A Complementarity Problem Formulation for Chance-constraine Games

Vikas Vikram Singh

1

, Oualid Jouini

2

and Abdel Lisser

1

1

Laboratoire de Recherche en Informatique, Universit

´

e Paris Sud XI, B

ˆ

at 650, 91405, Orsay, France

2

Laboratoire G

´

enie Industriel, Ecole Centrale Paris, Grande Voie des Vignes, 92290, Ch

ˆ

atenay-Malabry, France

Keywords:

Chance-Constrained Game, Nash Equilibrium, Normal Distribution, Cauchy Distribution, Nonlinear Com-

plementarity Problem, Linear Complementarity Problem.

Abstract:

We consider a two player bimatrix game where the entries of each player’s payoff matrix are independent ran-

dom variables following a certain distribution. We formulate this as a chance-constrained game by considering

that the payoff of each player is defined by using a chance-constraint. We consider the case of normal and

Cauchy distributions. We show that a Nash equilibrium of the chance-constrained game corresponding to nor-

mal distribution can be obtained by solving an equivalent nonlinear complementarity problem. Further if the

entries of the payoff matrices are also identically distributed with non-negative mean, we show that a strategy

pair, where each player’s strategy is the uniform distribution on his action set, is a Nash equilibrium of the

chance-constrained game. We show that a Nash equilibrium of the chance-constrained game corresponding to

Cauchy distribution can be obtained by solving an equivalent linear complementarity problem.

1 INTRODUCTION

It is well known that there exists a mixed strategy sad-

dle point equilibrium for a two player zero sum ma-

trix game (Neumann, 1928). John Nash (Nash, 1950)

showed that there exists a mixed strategy equilibrium

for the games with finite number of players where

each player has finite number of actions. Later such

equilibrium was called Nash equilibrium. For two

player case the game considered in (Nash, 1950) can

be represented by m ×n matrices A and B. The matri-

ces A = [a

i j

] and B = [b

i j

] denote the payoff matrices

of player 1 and player 2 respectively, and m, n denote

the number of actions of player 1 and player 2 respec-

tively. Let I = {1,2,··· ,m}, and J = {1,2,··· ,n}

be the action sets of player 1 and player 2 respec-

tively. The sets I and J are also called the sets of pure

strategies of player 1 and player 2 respectively. The

set of mixed strategies of each player is defined by

the set of all probability distributions over his action

set. Let X = {x = (x

1

,x

2

,··· , x

m

)|

∑

m

i=1

x

i

= 1, x

i

≥

0, ∀ i ∈ I} and Y = {y = (y

1

,y

2

,··· , y

n

)|

∑

n

j=1

y

j

=

1,y

j

≥ 0, ∀ j ∈ J} be the sets of mixed strategies of

player 1 and player 2 respectively. For a given strat-

egy pair (x,y), the payoffs of player 1 and player 2

are given by x

T

Ay and x

T

By respectively; T denotes

the transposition. For a fixed strategy of one player,

another player seeks for a strategy that gives him the

highest payoff among all his other strategies. Such a

strategy is called the best response strategy. The set of

best response strategies of player 1 for a fixed strategy

y of player 2 is given by

BR(y) =

¯x|¯x

T

Ay ≥x

T

Ay, ∀ x ∈X

.

The set of best response strategies of player 2 for a

fixed strategy x of player 1 is given by

BR(x) =

¯y|x

T

B ¯y ≥ x

T

By, ∀ y ∈Y

.

A strategy pair (x

∗

,y

∗

) is said to be a Nash equilib-

rium if and only if x

∗

∈ BR(y

∗

) and y

∗

∈ BR(x

∗

). A

Nash equilibrium of above bimatrix game can be ob-

tained by solving a linear complementarity problem

(LCP) (Lemke and Howson, 1964).

Both (Nash, 1950) and (Neumann, 1928) consid-

ered the games where the payoffs of the players are

exact real values. In some cases the payoffs of play-

ers may be within certain ranges. In (Collins and Hu,

2008) these situations are modeled as interval val-

ued matrix game using fuzzy theory. The compu-

tational approaches have been proposed to solve in-

terval valued matrix game

see (Deng-Feng Li and

Zhang, 2012), (Li, 2011), (Mitchell et al., 2014)

.

However, in many situations payoffs are random vari-

ables due to uncertainty which arises from various

external factors. The wholesale electricity markets

are the good examples

see (Mazadi et al., 2013),

(Couchman et al., 2005), (Valenzuela and Mazum-

dar, 2007), (Wolf and Smeers, 1997)

. One way to

58

Singh, V., Jouini, O. and Lisser, A.

A Complementarity Problem Formulation for Chance-constraine Games.

DOI: 10.5220/0005754800580067

In Proceedings of 5th the International Conference on Operations Research and Enterprise Systems (ICORES 2016), pages 58-67

ISBN: 978-989-758-171-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

handle this type of game is by taking the expecta-

tion of random payoffs and consider the correspond-

ing deterministic game

see (Valenzuela and Mazum-

dar, 2007), (Wolf and Smeers, 1997)

. Some recent

papers on the games with random payoffs using ex-

pected payoff criterion include (Ravat and Shanbhag,

2011), (Xu and Zhang, 2013), (Jadamba and Raciti,

2015), (DeMiguel and Xu, 2009).

The expected payoff criterion does not take a

proper account of stochasticity in the cases where

the observed sample payoffs are large amounts with

very small probabilities. These situations are bet-

ter handled by considering a satisficing payoff crite-

rion that uses chance-constrained programming

see

(Charnes and Cooper, 1963), (Cheng and Lisser,

2012), (Pr

´

ekopa, 1995)

. Under satisficing payoff

criterion the payoff of a player is defined using a

chance-constraint and for this reason these games are

called chance-constrained games. There are few pa-

pers on zero sum chance-constrained games available

in the literature

see (Blau, 1974), (Cassidy et al.,

1972), (Charnes et al., 1968), (Song, 1992)

. Re-

cently, a chance-constrained game with finite num-

ber of players is considered in (Singh et al., 2015a),

(Singh et al., 2015b) where authors showed the exis-

tence of a mixed strategy Nash equilibrium. In (Singh

et al., 2015a), the case where the random payoff vec-

tor of each player follows a certain distribution is con-

sidered. In particular, the authors considered the case

where the components of the payoff vector of each

player are independent normal random variables, and

they also consider the case where the payoff vector

of each player follows a multivariate elliptically sym-

metric distribution. In (Singh et al., 2015b), the case

where the distribution of payoff vector of each player

is not known completely is considered. The authors

consider a distributionally robust approach to handle

these games. In application regimes some chance-

constrained game models have been considered, e.g.,

see (Mazadi et al., 2013), (Couchman et al., 2005).

