A Binary Cuckoo Search Algorithm for Solving Project Portfolio

Problem with Synergy Considerations

Mohammed M. S. El-Kholany and Hisham M. Abdelsalam

Faculty of Computers & Information, Cairo University, 5 Ahmed Zewail Street, Cairo, Egypt

Keywords: Project Portfolio Selection (PPS), Synergy of Project, Cuckoo Search Algorithm.

Abstract: Many companies are moving toward a project-oriented way of managing their businesses while considering

the risk of losing the limited available resources because of selecting incorrect projects to be executed. With

a number of candidate projects larger than those which can be funded, organizations aim to select projects

that maximize benefit and enhance their competitive advantages. These reasons force organizations to

search for more effective techniques to improve their decision with project selection. The consideration of

synergy between projects is not addressed much in literature. This paper proposes new meta-heuristic

technique which is Cuckoo Search Algorithm to solve Project Portfolio Selection problem with synergy

among various projects is considered. Four scenarios are experimented on 0 – 1 optimization problem

contains two constraints budget and segmentation to show performance algorithm through iterations with

changing scenarios in addition to the effect of synergy on projects selection and total benefit for the

organization.

1 INTRODUCTION

An organization decision whether to select a project

for implementation or not is a crucial decision. Such

a decision has a high impact on the organization

resources and its benefit. On one hand the

organization loses resources which are used in

unsuitable projects and, on the other hand, it loses

benefit of more suitable projects that could have

been implemented instead, to achieve more benefit

for organization (Shakhsi-Niaei et al., 2011). This

kind of decisions is called Project Portfolio Selection

(PPS) in which a set of proposed or candidate

projects compete for scarce resources to be

implemented and satisfy all constraints. Project

Portfolio Selection (PPS) is choosing a group of

candidate projects to maximize benefit of

organization (Archer and Ghasemzadeh, 1999).

Research efforts were exerted in this direction to

develop and design models that represent the nature

of the PPS problem and to solve it using either

simulation techniques or optimization techniques.

PPS problem is classified as complex decision

making process due to many factors affecting the

decision such as: determining weights of different

criteria, performance value for each project in

addition to, other qualitative and quantitative factors

should be considered in decision making (Güngör

and Can, 2011). Careful attention should be given

when selecting the set of projects to be implemented,

as every organization tries to achieve its conflicting

organizational objectives while having a limited

amount of resources (Ahn et al., 2010). One of the

factors affecting the decision making process

concerning the PPS problem is the high level of risk

due to uncertainty or incompleteness of information

about the problem.

A recent stream of research was proposed to deal

with uncertainty in portfolio selection decision.

Studies such as (Shakhsi-Niaei et al, 2011) and

(George et al., 2013) proposed a two-stage

techniques that mainly depend on using Monte Carlo

simulation and considering the output of the first

stage as input for the second.

Several Evolutionary Algorithms (EA) were used

to solve the PPS problem since it is classified as NP-

hard and it is difficult to use exact algorithms to

solve it. Some of the EA used to solve this kind of

problem are Scatter Search Algorithm, Genetic

Algorithm (GA), Ant Colony Optimization (ACO)

and Cuckoo Search Algorithm (CS). Scatter Search

algorithm was introduced in (Carazo et al., 2010) to

aid decision maker to select optimal project

130

El-Kholany, M. and Abdelsalam, H.

A Binary Cuckoo Search Algorithm for Solving Project Portfolio Problem with Synergy Considerations.

DOI: 10.5220/0005694201300136

In Proceedings of 5th the International Conference on Operations Research and Enterprise Systems (ICORES 2016), pages 130-136

ISBN: 978-989-758-171-7

Copyright

c

2016 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

portfolio. The model takes into account

interdependencies between projects which are

assessed in groups, also the model takes into

consideration multiple objectives without taking

preferences from decision maker.

Doerner (2004) deployed Ant Colony

Optimization to solve multi-objective PPS with

limited resources. A modified Pareto Ant Colony

Optimization algorithm was introduced by

(Tofighian and Naderi, 2015) in order to solve a PPS

mixed integer linear programming model to

maximize total benefit.

