Towards an Understanding of the Connected Mobility Ecosystem from a

German Perspective

Anne Faber, Adrian Hernandez-Mendez and Florian Matthes

Chair of Software Engineering for Business Information Systems, Technische Universit

¨

at M

¨

unchen,

Garching bei M

¨

unchen, Germany

Keywords:

Connected Mobility, Ecosystem, Visualization.

Abstract:

This paper presents a model of the connected mobility ecosystem, which contains a description of the as-

sociated industry. Although connected mobility is a topic of global relevance and interest, we analyzed the

ecosystem from a Germany perspective due to Germany’s strong history of automotive OEMs and suppliers.

To gain a better understanding of the mobility ecosystem, we introduced a modified ego network visualization

focusing on mobility services. This visualization guarantees an user-centred design analysis of the ecosystem

and enables stakeholders to identify companies that are highly contributing in providing these services and

rather passive contributors. Additionally, it allows ecosystem stakeholders to understand the complex collab-

orations of companies in providing mobility services. We plan to continue our work focusing on mobility

scenarios addressing the needs and demands of mobility consumers.

1 INTRODUCTION

The enterprise’s competitive battleground is shifting

towards creation and contribution within the ecosys-

tem in which the business exists (Bosch, 2016).

This increases the relevance of modeling enterprises

from a holistic point of view, which considers not

only the company itself yet their business relation-

ships, networks, and alliances (Kelly, 2015) with part-

ners, suppliers, customers, and competitors (Bosch,

2016). Knowing and understanding the entire ecosys-

tem could lead to the selection of strategy deciding

about enterprise’s success or failure.

Several approaches for modeling the business

ecosystems are used in research. For example, the

importance of digital business ecosystems for small

and medium-sized enterprises (SME) in Europe is de-

scribed in (Nachira, 2002). Whereas, Basole et al. fo-

cus on the visualization and understanding of dynam-

ics of business ecosystems following a data-driven

approach ((Basole and Karla, 2011), (Basole et al.,

2015), (Iyer and Basole, 2016)).

As digitalization and its advancements has long

reached the personal urban mobility and is transform-

ing the mobility landscape (Henfridsson and Lind-

gren, 2005), it is also transforming the ecosystem for

mobility. Digital technologies are continuously inte-

grated in vehicles, traffic systems, and infrastructure

(Mitchell, 2010), and are changing the mobility be-

havior of humans, especially in big cities. New phe-

nomenon such as shared mobility, which includes car

sharing, ridesharing, and bike sharing, and their cor-

responding sustainability business models, arise (Co-

hen and Kietzmann, 2014). Thereby, the digitization

of mobility is often addressed with the term ”con-

nected mobility”, to emphasize the interconnected-

ness between mobility consumers, vehicles, and traf-

fic systems and infrastructure, both by industry (e.g.,

(Rossbach et al., 2013), (Robert Bosch GmbH, 2012),

(Mathes et al., 2015)) and research ((Plum, 2016),

(TUM LLCM, 2015)).

With this shift – from mobility to connected mo-

bility – the classical mobility ecosystem, consisting

mainly of automotive original-equipment manufac-

turers (OEMs), their specialized parts supplier con-

tributing in the value chain of car manufacturing and

public transportation and car rental companies offer-

ing complementary mobility to using the own car is

rapidly accelerating. Digital giant such as Google

and Apple are entering the mobility scene, especially

in connecting with self-driving cars and autonomous

driving ((Etherington and Kolodny, 2016), (Taylor,

2016)). As new groups of industries entering the

ecosystem, established mobility players are forced to

focus on innovation regarding the connectivity, safety

and assisted driving (Mosquet et al., 2015). By offer-

Faber, A., Hernandez-Mendez, A. and Matthes, F.

Towards an Understanding of the Connected Mobility Ecosystem from a German Perspective.

DOI: 10.5220/0006388005430549

In Proceedings of the 19th International Conference on Enterprise Information Systems (ICEIS 2017) - Volume 3, pages 543-549

ISBN: 978-989-758-249-3

Copyright © 2017 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

543

ing own mobility services, such as BMW’s DriveNow

(BMW Group, 2017) or Daimler’s Car2Go (Daim-

ler AG, 2017), the automotive OEMs are already ad-

dressing these changes. This holds true also for public

transportation companies offering for example mobile

scheduling and ticketing. Thus, the connected mobil-

ity ecosystem demonstrates innovative characteristics

and a high dynamic.

