DETERMINING REQUIREMENTS AND SPECIFICATIONS OF

ENTERPRISE INFORMATION SYSTEMS FOR PROFITABILITY

K. Donald Tham

Dept. of Mechanical and Industrial Engineering, Ryerson University, Toronto, Ontario, Canada, M5B2K3

Mark S. Fox

Dept of Mechanical and Industrial Engineering, University of Toronto , Toronto, Ontario, Canada, M5S3G9

Keywords: Traditional costing, traditional Activity-based

Costing (ABC), enterprise model, ontology, strategic

intelligence, Enveloped Activity-Based Enterprise Model (EABEM™)

1

, Temporal-ABC™

2

.

Abstract: A company’s profits may be defined as the posit

ive difference between its income revenues and operational

costs. Today, most companies use traditional costing methods and/or traditional Activity-Based Costing

(ABC) to determine their operational costs with a view to direct operational and business process changes

so that profits are realized. A tripartite approach is presented towards determining requirements and

specifications of enterprise information systems for profitability (EISP). In the first part, an understanding

of the nuances of traditional costing and ABC as is currently practiced in enterprises is presented to point

the shortcomings of these current costing practices. The second part provides a case study that vividly

demonstrates the problems in the current costing methods and clearly points their inadequacies towards

profitability. The third part presents a framework for the specifications of enterprise information systems

for profitability through ontology-based enterprise modeling, EABEM and Temporal-ABC for the

attainment of improved knowledge about costs.

1

EABEM is a trademark of Nulogy Corporation.

2

Temporal-ABC is a trademark Nulogy Corporation.

1 INTRODUCTION

A company’s profits may be defined as the positive

difference between its income revenues and

operational costs. Today, most companies use

traditional costing methods and/or traditional

Activity-Based Costing (ABC) to determine their

operational costs with a view to understand and

direct operational and business process changes so

that profits are realized.

If Enterprise Information Systems for

Profitab

ility (EISP) are to be developed, first, the

determination of requirements and specifications

for such systems must be based upon a clear

understanding of current costing methods and the

shortcomings of such methods towards profitability.

Second, achieving systemic profitability must

begi

n with improved knowledge about costs. From

production floor worker, to office clerk and

administrator, to chief executive officer – there must

be actionable and unambiguous cost knowledge to

guarantee a superior return on capital investments, to

ensure fewer operational mistakes, to make better

use of resources, and to ensure profit generation.

These challenges are interdependent and evolving

operational problems that enterprises need to solve

on an ongoing basis towards achieving systemic

profitability. Thirdly, one way to effectively access

and share information towards costs of products,

services, processes and systems of an enterprise is to

represent and reason about costs using ontology-

based enterprise models [Kosanke, 1997].

A tripartite approach towards determining

requirem

ents and specifications for EISP is

presented. In the first part, an understanding of the

nuances of traditional costing and ABC as is

currently practiced in enterprises is presented to

point the shortcomings of these current costing

practices. The second part provides a case study that

vividly demonstrates the problems in the current

309

Donald Tham K. and S. Fox M. (2004).

DETERMINING REQUIREMENTS AND SPECIFICATIONS OF ENTERPRISE INFORMATION SYSTEMS FOR PROFITABILITY.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 309-316

DOI: 10.5220/0002652803090316

Copyright

c

SciTePress

costing methods and clearly points their

inadequacies towards profitability. The third part

presents a framework for the specifications of

enterprise information systems for profitability

through ontology-based enterprise modeling,

EABEM, and Temporal-ABC for the attainment of

improved knowledge about costs.

2 EXPLAINING THE NUANCES

OF TRADITIONAL COSTING

AND ABC

Traditional costing systems use volume-driven

allocation bases such as direct labour hours, direct

machine hours, direct labour dollars, direct material

dollars, and sales dollars as the primary means of

assigning organizational expenses and overheads to

individual products, services and customers.

However, many of the resource demands by

individual products and customers are not

proportional to the volume of units produced or sold.

Thus, traditional cost systems do not measure

accurately the costs of resources used to design, to

produce, to sell and to deliver products to customers.

In general, according to Cooper [1988a][1988b]

and Kaplan [1988], the apportionment of indirect

and overhead costs to products and service products

based on volume related units such as direct labour

or machine hours according to traditional or

conventional cost systems provide irrelevant costs

for decision making and for the determination of

product or service profitability.

