AN EXCHANGE SERVICE FOR FINANCIAL MARKETS

Hairong Yu, Fethi A. Rabhi and Feras T. Dabous

School of Information Systems, Technology and Management,The University of New South Wales, Sydney 2052, Australia

Keywords: Information Systems Integration, Legacy Systems, Web services, Performance, Security, Trading Systems

Abstract: The critical business requirements and compelling nature of the competitive landscape are pushing

Information Technology systems away from the traditional centrally controlled corporate-wide architectures

towards dynamic, loosely coupled, self-defining and service-based solutions. Web services are regarded as a

key technology for addressing the need for connecting extended applications and providing standards and

flexibility for enterprise legacy systems integration. This paper reports our experiences when integrating a

financial market trading system. This integration process starts from analysing the trading system’s

architecture, then identifying system functionality and finally realising the design and implementation of a

Web service. Performance and security and the trade-offs involved are the major focus points throughout

this process. Comprehensive benchmarking is conducted with and without Web service and security

considerations.

1 INTRODUCTION

Information technology innovations such as

electronic communication networks have enormous

impact on the way people are doing business

nowadays. For example, the finance industry is

evolving rapidly as companies adapt new

technologies in order to survive in a highly

competitive and dynamic business environment. The

explosive growth in online trading systems that

operate from different locations worldwide is just

one example. However many mature, well

developed existing legacy trading systems do not

meet new business requirements. Their design

prevents them from interacting with other financial

systems in order to provide more services and

extend enterprise solutions. Developing applications

which try to supply best approaches to solve this

problem is becoming highest priority (Hendershott,

2003).

As interoperable trading systems are becoming

m

ore common (Allen, 2001), this paper is concerned

with adapting centrally-controlled corporate-wide

legacy systems to satisfy these new requirements.

There are many challenges:

• Business P

artner Integration: a centrally

controlled architecture hardly ensures complete,

expeditious and flexible integration between

systems including legacy systems when new

business partners are introduced or supply

chains cross a community are needed to be

chosen or outsourcing units are required to be

seamlessly connected.

• Serv

ice Accessibility: traditionally packaged

and tightly coupled systems cannot easily be

delivered as streams of services and accessed

pervasively from anywhere.

• Sys

tem Development: slow software

development obstructs organizations' ability to

expose system functionalities for external use

on value added tasks or extend to new markets.

• Stand

ardization: individual specifications and

standardizations are carried out without industry

agreements on data exchange, messaging,

interface description and business process layer.

New technologies such as Web Services are

pus

hed by many key IT vendors (IBM, Microsoft,

Hewlett-Packard, Oracle, Sun etc) and do not require

the adoption of a common implementation platform.

The technologies only require conformity to some

standard protocols and are extremely efficient for

leveraging existing applications and infrastructure.

Despite those promises (CBDI, 2003), there are not

many Web services currently operating in important

application domains, particularly financial trading.

403

Yu H., A. Rabhi F. and T. Dabous F. (2004).

AN EXCHANGE SERVICE FOR FINANCIAL MARKETS.

In Proceedings of the Sixth International Conference on Enterprise Information Systems, pages 403-410

DOI: 10.5220/0002626604030410

Copyright

c

SciTePress

One of the impediments is that in addition to

integration difficulties, there are serious concerns

about meeting industry essential requirements in

performance and security.

To study the application of Web service

technology in financial trading, we are developing a

proof-of-concept prototype Web service called

Exchange Service (Exchange Service, 2003) while

addressing those critical requirements. The

Exchange Service is based on a full-fledged

commercial financial market trading system called

X-Stream (Computershare, 2003) which has been

developed for many years (Trading Technology,

2003).

This paper reports our experiences in developing

the Exchange Service. It is organised as follows:

section 2 gives background on trading systems and

their industry requirements. Section 3 illustrates the

Exchange Service design and implementation.

Experiments involving two focal points, namely

performance and security, are discussed in section 4.

Conclusions and future work are presented in section

5.