A binary Cuckoo Search Algorithm to solve PPS

was proposed by (El-kholany and Abdelsalam,

2015), it considered two types of constraints budget

and segmentation constraints. The algorithm results

showed that Cuckoo Search was an efficient choice

to solve this type of problem compared to Lingo

software results. Cuckoo Search Algorithm is new

meta-heuristic technique proposed by (Yang and

Deb, 2009) to solve combinatorial and NP-Hard

problems. This algorithm proved its efficiency for

getting solutions better than other heuristics such as

Genetic Algorithm and Particle Swarm Optimization

(Roy and Sinha Chaudhuri, 2013).

A main factor that affects the Project Portfolio

Selection problem is whether or not there is synergy

between the projects. Synergy can be defined as the

complement between two or more projects that

generate additional benefit besides projects’ own

benefit if executed separately. Synergy is powerful

phenomenon to execute projects together to increase

benefit with consuming the fewest available

resources. A framework of IT portfolio selection

was proposed by (Cho and Shaw, 2009) to examine

the importance effect of IT synergy. IT synergy was

classified into three types several sub additive cost,

two-way super-additive and one-way super additive

that used index ,& respectively and effects of

different types were examined and concluded that

firms with high tolerance and moderate are more

likely to obtain IT portfolio than firms with low

tolerance. In (Almeida and Duarte, 2011) a binary

non-linear decision model was proposed to study the

effect of synergy on the PPS decision. ACO is used

to solve PPS problem considering synergy and one

of its special cases where two or more projects

cannot be financially supported in the same time in

(Rivera et al., 2013). A framework considering

synergy between IT projects on the risk and return of

portfolio was proposed in (Cho and Shaw, 2013).

The main focus of this paper is to propose a

cuckoo search algorithm to study the effect of

synergy between projects on project portfolio

selection; considering segmentation and budget

constraints. The data used to perform the study and

test the algorithm was extracted from (Shakhsi-Niaei

et al., 2011) in the case of no synergy used. For

synergy case, the interdependencies data matrix was

generated hypothetically to study the impact of

considering synergy while selecting projects to be

implemented.

Following the introduction, the rest of the paper

is organized as follows. Section 2 covers the

problem formulation as a mathematical model.

Followed by the proposed solution algorithm in

Section 3. While Section 4 provides the results and

numerical analysis of the problem. Finally,

conclusions are given in Section 5.

2 PROBLEM DEFINITION AND

MATHEMATICAL MODEL

The problem considered here is one of the main

problems found in project based organizations. The

problem lies in that there is a set of candidate

projects that the organization should choose from -to

implement- in order to maximize its benefit without

violating any constraints. Two main cases are going

to be covered of this problem, the first is the effect

of executing each project alone on the company’s

total benefit and other is the synergy effect.

2.1 Project Evaluation

The project evaluation consists of two parts, benefit

for each project separately and the second is synergy

evaluation were proposed by (Almeida and Duarte,

2011).

Let’s assume m candidate projects to be

implemented and the evaluation will be based on n

criteria. Each project has performance value for each

criterion where each project is represented by an

array

where each value in the array for

example

, represents the performance value for

project 1 in criterion 2.

=

,

...

,

∀=1,2,….

(1)

Performance value for all projects can be

represented by Matrix Z, where each row represents

project and each column represents criterion j and

is performance value for project in criterion.

=

⋯

⋮⋯⋮

⋯

(2)

A Binary Cuckoo Search Algorithm for Solving Project Portfolio Problem with Synergy Considerations

131

Each criterion is assigned a weight where the

summation of these weights should equal to one

Equation 3.

=

,

,…,

,

=1

(3)

For each project, benefit is evaluated by

multiplying each criterion with performance value

represented by equation (4)

=

∀=1,2,……,

(4)

2.2 Synergy Evaluation

To establish measurement for synergy between

projects, decision maker determines added value

percentage to each project by his experience by

joining other projects in the portfolio. Synergy can

be evaluated by answering two questions

(Damodaran, 2005): (1) what is the form of synergy

expected to take? For example, in economic scale,

will the synergy reduce cost and increase profit? Or

market power, will it increase further growth?

