PRICE SKIMMING STRATEGY FOR NEW PRODUCT

DEVELOPMENT

Hassan Shavandi and Ata G. Zare

Industrial Engineering Dept., Sharif University of Technology, Tehran, Iran

P.O.Box: 11155-9414

Keywords: Skimming pricing, Non-linear programming, New product development.

Abstract: This article presents a new model for pricing a new product considering skimming pricing strategy in the

presence of the competition. We consider two periods for price setting including skimming and economy

period. The problem is deciding on a skimming price as well as an economy price in order to maximize the

total profit. The derived model is a non-linear programming model and we analyzed the structure and

properties of optimal solution to develop a solution method. Analytical results as well as managerial insights

are presented by mathematical analysis and numerical analysis.

1 INTRODUCTION

Pricing is a main step in the marketing planning that

generates revenue. Besides the other factors such as

product quality and performance, brand image,

distribution channels, and promotion plans, price

plays a main role to encourage the customers to buy

the product. So the companies have to consider

many factors and analyze them to set the price.

Hence, developing pricing models to get some

managerial insights are of interest to the marketing

managers. A company can consider any of five

major objectives for its pricing as survival,

maximum current profit, maximum market share,

maximum market skimming, or product-quality

leadership (Kotler, P., Armstrong, G., 2008).

The objective of price skimming involves a

relatively high price for a short time where a new,

innovative, or much-improved product is lunched to

the market. The objective is to skim off consumers

who are willing to pay more to have the product

sooner. Prices are lowered later when demand from

the early customers falls or competitors introduce

the same product with lower price. A company may

decide to be the product-quality leader in the market.

Price skimming is used by many companies

especially in the automobile, mobile phones, TV,

laptop, and many other luxury industries. For

example Sony Company is a frequent practitioner of

skimming pricing, where prices start high and are

lowered over time (Kotler, P., Armstrong, G., 2008).

The Apple inc., introduced its new mobile phone

named “iphone”, in June 2007 at a top price of $599

in the united states. Despite its high price,

consumers across the country stood in a long line to

buy the iphone on the first day of sales. After two

months later, Apple cut the price from $599 to $399

(D. Sliwinska, and et al., 2007-2008).

For the first time Nancy L. Stokey (1979),

develop a model to consider the price discrimination

policy to enter a new product to the market. It is

assumed a monopolist and the customer’s

reservation price to buy the product is considered as

a probability function. There is no competition and

the monopolist wants to maximize the present value

of profit over the time. D. Besanko and W L.

Winston (1990), consider rational customers and

analyze the optimal skimming price. The price

discrimination is considered over the time. The

objective of seller is to maximize its profit over the

time. L. Popescu and Y. Wu (2007), consider the

reference price and analyze the pricing strategy

using dynamic pricing. The consumers at each time

decide to buy the product based on their reference

prices. The reference price is shaped by the past

prices. So in a long run the monopolist can decide to

have a constant steady state price or skimming price

strategy. They investigate these situations using

dynamic programming method and show the optimal

policy.

108

Shavandi H. and G. Zare A..

PRICE SKIMMING STRATEGY FOR NEW PRODUCT DEVELOPMENT.

DOI: 10.5220/0003705301080113

In Proceedings of the 1st International Conference on Operations Research and Enterprise Systems (ICORES-2012), pages 108-113

ISBN: 978-989-8425-97-3

Copyright

c

2012 SCITEPRESS (Science and Technology Publications, Lda.)

Xuanming Su (2008), develops a model of

dynamic pricing with endogenous inter-temporal

demand. He assumes the finite inventory over a

finite time horizon. A. Haji and M. Asadi (2009),

develops a fuzzy expert system to new product

pricing. This fuzzy expert system includes practical

rule bases to analyze the appropriate price of new

product in fuzzy environment. A. Dolgui and J.