2 BACKGROUND AND

REQUIREMENTS

In this section, the application domain is briefly

introduced. Future directions and industry principal

requirements are also identified.

2.1 Financial Markets and Trading

Systems

A financial market’s purpose is to facilitate the

exchange of financial assets (Viney, 2000). A

trading system or a trading engine is a computerized

system used to trade financial products such as

equities, options, futures, currencies and

commodities in financial markets (Harris, 2002).

Business rules related to financial markets can be

supplied as parameters to the system, therefore

making it flexible and easily customised (Lee,

2002). An example of an in-house built trading

system is the Stock Exchange Automated Trading

System (SEATS) in Australian Stock Exchange

(SEATS, 2003)).

2.2 Future of Trading Systems in

Financial Markets

The internet has already changed the way many

investors trade financial products by bringing up-to-

date market information from Web and do-it-

yourself trading online. For example, international

brokers want to trade in multiple markets

simultaneously wherever they are; diversified

investors want to trade bundled portfolios. Trading

systems in the future will be required to offer

investors unprecedented convenience, choices and

security in accessing fast updating information in

order to make decisions in real time.

Traditionally and structurally, a trading system is

a core part in financial markets. Therefore it plays a

leading role in Business-to-Business (B2B) and e-

business/e-Commerce-to-Enterprise (e2B)

integrations. The development of an exchange

service to tie other services in financial markets

together becomes a compelling and urgent task for

many trading firms and whole enterprises.

2.3 Exchange Service Requirements

Many new technologies will play fundamental roles

to achieve those intentions and integrations in the

information-intensive financial market industry. For

an exchange service, there will be two leading

aspects in quality of service: performance and

security.

2.3.1 Performance Requirements

Trading engines are performance-critical systems

and performance has always been a main key to their

success. The transaction rates vary largely during

different periods of day or year, when new securities

are introduced. In some rare cases, it could go up to

more than 60,000 orders/sec. Given the possibly

large volumes of data in a short time and the need

for timely dissemination, integration between a real-

time trading system and other pre-trade and post-

trade processes is the most important requirement

in a financial market domain. In this case, the

connection of a trading system with other

applications should maintain an acceptable level of

efficiency, more precisely saying that around 10% of

performance degradation should be sufficient.

2.3.2 Security Requirements

Security is extremely critical in the finance industry

trading systems. Financial market information

infrastructure should especially provide the

following basic security features:

• Authentication and authorization. If an

exchange service receives an order from a

trader, it must be able to identify the trader and

his/her privileges. Likewise when the trader

receives any information from the exchange

ICEIS 2004 - DATABASES AND INFORMATION SYSTEMS INTEGRATION

404

service e.g. trade confirmation; the client side

systems should be able to determine that the

confirmation comes from the exchange service,

as a trusted service, not from other sources.

• Data integrity. Buy or sell messages sent from

investors to an exchange service travel through

multiple routers over the open/private network.

The system should make sure that orders are the

same as the ones the exchange service receives.

• Confidentiality. Many traders require strong

anonymity and high confidentiality. A

confidential financial data leak can cause

substantial damage to participants and ruin the

trading market reputation. The most popular

and effective approach to ensure confidentiality

on a public network is through encryption.

• Non-repudiation. When brokers submit orders,

they want to be assured that the exchange

service does receive an identical order and can

provide a proof to a third party to avoid disputes

in case the order does not “go through” for any

reason.

• Denial-of-service (DoS) attack prevention. A

DoS attack could jam financial services or their

communication channels with a huge amount of

bogus data to prevent the system/service from

responding to normal requests.

Other features like shill fraud prevention and

front-running prevention are addressed by some

more specific methodologies (Long et al., 2003).

Special security concerns may be raised on

integrated financial markets. For example, multiple

vendors who all have individual user authentication

and authorization should be controlled by single

sign-on schemes.