; and (2) when will the synergy effect start?

There are 3 steps to estimate synergy: (1) benefit

for each project is estimated separately; (2) the value

of the combined projects are evaluated, without

synergy by adding values that obtained in first step;

and (3) by expecting rate of growth, combined

projects with synergy is evaluated and the difference

between the value of combined projects without

synergy and value of combined projects with

synergy provides value of synergy.

Relationships between projects can be changed

by changing strategy of company. For example,

organization changed its strategy from increasing

profit to applying legal projects. Legal Projects can

coordinate interactions more effectively than others

that increase profit (Cho and Shaw, 2013) as a result

of this decision maker increases value percentage for

legal projects. Synergy is important feature differs

because from other criteria which involves

interrelated groups of projects, when whole

synergetic group is supported the benefit are bigger

than the same group will be applied separately

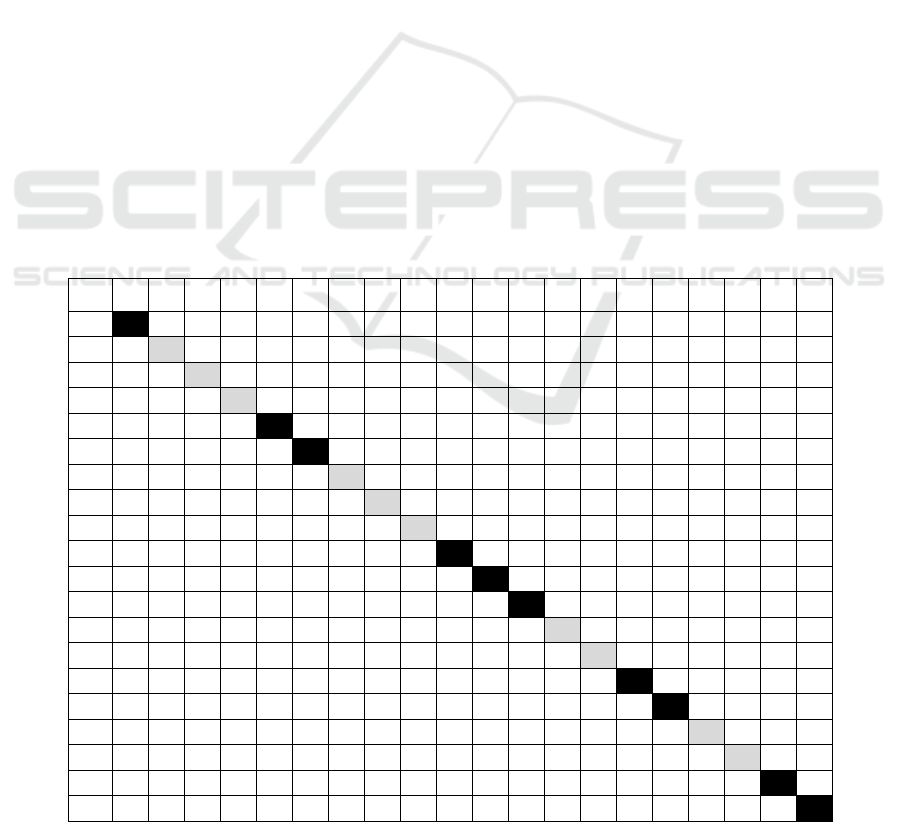

(Rivera et al., 2013). Synergy matrix was developed

in matrix (5) to represent synergy between projects.

=

⋯

⋮⋯⋮

⋯

(5)

Where

is degree of contribution of project to

project, in percentage value of project.

2.3 Objective Function

Objective function is to maximize fitness which

evaluated by aggregating benefit and synergy

evaluation in equation (6).