Kaplan and Cooper of Harvard Business School

developed the ABC Principle as an approach to

product or service costing as a means to overcoming

some of the problems with traditional costing

systems. These problems are exacerbated in that

existing enterprise modeling frameworks provide a

modeling infrastructure that tend to support

traditional cost systems [Tham & Fox, 1998].

The traditional ABC Principle includes the

assignment of costs to activities based on their use of

resources, and the assignment of costs to “cost

objects”

3

based on their use of activities [Cokins,

2001]. Since ABC assigns costs to activities based

on their use of resources, the logical formulation of

3

Within the ABC literature, the term “cost objects” refers

to the reasons for which activities are performed in

enterprises. Products, services, and customers are

considered cost objects as they may be the reasons why

activities are performed.

ABC must be premised upon the existence of some

given or identifiable costs of resources.

Nothwithstanding this obvious rationale, the

fundamental question then that begs to be asked at

the macro level is :- “From where and how does one

get the costs of resources for ABC?” At the more

micro level, and definitely from an ABC

implementation perspective, two fundamental

questions arise relevant to ABC:- (i) What unit

resource costs are associated with a resource? (ii)

How does one deduce unit resource cost(s) so that

direct, indirect and overhead costs are accounted for

within the costs of a resource?

According to the ABC concept, costing of cost

objects proceeds with the assignment of cost to

activities based on their use of resources, and the

assignment of costs to cost objects based on their use

of activities. First, the question is: From where and

how does one get the costs of resources for ABC?

Second, ABC emphasizes the need to obtain a better

understanding of cost behaviour and thus ascertain

what causes the overhead costs. However, towards

solving the question and fulfilling this need, there

are some problems that influence the feasibility of

ABC being applied to enterprises.

Let us examine the current costing process in

ABC as is done in existing ABC related softwares.

ABC is typically accomplished in a two stage

process. In the first stage, the cost assignment of

resources to an activity is accomplished through a

resource cost assignment phase through “resource

drivers”. In the second stage, the cost assignment of

activities to cost objects is accomplished through

“activity drivers”. A resource driver is a measure of

an activity’s resource consumption. It is used to

determine the portion of the total cost assigned to

each activity that uses the resources. Resource

drivers take cost from the general ledger and assign

it to activities. An activity driver is a factor used to

assign cost from an activity to a cost object.

Activity drivers are the mechanisms for assigning

the costs of activities to products. An activity driver

is a measure of the frequency of activity

performance and the effort required to achieve the

end result. In short, various factors referred to as

resource drivers, are used to assign cost to activities;

whereas activity drivers are methods for assigning

the cost of activities to cost objects.

Besides contending with the confusing selection

of resource drivers and activity drivers, the current

ABC user must also contend with the concept of

“cost drivers”. Cost drivers are associated with the

input of activities towards cost objects. Cost drivers

are supposed to reflect what causes an activity to be

ICEIS 2004 - INFORMATION SYSTEMS ANALYSIS AND SPECIFICATION

310

performed and what causes the cost of performing

the activity to change. An ABC system achieves

improved accuracy in estimation of costs by using

multiple cost drivers to trace the cost of activities to

the products associated with the resources consumed

by those activities. Hence, this leads to an ABC user

involved in an “art” towards ABC implementation

rather than a “science”. The “art” attempted

involves making two separate but interrelated

decisions about the number of cost drivers needed

and which cost drivers to use. The “art” gets further

confusing because the cost drivers selected changes

the number of resource drivers and activity drivers

needed to achieve a desired level of accuracy.

In summary, the current state of the “art”, or

perhaps, better stated as the problems in ABC

implementations today have led to the following

conclusions:-

1. Based upon the “artful” selection of cost drivers,

resource drivers and activity drivers, “overhead

and indirect costs” get allocated and included into

the cost of a cost object through cost pools.

2. According to the Armstrong Laing Group

[Armstrong, 2002]:- “One of the most difficult

parts of ABC implementation is the identification

and selection of suitable drivers…..you need to be

open to the idea that you may have to change

your assumption about driver assignment, and so

choose a solution that allows this easily.”

3. According to Babad & Balachandran [1993]:-

“An ABC system achieves improved accuracy in

estimation of costs by using multiple cost drivers

to trace the cost of activities to the products

associated with the resources consumed by those

activities. In this respect, a cost driver is an

event, associated with an activity, that results in

the consumption of the firm’s resources.”

