On App-based Matrix Code Authentication in Online Banking

Vincent Haupert and Tilo Müller

Department of Computer Science, Friedrich-Alexander University Erlangen-Nürnberg (FAU), Erlangen, Germany

Keywords:

Mobile Banking, App-based Authentication, Malware, PSD2, Compliance.

Abstract:

Owing to their growing popularity, smartphones have made two-step authentication schemes not only accessible

to everybody but also inexpensive for both the provider and the end user. Although app-based two-factor

methods provide an additional element of authentication, they pose a risk if they are used as a replacement for

an authentication system that is already secured by two-factor authentication. This particularly affects digital

banking. Unlike methods backed by dedicated hardware to securely legitimize transactions, authentication apps

run on multi-purpose devices such as smartphones and tablets, and are thus exposed to the threat of malware.

This vulnerability becomes particularly damaging if the online banking app and the authentication app are both

running on the same device. In order to emphasize the risks that single-device mobile banking poses, we show

a transaction manipulation attack on the app-based authentication schemes of Deutsche Bank, Commerzbank,

and Norisbank. Furthermore, we evaluate whether the matrix code authentication method that these banks

and Comdirect implement — widely known as photoTAN — is compliant with the upcoming Revised Payment

Service Directive (PSD2) of the European Banking Authority (EBA).

1 INTRODUCTION

Online banking has become an essential service that

virtually every bank offers to its customers and that

enjoys wide popularity. In a 2016 representative sur-

vey, Bitkom Research (Bitkom e.V., 2016) revealed

that

70%

of German internet users access their bank’s

online banking service to check their account balance

and to initiate transactions. Multiple surveys indicate,

however, that the digital banking activities currently

shift towards mobile banking. The annual internatio-

nal report conducted by Bain & Company (Company,

2016) concludes that mobile banking gains traction

and that the mobile interactions in some European

countries — for example Sweden, the Netherlands,

Italy and Spain — already exceeded the interactions

using classic online banking. Similar results a survey

on behalf of ING (ING, 2016) yields as “the share of

mobile device users in Europe who bank by mobile

has grown to 47%” and is expected to outrun the usage

of traditional online banking in 2017. Furthermore, all

studies emphasize that the popularity of local branch

banking has declined due to younger customers opting

for the increasing convenience of banking services

through their smartphone.

The change in people’s way of accessing their

bank accounts and financial services, that is through

their mobile device instead of visiting the bank’s local

branch, even has led to the emergence of new financial

institutions (commonly known as FinTechs) like the

pan-European banking startup N26 (Number26 GmbH,

2016). By now, every major bank offers a mobile ban-

king application for customers to check their accounts,

initiate transactions, and confirm them. The unabated

success of smartphones caused many financial institu-

tions to pursue a “mobile first” strategy: Unlike previ-

ous authentication procedures used in online banking,

recent methods aim at enabling mobile transactions

on a single device (mobile banking). As opposed to

the out-of-band authentication scheme of established

procedures, mobile banking no longer requires two

separate devices. Instead, the authentication elements

are either implemented in two segregated apps, or inte-

grated into a single app.

Although mobile devices are appreciated for provi-

ding cost-effective and accessible two-factor authenti-

cation as an additional layer of security, it is a matter

of concern that smartphones are replacing high-end

security solutions basked by dedicated hardware. This

development especially affects authentication proce-

dures in online banking. Prior to the introduction of

app-based authentication methods, the evolution of the

second element used for transaction verification and

confirmation was characterized by a steady increase

Haupert, V. and Müller, T.

On App-based Matrix Code Authentication in Online Banking.

DOI: 10.5220/0006650501490160

In Proceedings of the 4th International Conference on Information Systems Security and Privacy (ICISSP 2018), pages 149-160

ISBN: 978-989-758-282-0

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

149

in security features. In particular, chipTAN is an esta-

blished procedure used in online banking. It uses the

customer’s personal bank card and a dedicated reader

device to securely authenticate a transaction.

While it is true that the use of apps as an additional

element of authentication can increase the security of

systems that were not using a second factor before, it

means a step backward for online banking that until

lately followed the rule that transaction initialization

and confirmation should never take place on the same

device. Unlike many other authentication schemes, the

security of online payments is subject to national and

supra-national regulations. In the following we not

only provide evidence that app-based authentication

schemes are less secure than their predecessors, but

also show that the upcoming EU regulations stipulating

strong customer authentication missed the target to

account for this decay in security.

1.1 Attacker Model: The Threat of

Privileged Malware

The main reason why app-based authentication sche-

mes provide less security than previous methods is

that they run on a smartphone. In contrast to methods

like chipTAN, a smartphone is not a dedicated but a

multi-purpose device. The reason for the success of

smartphones is their vast set of features and the possi-

bility to install apps on them. While the interface and

attack surface of dedicated hardware devices is tailored

to be as small as possible, smartphones have various

input channels. Additionally, smartphone operating

systems are designed to be modifiable and extensible,

making effective security a complex task. This leads

to a broad attack surface that is targeted by malware.

Apart from malicious apps that compromise the

security and privacy of apps within the security mo-

del of the system, malware that attempts to gain root

permissions (privileged malware) is particularly dan-

gerous. If malware succeeds in executing a privilege

escalation exploit (root exploit), it gets full control of

the system. While root exploits are also often used

by power users to gain maximum control over their

system, malware deploys them in order to bypass the

system’s isolation and sandboxing principles. After

rooting the victim’s device, malware can execute its

payload within the maximum privilege level.

That this threat is no fiction and that an app contai-

ning a root exploit can actually make its way into

the official Google Play Store has been proven in

2014 (Maier et al., 2014). The following year an app

called Brain Test (Polkovnichenko and Boxiner, 2015)

was detected in the Play Store that followed the pre-

dicted scenario. The Brain Test app would conceal

itself as a functional IQ testing app while trying to

root the user’s device in the background. Afterwards,

it would download a malicious code from an external

server to execute it with root privileges. Shortly after

the app was removed by Google, 13 similar apps —

each with a different name and game logic — were

detected in the Play Store (Dehghanpoor, 2016).

Then there are apps based on the malware family

Godless (Zhang, 2016) or HummingBad (Check Point

Mobile Research Team, 2016) that also root the device

they are run on. According to TrendMicro, “Godless

can target virtually any Android device running on

Android 5.1 (Lollipop) or earlier”, which meant

90%

of all Android devices when the article was released

on June 21, 2016. By the end of 2015 the Humming-

Bad malware was detected in various apps, and it was

estimated that it had already infected and rooted more

than 10 million devices (Goodin, 2016a).

In August 2016 Check Point announced that it had

found a set of four vulnerabilities in “Android devi-

ces sporting Qualcomm chipsets” (Donenfeld, 2016).

Each of them could be used to gain root permissions

on the device. The same line Dirty Cow takes, a Linux

kernel vulnerability capable of rooting any Android

version (Goodin, 2016b). It is merely a matter of

time until malware makes use of these vulnerabilities.

Owing to the great diversity of device manufacturers

that usually ship their own, often modified, versions

of Android, there is no centralized update mechanism.

