An Agent-based Electronic Market to Help Airlines to Recover from

Delays

Lu

´

ıs Reis

1

, Ana Paula Rocha

2

and Antonio J. M. Castro

2

1

FEUP, University of Porto, Portugal

2

LIACC, FEUP, DEI, University of Porto, Portugal

Keywords:

Electronic Market, Multi-agent Systems, Negotiation, Case-Based Reasoning, Air Transport, Disruption

Management, Flight Disruption, Irregular Operations, Recovery Process.

Abstract:

The Airline Operations Control Center (AOCC) has the responsibility to ensure that flights meet their planned

schedule or, if any problem arises, to find a viable solution that minimizes both the impact in the operational

plan and its cost. The high cost of resources involved in this process (aircraft and crew members) leads to a lack

of additional resources from the airline companies, implying a restricted solution space. Here, we propose an

electronic market modeled as a multi-agent system where airline companies can negotiate and lease each other

the required resources when solving a disruption problem, thus expanding their solution space. The proposed

negotiation occurs in several rounds, where qualitative comments made by the buyer agent on proposals sent by

the sellers enables these to learn how to calculate new proposals, using a case-based reasoning methodology.

1 INTRODUCTION

According to Kohl (Kohl et al., 2004), ”research on

the recovery operation to this date only deals with

a single airline. Cooperation between airlines is not

supported”. Nowadays, each airline tries to solve

the operations recovery problems with their own re-

sources (Castro et al., 2014). If they have an open

position for a specific type of crew in a flight, they try

to find a suitable one from their own staff. The same

happens with aircraft.

Sometimes, the airlines have to rent aircraft and

crew members when needed (known in the industry as

ACMI - Aircraft, Crew, Maintenance and Insurance),

but through a direct contact with charter airlines. It is

not a usual practice to use only crew members (with-

out being part of the aircraft) from other companies.

The electronic market (EM) that we propose in

this paper, is a permanently open virtual market-

place where registered airlines (represented by soft-

ware agents) can meet each other to purchase services

and has the possibility to be integrated with systems

or tools for airline operations control, like the one we

use in this paper. It has the following advantages:

• Airlines that participate in this EM will have more

resources available to solve their problems.

• Airlines may take advantage of exceeding re-

sources in specific dates and times and sell ser-

vices performed by these resources to other air-

lines.

• Can reduce costs and time for the airline that has

a specific problem.

When compared with the work of Malucelli

(Malucelli et al., 2006) we complete the work by

proposing a negotiation algorithm for the EM.

Airlines have an organization called Airline Oper-

ations Control Center (AOCC) that has the responsi-

bility to ensure that flights meet their planned sched-

ule or, if any problem arises, to find a viable solution

that minimizes both the impact in the operational plan

and its cost. Research in the air transportation domain

has shown that airline companies lose between 2% to

3% of their annual revenue as consequence of disrup-

tions and, that, the impact caused by small disruptions

in companies’ profits can be reduced by at least 20%,

through a better recovery process (Chen et al., 2010).

Currently, operations management is essentially

a manual process, supported by tools, that among

other functions include monitoring, event detection

and problems resolution and, strongly depends on the

tactical knowledge of the AOCC’s members (Castro

et al., 2014).

Every time an irregular event that has an impact

on the scheduled plan is detected, the AOCC’s team

176

Reis, L., Rocha, A. and Castro, A.

An Agent-based Electronic Market to Help Airlines to Recover from Delays.

DOI: 10.5220/0006582401760183

In Proceedings of the 10th International Conference on Agents and Artificial Intelligence (ICAART 2018) - Volume 1, pages 176-183

ISBN: 978-989-758-275-2

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

has to plan carefully an alternative schedule, to ensure

that it minimizes at most the disruption cost. A dis-

ruption can be view as composed by four dimensions

(Castro et al., 2014): aircraft, crew member, passen-

ger and flight. In disruption management, the AOCC

commits to recover all the dimensions affected.

To test our proposed EM, we use MASDIMA

(Multi-Agent System for Disruption Management)

(Castro et al., 2014) that addresses the Aircraft, Crew

and Passenger recovery problem using an approach

that is able to recover all problem dimensions simul-

taneously.

In Multi-Agent Systems it is required for an agent

to interact with other agents whom may not share

common goals. This leads to the need to reach agree-

ments (Wooldridge, 2009) through an automated ne-

gotiation process. The existent automated negotiation

systems are composed of three major groups (Oliveira

and Rocha, 2001):

• Auctions;

• Game Theory;

• Negotiation.

Although it only considers a single attribute, due to its

simplicity and well predefined rules, auctions (Vulkan

and Jennings, 2000) are a very popular negotiation

mechanism.

