Continuous-time Revenue Management in Carparks

Part Two: Refining the PDE

Andreas Papayiannis, Paul Johnson, Dmitry Yumashev and Peter Duck

School of Mathematics, University of Manchester, Oxford Road, Manchester M13 9PL, U.K.

Keywords:

Expected Revenue, Rejection Policy.

Abstract:

In this paper, we study optimal revenue management applied to carparks, with the primary objective to max-

imize revenues under a continuous-time framework. This work is an extension to (Papayiannis et al., 2012)

where the authors developed a Partial Differential Equation (PDE) model that could solve for the rate at which

cash is generated through an infinitesimal time. However, in practice, carpark managers charge customers

per day or per hour which is a finite period of time. Unfortunately, this situation was currently not captured

by this previous work. Therefore, our current work attempts to reformulate the existing PDE in a way that

it does capture the revenue that is generated within any finite time interval of length ∆T. The new model is

compared against the Monte Carlo (MC) approach for several choices of ∆T; the results are remarkable as the

improvement in computation speed and efficiency are significant. Since, the algorithm in the PDE still does

not solve the ‘exact’ problem, a method is proposed to marry the benefits of the PDE with those of the MC

approach. Our results are prominent as the optimal values generated in this case have shown to be extremely

close to the MC ones while the computation times are kept to a minimum.

1 INTRODUCTION

The primary objectiveof this paper is to study revenue

management applied to carparks, in order to optimally

manage the expected revenues of the carpark under a

continuous time framework. There has been an in-

creasing interest on car parking problems within the

last two decades. Many researchers have worked on

traffic congestion problems, among them are (Teodor-

ovi´c and Vukadinovi´c, 1998), (Arnott and Rowse,

1999) and (Zhao et al., 2010), to just list a few. An

extensive review on urban car parking models can be

found in (Young et al., 1991). In the context of rev-

enue management we refer to (Teodorovi´c and Luˇci´c,

2006) who proposed an intelligent parking inventory

control system based on fuzzy logic theory. More-

over, (Onieva et al., 2011) have formulated and solved

a Linear Programming (LP) problem in both a de-

terministic and a stochastic environment. In this pa-

per, however, we aim to build upon the framework

laid down by (Papayiannis et al., 2012) and extend

the Partial Differential Equation (PDE) approach to a

more realistic discrete time framework. In (Papayian-

nis et al., 2012) the authors present two approaches

of modelling such a continuous-time stochastic opti-

mization problem; the Monte-Carlo (MC) approach

and the PDE approach. The first one solves the prob-

lem by first setting up the selling horizon and then

discretising the horizon into finite intervals of time

∆T. Bookings in both cases are modelled using fixed

time-invariant Poisson distribution for the number of

bookings with exponential waiting times for time be-

tween booking and length of stay exponential arrival

times have also been employed in (Onieva et al.,

2011; Teodorovi´c and Luˇci´c, 2006). The carpark is

then managed by assigning an accept/reject decision

to the bookings in each time interval given the cur-

rent state of the carpark (i.e. number of spaces re-

maining and time until stay). This decision was opti-

mally taken so that a parking slot never sells for less

than what we might expect to receive for it in the fu-

ture. For the PDE approach, the authors derive an-

alytical formulae for the probability distributions of

bookings so that they can formulate an expression for

the expected value of all the available spaces at time t

given we know the value of spaces remaining at time

t + dt. Since the process is essentially Markov they

can evoke the Hamilton-Jacobi-Bellman principle as

in (Gallego and van Ryzin, 1994) to express this as a

dynamic programming problem. The resulting PDE

was in fact solving for the rate at which the value is

generated through an infinitesimal time, rather than

over some discrete time as in the case of the Monte

Carlo method. Thus, a comparison on the optimal so-

274

Papayiannis A., Johnson P., Yumashev D. and Duck P..

Continuous-time Revenue Management in Carparks - Part Two: Refining the PDE.

DOI: 10.5220/0004219200760081

In Proceedings of the 2nd International Conference on Operations Research and Enterprise Systems (ICORES-2013), pages 76-81

ISBN: 978-989-8565-40-2

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

lution between the MC and the PDE methodologies

could only be made in the limit i.e. as the time in-

tervals in the MC tend to zero ∆T → 0; the optimal

values however were showed to be remarkably close

to one another.

