Stealth Address and Key Management Techniques in Blockchain Systems

Nicolas T. Courtois

1

and Rebekah Mercer

1,2

1

Computer Science Department, University College London, London, U.K.

2

R&D division, Clearmatics Technologies Ltd, London, U.K.

{n.courtois, rebekah.mercer.15}@ucl.ac.uk

Keywords:

Applied Cryptography, Bitcoin, DarkWallet, CryptoNote, ShadowCash, Key Management, Privacy, Anony-

mous Payment, Stealth Address Technique, Audit Capability, ECDSA, HD Wallets, BIP032, Leakage-resistant

Cryptography.

Abstract:

Bitcoin is an open source payment system with a market capitalization of about 15 G$. During the years

several key management solutions have been proposed to enhance bitcoin. The common characteristic of

these techniques is that they allow to derive public keys independently of the private keys, and that these keys

match. In this paper we overview the historical development of such techniques, specify and compare all

major variants proposed or used in practical systems. We show that such techniques can be designed based on

2 distinct ECC arithmetic properties and how to combine both. A major trend in blockchain systems is to use

by Stealth Address (SA) techniques to make different payments made to the same payee unlikable. We review

all known SA techniques and show that early variants are less secure. Finally we propose a new SA method

which is more robust against leakage and against various attacks.

1 INTRODUCTION

Bitcoin has been in existence for nearly 8 years.

It is a digital currency, payment and final clear-

ing/settlement system and technology, a distributed

property register and digital notary service, all in one.

Bitcoin allows owners to authorize the transfer of

their coins using digital signatures. Currently, bit-

coin uses ECDSA cryptography with SHA256 and

the secp256k1 curve. Cryptographic literature does

not provide an answer to whether or not ECDSA is

provably secure, and whether there is an attack on

ECDSA other than computing discrete logs. However

it is widely believed that ECDSA is secure modulo

some usage precautions.

Cryptographic literature shows that both RSA and

ECDSA-based public key cryptography can fail if de-

ployed at a large scale if keys and random nonces

are generated with insufficient entropy. More pre-

cisely there are three major ways in which ECDSA

can fail in practice, in systems such as bitcoin:

due to bad or repeated randoms (Courtois3d, 2015;

N.T. Courtois, 2014), due to weak or user-chosen

passwords (N.T. Courtois, 2016) and due to poor key

management (Courtois3b, 2015; S. Eskandari, 2015;

G. Gutoski, 2015). There are also combination at-

tacks which exploit several of the above properties

(N.T. Courtois, 2014; Courtois3d, 2015). In this pa-

per we concentrate on the questions of private/public

key management. The usage of such techniques have

greatly increased in crypto currency systems in the re-

cent years.

1.1 Why Key Management?

We refer to (N.T. Courtois, 2014; Courtois3b, 2015;

S. Eskandari, 2015; G. Gutoski, 2015) for a de-

tailed discussion on how the need for key manage-

ment emerges in bitcoin and in the industry at large.

Main reasons are the necessity to use several keys due

to poor anonymity of existing blockchain systems,

possibility to hide the public key and to use each key

only once for security reasons, questions of reliable

backup of bitcoin wallets and cold storage, etc. In

recent works on this topic cf. (N.T. Courtois, 2014)

the primary reasons to use advanced key management

techniques in bitcoin were first just to diversify keys

to be used in different transactions, then to develop

so called “Type 2 techniques” cf. (N.T. Courtois,

2014; Courtois3b, 2015). Here the important prop-

erty , which we will also need in this paper, is to have

“Audit Capabilities” which allow third parties to de-

rive public keys from certain “master public keys” and

without knowledge of private keys.

More recently the Stealth Address techniques

have become popular. These techniques have an ad-

Courtois, N. and Mercer, R.

Stealth Address and Key Management Techniques in Blockchain Systems.

DOI: 10.5220/0006270005590566

In Proceedings of the 3rd International Conference on Information Systems Security and Privacy (ICISSP 2017), pages 559-566

ISBN: 978-989-758-209-7

Copyright

c

2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

559

ditional major objective: privacy for the receivers

of moneys. These methods allow public keys which

appear in the blockchain to be totally disconnected

from “stealth” public keys which are advertised by

merchants. In the same way as in HD Wallet solu-

tions (N.T. Courtois, 2014; Courtois3b, 2015) here

again, the public keys advertised serve as “master

public keys” from which ephemeral public keys are

derived. In this paper we study all major variants of

such techniques, their security, we propose more gen-

eral methods, and show how can they be made even

more robust against certain attacks.