Game Theory (Rosenschein and Zlotkin, 1994) is

a mechanism that can only be applied to perfect infor-

mation and rationality contexts.

Negotiation is the generic name given to other

techniques where agents must reach agreements on

matters of mutual interest (Wooldridge, 2009). These

techniques are more flexible than auctions and game

theory in terms of preexistent protocols and rules, thus

more suitable for open and dynamic environments

(Oliveira and Rocha, 2001).

From the Negotiation group, stands out the multi-

attribute negotiation, which is useful in the situation

where the negotiation decision does not consider only

one attribute but multiple attributes as it is in the case

of AOCC. For instance, when buying any product, the

buyer considers the price as an important attribute in

its decision but the delivery time or the product qual-

ity may also be (usually are) factors to be considered

in the decision of buying or not a certain product.

Giving different utility values to the different

attributes under negotiation solves the problem of

multi-attribute evaluation. The most common pro-

posal evaluation formula is a linear combination of

the attribute correspondent values, weighted by the

respective utilities. Therefore, a multi-attribute ne-

gotiation is converted to a single-attribute one, to be

made over the evaluation value (examples of this are

the work in (Oliveira et al., 1999), (Vulkan and Jen-

nings, 2000), (Matos et al., 1998) and (Cardoso and

Oliveira, 2000)). This is also the approach followed

in our work, although we agree that, in some cases, it

can be difficult to give an exact numeric value to an

attribute utility. A solution which leads to a more intu-

itive situation, can be just to impose a preferential or-

der over the domain values for the different attributes

or on the attributes itself.

The multi-agent system based Electronic Market,

presented in this paper, allows companies to negoti-

ate among themselves the missing resources. The ne-

gotiation algorithm includes case-based reasoning to

learn how to make a counter-proposal. According to

Riesbeck and Schank (Riesbeck and Schank, 2013),

”A case-based reasoner solves problems by using or

adapting solutions to old problems.”, i.e. case-based

reasoning (CBR) focuses on the reuse of knowledge

acquired from previous experiences in order to solve

new problems. Like humans do, CBR is a problem

solving paradigm that uses incremental and sustained

learning since new experiences are retained each time

a problem is solved making those available for future

problems. A negotiation algorithm with a CBR ap-

proach has never been considered in the works men-

tioned.

The rest of this paper is as follows: section 2 is the

main section and presents the proposed multi-agent

system EM. In section 3 it is presented the scenar-

ios but only one of the experiments done, as well as

the results obtained. Finally, section 4 concludes the

work presented.

2 AIRLINE ELECTRONIC

MARKET SOLUTION

When a disrupted flight is detected, the AOCC’s team

should find an alternative trying to minimize both the

delay and the disruption cost. The airline electronic

market proposed here intends to help the airline com-

pany in this disruption management process, by al-

lowing to find external resources, possibly less costly

or available sooner than the company’s own. In this

market there are two types of entities:

• The buyer, that represents an injured airline com-

pany. This is the airline company that has a dis-

rupted flight (an unexpected event causing a delay

in the flight).

• The seller, that represents a service provider air-

line company

Being the object under negotiation, a Need is iden-

tified by the resource(s) needed: a list of crew mem-

An Agent-based Electronic Market to Help Airlines to Recover from Delays

177

bers and an aircraft fleet as well as relevant informa-

tion related to the disrupted flight (scheduled depar-

ture time, trip time, delay, origin and destination), as

depicted in equation (1).

Need =< Res, ST D, TripD, Del, Orig, Dest > (1)

with Res =< CrewList, Aircra f t Fleet >

where:

• Res is the resource(s) needed

• ST D is the trip duration

• Del is the delay of the disrupted flight

• Orig is the airport origin

• Dest is the airport destination

Buyer and sellers will negotiate the resource that

buyer identifies as its need. This resource can be a

set of crew members, an aircraft or both. When the

resource under negotiation is an aircraft, it is required

that a crew to handle it should also be provided. For

the negotiation to take place, buyers and sellers need

to know each other. Sellers should register first, other-

wise will be no one in the market to be asked for some

resource(s). So, the first step is to have multiple sell-

ers registered and wait for some buyer to register too.

When a buyer registers in the market, it retrieves a list

containing all registered sellers and starts a negotia-

tion with them. The negotiation is a process where

proposals are exchanged between buyer and sellers

until an agreement is reached between the buyer and

one of the sellers, and the negotiation ends success-

fully, or no agreement is reached and the negotiation

fails.

2.1 An Adaptive Negotiation

The negotiation protocol proposed for the airline elec-

tronic market is based in the FIPA Iterated Contract

Net and was chosen because it allows multi-round it-

erative bidding. This way, it is ensured that a wide

space of solutions is subject to discussion and refine-

ment, as it is the case of humans’ negotiations. This

protocol works with an initiator (buyer in this case)

and multiple responders (sellers ).