Proth (2010), discuses the pricing strategies and

models. They discuss the benefits price skimming

strategy for a company in the monopolistic market

and they recommend that the high price cannot be

maintained for a long time. A good review of pricing

models and their coordination with inventory

decisions can be found in Chan, L., et al. (2004).

In this paper, we develop a new model

considering price skimming and economy pricing in

the presence of competitor’s effects and customers

demand elasticity. The objective of the model is to

maximize the total profit of company at both

skimming and economy phases. In this article we try

to analyze the structure of the problem as well as

optimal solution properties to derive a solution

approach as well as managerial insights.

2 PROBLEM FORMULATION

Consider a market which can be segmented to two

segments: A and B. Segment A, contains the

customers who are willing to purchase the product

sooner with a higher price. Conversely in segment B,

the customers will purchase the product when the

market price is lower than their reservation price.

We set skimming price for segment A and economy

price for segment B. But at the first time that a new

product is introduced to the market, the skimming

phase is considered and the company set a higher

price to skim the segment A to achieve more profit.

The length of the skimming phase depends on

competitor’s ability and the profit margin of the

skimming price. The skimming phase will end when

the demand falls or a competitor joined the market

with a lower price. At this time, the economy phase

starts and the company has to decrease its price

based on its skimming price, the competitor’s price

and customer’s elasticity.

We assume that it is possible to estimate the

maximum volume of demand for each market

segment and the penetration rate of company to

capture the demand depends on its price. The

problem objective is to determine the best price for

skimming and economy phase in order to maximize

its overall profit and market share. At first two

definitions that are considered to model the problem

are presented in the following.

Definition 1. Maximum Reservation Price (MRP), is

the price above which none of the customers will

buy the product. In other words it is the lowest price

at which demand is equal to zero. Maximum Willing

to Buy (MWB), is the lowest price which all of the

customers will buy the product (Philips, Robert L.,

2005).

Definition 2. A myopic customer is one who makes

a purchase immediately if the price is below her

reservation price without considering the future

prices. Conversely, a strategic (or rational) customer

takes into account the future estimated prices when

making purchasing decisions (Philips, Robert L.,

2005).

In this article we assume the myopic behavior for

customers. The parameters and variables needed to

formulate the problem are defined as follows.

2.1 Notations

Parameters:

FC: The finished cost of product.

: Maximum reservation price.

: The maximum estimated of total market demand

volume.

: The maximum estimated of market demand

volume for skimming phase.

: The penetration rate function at skimming

phase.

: The penetration rate function at economy

phase.

Variables:

(

) : The skimming (economy) price for

product.

2.2 Analysis of Penetration Rate

Functions

The penetration rate at the skimming phase depends

on the price of product. If the skimming price is

high, then the penetration rate is low. In the real

situation the relationship between penetration rate

and price is non-linear and the negative exponential

function is more consistent and was applied more

than other functions in the literature. So we apply

the negative exponential function to model the

penetration rate at the skimming and economy

phases. We propose the penetration rate at skimming

phase as:

=

(

)

(1)

PRICE SKIMMING STRATEGY FOR NEW PRODUCT DEVELOPMENT

109

It can be simplified by substituting the

parameters as:

=

(

)

(2)

Where, =

and ≥1. The parameter is

the shape parameter which is estimated by historical

data from market for previous product that presents

the behavior of customers.

The penetration rate at economy phase depends

on the skimming price, competitor’s price and also

the economy price. We assume that the competitor

will join the market with a lower price. So the

competitor will set its price smaller than skimming

price and larger than finished cost of product. We

assume that the cost function of production for

competitor is the same as company. We also assume

that there is just one opportunity to set the price and

the company cannot estimate the exact price of the

competitor. A high skimming price increases the

penetration rate of competitor and the company will

lose its market share for economy phase and we

apply this concept by defining the coefficient .