3 EXCHANGE SERVICE DESIGN

AND IMPLEMENTATION

We choose to design and implement our exchange

service according to the principles of Web Service

Architectures (Web Service, 2003). Technically

described, such architectures are based on loosely

coupled, self-defining and service-based software

components communicating in XML-based

messages over Internet standard protocols. More

specific definitions can be found at the World Wide

Web Consortium (W3C). Web services enable

enterprises to expose their internal applications on

the Web and make them accessible to business

partners and broader communities. Its introduction

in financial markets could facilitate inter-enterprise

business processes, such as automated straight-

through processing (STP).

As mentioned in the introduction, the proposed

Exchange Service is based on a commercial trading

system call X-Stream. We briefly overview the X-

Stream system, before describing the design and

implementation of the Exchange Service,

3.1 Architecture of X-Stream

X-Stream is one of first generation exchange trading

systems that have been designed around a client-

server architecture (Trading Technology, 2003). It

has been used extensively as critical business

application for many years. It is a proprietary system

with a number of distinctive components such as:

• Trading engine: This is the essence of X-

Steam. It performs order management, trade

matching, reporting and circulation of market

and trading data. Relational databases

(Informix) are used to keep all necessary pre-

trade and post-trade related information. A rich

set of Application Program Interface (API)

functions are provided for client and server

application development.

• Backup trading engine: It serves as a standby

trading engine in the event of trading engine

failure, where it can be used as a primary

trading engine transparently.

• Distribution gateways: They provide

scalability, fault tolerance and market data

distribution to clients.

• Trader workplace: It provides a client

environment for brokers and users accessing

exchange market sensitive information and

submitting orders.

Built with Object-Oriented and relational

database design methodologies (Jessup, 2002), X-

Stream is highly configurable through Informix

database parameters and is re-configurable in real-

time via market control transaction. It is a huge,

comprehensive, closely-coupled and mature system

written in C++.

3.2 Overview of the Exchange Service

Our goal is to enable the integration of the trading

system, in a seamless way, with some current and

future applications, e.g. Web applications. We also

plan to allow the system to be used in trading over

the Internet, which becomes more and more popular

among investors and brokers.

The Exchange Service makes X-Stream more

visible and accessible for interaction with other

AN EXCHANGE SERVICE FOR FINANCIAL MARKETS

405

applications, and is not meant to be a replacement of

X-Stream.

The main advantage of using Web service

technology is that it does not require any

modification to the legacy systems. However its

integration is not a trivial task. It depends on internal

applications and business processes from various

back-end systems.

A very feasible method for integrating X-Stream

is based on an access wrapper. Figure 1 depicts the

Exchange Service stack reference architecture.

Figure 1: The layered architecture

Since X-Stream and its Client API are designed

in Object Oriented style, the Client Implementation

layer is drafted in the same fashion. The Exchange

Service can be invoked in Client-Server fashion. For

example a client process can place an order by

requesting the appropriate service from the

Exchange Service. More details are highlighted in

the next subsections.

3.3 Wrapper/Client Implementation

Because Java has facilitated several popular, easy-

use e-commerce enabling technologies, we first

considered developing a Java wrapper allowing Java

methods to invoke C++ codes by using the Java

Native Interface (JNI), a part of the Java 2 Platform,

Standard Edition (J2SE) (J2SE, 2003)

However, the overheads introduced by the Java

wrapper made the frequently used functions almost

five times slower than the original functions from X-

Stream performance. This is unsatisfactory for a real

time exchange service. We found that JNI related

operation is the main reason for unsatisfactory

performance. So we believe that we have to adapt a

C++ wrapper instead of Java wrapper for the

exchange service.

Web services are popular partially because of the

XML-based SOAP protocol, which brings a

powerful and versatile message exchange format. So

we choose a SOAP development environment,

gSOAP, to build a SOAP/XML web service.

gSOAP, an open source (gSOAP, 2003),

provides a platform-independent development

environment for deploying efficient SOAP/XML

Web services in C and C++. Also there are other

reasons for selecting it as a development tool

(Engelen, 2003):

• Rapid application development (RAD) by

automatic mapping XML-C++ and unique

SOAP-C/C++ binding:

• Efficiency, eg precompiled RPC stub and

skeleton routines quicken runtime encoding and

decoding; steaming technology.