The aforementioned elements are the main chal-

lenges of modeling the connected mobility ecosys-

tem, which also includes a description of the industry

structure.

The research approach could be considered as the

first iteration of Hevner’s three cycle view of the de-

sign science research framework (Hevner, 2007). The

three cycles within this research framework corre-

spond to:

• Relevance cycle: Identifying relevant entities and

their relations, in the connected mobility indus-

try by analysing related German companies. Al-

though connected mobility is a topic of global rel-

evance and interest, we consider that Germany of-

fers a good starting point for the analysis of the

connected mobility ecosystem, due to the strong

history of automotive OEMs and suppliers.

• Design cycle: Representing the ecosystem model

with a modified ego network visualization type fo-

cusing on mobility services. This approach is ap-

plied to the connected mobility ecosystem from a

German perspective.

• Rigor cycle: Evaluating the existing literature of

modeling business ecosystems, especially the data

visualization following a data-centric approach

and extend the existing models with an ecosystem

services focus.

Additionally, we lay the groundwork for evaluat-

ing the requirements for a tool, which allows the

ecosystem stakeholders to explore and thereby under-

stand the connected mobility ecosystem from an user-

centered design perspective.

The remainder of this paper is organized as fol-

lows: section 2 describes the process steps to visual-

ize the connected mobility ecosystem with an user-

centered approach. Subsequently, the German per-

spective of the connected mobility ecosystem is dis-

cussed in section 3 together with limitations of the ap-

proach in section 4. Finally, in section 5 we conclude

and provide an outlook for future work.

2 VISUALIZING THE

CONNECTED MOBILITY

ECOSYSTEM

One possible way to support stakeholders in gaining

a better understanding of the ecosystem their compa-

nies are acting in is applying a visual approach (Iyer

and Basole, 2016). The resulting network visual-

izations are valuable for executives, venture capital-

ists and additional user groups in supporting them in

their ecosystem related decisions and thus applying

the ”wide lens” (Basole et al., 2016).

To gain insights about the connected mobility

ecosystem, we apply the proposed visual approach,

which consists of the four process steps (1) Determine

industry structure, (2) Identify companies and their

attributes, (3) Finalize semantics for nodes and de-

pendencies and (4) Visualize, analyze, and interpret.

2.1 Determine Industry Structure

The first step of the visual approach to understand

ecosystems is analyzing the industry structure ( i.e.,

the connected mobility industry). To identify and de-

termine the value chain of the connected mobility, in-

dustry and trade publications and newspaper articles

addressing the connected mobility were considered

(e.g., (Rossbach et al., 2013), (Robert Bosch GmbH,

2012), (Mathes et al., 2015), (Mosquet et al., 2015)).

The identified stack is shown in Table 1.

Additional to the classic mobility ecosystem players –

the automotive OEMS, their parts suppliers, car rental

agencies and public institutions offering public trans-

portation – new industry groups gain relevance.

The first addition to the classic mobility stack are

technology companies, which vary from companies

focusing on advanced driver assistance systems, ma-

chine learning, artificial intelligence to cyber security

(Nayak, 2016), all addressing the digitized advance-

ments of mobility. These companies enrich the mobil-

ity environment by adding completely new services,

such as the Starship’s delivery robot, or by supplying

automotive OEMs with software and hardware, such

as thinkstep’s data analysis software. For a better un-

derstanding of the influence of technology companies

on the ecosystem, a further subdivision of this group

is envisioned for the future.

Companies offering the transmission of data and

providing access to mobility services are bundled

in the platform and connectivity provider group.

Thereby, they play an important role in enabling dig-

itized mobility, connecting users to the provided ser-

vices.

AEM 2017 - 1st International Workshop on Advanced Enterprise Modelling

544

Table 1: Identified connected mobility stack.