Therefore deciding the best skimming price to gain

more profit at skimming phase as well as more

market share and profit at economy phase is the aim

of this model. Customers who buy the product at the

skimming phase are removed from the market and

the penetration rate at economy phase is calculated

for remained market volume. When the skimming

price is equal to MRP then the competitor will have

a big chance to increase its penetration rate but we

assume that it cannot capture the whole market

because of the originality of company brand and we

apply this concept in defining coefficient and

formulate the penetration rate of company at

economy phase as:

=

(

)

(3)

It can be also simplified as:

=

(

)

(

)

(4)

Where, ≥0 and ≥1 are the shape parameters

for economy phase and are estimated based on the

market situation. So by considering these penetration

rate functions at skimming and economy phase, we

can write the model of the problem which is

appeared in the next sub-section.

2.3 The Model

The problem can be formulated as a non-linear

programming (NLP) model as follows:

=.

〖

〗

^(^−)+(

−.

〖

〗

^)

〖

〗

^(^−)

(5)

s.t.

≤ (6)

≤

(7)

≥0,

≥0

The objective function (5), attempts to maximize the

company’s profit over the skimming and economy

phases. By substituting the penetration rate functions

from relations (2) and (4) in the objective function

we see that it has the non-linear. All the constraints

are in the form of linear and constraint (6) states that

the price cannot be larger than maximum reservation

price and the economy price also cannot be larger

than skimming price (7).

3 STRUCTURAL ANALYSES

3.1 Optimal Solution Analysis

In this section we are going to do some structural

analysis on the model to find the properties of

optimal solution. By replacing the penetration

functions the objective function is as the form of:

(

,

)

=

(

)

(

−

)

+−

(

)

(

)

(

(

)

)(

−)

Theorem 1. The optimal economy price is derived

based on the optimal skimming price by the

following equation:

∗

=

+

−

(8)

Proof: By taking the first derivative condition of

objective function with respect to

we have:

=−

1

−

−

(

)

)

(

)

(

)

(

−

)

+−

(

)

(

)

(

(

)

)

=−

(

)

(

)

(

)

1

−

(

−

)

−

=0

∗

=

+

−

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

110

The second derivative of Z with respect to

ensures that the maximum value of Z can reach at

∗

and hence it is the optimal economy price.

=

1

(

−)

−

(

)

)

(

)

(

)

(

−

)

−

1

−

2

−

(

)

)

(

)

(

)

=

−

(

)

(

)

(

)

−

×(

(

−

)

−

−2)

=

−

(

)

(

)

(

)

−

(

1−2

)

<0

Proposition 1: The economy price is increasing in

skimming price and the skimming strategy is

reasonable for >1. Considering the constraint,

≤

, if ≤1 then the skimming and economy

prices are equal and it means that obtaining a single

price is optimal and the skimming strategy is not

acceptable. Therefore the economy price is always

equal or less than skimming price and hence the

constraint

≤

is surplace in the model and can

be eliminated.

Observation 1: Based on proposition 1, the

company can estimate the parameter using the

historical information about the price and demand of

previous products and decide to apply the skimming

strategy according to parameter . If ≤1 then the

price skimming strategy is not reasonable. The

historical data show the behaviour of customers

regarding to different values of price and if the value

of parameter is equal or less than 1 it means the

customers prefers to buy the product in one and

lower price.

Observation 2: The economy price is the average of

finished cost and skimming price in case of =2:

=

+

2

The model can be modified by replacing the

equation of optimal economy price in the objective

function and transforming it to a function of single

variable

. Therefore the model becomes:

=(

−)

(

)

+

(

(

)

−

()

(

)

s.t.

≤

≥0

By replacing, =

−, the objective function

can be transformed as:

=

+

(

−

(

)

(9)

In order to analyze the objective function and

optimal solution, it can be simplified as:

=

+

−

(

)

(10)

Parameters

and

are positive and,

=,

=

The parameters

,

and

are as follows:

=,

=

,

=

Since, ≥1 and TV>V, therefore we have

>

and

>

.