On the one hand, the pricing structure of most

carparks dictates that spaces are sold to customers

in slots, typically an integer number of fixed periods

of time, such as day or hour over which the space

will be reserved (see (Teodorovi´c and Luˇci´c, 2006;

Onieva et al., 2011)). On the other hand, (Bitran and

Caldentey, 2003) argue that “the explosive growth of

the Internet and e-commerce make the continuous-

time model much more suitable in practice”. More-

over, the results of (Papayiannis et al., 2012) have

shown the superiority of the PDE method over the

MC method with respect to both efficiency and com-

putational speed, but the PDE method presented there

could not capture discrete time intervals. These then

provide the motivation for the current study to ex-

tend the PDE model so that it can solve for the rate

at which value is generated within any time period of

finite size ∆T.

The remainder of this report is organized as fol-

lows. In section 2 we explain the steps taken in or-

der to reformulate the problem. Section 3 illustrates

some numerical results along with discussion. All re-

sults which are presented in this paper are obtained

using an Intel Xeon(R) CPU E5450 @3.00GHz with

16GB of RAM. Finally our conclusions can be found

in section 4.

2 PROBLEM FORMULATION

The derived PDE in (Papayianniset al., 2012) is based

on the probability densities P

s

and g which are used

to calculate the rate at which bookings turn up and

stay as of time t for the infinitesimal period T > t,

and the rate of cash-flow running through that period.

However, we note that the continuous time effect of

the PDE is on the booking decision rather than the

actual time spent in the carpark.

Therefore, we can still have the bookings arriv-

ing in a continuous-time but rather calculate the as-

sociated revenue rates within a discrete time inter-

val in the future, the size of which can be of any fi-

nite length ∆T. In other words, we can still consider

that bookings are made instantaneously but, also ad-

just the probability distributions in such a way that

we rather capture the probability of a customer being

present within the interval [T, T + ∆T] which takes

place between [τ, τ + ∆T] days after the booking is

made.

Now within the time-invariant framework, we in-

troduce ˜g(τ) (the symbol ‘∼’ will be used in the defi-

nitions throughout this report to distinguish the terms

that involve the finite interval ∆T) to be the fraction

of customers who made their bookings to be present

between τ and τ + ∆T days later. It is not difficult to

show that this may be written as

˜g(τ) = P

a

(τ+ ∆T) − P

d

(τ). (1)

Similarly, we introduce

˜

f(τ) to be the average inten-

sity for bookings made so that they are present be-

tween [τ, τ + ∆T] days later. This can be expressed

as

˜

f(τ) = λ

b

˜g(τ). (2)

Moreover, we define the probability density of a cus-

tomer staying ξ days given that he/she is present be-

tween [τ, τ + ∆T] days after the booking made by

˜

ρ

s

(ξ|τ) which can be expressed as,

˜

ρ

s

(ξ|τ) =

ρ

s

(ξ)[P

a

(τ+ ∆T) − P

a

({τ− ξ, 0}

+

)]

˜g(τ)

. (3)

It should be made clear at this stage that ρ

s

(ξ|τ) ⊆

˜

ρ

s

(ξ|τ).

Consequently, the cumulative probability of a cus-

tomer staying no more than ξ days given that he/she is

present between [τ, τ+∆T] after the booking,

˜

P

s

(ξ|τ),

is given by

˜

P

s

(ξ|τ) =

Z

ξ

0

˜

ρ

s

(s|τ)ds. (4)

It is important to mention that although we have

modified the probability distributions, the customers

are still booking in continuous time and request to

park for any length of stay which is again still a con-

tinuous quantity. For the case of maximising the cash-

flows within a finite time period, any bookings that

happen to be present at any time within this interval

do contribute to the solution. In (Papayiannis et al.,

2012) PDE model we looked at all bookings that are

present during the same infinitesimal and given that

bookings could only be distinguished by their length

of stay (the larger the length of stay, the less the price

to be paid per day) we imposed a rule to reject those

of length greater than ξ

∗

. In our new formation, the

idea is similar with the only difference that we are

now looking at all bookings that are present at any

time within a finite time interval. Unfortunately, this

increases the complexity of the problem as bookings

present in the same period, although being of same

length of stay, they might have pay a different price

rate according to how many time periods ∆T each

falls into in total (this depends on the exact time point

the bookings lie when being within the time period).