Therefore, every manufacturer is responsible for rol-

ling out software and security updates. The cruel rea-

lity is that many of these companies take significantly

long to release security patches, if they deliver them

to the end user at all (Thomas et al., 2015).

Interestingly, the way of monetarization that mal-

ware based on Brain Test, Godless, or HummingBad

often uses today is displaying advertisements to the

user. The rapid spread of mobile banking, however,

is set to give rise to mobile banking trojan campaigns.

For example, Kaspersky recently reported that the ban-

king malware Tordow has significantly evolved (Kivva,

2016). The fact that Tordow roots a user’s device

will allow “cybercriminals to carry out new types of

attacks”.

1.2 Related Work

The most important past research in the field of mo-

bile banking security is our 2015 analysis of the Spar-

kasse pushTAN authentication procedure (Haupert and

Müller, 2016). Apart from a transaction manipulation

attack, we also mention that an attack which aims at

replicating the pushTAN app might be feasible but

refrained from executing it. Their first mentioned tran-

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

150

saction manipulation attack, however, was realized

using the Xposed hooking framework on a SuperSU-

rooted, i. e., heavily prepared device. In their official

statement, Sparkasse picked these circumstances up to

discount the attack to be only doable under laboratory

conditions (Deutscher Sparkassen- und Giroverband,

2015). We also had demanded to fill the regulatory

gap that mobile banking authentication schemes were

taking advantage of and that is now covered by the

Revised Payment Service Directive of the European

Union. The Regulatory Technical Standards, however,

were still in preperation.

Another contribution (Dmitrienko et al., 2014) also

deals with the security of the CrontoSign / photoTAN

procedure. They already showed in 2014 that an early

demo version of the app could not withstand a copy

attack. In contrast to recent versions used in the field,

however, the procedure did neither yet implement any

device binding to mitigate copy attacks nor was it pos-

sible to operate it on the same device used to initiate

the corresponding transaction. Furthermore, the pho-

toTAN procedure at this time could only be used with

two different devices. This, however, has changed in

the meantime and single-device transactions form the

core of our criticism.

Further research on the security impact of mobile

devices with respect to authentication procedures has

been conducted in the research paper How Anywhere

Computing Just Killed Your Phone-Based Two-Factor

Authentication (Konoth et al., 2016). They show that

the heavy synchronization between a user’s devices

can invalidate the additional protection of a two-factor

authentication scheme by, e.g., also synchronizing a

token received via SMS with a user’s computer, hence

eliminating the separation of channels. In general, the

SMS technology — still widely used for authentica-

ting online banking transactions — is well-researched

and several issues have been revealed (Mulliner et al.,

2013; Reaves et al., 2016; Rao et al., 2016).

1.3 Contributions

In our scenario the victim uses an app-based matrix

code authentication scheme for online banking on his

or her Android device. The system on the device does

not have to be modified; in particular, the device does

not have to be rooted. However, a device weakness

must be known to gain full access to the system, which

is exploited by criminals as described above. In case

the device runs both the online banking app and the

authentication app, there are no additional require-

ments. This is also true for authentication schemes that

carry out transaction initialization and confirmation

within a single app. If the app-based authentication

scheme forces another device to initiate a transaction,

the knowledge-based authentication factor must additi-

onally be compromised. Based on these assumptions,

we make the following contributions:

•

First, we show a real-time transaction manipula-

tion attack for the mobile banking use case of the

photoTAN procedure of Deutsche Bank, Commerz-

bank, and Norisbank. The transaction manipulation

remains invisible to the victim in all steps of the

attack and is entirely technical, meaning that it does

not involve social engineering.

•

Second, we analyze the compliance of the photo-

TAN procedure with respect to the forthcoming Re-

vised Payment Service Directive of the European

banking authority. Although a previous draft sugge-

sted that running two authentication factors on the

same device may lead to violation of the require-

ment of the independence of authentication factors,

the final draft presumably allows procedures imple-

mented in this way. Furthermore, the photoTAN app

alone may not be considered a possession element

within the definition of strong customer authoriza-

tion. In support of this argument, we show that the

photoTAN app of Deutsche Bank, Commerzbank,

Norisbank, and Comdirect cannot withstand a repli-

cation attack.

2 APP-BASED

AUTHENTICATION IN

DIGITAL BANKING

Particularly in German speaking countries, the second

factor procedure used to confirm transactions is called

TAN method. TAN stands for transaction authentica-

tion number and is a one-time password (OTP) that

is received, processed or even generated by the TAN

method after a customer issued a credit transfer. The

user afterwards transmits the TAN manually or auto-

matically to the bank’s backend causing the transaction

to become into effect. Even though modern second-

factor authentication schemes do frequently no longer

involve a TAN, the expression TAN method remained

due to historic reasons and denotes a procedure to

confirm digital banking transactions.

Although the development of high-end TAN proce-

dures could successfully defeat most threats in online

banking, they were expensive either for the bank or

for the user. The chipTAN procedure, for example,

introduced a dedicated reader to generate TANs in

conjunction with the customer’s personal bank card.