1.2 Key Management with Audit - Main

Principle

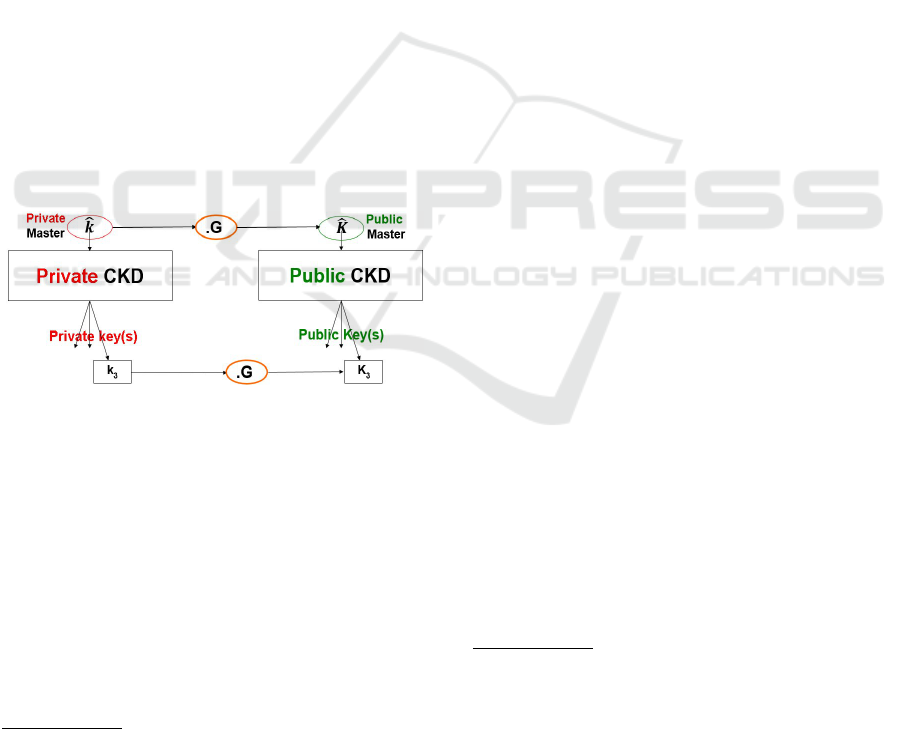

We outline the primary methods used in creating “Au-

ditable” key management sometimes called “Type 2

techniques” cf. (N.T. Courtois, 2014; Courtois3b,

2015). The crucial property we need is to be able

to derive public keys independently from the private

keys, or rather do both in bulk from some sort of

“Master” public key

1

and a “Master” private key, cf.

Fig. 1 below. We need two key Child Key Deriva-

tion (CKD) functions, a “Private CKD” function and

a “Public CKD” function as shown on Fig. 1.

Figure 1: General key derivation principle from (N.T. Cour-

tois, 2014) with modified notations. It must be such that the

diagram commutes and public keys K

i

obtained either way

are identical.

The crucial property is then that the correspond-

ing lower level keys match. This property means that

our diagram in Fig. 1 should commute.

One-wayness. In (N.T. Courtois, 2014) it is also re-

quired that all the 4 arrows (derivations) are one-way

functions and that the public master key/seed should

NOT reveal the private master key/seed or any of the

private keys.

1

Sometimes a word “SEED” is used instead of the word

“key”, and sometimes other terms such as “Extended” Pub-

lic/Private Key are used (N.T. Courtois, 2014; Courtois3b,

2015). In this paper we prefer to use the term of “Master”

keys.

Extensions. It possible to see that such solutions

can be deployed at several levels and lead to Hi-

erarchical Deterministic (HD) solutions where more

complex multi-level diagrams will also commute,

cf. (N.T. Courtois, 2014; Courtois3b, 2015; Wuille,

2014). Such systems can be studied in terms of “se-

curity domains” or partially ordered sets which al-

lows for information flow analysis cf. (N.T. Courtois,

2014).

2 KEY MANAGEMENT WITH

AUDIT SOLUTIONS

The main idea in constructing such schemes [at-

tributed to Greg Maxwell and improved/developed

by Peter Wuille] is as follows, cf. (Wuille, 2014).

