Lowest Unique Bid Auctions with Resubmission Opportunities

Yida Xu and Hamidou Tembine

Learning & Game Theory Laboratory, New York University Abu Dhabi, United Arab Emirates

Tandon School of Engineering, New York University, U.S.A.

Keywords:

LUBA, Auction, Game Theory, Imitative Learning, Reinforcement Learning.

Abstract:

The recent online platforms propose multiple items for bidding. The state of the art, however, is limited

to the analysis of one item auction. In this paper we study multi-item lowest unique bid auctions (LUBA)

in discrete bid spaces under budget constraints. We show the existence of mixed Bayes-Nash equilibria for

an arbitrary number of bidders and items. The equilibrium is explicitly computed in two bidder setup with

resubmission possibilities. In the general setting we propose a distributed strategic learning algorithm to

approximate equilibria. Computer simulations indicate that the error quickly decays in few number of steps

by means of speedup techniques. When the number of bidders per item follows a Poisson distribution, it is

shown that the seller can get a non-negligible revenue on several items, and hence making a partial revelation

of the true value of the items.

1 INTRODUCTION

With the increasing impact of information technology,

the traditional structure of economic and financial

markets has been revolutionized. Today, the market

includes millions of economic agents worldwide and

reaches an annual transaction of billions U.S. dollars.

In this paper, we study a little-studied type auction

which is called lowest unique bid auction (LUBA).

Because of a limited number of items provided by the

auctioneers and budget restrictions, bidders need to

manage their behaviors in a strategic way.

Literature Review

Auctions: In 1961 in the work of Vickrey (Vick-

rey, 1961), the theory of auctions as games of in-

complete information is first proposed. Auctions

with homogeneous valuation distributions (symmet-

ric auctions) and self-interested non-spiteful bidders

are well-investigated in the literature. However, auc-

tions with asymmetric bidders remain a challenging

open problem (see (Maskin and Riley, 2000; Lebrun,

1999; Lebrun, 2006) and the references therein). In

asymmetric auction scenarios, the expected “revenue

equivalence theorem” ( Myerson 1981) does not hold,

i.e., the revenue of the auctioneer depends on the

auction mechanism employed. In addition, there is

no ranking revenue between the auction mechanisms

(first, second, English or Deutch). Most of research

articles (Bang-Qing, 2003; C. Yi, 2015 ; N. Wang,

2014; Rituraj and Jagannatham, 2013) on multi-item

auctions works provide computer simulation or nu-

merical experiments results. However, no analysis

of the outcome of the multi-item auction is available.

There is no analysis of the equilibrium seeking algo-

rithm therein.

LUBA: LUBA is different from the lowest cost auc-

tion called procurement auction which is widely used

in e-commerce(J. Zhao, 2015), hybrid cloud comput-

ing or in demand-supply matching in power grids (R.

Zhou, 2015). As a special case of unmatched bid auc-

tions, the single-item LUBAs have been studied by

other researchers (H. Houba, 2011; Stefan and Nor-

man, 2006; Rapoport, 2007; Erik, 2015; J.Eichberger,

2008).

The authors (Stefan and Norman, 2006) run lab-

oratory experiments with one bid min bid auctions.

They consider the results of a Monte Carlo simula-

tion under the restriction of one bid per player. The

work in (Erik, 2015) considers a lowest unique posi-

tive integer experiment in a single bid per player set-

ting. The observed behaviors are compared with the

solution of a Poisson game. The authors in (Rapoport,

2007) consider both high and low unique bid auctions,

and they also assume that bidders are restricted to a

single bid. A numerical approximation of the solu-

tion for a game-theoretic model is provided. The so-

330

Xu, Y. and Tembine, H.

Lowest Unique Bid Auctions with Resubmission Opportunities.

DOI: 10.5220/0006548203300337

In Proceedings of the 10th International Conference on Agents and Artificial Intelligence (ICAART 2018) - Volume 2, pages 330-337

ISBN: 978-989-758-275-2

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

lutions are compared with the results of a laboratory

experiment. (J.Eichberger, 2008; J.Eichberger, 2015;

J. Eichberger, 2016) conduct field experiments on

Lowest-Unmatched Price Auctions with high prizes

involving large numbers of participants (tens and hun-

dreds of thousands). The work in (Dong-Her, 2011)

discusses security and privacy issues of multi-item re-

verse Vickrey auction. They provide more secure pro-

tocol design. Most of the above works restrict the

number of submissions per bidder to one. The re-

cent focus within the auction field has been multi-item

auctions. The bidder can also place multiple bids for

each item. It has been of practical importance in In-

ternet auction sites and has been widely executed by

them.

2 PROBLEM STATEMENT

A LUBA operates under the following three main

rules: Whoever bids the lowest unique positive bid

wins; If no unique bid exits then no one wins; No

participant can see bids placed by other participants.

“Lowest unique bid” means the lowest amount that

nobody else has bid.

In the multi-item LUBA, there are n ≥ 2 bidders

exerting effort for m items (objects) proposed by the

auctioneers. Each bidder has the information as fol-

low. Valuation vector: Each bidder j has a vector of

values v

j

= (v

ji

)

i∈I

, for assessing the worth of each

object i offered for the auction. The random variable

v

ji

has support [v, ¯v] where 0 < v < ¯v. A bidder may

have his/her own valuation vector but not the valua-

tion vector of the others. Budget: Each bidder j has a

initial total budget of

¯

b

j

to be used for all items. Reg-

istration fee: To participate in the LUBA, each bidder

needs to pay a one time registration fee c

r

. Submis-

sion fee: To participate in the auction on item i, he/she

needs to pay a submission fee c

i

for each submission.

Note that each bidder can resubmit bids a certain

number of times subject to his or her available bu-

ject. If bidder j has (re)submitted n

ji

times on item i,

his/her total submmission/bidding cost would be n

ji

c

i

in addition to the registration fee. The set that con-

tains all the bids of bidder j on item i is denoted by

B

ji

⊂ N. Thus, we can obtain the set of bidders who

are submitting b on item i by N

i,b

= { j ∈ J | b ∈ B

ji

}.