Therefore, we suggest a simple procedure to estimate

Continuous-timeRevenueManagementinCarparks-PartTwo:RefiningthePDE

275

the number of time periods (n) for which the cus-

tomers are likely to occupy the slot, which will in turn

enable us to determine a better estimate for the price

rates that should be applied. We note that n should

strongly depend on the size of the time period, ∆T.

In particular, we assume that the required length

of stay ξ is between k and k + 1 times larger than the

length of the interval ∆T, i.e. k∆T ≤ ξ ≤ (k + 1)∆T,

where k ∈ Z. For simplicity, we assume that cus-

tomers arrival times follow a uniform distribution, u.

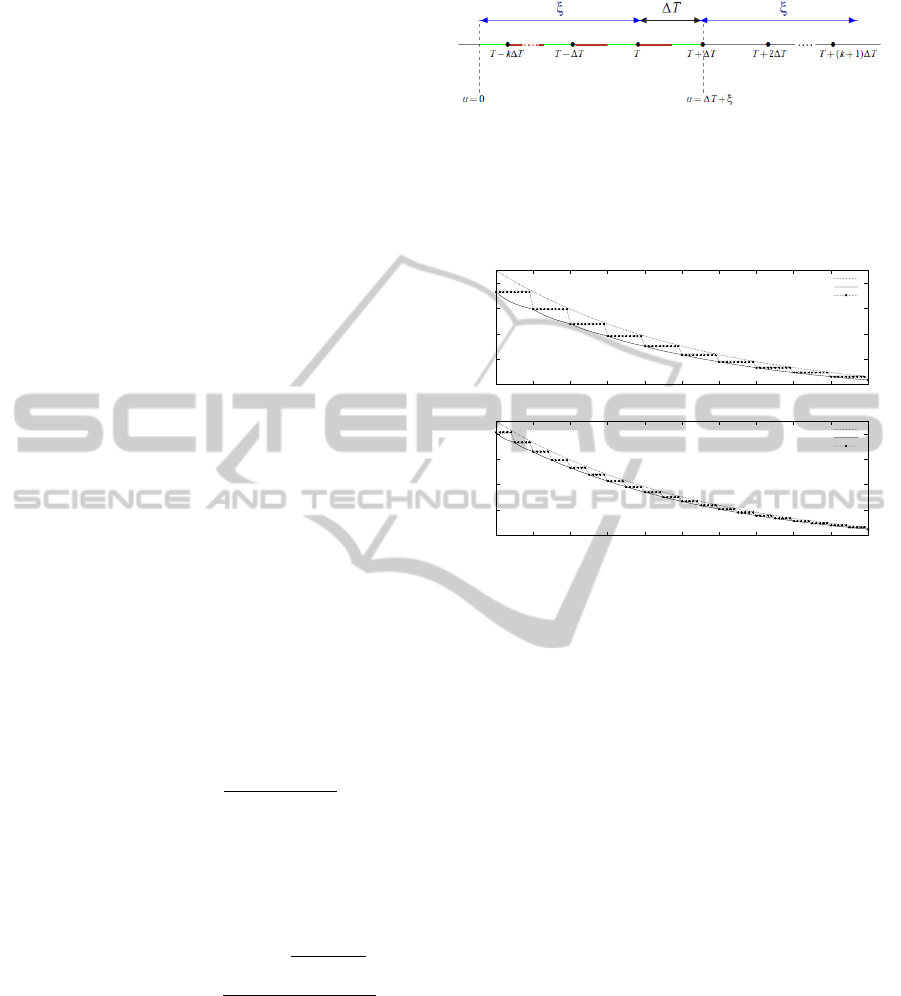

Figure 1 illustrates the situation; In order for cus-

tomers who stay for ξ days to be accounted within the

time interval [T, T + ∆T], they must have arrived no

more that ξ days in advance and no later than T + ∆T.

Thus the feasible region, within which customers con-

tribute to the solution, is T − ξ ≤ t ≤ T + ∆T. There-

fore, the uniform distribution’s endpoints become 0 ≤

u ≤ ∆T + ξ.