Both derivation functions are essentially the same

and have the same inputs or other “higher sensitive”

inputs which allow to derive them. Then in the

“Private Type 2 Derivation” function the private

key is simply used to compute the corresponding

public key and algebraic properties of ECC crypto

are used. Following (N.T. Courtois, 2014) there are

two distinct major ways to achieve this objective, a

multiplicative one and an additive one.

Notation. In what follows we will assume that we

work with an elliptic curve group generator G of

E(IF

P

) with Q elements, where P,Q are two large

primes. We will use small letters for private keys

(integers mod Q) and capital letters for public keys

∈ E(IF

P

). We will write

ˆ

k and

ˆ

K for master pri-

vate/public keys. We will then write the application

of “Private CKD” function k(x) instead of SK

x

in

(N.T. Courtois, 2014) and Fig. 1. Then let K(x) be the

corresponding “Public CKD” function which would

be denoted by PK

x

in (N.T. Courtois, 2014). Our new

notations emphasize the fact that x will no longer be a

low-entropy index i but can be a quantity with a larger

entropy.

Now we can propose the two basic methods and

prove their correctness.

Theorem 2.0.1 (Two Basic Methods). The mul-

tiplicative method based on (older

2

) Solution 1 of

2

Both solutions have been implemented and widely

used in bitcoin community. Their history goes back

to June 2011, a date when the forum thread “De-

terministic Wallets” was started by Greg Maxwell at

https://bitcointalk.org/index.php?topic=19137.0. The mul-

tiplicative solution was proposed earlier and was used in

various systems such as Electrum. Since April 2013 there

was a shift towards the additive method, claimed to be faster

and easier to implement (Wuille, 2014) which became stan-

ICISSP 2017 - 3rd International Conference on Information Systems Security and Privacy

560

(N.T. Courtois, 2014) has Private CKD function:

k(x) =

ˆ

k · H(

ˆ

k.G, x) mod Q

The additive method based on (more recent

2

) So-

lution 2 of (N.T. Courtois, 2014) is:

k(x) =

ˆ

k + H(

ˆ

k.G, x) mod Q

where H is some hash function with output re-

duced mod Q. Now in the multiplicative method

we use the Public CKD:

K(x) = H(

ˆ

K,x).

ˆ

K in E(IF

P

)

where

ˆ

K =

ˆ

k.G and for the additive method we use:

K(x) =

ˆ

K + H(

ˆ

K,x).G in E(IF

P

)

Then for each method both CKD functions match, i.e.

K(x) = k(x).G.

Proof: We write the proof to see what is that makes

the result true. In the multiplicative solution we have

k(x).G = (

ˆ

k · H(

ˆ

k.G, x)).G =

(H(

ˆ

k.G, x)).(

ˆ

k.G) = (H(

ˆ

K,x)).

ˆ

K = K(x).

the property we needed is that a.(b.P) = b.(a.P)

which we could call the scalar property or DH prop-

erty. For the additive solution we have

k(x).G = (

ˆ

k + H(

ˆ

k.G, x)).G =

ˆ

k.G + H(

ˆ

k.G, x).G =

ˆ

K + H(

ˆ

K,x).G = K(x).

the property we needed was that (a+b).P = a.P+

b.P a.k.a. distributive (or homomorphic) property. We

see that both methods work and use two distinct alge-

braic properties of elliptic curve cryptography in or-

der to obtain the same sort of result.

2.0.1 New Combined Method

It appears that nobody have yet noticed that both

methods can be combined and that we can have a

combined key derivation technique with a combined

correctness result as follows:

Theorem 2.0.2 (Combined Method) . We assume

that

ˆ

K =

ˆ

k.G for the master secrets. We define a de-

rived private key by:

k(x) =

ˆ

k · H(

ˆ

k.G, x) +H

0

(

ˆ

k.G, x) mod Q

where H, H

0

are two different hash functions with

output reduced mod Q. The corresponding public

key will be then:

K(x) = H(

ˆ

K,x).

ˆ

K + H

0

(

ˆ

K,x).G in E(IF

P

)

For this new combined method we also have K(x) =

k(x).G.

Proof: Proof needs simply to combine the two proofs

above, one with H and other with H

0

to prove the

equality of both parts independently.

dardized inside BIP032 specification. Later in 2014-15 a

multi-key multiplicative method is shown to bring extra ro-

bustness (G. Gutoski, 2015).