In the past banks supplied their customers with the

device free of charge. Today, however, it is common

On App-based Matrix Code Authentication in Online Banking

151

Auth

App

Banking

App

Auth

App

Banking

+

Out-of-Band Authentication

One-Device Authentication

Banking

Auth

App

Two-App Authentication

2aa

1aa

One-App Authentication

Two-Device Authentication

2da

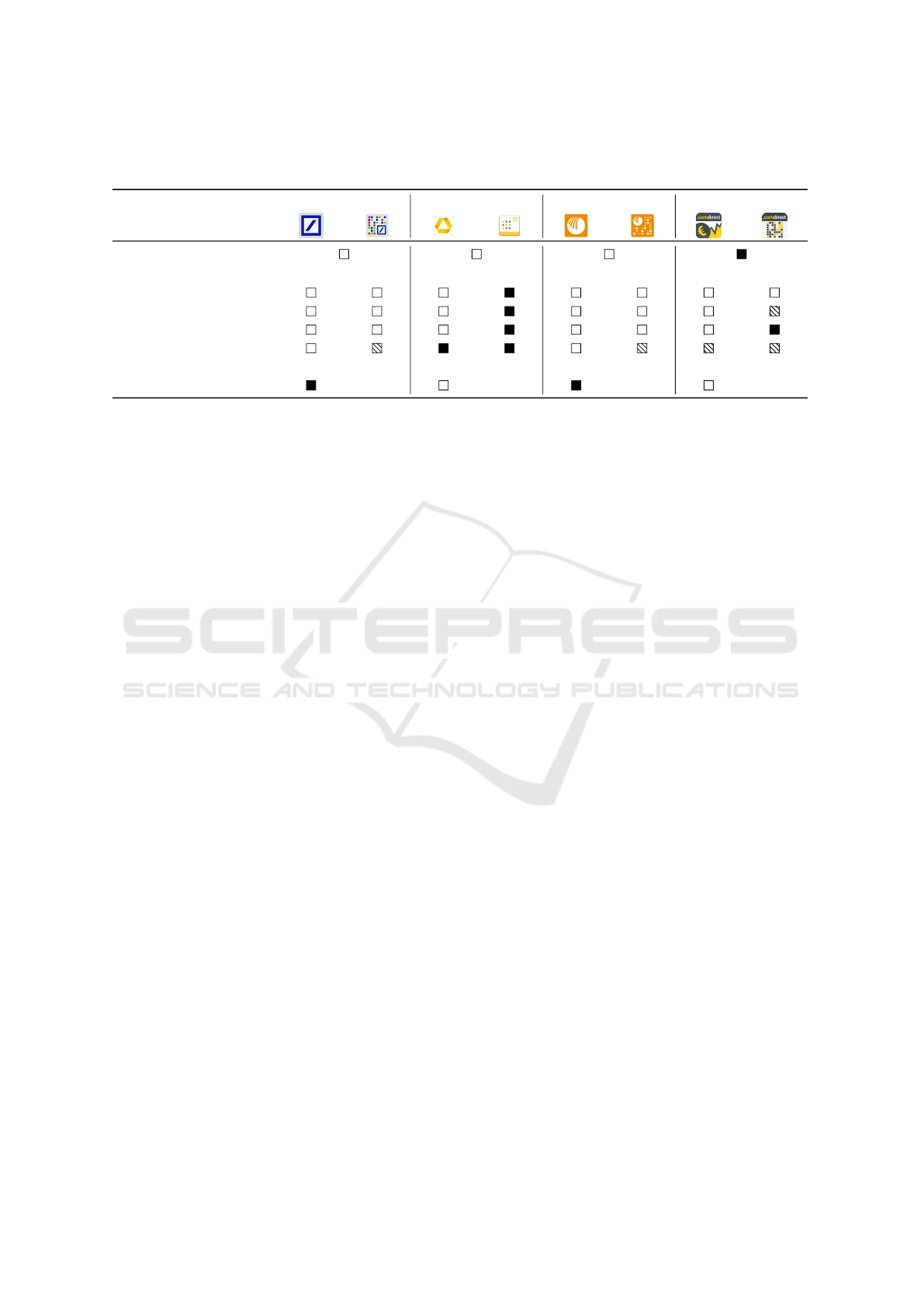

Figure 1: The different types of app-based authentication methods. The two-device authentication (2da) scheme, which makes

use of two independent devices, is suitable for out-of-band authentication of transactions. Two-app authentication (2aa) and

one-app authentication (1aa) were developed in order to enable mobile banking on one device. While 2da and 2aa use two

different apps for authentication, 1aa issues and confirms transactions only within a single app.

practice to pass the acquisition costs to the end user.

In contrast, smartphone-based authentication schemes

allow both the financial institution and the end user to

reduce costs. Banking apps are usually freely available

to the customers, guaranteeing high acceptance rates.

In contrast to previous authentication methods, app-

based authentication can be divided into three catego-

ries: two-device, two-app, and one-app authentication

schemes, as shown in Section 2. All three types of

apps display transaction details to the user in order to

get a second confirmation of the transaction. Only if

the user confirms the transaction via a second channel

does the transaction come into effect. In the following

each type of app-based authentication is described:

Two-Device Authentication (2da).

This mode of au-

thentication is largely similar to established methods

like mTAN and chipTAN, as it is a true two-factor

authentication scheme using two independent devices.

First, the user logs into the banking app or web inter-

face to issue a transaction order. Second, the user uses

an independent device to confirm the transaction. The

delivery of transaction details to the authentication app

differs across vendors, but it is dependent on whether

the method is an online or offline procedure. An off-

line procedure obtains the transaction details through

an input different from the network channel. The user

often has to scan a matrix barcode using the smartp-

hone camera. The authentication app then extracts

the transaction details from the obtained image and

displays them to the user. As the procedure takes place

offline, a TAN is displayed after the transaction has

been confirmed, and the user has to manually transfer

the TAN to the banking app or web interface.

Two-App Authentication (2aa).

In contrast to 2da,

the 2aa method does not rely on two different devices

but two different apps running on the same mobile

device. To initiate a transaction the user opens the

banking app and enters his or her login credentials.

After sending a transfer order, the banking app opens

the authentication app. Depending on whether the au-

thentication app works online or offline, the banking

app sends the transaction details to the authentication

app based on app-to-app communication, or the au-

thentication app receives the transfer data over the

network from the banking server. Likewise, when the

user confirms the transaction, the authentication app

either sends the TAN via app-to-app communication,

or directly confirms the transaction over the network.

One-App Authentication (1aa).

As the name sugge-

sts, this method does both transaction initialization

and confirmation not only on the same device but also

inside the same app. When a customer uses this app

to issue a transaction, he or she is no longer required

to use a different app. Instead, the app shows the con-

firmation dialog right after the transaction submission.

In contrast to 2da and 2aa, this method only displays

the transaction details but never shows a TAN to the

user as that would not add value to the procedure.

3 THE photoTAN METHOD

The photoTAN procedure is a TAN method which

is based on CrontoSign, a visual signing techno-

logy developed by Cronto (Cronto, 2011). In 2008,

Commerzbank was the first bank that experimented

with Cronto’s technology, using it as a secure, cost-

effective, and usable second-factor authorization met-

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

152

hod (Cronto, 2008). To bring it in line with the already

existing naming scheme for previous methods, it was

labeled photoTAN.

The photoTAN method is a popular app-based au-

thentication procedure based on matrix code scanning.

Even though mostly German and Swiss banks have

adopted the photoTAN method, it is also used interna-

tionally, presumably under different names. We have

chosen Deutsche Bank and Commerzbank, along with

their direct banking subsidiaries Norisbank and Com-

direct, because they all play a significant role in the

German banking landscape. With respect to their ba-

lance sheet total (Bundesverband deutscher Banken

e.V., 2015), Deutsche Bank and Commerzbank are

Germany’s largest banks, while Norisbank and Com-

direct are popular direct banks.

3.1 Order and Activation

In order to use the photoTAN procedure to legitimize

transactions, the photoTAN app of the respective bank

and an activation graphic is needed to initialize the app.

While one might download and install photoTAN im-

mediately, all analyzed banks send the graphic printed

on a postal letter. As such, the delivery takes at least

one or two days. After receiving the activation letter

and installing the app, one can begin the activation

process.

First, the user has to scan the activation graphic

found on the bank’s postal letter. Afterward, the cu-

stomer is asked to log into the online banking app

to add a new photoTAN device through the TAN ad-

ministration web page. Depending on the bank, the

remainder of the procedure continues differently. If

using photoTAN by Deutsche Bank or Norisbank, the

last step generated a 12-digit numerical token, and the

photoTAN app prompts the user to enter and send it

through the online banking. Thereafter, the online ban-

king app shows another photoTAN graphic which the

user must scan to generate a 7-digit TAN to transfer

it to the online banking and complete the activation

process. In the case of Commerzbank and Comdirect,

the process is slightly different: Instead of showing a

token to the user after scanning the activation graphic,

the online banking asks the user to scan another photo-

TAN graphic right away. This generates a 7-digit TAN

just like in the last step of the activation procedure of

Deutsche Bank and Norisbank. In all cases, the photo-

TAN app is assigned a unique identifier that consists of

five uppercase alphabetic letters. Even though multiple

devices might be registered with the same activation

letter, they do not generate the same TAN. Therefore,

each transaction can be confirmed by multiple TANs.