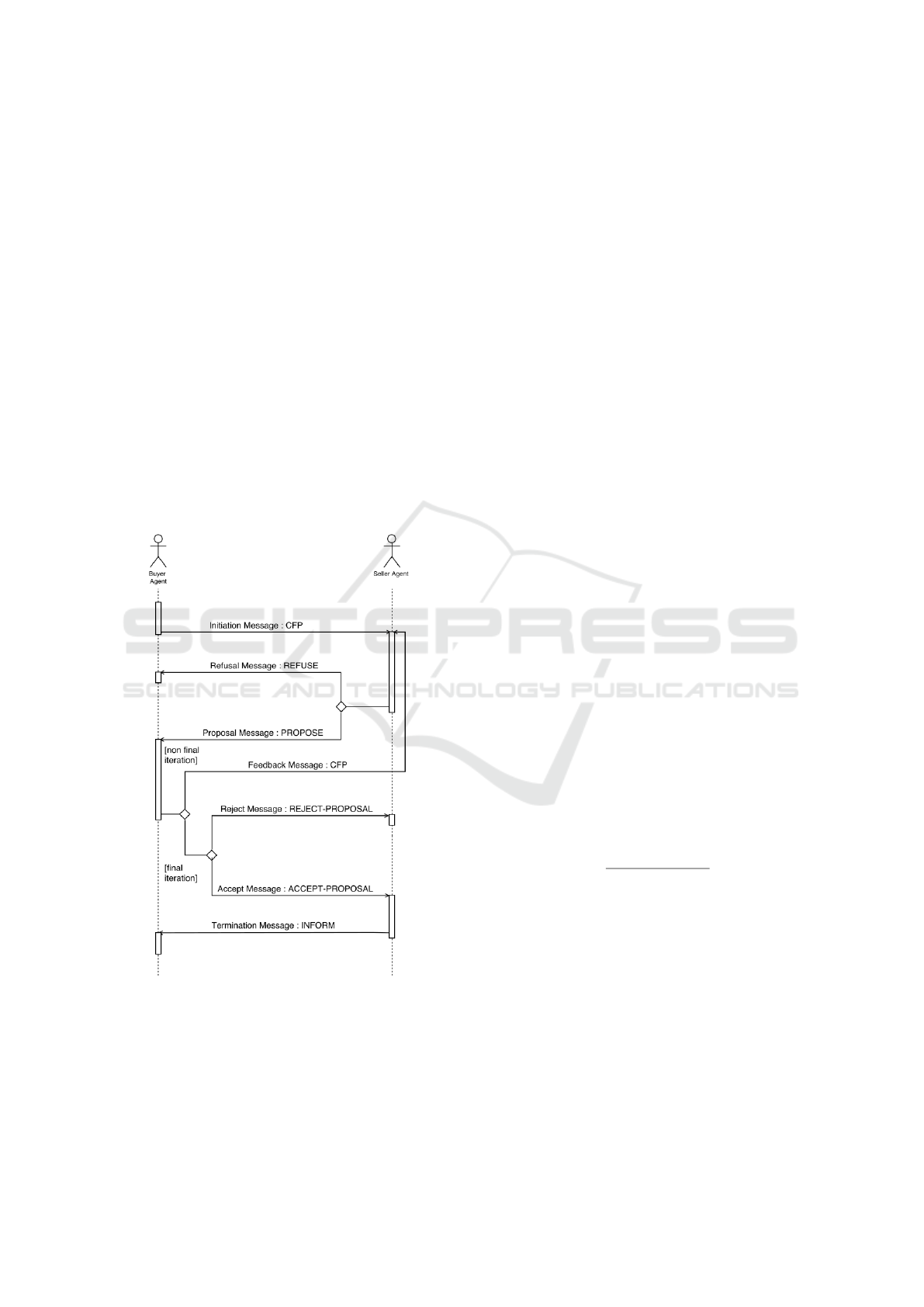

The negotiation protocol is depicted on figure 1.

The buyer initiates the negotiation, by sending to all

sellers an Invitation message, (CFP - Call For Pro-

posals), containing relevant information about the dis-

rupted flight and resource needs (as indicated in (1)).

After sending the Invitation message, the buyer gives

a timeout for sellers to respond. If a seller did not

respond after that timeout, it is removed from the ne-

gotiation.

When a seller receives the Invitation message, it

processes the message verifying if it is able to pro-

vide the required resources or not. If yes, the seller

replies with a Proposal message, containing the price

and availability of its proposal (equation (2)).

Proposal =< α, ρ > (2)

with α ∈ [0, delay o f disrupted f light]

where:

• α is the proposed availability

• ρ is the proposed price

If the seller is not able to provide the resources re-

quired by the buyer, it replies with a Refusal message.