Regarding the number of periods (n) the cus-

tomers are likely to occupy a slot for, there are only

two possible scenarios;

1. the customer stays k+ 1 periods when his/her re-

quired duration of stay covers k periods plus a

fraction of an additional period either before or

after this interval (his/her arrival time lies on a red

segment of figure 1),

2. or stays k + 2 periods when his/her then required

duration of stay covers the same k periods plus a

fraction before and after this interval (his/her ar-

rival time lies on a green segment of figure 1).

In particular, we can show that the associated proba-

bility in each case is given by,

P(n = k + 1) = (k+ 1)

(k+ 1)∆T − ξ

ξ+ ∆T

(5)

while,

P(n = k + 2) = 1− P(n = k + 1) (6)

Therefore, n is given by

n =

k+ 1 w.p P

1

= (k+ 1)

(k+1)∆T−ξ

ξ+∆T

k+ 2 w.p P

2

=

(k+2)ξ−

(

1−(k+1)

2

)

∆T

ξ+∆T

Consequently, the expected length of stay (E[n])

becomes

E[n] = (k+ 1)P

1

+ (k+ 2)P

2

. (7)

Finally, we can replace the exact duration of stay,

ξ, by the expected number of time periods (of length

∆T) the customer is staying for, E[n], and then we can

calculate the required price rate per period as,

Ψ(ξ) →

˜

Ψ(E[n]) ≡ ψ

1

+ ψ

2

e

−µE[n]∆T

. (8)

Figure 1: Uniform arrival distribution u(0, ∆T + ξ) for cus-

tomers that stay for k∆T ≤ ξ ≤ (k + 1)∆T days and they

are present within the interval [T, T + ∆T]. Customers who

arrive anywhere on the red segments will occupy k+1 inter-

vals while those that arrive anywhere on the green segments

will occupy k + 2 intervals.

6

8

10

12

14

0 1 2 3 4 5 6 7 8 9 10

Price Rate

ξ

Continuous

Adjusted (∆T=1.0)

Jump (∆T=1.0)

6

8

10

12

14

0 1 2 3 4 5 6 7 8 9 10

Price Rate

ξ

Continuous

Adjusted (∆T=0.5)

Jump (∆T=0.5)

Figure 2: Plots of the adjusted price rate function used in

the reformulated PDE and the discrete-jump price func-

tion used in the MC. Upper figure compares the two for

∆T = 1.0 while the lower figure plots these for ∆T = 0.5.

The continuous pricing function (as in (Papayiannis et al.,

2012)) is shown as well.

with parameters ψ

1

, ψ

2

, µ identical to those in (Pa-

payiannis et al., 2012). Figure 2 compares the ad-

justed price rate function (8) with the corresponding

discrete-jump price function that has been used in the

MC; the upper figure illustrates this comparison for

∆T = 1.0 while the lower figure for ∆T = 0.5. In

each figure the continuous pricing function (as in (Pa-

payiannis et al., 2012)) is plotted as well. The ad-

justed price rate function seems a reasonable approx-

imation to the discrete-jump price function; the two

functions approach one another as ∆T decreases and,

in fact, they become equal in the limit (as ∆T → 0).

In the limiting case both pricing functions are equal

to the continuous pricing function (8). Finally, we

define

˜

V(Q, t;T) to the rate at which revenue is gen-

erated in the carpark with Q spaces remaining for the

future period [T, T + ∆T] as of time t. Thus, within

the time-invariant framework we may define

˜

V(Q, τ)

as the rate at which revenue is generated from cars

present over the period interval which is formed be-

tween [τ, τ+ ∆T] days later.

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

276

Therefore, the modified PDE can be written as

∂

˜

V

∂τ

= max

ξ

∗

˜

P

s

(ξ

∗

|τ)

˜

f(τ)(

˜

V(Q− 1, τ) −

˜

V(Q, τ))

+

˜

f(τ)

Z

ξ

∗

0

˜

ρ

s

(ξ|τ)

˜

Ψ(ξ)dξ

, (9)

with the same boundary conditions as before

˜

V = 0 when τ = 0 (10)

˜

V = 0 when Q = 0. (11)

The solution to this system gives the rate at which the

value is generated in the future time period [T, T +

∆T] which takes place between τ and τ+ ∆T days af-

ter the current time t and the values ξ

∗

= ξ

∗

(Q, τ) that

achieve the supremum construct the optimal rejection

policy

1

.