4. According to Cooper [1988a][1988b]:- “The art

of designing an ABC system can be viewed as

making two separate but interrelated decisions

about the number of cost drivers needed and

which cost driver to use. These decisions are

interrelated because the type of cost drivers

selected changes the number of drivers required

to achieve a desired level of accuracy.”

5. Due to the increasing costs of overheads, current

ABC softwares and implementations use cost

pools for overheads drawn from the traditional

General Ledger cost accounting systems for the

allocation of overheads to products and services.

However, according to Gary Cokins [1996]: “In

effect, traditional general ledger cost accounting

systems act like thick cloud covers. The clouds

prevent any observation, and eventual

understanding, of the locations and rates at which

the enterprise uses resources to enable the

creation of value or to actually create value for

customers.”

The aforementioned statements express a need to

operationalize the cost assignment with better

consistency, better accuracy, better traceability of

“overheads and indirect costs”, and less ambiguity.

With regard to ambiguity, notice the confusing

usage of terms – resource driver, activity driver,

cost driver, event and drivers.

Given that there can be several different resource

drivers and activity drivers, the cost of the activity is

only as good as a resource driver, and the cost of the

cost object is only as good as an activity driver. This

inconsistent costing situation is further aggravated

depending upon cost driver selections, which in turn,

influences resource driver and activity driver

selections. Indeed, a sorry state of affairs – ABC, as

a means to a more accurate and consistent cost

system for better decision making, has been

basically reduced to the confusing art of driver

selections!

3 CASE STUDY: TRADITIONAL

COST ACCOUNTING (TCA)

VERSUS (TRADITIONAL) ABC

Traditional Cost Accounting (TCA) and traditional

ABC as implemented and practiced today is applied

to the following company data to vividly illustrate

the inadequacies of TCA and traditional ABC in a

company’s quest towards profitability.