The first round is now concluded and until the end

of the negotiation, all rounds are processed the same

way, explained as follows.

Buyer Role: Buyer receives one proposal from

each interested seller, evaluates all proposals and se-

lects the best one of the current round according to its

utility (agents’ utility is explained in section 2.2). If

the best proposal of the current round is better than

the best one found in previous rounds (if any), it is

considered the new best proposal. If not, the best pro-

posal remains unchanged. Buyer creates then a reply

for each received proposal, issuing a qualitative feed-

back over the availability and price in it, by comparing

these values with the ones in the best proposal. This

reply or Feedback message is send to all sellers that

are currently in the negotiation (equation (3)). The

qualitative comment included in the Feedback mes-

sage (QlEv in equation (3)) can assume one of the

three options:

• OK: means there is no need to improve the at-

tribute that received this feedback

• LOWER: means the attribute that received this

feedback has a high value, should be reduced

• MUCH LOWER: means the attribute that re-

ceived this feedback has a very high value, should

be greatly reduced

Feedback =< QlEv

α

, QlEv

ρ

> (3)

where:

• QlEv

α

is the qualitative evaluation of the pro-

posed availability

• QlEv

ρ

is the qualitative evaluation of the pro-

posed price

Seller Role: When a seller receives the feedback

for the proposal sent, it updates its experience history,

by recording and reasoning the concerned feedback.

Sellers will use its experience history (similar to what

humans do) to formulate new proposals during the

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

178

current and future negotiations. If a seller does not

have any more proposals to propose, it sends a Refuse

message. This process is explained in more detail in

section 2.3.

The negotiation is over when all sellers have sent

a refusal message or a deadline is reached. In the last

round of the negotiation, buyer sends an Accept mes-

sage to the best proposal’s owner, with the accepted

proposal data and a Reject message to all others. The

seller that received the accept message sends back to

buyer a Termination message with all relevant data

about the Need. Upon receiving the termination mes-

sage, buyer unregisters himself from the market as the

negotiation is over.

Note that messages exchanged during all the nego-

tiation ensure that agents’ (buyers or sellers) informa-

tion is kept private. Agents never reveal their costs or

utility. For instance, if sellers would know the buyer’s

disruption cost, their strategy would be to ask for a

price slightly lower than that cost, making the market

an unpractical alternative for buyer.

Figure 1: Negotiation Protocol.

2.2 Agents’ Utility

Agent’s utility is a way of representing its preferences

over a set of possible alternatives, in this case, a set of

possible Need, which will constitute the negotiation

set. The higher the utility, more preferred is the cor-

respondent Need.

Buyer Utility. Buyer uses the utility to evaluate the

proposals sent by the different sellers in response to

its Invitation or Feedback messages. Remember that a

proposal tells the buyer what are the conditions under

which a seller provides a Need, and contains two val-

ues: the proposed availability for the disrupted flight,

and the rental price. In buyers perspective, the utility

of a proposal must measure its availability and price,

where it tries to minimize both. Its value ranges from

0 to 1, and its calculation follows equation (4).

µ = µ

α

× β + µ

ρ

× (1 − β) (4)

with β ∈ [0, 1] where:

• µ is the utility of the proposal

• µ

α

is the utility of the availability parameter [0, 1]

• µ

ρ

is the utility of the price parameter [0, 1]

• β is the importance factor of the availability pa-

rameter

As shown in equation (4), to the buyer, the utility

of a proposal is composed of two parcels, the avail-

ability utility (µ

α

) and the price utility (µ

p

). The main

purpose of the availability utility (µ

α

) is to relate the

availability proposed by the seller with the delay of

the disrupted flight.

Seller Utility. In the case of sellers, the measure of

how preferable a proposal is, is given exclusively by

its price. This is materialized in the fact that sellers

do not need to fulfill any disrupted schedule but it just

has to compensate the leasing associated cost. From

the seller point of view, a proposal is more profitable

the higher is the price. The seller utility is given by

equation (5), and its value ranges from 0 to 1.

µ =

ρ − γ × ζ

(σ × ζ) − (γ × ζ)

(5)

where:

• µ is the utility of the proposal

• ρ is the proposed price

• γ is the minimum price multiplier

• σ is the maximum price multiplier

• ζ is the leasing associated cost

The price multiplier is a static interval generated to

ensure that seller is not impaired, what would happen

if the price was only the leasing associated cost. This

way, it is ensured that seller gets some profit even with

a low utility deal.

An Agent-based Electronic Market to Help Airlines to Recover from Delays

179

2.3 Agents Learning through

Case-based Reasoning

Sellers use CBR (Case-based Reasoning) to decide

what to do upon receiving the buyer feedback over the

proposal they have sent, consulting a record of previ-

ous experiences classified according to its usefulness.