We use |N

i,b

| to represent the cardinality of N

i,b

. Ob-

viously, |N

i,b

| = 1 yields that b was chosen by only

one bidder. Then, the set of all positive natural num-

bers that were unique on item i can be calculated by

B

∗

i

= {b > 0 | |N

i,b

| = 1}. B

∗

i

=

/

0 yields no winner

on item i at that round. If B

∗

i

6=

/

0, there is a winner

on item i, and the winning bid is inf B

∗

i

. At the same

time, the winner can be calulated by j

∗

∈ N

i,infB

∗

i

.

2.1 The Payoff of Participants

The cost of bidder j on item i consists of the registra-

tion fee c

r

, the submission fee |B

ji

|∗c

i

, and the bid fee

which is conditional on moves by the other bidders. If

he/she is the winner, the bid fee is infB

∗

i

calculated by

the proceeding subsection. Losing the LUBA yields

no bid fee. Thus, the payoff of bidder j on item i at

a round would be r

ji

= v

ji

− |B

ji

|c

i

− inf B

∗

i

− c

r

, if j

is a winner on item i, and r

ji

= −|B

ji

|c

i

− c

r

, if j is

not a winner on item i. The payoff of bidder j on item

i is zero if B

ji

is reduced to {0} (or equivalently the

empty set). Thus, it is easy to conclude that

r

ji

(B)

= [−c

r

− c

i

|B

ji

| −(v

ji

− b

ji

)1l

{b

ji

=infB

∗

i

}

]1l

{B

ji

6={0}}

,

(1)

where the infininum of the empty set is zero. Over-

all, the total payoff of bidder j is r

j

(B) =

∑

i∈I

r

ji

(B).

The instant payoff of the auctioneer of item i can be

calculated by

r

a,i

=

∑

j

c

r

1l

{B

ji

6=

/

0}

+ infB

∗

i

+

∑

j=1

|B

ji

|c

i

!

− v

a,i

,

where v

a,i

is the realized valuation of the auctioneer

for item i. Obviously, the instant payoff of the auc-

tioneer of a set of item I is r

a,I

=

∑

i∈I

r

a,i

. In terms of

reward seeking, bidders are interested in optimizing

their payoffs, and auctioneers are interested in their

revenue.

3 SOLUTION APPROACH

Since the game is of incomplete information, the

strategies of participating in the game must be spec-

ified as a function of the information structure. We

introduce the definition of pure strategy and mixed

strategy as follows.

Definition 1. A pure strategy of a bidder is a choice

of a subset of natural numbers contingent on the own-

value and own-budget. Thus, given a bidder’s own

valuation vector v

j

= (v

ji

)

i

, the bidder j will choose

an action (B

ji

)

i

that satisfies the budget constraints,

which is

∑

i

c

r

1l

{B

ji

6={0}}

+

m

∑

i=1

[infB

∗

i

]1l

B

ji

∩[infB

∗

i

]

+

m

∑

i=1

|B

ji

|c

i

≤

¯

b

j

.

The set of multi-item bid space for bidder j is

B

j

(v

j

,

¯

b

j

) = {(B

ji

)

i

| B

ji

⊂ {0, 1, . . . ,

¯

b

j

− c

r

},

∑

i

c

r

1l

{B

ji

6={0}}

+

∑

m

i=1

[infB

∗

i

]1l

B

ji

∩[infB

∗

i

]

+

∑

m

i=1

|B

ji

|c

i

≤

¯

b

j

}.

Lowest Unique Bid Auctions with Resubmission Opportunities

331

• A pure strategy is a mapping v

j

7→ B

j

⊂ N. A con-

strained pure strategy is a mapping v

j

7→ B

j

∈ B

j

.

• A mixed strategy is a probability measure over the

set of pure strategies.

The action set B

j

(v

j

,

¯

b

j

) is finite because of bud-

get limitations; hence, a bid b

ji

∈ B

ji

is less than

min(

¯

b

j

, v

ji

− c

r

). We define a solution concept of

the above game with incomplete information: Bayes-

Nash equilibrium.

Definition 2. A mixed Bayes-Nash strategy equilib-

rium is a profile (s

j

(v

j

))

j

such that for all bidders j

E

s

j

,s

− j

r

j

(B

j

(v

j

), B

− j

| v

j

) ≥ E

s

0

j

,s

− j

r

j

(B

0

j

, B

− j

| v

j

), for

any strategy s

0

j

.

The information structure of the auction is as fol-

lows. Each bidder knows its own-value and own-bid

but not the valuation of the other bidders. Each bidder

has the valuation cumulative distribution of the others.

The structure of the game is common knowledge. We

are interested in the equilibria, the equilibrium pay-

offs of the bidders, and the revenue of the seller.

Existence of Bayes-Nash Equilibrium

Proposition 1. The multi-item Bayesian LUBA game

(without resubmission) but with arbitrary number of

bidders has at least one Bayes-Nash equilibrium in

mixed strategies under budget restrictions.

Proposition 1 provides the existence of at least one

Bayes-Nash equilibrium. However, it does not tell us

what are those equilibria or how can we target them.

The next subsection computes some of the equilibria

in specific setups.

Computation of Bayes-Nash Equilibrium

Proposition 2. Any strategy b

j

such that b

ji

>

min

v

ji

− ˜c − 1,

¯

b

j

is strictly dominated by strat-

egy“0”. If v

ji

< c, bidder j is better off of not par-

ticipating on item i.

Thus, the bid space of j can be reduced to

∏

m

i=1

{0, 1, 2, . . . , min(v

ji

− ˜c − 1,

¯

b

j

)}. Now, we ana-

lyze some of the equilibria in specific setups.

Two Participants. Let n = 2, and the action space is

restricted to {0, 1, 2, . . . , v − ˜c}, where ˜c = c + c

r

.

Proposition 3. Suppose v > ˜c + 1 and n = 2. With

the non-participation option, i.e., when the bid can

be zero, (0, . . . , 0, 1, 0, . . . , 0) and its permutations are

equilibria.

We can easily derive proposition 3 from the payoff

matrix, which is shown in Table 1.

Table 1: Payoff matrix of 2 bidders bidding 1 item.