2.1 Simple Exploit and More Robust

Methods

In all these schemes we have the following

well known [folklore] privilege escalation attack

(N.T. Courtois, 2014; Courtois3b, 2015; G. Gutoski,

2015) in which one single derived key k(x) and the

higher level public key

ˆ

K allows to recompute the

master private key

ˆ

k. If we show it for our new com-

bined scheme it will work also for earlier schemes

which can be seen as special cases. Here is the for-

mula which allows the attacker to recover the mas-

ter private key:

ˆ

k =

H

0

(

ˆ

k.G,x)−k(x)

H(

ˆ

k.G,x)

mod Q. In 2014-

15 Gutoski and Stebila proposed a multi-key multi-

plicative key management technique which allows to

avoid this attack (G. Gutoski, 2015). A similar tech-

nique designed for our (different) purpose and against

a wider range of attacks will be proposed in Section 6

below.

3 STEALTH ADDRESS KEY

MANAGEMENT METHODS

The most basic Stealth Address (SA) technique was

invented by user ‘bytecoin’ in bitcoin forum on 17

April 2011 (user ‘bytecoin’, 2011). Improved vari-

ants were proposed later in 2013-14 (van Saberhagen,

2013; Todd, 2014) which we study below in Section

3.1.

The goal of all Stealth Address (SA) methods is

to send money to a certain “publicly visible” master

key in such a way that this key does not appear in the

blockchain. For this purpose, other seemingly totally

unrelated keys are used, and in their essence all these

methods are key management techniques with addi-

tional secrets or/and randomness very similar to those

we have studied so far. We first summarize and ex-

amine the exact original method of (user ‘bytecoin’,

2011) using the notations of slide 21 in (Courtois6,

2016).

1. The recipient has a public key B = b.G

2. The sender uses public key A = a.G

3. Now Diffie-Hellman allows both the sender and

the recipient to compute a certain value S.

S = a.B = b.A ∈ E(IF

P

)

4. The ephemeral transfer address is then simply

H(S).G in E(IF

P

), private key is c = H(S)

mod Q and in normal bitcoin operation only

H

0

(H(S).G) would be revealed initially when

coins are sent to pk = H(S).G.

Stealth Address and Key Management Techniques in Blockchain Systems

561

5. The receiver actively monitors the blockchain

or other channels for all plausible A and

checks if somebody is sending coins to some

H

0

(H(b.A).G). He can spend all such outputs.

This original 2011 method contains two serious mis-

takes which affect both security and privacy. The first

mistake is to use words ’by his private key’ for the

sender which wrongly suggests or implies the usage

of a permanent identity A, or it is not clear on this

and allows the developers to get it wrong. Now if the

sender uses this A more than once or if this key A is

in any way related to his other actions in the network,

this is not a good idea, cf. slides 15-38 in (Courtois6,

2016). Later specifications such as (van Saberha-

gen, 2013) and Todd post (Todd, 2014) make it clear

we need to use a random ephemeral ’nonce keypair’

here denoted

3

as r,R. In this case the value R must

be somewhat transmitted with the transaction which

increases the blockchain space required. A popular

modern method to publish extra data in bitcoin is to

use the OP RETURN instruction which allows to put

arbitrary data in outputs of bitcoin transactions.

A second mistake in the original method which

was also already discussed in 2011 (user ‘bytecoin’,

2011) and fixed in all later proposals (van Saberha-

gen, 2013; Todd, 2014), is that in this scheme both

the sender and the receiver can spend. Both can com-

pute the ephemeral private key c, cf. (user ‘bytecoin’,

2011; Todd, 2014; Courtois6, 2016). Therefore if the

receiver does not spend them immediately or is of-

fline, the sender can change his mind and take his

money back.

3.1 Improved Basic Stealth Address

Method

Fixing these 2 problems leads to an improved basic

method which is basically extended by an additive key

management technique in the sense of Thm. 2.0.1.

where a DH public key mechanism is used to de-

rive the private key offset. This method is frequently

claimed to be designed in Jan. 2014 by Todd in (Todd,

2014) and is also described in (dev. team Darkwallet,

2014) and on slides 27-29 in (Courtois6, 2016) if we

rename a,A by r, R. In fact it was clearly known ear-

lier and the same exact method with exactly the same

formulas was already earlier described by Nicolas van

Saberhagen in CryptoNote white paper in Oct. 2013

3

The notation used is P = e.G in (Todd, 2014; dev. team

Darkwallet, 2014) and R = f .G in DarkWallet (dev. team

Darkwallet, 2014) and P = e.G in ShadowCash source code

at github.com/shadowproject. Our preferred notation is

rather R = r.G as in (van Saberhagen, 2013; Courtois6,

2016).