The object that represents an experience, along with

its usefulness, is called case and is represented by a

set of parameters, grouped into three types (Features,

Solution and Evaluation), as shown in figure 2.

The parameters in Features identify the situation of

the current case, regarding the feedback buyer gave,

the number of sellers in the negotiation and the iden-

tification of the resource under negotiation (aircraft or

crew). The parameters in Solution identify the actions

performed (price changing, availability changing) in

that specific situation. The parameter in Evaluation

assigns an evaluation value to the case, that measures

its usefulness.

Case

Features

Price Availability Number

Sellers

Resource

Asked

Solution

Price

Action

Availability

Action

Evaluation

Evaluation

Value

Figure 2: Case Composition.

Find Similar Cases

CBR starts by retrieving similar cases to the one re-

ceived. For this purpose, only parameters identified

as Features in figure 2 are used to compare cases and

to identify equal ones. Although all features are used,

they do not have the same preponderance on the task,

because the feedback over a proposal is more relevant

to decide the action to be made than the others pa-

rameters. So, to each parameter in Features is given a

weight. Similar cases are found through the euclidean

distance between them, a distance of 0 means that the

case is identical, a distance greater than 0 means a

different case. To ensure that features’ weight has

relevance in the distance calculation, the weight was

added to the well known euclidean distance formula.

So, the distance between two cases is the weighted

sum of their features distances, as presented in equa-

tion (6).

d(κ, χ) =

∑

η

q

(κ

η

− χ

η

)

2

× ε

η

(6)

with η ∈ {Features}

where:

• κ is the case received

• χ is one of the case in the data set

• η is the current feature

• ε

η

is the weight of feature η

Select a Case

After identify the set of similar cases, the seller has

to select one of them to apply at the current situation,

what it does using a softmax algorithm (Sutton and

Barto, 1998). This algorithm applies a probability to

each similar case retrieved from CBR, where a case’s

probability is greater the higher its evaluation value.

The probability of a case being selected is given by

equation (7).

P(k) =

e

ϒ

k

∑

n

i=1

e

ϒ

i

(7)

where:

• ϒ

i

is the evaluation of case i

• P(k) is probability of the item k being selected

• n is the number of similar cases

After being assigned a probability to each case,

a random value is generated and the first case with

cumulative probability greater than that random value

is selected. The new proposal to be sent by the seller

is generated by applying the actions enumerated in the

selected case.

If no similar cases exist in the history set, the seller

generates a new proposal by following the qualitative

comments in the feedback received.

Update History

In order to prevent obsolete cases, every time an expe-

rience is reproduced, its evaluation is updated, where

the latter the experience, the more important its eval-

uation is. The evaluation of an experience is updated

as equation (8) shows.

ϒ = ϒ

n−1

∗ (1 − I ) + ϒ

n

∗ I (8)

where:

• ϒ is the updated evaluation value

• ϒ

prev

is the evaluation value of an equal experi-

ence found in the history set

• ϒ

curr

is the evaluation value for the current expe-

rience

• I is the weight given to the most recent experi-

ment

If there is no previous experience equal to the

current one in the history, the evaluation is simply:

ϒ = ϒ

curr

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

180

Evaluate a Case

The evaluation of the current experience ϒ

curr

is cal-

culated as the difference between the feedback over

previous round proposal and the current round pro-

posal, as presented in equation (9).

ϒ

curr

= ∆ρ

f eedback

+ ∆α

f eedback

(9)

where:

• ∆ρ

f eedback

is the price feedback variation;

• ∆α

f eedback

is the availability feedback variation.

If the feedback variation is greater than 0, the eval-

uation is incremented by 0.5 for each attribute. This

means that in the worst scenario, where feedback re-

mains unchanged, evaluation is 0. If only one of the

feedback values changed, evaluation is set to 0.5 and

if both changed, best scenario, evaluation is set to 1.

3 EXPERIMENTS AND RESULTS

To validate our proposal, we have used data provided

by a TAP Air Portugal expert in disruption manage-

ment, regarding disruptions and solutions found for

real problems. Each test reflected a disruption and as-

sorted solution possibilities.

The data provided to test the electronic market is

composed by 12 disruptions where each disruption

contained a considerable amount of fields of which

stand out the ID, delay, cost, disrupted resource, as

well as the estimated departure time and number of

passengers. The number of crew members of each

category (captain, first office, senior cabin crew and

flight attendant) was also included.

The following metrics will be used to measure the

benefit of the solution’s found with the electronic mar-

ket:

• Buyer utility;

• Seller utility;

• Delay reduction;

• Price reduction.