It is also noteworthy that registering an additional de-

vice does not require the confirmation of an already

activated device.

The photoTAN procedure is a strict offline met-

hod. By implication, the app cannot send any data

over the network back to the bank’s server. The only

possibility to transfer any device information is by

coding the information inside the activation code of

the TAN. Apparently, only Deutsche Bank and Noris-

bank receive data from the photoTAN app as neither

Commerzbank nor Comdirect use an activation code

at all. Although ultimately unknown, as a deep ana-

lysis of the protocol was out of scope, it is likely that

the photoTAN app of Commerzbank and Comdirect

is immediately activated after scanning the activation

graphic while Deutsche Bank and Norisbank transfer

additional information coded inside the 12-digit num-

ber. This code offers the possibility to carry only very

limited amounts of data. After this step, the process

continues equally, and the scanned PhotoTAN graphic

serves to confirm the activation. Due to its short length

of only 7 digits, it is highly unlikely that the TAN trans-

fers any device information back to the online banking

without substantially decreasing the entropy of the ac-

tual payload. In the end, it seems most probable that

Commerzbank and Comdirect do not obtain any addi-

tional information. Even though Deutsche Bank and

Norisbank ascertain further device information, their

activation process does not involve any seed. As a

consequence, the last step in the activation always ge-

nerates the same TAN if performed on the same device

again. This behavior differs from Commerzbank and

Comdirect, as their activation process always yields a

different TAN, even if repeated on the device.

3.2 Usage and Modes of Operation

The photoTAN image is a matrix code that contains

the transaction data and additional metadata to ens-

ure its integrity. Recent versions of the photoTAN

method of Deutsche Bank, Commerzbank, and Noris-

bank offer two different ways of receiving the payload:

(1) Scanning a photoTAN image with the device ca-

mera and decoding its payload, and (2) receiving the

photoTAN payload directly via app-to-app communi-

cation (mobile banking). Both modes are illustrated

in Figure 2. In any case, the photoTAN app uses its

cryptographic key received during the app’s activation

process to decrypt the payload and to generate a TAN

that corresponds to the transaction details.

The first mode of operation is used for the out-

of-band approach involving two devices (2da). After

the customer has sent a transfer order using the tran-

saction initiation channel — which is the banking app

or web interface — , a matrix code is displayed. The

On App-based Matrix Code Authentication in Online Banking

153

Online Banking

photoTAN

App

Scan

photoTAN

Two-Device Authentication

Banking App

photoTAN App

photoTAN

Payload

Two-App Authentication

Figure 2: The two different operation modes of the photoTAN method. Either the user scans a matrix code with the device

camera (2da), or the decoded photoTAN payload is directly transferred from the banking to the photoTAN app (2aa).

photoTAN app generates a TAN from the decoded

transaction details of the matrix code. Finally, the user

manually transfers the TAN to verify the transaction

details and to finally confirm the transaction.

The second option implements the 2aa scheme to

facilitate mobile banking transactions. The customer

uses the banking app to fill in the transaction details

and send them to the banking server. As a mobile

device with an integrated camera cannot scan its own

display, the banking app transfers the decoded pho-

toTAN payload to the photoTAN app via app-to-app

communication. Thereafter, the app displays the tran-

saction details and asks the user for confirmation. But

instead of transferring the TAN back manually, the

photoTAN app automatically sends it to the banking

app. Ironically, the term “photoTAN” entirely loses

its justification when used in this mode of operation

because no matrix code scanning is involved.

As of February 2017, mobile banking transactions

are currently supported by Deutsche Bank, Norisbank,

and recently also by Commerzbank. Comdirect only

supports out-of-band photoTAN transactions. Cur-

rently, there is no photoTAN implementation that inte-

grates both authentication steps in one app, as evident

from N26.

3.3 Security Features

In this section we provide an overview of the security

features of the photoTAN procedure and the different

apps offered by Deutsche Bank, Commerzbank, Noris-

bank, and Comdirect. As some attacks also involve the

respective banking apps, their security is also addres-

sed, if necessary. The following description of security

properties is summarized in Table 1.

No Access Barrier.

None of the analyzed photoTAN

derivates restricts the photoTAN app by explicitly au-

thenticating the customer. On the one hand, this allows

quick access to the photoTAN app, but on the other,

this means there is no additional security barrier to

physical access attacks for users without screen lock.

Fingerprinting.

To mitigate replication attacks, all

variants employ device fingerprinting to bind certain

device properties to the installed and activated app.

The fingerprinting step, however, only relies on the

IMEI

and the

ANDROID_ID

. In the case of the Comdi-

rect photoTAN app, fingerprinting is solely based on

the ANDROID_ID. Both values can be easily forged.

Repackaging Protection.

Repacking is the process

of decoding, modifying, and encoding an existing app.

Ultimately, the app is signed with a new key. More

often than not, repackaging is used to trojanize ex-

isting apps and spread them using third-party stores.

Furthermore, repackaging is an important assistant for

dynamic analysis and reverse engineering. To mitigate

repackaging, apps check their own signature at run-

time to spot modifications. Even though the photoTAN

apps carry sensitive information, only Commerzbank

and Comdirect have taken active measures to prevent

it. These banking apps do not account for repackaging,

which means none of them employs any mitigation

technique.

Rooting Policy.

In the Android universe, the process

of gaining system privileges and installing the

su

bi-

nary to permit apps to ask for root permissions is called

rooting. As this process could disable important se-

curity anchors and features, many apps dealing with

sensitive data employ a restrictive usage policy for

rooted devices. Nonetheless, only the photoTAN app

of Commerzbank enforces a restrictive rooting po-

licy, whereas Comdirect only shows a message hinting

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

154

Table 1: Overview of the security features of different Android photoTAN derivates and their corresponding banking apps. The

first sub-column deals with the respective banking app while the second refers to the bank’s photoTAN app.

Deutsche Bank Commerzbank Norisbank Comdirect

Enforces Out-of-Band

Analyzed Version

2.6.0

2.1.7

4.0.1

7.1.7

2.6.0

2.1.7

2.1.5 6.0.6

Denies Backup

Anti-Rooting

Anti-Repackaging

Obfuscation

Fingerprinting

–

ID, IMEI

–

ID, IMEI

–

ID, IMEI

–

ID

TLS Pinning

– – – –

at the risks involved. Deutsche Bank and Norisbank

neither advise about nor restrict access to rooted de-

vices. None of the banking apps actually checks for

rooting.

Prevent Backup.

Android offers the option of crea-

ting backups of apps and their data. As this feature re-

presents a legitimate, non-root opportunity to access an

app’s data, it poses the risk of the data getting compro-

mised. As this could happen due to a system feature,

it can also be disabled using the

allowBackup

flag in

the Android manifest. Despite the risks, only Commer-

zbank has disabled the option of creating backups.

