

component, we conduct a content analysis of each

AR and construct an EDI, following the studies of

Patten (2002), Cho and Patten (2007) and Monteiro

(2007). Also, Clarkson et al. (2008) developed a

content analysis index, based on the GRI reporting

guidelines to assess the level of discretionary ED in

environmental and social responsibility reports

(GRI, 2014). They included this information in the

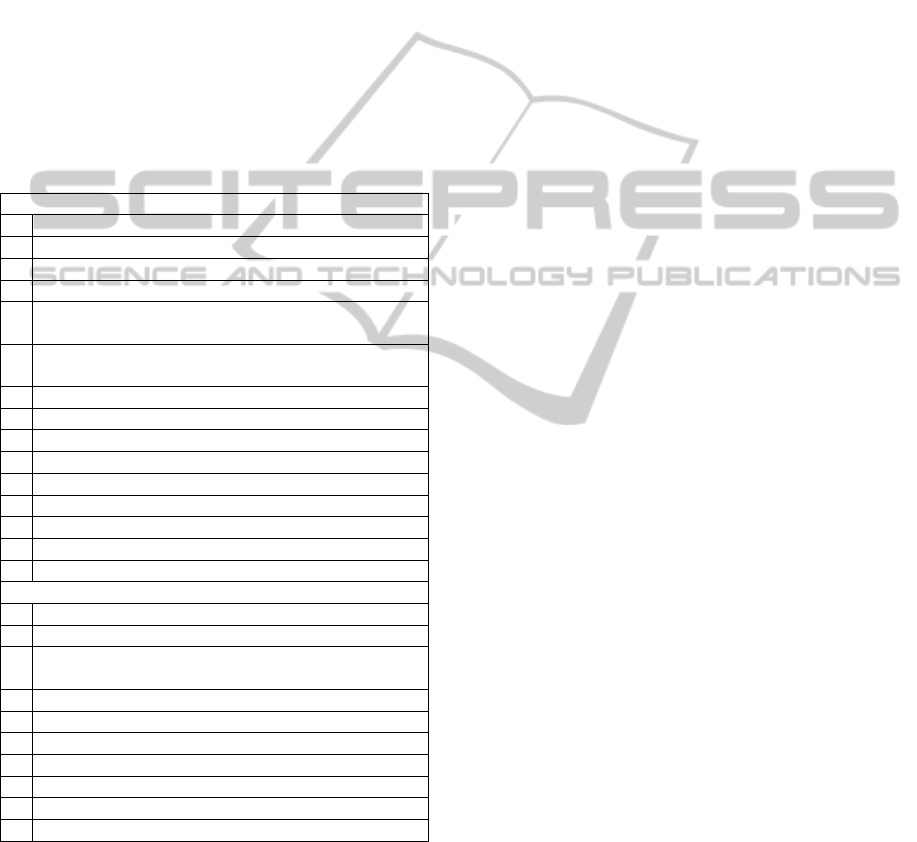

model as their ED variable presented in Table 1.

The main purpose of EDI will measure the extent of

information based on the firms’ AR and it applies a

scoring system awarding zero points in the absence

of the item or one point in their presence.

Table 1: Items include on Environmental Disclosure Index.

Annual Report

A Environmental programmes and policies

B Preventive measures/environmental protection

C Compliance with environmental regulations

D Reference to certification

E

Environmental investments/capital expenditures

(past and in the current year)

F

Environmental performance/risks and impact on the

environment (quantitative information)

G Environmental indicators

H Environmental management system

I Training on the environment

J External environmental audit

K Future environmental investment & expenditures

L Awards and recognition related to the environment

M Mention of improvements made year by year

N Mention of an environmental/sustainability report

O Initiative, awareness campaign, study, conferences

Annex

P Measurement criteria related with the environment

Q Environmental incentives

R

Environmental expenditures allocated to results

(expenses: operating costs)

S Environmental capitalized expenditures (investment)

T Environmental liabilities

U Environmental contingent liabilities

V Environmental provisions

W Fees/penalties relating to environmental issues

X Heading: "Information on environmental matters"

Y Heading "CO2 licenses"