In (Mazadi et al., 2013), the randomness in payoffs is

due to the installation of wind generators on electric-

ity market, and they consider the case of independent

normal random variables. Later, for better represen-

tation and ease in computation the authors, in detail,

considered the case where only one wind generator

is installed in the electricity market. In (Couchman

et al., 2005), the payoffs are random due to uncertain

demand from consumers which is assumed to be nor-

mally distributed.

In this paper, we consider the case where the en-

tries of the payoff matrices are independent random

variables following the same distribution (possibly

with different parameters). For a given strategy pair

(x,y), the payoff of each player is a random vari-

able which is a linear combination of the indepen-

dent random variables. We consider the distributions

that are closed under a linear combination of the in-

dependent random variables. The normal and Cauchy

distributions satisfy this property. We consider each

distribution separately. We show that a Nash equi-

librium of the chance-constrained game correspond-

ing to normal distribution can be obtained by solv-

ing an equivalent nonlinear complementarity problem

(NCP). Further we consider a special case where the

entries of the payoff matrices are also identically dis-

tributed with non-negative mean. We show that a

strategy pair, where each player’s strategy is a uni-

form distribution over his action set, is a Nash equilib-

rium. We show that a Nash equilibrium of the chance-

constrained game corresponding to Cauchy distribu-

tion can be obtained by solving an equivalent LCP.

Now, we describe the structure of rest of the pa-

per. Section 2 contains the definition of a chance-

constrained game. Section 3 contains the comple-

mentarity problem formulation of chance-constrained

game. We conclude the paper in Section 4

2 THE MODEL

We consider two player bimatrix game where the en-

tries of the payoff matrices are random variables. We

denote the random payoff matrices of player 1 and

player 2 by A

w

and B

w

respectively, where w denotes

the uncertainty parameter. Let (Ω,F ,P) be a proba-

bility space. Then, for each i ∈ I, j ∈ J, a

w

i j

: Ω → R,

and b

w

i j

: Ω → R. For each (x,y) ∈ X ×Y , the payoffs

x

T

A

w

y and x

T

B

w

y of player 1 and player 2 respec-

tively would be random variables. We assume that

each player uses satisficing payoff criterion, where

the payoff of each player is defined using a chance-

constraint. At strategy pair (x,y), each player is in-

terested in the highest level of his payoff that he can

attain with at least a specified level of confidence.

The confidence level of each player is given a pri-

ori. We assume that the confidence level of one

player is known to another player. Let α

1

∈ [0,1]

and α

2

∈ [0,1] be the confidence levels of player 1

and player 2 respectively. Let α = (α

1

,α

2

) be a con-

fidence level vector. For a given strategy pair (x, y)

and a given confidence level vector α, the payoff of

player 1 is given by

u

α

1

1

(x,y) = sup{u|P(x

T

A

w

y ≥ u) ≥ α

1

}, (1)

and the payoff of player 2 is given by

u

α

2

2

(x,y) = sup{v|P(x

T

B

w

y ≥ v) ≥ α

2

}. (2)

A Complementarity Problem Formulation for Chance-constraine Games

59

We assume that the probability distributions of the en-

tries of the payoff matrix of one player are known to

another player. Then, for a given α the payoff func-

tion of one player defined above is known to another

player. That is, for a given α the chance constrained

game is a non-cooperative game with complete infor-

mation. For a given α, the set of best response strate-

gies of player 1 against the fixed strategy y of player

2 is given by

BR

α

1

(y) =

¯x ∈X|u

α

1

1

( ¯x,y) ≥ u

α

1

1

(x,y), ∀ x ∈ X

,

and the set of best response strategies of player 2

against the fixed strategy x of player 1 is given by

BR

α

2

(x) =

¯y ∈Y |u

α

2

2

(x, ¯y) ≥u

α

2

2

(x,y), ∀ y ∈Y

.

Next, we give the definition of Nash equilibrium.

Definition 2.1 (Nash equilibrium). For a given con-

fidence level vector α, a strategy pair (x

∗

,y

∗

) is said

to be a Nash equilibrium of the chance-constrained

game if the following inequalities hold:

u

α

1

1

(x

∗

,y

∗

) ≥ u

α

1

1

(x,y

∗

), ∀ x ∈ X ,

u

α

2

2

(x

∗

,y

∗

) ≥ u

α

2

2

(x

∗

,y). ∀ y ∈Y.

3 COMPLEMENTARITY

PROBLEM FOR

CHANCE-CONSTRAINED

GAME

In this section, we consider the case where the en-

tries of payoff matrix A

w

of player 1 are independent

random variables following a certain distribution, and

the entries of payoff matrix B

w

of player 2 are inde-

pendent random variables following a certain distri-

bution. Then, at strategy pair (x,y) the payoff of each

player is a linear combination of the independent ran-

dom variables. We are interested in those probabil-

ity distributions that are closed under a linear com-

bination of the independent random variables. That

is, if Y

1

,Y

2

,··· ,Y

k

are independent random variables

following the same distribution (possibly with differ-

ent parameters), for any b ∈ R

k

, the distribution of

∑

k

i=1

b

i

Y

i

is same as Y

i

up to parameters. The normal

and Cauchy distributions satisfy the above property

(Johnson et al., 1994). We discuss each probability

distribution mentioned above separately. For the case

of normal distribution we show that a Nash equilib-

rium of the chance-constrained game can be obtained

by solving an equivalent NCP, and for the case of

Cauchy distribution we show that a Nash equilibrium

of the chance-constrained game can be obtained by

solving an equivalent LCP.

3.1 Payoffs Following Normal

Distribution

We assume that all the components of matrix A

w

are independent normal random variables, where the

mean and variance of a

w

i j

, i ∈ I, j ∈ J, are µ

1,i j

and

σ

2

1,i j

respectively, and all the components of ma-

trix B

w

are independent normal random variables,

where the mean and variance of b

w

i j

, i ∈ I, j ∈ J,

are µ

2,i j

and σ

2

2,i j

respectively. For a given strat-

egy pair (x,y), x

T

A

w

y follows a normal distribution

with mean µ

1

(x,y) =

∑

i∈I, j∈J

µ

1,i j

x

i

y

j

and variance

σ

2

1

(x,y) =

∑

i∈I, j∈J

x

2

i

y

2

j

σ

2

1,i j

, and x

T

B

w

y follows a nor-

mal distribution with mean µ

2

(x,y) =

∑

i∈I, j∈J

µ

2,i j

x

i

y

j

and variance σ

2

2

(x,y) =

∑

i∈I, j∈J

x

2

i

y

2

j

σ

2

2,i j

. Then,

Z

N

1

=

x

T

A

w

y−µ

1

(x,y)

σ

1

(x,y)

and Z

N

2

=

x

T

B

w

y−µ

2

(x,y)

σ

2

(x,y)

follow a

standard normal distribution. Let F

−1

Z

N

1

(·) and F

−1

Z

N

2

(·)

be the quantile functions of a standard normal distri-

bution. From (1), for a given strategy pair (x,y) and

a given confidence level α

1

, the payoff of player 1 is

given by

u

α

1

1

(x,y) = sup{u|P(x

T

A

w

y ≥u) ≥ α

1

}

= sup{u|P(x

T

A

w

y ≤u) ≤ 1 −α

1

}

= sup

u|F

Z

N

1

u −µ

1

(x,y)

σ

1

(x,y)

≤ 1 −α

1

= sup

n

u|u ≤ µ

1

(x,y) + σ

1

(x,y)F

−1

Z

N

1

(1 −α

1

)

o

.