TLS Pinning.

While the photoTAN method operates

completely offline, the respective banking apps them-

selves must retrieve data from the internet. It is im-

portant that all apps — especially those that receive

or send sensitive information — use TLS-encrypted

connections. An attacker might still use a man-in-the-

middle (MITM) attack to compromise the integrity and

confidentiality of a connection. To prevent this kind

of attack, an app can pin a specific certificate used for

network communication. Even though MITM attacks

against TLS-encrypted connections have been known

for years, only Deutsche Bank and Norisbank use certi-

ficate pinning to prevent MITM attacks targeting their

banking apps.

Obfuscation.

In order to reverse-engineer, under-

stand, and modify the logic of a program, its code

can be disassembled for static analysis. In the case

of Android, apps are not delivered as machine code

for the target architecture but as Java bytecode. The

latter contains significantly more metadata, thereby

easing the reverse engineer’s analysis and allowing au-

tomatic decompilers to produce results that are close

to the original source code. Obfuscation is the pro-

cess of making mainly static but also dynamic analysis

harder by removing or modifying metadata and intro-

ducing additional code to conceal the idea and logic

behind a particular piece of code. Even though the

default Android build configuration provides for Pro-

Guard (Lafortune, ), not all apps use it. ProGuard is

primarily a code minifier aimed at improving perfor-

mance. However, certain features, such as the function

renaming employed by ProGuard, also have a signi-

ficant obfuscating effect. The Deutsche Bank and

Norisbank photoTAN apps, as well as the Comdirect

banking and photoTAN app, make use of this. Both

the Commerzbank banking and photoTAN apps are

processed with tools that employ obfuscation techni-

ques that go beyond ProGuard. The banking apps of

Deutsche Bank and Norisbank are not protected at all.

Third-Party Protection.

For enhanced security,

third parties offer solutions to provide apps with additi-

onal safeguards. Promon Shield (Promon AS, 2016), a

product designed by the Norwegian company Promon,

offers protection against various threats — including

most of those noted so far — without much interaction

from the developers of the app. Even though research

has shown that app transformations can be powerful,

it is difficult for Promon Shield to provide effective

protection against real attacks without causing false

positives (Commerzbank A.G., 2016). The only app

that uses such a solution is Commerzbank which

introduced Promon Shield with a recent update of

their photoTAN app.

In summary, the photoTAN method has a very per-

missive security model. One security decision is to not

secure the app and its data using an additional login

screen, even though many other app-based TAN met-

hods like pushTAN employ such protection. As stated

before, this decision does not only influence who can

use the app but also prevents encryption of the user’s

credentials. The only safeguard that mitigates a naive

replication attack is the app’s device fingerprinting.

The device fingerprinting involves the

IMEI

(hardware

property) and the

ANDROID_ID

(software property), but

both values are common device and system properties

On App-based Matrix Code Authentication in Online Banking

155

that can easily be replicated.

Commerzbank and Comdirect have taken more

measures to ensure the security of the system and the

integrity of their apps. The Comdirect photoTAN app

does not only warn the customer about the risks of root-

ing, but also checks the integrity of the app at runtime,

and more precisely during registration. When the user

scans the matrix code, it also checks the signature of

the app. Comdirect sends the expected signature of the

app along with the payload of the matrix code. Com-

merzbank provides protection against repackaging and

uses a restrictive rooting policy, as enforced by the

third-party security module developed by Promon.

Last but not least, please note that the photoTAN

procedure is not only available as a smartphone app

but also as dedicated hardware (Cronto, 2011). Na-

turally, our statements about the security features of

app-based authentication cannot be transferred to the

photoTAN hardware device. Quite the contrary, a

dedicated photoTAN device — available for all three

analyzed banks — offers excellent security properties

largely similar to those of chipTAN.

4 TRANSACTION

MANIPULATION ATTACK

AGAINST photoTAN

This section describes a real-time transaction manipu-

lation attack that we implemented against the photo-

TAN procedure of Deutsche Bank, Commerzbank, and

Norisbank. The attack cannot be used against Comdi-

rect, as Comdirect does not support mobile banking

on a single device. For the other three banks, however,

the attack manipulates the transaction data the victim

(1) sends during initialization (banking app), (2) sees

during verification (banking app), and (3) sees during

confirmation (photoTAN app).

4.1 Banking App: MITM

In order to manipulate the data the user sends and

sees inside the banking app, we use a TLS man-in-the-

middle (MITM) attack. The Android system — just

like any other operating system — ships a bundle of

certificates it regards as trusted. To get the system to

trust the certificate presented by the MITM proxy, the

attacker needs to install it. This process is straightfor-

ward as the system regards certificates that reside in

a specific system directory as trusted. Owing to the

attacker’s privilege level we assume in our attacker

model, files can be placed in any location.

Especially applications dealing with sensitive data

are developed with MITM attacks in mind. Conse-

quently, manufacturers employ certificate pinning to

protect their apps against such attacks. This technique

causes the app to only trust a specific set of certificates

instead of solely relying on the system’s trust settings.

Although certificate pinning effectively protects an

app against MITM attacks, only the banking apps of

Deutsche Bank and Norisbank employ this method.

The banking app of Commerzbank does not pin its

certificate. But also disabling the certificate pinning

the Deutsche Bank and Norisbank is possible, because

both use a flag that controls if the application should

quit due to the detection of a certificate error or not.

Therefore, our patch does not stop the apps from de-

tecting the error but simply prevents any consequences

of it. Furthermore, neither of the two apps performs

any repackaging checks. Therefore, an attacker only

needs to introduce a patch that toggles the flag to make

the apps accept connections with the attacker server.

Besides the possibility to manipulate the data a

user sends and receives, we were able to eavesdrop on

the user’s login credentials. The latter was true for all

the analyzed banks including Comdirect.

4.2 PhotoTAN App: Repackaging

To forge the data the photoTAN app presents to the

user during transaction confirmation, an attacker needs

to either modify the environment the app is running in,

hook particular app methods, or patch the app’s code

statically. We decided to modify the app statically, as

this has the least impact on the system and represents

the method a real attacker would most likely choose in

practice. This process was straightforward for the pho-

toTAN apps of Deutsche Bank and Norisbank because

none of them protects itself against repackaging. The

photoTAN app of Commerzbank and Comdirect, ho-

wever, required extra work to disable their repackaging

protection.

Commerzbank.

The repackaging protection of Com-

merzbank’s photoTAN app is provided by Promon

Shield. The protection solution by Promon is integra-

ted into the app and delivered in the form of a native

library that loads when the app starts. As the repacka-

ging protection is part of the native library, which itself

is obfuscated and uses tamper resistance to spot modi-

fications, it would be rather hard to patch the library.

Another idea is to remove Promon Shield entirely from

the app, but even though this would be theoretically

possible, it is also assumed to be rather difficult be-

cause Promon strips the app of all strings and outsour-

ces them to the native library. The Java code then

queries these strings at runtime using a defined index.