Company X Data:-

• Produces 100 units of product A and 500

units of product B for year

• Direct labour for product A is 3 hours and

for product B is 2 hours

• Labour cost is $20 per hour and total labour

hours is 2000 hrs per year

• Total overhead cost per year is $100,000

• Cost of overhead (O/H) = $100,000/2,000

hrs = $50/hour

• Activities required for each of products A

and B are:- Setup, Machining, Receiving,

Packing, Engineering

DETERMINING REQUIREMENTS AND SPECIFICATIONS OF ENTERPRISE INFORMATION SYSTEMS FOR

PROFITABILITY

311

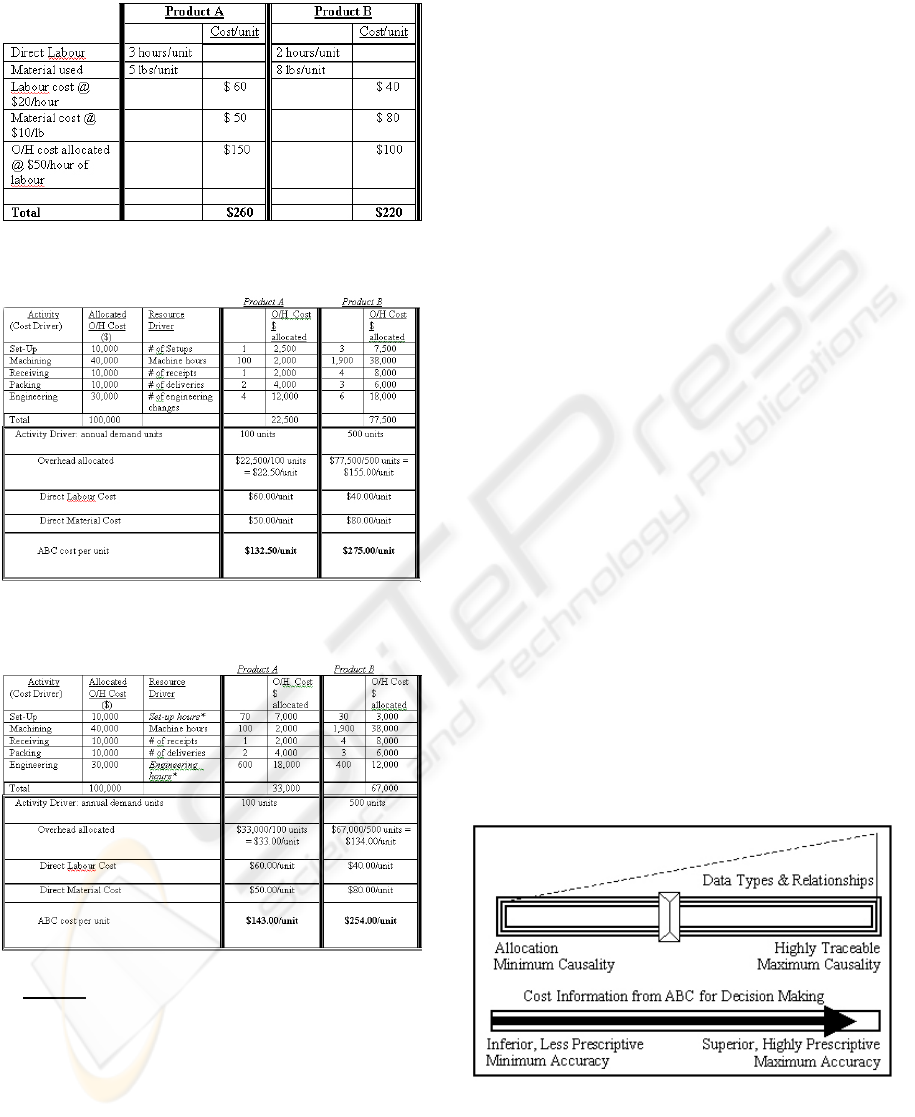

TCA in Company X

ABC in Company X

ABC in Company X with Resource

Driver Changes

*Note:- The resource driver - # of Setups – of

Table 2 is changed to Set-up hours in Table 3; and

the resource driver - # of engineering changes – of

Table 2 is changed to Engineering hours in Table 3.

These resource driver changes in Table 3 provide

better traceability and causal information linking

resource consumption by activities that output

Product A and Product B.

4 CASE STUDY CONCLUSIONS

1. Significant differences in cost per unit for Product

A and Product B are seen by comparisons of

Table 1 versus Table 2, and Table 1 versus Table

3. In short, significant differences in cost per unit

for Product A and Product B have resulted by the

application of Traditional Cost Accounting

(TCA) for Table 1 versus Traditional Activity-

Based Costing (ABC) for Tables 2 and 3. More

importantly, the ABC results from Table 2 and

Table 3 provide superior cost information for

profit improvement relative to the cost

information provided in Table 1.

2. On the other hand, by comparing Table 2 and

Table 3, significant differences in cost per unit for

Product A and Product B have resulted due to the

mere changes in resource drivers of Table 2 to

those of Table 3, notwithstanding the fact that

ABC has been applied to both tables. More

importantly, the ABC results of Table 3 are more

accurate and superior for profit improvement

relative to the ABC results of Table 2. The less

accurate cost assignment by allocation in Table 2

due to minimal causal data, has shifted to the

more accurate traceable cost assignment of Table

3 due to better traceability and causal data

changes of Table 3. In short, the accuracy of cost

assignment in ABC and the value of cost

information for decision making varies according

to the degree to which one can establish causal

and traceable data types and relationships (refer

Figure 1).

Decision Making with Cost Information

from ABC

ICEIS 2004 - INFORMATION SYSTEMS ANALYSIS AND SPECIFICATION

312

5 REQUIREMENTS FOR EISP

As illustrated in Figure 1, as data types and

relationships represented by the volume control

button, “slide” from being mere allocation with

minimal causality towards being highly traceable

with maximum causality, the decision making

information from ABC correspondingly changes

from being, inferior, less prescriptive with minimum

accuracy, to becoming superior, highly prescriptive

with maximum accuracy.

Owing to lack of overhead cost traceability and

hence its accountability, companies attempting to

implement ABC form overhead cost pools for

allocation to activities. Too often, different types of

costs are combined into one diffused overhead pool,

so cost object costs are often grossly distorted due to

allocation. Tracing enables one to assign costs

based on specific data, whereas allocation from

pools often involves indirect assignment of costs to

activities.

In short, EISP must be based upon enterprise

data types and relationships that have properties

and/or attributes that are highly traceable and exhibit

maximum causality for their existence. If such data

types and relationships are deployed in EISP, our

case study vividly illustrates that cost information

generated from the application of ABC tends to be

superior, highly prescriptive and maximally

accurate.