Now by first derivative condition on equation

(10) the optimal value of x can be determined as:

∗

=

+

−

(

)

+

−

(

+

)

(11)

The above equation can be solved numerically

by Mayple software. If equation (11) has one unique

solution then it is the optimal solution.

Now we are going to show the uniqueness of

optimal skimming price. Recalling the equation (11),

it can be transformed as equation (12). If we show

that the equation (12) has just one solution therefore

we can develop a procedure to obtain the optimal

solution.

(

)

=

(

1−

)

+

(

1−

)

−

(

)

(

1

−

(

+

)

)

=0

(12)

To show the uniqueness of solution for equation

(12), we solved 560 example problems which the

summary of their parameters are shown in table 1. In

all sample problems there was just one solution for

PRICE SKIMMING STRATEGY FOR NEW PRODUCT DEVELOPMENT

111

equation (12). The behaviour of equation (12) with

respect to x is shown in figure 1.

Table 1: The summary of example problems parameters.

FC TV V MRP

10 1660 744

15 1 1 1

20 1.5 1.5 1.5

50 2 3 2

100 3 5 2.5

5 3

5

10

Number of values 4 5 4 7

Based on this observation we can propose a solution

algorithm to solve the model which is presented in

the next sub-section.

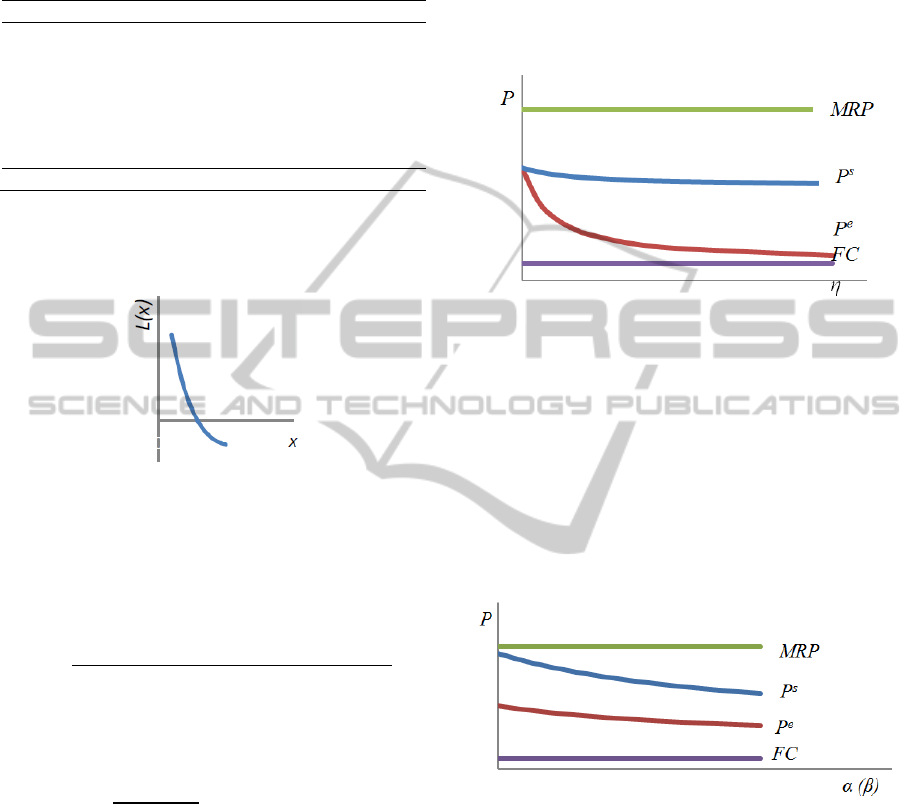

Figure 1: The behaviour of relation (18) respect to x.