The easiest way to disable Promon’s repackaging pro-

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

156

Banking

photoTAN

Transaction

1

Transaction

TAN

1

3

Generate TAN

Verification

Verification and Confirmation

4

Transaction

2

5

details

6

Send TAN

Transfer

8

effective

7

Manipulation

1

Manipulation

3

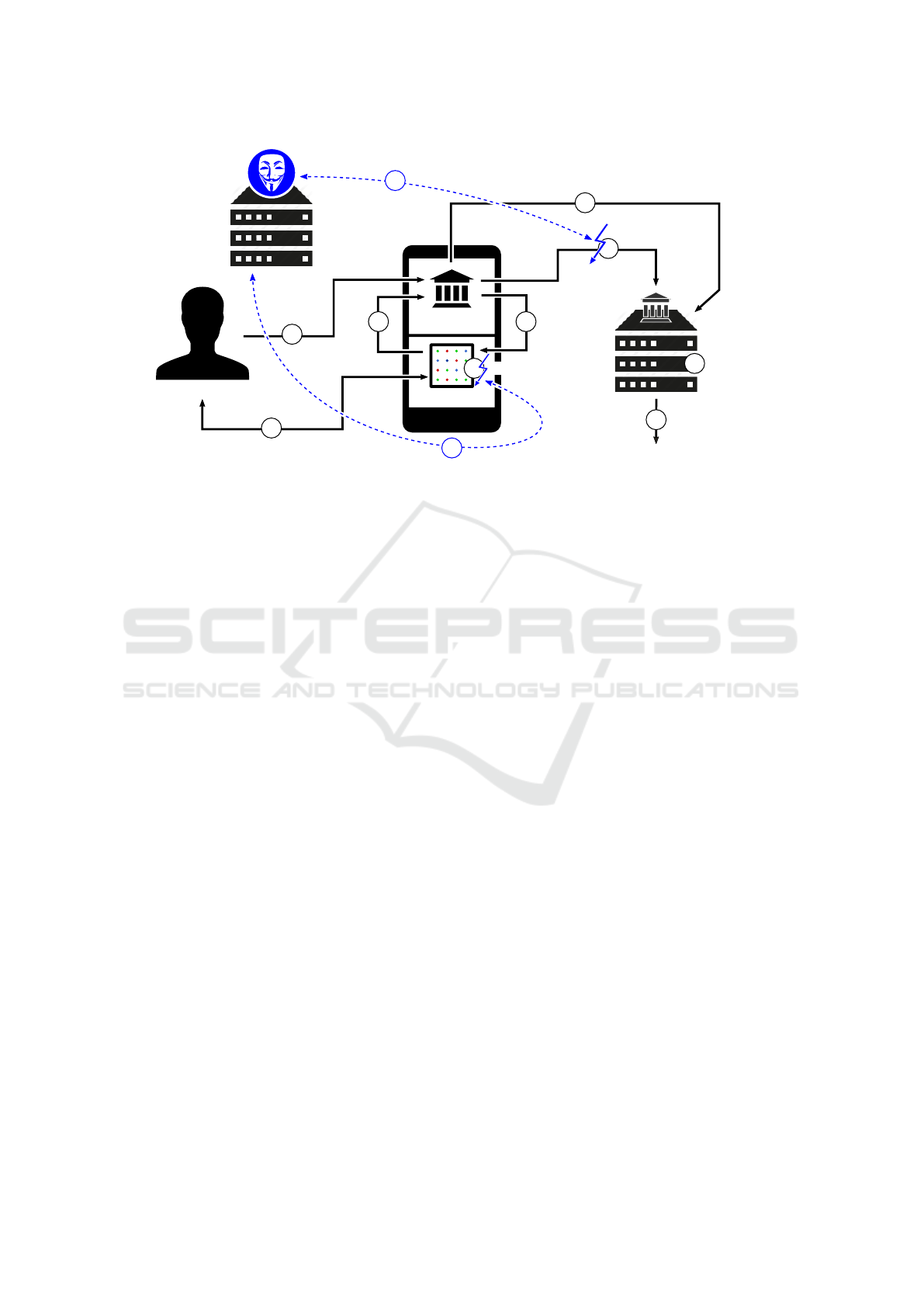

Figure 3: Overview of the steps involved in the implementation of real-time transaction manipulations.

tection is using

LD_PRELOAD

. The only hook required

to disable the repackaging protection was to return a

file descriptor to the original app whenever Promon

tried to open the repackaged app. When the system

ran our modified app, Promon Shield reads the app

that had not been tampered with; hence, all security

checks were passed, and the app continued to execute

both its own and the attacker’s code. This approach

disabled the core security features of Promon in less

than 100 lines of C.

Comdirect.

Unlike Commerzbank, the Comdirect

photoTAN app implemented its own routines to check

the integrity of an app. Unlike Promon, which checks

the app’s signature during app startup, the Comdirect

photoTAN app is not shipped with a hardcoded certifi-

cate. Instead, parts of the app’s signing certificate are

checked with values encoded in the matrix code. If the

repackaging check cannot validate the app’s signature,

the app crashes without a warning. After we learned

how the repackaging protection works, patching it was

straightforward too: A function of the app responsible

for returning the signing certificates is compared with

the values found inside the matrix code. Instead of

retrieving the certificates at runtime, we patched the

app to statically return the certificate the original app

was signed with.

After the repackaging protection was defeated, we

could patch the photoTAN app to display arbitrary

data. All of the analyzed banks limit the transferred

data to the minimum required to verify a credit transfer,

namely its IBAN and amount. As a result, we only

needed to forge those two values to conceal transaction

manipulations. This could be achieved by statically

injecting additional code right before the IBAN and

the amount are displayed to the client. The injected

code searches our attacker server for details of the

manipulated transaction, and so the photoTAN app

eventually processes different transaction details as

those the user sees during confirmation.

4.3 The Attack

With the ability to modify the transaction initialization,

verification, and confirmation process, we are able

to execute real-time transaction manipulations. The

attack visualized in Figure 3 works as follows:

1.

The victim, Bob, wants to execute a mobile ban-

king transaction to Alice using a malware-infected

Android device. To complete the transaction, Bob

opens the banking app and provides the required

details (beneficiary, IBAN, amount, and reference).

When he submits the transaction details, however,

they are not delivered to the bank’s server. Instead,

all requests are routed to our attacking server where

we cannot only eavesdrop on the victim’s creden-

tials but also modify the transaction. First, the

original transaction Bob issued is saved for later

use, and then Bob’s transaction is replaced with our

own transaction that benefits our own bank account.

2.

After submitting the transaction, the banking app

prompts Bob to verify and confirm his transaction

using the photoTAN app. As Bob is using the ban-

king app and the photoTAN app on the same de-

vice, the photoTAN app opens automatically. When

he starts the verification process, the banking app

sends the decoded matrix challenge with our for-

On App-based Matrix Code Authentication in Online Banking

157

ged transaction details to the photoTAN app via

app-to-app communication.

3.

Next, the photoTAN app displays the transaction

details and generates a corresponding TAN. Bob

would normally spot the fraud when the photoTAN

app displays transaction details as different from his

input. As the photoTAN app is attacker-controlled,

however, it retrieves the transaction details that Bob

originally entered from our attacking server.