0 1 2 3

0 0, 0 (0, v − ˜c − 1)

∗

0, v − ˜c − 2 0, v − ˜c − 3

1 (v − ˜c − 1, 0)

∗

− ˜c,−˜c v − ˜c − 1,− ˜c v − ˜c − 1,− ˜c

2 v − ˜c − 2,0 − ˜c,v− ˜c − 1 − ˜c, −˜c v − ˜c − 2,− ˜c

Proposition 4. When the budgets are identical and

equal to k, and n = 2, There is a partially mixed equi-

librium which is symmetric and is explicitly given by

(X

0

, X

1

, X

2

, . . . , X

k

) = (

˜c

v − 1

, 1 −

˜c

v − 1

, 0, . . . , 0).

Three Participants. With three participants, the ac-

tion profile (1, 1, 1) is not an equilibrium anymore: if

players 1 and 2 bid 1 cent then player’s 3 best re-

sponse is to bid 2 and player 3 will be the winner

of the auction. The game is not a dominant solvable

game.

Table 2: Payoff matrix of 3 bidders targetting 1 item.

0 1

0 0, 0, 0 (0, v − ˜c − 1, 0)

∗

1 (v − ˜c − 1, 0, 0)

∗

− ˜c,− ˜c,0

0 1

0 (0, 0, v − ˜c − 1)

∗

0, − ˜c, −˜c

1 − ˜c,0, −˜c − ˜c,− ˜c, − ˜c

Proposition 5. When the budgets are identical and

n ≥ 3, There is a partially mixed equilibrium which is

symmetric and is explicitly given by

(X

0

, X

1

, X

2

, . . . , X

k

) = (

n−1

r

˜c

v − 1

, 1 −

n−1

r

˜c

v − 1

, 0, . . . , 0).

3.1 Multi-item LUBA Game

Now we investigate the property of multi-item LUBA

game. First, we analyze a simple setup, then we ex-

tend it to a general form. We assume n = 2, b

1

= 4+ ˜c,

and b

2

= 3 + ˜c. Thus, the action profiles of each bid-

der can be expressed as A

1

= {b

1

: b

11

+b

12

≤ 4} and

A

2

= {b

2

: b

21

+ b

22

≤ 3}. More specifically,

A

1

= {(0, 0), (1, 0), (0, 1), (2, 0), (1, 1), (0, 2), (3, 0),

(0, 3), (2, 1), (1, 2), (4, 0), (3, 1), (0, 4), (1, 3), (2, 2)}

A

2

= {(0, 0), (1, 0), (0, 1), (2, 0), (0, 2), (1, 1), (3, 0),

(0, 3), (1, 2), (2, 1)}

From the action files, we can derive that

{(0, 0), (1, 1)}, {(1, 1), (0, 0)}, {(0, 1), (1, 0)},

and {(1, 0), (1, 0)} are pure Nash equilibria.

For the extended version, the game can be de-

fined as G(J, (b

j

)

j∈J

, (c, c

r

), m, (F

j

)

j∈J

). When

b

j

is given, we can derive that the action

profile A

j

= D

0

∪ D

1

∪ D

2

∪ . . . ∪ D

b

j

, where

D

k

= {(a

1

, . . . , a

m

) ∈ N

m

| a

i

≥ 0,

∑

m

i=1

a

i

= k} is the

set of all possible decomposition of the integer k.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

332

Proposition 6. If b

j

> 1 + ˜c, the set of pure

Nash equilibria of multi-item auction game

G(J, (b

j

)

j∈J

, (c, c

r

), m, (F

j

)

j∈J

), n ≥ 1, m ≥ 1

without resubmission is the set of matrices

b

11

b

12

b

13

. . . b

1m

b

21

b

22

b

23

. . . b

2m

b

31

b

32

b

33

. . . b

3m

. . . . . . . . . . . . . . . . . . . . . . . .

b

n1

b

n2

b

n3

. . . b

nm

such that ∀i, j, b

ji

∈ {0, 1}, ∀i ∈ {1, . . . , m},

∑

n

j=1

b

ji

=

1 and ∀ j ∈ {1, . . . , n},

∑

m

i=1

b

ji

≤

b

j

− ˜c. The pure

Nash equilibria are also global optima of the game.

3.2 Learning Algorithm

Imitative learning plays a role in many applications

(Tembine, 2012) such as security & reliability, cloud

networking, power grid and evolution of protocols

and technologies. It has been successfully utilized in

order to capture human learning and animal behav-

ior. We calculate the instant payoff of bidder j tar-

geting item i at tth round through R

t

ji

= −c

r

− c +

1l

j wins

(v

ji

− b

t

ji

). Bidder j wins item i at round t if

the placing bid b

t

ji

is the lowest unique bid on item i.

R

t

ji

= 0 if bidder j does not participate to item i. This

algorithm below describes how to update the reward

and the strategy in the bid space.

ˆ

R

t

ji

(k) is the estima-

tion of the reward a bidder j can obtain by holding the

bid k. Denote the estimate of R

t

ji

(k) by

ˆ

R

t

ji

(k) .

Algorithm 1: The Imitative learning algorithm.

Initialization: Generate

ˆ

R

0

ji

(0),

ˆ

R

0

ji

(1), . . . ,

ˆ

R

0

ji

(

¯

b(0)) from the uniform distribution.

For Round t +1:

1.Update the reward estimation:

ˆ

R

t

ji

(k) :

ˆ

R

t+1

ji

(k) =

ˆ

R

t

ji

(k) +1l

{b

t

ji

=k}

α

t

ji

(R

t

ji

−

ˆ

R

t

ji

(k))

2.Update the mixed strategy: X

t+1

ji

(k) = X

t

ji

(k)(1 + λ

t

ji

)

ˆ

R

t

ji

(k)

3.Normalize the mixed strategy.

Iterate until convergence.

The next result provides a convergence of the al-

gorithm to pure equilibria.

Proposition 7. If the algorithm starts from interior

point, it converges to an ending point in a stable

steady state of the replicator equation. This counts

for an arbitrary number of participants. Therefore it

is a Nash equilibrium. In the asymmetric case, the

mixed equilibrium is unstable and the algorithm con-

verges to one of pure Nash equilibria.