6 SPECIFICATION FRAMEWORK

FOR EISP

It is proposed that an ontology-based enterprise

model should form the specification basis for EISP.

First, by doing so, the design issues of enterprise

modeling can be overcome. Secondly, enterprise-

wide strategic intelligence is promoted. Thirdly, an

ontology-based enterprise models can provide a

superior generic modeling infrastructure towards

enterprise profitability through the support of highly

traceable, maximally causal data types and

relationships in all enterprises.

According to Fox & Gruninger [1998]:-

“An Enterprise Model is a computational

representation of the structure, activities, processes,

information, resources, people, behaviour, goals and

constraints of a business, government, or other

enterprise. It can be both descriptive and

definitional spanning what is and what should be.

The role of an enterprise model is to achieve model-

driven enterprise design, analysis and operation.

From a design perspective, an enterprise model

should provide the language used to explicitly define

an enterprise……

From an operational perspective, the enterprise

model must be able to represent what is planned,

what might happen, and what has happened. It must

supply the information and knowledge necessary to

support the operations of the enterprise, whether

they be performed manually or by machine. It must

be able to provide answers to questions commonly

asked in the performance of tasks.”

To represent and reason about costs using an

enterprise model, the model should be descriptive,

i.e., it should represent key entities, structures and

concepts needed to describe the enterprise’s

activities, resources, products, information flows and

costs.

The model should also be prescriptive. It should

be possible to prescribe the costs of activities,

resources and products of an enterprise using this

model.

A number of issues exist concerning the design of

enterprise models [Fox & Grüninger, 1998]. The

issues are:-

1. Reusability: it is concerned with the large cost of

building enterprise-wide data models. Is there

such a thing as a generic, reusable enterprise

model whose use will significantly reduce the

cost of information system building?

2. The consistent usage of the model: given the set

of possible applications of the model, can the

model’s contents be precisely and rigorously

defined so that its use is consistent across the

enterprise?

3. Accessibility: given the need for people and other

agents to access information relevant to their role,

can the model be defined so that it supports query

processing so that answers to common queries in

an agent’s domain, e.g., costing and profitability,

may be obtained.

4. Selectivity: how does one know which is the right

Enterprise Model for one’s application?

An ontology is a data model that “consists of a

representational vocabulary with precise definitions

of the meanings of the terms of this vocabulary plus

a set of formal axioms that constrain interpretation

and well-formed use of these terms” (Campbell &

Shapiro, 1995).

The goal of ontology-based enterprise modeling

is the implementation of an environment that

supports the modeling and design of enterprises. To

support this, ontological engineering deals with the

DETERMINING REQUIREMENTS AND SPECIFICATIONS OF ENTERPRISE INFORMATION SYSTEMS FOR

PROFITABILITY

313

design and evaluation of a shareable representation

of knowledge that minimizes ambiguity and

maximizes understanding and precision in

communication in an enterprise. The product of

ontological engineering is an ontology and/or micro-

theory. An ontology is a formal description of

enterprise objects, properties of objects, and

relations among such objects. A micro-theory,

however, is a formal knowledge required to solve a

problem in a domain (e.g., costing, quality) or

describes a subset of the domain in detail (e.g., ISO

9000 compliance as a subset of quality). A micro-

theory is separate from, but constructed upon an

ontology.

Vocabulary, definitions, and axioms that

describe

the enterprise are

formally represented using

ontologies, and

prescriptions for achieving goals are

formally defined using ontology representations.

Tham [1999] formalizes enterprise activity-based

costing, and prescribes to strategic cost

management. Parts of these models can be

shared

and re-used by others with minimized interpretation

ambiguity because they are modeled formally.

The business environment of an enterprise is

defined by activities, resources, markets,

customers, products, services, regulations and costs

associated with the enterprise. Strategic intelligence

is what a company needs to know of its business

environment to enable it to gain insight into its

present processes, anticipate and manage change for

the future, design appropriate strategies that will

create business value for customers, and improve

profitability in current and new markets. Therefore,

an ontology based enterprise model can provide an

explicit knowledge representation infrastructure of

shared understanding (Gruber, 1993) to promote

strategic intelligence that guarantees profitability.

There is a distinction between a language and

knowledge representation. A language is commonly

used to refer to means of communication among

people in the enterprise. Representation refers to the

means of storing information (aka knowledge) in a

computer (e.g. database). A representation is

essentially a set of syntactic and semantic

conventions that enables one to form a knowledge

repository or database in a computer for usage by

various agents in a distributed systems environment.