• Low memory overheads, low SOAP RPC

latencies, easy control of memory allocation and

development for real-time system.

• Support for Secure Socket Layer (SSL).

• Ease of use, eg gSOAP SDK generates a WSDL

specification; client applications become an

extensively automated development.

The pre-compiled marshalling routines for native

C++ and user-defined data types enable the

integration of C++ legacy applications, in this case

X-Stream within SOAP services and clients.

Functions such as placeOrder, getQuote are exposed

as SOAP remote service methods.

The performance test results will be discussed in

section 4 and exhibit sufficient outcomes which are

compatible with performance of another component,

the surveillance service (Dabous et al., 2003), in our

financial market architecture.

3.4 Security

Although Web Services raise many security

challenges, they can also function as powerful and

flexible security tools. We investigated the

possibilities of providing security as a shared service

among our other services (Kong, 2002) and offer

security service as utilities. This could separate the

business functions of information service providers

from security service providers – and let users

choose and pay for the security service they need

(Long et al., 2003). The preliminary results show

significant benefits for cost control, maintainability,

interoperability, visibility and manageability.

However there are also disadvantages such as

multiple standards, support technologies and

possible bottlenecks with non-scalable solutions etc.

So we decided to concentrate on authentication and

data integrity by using digital signature and secure

communication in SSL. Because of limited space,

we only sketch our experience with SSL briefly.

Web Services have no built-in security model.

More specifically, SOAP does not define vocabulary

ICEIS 2004 - DATABASES AND INFORMATION SYSTEMS INTEGRATION

406

elements to transport security references from

requesters to service providers and Web Services

Description Language (WSDL) does not define

elements to describe security capabilities and

requirements. Therefore we must add a security

protocol such as SSL (Freier, 1996) to meet the

security requirements. In general, we believe that

Public Key Infrastructure (PKI), for supporting

digital signatures and document encryption and

HTTPS/SSL, for secure point-to-point

communication with known trusted parties will

provide basic security for our application systems.

We chose SSL because it is:

• The main protocol for Web security;

• Fairly mature with almost a decade of

improvements;

• Very widely implemented in many open source

development kits; and

• Easy to use and to be deployed.

SSL is the current standard method of securing

Web transactions. However it involves essential

mathematical computations that take up CPU cycles

and becomes a major cause of performance

degradation. Some performance results will be

discussed in section 4.

3.5 Other Work

Besides the development of a secure Exchange

service, we have been working on three other

directions.

Firstly, X-Stream has no push communication

model, which means that brokers are not informed

automatically when their orders become trades in the

exchange system. Therefore we build a Peer-to-Peer

Web Service on top of the Exchange Service for

trade data disseminations. This will extend the

functionality of X-Stream by informing brokers

automatically.

Secondly, as gSOAP only supports request-

response messaging, we are investigating the use of

the Financial Information Exchange (FIX) protocol

whose session is defined as a “bi-directional stream

of ordered messages between two parties” (FIX

Protocol, 2001). This means that there are no

request-response semantics imposed by the

specification. The Exchange Service could choose

to apply a combination of one-way and notification

interaction patterns rather than use Remote

Procedure Call (RPC)-style communication in terms

of implementing trading data dissemination

scenario.

Thirdly, the Universal Description, Discovery

and Integration (UDDI) is basically a service

registry between the web service requestors and the

web service providers (UDDI, 2002). In our case,

the UDDI behaves as a locator of our Exchange

Service for clients to discover its IP, port numbers

WSDL-described services (WSDL, 2003).

Additional details on the Exchange Service

design and implementation can be found in (Yip and

Mok, 2003).

4 EXCHANGE SERVICE

EVALUATION

This section discusses performance and security

aspects of the proposed Exchange Service.