=

+

(6)

D.V

=

1

0

(7)

2.4 Constraints

There are two types of constraints as mentioned in

(Shakhsi-Niaei et al., 2011). The first is budget

constraint equation (8), where the implementation cost

of all the selected projects cannot exceed the available

organizational budget.

≤

(8)

Where

is cost of project to be carried out and

budget is total available budget for organization.

The second type of constraints is segmentation

constraint, where all the projects are classified into

three general categories A, B and C. Each category

must achieve specific percentage from all selected

projects. Equations (9-11) will represent

segmentation constraints.

≤1

(9)

≤2

(10)

≤3

(11)

1,2 and 3 are percentage of candidate

projects to be achieved for each type.

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

132

3 PROPOSED SOLUTION

ALGORITHM

3.1 Cuckoo Search Algorithm

Cuckoo Search is new meta-heuristic technique

which simulates behaviour of cuckoo bird which is

laying its eggs on nest for host bird. Cuckoo Female

special way in mimicry colour and pattern of the egg

in order to decrease probability of eggs being

abandoned and increase reproductively. Cuckoo has

skill in the timing of laying eggs by selecting host

bird’s nest just laid its eggs so, cuckoo eggs hatch

earlier than host eggs. Once first child cuckoo is

hatched, it moves randomly and throws other eggs

for host bird which increases probability of cuckoo

to share food with host bird. There are rules applied

in algorithm

• Each Cuckoo lays one egg at time and chosen

nest to dump its egg randomly.

• Nest with best quality will be remained to next

generation.

• Number of nests is fixed, probability of

discovering host bird cuckoo egg Pa

∈

[0,1].

The quality of nests is determined by value of

objective function. For maximization problems, nest

that achieves maximum value for given objective

function will be the best and will continue for next

generation. Figure 1 provides pseudo code for

Cuckoo Search Algorithm.

3.2 Implementation Step

3.2.1 Solution Representation

Cuckoo Search is a multi solution algorithm, each

solution is represented by nest. For the problem at

hand, the solution is represented by length M which

is total number of candidate projects. Available

values for each cell either zero or one. If cell number

assigned to 1 so project will be selected otherwise

project will not be selected.

3.3 Binary Cuckoo Search

Cuckoo Search is meta-heuristic technique designed

to handle continuous variables which are generated

between upper and lower bound however, more

researcher modified it to handle discrete and binary

problems. An improved Cuckoo Search was

proposed in (Feng et al., 2014) for solving knapsack

problem by converting continuous numbers to binary

using sigmoid function as shown in equation 12.

=

1(

)0.5

0

(12)

Where

is real nest number ,

is binary nest

(

)

=

1

(1+

)

3.4 Handling Constraints

The problem on hand has two types of constraints:

budget and segmentation constraints. Two methods

were applied to handle these kinds of constraints.

Greedy Transform Method (GTM) was proposed to

handle the budget constraint as applied in (Feng et

al., 2014), this function depends on calculating

efficiency for each decision variables by dividing

benefit by cost and select most efficient decision

variable as long as constraint is satisfied.

Segmentation handling was proposed by (El-kholany

and Abdelsalam, 2015) to handle second type of

constraints.

3.5 Generation New Solution and

Stopping Criteria

Two ways are applied to generate new solution.

Lévy flight distribution represented in equation 13 is

used to generate new solution. The other way was

proposed by (Feng et al., 2014) and replaced by

function of discovering host bird for cuckoo eggs in

its own nest. Algorithm stopped when it reaches to

predefined maximum number of iterations.

Figure 1: Cuckoo Search Algorithm.

A Binary Cuckoo Search Algorithm for Solving Project Portfolio Problem with Synergy Considerations

133

()

=

+⊕é()

(13)

Where

()

is solution for next generation

()

is solution in current generation

α is transition probability where α>0

lévy (λ) is random walk based on lévy flights.