The set of syntactic conventions specify the form of

the notation used to express descriptions of the

knowledge entities. The set of semantic conventions

specify how expressions in the notation correspond

to the entities described. With the proliferation of

computer based distributed systems, enterprises can

make significant gains towards data traceability and

causality through the direct communication of

various enterprise processes (aka agents) with one

another. Consequently, the representation of

knowledge becomes the language of communication

for enterprises.

7 ENVELOPED ACTIVITY-BASED

ENTERPRISE MODEL (EABEM)

AND TEMPORAL-ABC

The motivation towards the research and

development of EABEM and Temporal-ABC is

based, first, upon the practical and implementation

needs towards solving the fundamental macro level

question in ABC as stated in Section 2 – “From

where and how does one get the costs of resources

for ABC?” Secondly, as demonstrated in the

previous section, there is need to give every

consideration to enterprise data, i.e., enterprise-wide

information and knowledge, to be represented with

maximum traceability, maximum causality, high

consistency and minimal ambiguity for the eventual

goal of obtaining highly accurate and prescriptive

cost information to support decision making towards

profitability.

Ontologies by design are constructed from

existing ontologies. For example, Kim’s [1999] and

Tham’s [1999] ontologies for quality and costs

respectively are developed using ontologies of

activity, state, causality, time, resource, and

organizational structure that describe fundamental

concepts about an enterprise. These are collectively

called the TOVE Core Ontologies (Grüninger &

Fox, 1995).

Enterprises are action oriented, and therefore, the

ability to represent action lies at the heart of all

enterprise models. In TOVE, action is represented

by the combination of an activity and its

corresponding enabling and caused states. An

activity is the basic transformational action primitive

with which processes and operations can be

represented.