We give a simple example to show that the mixed

equilibrium is unstable, and the algorithm converges

to one of pure Nash equilibria. We analyze the situa-

tion where n = 2, v = 4, c = 1. In this specific parame-

ter setting, the ordinary differential equations (ODEs)

𝑋

1𝑖

(1)

𝑋

2𝑖

(1)

Figure 1: The vector field of ODEs where n = 2, v = 4,

c = 1.

are given by

˙

X

1i

(1) = X

1i

(1)(1 − X

1i

(1))(2 − 3X

2i

(1))

˙

X

2i

(1) = X

2i

(1)(1 − X

2i

(1))(2 − 3X

1i

(1))

Figure 1 shows the vector field of the ODEs. By an-

alyzing the vector field, we can observe that the algo-

rithm always converges to one of pure Nash equilibria

except the symetric situation; however, the probabil-

ity of symmetric situation is zero.

Proposition 8. In the symmetric case, the mixed equi-

librium is stable and the dynamical system converges

to it. However, the probability of obtaining equal

numbers by stochastic processes is nearly zero.

4 EXPERIMENT

In this part, we do experiments to show the effective-

ness of the imitative learning algorithm. First, we

present a numerical investigation focusing on learn-

ing symmetric equilibria for two bidders setting; then,

we extend to the asymmetric situation. Table 3 shows

the experiment setting. We compare and contrast the

results with the theory value presented in proposition

4.

Table 3: Summary of two bidders setting.

Symbol Setting

n 2

I 1

c 1

b

min

1

Initial of

ˆ

R

0

ji

[1 1 1]

Budget Static budget constraint

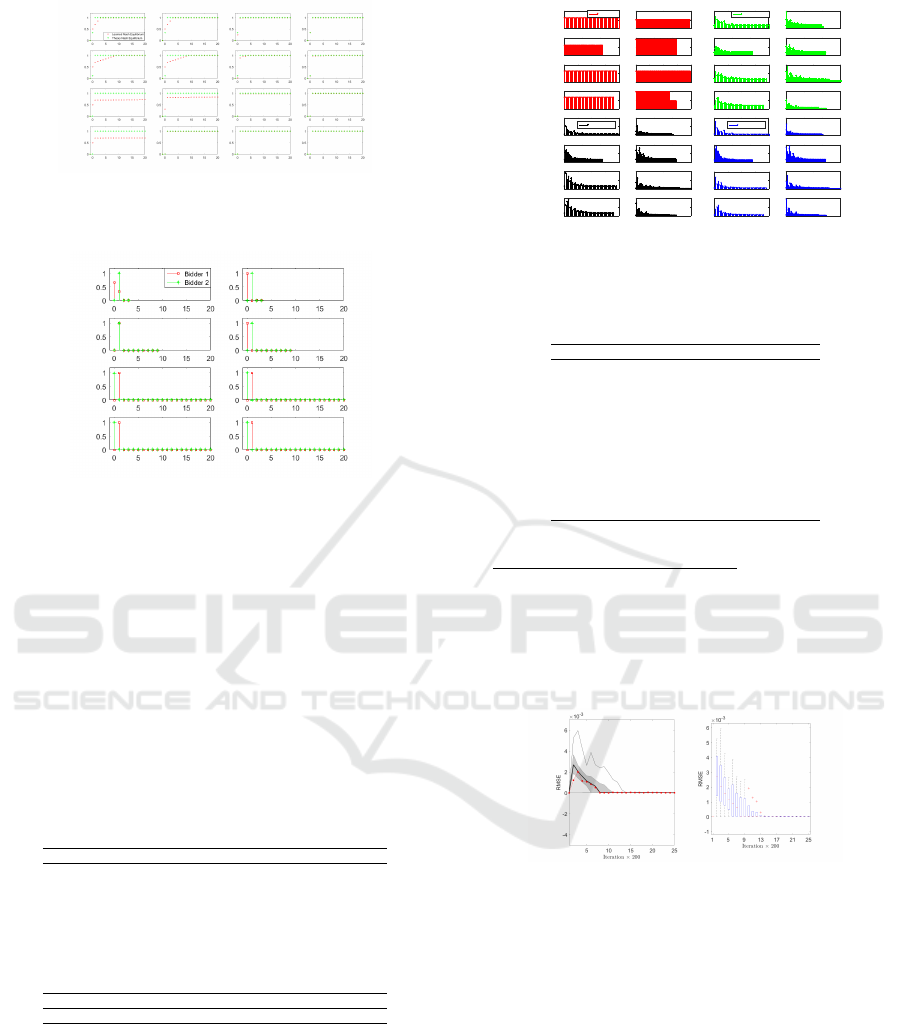

As shown in Figure 2, the proposed algorithm can

effectively learn the Nash equilibrium at a fast conver-

gence rate. More specifically, for big v, the learning

algorithm converges in a few steps. For the asymmet-

ric situation, the experiments in Figure 3 show that

the learning process can also converge to one of pure

equilibria in a few steps.

Lowest Unique Bid Auctions with Resubmission Opportunities

333

Bid

Cumulative distribution function

𝑣 = 4

𝑣 = 10

𝑣 = 200

𝑣 = 1000

1𝑠𝑡 𝐼𝑡𝑒𝑟𝑎𝑡𝑖𝑜𝑛 1000𝑡ℎ 𝐼𝑡𝑒𝑟𝑎𝑡𝑖𝑜𝑛

10𝑡ℎ 𝐼𝑡𝑒𝑟𝑎𝑡𝑖𝑜𝑛

8000𝑡ℎ 𝐼𝑡𝑒𝑟𝑎𝑡𝑖𝑜𝑛

(𝑛 = 2)

Figure 2: Nash equilibrium. The red squares present the

strategy learned by the proposed algorithm and the green

stars represent the theoretical equilibrium.

10𝑡ℎ 𝐼𝑡𝑒𝑟𝑎𝑡𝑖𝑜𝑛

80𝑡ℎ 𝐼𝑡𝑒𝑟𝑎𝑡𝑖𝑜𝑛

Probability mass function

𝑣 = 4

𝑣 = 10

𝑣 = 200

𝑣 = 1000

Bid

𝑛 = 2

Figure 3: Learned strategies. The red squares present bidder

1’s learned strategy under the proposed algorithm and the

green stars represent bidder 2’s learned strategy.