Automotive OEMs For example, BMW, Volkswagen, Mercedes

Parts Supplier For example, Robert Bosch, Drxlmaier, Continental, Denso

Technology Companies For example, thinkstep AG, Panoratio, Starship Technologies, Siemens

Platform & Connectivity Provider For example, Deutsche Telekom, Vodaphone, Google, RideCell

New competitors of affected industries For example, Allianz, RWE, Sixt

Public Institutions For example, City of Munich, SWM (Munich City Utilities operating

inner city city public transportation), StMWi (Bavarian Ministry of

Economic Affairs and Media, Energy and Technology)

Mobility services address the user’s wish for mo-

bility as a service, which is ”a mobility distribution

model in which all users major transport needs are

met over one interface and are offered by mobility op-

erators” (ITS Finland, 2015). Mobility services gain-

ing more and more importance, especially in cities,

and might even be the future of OEMs business, re-

placing the automotive production and sales (Bots-

man, 2015). Using mobility services to get from point

A to B, mobility consumers have the option to choose

several means of transportation. Especially popular

and widely discussed became transportation network

companies (TNCs) as mobility services, such as Uber,

Lyft or Gett, which connect private drivers using their

own cars to passengers searching for a lift.

New competitors of affected industry also recog-

nize the advancements in connection with digitized

mobility. An obvious example are insurance com-

panies, offering insurance rates depending on driving

habits or user’s general mobility footprint. Other in-

dustries are energy providers, addressing the charg-

ing challenge in connection with e-mobility. As the

affected industries – compared to other groups of the

connected mobility ecosystem stack – participate but

not shape the ecosystem, they are collectively repre-

sented.

The last group of entities, identified in the con-

nected mobility ecosystem, covers public institutions

including public transportation companies in the clas-

sic mobility ecosystem. These companies have to

adapt to the digitized service landscape for exam-

ple by proving online travel planning and ticketing.

However, of even greater importance are public in-

stitutions responsible for legal and tax regulations.

They have the power and ability to influence the

mobility ecosystem by enabling business models or

forestalling them. Especially in the context of pri-

vacy of mobility data and the liability in context with

autonomous driving, new regulations are necessary

(Collingwood, 2016), which will form the connected

mobility ecosystem.

The separation of these identified groups of

ecosystem entities is not strict, as entities might fit

into more than one group. This will be considered

in the refinements of the stack, which are necessary

since the ecosystem further evolves.

2.2 Identify Companies and Attributes

To understand the connected mobility ecosystem, for

all identified industry groups of the connected mobil-

ity stack (see Table 1) companies and their attributes

have to be gathered and documented. Additionally,

the type of relationship between these entities is re-

quired to understand the interaction within the ecosys-

tem. Thereby, the type of relationship varies from ne-

gotiation and failed talks, investments, partnership or

cooperations, personnel move to acquisitions. With

the large amount of entities in the connected mobil-

ity ecosystem and their various types of relations, an

understanding of the ecosystem is a challenging task.

Following the aforementioned visual approach

(Iyer and Basole, 2016) industry publications, internet

search engines, news portals, and websites, but also

company’s websites should be evaluated to gather rel-

evant entities of the ecosystem and their relations.

2.3 Visual Model Language

From the data model perspective, the connected mo-

bility ecosystem can be modeled using a graph. The

entities (i.e., the companies and their attributes) are

the nodes and their relations are the links. The graph

model allows the visual representation of the ecosys-

tem using the traditional information visualization

Towards an Understanding of the Connected Mobility Ecosystem from a German Perspective