To evaluate price and delay reductions and both

agents utility variations, three different experiments

were executed. The first experiment considered equal

weights for the attributes price and availability. The

second experiment valued the availability with a

weight of 80% and the price with a weight of 20%

in the utility calculation. The third and last experi-

ment showed an inversion regarding the values of the

second one, i.e. availability with a weight of 20% and

the price with a weight of 80% in the utility calcula-

tion. In all experiments, disruption number 12 has no

results to present because does not exists in seller’s

data set any resource similar to the one required, so

seller gives up the negotiation. Due to paper space

limitations, we will only describe the first experiment

in section 3.1. However, in section 4, the results pre-

sented consider the three experiments.

3.1 Experiment 1 (50/50 Experiment)

In this experiment, it was expected to find a similarity

between cost and delay reductions, given that both are

equally valued in the buyer’s utility calculation. The

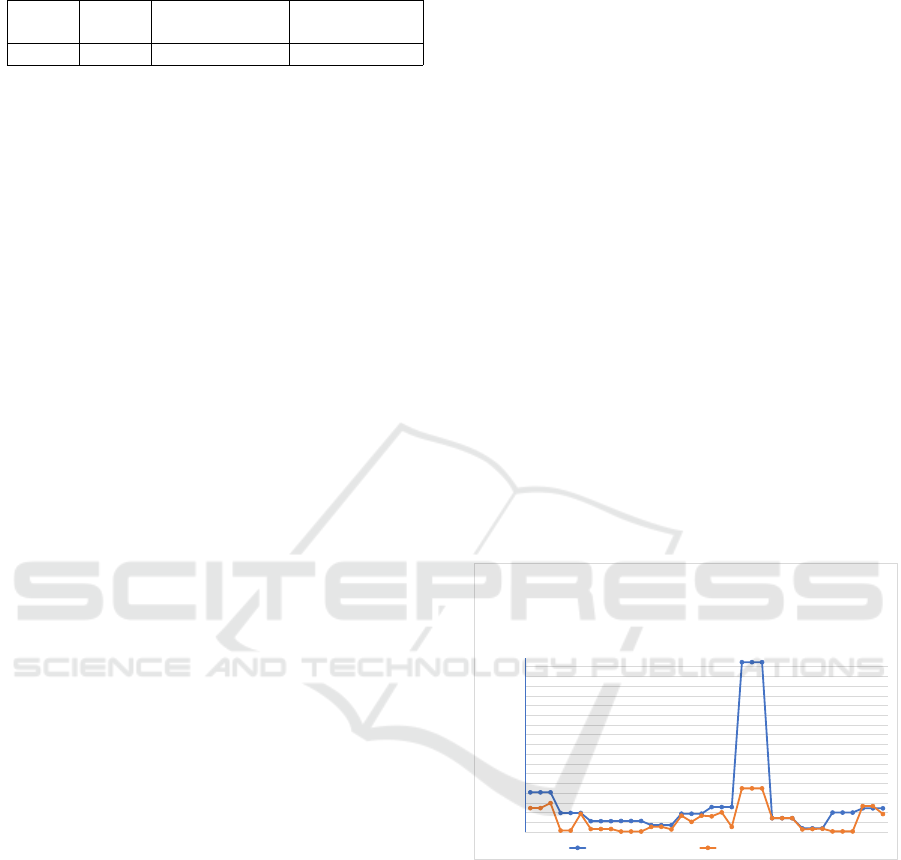

chart in figure 3 presents the results obtained.

-1

-0,8

-0,6

-0,4

-0,2

0

0,2

0,4

0,6

0,8

1

0 1 2 3 4 5 6 7 8 9 10 11 12

Parameter Value

Disruption Number

Experiment 1 - Results

Seller Utility Buyer Utility Delay Reduction(%) Cost Reduction(%)

Figure 3: Experiment 1 Results.

The points below zero are solutions that had a

price greater than the disruption cost, or in the case

of agents’ utilities, unfeasible solutions, like disrup-

tion number 6 that has a negative value for buyer’s

utility and for this reason it is not a viable solution.

The fact that there is no delay reduction or the seller’s

utility being zero supports that statement, so this is a

case that would never result in a leasing contract.

One interesting fact that can be extracted is that

seller’s utility and delay reduction lines are over-

lapped, which means that have the same values for

every disruption. This is explained by both agents’

utility formulas, detailed in section 2.2.

The results obtained for this experiment show that

with equal weights in the utility calculation, all but

one disruption had its delay minimized by at least

68%. Relatively to the cost reduction the results are

not as good as for availability, which is explained by

the need to minimize a flight’s delay. If the delay is

largely reduced, as showed, then the buyer is willing

to pay more than the disruption cost. Regarding this

experiment results, the average values for each of the

metrics used are presented in table 1.