The first set of experiments addresses the

concerns of performance of Web services (Vaughan-

Nichols, 2002). The main reason is that XML is text-

based rather than binary-based like CORBA's

Internet Inter-ORB Protocol (IIOP), requiring more

data to process (Davis and Parashar, 2002). The

speed of coding and decoding and the message size

are negatively impacted (Chiu et al. 2002).

We set up a performance testing environment

within a Local Area Network (LAN). All exchange

engines and gateways are supported by Dual Intel

Xeon 2.8GHz processors. We adopt the classical

methodology to test one of simplest functionalities:

placing orders like brokers do in real life. We choose

to submit one single order at a time only for the

computing processes

1

in a few scenarios: one single

client and multiple clients (up to 16) and four

gateways to support load balancing.

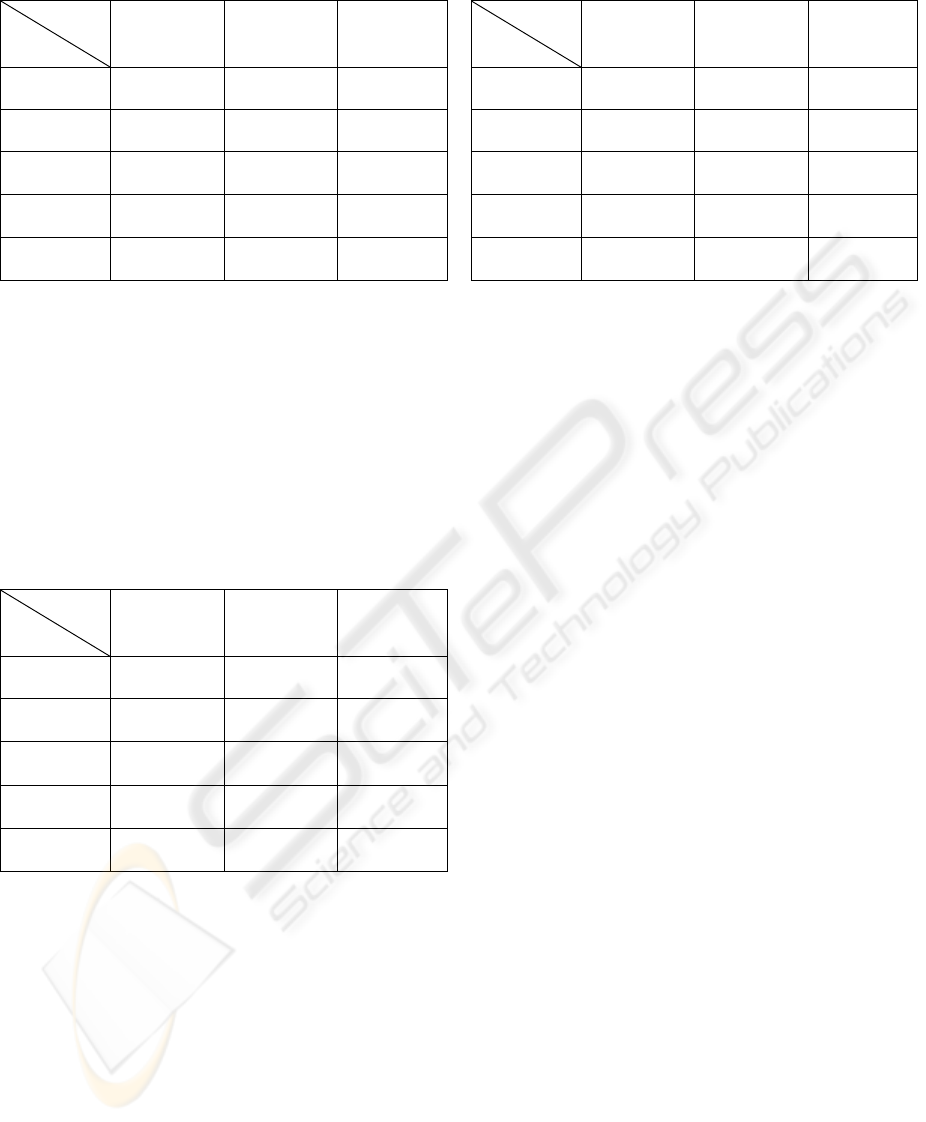

The initial performance results (orders/sec) of

Exchange Service are shown in Table 1. The

performance overhead is generally defined as a ratio

of absolute performance difference over the

combined unit performance in percent. Take the

example of 1 client case in Table 1, its overhead is

(42.5-40.0)(orders/sec)/40.0(orders/sec) = 6.25%.