That is,

u

α

1

1

(x,y) =

∑

i∈I, j∈J

µ

1,i j

x

i

y

j

+

∑

i∈I, j∈J

x

2

i

y

2

j

σ

2

1,i j

!

1/2

F

−1

Z

N

1

(1 −α

1

).

(3)

Similarly, from (2) for a given strategy pair (x,y) and

a given confidence level α

2

, the payoff of player 2 is

given by

u

α

2

2

(x,y) =

∑

i∈I, j∈J

µ

2,i j

x

i

y

j

+

∑

i∈I, j∈J

x

2

i

y

2

j

σ

2

2,i j

!

1/2

F

−1

Z

N

2

(1 −α

2

).

(4)

Theorem 3.1. Consider a bimatrix game (A

w

,B

w

).

If all the components of matrix A

w

are independent

normal random variables, and all the components

of matrix B

w

are also independent normal random

variables, there exists a Nash equilibrium for the

chance-constrained game in mixed strategies for all

α ∈ [0.5,1]

2

.

Proof. The proof follows from (Singh et al., 2015a)

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

60

3.1.1 Nonlinear Complementarity Problem

Formulation

The payoff function of player 1 defined by (3) can be

written as follows:

u

α

1

1

(x,y) = x

T

µ

1

(y) + ||Σ

1/2

1

(y)x||F

−1

Z

N

1

(1 −α

1

), (5)

where || · || is the Euclidean norm, and

µ

1

(y) =

µ

1,i

(y)

i∈I

is an m × 1 vector where

µ

1,i

(y) =

∑

j∈J

µ

1,i j

y

j

, and Σ

1

(y) is an m × m

diagonal matrix whose ith diagonal entry

Σ

1,ii

(y) =

∑

j∈J

σ

2

1,i j

y

2

j

. Similarly, the payoff

function of player 2 defined by (4) can be written as

follows:

u

α

2

2

(x,y) = y

T

µ

2

(x) + ||Σ

1/2

2

(x)y||F

−1

Z

N

2

(1 −α

2

), (6)

where µ

2

(x) =

µ

2, j

(x)

j∈J

is an n ×1 vector where

µ

2, j

(x) =

∑

i∈I

µ

2,i j

x

i

, and Σ

2

(x) is an n × n diag-

onal matrix whose jth diagonal entry Σ

2, j j

(x) =

∑

i∈I

σ

2

2,i j

x

2

i

. For fixed y ∈ Y and α

1

∈ [0.5, 1], the

payoff function u

α

1

1

(·,y) of player 1 defined by (5)

is a concave function of x because F

−1

Z

N

1

(1 −α

1

) ≤ 0

for all α

1

∈ [0.5,1]. Similarly, for fixed x ∈ X and

α

2

∈ [0.5, 1], the payoff function u

α

2

2

(x,·) of player 2

defined by (6) is a concave function of y.

Then, for a fixed y ∈Y and α

1

∈[0.5, 1], a best re-

sponse strategy of player 1 can be obtained by solving

the convex quadratic program [QP1] given below:

[QP1] max

x

x

T

µ

1

(y) + ||Σ

1/2

1

(y)x||F

−1

Z

N

1

(1 −α

1

)

s.t

(i)

∑

i∈I

x

i

= 1

(ii) x

i

≥ 0, i ∈ I.

It is easy to see that a feasible solution of [QP1]

satisfies the linear independence constraint qualifica-

tion. Then, Karush-Kuhn-Tucker (KKT) conditions

of [QP1] will be necessary and sufficient conditions

for optimal solution

for details see (Nocedal and

Wright, 2006), (Bazaraa et al., 2006)

. For a given

vector ν, ν ≥ 0 means ν

k

≥ 0, for all k. The equal-

ity constraint of [QP1] can be replaced by two equiv-

alent inequality constraints, and the free Lagrange

multiplier corresponding to equality constraint can be

replaced by the difference of two nonnegative vari-

ables. By using these transformations, the best re-

sponse strategy of player 1 can be obtained by solving

the following KKT conditions of [QP1]:

0 ≤ x ⊥−µ

1

(y) −

Σ

1

(y)x ·c

α

1

||Σ

1/2

1

(y)x||

−λ

1

e

m

+ λ

2

e

m

≥ 0,

0 ≤ λ

1

⊥

∑

i∈I

x

i

−1 ≥0,

0 ≤ λ

2

⊥ 1 −

∑

i∈I

x

i

≥ 0,

(7)

where e

m

is the m × 1 vector of ones, and

c

α

1

= F

−1

Z

N

1

(1 − α

1

), and ⊥ means that element-

wise equality must hold at one or both sides. For

fixed x ∈ X and α

2

∈ [0.5,1], a best response strat-

egy of player 2 can be obtained by solving the convex

quadratic program [QP2] given below:

[QP2] max

y

y

T

µ

2

(x) + ||Σ

1/2

2

(x)y||F

−1

Z

N

2

(1 −α

2

)

s.t

(i)

∑

j∈J

y

j

= 1

(ii) y

j

≥ 0, j ∈J.

From the similar arguments used in previous case, the

best response strategy of player 2 can be obtained by

solving the following KKT conditions of [QP2]:

0 ≤ y ⊥−µ

2

(x) −

Σ

2

(x)y ·c

α

2

||Σ

1/2

2

(x)y||

−λ

3

e

n

+ λ

4

e

n

≥ 0,

0 ≤ λ

3

⊥

∑

j∈J

y

j

−1 ≥0,

0 ≤ λ

4

⊥ 1 −

∑

j∈J

y

j

≥ 0,

(8)

where c

α

2

= F

−1

Z

N

2

(1 −α

2

).