The optimal rejection policy can alternatively be

expressed in terms of the ‘Added Values’ of the

spaces (Papayiannis et al., 2012); in particular the op-

timal policy satisfies

˜

Ψ(ξ

∗

) =

˜

V(Q, τ) −

˜

V(Q− 1, τ) ∀Q ∀τ.

In the revenue management literature this quantity is

usually referred to as the opportunity cost of selling

a unit of capacity when the time left is τ and the

available inventory is Q, or simply as the expected

marginal value of capacity at time τ (see (Talluri and

van Ryzin, 2004)).

3 NUMERICAL RESULTS

3.1 Numerical Solution of the PDE

In this section we present some numerical results to

compare the PDE scheme in (9) with the MC ap-

proach

2

. We have used a time horizon T = 30 and

carpark capacities 1 ≤ Q ≤ 100. Regarding the book-

ing patterns, we use exponential distributions with

constant intensities and two distinct booking classes

as in (Papayiannis et al., 2012).

Below, we present the expected revenues gener-

ated within the period [T, T + ∆T] as of time t = 0,

calculated by the MC approach first and then from our

adjusted PDE scheme. By assuming time-invariance,

1

Note that the optimal durations ξ

∗

are now applied to

entire period intervals of length ∆T.

2

In the MC approach we obtain the correct solution us-

ing an iteration scheme for which the number of paths (sim-

ulations) increase in each iteration. The iterations terminate

once the frobenious norm is minimised and the converged

solution forms the optimal solution.

0

100

200

300

400

500

600

0 5 10 15 20 25

Expected Revenues

Time Left, τ

MC- Expected Revenues (Q=50)

∆T=1.0

∆T=0.5

∆T=0.25

∆T=0.125

Figure 3: Expected Revenues using the MC approach as a

function time left τ. The capacity is fixed to Q = 50 and the

finite period is allowed to vary, ∆T = 1.0, 0.5, 0.25, 0.125.

0

100

200

300

400

500

600

0 5 10 15 20 25

Expected Revenues

Time Left, τ

PDE- Expected Revenues (Q=50)

∆T=1.0

∆T=0.5

∆T=0.25

∆T=0.125

Figure 4: Expected Revenues using the reformulated PDE

as a function time left τ. The capacity is fixed to

Q = 50 and the finite period is allowed to vary, ∆T =

1.0, 0.5, 0.25, 0.125.

these can be interpreted as the value of the carpark

with capacity Q as of [τ, τ + ∆T] time before all re-

maining spaces must be occupied. Figure 3 shows

results from the MC approach when the capacity is

50 and ∆T is allowed to change, while figure 4 shows

the corresponding results using the PDE method. The

expected revenues of the two approaches are remark-

ably close to each other for all choices of ∆T. De-

spite its simplicity, the PDE in (9) proves capable

of approximating the revenues, as these are derived

from the MC approach, for any given ∆T. We notice

that the expected revenues increase as the time left

increases; this implies that as the selling horizon in-

creases the carpark manager faces a larger population

of potential customers and therefore he/she can tar-

get the available capacity to the most lucrative ones

(see (Bitran and Caldentey, 2003), (Gallego and van

Ryzin, 1994)). In addition, the expected revenues in-

crease as ∆T increases; this is because when the pric-

Continuous-timeRevenueManagementinCarparks-PartTwo:RefiningthePDE

277

Table 1: Computation Times and Convergence for the MC

approach.

∆T # of Paths Iterations Comput. Times

1.0 12672 15 126.7s

0.5 25342 17 325.8s

0.25 35839 18 621.1s

0.125 50683 19 1334.6s

ing policy of the carparks management is to sell the

slots per day rather than per hour, for instance, a cus-

tomer is forced to pay the price rate for the entire

day even though he/she might only be staying for one

hour.

Table 1 illustrates the statistics obtained in the pro-

cess of calculating the entire set of optimal values (the

entire matrix for all capacities and times). The results

in table 1 indicate that the MC method (on its own)

is infeasible in practice; for carparks that operate with

slots that can be booked for a minimum of 3 hours

(∆T = 0.125) the MC approach is very poor as a cus-

tomer would have to wait an unrealistically long time

(more than 22 minutes!) until a decision would be

made as to whether he/she is allowed to park or not.