4 NUMERICAL ANALYSIS

4.1 Case and Data

Data taken from (Shakhsi-Niaei et al., 2011) was

used to test the proposed algorithm. The data used as

it is in case of no synergy between projects. The data

used was deterministic data in the purpose of

simplicity. While for synergy case, the

interdependencies data matrix was generated

hypothetically to study the impact of considering

synergy while selecting projects to be implemented.

The extracted data covers information about 20

candidate projects in R&D department, only a set of

them should be chosen based on 5 different criteria

as follows:

1. Cost: Total cost is required to complete

selected project.

2. Proposed Methodology: efficiency level of

project planning and discipline.

3. Abilities of personnel: level of experience for

project team that is assigned for proposed

project.

4. Scientific and actual capability: level of

education and scientific degree for team and

scientific degree.

5. Technical capability: ability for providing

technical facilities.

As mentioned in equations (9-11) Basic, Developing

and Applied are three categories represented in case

of research centre in Iran, total available budget is

6000 $ r1, r2 and r3 equal 10%, 30% and 60%

respectively and project types have been mentioned

in (14-16). For example, Project 2, 5 and 1 are of

Basic, Developing and Applied.

+

+

+

+

+

+

≤0.1

(14)

+

+

+

≤0.3

(15)

+

+

+

+

+

+

+

+

≤0.6

(16)

Table 1: Synergy Matrix for Scenario 2.

Projects

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20

1

0.0129 0.0047 0.0182 0.02 0 0.004 0 0.0082 0.0171 0.003 0.011 0 0.0142 0.009 0.001 0.0033 0 0.014 0.003

2

0 0.016 0.0171 0.0029 0.0014 0.0182 0 0.0084 0.0023 0.01 0.0071 0.005 0.0012 0.0213 0.007 0.0017 0 0

3

0.0124 0.0143 0 0.0092 0 0 0.0114 0.0023 0.01 0.0092 0.0045 0.0011 0.0033 0.0029 0.0045 0.022 0.011

4

0.014 0.0061 0.0005 0.0037 0 0.0042 0.0071 0.005 0.0029 0 0.006 0.0291 0.0173 0.003 0 0.0198

5

0.0058 0.0092 0.0058 0 0.0171 0.0419 0.0582 0 0.0044 0.0017 0 0.0631 0.0592 0.0193 0.0839

6

0 0 0.0066 0.0075 0 0.0391 0.0637 0.0039 0 0.0553 0.0794 0.0502 0.0836 0

7

0.0197 0 0 0.0374 0 0.0485 0.031 0.0847 0.045 0 0.0379 0.0883 0.008

8

0.0067 0.0187 0.0384 0.0182 0 0.01 0.0375 0.0274 0.0172 0 0 0.0374

9

0.0182 0 0.0379 0.0576 0.0937 0.0465 0 0.0917 0.0178 0.0112 0.0435

10

0.0176 0.0735 0 0.0818 0 0.0716 0.0183 0.0993 0 0.0375

11

0.0485 0 0.0373 0.0222 0.0188 0 0.0991 0.0737 0.0736

12

0.0118 0.0775 0 0.0884 0.0223 0 0.0919 0.0636

13

0.0226 0 0 0.0732 0.0335 0 0

14

0.0885 0.05 0 0.0449 0.0782 0

15

0

7

29 0 0.0924 0.0394

16

0.0592 0 0.734 0

17

0.304 0 0.055

18

0.0088 0

19

0.0021

20

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

134

Four different scenarios were applied to test how

synergy affects project selection and the company

total benefit:

• Scenario 1 is characterized based on absence of

synergy between projects.

Scenario 2 is applied based on synergy between all

projects together that shown in

• Table 1which assigned based on experts.

• Scenario 3 only project 4 receives

synergistically from other projects.

• Project 18 only contributes synergistically for

all other projects in scenario 4.