545

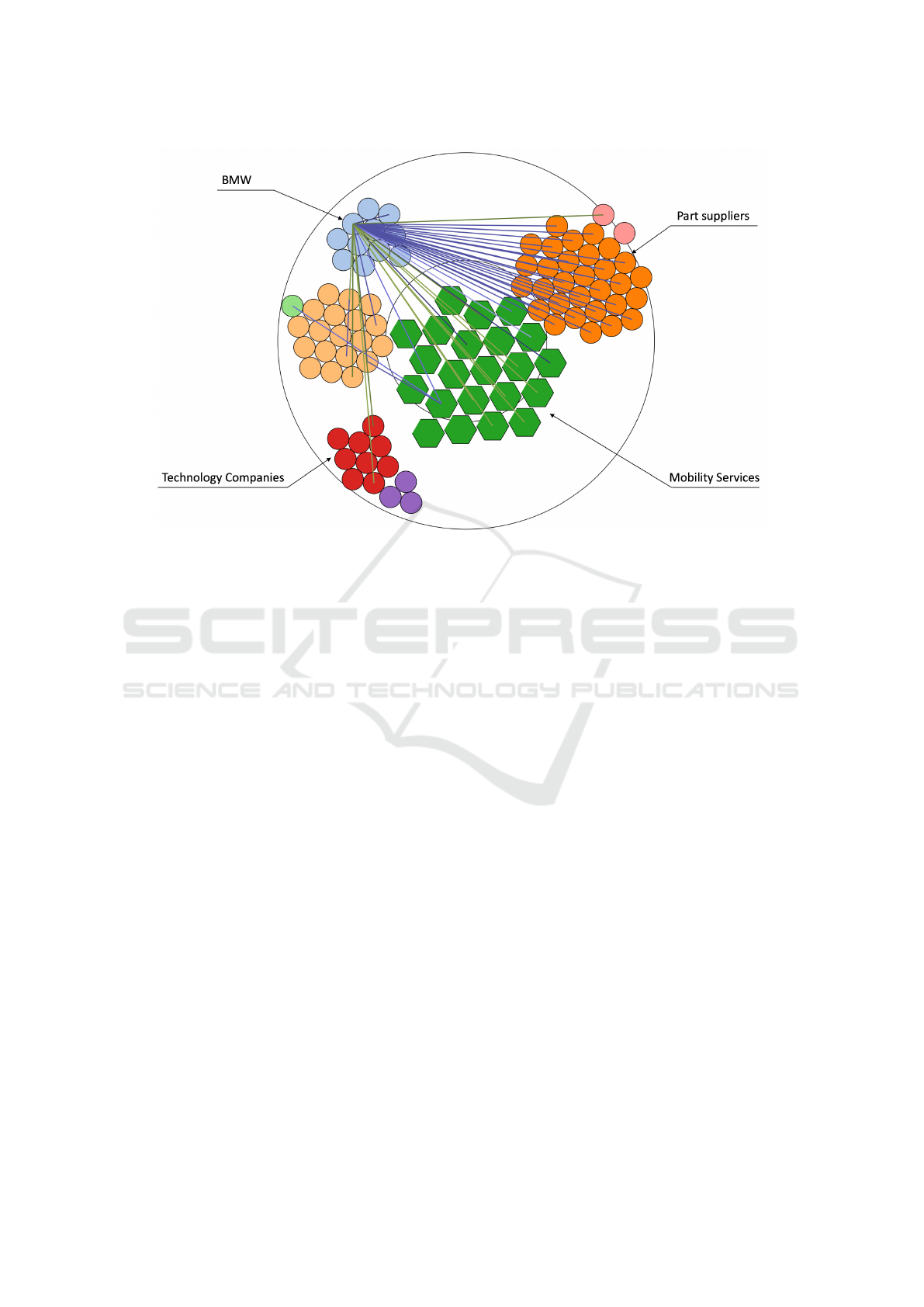

Figure 1: Proposed ego network visualization for the con-

nected mobility ecosystem.

techniques such as Adjacency Matrix

1

and Node-Link

diagrams

2

. However, the visualization of graph mod-

els are a challenging task in the area of information

visualization (Iyer and Basole, 2016).

In this paper, we proposed a modified ego network

visualization

3

where the focus is on the mobility ser-

vices provided in the ecosystem (see Figure 1). The

center of the visualization contains the mobility ser-

vices represented using hexagons as marks. Addition-

ally, the entities are represented as circles, grouped

into categories of the connected mobility ecosystem

stack (see Table 1). Finally, each category and type

of relation between entities is mapped to a different

color, using a 30 colors scale to differentiate them in

the graph.

2.4 Interpretation

By putting the mobility services in the center of

the visualization, we adopt an user-centered view, as

these services have direct interfaces to the mobility

users, addressing the need for mobility as a service.

This visualization enables the ecosystem stakeholder

to gain an understanding of which and how compa-

nies are collaborating to provide a mobility service.

Additionally, relations – and with that entities – are

identified, which do not link and thus contribute to

any mobility service, suggesting that these companies

might have a backlog adjusting to digitized mobility.

By visualizing all relations necessary to provide a mo-

bility service, the complexity of the provided mobility

service are demonstrated.