For multi-item under budget constrains, we also

do a simulation experiment to show the performance

of the proposed learning algorithm. The experiment

settings are shown in Table 4. We utilize a dynamic

setting with changing budget in this experiment by

setting different v

ji

and different initial budget. Con-

sidering the resources of item is limited, we also as-

sign resources of each item. Figure 4 shows the re-

sults.

Table 4: Summary of Multi-Items Experiment Setting.

Symbol Setting

N 4

I 2

c 1

b

min

1

Resource for item 1 and 2 [2000 1500]

Initial of Budget [100 120 80 90]

Initial of

ˆ

R

0

ji

0.0001

v for j ∈ {1, 2, 3, 4} [40,102],[42,109],[38,100],[36,110]

¯

b

ji

min(v

ji

, budget

ji

)

Assumption Description

Budget Budget evolves with the iteration.

4.1 Statistic Properties

In order to show the robustness of the proposed algo-

rithm, we do an experiment analysis under the static

budget constraint and analyze its statistic properties.

Table 5 presents the experiment setting.

We evaluate the convergence rate by introduc-

ing the root-mean-square error (RMSE). The prob-

ability distributions of sequential round strategies

0

10 20

30

40

0

0.1

0.2

Iteration 1800

0

50

100 150

0

0.05

0.1

0

20

40

60

0

0.05

0.1

0

50

100 150

0

0.02

0.04

0

10 20

30

40

0

0.05

0.1

0

50

100

0

0.05

0.1

0

10 20

30

40

0

0.05

0.1

0

50

100 150

0

0.05

0.1

0

10 20

30

40

0

0.1

0.2

Iteration 2000

0

50

100 150

0

0.05

0.1

0

20

40

60

0

0.05

0.1

0

50

100 150

0

0.02

0.04

0

10 20

30

40

0

0.1

0.2

0

50

100

0

0.05

0.1

0

10 20

30

40

0

0.1

0.2

0

50

100 150

0

0.05

0.1

Item1

Item2

Item1 Item2

0

10 20

30

40

0

0.02

0.04

Iteration 1

0

50

100

0

0.01

0.02

0

20

40

60

0

0.02

0.04

0

50

100 150

0

0.005

0.01

0

10 20

30

40

0

0.02

0.04

0

20

40

60 80

0

0.01

0.02

0

10 20

30

40

0

0.02

0.04

0

50

100 150

0

0.005

0.01

0

10 20

30

40

0

0.05

0.1

Iteration 1500

0

50

100 150

0

0.02

0.04

0

20

40

60

0

0.05

0.1

0

50

100 150

0

0.02

0.04

0

10 20

30

40

0

0.05

0.1

0

50

100

0

0.05

0

10 20

30

40

0

0.05

0.1

0

50

100 150

0

0.05

0.1

Bidder1

Bidder2

Bidder2

Bidder3

Bidder1

Bidder4

Bidder3

Bidder4

Probability mass function

Bid

Figure 4: Probability mass function of four players and two

items in the auction system with budget update.

Table 5: Summary of Experiment Setting.

Symbol Setting

N 4

I 1

α 0.1

λ 0.1

c 1

b

min

1

Initial of X

0

ji

Uniform distribution

Initial of

ˆ

R

0

ji

Unidrnd(20,1,Budget)

v

ji

for j ∈ {1, 2, 3, 4} [147,165,170,177]

¯

b

j

i for j ∈ {1, 2, 3, 4} [100,100,100,100]

Budget Static Budget Constraint

are utilized to calculate the RMSE. RMSE

t,t−1

=

q

∑

N

j=1

∑

¯

b

j

(t)

k=1

(X

t

ji

(k) − X

t−1

ji

(k))

2

. In order to analyze

the statistic property of the experiment results, we re-

conduct the experiment 200 times using the experi-

ment setting in the Table 5. The analysis of the statis-

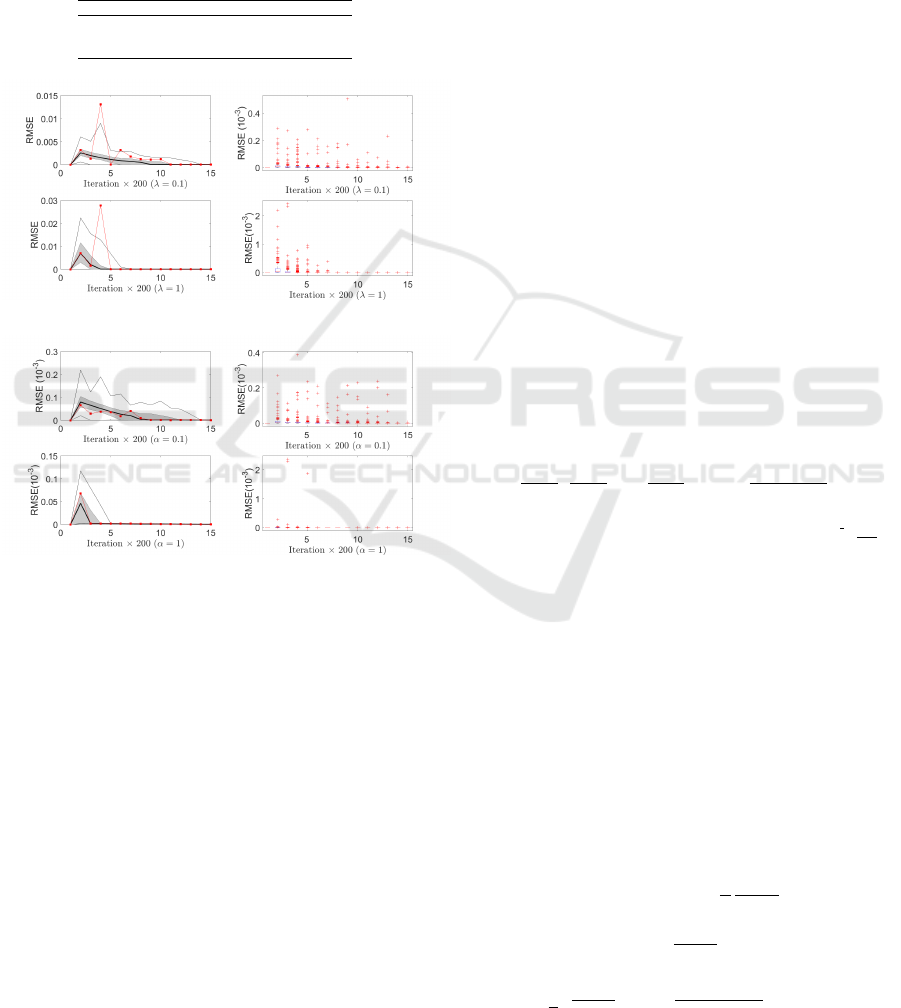

tic properties are shown in Figure 5.