4.2 Numerical Results

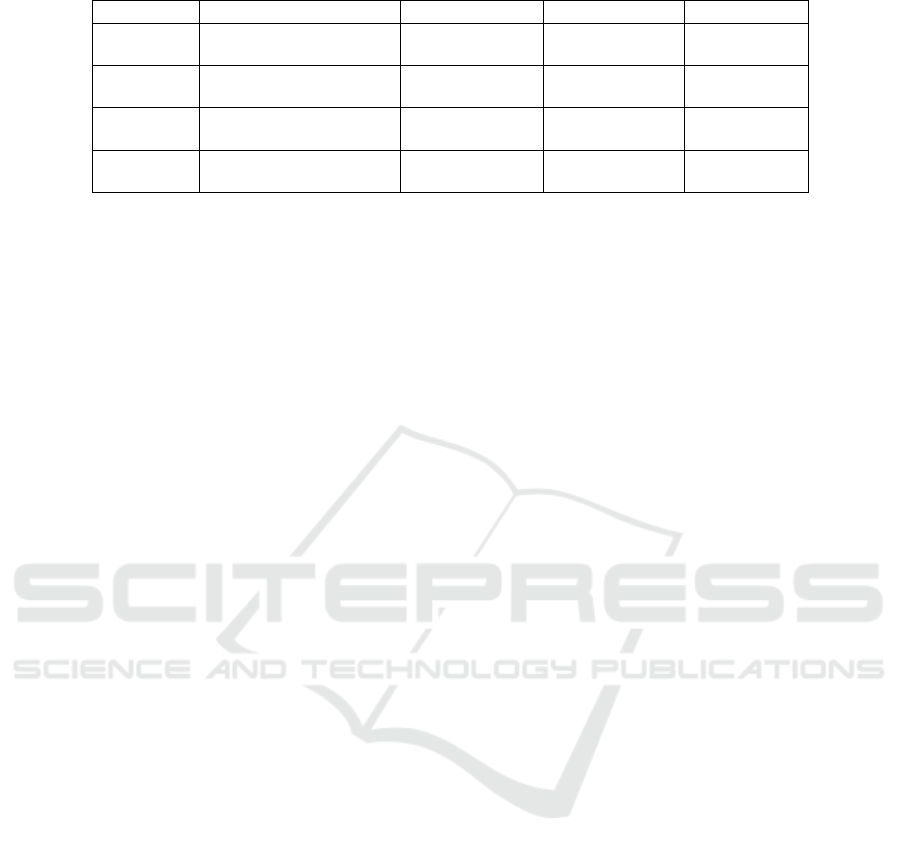

In Table 2 represents the results of applying the

proposed cuckoo search on the extracted data for the

previously mentioned scenarios. The first column of

the table is the scenario number; the second is the set

of projects selected, while the third represents

the total benefit from implementing the selected

portfolio. The fourth column shows the synergy

gained which was calculated by equation 17 and

finally the total cost of the selected portfolio in the

fifth column.

=

∑

∑

∑

∑

(17)

In the first scenario, it is observed that the

projects selected are those with greatest overall

evaluations where synergy between projects wasn’t

taken into consideration. However, when synergy

was considered in scenario 2, project 11 and project

12 is more attractive than projects 3 and13

respectively, because synergy gain provided by

project 11 is 0.2993 that’s greater than synergy gain

provided by project 3 0.0603, on the other hand

project 12 is more attractive than project 13. In

scenario 3 synergy between projects are cancelled

but only project 4 receives synergistically from all

projects which it makes it more attractive project to

be selected than project 20 which are in type C.

Total benefit increases to 634.298 with increase

of 7%. In scenario 4, project 18 contributes

synergistically for all other projects, it entered to

portfolio instead of project 20 which are in type C

and total benefit increased to 652.423 with 5.8%.