Nonlinear Complementarity Problem: By combin-

ing the KKT conditions given by (7) and (8), a Nash

equilibrium (x, y) can be obtained by solving the fol-

lowing NCP:

0 ≤ ζ ⊥ G(ζ) ≥ 0, (9)

where ζ,G(ζ) ∈ R

m+n+4

are given below:

ζ

T

= (x

T

,y

T

,λ

1

,λ

2

,λ

3

,λ

4

),

G(ζ) =

−µ

1

(y) −

Σ

1

(y)x·c

α

1

||Σ

1/2

1

(y)x||

−λ

1

e

m

+ λ

2

e

m

−µ

2

(x) −

Σ

2

(x)y·c

α

2

||Σ

1/2

2

(x)y||

−λ

3

e

n

+ λ

4

e

n

∑

i∈I

x

i

−1

1 −

∑

i∈I

x

i

∑

j∈J

y

j

−1

1 −

∑

j∈J

y

j

.

A Complementarity Problem Formulation for Chance-constraine Games

61

For given k, l, 0

k×l

is a k ×l zero matrix and 0

k

is a

k ×1 zero vector. Define,

Q =

0

m×m

−µ

1

−e

m

e

m

0

m

0

m

−µ

T

2

0

n×n

0

n

0

n

−e

n

e

n

e

T

m

0

T

n

0 0 0 0

−e

T

m

0

T

n

0 0 0 0

0

T

m

e

T

n

0 0 0 0

0

T

m

−e

T

n

0 0 0 0

,

where µ

1

= (µ

1,i j

)

i∈I, j∈J

, µ

2

= (µ

2,i j

)

i∈I, j∈J

are m ×n

matrices. Define,

R(ζ) =

−c

α

1

·Σ

1

(y)

||Σ

1/2

1

(y)x||

0

m×n

0

m×4

0

n×m

−c

α

2

·Σ

2

(x)

||Σ

1/2

2

(x)y||

0

n×4

0

4×m

0

4×n

0

4×4

, r =

0

m

0

n

−1

1

−1

1

.

Then, G(ζ) =

Q + R(ζ)

ζ + r.

Theorem 3.2. Consider a bimatrix game (A

w

,B

w

)

where all the components of matrix A

w

are indepen-

dent normal random variables, and all the compo-

nents of matrix B

w

are also independent normal ran-

dom variables. Let ζ

∗T

= (x

∗T

,y

∗T

,λ

∗

1

,λ

∗

2

,λ

∗

3

,λ

∗

4

) be

a vector. Then, the strategy part (x

∗

,y

∗

) of ζ

∗

is a

Nash equilibrium of the chance-constrained game for

a given α ∈ [0.5,1]

2

if and only if ζ

∗

is a solution of

NCP (9).

Proof. Let α ∈ [0.5,1]

2

, then (x

∗

,y

∗

) is a Nash equi-

librium of the chance-constrained game if and only if

x

∗

is an optimal solution of [QP1] for fixed y

∗

and y

∗

is an optimal solution of [QP2] for fixed x

∗

. Since,

[QP1] and [QP2] are convex optimization problems

and linear independence constraint qualification holds

at all feasible points, then the KKT conditions (7) and

(8) are both necessary and sufficient conditions for

optimality. Then, the proof follows by combining the

KKT conditions (7), (8).

For computational purpose freely available

solvers for complementarity problems can be used,

e.g., see (Schmelzer, 2012), (Ferris and Munson,

2000), (Munson, 2000).

3.1.2 Special Case

Here we consider the case where the components of

payoff matrices A

w

and B

w

are independent as well

as identically distributed. We assume that the com-

ponents of matrix A

w

are independent and identi-

cally distributed (i.i.d.) normal random variables with

mean µ

1

≥ 0 and variance σ

2

1

, and the components

of matrix B

w

are i.i.d. normal random variables with

mean µ

2

≥ 0 and variance σ

2

2

.

Theorem 3.3. Consider a bimatrix game (A

w

,B

w

)

where all the components of matrix A

w

are i.i.d. nor-

mal random variables with mean µ

1

≥0 and variance

σ

2

1

, and all the components of matrix B

w

are also i.i.d.

normal random variables with mean µ

2

≥0 and vari-

ance σ

2

2

. The strategy pair (x

∗

,y

∗

), where,

x

∗

i

=

1

m

, ∀ i ∈ I, y

∗

j

=

1

n

,∀ j ∈J, (10)

is a Nash equilibrium of the chance-constrained game

for all α ∈ [0.5,1]

2

.

Proof. Fix α ∈ [0.5,1]

2

. From Theorem 3.2, it is

enough to show that there exist (λ

∗

1

,λ

∗

2

,λ

∗

3

,λ

∗

4

) which

together with (x

∗

,y

∗

) defined by (10) is a solution

of NCP (9). For all (x, y), we have µ

1

(y) = µ

1

e

m

and µ

2

(x) = µ

2

e

n

because µ

1,i j

= µ

1

and µ

2,i j

= µ

2

for all i ∈ I, j ∈ J, and Σ

1

(y) = σ

2

1

||y||

2

I

m×m

and

Σ

2

(x) = σ

2

2

||x||

2

I

n×n

because σ

2

1,i j

= σ

2

1

and σ

2

2,i j

= σ

2

2

for all i ∈I, j ∈J; I

k×k

is a k ×k identity matrix. Using

above expressions, we have

G(ζ) =

−µ

1

e

m

−

σ

1

||y||x·c

α

1

||x||

−(λ

1

−λ

2

)e

m

−µ

2

e

n

−

σ

2

||x||y·c

α

2

||y||

−(λ

3

−λ

4

)e

n

∑

i∈I

x

i

−1

1 −

∑

i∈I

x

i

∑

j∈J

y

j

−1

1 −

∑

j∈J

y

j

.

Consider the Lagrange multipliers (λ

∗

1

,λ

∗

2

,λ

∗

3

,λ

∗

4

) as

follows:

λ

∗

1

= −

σ

1

·c

α

1

√

mn

, λ

∗

2

= µ

1

, λ

∗

3

= −

σ

2

·c

α

2

√

mn

, λ

∗

4

= µ

2

.

Since, µ

1

≥ 0, µ

2

≥ 0, and for α ∈ [0.5,1]

2

, c

α

1

≤ 0

and c

α

2

≤0, then, λ

∗

1

≥0, λ

∗

2

≥0, λ

∗

3

≥0, λ

∗

4

≥0. It is

easy to check that (x

∗

,y

∗

,λ

∗

1

,λ

∗

2

,λ

∗

3

,λ

∗

4

) is a solution

of NCP (9). That is, (x

∗

,y

∗

) defined by (10) is a Nash

equilibrium of chance-constrained game.