Figure 5: Statistic information on the RSME of the strate-

gies.

Figure 5 presents the distribution of RMSE (per-

centiles P5 P25 P50 P75 P90) obtained from the pro-

posed learning algorithm. The results in this figure

show all the repeat experiment converge to zero and a

narrow distribution of RMSE over the whole period.

4.2 Impact of Parameters

We investigated the impact of the parameters in the

proposed learning algorithm described in Sect.3.2.

Table 6 shows experiment setting details. Figure 6

and 7 present the statistic properties of RMSE evo-

lution obtained by the proposed learning algorithm.

Compared to α = 0.1 and λ = 0.1, the results show

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

334

a fast convergence rate. The Boxplot shows that the

large parameter setting results less outliers in the ex-

periment results. According to the results in Figure

6 and 7, the parameter α and λ influence the conver-

gence of the proposed algorithm equally and a large α

can reduce disturbance and outliers more effectively.

Table 6: Summary of Experiment Setting in Parameters Im-

pact Investigation.

Symbol Original Setting Compared Setting

α 0.1 1

λ 0.1 1

Others Same as Table 5

Figure 6: Statistic information on RSME on strategies.

Figure 7: Statistic information on RSME.

5 LUBA WITH RESUBMISSION

In this section, we assume that each bidder can resub-

mit bids a certain number of times subject to her avail-

able budget, each resubmission for item i will cost c

i

.

If bidder j has (re)submitted n

ji

times on item i, his

or her total submission cost would be n

ji

c

i

in addition

to the registration fee. Denote by the set that con-

tains all the bids of bidder j on item i by B

ji

. Thus,

n

ji

= |B

ji

| is the cardinality of the strictly positive bids

by j on item i. The set of bidders who are submitting

b on item i is denoted by N

i,b

= { j ∈ N | b ∈ B

ji

}. In

order to get the set of all unique bids, we introduce

the following: The set of all positive natural num-

bers that were chosen by only one bidder on item i

is B

∗

i

= {b > 0 | |N

i,b

| = 1}. If B

∗

i

=

/

0 then there is

no winner on item i at that round (after all the resub-

mission possibilities). If B

∗

i

6=

/

0 then there is a winner

on item i and the winning bid is inf B

∗

i

and winner is

j

∗

∈ N

i,infB

∗

i

. The payoff of bidder j on item i at that

round would be r

ji

= v

ji

−|B

ji

|c

i

−inf B

∗

i

, if j is a win-

ner on item i, and r

ji

= −|B

ji

|c

i

, if j is not a winner

on item i. A pure strategy of a bidder is a choice of a

subset of natural numbers. That set is finite because

of budget limitation. Thus, given its own valuation

vector (v

ji

)

i

bidder j will choose an action (B

ji

)

i

that

respect the budget constraints

∀ j, c

r

+

m

∑

i=1

[infB

∗

i

]1l

B

ji

∩[infB

∗

i

]

+

m

∑

i=1

|B

ji

|c

i

≤

¯

b

j

.

A bid is hence less than min(

¯

b

j

, v

ji

− c). The instant

payoff of the auctionner of item i is

r

a,i

=

∑

j

c

r

1l

{B

ji

6=

/

0}

+ infB

∗

i

+

∑

j=1

|B

ji

|c

i

!

− v

a,i

.

The instant payoff of the auctionner of a set of item I

is r

a,I

=

∑

i∈I

r

a,i

. The following result provides exis-

tence of equilibria in behavioral mixed strategies.

Proposition 9. The multi-item LUBA game with re-

submission has at least one equilibrium in behavioral

mixed strategies.

Proposition 10. Let n = 2 and each bidder can re-

submit a certain number of bids, each resubmission

will cost c < v − 1. The game has a partially mixed

equilibrium which is explicitly given by

y

∗

= (

c

v − 1

,

c

v − 2

, . . . ,

c

v − k

, 1 −

k−1

∑

l=0

c

v − (l + 1)

, 0, . . . , 0)

where k is the maximum number such that

∑

min(

¯

b,

v

c

)

l=0

˜c

v−l

<

1.

We now investigate how much money the on-

line platform can make by running multi-item LUBA.

Since the platform will be running for a certain time

before the auction ends, each bidder is facing a a

random number of other bidders, who may bid in

a stochastic strategic way. Their valuation is not

known. We need to estimate the set of bids B

i

and

the bid values on item i. We denote by n

ib

the random

number of bidders who bid on b. If n

i,b

follows a Pois-

son distribution with parameter λ

i,b

, and that all vari-

ables n

i,b

are independent. The value λ

i,b

is assumed

to be non-decreasing with b. The expected payoff of

the seller on item i is

∑

j

c

r

+

∑

b

En

i,b

c

i

+E inf B

∗

i

−v

i

.

Proposition 11. Let λ

i,b

=

v

i

c

i

1

(1+b)

z

, with z > 0.