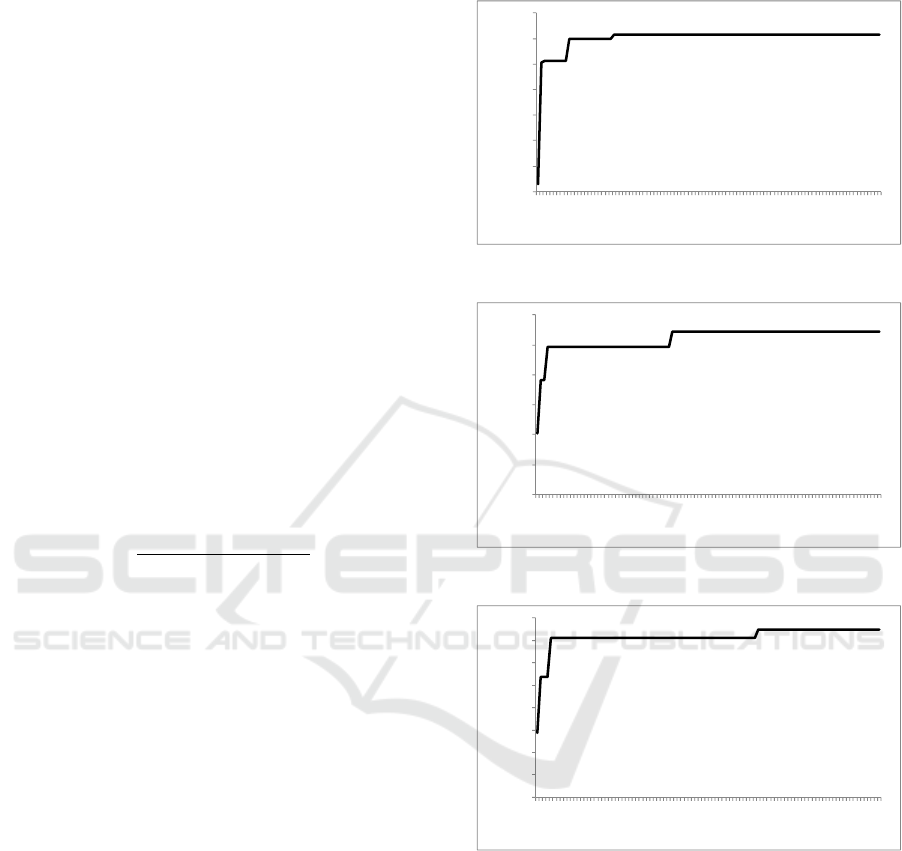

As shown figures 2 – 4 show solution progress

through 100 iterations for scenarios 2 – 4 and

observed that in scenario 2, algorithm got total

benefit 820.01 which is highest value reached at

iteration number 25. On the other hand, scenario 3

takes more time to find maximum solution reached -

Iteration number 41-. Finally, scenario 4 got value of

objective function 652.423 at iteration 65.

Figure 2: Solution Improvement with iteration - Scenario 2.

Figure 3: Solution Improvement with iteration - Scenario 3.

Figure 4:Solution Improvement with iteration - Scenario 4.

5 CONCLUSIONS

The model developed studied the synergy between

projects and provides multi criteria approach for

project portfolio selection. Cuckoo Search algorithm

was proposed to solve the problem considering

synergy relations between projects which were

represented by a matrix. This matrix should be

700

720

740

760

780

800

820

840

1 1223344556677889100

Objective Function

Iteration Number

580

590

600

610

620

630

640

1 1223344556677889100

Objective Function

Iteration Number

615

620

625

630

635

640

645

650

655

1 1223344556677889100

Objective Function

Iteration Number

A Binary Cuckoo Search Algorithm for Solving Project Portfolio Problem with Synergy Considerations

135

Table 2: Scenario Results.

Scenario Portfolio Selected Total Benefit Synergy Gain Total Cost

1

P1 P3 P5 P6 P10 P13

P15 P16 P19 P20

629.28 0 2928

2

P1 P5 P6 P10 P11 P12

P15 P16 P19 P20

820.01 38. 65 % 2896.5

3

P1 P3 P4 P5 P6 P8 P13

P15 P16 P18

634.29 7 % 2947.5

4

P1 P3 P5 P6 P10 P13

P15 P16 P18 P19

652.42 5. 87 % 2949.5

supported by experts or decision makers in order to

be accurate. The solved problem had two types of

constraints: budget and segmentation that were

handled using GTM and Segmentation handling

respectively. Results obtained illustrate the

importance of applying synergy between projects on

the company’s total benefit and the portfolio

selection process. There are several ways to extend

our work is to deal with synergy between groups of

projects in addition to, investigating other types of

Objective functions that also calculate synergy and

considering synergy with multi-objective problems.