In the quantitative component, we develop a

descriptive and multivariate statistical analysis to

test the 3 hypotheses formulated below (Hair et al,

2005; Greene, 2012). According to Monteiro (2007),

the analysis is based on the following variables:

Environmental Reporting. After the exploratory

study of the AR of the sample firms, we evaluate all

environmental items classified them according to the

items listed in Table 1 as required to be disclose in

the reports according to the NCRF 26. This standard

is applied to non-listed firms or to those firms

excluded from consolidation procedure. The

intention was to verify if these firms disclosure the

information in the consolidated AR, because the

statements are representative of an entire group of

firms and this type of information on the

environment has been considered increasingly

relevant over time and it cannot be totally

disregarded or overlooked when disclosing

information about the whole group. The score of the

EDI of each firm is obtained by dividing the total

score for a firm by the number of points awarded

(Monteiro, 2007).

Firm Size. According to

Hackston and Milne (1996), Legitimacy Theory

withholds arguments for the existence of a size-

environmental disclosure relationship. Firm size is

an important factor in the disclosure of

environmental matters since it has been shown in

previous empirical studies that it is the larger

companies that tend to disclose this type of

information, according Stray and Ballantine (2000).

Previous empirical evidence has shown that firm

size has been indicated as a key determinant of the

quantity of ED (Knox et al., 2005; Monteiro, 2007).

According to Hackston & Milne (1996) the proxy

used is Total Net Asset as presented on the balance

sheet.

Profitability. Neves (2002) and Penman

(2013), state that a firms’ financial performance can

be analyzed using both accounting and market

variables, knowing that accounting information is

based on past performance while the market

information is based on the investors expectatives

about the firms performance. Acording to Neves

(2002), Cho et al. (2010) and Penman (2013), the

proxy used is Return on Assets as a measure of the

performance.

Economic Sector. It is also important

to consider the economic sector to which a firm

belongs because several sectors have different

informational levels, but within each sector there are

also significant differences in disclosure (Leote and

Rita, 2008). In this exploratory study, the variable

that distinguishes the economic sector depends on

the impact they have on the natural environment

(more or less significant). It is a dichotomous

variable to identify sectors that are less “critical”,

such as: financial activities (banks), media, and

information technology with zero; and if the firm

belongs to a “critical” sector, such as all the others,

with one. This classification is subjective and as

Monteiro (2007) states: “any ad hoc grading is

necessarily accompanied by a high dose of

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

498

subjectivity”. The hypotheses are expected to

influence the disclosure of EI by the sample, then we

will answer to the significant relationships between

diferente variables and disclosure of EI. The first

hypothesis has been formulated: H

1-0

: There is no

significant relationship between firm size and

environmental disclosure. This variable appears

positively related to social and ED. Larger firms

disclosure more information on these matters

(Barros, 2008) and Patten (2002) says: “larger

companies, (...), tend to disclose more information

than smaller firms”. Similar conclusion has been

reached by Sahay (2004), Monteiro (2007) and Cho

et al. (2010). This can be due to the fact that larger

firms have greater visibility and consequently, social

and ED can be a way to gain a better corporate

reputation (Gray, 2006; Sánchez and Sottorrío,

2007). Due to this increased visibility, Knox et al.

(2005) and Barros (2008) also indicate that the

larger firms may be subject to greater pressure from

the general public and that this “makes these present

greater amounts of information” (Barros, 2008:38).

By other perspective, the second hypothesis has

been formulated: H2-0: There is no significant

relationship between profitability and environmental

disclosure. As Cho et al. (2010) defend: although

not as consistently documented as firm size and

industry affiliation, profitability (has) been shown to

be significantly associated with ED. Barros (2008)

argues that the relationship between the firms’

profitability and the ED has been studied by several

authors, but this relationship has been difficult to

evaluate. Some of other studies mentioned by

Monteiro (2007) and Barros (2008) reveal no

significant relationship between profitability and

disclosure on social responsibility, such as Hackston

and Milne’s (1996). The studies that suggest a

positive relationship between these two aspects are

fewer in number (Teoh et al., 1998; Suwaidan et al.,

2004). The third hypothesis has been formulated:

H3-0: There is no significant relationship between

economic sector and environmental disclosure. The

economic sector in which the firm operates seems to

be related to the good ED practices (Sahay, 2004;

Knox et al., 2005; Monteiro, 2007). DeVilliers and

van Staden (2006) argues that “prior research

indicates company size and industry are strong

predictors of the quantity of environmental

disclosures”. The economic sectors with greater

environmental impact are subject to a wide variety

of environmental legislation (Barros, 2008). Firms

find themselves obliged to make public their

environmental performances and actions (Monteiro,

2007). Patten (2002) argues that “firms from

industries that have high sensitivity to potential

environmental legislation, petroleum, chemical,

metals, and paper industries, tend to make more

extensive disclosures than firms from less

environmentally sensitive industries.” The data

collected was processed and statistically analyzed

using SPSS – version 17.0 for Windows. The EDI

measures the degree of

ER in the firms listed in the

sample. These values show several firms that reach a

higher score of EDI, i.e. disclosure more EI items

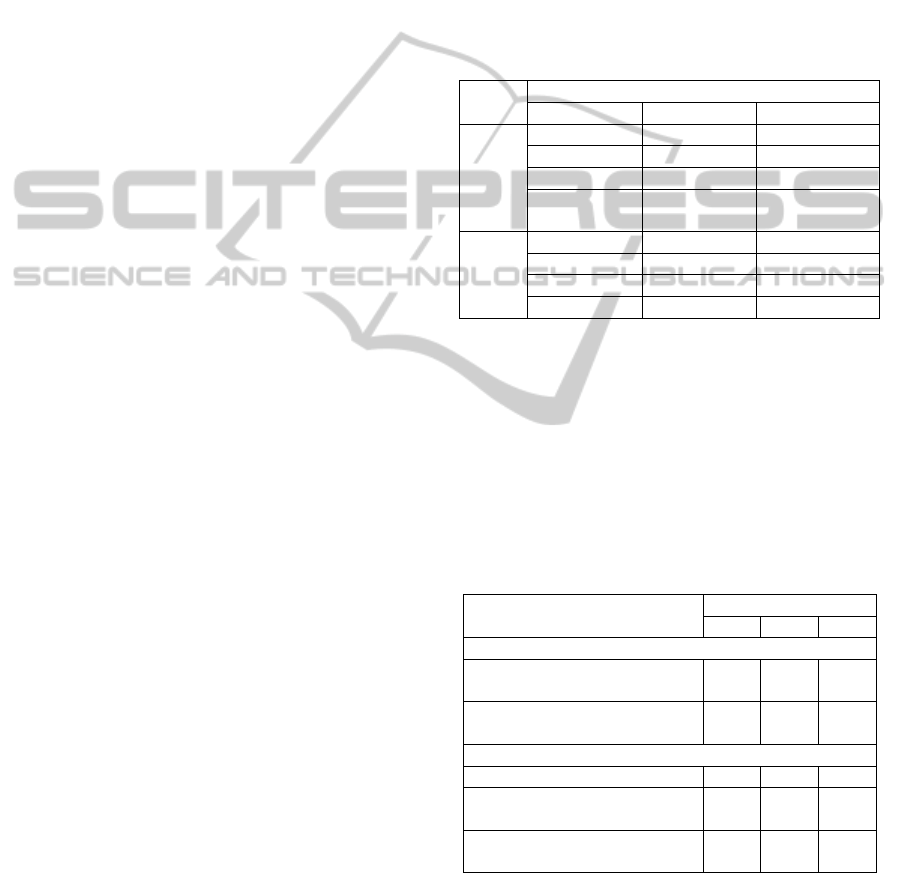

and others that get less score as shown in Table 2.

Table 2: Firms disclosure in EDI, 2007-2009.