3.2 Payoffs Following Cauchy

Distribution

We assume that all the components of matrix A

w

are independent Cauchy random variables, where the

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

62

location and scale parameters of a

w

i j

, i ∈ I, j ∈ J,

are µ

1,i j

and σ

1,i j

respectively, and all the compo-

nents of matrix B

w

are independent Cauchy ran-

dom variables, where the location and scale param-

eters of b

w

i j

, i ∈ I, j ∈ J, are µ

2,i j

and σ

2,i j

re-

spectively. Since, a linear combination of the in-

dependent Cauchy random variables is a Cauchy

random variable (Johnson et al., 1994), then, for

a given strategy pair (x,y), the payoff x

T

A

w

y of

player 1 follows a Cauchy distribution with location

parameter µ

1

(x,y) =

∑

i∈I, j∈J

x

i

y

j

µ

1,i j

and scale pa-

rameter σ

1

(x,y) =

∑

i∈I, j∈J

x

i

y

j

σ

1,i j

, and the payoff

x

T

B

w

y of player 2 follows a Cauchy distribution with

location parameter µ

2

(x,y) =

∑

i∈I, j∈J

x

i

y

j

µ

2,i j

and

scale parameter σ

2

(x,y) =

∑

i∈I, j∈J

x

i

y

j

σ

2,i j

. Then,

Z

C

1

=

x

T

A

w

y−µ

1

(x,y)

σ

1

(x,y)

and Z

C

2

=

x

T

B

w

y−µ

2

(x,y)

σ

2

(x,y)

follow a

standard Cauchy distribution. Let F

−1

Z

C

1

(·) and F

−1

Z

C

2

(·)

be the quantile functions of a standard Cauchy dis-

tribution. For more details about Cauchy distribution

see (Johnson et al., 1994). Similar to the normal dis-

tribution case, for a given strategy pair (x,y) and a

given α the payoff of player 1 is given by

u

α

1

1

(x,y) = sup

u|F

Z

C

1

u −µ

1

(x,y)

σ

1

(x,y)

≤ 1 −α

1

= sup

n

u|u ≤ µ

1

(x,y) + σ

1

(x,y)F

−1

Z

C

1

(1 −α

1

)

o

.

That is,

u

α

1

1

(x,y) =

∑

i∈I, j∈J

x

i

y

j

µ

1,i j

+ σ

1,i j

F

−1

Z

C

1

(1 −α

1

)

!

.

(11)

Similarly, the payoff of player 2 is given by

u

α

2

2

(x,y) =

∑

i∈I, j∈J

x

i

y

j

µ

2,i j

+ σ

2,i j

F

−1

Z

C

2

(1 −α

2

)

!

.

(12)

The quantile function of a standard Cauchy distribu-

tion is not finite at 0 and 1. Therefore, we consider

the case of α ∈ (0,1)

2

, so that payoff functions de-

fined by (11) and (12) have finite values. Define, a

matrix

˜

A(α

1

) = ( ˜a

i j

(α

1

))

i∈I, j∈J

, where

˜a

i j

(α

1

) = µ

1,i j

+ σ

1,i j

F

−1

Z

C

1

(1 −α

1

), (13)

and a matrix

˜

B(α

2

) =

˜

b

i j

(α

2

)

i∈I, j∈J

, where

˜

b

i j

(α

2

) = µ

2,i j

+ σ

2,i j

F

−1

Z

C

2

(1 −α

2

). (14)

Then, we can write (11) as

u

α

1

1

(x,y) = x

T

˜

A(α

1

)y,

and we can write (12) as

u

α

2

2

(x,y) = x

T

˜

B(α

2

)y.

Then, for a given α ∈ (0, 1)

2

, the chance-

constrained game is equivalent to the bimatrix game

˜

A(α

1

),

˜

B(α

2

)

.

Theorem 3.4. Consider a bimatrix game (A

w

,B

w

). If

all components of matrix A

w

are independent Cauchy

random variables, and all components of matrix B

w

are also independent Cauchy random variables, there

exists a Nash equilibrium for the chance-constrained

game in mixed strategies for all α ∈ (0,1)

2

.

Proof. For each α ∈ (0, 1)

2

the chance-constrained

game is equivalent to the bimatrix game

˜

A(α

1

),

˜

B(α

2

)

. Hence, the existence of a Nash

equilibrium in mixed strategies follows from (Nash,

1950).

Remark 3.5. For case of i.i.d. Cauchy random vari-

ables each strategy pair (x, y) is a Nash equilibrium

because from (11), (12) the payoff functions of both

the players are constant.

3.2.1 Linear Complementarity Problem

For a given matrix N = [N

i j

], N > 0 means that N

i j

> 0

for all i, j. Let E be the m×n matrix with all 1’s. Let k

be the large enough such that kE

T

−(

˜

B(α

2

))

T

> 0 and

kE −

˜

A(α

1

) > 0. Then, from (Lemke and Howson,

1964), (Lemke, 1965) it follows that for a given α, a

Nash equilibrium of the chance-constrained game can

be obtained by following LCP:

0 ≤ z ⊥Mz + q ≥ 0, (15)

where

z =

x

y

, M =

0

m×m

kE −

˜

A(α

1

)

kE

T

−(

˜

B(α

2

))

T

0

n×n

!

,

q =

−e

m

−e

n

.

Theorem 3.6. Consider a bimatrix game (A

w

,B

w

)

where all the components of matrix A

w

are indepen-

dent Cauchy random variables, and all the compo-

nents of matrix B

w

are also independent Cauchy ran-

dom variables, then,

1. For a α ∈ (0,1)

2

, if (x

∗

,y

∗

) is a Nash equi-

librium of the chance-constrained game, z

∗T

=

x

∗T

k−x

∗T

˜

B(α

2

)y

∗

,

y

∗T

k−x

∗T

˜

A(α

1

)y

∗

is a solution of LCP

(15) at α.

2. For a α ∈ (0,1)

2

, if ¯z

T

= ( ¯x

T

, ¯y

T

) is a solution

of LCP (15), (x

∗

,y

∗

) =

¯x

∑

i∈I

¯x

i

,

¯y

∑

i∈I

¯y

j

is a Nash

equilibrium of the chance-constrained game at α.

A Complementarity Problem Formulation for Chance-constraine Games

63

Proof. For a α ∈(0,1)

2

, the chance-constrained game

corresponding to Cauchy distribution is equivalent

to a bimatrix game

˜

A(α

1

),

˜

B(α

2

)

, where

˜

A(α

1

)

and

˜

B(α

2

) is defined by (13) and (14) respectively.

Then, the proof follows from (Lemke and Howson,

1964).

3.2.2 Numerical Results

We consider few instances of random bimatrix game

of different sizes. We compute the Nash equilib-

ria of corresponding chance-constrained game by us-

ing Lemke-Howson algorithm (Lemke and Howson,

1964). We use the MATLAB code of Lemke-Howson

algorithm given in (Katzwer, 2013).