REFERENCES

Ahn, M. J., Zwikael, O. & Bednarek, R., 2010.

Technological invention to product innovation: A

project management approach. International Journal

of Project Management, 28(6), pp.559–568.

Almeida, A.T. de & Duarte, M., 2011. A multi-criteria

decision model for selecting project portfolio with

consideration being given to a new concept for

synergies. Pesquisa Operacional, 31(2), pp.301–318.

Archer, N.. N.P. & Ghasemzadeh, F., 1999. An integrated

framework for project portfolio selection.

International Journal of Project Management, 17(4),

pp.207–216.

Carazo, A. F., Gómez, T., Molina, J., Hernández-Díaz, A.

G., Guerrero, F. M., & Caballero, R. (2010). Solving a

comprehensive model for multiobjective project

portfolio selection. Computers & operations

research,37(4), 630-639.

Cho, W. & Shaw, M.J., 2009. Does IT Synergy Matter in

IT Portfolio Selection? ICIS 2009 Proceedings, p.160.

Cho, W. & Shaw, M.J., 2013. Portfolio selection model

for enhancing information technology synergy. IEEE

Transactions on Engineering Management, 60(4),

pp.739–749.

Damodaran, A., 2005. The value of synergy. Available at

SSRN 841486.

El-kholany, M.M.S. & Abdelsalam, H.M., 2015. Optimal

Project Portfolio Selection Using Binary Cuckoo

Search Algorithm. Metaheuristics Internationa

Conference, June..

Feng, Y., Jia, K. & He, Y., 2014. An improved hybrid

encoding cuckoo search algorithm for 0-1 knapsack

problems. Computational intelligence and

neuroscience, 2014, p.1.

George, M., Mavrotas, G. & Pechak, O., 2013. The

trichotomic approach for dealing with uncertainty in

project portfolio selection: combining MCDA,

mathematical programming and Monte Carlo

simulation. International Journal of Multicriteria

Decision Making, 3(1), pp.79–96.

Rivera, G., Gómez, C.G., Fernández, E.R., Cruz, L.,

Castillo, O. & Bastiani, S.S., 2013. Handling of

synergy into an algorithm for project portfolio

selection. In Recent Advances on Hybrid Intelligent

Systems (pp. 417-430). Springer Berlin Heidelberg.

Roy, S. & Sinha Chaudhuri, S., 2013. Cuckoo Search

Algorithm using Lèvy Flight: A Review. International

Journal of Modern Education and Computer Science,

5(12), pp.10–15.

Shakhsi-Niaei, M., Torabi, S. a. A. & Iranmanesh,

S.H.S.H., 2011. A comprehensive framework for

project selection problem under uncertainty and real-

world constraints. Computers & Industrial

Engineering, 61(1), pp.226–237.

Tofighian, A.A. & Naderi, B., 2015. Modeling and solving

the project selection and scheduling. Computers &

Industrial Engineering, 83, pp.30–38.

Yang, X.-S. & Deb, S., 2009. Cuckoo search via Lévy

flights. In Nature & Biologically Inspired Computing,

2009. NaBIC 2009. World Congress on. pp. 210–214.

Güngör, Ş. Ceyda & Erkan Can, G., 2011. A Simulation

Based Optimization Methodology for Information

System Project Selection Problem. In

Trends in the

Development of Machinery and Associated

Technology. pp. 241–244.

Doerner, K., Gutjahr, W.J., Hartl, R.F., Strauss, C. and

Stummer, C., 2004. Pareto ant colony optimization: A

metaheuristic approach to multiobjective portfolio

selection. Annals of operations research, 131(1-4),

pp.79-99.

ICORES 2016 - 5th International Conference on Operations Research and Enterprise Systems

136