ICEIS 2004 - INFORMATION SYSTEMS ANALYSIS AND SPECIFICATION

314

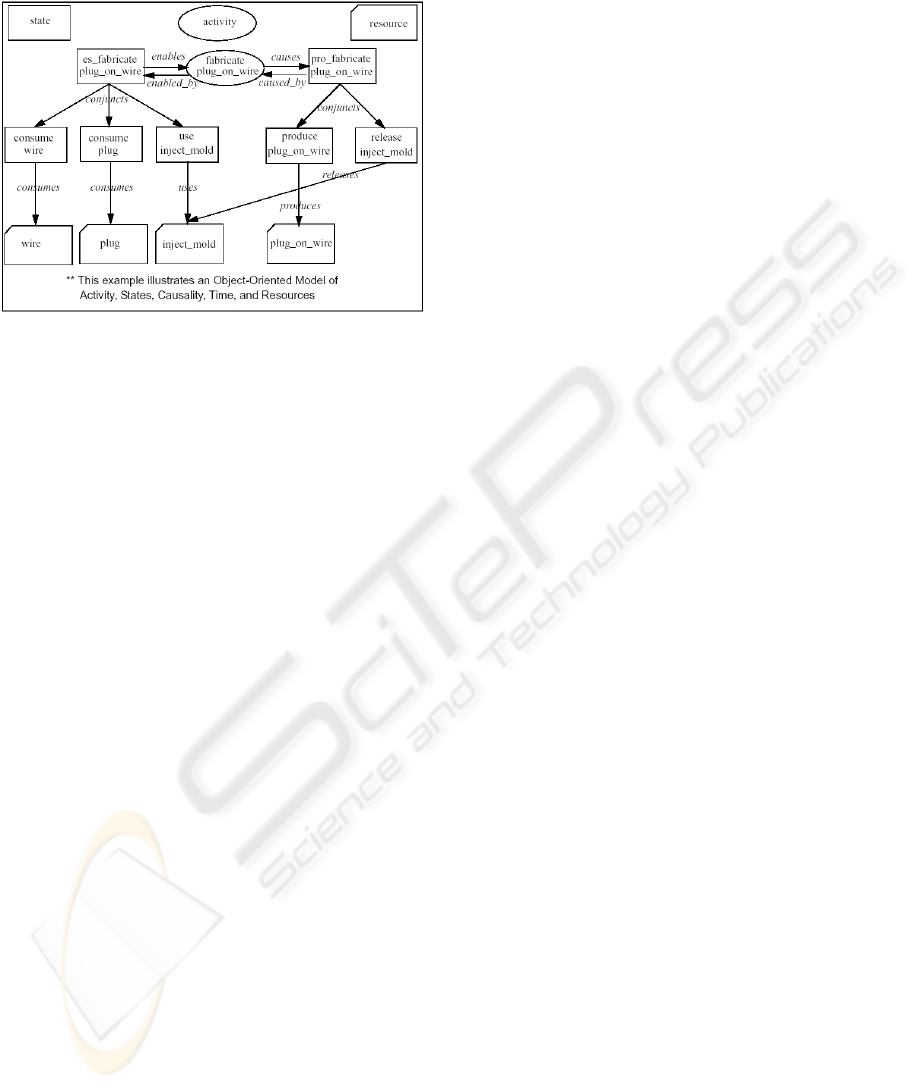

Activity-State Resource Cluster

An activity specifies a transformation of the world.

Its status is reflected in an attribute called status.

The domain of an activity’s status is a set of

linguistic constants:-

• Dormant – the activity is idle and has never been

executing before.

• Executing – the activity is executing.

• Suspended – the activity was executing and has

been forced to an idle state.

• ReExecuting – the activity is executing again.

• Completed – the activity has finished.

A state in TOVE represents what has to be true

in the world for an activity to be performed. An

enabling state defines what has to be true of the

world in order for the activity to be performed. A

caused state defines what will be true of the world

once the activity has been completed. An activity

along with its enabling and caused state is called an

activity state cluster or simply activity cluster. The

activity-state resource cluster (Fig. 2) is the nucleus

in building EABEM.

States associate resources with activities through

the four types of states which reflect the four ways

in which a resource is related to an activity – use,

consume, release, produce. The status of a state, and

any activity, is dependent on the status of the

resources that the activity uses or consumes. All

states are assigned a status with respect to a point in

time. There are four different status predicates:-

• Committed – a unit of the resource that the

state consumes or uses has been reserved for

consumption.

• Enabled – a unit of the resource that the state

consumes or uses is being consumed.

• Disenabled – a unit of the resource that the

state consumes or uses has become unavailable.

• Reenabled – a unit of the resource that the

state consumes or uses is re-available.

• Completed – unit of the resource that the

state consumes or uses has been consumed or

used and is no longer needed.

EABEM represents the enterprise-wide

infrastructure for representation of information and

knowledge such that various domains of interests

like cost management, performance measurement,

quality, etc., can be supported in the enterprise. A

formalized schema for EABEM may be represented

as follows:-

• E ≡ [Σ

internal resources

∩ (ξ

sig

)] U [Σ

external

resources

∩

(ξ

sig

)] U [Σ

activities

∩ (η

sig

)] U [Σ

frontier activities

]

where

• [Σ

internal resources

∩ (ξ

sig

)]: the set of sentences

defining significant internal enterprise resources,

• [Σ

external

resources

∩ (ξ

sig

)]: the set of sentences

defining significant external resources (aka as

frontier resources) to the enterprise,

• [Σ

activities

∩ (η

sig

)]: the set of sentences

defining significant activities of the enterprise,

• [Σ

frontier activities

]: the set of sentences defining

the enterprise frontier activities (aka as boundary

activities that representationally envelope or

surround the enterprise). Hence, the coining of

the term Enveloped Activity Based Enterprise

Model – EABEM.

To overcoming the shortcomings of current

practices based upon traditional ABC, the Principle

of Temporal-ABC states:-

• A cost object, i.e., a product or service, is the

reason why activities are performed.

• The assignment of costs to activities is based

upon their requirements of resources and the

possible changing temporal states of those

resources, thereby resulting in temporal costs for

activities.

• The cost of a cost object is based upon the

temporal costs of activities that produce it.

8 CONCLUDING REMARKS

This paper explains the nuances of traditional

costing and traditional ABC methodologies and

points to the inadequacies of these methodologies

towards profitability. Applications of these methods

to a case study, aptly demonstrates that companies

can unwittingly stray away from the profitability

path due to the inferior and incomplete knowledge

about product and service costs produced by these

methodologies. From a systems and information

engineering perspective, the case study provides

DETERMINING REQUIREMENTS AND SPECIFICATIONS OF ENTERPRISE INFORMATION SYSTEMS FOR

PROFITABILITY

315

evidence for the requirements criteria of high

traceability and maximum causality of data types

and relationships for EISP. Finally, a specification

framework for EISP is presented that is founded

upon ontology based enterprise modeling, EABEM

and the Principle of Temporal-ABC.