(i) 3 ×3 random bimatrix game: We consider five

instances of random bimatrix game of size 3 ×3. The

datasets consisting of location parameters µ

1

= [µ

1,i j

],

µ

2

= [µ

2,i j

], and scale parameters σ

1

= [σ

1,i j

], σ

2

=

[σ

2,i j

] of independent Cauchy random variables that

characterizes chance-constrained game are follows:

1. µ

1

=

1 2 1

2 3 1

1 2 3

, σ

1

=

1 1 2

1 2 3

2 1 2

,

µ

2

=

2 1 2

3 2 1

1 2 3

, σ

2

=

1 2 3

3 1 2

2 3 1

.

2. µ

1

=

1 1 2

2 1 1

2 1 3

, σ

1

=

2 2 3

3 2 1

1 2 3

,

µ

2

=

2 2 1

3 2 3

2 1 2

, σ

2

=

1 2 2

2 3 1

2 1 3

.

3. µ

1

=

2 1 3

3 2 1

1 3 2

, σ

1

=

2 3 1

3 1 2

1 2 3

,

µ

2

=

1 2 3

2 1 3

3 1 2

, σ

2

=

1 1 2

1 2 1

3 1 1

.

4. µ

1

=

3 1 2

2 1 3

1 2 3

, σ

1

=

2 4 1

1 2 3

3 2 1

,

µ

2

=

4 1 3

3 2 4

2 1 3

, σ

2

=

5 2 3

3 2 1

4 2 3

.

5. µ

1

=

1 2 1

2 3 1

1 2 3

, σ

1

=

2 2 3

3 2 1

1 2 3

,

µ

2

=

1 2 3

2 1 3

3 1 2

, σ

2

=

5 2 3

3 2 1

4 2 3

.

The entries of µ

1

, σ

1

, µ

2

, σ

2

defined above are the

location and scale parameters of corresponding in-

dependent Cauchy random variables. For example,

in dataset 1 random payoff a

11

is a Cauchy random

variable with location parameter 1 and scale param-

eter 1. The Table 1 summarizes the Nash equilibria

of chance-constrained game corresponding to datasets

given for five instances of 3 ×3 random bimatrix

game.

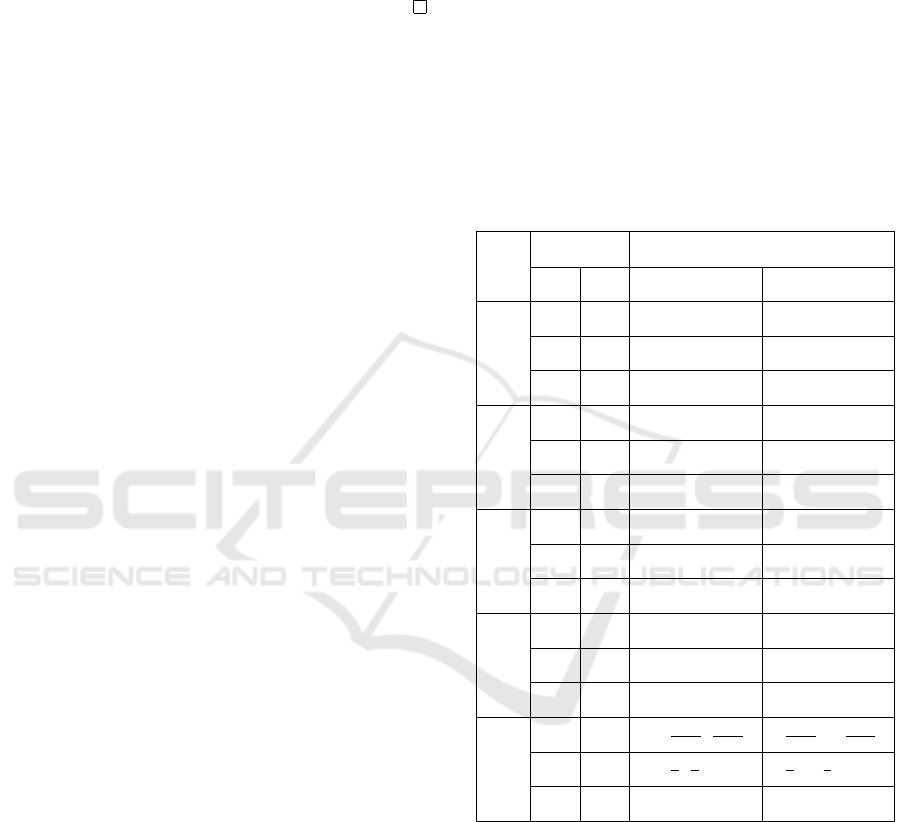

Table 1: Nash equilibria for various values of α.

No.

α Nash Equilibrium

α

1

α

2

x

∗

y

∗

1

0.4 0.4 (0, 0, 1) (0, 0, 1)

0.5 0.5 (0, 1, 0) (1, 0, 0)

0.7 0.7 (0, 1, 0) (0, 1, 0)

2

0.4 0.4 (1, 0, 0) (0, 1, 0)

0.5 0.5 (0, 1, 0) (1, 0, 0)

0.7 0.7 (0, 0, 1) (1, 0, 0)

3

0.4 0.4 (1, 0, 0) (0, 0, 1)

0.5 0.5 (1, 0, 0) (0, 0, 1)

0.7 0.7 (1, 0, 0) (0, 0, 1)

4

0.4 0.4 (1, 0, 0) (1, 0, 0)

0.5 0.5 (1, 0, 0) (1, 0, 0)

0.7 0.7 (0, 0, 1) (0, 0, 1)

5

0.4 0.4

0,

791

1000

,

209

1000

616

1000

,0,

384

1000

0.5 0.5

0,

1

2

,

1

2

2

3

,0,

1

3

0.7 0.7 (0, 0, 1) (1, 0, 0)

(ii) 5 ×5 random bimatrix game: We consider two

instances of random bimatrix game of size 5 ×5. The

location parameters µ

1

, µ

2

, and scale parameters σ

1

,

σ

2

of independent Cauchy random variables are as

follows:

1. µ

1

=

1 2 1 1 3

2 3 1 1 2

1 2 3 2 3

2 1 3 4 2

1 2 4 5 2

,σ

1

=

2 2 3 2 1

1 2 3 2 1

1 2 3 3 1

2 1 3 4 2

3 1 2 5 2

,

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

64

µ

2

=

1 2 3 2 1

3 2 2 1 3

1 2 3 1 2

2 1 4 2 1

1 1 2 1 3

, σ

2

=

5 2 3 2 3

2 4 3 2 1

1 3 4 2 3

2 1 3 5 1

2 1 2 3 4

.