4.

Bob verifies the transaction, and since everything

visually appears as expected, he confirms the tran-

saction.

5.

The TAN is automatically transferred back into the

banking app.

6.

Bob must confirm once again in order to send the

TAN to the bank server.

7.

The bank server checks if the TAN matches the

expected TAN.

8.

Finally, it passes verification, and the transaction is

eventually completed.

Note that Bob confirmed a different transaction

than he had actually intended without realizing it du-

ring or after the attack. As the victim’s phone was

compromised, we could even change the transaction

overview to hide the tampering. The only way for

the victim to spot the fraud was consulting the bank’s

online banking from an independent device.

5 LEGAL CONFORMITY WITH

UPCOMING EU REGULATIONS

The security of online transactions is subject to na-

tional and supranational regulations. EU Directive

2015/2366 (European Union, 2015) was issued on Ja-

nuary 12, 2016, and it will come into effect on January

13, 2018. Being the successor to the Payment Service

Directive (PSD), it is better known as the Revised Pay-

ment Service Directive, or just PSD2. The directive

will make strong customer authentication mandatory

for all payment services and platforms, especially mo-

bile devices. On February 23, 2017, the EBA has rele-

ased the final draft of its regulatory technical standards

(RTS) (European Banking Authority, 2017) that pro-

vide a more detailed description of the requirements

of strong customer authentication (SCA). Much to our

surprise, the EBA significantly relaxed the rules defi-

ned in the previous draft (European Banking Authority,

2016), thus having introduced a longer lasting weake-

ning effect on the security requirements of European

online and particularly mobile banking.

Article 4(30) PSD2 demands strong customer au-

thentication based on two or more elements, catego-

rized as knowledge (something only the user knows),

possession (something only the user possesses), and

inherence (something only the user is).

5.1 The photoTAN App as a Possession

Element

Section 4 showed that it is particularly dangerous to

use one-device mobile banking. Although this is a

valid scenario, currently only

13%

of German online

banking users initiate and confirm transactions on the

same device (Bitkom e.V., 2016). By implication, the

vast majority of photoTAN customers of Deutsche

Bank, Commerzbank, and Norisbank still use out-of-

band authentication in order to legitimize their tran-

sactions with two independent devices. Even though

using the photoTAN app in conjunction with another

device is substantially more secure, it cannot be com-

pared to the level of security that dedicated hardware

gives.

The photoTAN procedure makes use of a know-

ledge element during transaction initialization — the

login credentials — and a possession element during

transaction confirmation — the activated photoTAN

app. In the past it allowed for substantial divergen-

ces in the interpretation of the essential features of

the individual factors. With respect to the possession

element, the EBA RTS require it to be “designed to

prevent replication of the elements”.

Owing to the weak device binding of the photo-

TAN app, we were able to copy all the analyzed pho-

toTAN apps from a victim’s device to our attacker

device. After cloning, the photoTAN app on both

devices generated the same TAN for a specific tran-

saction. The photoTAN method fails to guard against

our replication attack because of two reasons. First,

the photoTAN app only relies on the device’s

IMEI

and the system’s

ANDROID_ID

. Both of these are com-

mon values for implementing device binding and any

attacker would look into them first. Second, cloning

of the photoTAN app is successful because it has no

access protection. If the photoTAN app were secured

by knowledge or an inherence element, the app could

store its data in an encrypted format.

5.2 Independence of the Elements in

Mobile Banking

Apart from the description of the elements used for

strong customer authentication, the EBA also specifies

the requirements with respect to their independence.

This is particularly relevant for single-device mobile

banking transactions.

While the RTS draft found in the EBA discussion

paper still suggested strong security standards that re-

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

158

quire the channel used for transaction initialization and

confirmation to “be independent or segregated”, the fi-

nal report withdrew this demand. The same line the re-

statement requiring the elements to be implemented in

“discrete trusted execution environments” takes: This

formulation suggested that one-device mobile banking

transactions should only be compliant on devices and

apps leveraging explicit hardware support like ARM

TrustZone. The final version, however, only requires

that the initialization and confirmation logic make “use

of separated secure execution environments”.

Although the final RTS demands “that the breach

of one does not compromise the reliability of the ot-

hers, in particular when any of these elements are used

through a multi-purpose device”, the EBA also clari-

fies that a “mobile phone which can be used for both

giving the instruction to make the payment and for

being used in the authentication process” does comply

with the requirements of SCA. Furthermore, the au-

thentication procedure needs to ensure that neither the

user nor a third party has modified the software or de-

vice. Alternatively, the scheme needs to take measures

to “mitigate the consequences of such alteration”.

Within the purview of the EBA regulations, the

banking and the photoTAN app can be likely descri-

bed as independent even though we oppose the EBA’s

decision. However, if the regulation requiring the au-

thentication procedure to detect and mitigate device

modifications is currently met, remains debatable:

•

The breach of the banking app can compromise

the photoTAN app and vice versa. It is true that

the sandboxing mechanism of the prevailing mobile

operating systems mitigates the risk of a successful

attack against one app — due to an app-specific vul-

nerability — also compromising the other app. If the

system layer of the device is compromised, however,

both elements are affected equally, and an attacker

can gain access to the knowledge and possession fac-

tor at the same time. This is not only true for all ana-

lyzed banks but also for any multi-factor authentica-

tion scheme implemented on a single multi-purpose

device. It remains unclear if implementing the au-

thentication procedure using two separate apps is a

strict guideline or if one-app authentication schemes

could also be regarded as compliant if they take —

yet to be definded — software-based measures.

•

None of the analyzed apps provides protection

against a device that has been compromised by a

third party with privileged malware. Some of the

apps — Commerzbank and Comdirect — reduce the

tampering of their photoTAN app. All of the ana-

lyzed banking apps, however, are totally exposed

to attacks as they do not apply effective safeguards

against system-level malware. In general, however,

this is an impossible task to perform on today’s com-

modity smartphones without hardware support for

strong isolation like the ARM TrustZone.

•

Only Commerzbank and Comdirect deal with the

alteration of the system by detecting rooted devices.

In such a case, the photoTAN app by Commerzbank

refuses to run, and the photoTAN app by Comdirect

advises the user. However, the photoTAN apps of

Deutsche Bank and Norisbank do not take any mea-

sures in this respect. Moreover, none of the banking

apps addresses system alterations at all. Again, it is

generally impossible to effectively scan the system

layer from an unprivileged app.

6 CONCLUSION

The transaction manipulation attack demonstrated that

running the banking and the photoTAN app on the

same device cannot technically be regarded as secure.

Compromising one authentication channel immedia-

tely leads to compromising the other authentication

channel. Even though the photoTAN procedure has

flaws that are specific to it, the core issues lie in the

conception of app-based authentication and are thus

common to all authentication schemes of this kind.