Although the average delay reduction is good

(74.91%), there is a cost incresase (6.55%) intead of

a cost reduction. Concerning to utilities, the aver-

An Agent-based Electronic Market to Help Airlines to Recover from Delays

181

Table 1: Experiment 1 - Average values.

Seller

Utility

Buyer

Utility

Delay

Reduction (%)

Cost

Reduction(%)

0.75 0.35 74.91 -6.55

age seller utility reveals that the electronic market is

highly useful, at least for this experiment. Regarding

the average buyer utility, it shows some improvement

but in some cases at a great cost, which explains the

considerable difference between seller and buyer util-

ities.

3.2 Results

The electronic market does not consider any costs un-

related to the disrupted resources. However, in order

to choose the most cost-effective solution, passenger

related costs must be considered after the market re-

turns its solutions. For instance, the number of pas-

sengers that will miss a flight connection due to the

delay carries an extra cost to the injured company

(passenger cost) and will affect the passenger satis-

faction, which also carries an extra cost to the com-

pany (passenger goodwill cost). These costs will be

added to the aircraft and crew costs, being distributed

as follows:

• Direct Costs: Aircraft cost plus crew cost plus

passenger cost;

• Integrated Solution Costs: Passenger goodwill

cost times passenger goodwill weight plus direct

costs.

All these costs are considered by the human specialist

(at the AOCC) when it must choose a solution to a dis-

ruption in its daily operation. This section intends to

compare the solutions found by the electronic market

to the ones chosen by a human specialist, by present-

ing the electronic market solutions to the human for

him to analyze and validate. The passenger goodwill

weight is 5, by default, according to the specialist.

The first step in the comparison between the solu-

tions found by the electronic market and the ones cho-

sen by a human specialist is to see how the three so-

lutions (one of each experiment) obtained in the elec-

tronic market impacts in the flight delay and in the

number of passengers missing the flight connections.

The second step is to see the disruption and each

solution cost and its influence on the passenger and

passenger goodwill costs.

The third step is to see the costs without consid-

ering the electronic market solutions: original direct

costs and original integrated solution cost, i.e. the

original integrated solution cost is the sum of aircraft,

crew and passenger costs to which is added the re-

sult of the multiplication between passengers good-

will cost and its weight, as shown in equation (10).

IC

orig

= c

a

+ c

cr

+ c

pax

+ (c

paxgw

× w

gw

) (10)

where:

• c

a

is the aircraft cost;

• c

cr

is the crew cost;

• c

pax

is the passenger cost;

• c

paxgw

is the passenger good will cost;

• w

gw

is the weight of good will.

The new integrated costs represent the integrated

costs of the electronic market solutions while the orig-

inal integrated costs represent the company solution

integrated costs. The final step is to see if there are

savings provided by each one of the electronic mar-

ket solutions because the specialist always chooses

the solution with a higher value of integrated savings.

After being introduced the methodology used to cal-

culate the Integrated Savings, the results over all dis-

ruptions are presented in figure 4.

0

10000

20000

30000

40000

50000

60000

70000

80000

90000

100000

110000

120000

130000

140000

150000

160000

170000

180000

50-50 -CSTTJ

80-20 - CSTTJ

20-80 - CSTTJ

50-50 - CSTQD

80-20 - CSTQD

20-80 - CSTQD

50-50 - CSTTP

80-20 - CSTTP

20-80 - CSTTP

50-50 - CSTJG

80-20 - CSTJG

20-80 - CSTJG

50-50 - CSTTK

80-20 - CSTTK

20-80 - CSTTK

50-50 - CSTNL

80-20 - CSTNL

20-80 - CSTNL

50-50 - CSTNJ

80-20 - CSTNJ

20-80 - CSTNJ

50-50 - CSTNN

80-20 - CSTNN

20-80 - CSTNN

50-50 -CSTJF1

80-20 - CSTJF1

20-80 - CSTJF1

50-50 - CSTTU

80-20 - CSTTU

20-80 - CSTTU

50-50 - CSTJF2

80-20 - CSTJF2

20-80 - CSTJF2

50-50 - CSTNM

80-20 - CSTNM

20-80 - CSTNM

Monetary Units (€)

Disruption - EM Scenario

Costs and Savings

Original Integrated Solution Cost New Integrated Solution Cost

Figure 4: Costs and Savings.