2. µ

1

=

1 2 2 4 3

2 1 3 2 2

1 2 4 2 1

2 2 3 4 1

1 2 4 5 2

,σ

1

=

2 3 1 2 1

1 1 3 1 2

3 1 3 3 1

2 2 5 4 2

3 1 3 5 2

,

µ

2

=

1 2 3 2 1

3 1 2 1 4

2 1 3 4 2

3 2 4 2 1

2 4 2 1 3

, σ

2

=

5 2 4 2 1

2 4 3 2 1

4 3 3 2 3

2 1 3 5 3

1 3 4 3 4

.

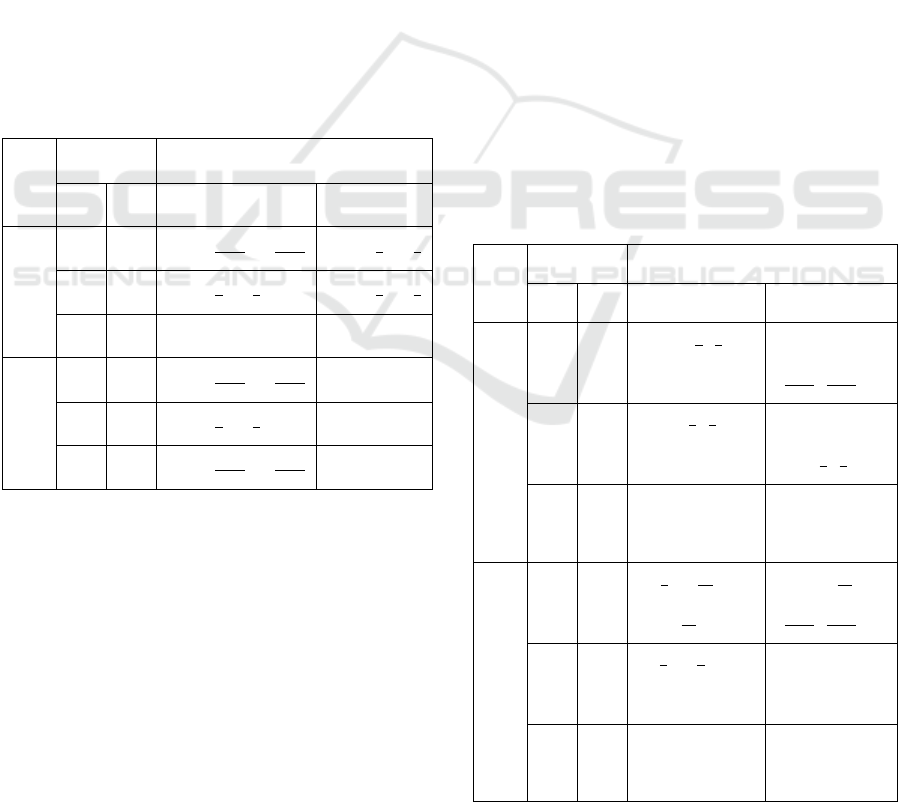

The Table 2 summarizes the Nash equilibria of

chance-constrained game corresponding to datasets

given for two instances of 5 × 5 random bimatrix

game.

Table 2: Nash equilibria for various values of α.

No.

α Nash Equilibrium

α

1

α

2

x

∗

y

∗

1

0.4 0.4

0,0,

555

1000

,0,

445

1000

0,0,

1

2

,0,

1

2

0.5 0.5

0,0,

1

2

,0,

1

2

0,0,

1

2

,0,

1

2

0.7 0.7 (0,0,0,0,1) (0,0,1,0,0)

2

0.4 0.4

0,0,

663

1000

,0,

337

1000

(0,0,1,0,0)

0.5 0.5

0,0,

1

2

,0,

1

2

(0,1,0,0,0)

0.7 0.7

0,0,

446

1000

,0,

554

1000

(0,1,0,0,0)

(iii) 7 ×7 random bimatrix game: We consider two

instances of random bimatrix game of size 7 ×7. The

location parameters µ

1

, µ

2

, and scale parameters σ

1

,

σ

2

of independent Cauchy random variables are as

follows:

1. µ

1

=

1 2 2 4 3 2 1

1 1 2 1 3 2 2

3 2 1 2 4 2 1

2 4 2 2 3 4 1

1 2 4 5 2 2 3

1 3 4 3 2 2 3

2 1 4 2 3 2 1

,σ

1

=

2 3 1 2 1 1 2

1 1 3 1 2 2 4

2 1 3 1 3 3 1

2 2 5 4 2 1 3

2 1 3 1 3 5 2

1 2 3 1 2 3 2

2 1 4 2 3 1 2

,

µ

2

=

1 2 3 2 3 2 1

1 2 3 1 2 1 4

2 1 2 1 3 4 2

1 2 3 2 4 2 1

2 3 1 4 2 1 3

1 2 3 2 1 3 4

2 3 1 2 3 4 2

, σ

2

=

5 2 4 2 1 2 3

1 2 2 4 3 2 1

2 3 4 3 3 2 3

2 3 2 1 3 5 3

2 1 2 3 4 3 4

1 2 2 3 1 3 1

2 4 1 2 3 1 2

.

2. µ

1

=

1 2 3 1 3 4 1

2 1 2 1 2 4 2

1 2 1 5 3 2 1

1 3 2 2 3 2 1

2 3 4 5 2 1 3

1 3 2 1 2 4 3

2 1 3 2 1 2 1

,σ

1

=

1 3 1 2 1 2 2

2 1 3 1 2 2 4

2 1 3 2 3 4 1

2 2 3 4 2 1 3

2 4 3 1 3 2 2

1 2 3 2 2 4 2

2 3 4 1 3 1 2

,

µ

2

=

2 1 3 4 3 2 1

1 2 3 3 2 1 4

2 1 2 1 3 4 2

1 2 3 2 4 2 1

2 3 2 4 2 1 3

1 2 1 2 5 3 4

2 3 1 2 1 4 2

, σ

2

=

5 2 4 3 1 2 3

1 2 3 4 3 2 3

1 3 4 2 1 2 3

2 3 2 2 3 4 3

2 1 2 2 4 1 4

2 3 2 3 4 3 1

2 4 3 2 3 1 2

.

The Table 3 summarizes the Nash equilibria of

chance-constrained game corresponding to datasets

given for two instances of 7 × 7 random bimatrix

game.

Table 3: Nash equilibria for various values of α.

No.