Firms Environmental Disclosure Index

2007 2008 2009

M

ore disclosure

items

Portucel=0,64 Portucel=0,72 EDP = 0,88

Semapa=0,60 Semapa = 0,72 EDPR = 0,84

Cimpor=0,56 EDPR = 0,72 Semapa = 0,72

Galp=0,56 Galp = 0,60

Portucel;

Galp=0,68

Less

disclosure

items

Cofina=0,00 Cofina =0,00 Cofina = 0,00

Novabase=0,00Novabase=0,00 Impresa = 0,08

ZON = 0,00 ZON = 0,04 BPI = 0,12

BCP= 0,04 BCP = 0,04 BES = 0,16

Table 3 presents firms that disclose more items

than those that belonging to industry sectors with a

significant impact on the natural environment:

building materials and fixtures, oil and gas,

electricity, and paper. Those firms that disclosure

less have minor impact on the environment, such as:

three banks, two media branches firms and two

belonging to information technology and

entertainment sectors.

Table 3: Items disclosure in EDI, 2007-2009.

Number of firms

EDI

2007 2008 2009

More Disclosed Items

A-Environmental programmes

and policies

15 17 21

B-Preventive measures and

environmental protection

14 16 18

Less Disclosed Items

J-External environmental audit 1 --- ---

U-Environmental contingent

liabilities

3 2 2

W-Fees/penalties relating to

environmental issues

--- 1 1

The first two hypotheses were tested by examining

the correlations between variables. For this purpose,

we based on Hair et al (2005), Jain and Aggarwal

(2011) and Greene (2012). The Pearson’s statistics

allows to analyze whether the variables are

positively or negatively correlated and whether the

EnvironmentalDisclosure-FromtheAccountingtotheReportPerspective

499

relationship between them is strong or weak.

Associated to this, we have the significance level (or

p-value), which concludes with the relationship

between two variables is statistically significant or

not. The smaller value, then better indicator when <

0,05. Hypothesis 1 (Firm Size). The correlations

between the firm size and the EDI are negative

throughout the three-year period. Thus, one of these

variables tends to increase, when the other decrease.

Also, the correlation is weak because Pearson’s

statistics is very low (24% in 2007, 25% in 2008 and

only 7% in 2009). This may imply that the two

variables are not directly associated at all. According

to the statistic results, the association between firm

size and the ED level is not statistically relevant,

whereby hypothesis 1 is not supported. Hypothesis 2

(Profitability). The correlation between the

profitability and EDI, during 2007-2008, Pearson’s

statistics is above 50%, demonstrating a positive and

significant relationship between the profitability and

EDI. However, in 2009, the significance level

persists on p-value equal to 0,749, despite the

positive correlation. Pearson’s statistics is only 7,2%

in 2009, reflecting a much weaker relationship

between the variables than during the two previous

years. The correlations between profitability and

EDI present mixed values. The association between

two variables is therefore inconclusive, then it is

reject hypothesis 2. These results are similar to those

of Freedman and Jaggi (1988), Belkaoui and Karpic

(1989), Roberts (1992), Gray (2006), as opposed to

those of Al-Tuwaijri et al. (2004), Teoh et al. (1998),

Suwaidan et al. (2004) who found a positive

relationship between profitability and ED.

Hypothesis 3 (Economic Sector). The T-test of the

economic sector and the EDI present large

differences between the mean values of the

economic sectors classified as “non critical” and

those classified as “critical”, over the three years.

Also, it is possible to conclude that the firms that

belong to “critical” sectors, on average, disclosure

more EI than those belonging to “non critical”

sectors. The average values for the “critical” sectors

are substantially higher than those of “non-critical”

sectors. These same values, in both cases, tend to

increase over these three years, which means that the

sample tends to gradually increase the ED and

determined a significant relationship between the

type of economic sector in which a firm operates and

its ER level: Niskala and Pretes (1995), Sahay

(2004), Knox et al. (2005), Monteiro (2007).

Hypothesis 3 in our study is supported.