As shown, the solutions obtained through the elec-

tronic market are more cost-effective than the com-

pany’s solutions, except in the disruption which is

identified by CSTJF that has no similar resources in

the electronic market. When comparing the chosen

solution from the electronic market with the disrup-

tive solution, the electronic market solutions present

an average delay reduction of 66.85% and an average

cost reduction of 63.51%. Disregarding the CSTJF

disruption, there is at least one solution obtained (con-

sidering the three experiments made) in the electronic

market that is more cost-effective than the disruptive

solution for each disruption, having a total of seven

disruptions minimized in each experiment.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

182

4 CONCLUSIONS AND FUTURE

WORK

In this paper, it is proposed an electronic market

modeled as a multi-agent system to expand a com-

pany’s solution space regarding disruptions manage-

ment. This electronic market provides alternative

solutions to companies affected by disruptions, us-

ing resources from other companies (and, as such,

contributing to increase collaboration between air-

lines), which is achieved through automated negotia-

tion, where agents negotiate the resource’s availability

and price for a disrupted flight. Human validation (at

the AOCC) is also included to compare the solutions

obtained through the EM with the ones obtained with

the company’s own resources. The Seller agent in the

EM uses case-based reasoning to reuse or adapt pre-

vious experiences, to the current negotiation, which is

also a contribution of our work.

Three different scenarios were tested to validate

the concept, as described in section 3. As there were

no available resources for only one disruption in the

electronic market, the success rate is 91.7% consider-

ing the cost reduction parameter and 67.7% consider-

ing both cost and delay minimized.

Possible future directions to improve this work,

could include firstly, different approaches in the

whole process of identifying previous similar expe-

riences (by the seller), like machine learning and q-

learning in order to understand how the agent learn-

ing process influences the negotiation, either in terms

of proposals’ price and availability or in terms of util-

ity for each agent. The methodology used (CBR) can

also be improved by creating better evaluation scenar-

ios and benefiting the accepted proposal (or the tree of

the proposals that lead to the accepted one).

Secondly, the usage of heuristics to combine re-

sources instead of doing all possible combinations,

would be an interesting feature to include. The usage

of clustering algorithms to classify resources (where

the parameters would be availability and/or price) in

order to have a better and more efficient resource

combination is also something to explore.

Finally, it would be worthy to use trust mod-

els to evaluate the electronic market outcome when

considering the relations established between agents

and whether that trust measure would influence the

agents’ behaviour.

REFERENCES

Cardoso, H. L. and Oliveira, E. (2000). A platform for

electronic commerce with adaptive agents. In Interna-

tional Workshop on Agent-Mediated Electronic Com-

merce, pages 96–107. Springer.

Castro, A. J., Rocha, A. P., and Oliveira, E. (2014). A New

Approach for Disruption Management in Airline Op-

erations Control, volume 562. Springer-Verlag Berlin

Heidelberg.

Chen, X., Chen, X., and Zhang, X. (2010). Crew schedul-

ing models in airline disruption management. In 2010

IEEE 17Th International Conference on Industrial

Engineering and Engineering Management (IE&EM),

pages 1032–1037. Conference Publications.

Kohl, N., Larsen, A., Larsen, J., Ross, A., and Tiourline,

S. (2004). Airline disruption management - perspec-

tives, experiences and outlook. Carmen Research and

Technology Report CRTR-0407.

Malucelli, A., Castro, A. J. M., and Oliveira, E. (2006).

Crew and aircraft recovery through a multi-agent elec-

tronic market. In Krishnamurthy, S. and Isaias, P., ed-

itors, Proceeding of IADIS International Conference

on e-Commerce 2006, pages 51–58, Barcelona Spain.

IADIS Press.

Matos, N., Sierra, C., and Jennings, N. R. (1998). Determin-

ing successful negotiation strategies: An evolutionary

approach. In Multi Agent Systems, 1998. Proceedings.

International Conference on, pages 182–189. IEEE.

Oliveira, E., Fonseca, J. M., and Steiger-Garc¸

˜

ao, A.

(1999). Multi-criteria negotiation in multi-agent sys-

tems. CEEMAS’99, page 190.

Oliveira, E. and Rocha, A. (2001). Agents advanced fea-

tures for negotiation in electronic commerce and vir-

tual organisations formation process. Agent Mediated

Electronic Commerce, pages 78–97.

Riesbeck, C. K. and Schank, R. C. (2013). Inside case-

based reasoning. Psychology Press.

Rosenschein, J. S. and Zlotkin, G. (1994). Rules of en-

counter: designing conventions for automated nego-

tiation among computers. MIT press.

Sutton, R. S. and Barto, A. G. (1998). Reinforcement learn-

ing: An introduction, volume 1. MIT press Cam-

bridge.

Vulkan, N. and Jennings, N. R. (2000). Efficient mecha-

nisms for the supply of services in multi-agent envi-

ronments. Decision Support Systems, 28(1):5–19.

Wooldridge, M. (2009). An introduction to multiagent sys-

tems, pages 15–23,105–111,129–148. John Wiley &

Sons.

An Agent-based Electronic Market to Help Airlines to Recover from Delays

183