(van Saberhagen, 2013). Only later on 6 January 2014

it was adapted

4

by Todd to make it work within bit-

coin spec (Todd, 2014).

1. The recipient has a public key B = b.G

2. The sender uses a one-time nonce pair R = r.G,

r ← random mod Q.

3. Diffie-Hellman allows both to compute the same

value c = H(S):

c = H(S) = H(r.B) = H(b.R) mod Q

4. The ephemeral private key which only the receiver

can compute is then:

c + b = H(b.R)+ b mod Q

and the publicly visible address which will appear

on the blockchain (which all three: sender, audi-

tor and receiver can compute) is the address with

public key equal to B + H(S).G and:

H(S).G + B = H(r.B).G + B = H(b.R).G + b.G

5. The receiver actively monitors the blockchain for

transactions which included a publication of some

R value for example after an OP RETURN, and

for such transactions he can compute the private

key and spend.

Speed vs. Privacy Variants. In (Todd, 2014) Todd

suggests several additional methods to publish a few

bits of extra information together with R in order to

do blockchain scanning faster.

3.2 The Question of Audit and

View-only Wallets

Until now the SA solutions have a serious problem:

the same entity has to know the private ‘spend’ key

b and scan the blockchain in the real-time for some

pairs H(S).G + B,R. This is contrary to very common

practice of cold/disconnected storage of private keys.

One very simple solution to this problem is called

“Non-P2SH-Multisig stealth” in (dev. team Darkwal-

let, 2014). The solution proposed is to use the pre-

vious method twice, with B = b.G and B

0

= b

0

.G and

B

0

is advertised together with B as a (twice longer)

stealth address. Here b

0

can be held in cold storage

and will not be needed to check for incoming pay-

ments. This is achieved by using multi-sig on the top

of PK1 = H(S).G + B transfer key which is not used

4

Todd clearly says that the orignal (more basic and

partly flawed) idea comes from 2011 ‘bytecoin’ post and

also credits Maxwell, Back, Taaki and others for inputs, yet

he omits to mention (van Saberhagen, 2013).

ICISSP 2017 - 3rd International Conference on Information Systems Security and Privacy

562

directly. Instead the sender sends coins to a 2-out-of-

2 multi-sig address of type PK1,PK2, i.e. two keys

are needed to spend. The nonce r which is called e

in (dev. team Darkwallet, 2014) is proposed to be the

same in both cases. We have:

PK1 = H(r.B).G + B = H(b.R).G + b.G ∈ E(IF

P

)

PK2 = H(r.B

0

).G + B

0

= H(b

0

.R).G + b

0

.G ∈ E(IF

P

)

This can be extended to more general multisig

scenarios. To the best of our knowledge, using the

same nonce r twice here is NOT a problem in this

method of (dev. team Darkwallet, 2014). Re-using

r’s is also encouraged on p. 7 of (van Saberhagen,

2013).

Disambiguation. The method above, although it uses

two keys is NOT what is commonly called Dual-key

or 2-key SA, which do not require any multi-sig, and

which we study below.

4 DUAL-KEY IMPROVED

STEALTH ADDRESS METHODS

An important enhancement to SA methods is due

to a developer known as rynomster/sdcoin who has

on 2/08/2014 announced a first full working im-

plementation of Dual-key SA in ShadowCash at

https://bitcointalk.org/ index.php? topic=700087.msg

8153845. Here is a short description of Dual-key SA

method which is used in many current systems [Mon-

ero,DarkWallet,ShadowCash,etc] and is described in

Section ‘Dual-key stealth’ of (dev. team Darkwallet,

2014) and on slides 31-40 in (Courtois6, 2016).

1. The recipient has Stealth Address SA in the form

of two public keys hence Dual-key name. We

have a ‘scan’ public key V and a ‘spend’ pub-

lic key B using vocabulary of (sx library, 2013;

dev. team Darkwallet, 2014). We have V = v.G

and B = b.G using the notations on slides 31-40

in (Courtois6, 2016). ECC points V,B have 33

bytes typically, cf. (sx library, 2013), the scalars

v,b require only 32 bytes.