α Nash Equilibrium

α

1

α

2

x

∗

y

∗

1

0.4 0.4

0,0,

2

3

,

1

3

,

0,0,0

0,0,0,0,

505

1000

,

495

1000

,0

0.5 0.5

0,0,

2

3

,

1

3

,

0,0,0

0,0,0,0,

2

3

,

1

3

,0

0.7 0.7

1,0,0,0,

0,0,0

0,0,0,0,

1,0,0)

2

0.4 0.4

1

5

,0,

13

25

,0,

7

25

,0,0

0,0,

13

50

,0,

675

1000

,

65

1000

,0

0.5 0.5

1

2

,0,

1

2

,0,

0,0,0

0,0,0,0,

1,0,0

0.7 0.7

1,0,0,0,

0,0,0

0,0,0,0,

1,0,0

A Complementarity Problem Formulation for Chance-constraine Games

65

4 CONCLUSIONS

We formulate the bimatrix game with random payoffs

as a chance-constrained game. We consider the case

where the entries of payoff matrices are independent

random variables following a certain distribution. In

particular, we discuss the case of normal and Cauchy

distributions. We show that the chance-constrained

game corresponding to normal distribution can be for-

mulated as an equivalent NCP. Further if the entries of

payoff matrices are also identically distributed with

non-negative mean, a uniform strategy pair is a Nash

equilibrium. We show that the chance-constrained

game corresponding to Cauchy distribution can be

formulated as an equivalent LCP. Recently, the elec-

tricity markets over the past few years have been

transformed from nationalized monopolies into com-

petitive markets with privately owned participants.

The uncertainties in electricity markets are present

due to various external factors. These situations can

be modeled as chance-constrained games and the ap-

proaches developed in this paper can be applied to

compute the Nash equilibrium.

REFERENCES

Bazaraa, M., Sherali, H., and Shetty, C. (2006). Nonlinear

Programming Theory and Algorithms. John Wiley and

Sons, Inc., U.S.A, Third ed.

Blau, R. A. (1974). Random-payoff two person zero-sum

games. Operations Research, 22(6):1243–1251.

Cassidy, R. G., Field, C. A., and Kirby, M. J. L. (1972). So-

lution of a satisficing model for random payoff games.

Management Science, 19(3):266–271.

Charnes, A. and Cooper, W. W. (1963). Determinis-

tic equivalents for optimizing and satisficing under

chance constraints. Operations Research, 11(1):18–

39.

Charnes, A., Kirby, M. J. L., and Raike, W. M. (1968).

Zero-zero chance-constrained games. Theory of Prob-

ability and its Applications, 13(4):628–646.

Cheng, J. and Lisser, A. (2012). A second-order cone

programming approach for linear programs with joint

probabilistic constraints. Operations Research Let-

ters, 40(5):325–328.

Collins, W. D. and Hu, C. (2008). Studying interval val-

ued matrix games with fuzzy logic. Soft Computing,

12:147–155.

Couchman, P., Kouvaritakis, B., Cannon, M., and Prashad,

F. (2005). Gaming strategy for electric power with

random demand. IEEE Transactions on Power Sys-

tems, 20(3):1283–1292.

DeMiguel, V. and Xu, H. (2009). A stochastic multiple

leader stackelberg model: analysis, computation, and

application. Operations Research, 57(5):1220–1235.

Deng-Feng Li, J.-X. N. and Zhang, M.-J. (2012). Inter-

val programming models for matrix games with in-

terval payoffs. Optimization Methods and Software,

27(1):1–16.

Ferris, M. C. and Munson, T. S. (2000). Complementarity

problems in GAMS and the PATH solver. Journal of

Economic Dynamics and Control, 24:165–188.

Jadamba, B. and Raciti, F. (2015). Variational inequality ap-

proach to stochastic nash equilibrium problems with

an application to cournot oligopoly. Journal of Opti-

mization Theory and Application, 165(3):1050–1070.

Johnson, N. L., Kotz, S., and Balakrishnan, N. (1994). Con-

tinuous Univariate Distributions, volume 1. John Wi-

ley and Sons Inc., 2nd edition.

Katzwer, R. (2013). Lemke-Howson Algorithm for 2-Player

Games. File ID: #44279 Version: 1.3.

Lemke, C. and Howson, J. (1964). Equilibrium points of

bimatrix games. SIAM Journal, 12:413–423.

Lemke, C. E. (1965). Bimatrix equilibrium points and

mathematical programming. Management Science,

11(7):681–689.

Li, D.-F. (2011). Linear programming approach to solve

interval-valued matrix games. Journal of Omega,

39(6):655–666.

Mazadi, M., Rosehart, W. D., Zareipour, H., Malik, O. P.,

and Oloomi, M. (2013). Impact of wind integration

on electricity markets: A chance-constrained Nash

Cournot model. International Transactions on Elec-

trical Energy Systems, 23(1):83–96.

Mitchell, C., Hu, C., Chen, B., Nooner, M., and Young,

P. (2014). A computational study of interval-valued

matrix games. In International Conference on Com-

putational Science and Computational Intelligence.

Munson, T. S. (2000). Algorithms and Environments for

Complementarity. PhD thesis, University of Wiscon-

sin - Madison.

Nash, J. F. (1950). Equilibrium points in n-person games.

Proceedings of the National Academy of Sciences,

36(1):48–49.

Neumann, J. V. (1928). Zur theorie der gesellschaftsspiele.

Math. Annalen, 100(1):295–320.

Nocedal, J. and Wright, S. J. (2006). Numerical Optimiza-

tion. Springer Science + Business Media LLC, New

York, 2 edition.

Pr

´

ekopa, A. (1995). Stochastic Programming. Springer,

Netherlands.

Ravat, U. and Shanbhag, U. V. (2011). On the characteriza-

tion of solution sets of smooth and nonsmooth convex

stochastic Nash games. Siam Journal of Optimization,

21(3):1168–1199.

Schmelzer, S. (2012). COMPASS: A free solver for mixed

complementarity problems. Master’s thesis, Univer-

sit

¨

at Wien.

Singh, V. V., Jouini, O., and Lisser, A. (2015a).

Existence of nash equilibrium for chance-

constrained games. http://www.optimization-

online.org/DB FILE/2015/06/4977.pdf.

Singh, V. V., Jouini, O., and Lisser, A. (2015b). Exis-

tence of nash equilibrium for distributionally robust

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

66

chance-constrained games. http://www.optimization-

online.org/DB FILE/2015/09/5120.pdf.

Song, T. (1992). Systems and Management Science by

Extremal Methods, chapter On random payoff matrix

games, pages 291–308. Springer Science + Business

Media, LLC.

Valenzuela, J. and Mazumdar, M. (2007). Cournot prices

considering generator availability and demand un-

certainty. IEEE Transactions on Power Systems,

22(1):116–125.

Wolf, D. D. and Smeers, Y. (1997). A stochastic version of a

Stackelberg-Nash-Cournot equilibrium model. Man-

agement Science, 43(2):190–197.

Xu, H. and Zhang, D. (2013). Stochastic nash equilibrium

problems: sample average approximation and applica-

tions. Computational Optimization and Applications,

55(3):597–645.

A Complementarity Problem Formulation for Chance-constraine Games

67