The expected revenue of the seller on item i is

∑

j

c

r

+ E inf B

∗

i

+ v

i

[

∑

b

1

(1+b)

z

], exceeds the value

v

i

of the item i for small value of z whenever

∑

b≤min(

¯

b,

v

i

c

i

)

1

(1+b)

z

> 1 −

∑

j

c

r

+E infB

∗

i

v

i

Lowest Unique Bid Auctions with Resubmission Opportunities

335

6 CONCLUSION

We propose and analyze a multi-item LUBA game

with budget constraint, registration fee and resubmis-

sion cost. We show that the analysis can be reduced

into a finite game (with incomplete information) by

eliminating the bids that are higher than the value of

the item or by the bid that are higher the total available

budget. Using classical fixed-point theorem, there is

at least one Bayes-Nash equilibrium in mixed strate-

gies. Next, we address the question of computation

and stability of such an equilibrium. We provide ex-

plicitly the equilibrium structure in simple cases. In

the general setting, we provide a learning algorithm

that is able to locate equilibria. We propose an im-

itative combined fully distributed payoff and strat-

egy learning (imitative CODI- PAS learning) that is

adapted to LUBA. We examine how the bidders of the

game are able to learn about the online system output

using their own-independent learning strategies and

own-independent valuation. The revenue of the auc-

tionner is explicitly derived in a situation where a ran-

dom number of bids are placed.

REFERENCES

Vickrey, W.: Counterspeculation, auctions, and competitive

sealed tenders. J. Finance 16, 837.1961.

Maskin E. S., Riley J. G. Asymmetric auctions. Rev.

Econom. Stud. 67, 413-438, 2000.

Lebrun B: First-price auctions in the asymmetric n bid-

der case. International Economic Review 40:125-142,

(1999)

Lebrun B.: Uniqueness of the equilibrium in first-price

auctions. Games and Economic Behavior 55:131-151,

2006.

Myerson R., Optimal Auction Design, Mathematics of Op-

erations Research, 6 (1981),pp. 58-73.

Bang-Qing Li, Jian-Chao Zeng, Meng Wang and Gui-Mei

Xia, A negotiation model through multi-item auction

in multi-agent system, Machine Learning and Cyber-

netics, 2003 International Conference on, 2003, pp.

1866-1870 Vol.3.

C. Yi and J. Cai, Multi-Item Spectrum Auction for Recall-

Based Cognitive Radio Networks With Multiple Het-

erogeneous Secondary Users, in IEEE Transactions

on Vehicular Technology, vol. 64, no. 2, pp. 781-792,

Feb. 2015.

N. Wang and D. Wang, Model and algorithm of winner

determination problem in multi-item E-procurement

with variable quantities,” The 26th Chinese Control

and Decision Conference (2014 CCDC), Changsha,

2014, pp. 5364-5367.

Rituraj and A. K. Jagannatham, Optimal cluster head se-

lection schemes for hierarchical OFDMA based video

sensor networks,” Wireless and Mobile Networking

Conference (WMNC), 2013 6th Joint IFIP, Dubai,

2013, pp. 1-6.

J. Zhao, X. Chu, H. Liu, Y. W. Leung and Z. Li, Online

procurement auctions for resource pooling in client-

assisted cloud storage systems, IEEE Conference on

Computer Communications (INFOCOM), 2015, pp.

576-584.

R. Zhou, Z. Li and C. Wu, An online procurement auc-

tion for power demand response in storage-assisted

smart grids, IEEE Conference on Computer Commu-

nications, INFOCOM, 2015, pp. 2641-2649.

H. Houba, D. Laan, D. Veldhuizen, Endogenous entry in

lowest-unique sealed-bid auctions,Theory and Deci-

sion, 71, 2, 2011, pp. 269-295

Stefan De Wachter and T. Norman, The predictive power

of Nash equilibrium in difficult games: an empirical

analysis of minbid games, Department of Economics

at the University of Bergen, 2006

Rapoport, Amnon and Otsubo, Hironori and Kim, Bora

and Stein, William E.: Unique bid auctions: Equi-

librium solutions and experimental evidence, MPRA

Paper 4185, University Library of Munich, Germany,

Jul 2007.

J.Eichberger and D. Vinogradov, Least Unmatched Price

Auctions : A First Approach, Discussion Paper Series

471, 2008

J. Eichberger, Dmitri Vinogradov: Lowest-Unmatched

Price Auctions, International Journal of Industrial Or-

ganization, 2015, Vol. 43, pp. 1-17

J. Eichberger, Dmitri Vinogradov: Efficiency of Lowest-

Unmatched Price Auctions, Economics Letters, 2016,

Vol. 141, pp. 98?102

Erik Mohlin, Robert Ostling, Joseph Tao-yi Wang, Lowest

unique bid auctions with population uncertainty, Eco-

nomics Letters, Vol. 134, Sept. 2015, Pages 53-57.

Huang, G.Q., Xu, S.X., 2013. Truthful multi-unit

transportation procurement auctions for logistics e-

marketplaces. Transport. Res. Part B: Methodol. 47,

127-148.

Dong-Her Shih, David C. Yen, Chih-Hung Cheng, Ming-

Hung Shih, A secure multi-item e-auction mechanism

with bid privacy, Computers and Security 30 (2011)

273-287

Tembine, H., Distributed strategic learning for wireless en-

gineers, Master Course, CRC Press, Taylor & Francis,

2012.

Harsanyi, J. 1973. Games with randomly disturbed payoffs:

A new rationale for mixed strategy equilibrium points.

Internat. J. Game Theory 2, 1-23.

Weibull, J., Evolutionary game theory, MIT Press, 1995.

PROOFS

Proof of Proposition 2. By budget constraint, j

0

s

bids must fulfill

∑

i

b

ji

≤

¯

b

j

. If b

i j

> v

ji

− ˜c, j gets

v

ji

− ˜c−b

ji

which is negative (loss), and j could guar-

antee zero by not participating. Therefore the strategy

0 dominates any b

ji

higher than v

ji

− ˜c.

ICAART 2018 - 10th International Conference on Agents and Artificial Intelligence

336

Proof of Proposition 1. By Proposition 2 the con-

strained game has a finite number of actions. By stan-

dard fixed-point theorem, the multi-item Bayesian

LUBA game has at least one Bayes-Nash equilibrium

in mixed strategies.

Proof of Proposition 3. Suppose v > ˜c + 1. Then

the payoff when only one agent places a bid of 1 on

item i is v − ˜c − 1 > 0 for that agent, and others get

0. When a single devient change any other bidders’

decision to bid 1 instead of non-participation, there

is a collision and the bid 1 is not unique anymore.