4 CONCLUSIONS

The ED is a topic that has gained interest of many

researchers from the accounting to the report

perspective. Although, there is separation in the

voluntary and mandatory nature of the AR, the last

one is based on the accounting theory that obliges to

use a more rigorous AR. The voluntary disclosure

aims to answer to the report perspective of the ED

focuses on the socio-political theories. Further

evidence to support the previous arguments appears

from the EDI that aim to measure the degree of

disclosure of environmental report in firms

comprised in sample, following Patten (2002),

Clarkson et al. (2008) and Monteiro (2007). The

EDI values, over the three years, tend to increase

which allows authors to conclude that the disclosure

level of ER has increased over time and there have

been more and more items of environmental matters

published in the firms’ AR. However, we must not

forget that the EDI values for one firm are not

directly comparable with another. Despite these

findings, several issues remain unsolved with this

literature. One is related with size sample, because

24 firms introduce sample bias to the relevance of

the statistical result. Another limitation is the firm

size, which it could introduce size bias due to

several reasons that led to the rejection of the first

hypothesis and the size of these listed firms is still

far from the classification as Small and Medium

Enterprises. The EDI based on NCRF 26 allows

firms in the sample to not apply these items from the

accounting standard. The data collecting method was

limited to the content analysis of the AR. It is only

public available information and the degree of bias

in these narratives varies systematically with the

expert environment that exhibit significantly more

optimism and certainty. As Milne and Patten (1996)

argue, the aim is to change firms behaviour from the

Stock Market, in the sense that, the focus has largely

been upon what firms are doing with information

rather than upon whom the actual or intended

recipients might be, and what they are or are

expected to be doing with information…

ACKNOWLEDGEMENTS

Project PEst-OE/EGE/UI4056/2014a UDI/IPG,

finance by the FCT.

ICEIS2014-16thInternationalConferenceonEnterpriseInformationSystems

500

REFERENCES

Al-Tuwaijri, S., Christensen, T., Hughes II, K. (2004). The

Relations among Environmental Disclosure,

Environmental Performance, and Economic

Performance: a Simultaneous Equations Approach.

Accounting, Organizations and Society, 29: 447-471.

Barros, T. (2008). A Divulgação de Informação sobre

Responsabilidade Social nas Páginas Web das

Empresas Portuguesas. Porto: Universidade do Porto.

Belkaoui, A., Arpik, P.G. (1989): Determinants of the

corporate decision to disclose social information. AAA

Journal, 2(1): 36- 51.

Bowen, G.A. (2009). Document Analysis as a Qualitative

Research Method. Qualitative Research, 9 (2): 27-40

Byrch, C., Kearins, K., Milne, M., Morgan, R. (2007).

Sustainable ‘What’? A Cognitive Approach to

Understanding Sustainable Development. Qualitative

Research in Accounting & Management, 4: 26-52.

Carlson, R., Erixon, M., Forsberg, P., Palsson, A-C.

(2001). System for integrated business environmental

information management. Advances in Environmental

Research, 5: 369-375.

Chan, J., Welford, R. (2005). Assessing Corporate

Environmental Risk in China. CSR and Environmental

Management, 12: 88-104.

Cho, C., Patten, D. (2007). The Role of Environmental

Disclosures as Tools of Legitimacy: A Research Note.

Accounting, Organizations and Society, 32: 639-647.

Cho, C., Robets, R., Patten, D. (2010). The Language of

US Corporate Environmental Disclosure. Accounting,

Organizations and Society, 35: 431-443.

Clarkson, P.; Li, Y., Richardson, G., Vasvari, F. (2008).

Revisiting the Relation Between Environmental

Performance and Environmental Disclosure.

Accounting, Organizations and Society, 33: 303-327.

Comissão de Normalização Contabilística (CNC, 2005).

DC nº 29 – Matérias Ambientais. Lisboa: CNC.

Comissão de Normalização Contabilística (CNC, 2009).

NCRF 26 – Matérias Ambientais. Diário da

República, 2ª série, 173, 07/09: 36.345-36.349.

DeVilliers, C., van Staden, C. (2006). Can Less

Environmental Disclosure Have a Legitimising Effect?

Accounting, Organizations and Society, 31: 763-781.

Fernando, A., Albuquerque, F., Almeida, M. (2010). As

Matérias Ambientais, as Licenças de Emissão de

Gases com Efeito Estufa e os Normativos Aplicáveis

em Portugal. Jornal de Contabilidade, 395: 31-38.