1

In reality, most trading engines process orders in batch

mode i.e. a group of order is processed at once.

AN EXCHANGE SERVICE FOR FINANCIAL MARKETS

407

Table 1: Preliminary performance results (orders/sec)

Engine

without

Service

Engine

with

Service

Service

Overhead

1 client 42.5 40.0 6.25%

4 clients 153.11 146.02 4.86%

8 clients 166.7 149.5 11.51%

12 clients 180.0 164.11 9.68%

16 clients 190.0 180.6 5.20%

Because the additional Web Service

implementations increase memory usage during

SOAP message processing, overheads must be due

to SOAP messages that include numerous XML

elements. The next experiment attempts to improve

the performance and scalability of Web services

using chunked transfers, HTTP keep-alive support,

and increasing buffer size at both client and server

sides. However the improvements on performance

are not very significant. The results are depicted in

Table 2.

Table 2: Enhanced performance results (orders/sec)

Engine

without

Service

Engine

with

Service

Service

Overhead

1 client 42.5 40.1 5.99%

4 clients 153.11 147.0 4.16%

8 clients 166.7 151.0 10.40%

12 clients 180.0 169.5 6.19%

16 clients 190 182.6 4.05%

Overall, the results show that the Exchange

Service has not much negative impact on the

performance of X-Stream.

Since security is another imperative but non-

functional requirement for trading systems, the next

experiment benchmarks the performance of a fully

SSL-protected Exchange Service.

The added security protocol SSL slows the

performance considerably. This is due to substantial

processing time taken on encryption and decryption.

Table 3: with SSL performance results (orders/sec)

Service

without

SSL

Service

with

SSL

SSL

Overhead

1 client 42.5 5.6 658.93%

4 clients 153.11 6.5 2255.54%

8 clients 166.7 5.7 2824.56%

12 clients 180.0 5.85 2976.92%

16 clients 190.0 6.95 2633.81%

Table 3 shows of two orders of magnitude

performance decrease, which is consistent with

experiments conducted by another commercialising

company, e.g. Preact Ltd.

(Preact, 2003). Some

improvements are recommended by Rescorla in

(Rescorla, 2001).

Obviously the results, e.g. around six times

slower in 1 client case, shown in Table 3 are

unacceptable in reality. Currently we’re considering

element-wise encryption (with SOAP messaging),

eg only sensitive parts should remain encrypted from

beginning to end or in a more general manner of

providing different levels of protection according to

specific requirements. It will considerably increase

the performance by reducing the noncompulsory

computation overheads.

The choice of a Web server with better tuning of

SSL transactions and cryptographic library on

algorithm, suite on balance between security and

performance all are significantly impact the speed

(HPSSLperf, 2002).

A detailed experiment description and analysis

can be found in (Yip and Mok, 2003).

5 CONCLUSION AND FUTURE

WORK

From our development experiences, we ascertain

that Web Services are suitable for dynamic

integration with high availability, open standard and

rapid engineering approaches.

The current Exchange Service intimately meets

the requirement of a trading system in performance.

A similar conclusion is drawn by (Kohlhoff and

Steele) in terms of SOAP efficiency only. We are

planning to continue our experiments with realistic

data to compare the results between X-Stream and

the Exchange Service. More work is required to

address and ensure that both privacy and security

can be preserved while customers, brokers, traders

ICEIS 2004 - DATABASES AND INFORMATION SYSTEMS INTEGRATION

408

and researchers access the financial information

easily, quickly and confidently.