If profits are to be realized, companies urgently

need to closely question and examine their current

cost management practices towards profitability.

The situation is further exacerbated as companies

throw millions of dollars and countless human

resource hours in the deployment of enterprise

planning systems that incorporate the inadequate

costing methodologies discussed in this paper.

In the hope that the terms and fundamental

philosophies of the Sarbanes-Oxley Act are

embraceable [Gartner, 2003], the following quote

serves best as a practical and real motivation for

adopting “change thinking” towards profitability:-

“Complying with the legal requirements of

Sarbanes-Oxley is one thing; complying with the

spirit of the Act is another. The fundamental

message of the Act is that CFO’s and boards need to

know their businesses better. To comply with the

Act, organizations will need to ensure that their

senior finance managers really understand what

drives their increasingly complex and diverse

operations, and are constantly attuned to any

changes that impact financial reporting and

business performance.” [Armstrong, 2003]

REFERENCES

Armstrong Laing Group Inc., 2003. “The Sarbanes-Oxley

Act Section 409 – Real Time Issuer Disclosure”, ALG

White Paper.

Armstrong Laing Group Inc., 2002. “Activity Based

Costing Implementation Issues”, ALG White Paper.

Babad, Yair M. and Balachandran, Bala V., 1993. “Cost

Driver Optimization in Activity-Based Costing”, The

Accounting Review, Vol. 68, No. 3, pp. 563–575,

July.

Campbell, A. E. and Shapiro, S. C., 1995. Ontological

Mediation: An Overview”, Proceedings of the IJCAI

Workshop on Basic Ontological Issues in Knowledge

Sharing, Menlo Park CA: AAAI Press.

Cokins, G., 2001. Activity-Based Cost Management: An

Executive’s Guide, John Wiley & Sons, Inc.

Cooper, R., 1988a, “The Rise of Activity Based Costing –

Part One: What is an Activity-Based Cost System?”,

Journal of Cost Management, pp. 45 – 54, Summer.

Cooper, R., 1988b, “The Rise of Activity Based Costing –

Part Two: When Do I Need an Activity-Based Cost

System?”, Journal of Cost Management, pp. 41 – 48,

Fall.

Fox, Mark S. and Grüninger, Michael, 1998. Enterprise

Modeling, AI Magazine, AAAI Press, Fall 1998, pp.

109-121.

Gartner Inc., 2003, “The Sarbanes-Oxley Act Will Impact

Your Enterprise”, Research Note, 20

th

March.

Gruber, Thomas R., 1993. Towards Principles for the

Design of Ontologies Used for Knowledge Sharing, In

International Workshop on Formal Ontology, N.

Guarino & R. Poli, (Eds.), Padova, Italy.

Grüninger, M., and Fox, M.S., 1995. Methodology for the

Design and Evaluation of Ontologies, Workshop on

Basic Ontological Issues in Knowledge Sharing,

IJCAI-95, Montreal.

Kaplan, Robert S., 1988, “One Cost System Isn’t

Enough”, Harvard Business Review, pp. 61 – 66,

January – February

Kim, Henry M., 1999. Representing and Reasoning about

Quality using Enterprise Models, Ph.D. Thesis,

Department of Mechanical and Industrial Engineering,

University of Toronto, Toronto, Ontario, CANADA,

M5S 3G9.

Kosanke, K., 1997, “Enterprise Integration – International

Consensus: A Europe-USA Initiative”, Proceedings of

International Conference on Enterprise Integration and

Modelling Technology, Torino, Italy, October 28-30.

Tham, K. Donald, 1999. Representing and Reasoning

about Costs using Enterprise Models and ABC, Ph.D.

Thesis, Department of Mechanical and Industrial

Engineering, University of Toronto, Toronto, Ontario,

CANADA, M5S 3G9.

Tham, K. Donald and Fox, Mark S., (1998), “Enterprise

Models and Their Cost Perspectives”, Proceedings for

Industrial Engineering and Management, Canadian

Society for Mechanical Engineers (CSME) Forum,

Toronto, May 19-22.

ICEIS 2004 - INFORMATION SYSTEMS ANALYSIS AND SPECIFICATION

316