Freedman, M. e Jaggi, B. (1988): An Analysis of the

Association between Pollution Disclosure and

Economic Performance, AAA Journal, 1 (2), 43 - 58

Global Report Initiative (GRI, 2014). Sustainability

Disclosure Database. Amsterdam: GRI.

Gray, R. (2002). Of Messiness, Systems and

Sustainability: Towards a More Social and

Environmental Finance and Accounting. British

Accounting Review, 34: 357-386.

Gray, R. (2006). Does Sustainability Reporting Improve

Corporate Behaviour?: Wrong Question? Right Time?

Accounting and Business Research, 65-88.

Gray, R., Collison, D. (2002). Can’t See the Woods for the

Trees, Can’t See the Trees for the Numbers?

Accounting Education, Sustainability and the Public

Interest, Critical Perspectives Accounting,13:797-836.

Greene, W. (2012). Econometric Analysis. London:

Prentice Hall Inc.

Hackston, D., Milne, M. (1996). Some determinants of

social and environmental disclosures in New Zealand

companies. AAA Journal, 9 (1): 77 - 108

Hair, J., Anderson, R., Tatham, R., Black, W. (2005).

Análisis Multivariante. Madrid: Prentice-Hall

Jain, T., Aggarwal, S. (2011). Statistical Analysis for

Business. New Delhi: VK Enterprises.

Knox, S., Maklan, S., French, P. (2005). Corporate Social

Responsibility: Exploring Stakeholder Relationships

and Programme Reporting across Leading FTSE

Companies. Business Ethics, 61: 7-28.

Kuk, G., Fokeer, S., Hung, W. (2005). Strategic

Formulation and Communication of Corporate

Environmental Policy Statements: UK Firms’ Pers-

pective. Business Ethics, 58: 375-385.

Lamberton, G. (2005). Sustainability Accounting – a Brief

History and Conceptual Framework. Accounting

Forum, 29: 7-26.

Leote, F., Rita, R. (2008). A Divulgação Ambiental:Volun-

tária ou Compulsiva, Huelva, Spain:X Seminario HLEE.

Mendes, M. (2007). A Responsabilidade Social da

Empresa no Quadro da Regulação Europeia. Lisbon:

Instituto Superior do Trabalho e da Empresa.

Merriam, S. (2009). Qualitative research: A guide to

design and implementation. S.Francisco: Jossey-Bass.

Milne, M., Patten, D. (2001). Securing organizational

legitimacy: an experimental decision case examining

the impact of ED. APIRA Conference, 1-44

Monteiro, S. (2007), Factores Explicativos do Grau de

Divulgação Ambiental em Grandes Empresas a

Operar em Portugal, XVII JHLGC, Logroño, Spain.

Neves, J. C. (2002). Avaliação de Empresas e Negócios.

Lisboa: McGraw-Hill de Portugal.

Neyland, D. (2007). Achieving Transparency: The Visible,

Invisible and Divisable in Academic Accountability

Networks, Organization, SAGE, 14: 499-516.

Niskala, M., Pretes, M. (1995). Environmental Reporting

in Finland: A Note on the Use of Annual Reports.

Accounting, Organizations and Society, 20: 457-466.

Patten, D. (2002): The Relation between Environmental

Performance and Environmental Disclosure.

Accounting, Organizations and Society, 27: 763-773.

Penman, S. (2013). Financial Statement Analysis and

Security Valuation. London: McGraw-Hill/Irwin.

Sahay, A. (2004). Environmental Reporting by Indian Co.

CSR and Environmental Management, 11: 12-22.

Sánchez, J., Sotorrio, L. (2007). The Creation of Value throu-

gh Corporate Reputation. Business Ethics 76:335-346.

Teoh, S, Welch, I, Wong, T (1998). Earnings management

and the long-run market performance of initial public

offerings. Journal of Finance, 53: 1935–1974.

van Dijk, A., Mount, R., Gibbons, P., Vardon, M.,

Canadell, P. (2014). Environmental reporting and

accounting in Australia,

Sci Total Environ, 473-474,

338-349.

EnvironmentalDisclosure-FromtheAccountingtotheReportPerspective

501