3.2 Solution Algorithm

Step 1: compute the value of

∗

by Mayple software

using the equation:

∗

=

+

−

(

)

+

−

(

+

)

(

)

Step 2: The optimal solution is:

∗

=

∗

+

∗

=

∗

4 EXPERIMENTAL RESULTS

By solving the 560 example problems we analyzed

the sensitivity of each parameter on solution. We

considered the distance between economy price and

skimming price as a criteria to analyze the effects of

each parameter to this criteria. The distance between

economy and skimming price gives an insight to

management about the importance of skimming

strategy. The more distance between economy and

skimming price, the more interest to apply the price

skimming strategy. Our observations are as follows:

1. The distance between skimming and economy

price (

−

) is increasing in . Figure 2, presents

the relation between skimming price and economy

price in . Skimming and economy prices are the

same in =0. By increasing , the economy price

decreases to finished cost and its distance from

skimming price increases.

Figure 2: The behavior of skimming and economy price in

.

2. For parameters and we observed that

−

is decreasing in both parameters and .

Figure 3 shows the behavior of skimming as well as

economy price respect to and . Decreasing in

skimming price is sharper than economy price in

both and . The most distance between skimming

and economy price is where and are equal to

one and by increasing theses parameters the distance

between skimming and economy price decreases.

Figure 3: The behavior of skimming and economy price in

().

5 CONCLUSIONS

In this article a new pricing model was developed

considering skimming pricing strategy for

introducing new product. We considered two periods

for price setting: first the skimming period and the

second one is economy period. In the skimming

period the company faces a monopolistic market but

in the economy period there is at least one

competitor. We formulate the effect of competitor in

ICORES 2012 - 1st International Conference on Operations Research and Enterprise Systems

112

the economy phase by penetration function. The

penetration rates at skimming and economy phases

were formulated as an exponential function and the

effect of competitor’s price was formulated as loss

of the market share in economy phase penetration

rate. The optimal economy price is calculated

considering the skimming price. An algorithm was

developed to solve the model based on the lower and

upper bound derived in structural analysis. Many

example problems were solved and some managerial

insights presented by numerical analysis. As an

extension, this problem can be analyzed by game

theory to realize the competition in dynamic

environment considering the reaction of competitor

and company. The other functions to formulate the

penetration rates and other solution methods can be

of interest for future research.

REFERENCES

Kotler, P., Armstrong, G., 2008. Principles of Marketing,

Pearson Prentice Hall.

D. Sliwinska, J. Ranasinghe, I. Kardava, 2007-2008.

Apple’s pricing strategy. Affaires Internationales Et

Negociation Interculturelle, Paris-X Nanterre.

Dolgui, A., Proth, J., 2010. Pricing strategies and models,

Annual Reviews in Control. 34 101–110.

Stokey, N. L., 1979. Inter temporal price discrimination.

The Quarterly Journal of Economics. 93 (3) 355-371.

Besanko, D., Winston, W., L., 1990. Optimal price

skimming by a monopolist facing rational consumers.

Management Science. 36 (5) 555-567.

Popesco, L., Wo, Y., 2007. Dynamic pricing strategies

with reference effects. Operations Research. 55 (3)

413-429.

Su, X., Zhang, F., 2008. Strategic customer behavior,

commitment, and supply chain performance.

Management Science. Published online ahead of print,

July 21.

Haji, A. and Asadi, M., 2009. Fuzzy expert systems and

challenge of new product pricing. Computers and

Industrial Engineering. 56, 616-630.

Chan, L., M., A., Max Shen, Z., J., Simchi-Levi, D.,

Swann, J., L., 2004. Coordination of pricing and

inventory decisions: A survey and classification,

Handbook of Quantitative Supply Chain Analysis in

the eBusiness Era, Kluwer Academic Publishers, pp.

335-392.

Philips, Robert L., 2005. Pricing and Revenue

Optimization, Stanford University Press.

PRICE SKIMMING STRATEGY FOR NEW PRODUCT DEVELOPMENT

113