2. We have V = v.G and we call V a ‘scan pubkey’

(sx library, 2013) or ‘View key’ cf. (Courtois6,

2016). We have B = b.G and we call B a ‘spend

pubkey’ (sx library, 2013; dev. team Darkwallet,

2014).

3. The key advertised by the receiver of coins is B,V .

None of these keys ever appears in the blockchain,

only the sender and the receiver know B,V .

4. The sender uses a one-time nonce pair R = r.G,

r ← random mod Q.

5. Diffie-Hellman allows both the sender and the re-

cipient to compute the same value c = H(S):

c = H(S) = H(r.V ) = H(v.R) mod Q

6. The ephemeral private key which only the receiver

can compute is:

c + b = H(v.R) + b mod Q

and the publicly visible address which will appear

on the blockchain (which all three: sender, auditor

and receiver can compute) is again B + H(S).G:

H(S).G + B = H(r.V ).G + B = H(v.R).G + b.G

7. The auditor, hot wallet, proxy server or read-only

wallet knows/has the pair B,v.

8. The auditor actively monitors the blockchain for

transactions which included a publication of some

R value for example after an OP RETURN, and

for such transactions he can compute

pk = H(v.R).G + B ∈ E(IF

P

)

and see if this pk or its hash appears in the

blockchain.

9. The auditor is not able to spend coins because he

does not know b. Only the recipient knows b and

can compute sk = H(v.R) + b mod Q and spend

these bitcoins.

4.0.1 Dual-key SA In Practice

Details on how this can be done in practice in

bitcoin can be found in (dev. team Darkwallet, 2014;

sx library, 2013). For Monero an interactive tool is

available at https://xmr.llcoins.net/addresstests.html.

In ShadowCash the functionality is imple-

mented inside StealthSecretSpend() specified in

https://github.com/shadowproject/shadow/blob/

master/src/stealth.cpp.

4.1 Dual-key SA Security and Privacy

It is worth noting that the Dual-key SA is provides

very strong anonymity for receivers and unlink-

ability of different payments received by the same

receiver. Thus “users can receive CryptoNote-based

cryptocurrencies with no concern for their privacy”

(A. Mackenzie, 2015) for Monero, and the same

applies to ShadowCash and to bitcoin users who

use DarkWallet (dev. team Darkwallet, 2014).

Unhappily this property is frequently violated by

users themselves or by their software wallets see

(A. Mackenzie, 2015), this as soon as they spend

the moneys received. When various attributions are

Stealth Address and Key Management Techniques in Blockchain Systems

563

later inputs to the same transaction there is a good

chance that amounts sent to different PK belonging

to the same user will be later merged and thus linked

together in the blockchain (DarkWallet provides

additional mixing (dev. team Darkwallet, 2014)).

CryptoNote De-Anonymising Attacks. An interest-

ing question in all SA schemes is whether a bugged or

malicious choice of the hash function H could make

these schemes less secure. This has recently hap-

pened in ShadowCash extension of CryptoNote pro-

tocol where our Dual-key SA is combined with a ring

signature scheme cf. https://archive.is/3VEHr.

5 A BAD RANDOM ATTACK

In this section we describe a simple attack which

shows that a solution more robust than those de-

scribed above may be required. It is going to

be a combination attack similar as in (N.T. Cour-

tois, 2014). We refer to (N.T. Courtois, 2014)

and blog.bettercrypto.com/?page id=1467 for statis-

tics about bad random events in bitcoin. The key point

is that bad random attacks are not always very strong.

For example if the same random r is used twice in two

different signatures the only attack in such case is the

each of the two users can recover the other user’s pub-

lic key, cf. Proposition 43 in (N.T. Courtois, 2014).

Now additional attacks in which anyone can recover

their keys are possible in some configurations, see for

example Proposition 45 in (N.T. Courtois, 2014). Fur-

thermore many more additional attacks are possible

if user keys are derived using key popular key man-

agement techniques such as those we studied here in

Section 2 or HD Wallet/BIP032 techniques (Wuille,

2014) Then we have a larger of possible attacks, cf.

Sections 6-10 in (N.T. Courtois, 2014). In this paper

we show that similar attacks are also possible with

Stealth Address methods.

Theorem 5.0.1 (Combination Attack On Dual-key

Wallets). If the attacker knows the audit key B,v for

one recipient AND if two identical randoms are used

just once in any pair of transactions sent to this re-

cipients, then we can recover the private key b which

allows to spend all coins ever sent to B,V .