We appreciate the recent efforts of the European

Union and the EBA that defined common standards

for the security of online payments. Unfortunately, the

EBA has refrained from defining clear limits, particu-

larly for single-device mobile payments that can at best

keep an illusion of two-factor authentication. The final

draft poorly accounts for the threats that mobile devi-

ces already face but also the ones they will face in the

future, namely banking trojans that explicitly attack

single-device mobile banking. As a result, banks will

continue to affirm the same statement they gave when

we confronted them with our findings through the pu-

blic media (Tanriverdi, 2016): There are no claims

known to date.

REFERENCES

Bitkom e.V. (2016). Digital Banking. Accessed: 25 Septem-

ber 2016.

Bundesverband deutscher Banken e.V. (2015). Zahlen, Da-

ten, Fakten der Kreditwirtschaft. Accessed: 25 Sep-

tember 2016.

Check Point Mobile Research Team (2016). From Hum-

mingBad to Worse: New In-Depth Details and Analy-

sis of the HummingBad Android Malware Campaign.

Accessed: 11 September 2016.

On App-based Matrix Code Authentication in Online Banking

159

Commerzbank A.G. (2016). Commerzbank photoTAN -

Android Apps on Google Play. Accessed: 12 October

2016.

Company, B. . (2016). Customer Loyalty in Retail Banking:

Global Edition 2016.

Cronto (2008). Commerzbank and Cronto Launch Secure

Online Banking with photoTAN. Accessed: 20 Sep-

tember 2016.

Cronto (2011). Cronto Launches World’s First Visual Tran-

saction Signing Hardware. Accessed: 4 October 2016.

Cronto (2011). CrontoSign. Accessed: 02 October 2016.

Dehghanpoor, C. (2016). Brain Test re-emerges: 13 apps

found in Google Play. Accessed: 16 September 2016.

Deutscher Sparkassen- und Giroverband (2015). Stellung-

nahme zur Angreifbarkeit von App-basierten TAN-

Verfahren. Accessed: 19 November 2017.

Dmitrienko, A., Liebchen, C., Rossow, C., and Sadeghi, A.

(2014). On the (in)security of mobile two-factor au-

thentication. In Christin, N. and Safavi-Naini, R., edi-

tors, Financial Cryptography and Data Security - 18th

International Conference, FC 2014, Christ Church,

Barbados, March 3-7, 2014, Revised Selected Papers,

volume 8437 of Lecture Notes in Computer Science,

pages 365–383. Springer.

Donenfeld, A. (2016). QuadRooter: New Android Vulne-

rabilities in Over 900 Million Devices. Accessed: 11

September 2016.

European Banking Authority (2016). EBA consults on strong

customer authentication and secure communications

under PSD2.

European Banking Authority (2017). EBA paves the way

for open and secure electronic payments for consumers

under the PSD2.

European Union (2015). Directive (EU) 2015/2366 of the

European Parliament and of the Council of 25 Novem-

ber 2015 on payment services in the internal market,

amending Directives 2002/65/EC, 2009/110/EC and

2013/36/EU and Regulation (EU) No 1093/2010, and

repealing Directive 2007/64/EC (Text with EEA rele-

vance). 337:35–127.

Goodin, D. (2016a). 10 million Android phones infected by

all-powerful auto-rooting apps. Accessed: 11 Septem-

ber 2016.

Goodin, D. (2016b). Android phones rooted by "most seri-

ous" Linux escalation bug ever. Accessed: 31 October

2016.

Haupert, V. and Müller, T. (2016). Auf dem Weg verTAN:

Über die Sicherheit App-basierter TAN-Verfahren. In

Meier, M., Reinhardt, D., and Wendzel, S., editors,

Sicherheit 2016: Sicherheit, Schutz und Zuverlässig-

keit, Beiträge der 8. Jahrestagung des Fachbereichs

Sicherheit der Gesellschaft für Informatik e.V. (GI),

5.-7. April 2016, Bonn, volume 256 of LNI, pages 101–

112. GI.

ING (2016). ING International Survey: Mobile Banking

2016.

Kivva, A. (2016). The banker that can steal anything. Acces-

sed: 22 September 2016.

Konoth, R. K., van der Veen, V., and Bos, H. (2016). How

anywhere computing just killed your phone-based two-

factor authentication. In Grossklags, J. and Preneel,

B., editors, Financial Cryptography and Data Secu-

rity - 20th International Conference, FC 2016, Christ

Church, Barbados, February 22-26, 2016, Revised Se-

lected Papers, volume 9603 of Lecture Notes in Com-

puter Science, pages 405–421. Springer.

Lafortune, E. Proguard. Accessed: 12 October 2016.

Maier, D., Müller, T., and Protsenko, M. (2014). Divide-and-

conquer: Why android malware cannot be stopped. In

Ninth International Conference on Availability, Relia-

bility and Security, ARES 2014, Fribourg, Switzerland,

September 8-12, 2014, pages 30–39. IEEE Computer

Society.

Mulliner, C., Borgaonkar, R., Stewin, P., and Seifert, J.

(2013). Sms-based one-time passwords: Attacks and

defense - (short paper). In Rieck, K., Stewin, P., and

Seifert, J., editors, Detection of Intrusions and Mal-

ware, and Vulnerability Assessment - 10th Internatio-

nal Conference, DIMVA 2013, Berlin, Germany, July

18-19, 2013. Proceedings, volume 7967 of Lecture

Notes in Computer Science, pages 150–159. Springer.

Number26 GmbH (2016). N26 - Banking by Design. Acces-

sed: 10 October 2016.

Polkovnichenko, A. and Boxiner, A. (2015). BrainTest –

A New Level of Sophistication in Mobile Malware .

Accessed: 16 September 2016.

Promon AS (2016). Promon SHIELD

TM

- Rock-Solid App

Security! Accessed: 12 October 2016.

Rao, S. P., Kotte, B. T., and Holtmanns, S. (2016). Privacy

in LTE networks. In Yan, Z. and Wang, H., editors,

Proceedings of the 9th EAI International Conference

on Mobile Multimedia Communications, MobiMedia

2016, Xi’an, China, June 18-20, 2016, pages 176–183.

ACM.

Reaves, B., Scaife, N., Tian, D., Blue, L., Traynor, P., and

Butler, K. R. B. (2016). Sending out an SMS: charac-

terizing the security of the SMS ecosystem with public

gateways. In IEEE Symposium on Security and Privacy,

SP 2016, San Jose, CA, USA, May 22-26, 2016, pages

339–356. IEEE Computer Society.

Tanriverdi, H. (2016). Mobiles Banking: Hacker knacken

Photo-Tan-App. Süddeutsche Zeitung, 72(241).

Thomas, D. R., Beresford, A. R., and Rice, A. C. (2015).

Security metrics for the android ecosystem. In Lie,

D. and Wurster, G., editors, Proceedings of the 5th

Annual ACM CCS Workshop on Security and Privacy in

Smartphones and Mobile Devices, SPSM 2015, Denver,

Colorado, USA, October 12, 2015, pages 87–98. ACM.

Zhang, V. (2016). ‘GODLESS’ Mobile Malware Uses Multi-

ple Exploits to Root Devices. Accessed: 11 September

2016.

ICISSP 2018 - 4th International Conference on Information Systems Security and Privacy

160