In current financial market, a transaction can

bind concurrent related connections to multiple

parties and several layers of agents. For example, the

trading engine could simultaneously connect with

other brokers for placing orders, banks for

settlement or credit checking, financial institutes for

registry or market analysis etc. However SSL does

not support multiple-party communications very

well and cannot provide assurance of nonrepudiation

without a third-party server (Security Roadmap,

2002). We are researching and experimenting secure

XML protocols, e.g. XML Digital Signature (DSIG).

The XML Signature standard provides a means for

signing parts of XML documents. (XML Signature,

2003) and XML Encryption (XML Encryption,

2003) supported by W3C for efficient and secure

data communication to complement SSL.

The XML Encryption standard permits

encryption of portions of the message allowing

header and other information to be clear text while

leaving the sensitive contents encrypted to the

ultimate destination with true end-to-end

confidentiality. In web services environment, a

service provider may play the role as a service

requestor who sends information to multiple

services.

Another group lead by Pradeep Ray (Ray, 2003)

is collaborating with us on DoS attack prevention.

The DoS attacks, in distributed forms have to be

dealt with at the network management level.

Besides the security focus, in order to leverage

our existing web services and to achieve an efficient,

dynamic integration solution, a new approach of

user-centric, process-driven and real time oriented

service is designed and implemented in our lab. It is

called real time trade data service (Cheung and Wu,

2003).

Another component in our architecture is a

composite broker service for trading larger orders.

This includes searching existing databases,

generating trading plans based on output of analytics

services, placing the orders and receiving executing

results from trading service (Dabous and Lee, 2003).

There are some integration issues that must also

be addressed in order to tightly coordinate with other

organizations, individuals and working groups for

customer satisfaction, operational excellence and

legal requirements (Rabhi and Benatallah, 2002).

For instance, settlement, which happens after trade

completion, involves transferring funds between

buyers' and sellers' bank accounts, needs to be

promptly facilitated among different financial

institutes. Currently, STP occurs a few days later

after trading. The industry goal is T+0 (same day

settlement). We are targeting various information

technical solution options to explore and provide the

STP opportunity for Australian financial market

service sectors.

ACKNOWLEDGEMENT

We would like to sincerely acknowledge the

contribution of many people on this project. We

thank Stanley Yip, Joshua Mok, Chris Burgess,

Johan Fischer, Yun Ki Lee, Glen Tan, Robert Chu

Sunny Wu, Anthony Cheung, Rafal Konlanski and

Jamaria Kong, Anne-Laure Mazon. The work is

partially supported by Capital Markets Cooperative

Research Centre (CMCRC, 2003).

REFERENCES

Allen, H. et al., November 2001. Electronic trading and

its implications for financial systems.

At

http://www.bis.org/publ/bispap07.htm

Capital Markets Cooperative Research Centre(CMCRC),

2002-2003. At http://www.cmcrc.com/

CBDI, 2003. At http://www.cbdiforum.com/index.php3

Cheung, A. and Wu, S., 2003. A Trade Data Service,

Thesis, the University of New South Wales.

Chiu, K. et al., 2002. SOAP for high performance

computing, Technical report, Indiana University. At

http://www.extreme.indiana.edu/xgws/papers/soapPerf

Paper/soapPerfPaper.pdf

Computershare, 2003. At http://www.computershare.com

Dabous, F. et al. 2003. Performance Issues in Integrating

a Capital Market Surveillance System using Web

Services. In proc. of 4th International Conference on

Web Information Systems Engineering, Roma, Italy,

Dec 2003

Dabous, F and Lee, Y., 2003. Web Services Composition

in Capital Market Systems, Technical report, the

University of New South Wales.

Davis, D. and Parashar, M., 2002. Latency performance of

SOAP implementations, in proceedings of the 2

nd

IEEE/ACM International Symposium on Cluster

Computing and the Grid

Engelen, R. et al., 2003. Developing Web Services for C

and C++, IEEE Internet Computing, March|April 2003

pp53-61

Exchange Service, 2003.