Proof: We recall how a standard ECDSA signature

works. We pick a random non-zero number a mod Q

and the signature of m is the pair u,s with

u = (a.G)

x

; s = (H(m) + ku)/a mod Q

Now in our attack we have:

as = (H(m) + uk) mod Q

as

0

= (H(m

0

) + uk

0

) mod Q

k = H(v.R) + b mod Q

k

0

= H(v.R

0

) + b mod Q

So we have:

u(H(v.R) − H(v.R

0

)) = a(s − s

0

) + (H(m) − H(m

0

))

This equation allows to compute u by division

mod Q and then the first two equations allow to com-

pute k and k

0

which given the last two equations give

b and b

0

.

6 A NEW ROBUST STEALTH

ADDRESS TECHNIQUE

We are now going to define a new particularly robust

stealth payment technique which combines the ideas

of using both the additive and multiplicative tech-

nique of Thm. 2.0.2 and the idea of a multi-key mul-

tiplicative technique of (G. Gutoski, 2015) in order to

be resistant to key leakage and other attacks such as

above.

1. The recipient will have m + 1 private/public key

pairs. We have one ‘scan pubkey’ or a.k.a. ‘View

key’ V = v.G. and we have m different ‘spend’

public keys B

i

. and B

i

= b

i

.G.

2. The key advertised by the receiver of coins is

B

1

...B

m

,V . None of these need to appear in the

blockchain and only the sender and the receiver

need to know them.

3. The sender uses a one-time nonce pair R = r.G.

4. Diffie-Hellman allows both the sender and the re-

cipient to compute the same value S:

S = r.V = v.R ∈ E(IF

P

)

5. We assume that we have an expanding hash func-

tion H

0

,... H

m

with m + 1 outputs which are all

numbers mod Q, which can be implemented as

a combination of a standard hash function and a

stream cipher or RNG.

6. The ephemeral private key which only the receiver

can compute is:

H

0

(v.R) +

∑

H

i

(S).b

i

mod Q

and the publicly visible address which will appear

on the blockchain (which all three: sender, auditor

and receiver can compute) is now:

H

0

(S).G +

∑

H

i

(S).B

i

∈ E(IF

P

)

ICISSP 2017 - 3rd International Conference on Information Systems Security and Privacy

564

7. The auditor, hot wallet, proxy server or read-

only wallet contains/knows m + 1 values B

i

and

the secret key v. Again he actively monitors the

blockchain for transactions which included some

R value and for such transactions he can compute

pk = H(v.R).G +

∑

H

i

(v.R).B

i

∈ E(IF

P

)

and see if this pk or its hash appears in the

blockchain. Auditor is not able to spend coins be-

cause he does not know the b

i

.

Now we are going to specify our security assumption

(same as in (G. Gutoski, 2015)):

Definition 6.1 (EC 1MDLP Problem). We consider

all the attackers as follows. The attacker is a proba-

bilistic Turing machine M with bounded computations

with access to two oracles. The first is a challenge or-

acle which produces m random elements Q

i

∈ E(IF

P

).

The second oracle allows to solves the ECDL prob-

lem for up to m − 1 queries chosen by the attacker

machine M. We say that M wins if it is able to output

the discrete logarithms for all m elements Q

i

provided

by the first oracle.

Now we claim that:

Theorem 6.0.1 (Security of Robust SA Method).

Our new robust stealth payment scheme allows to pro-

tect anonymity of users and protect the spending keys

against thefts even when the attacker can recover

5

up to m

1

individual spending private keys and if up

to m

2

bad

6

randoms were used in ECDSA spending

transaction with any m

1

+ m

2

< m. If an attacker can

break our payment scheme, one can (efficiently) con-

vert it into an oracle solving EC 1MDLP. (G. Gutoski,

2015).

Proof [sketch]: With a recovery of up to m

1

in-

dividual spending private keys and up to m

2

re-

peated/bad/related randoms we can hope to obtain at

most m

1

+ m

2

< m linear equations which involve at

least m variables b

i

by formulas such as in the proof of

Thm. 5.0.1. This remains insufficient to solve a linear

system of equations and leads to a situation identical

as in the proof of main Thm. in (G. Gutoski, 2015).