Both agents gets − ˜c < 0 and the rest of the agents

gets nothing.

Proof of Proposition 4. In order to find a strictly

mixed equilibrium for each bidder, we can introduce

the indifference condition. Now we can easily cal-

culate X

m

by its general form and the initial condi-

tion. X

m

= max(0, y

m−1

− y

m−2

) = max(0,

˜c

v−(m−1)

−

˜c

v−m

) = 0, and X

1

= 1 −

˜c

v−1

, where

˜c

v−1

< 1. There-

fore X

∗

= (

˜c

v−1

, 1 −

˜c

v−1

, 0, . . . , 0) is a partially mixed

equilibrium, and the expected equilibrium payoff at

(X

∗

, X

∗

) is zero.

Proof of Proposition 5. As the payoff for bidder

i = 1 is equal to 0 when he or she bids 0, we can de-

duce that the first equation in the indifference condi-

tion is equal to 0. When bidder i = 1 bids 1, his or her

payoff can be presented by (v − ˜c − 1) ∗ P

11

(x) − ˜c ∗

(1 − P

11

(x)), where P

11

(x) = X

0

n−1

is the probability

that bidder 1 wins under bid 1.

Proof of Proposition 7. In the proposed algo-

rithm, we update the strategy according to X

t+1

ji

(k) =

X

t

ji

(k)(1+λ

t

ji

)

ˆ

R

t

ji

(k)

∑

k

X

t

ji

(k)(1+λ

t

ji

)

ˆ

R

t

ji

(k)

. Rewriting it by subtracting X

t

ji

(k),

then dividing the result by λ

t

ji

, we can conclude

X

t+1

ji

(k)−X

t

ji

(k)

λ

t

ji

= X

t

ji

(k)[

(1+λ

t

ji

)

ˆ

R

t

ji

(k)

λ

t

ji

∑

k

−

∑

k

λ

t

ji

∑

k

], where

∑

k

denotes

∑

k

X

t

ji

(k)(1+λ

t

ji

)

ˆ

R

t

ji

(k)

. As lim

λ→0

(1+λ)

n

−1

λ

=

1+

(

n

1

)

λ+

(

n

2

)

λ

2

+···

(

n

n

)

λ

n

−1

λ

= n, and lim

λ→0

(1 + λ)

n

= 1

we can get the

˙

X

ji

= X

ji

(

ˆ

R

t

ji

(k) −

∑

k

X

ji

ˆ

R

t

ji

(k)). Ac-

cording to Proposition 5, we only consider k = 0

and k = 1 and derive that

˙

X

ji

= X

ji

(1 − X

ji

)[(v −

1)

∏

p6= j

(1 − X

pi

) − c]. Obviously, an point X

ji

= 1 −

n−1

q

c

v−1

for j ∈ [1, . . . , n] is a steady point of ordinary

differential equations (ODEs), and its corresponding

matrix is A. Assuming det(A − λI) = (−1)

n

(λ −

a)

n−1

(λ + a(n − 1)) = 0, where a = c(1 −

n−1

q

c

v−1

),

we can deduce the eigenvalues vector of A is [-(n-1)a,

a ,a,. . . ,a]. There is at least one positive eigenvalue,

which means the steady point is not stable. So, the

mixed Nash equilibria is not stable.

Proof of Proposition 8. In the symmetric situation,

using the methodology used in the proof of Proposi-

tion 7, we can derive that the eigenvalues of the matrix

corresponding steady point have negative real parts.

Thus, the steady point is stable.

Proof of Proposition 9. A proof can be obtained

following similar lines as in Proposition 1 with a no-

table difference that here the action is a choice of sub-

set of the budget-constrained bid space.

Proof of Proposition 10. Let k be the largest in-

teger such that y

k

= P({0, 1, ..., k}) > 0, k ≤

¯

b. The

expected payoff of bidder 1 when playing {0, ..., l} is

therefore given by

Action{0} : r

1i

({0}, y) = 0.Action{01} :

r

1i

({01}, y) = (v − c − 1)y

0

− cy

1

− c(y

2

+ . . . + y

k

), . . .

Action{012. . . l} :

r

1i

({012. . . l}, y) = (v − lc − 1)y

0

+ (v − lc − 2)y

1

+. . . + (v − lc − l)y

l−1

− lcy

l

− lc(y

l+1

+ . . . + y

k

)

. . .

It turns out that

(v − 1)y

0

= c. (v − 1)y

0

+ (v − 2)y

1

= 2c

. . .

(v − 1)y

0

+ (v − 2)y

1

+ . . . + (v − l)y

l−1

= lc

. . .

(v − kc − 1)y

0

+ (v − kc − 2)y

1

+ . . . + (v − kc − k)y

k−1

= kc.

For l between 1 and k − 1 we make the difference

between line l + 1 and line l to get:

y

0

=

c

v−1

y

1

=

c

v−2

. . . y

l

=

c

v−(l+1)

. . . y

k−1

=

c

v−k

y

k

= 1 − (y

0

+ y

1

+ . . . + y

k−1

) > 0 y

k+1+s

= 0.

Thus, the partially mixed strategy

y

∗

= (

c

v − 1

,

c

v − 2

, . . . ,

c

v − k

, 1−

k−1

∑

l=0

c

v − (l + 1)

, 0, . . . , 0)

is an equilibrium strategy. The equilibrium payoff is

zero.

Proof of Proposition 11.

The expected payoff of the seller on item i is

equal to

∑

j

c

r

+

∑

b

En

i,b

c

i

+E inf B

∗

i

−v

i

. We can cal-

culate that En

i,b

= λ

i,b

=

v

i

c

i

1

(1+b)

z

. Rewrite the ex-

pected payoff of the seller, we can get it is equal to

∑

j

c

r

+

∑

b

En

i,b

c

i

+ E inf B

∗

i

− v

i

. Then we can easily

induce the condition for the expected revenue of the

seller exceeds the value of v

i

is

∑

b≤min(

¯

b,

v

i

c

i

)

1

(1 + b)

z

> 1 −

∑

j

c

r

+ E infB

∗

i

v

i

.

Lowest Unique Bid Auctions with Resubmission Opportunities

337