At http://129.94.244.61:8080/fit/prototypes.html/

FIX Protocol, 2001. The Financial Information Exchange

Protocol (FIX), version 4.3, At

http://www.fixprotocol.org/specification/fix-43-pdf.zip

AN EXCHANGE SERVICE FOR FINANCIAL MARKETS

409

Freier, A. et al., 1996. The SSL Protocol, Version 3.0.

Internet Draft.

At http://wp.netscape.com/eng/ssl3/draft302.txt

gSOAP, 2003.

At http://www.cs.fsu.edu/~engelen/soap.html

Harris, L., 2002. Trading and Exchanges: Market

Microstructure for Practitioners. Oxford University

Press

Hendershott, R., 2003. Electronic Trading in Financial

Markets. In IT Pro, July|August 2003. ICCC

Computer Society.

HPSSLperf, 2002. Delivering the world’s fastest HP-UX

11i SSL performance with the Intel

®Itanium®2

processor family, At http://www.hp.com/

Jessup, P., 2002. Product Overview for Computershare X-

Stream, Computershare Technology Services Pty Ltd.

Jessup, P., 2002. User Manual for Computershare ASTS,

Computershare Technology Services Pty Ltd.

J2SE, 2003. Java 2 Platform, Standard Edition (J2SE),

At http://java.sun.com/j2se/

Kohlhoff, C. and Steele, R., 2003, Evaluating SOAP for

High Performance Business Applications: Real-Time

Trading Systems, In proc. of The Twelfth International

World Wide Web Conference (WWW2003), Budapest,

Hungary, May, 2003

Kong, J., 2002. Security in Inter-domain Financial Market

System Integration, Thesis, the University of New

South Wales

Lee, Y., 2002. Design of Capital Market Systems, Thesis,

the University of New South Wales

Long, J. et al., July|August 2003. Securing a New Era of

Financial Services, IT Pro

Preact Ltd., 2003. SSL Performance,

At

http://www.preactholdings.com/performance/products/j

etnexus/jet-nexus/SSL/

Rabhi, F. and Benatallah, B., 2002. An Integrated Service

Architecture for Managing Capital Market Systems,

IEEE network, 16(1)pp15-19

Ray, P., 2003, Integrated Management from E-Business

Perspective, International Kluwer Academic/ Plenum

Publishers

Rescorla, E., 2001. SSL and TLS: Designing and

Building Secure Systems, Addison-Wesley.

SEATS, 2003.

At http://www.asx.com.au/markets/l4/seats_am4.shtm

Security Roadmap, 2002. Security in a Web Services

World: A Proposed Architecture and Roadmap – A

joint security whitepaper from IBM Corporation and

Microsoft Corporation. At

http://www-

106.ibm.com/developerworks/webservices/library/

ws-secmap/

Trading Technology, 2002. Trading Technology Survey of

Exchange Technology 2002. At

http://www.tradingtechnology.com

[Accessed in August 2003]

UDDI, 2002. UDDI Version 3 Specification,

At http://www.oasis-open.org/committees/uddi-

spec/doc/tcspecs.htm#uddiv3

Vaughan-Nicols, S., 2002. Web services: Beyond the

Hype, IEEE Computer, 35(2) pp18-21

Viney, C., 2000. McGrath’s Financial Institutions,

Instruments and Markets. McGraw Hill. Sydney. 3

rd

edition

Web Service, 2003. Web Services Architecture, At

http://www.w3.org/TR/2003/WD-ws-arch-

20030808/#whatis

WSDL, 2003. Web Services Description Language

(WSDL) Version 1.2, At http://www.w3.org/TR/wsdl2/

XML Encryption, 2003. XML Encryption WG,

At http://www.w3.org/Encryption/2001/

XML Signature, 2003. XML Signature WG,

At http://www.w3.org/Signature/

Yip, S. and Mok, J., 2003. An Exchange Web Service,

Thesis, the University of New South Wales.

ICEIS 2004 - DATABASES AND INFORMATION SYSTEMS INTEGRATION

410