In the PDE, the time it takes to obtain the optimal so-

lution is tiny (never more than 25 seconds) and it does

not depend on ∆T at all. That it is independent of ∆T

means that the PDE meets the needs of any carpark-

ing management since it fits to any given price policy,

while the speed advantage of the PDE over the MC

renders it ideal for being used in a web reservation

engine.

However, in accordance to (Papayiannis et al.,

2012) the PDE in (9) generates slightly higher rev-

enues as it still does not solve the ‘exact’ problem; the

optimal decision algorithm still looks at each booking

length as separate days and solves for each day indi-

vidually, whereas in the MC approach the rejection al-

gorithm regards each request as a ‘group’ of days and,

thus, the optimal decision is based on the entire book-

ing length with a booking being accepted/rejected as

a whole (which is the situation in a real carpark).

Therefore, to exploit the speed advantage of the PDE

while preserving the correct optimisation algorithm

(of the MC approach) the PDE could be used jointly

with a Monte-Carlo method.

3.2 Using the PDE and MC Methods

Jointly

The MC approach in section 3.1 did calculate the op-

timal solution to the ‘exact’ problem in question but it

failed to do that in a reasonable time; table 1 showed

the large number of iterations and paths required for

the MC approach to converge to the optimal solution.

By contrast, the PDE methodology (9) calculated the

optimal solution in significanlty less time but this so-

lution did not correspond to the ‘exact’ problem; the

optimal decision was found after solving for each pe-

riod of day individually whereas in the MC the opti-

mal solution takes into account the inter-dependence

within days see (Papayiannis et al., 2012). Therefore,

our aim is develop a new improved methodology that

combines the best elements of the PDE (speed and ef-

ficiency) with the best ones of the MC (correct rejec-

tion algorithm that regards each request as a ‘group’

of days).

The ‘Joint’ Method. The optimal rejection policy

(‘Added Values’) is derived using the PDE in (9).

Then, this policy is employed in a Monte-Carlo pro-

cedure, where booking simulations are taken and re-

quests are allowed/denied service as a ‘group’. The

expected revenues are approximated by averaging

over ten thousand paths. We note that this procedure

does not require any iterations, as the optimal rejec-

tion policy would have already been derived by the

PDE. The results are recorded and compared against

the true results that have previously been calculated

by running the MC approach solely.

0

100

200

300

400

500

600

0 5 10 15 20 25

Expected Revenues

Time Left, τ

Joint PDE and MC- Expected Revenues

∆T=1.0

∆T=0.5

∆T=0.25

∆T=0.125

Figure 5: Expected Revenues using the joint approach as a

function time left τ. The capacity is fixed to Q = 50 and the

finite period is allowed to vary, ∆T = 1.0, 0.5, 0.25, 0.125.

Figure 5 shows the expected revenues generated

by the ‘joint’ method when Q = 50 as functions of

time, for varying time intervals ∆T. It is clear that

the curves are now outstandingly close to those in

figure 3. Table 2 is provided in regards to the max-

imum relative percentage errors obtained (by consid-

ering all τ) for different carpark sizes and different

time intervals ∆T. from this one may notice that the

maximum relative error decreases with the size of the

interval ∆T. Indeed, this is the case because the opti-

mal policy comes from the PDE scheme and we know

that the PDE solution converges to the MC solution

ICORES2013-InternationalConferenceonOperationsResearchandEnterpriseSystems

278

Table 2: Relative (%) Errors for varying capacities.

∆T

Capacity, Q

10 20 40 60 80

1.0 6.67 3.15 1.68 0.91 0.55

0.5 1.83 0.64 0.48 0.51 0.51

0.25 1.58 1.17 1.46 1.46 1.46

0.125 1.65 0.87 0.58 0.58 0.58

Table 3: Computation Times for the ‘joint’ method.