If in our robust stealth payment scheme, all the m pri-

vate spend keys can be recovered by a certain attacker

M we can argue by game hopping that the attacker

should also be able to recover m private keys with

the knowledge of m − 1 discrete logs from an oracle,

querying these specific combinations. This is believed

to be a hard problem cf. (G. Gutoski, 2015).

5

Could be due to malware, side channel attacks, brain

wallets (N.T. Courtois, 2016) or other from of leakage or

compromise.

6

Random numbers can be repeated, guessed due low

entropy or related to each other, cf. Section 5 in (N.T. Cour-

tois, 2014).

7 CONCLUSION

In this paper we review the principal key manage-

ment and Stealth Address techniques which have been

invented in the recent years and are used in numer-

ous crypto currency and blockchain wallets and sys-

tems. We show their correctness, discuss additional

variants, and show that some techniques offer yet a

limited level of privacy and security. In addition we

show that one can do better than the Dual-key Stealth

Address technique which is the one which is used

in many current systems such as Monero or Dark-

Wallet. We propose a new improved SA technique

which was designed to be more robust against a va-

riety of attacks. Our new method is resistant to the

leakage/compromise of one or several private keys. It

can also resist to other incidents at operation such as

bad-random events. The price to pay for this is an

m-fold increase in the size of the higher level public

keys. The size of the actual transactions which need

to be published on the blockchain does not need to

increase.

REFERENCES

A. Mackenzie, S. Noether, M. C. T. (2015). Improving ob-

fuscation in the cryptonote protocol. In online paper.

https://lab.getmonero.org/pubs/MRL-0004.pdf.

Courtois3b, N. (2015). Bitcoin key manage-

ment: Hd wallets, bip032. In slides.

http://www.nicolascourtois.com/bitcoin/paycoin dig

sign key mng HD BIP032 3b.pdf.

Courtois3d, N. (2015). What bitcoin pri-

vate keys say to each other. In slides.

http://www.nicolascourtois.com/bitcoin/paycoin dig

sign combination attacks cold storage 3d.pdf.

Courtois6, N. (2016). Anonymous crypto cur-

rency, stealth address, ring signatures, mon-

ero, comparison to zero.cash. In slides.

http://www.nicolascourtois.com/bitcoin/paycoin

privacy monero 6.pdf.

dev. team Darkwallet (2014). Darkwallet/stealth. In

part of Dark Wallet public development wiki.

https://wiki.unsystem.net/en/index.php/DarkWallet/

Stealth.

G. Gutoski, D. S. (2015). Hierarchical deterministic bit-

coin wallets that tolerate key leakage. In Financial

Cryptography, volume LNCS 8975, pages 497–504.

https://eprint.iacr.org/2014/998.

N.T. Courtois, P. Emirdag, F. V. (2014). Private key recov-

ery combination attacks: On extreme fragility of pop-

ular bitcoin key management, wallet and cold storage

solutions in presence of poor rng events. In Eprint.

http://eprint.iacr.org/2014/848.

N.T. Courtois, G. Song, R. C. (2016). Speed optimizations

in bitcoin key recovery attacks. In will appear in proc.

of CECC 2016. https://eprint.iacr.org/2016/103.pdf.

Stealth Address and Key Management Techniques in Blockchain Systems

565

S. Eskandari, D. Barrera, E. S. J. C. (2015). A first

look at the usability of bitcoin key management.

In In Workshop on Usable Security (USEC).

https://people.inf.ethz.ch/barrerad/files/usec15-

eskandari.pdf.

sx library (2013). Stealth payments section 9,.

In part of online manual for “sx library”.

https://sx.dyne.org/stealth.html.

Todd, P. (2014). [bitcoin-development] stealth ad-

dresses. In post of 04:06:05 -0800 Mon

06 Jan. http://www.mail-archive.com/bitcoin-

development@lists.sourceforge.net/msg03613.html.

user ‘bytecoin’, A. (17 April 2011). Un-

traceable transactions which can con-

tain a secure message are inevitable.

https://bitcointalk.org/index.php?topic=5965.0.

van Saberhagen, N. (2013). Cryptonote v 2.0. In online

paper. https://cryptonote.org/whitepaper.pdf.

Wuille, P. (2014). Bip032 description, 15 jan.

In the official specification of BIP032.

https://github.com/bitcoin/bips/blob/master/bip-

0032.mediawiki.

ICISSP 2017 - 3rd International Conference on Information Systems Security and Privacy

566