∆T Comput. Times Relative Comput. Times

1.0 45.5s 46.7%

0.5 56.8s 17.5%

0.25 71.6s 11.5%

0.125 102.4s 7.7%

as ∆T → 0. To justify this further the reader is re-

ferred to figure 2 where it shows that the price rate

functions used in the two methods would converge

as ∆T → 0. Moreover, the maximum relative error

decreases with capacity. This observation has more

to do with the nature of the carpark rather than the

choice of the method, as relatively big carparks might

require little or even no optimization at all, which im-

plies that the role of any optimal policy is reduced and

thus both methods would be even closer to each other.

Lastly, table 3 presents the computation times needed

for the ‘joint’ method to calculate the full set of opti-

mal revenues (the entire matrix for all capacities and

times) along with a relative speed comparison against

the MC approach. Our results show that the reduction

in computation time is significant; in particular, for

∆T = 1, the ‘joint’ algorithm takes only 46% of the

time it would take the MC approach to calculate the

optimal solution. When ∆T = 0.125 the statistics are

even more impressive as it only needs less than 8% of

the original time. This monotonic increase in speed

is explained by the fact that the time the PDE takes

to calculate the optimal policy is independent of the

size of ∆T, while in the MC the computation times

increase linearly.

4 CONCLUSIONS

In this paper, we have worked with the continuous-

time PDE model and MC model proposed in (Pa-

payiannis et al., 2012). Since the PDE could only

solve for the rate at which cash is generated through

an infinitesimal time we reformulated it in such a way

that it solves for the cash that is generated within a

time period of finite size ∆T and matched that against

the MC. The results validated our expectations as the

optimal values and optimal rejection policies where

remarkably close to one another. Moreover, the opti-

mal surfaces from the reformulated PDE where much

smoother and the computation times have improved

significantly. However, as the PDE could still not

solve the ‘exact’ problem we have proposed a ‘joint’

method that calculates the optimal policy from the

PDE and it then employs this to make optimal deci-

sions by using the MC. This method performed ex-

ceptionally well as it produced revenues around 1%

of the actual ones at most cases. For carparks that op-

erate with slots that can be booked for a minimum of

3 hours (∆T = 0.125) the improvement in computa-

tional speed was more than 92% (it only took 7.7% of

the original time) which it renders it ideal for being

used in a web reservation engine; for even smaller ∆T

the speed improvement is expected to be greater.

REFERENCES

Arnott, R. and Rowse, J. (1999). Modeling parking. Journal

of Urban Economics, 45(1):97 – 124.

Bitran, G. and Caldentey, R. (2003). An overview of pricing

models for revenue management. Manufacturing and

Service Operations Management, 5(3):203 – 229.

Gallego, G. and van Ryzin, G. (1994). Optimal dynamic

pricing of inventories with stochastic demand over fi-

nite horizons. Management Science, 40(8):pp. 999–

1020.

Onieva, L., Mu˜nuzuri, J., Guadix, J., and Cortes, P. (2011).

An overview of revenue management in service indus-

tries: an application to car parks. The Service Indus-

tries Journal, 31(1):pp.91–105.

Papayiannis, A., Johnson, P., Yumashev, D., Howell, S.,

Proudlove, N., and Duck, P. (2012). Continuous-

time revenue management in carparks. In Proceed-

ings of the 1st International Conference on Opera-

tions Research and Enterprise Systems, pages 73–82.

ICORES, SciTePress Digital Library.

Talluri, K. and van Ryzin, G. (2004). The Theory and Prac-

tice of Revenue Management. Kluwer Academic Pub-

lishers, Boston/Dordrecht/London.

Teodorovi´c, D. and Luˇci´c, P. (2006). Intelligent parking

systems. European Journal of Operational Research,

175(3):1666 – 1681.

Teodorovi´c, D. and Vukadinovi´c, K. (1998). Traffic con-

trol and Trasport Planning: A Fuzzy Sets and Neural

Netweorks Approach. Kluwer Academic Publishers,

Boston.

Young, W., Thompson, R. G., and Taylor, M. A. (1991). A

review of urban car parking models. Transport Re-

views, 11(1):63–84.

Zhao, Y., Triantis, K., Teodorovic, D., and Edara, P. (2010).

A travel demand management strategy: The down-

town space reservation system. European Journal of

Operational Research, 205(3):584 – 594.

Continuous-timeRevenueManagementinCarparks-PartTwo:RefiningthePDE

279