The presented visualization might thereby help

stakeholders of the connected mobility in addressing

the trend from products towards (mobility) services

(Bosch, 2016).

1

https://en.wikipedia.org/wiki/Adjacency matrix

2

https://en.wikipedia.org/wiki/Graph drawing

3

http://www.analytictech.com/networks/egonet.htm

3 VISUALIZING THE

CONNECTED MOBILITY

ECOSYSTEM FROM A

GERMAN PERSPECTIVE

In a next step, the previously described approach is

applied to the connected mobility ecosystem. The

German automotive industry, being the largest indus-

try in Germany, comprising not only of world leading

automotive OEMs and tier-1 suppliers, but also – with

around 85 % – of medium-sized Tier 2 and 3 supplier

(Germany Trade & Invest, 2013). As these companies

are also affected by the changes of mobility, analyzing

the connected ecosystem from a German perspective

serves as a valid starting point for the collection and

evaluation of relevant data.

3.1 Identify Companies and their

Attributes

By applying a German perspective on the connected

mobility ecosystem, we collected data starting with

established German OEMs and their supplier net-

work. By analyzing the OEMs web presence and

published reports, the relations between OEMs and

supplier were identified. Additional to these classic

mobility ecosystem entities and relations, the mobil-

ity services already provided by OEMs were docu-

mented, including the associated relation. The same

was applied to companies providing public trans-

portation.

In a next step – to gather new ecosystem entities

and their relations – publicly accessible data sources

were collected and evaluated. The number of these

databases is huge, ranging from national databases,

e.g. Gr

¨

underszene

4

or Bayern- International

5

, to in-

ternational ones, e.g. Crunchbase

6

or AngelList

7

.

To identify especially technology companies for

this work, the database Crunchbase was used, which

provided a limited but free of charge access. Com-

panies are tagged with attributes describing their field

of action, for example, ”Transportation” or ”Mobile”.

By searching for German automotive OEMs, rele-

vant funding and acquisitions were identified using

Crunchbase. Additionally, news feeds were scanned

and evaluated regarding cooperations of German au-

tomotive OEMs, mobility services, technology com-

panies and affected industries.

4

http://www.gruenderszene.de/

5

http://www.bayern-international.de/en/

6

https://www.crunchbase.com

7

https://angel.co/

AEM 2017 - 1st International Workshop on Advanced Enterprise Modelling

546

Figure 2: The connected mobility ecosystem from a German perspective.

Conducting the above-described steps, an overall

sum of 97 connected mobility ecosystem companies

and 192 associated relations were collected and doc-

umented.

3.2 Visualize the Connected Mobility

Ecosystem Explorer from a German

Perspective

The collected data relevant to the mobility ecosystem

from a German perspective is visualized in Figure 2.

Due to the high amount of entities and relations, we

filtered the data and visualized one company and its

relations. Thereby, we chose the BMW group due to

its size and relevance for the German industrial land-

scape.

3.3 Interpretation

The visualization validates that the BMW group is

highly involved in providing mobility services, and

thereby adapting to the changes in context with dig-

itized mobility. It shows the strong integration with

German automotive part suppliers and already estab-

lished technology companies enriching the mobility

ecosystem.

By filtering for other companies, the same un-

derstanding of involvement in the connected mobility

ecosystem can be gained.

4 DISCUSSION

By using the presented visual approach and applying

it to connected mobility ecosystem, we realized the

following limitations.

First, the data gathering in this context is im-

mensely time-consuming. Although established au-

tomotive OEMs share their activities regarding pro-

vided mobility services openly, they are rather con-

servative with sharing collaboration information. To

gather this kind of information all potential enter-

prises, supplying automotive OEMs with technology

or hardware, have to be analyzed, in addition to in-

dustry publications, news portals and websites. That

is why we envision to explore techniques like crowd-

sourcing – also in combination with gamification ap-

proaches – to gather data enriching the process and

thereby the ecosystem.

Furthermore, the data model and the identified

categories are constantly evolving, as the ecosystem

is, and thus key attributes change. The presented vi-

sualization and with this the underlying tool provid-

ing the visualization have to adapt to these constant

changes.

Finally, the visual languages presented in this

work must be enlarged to address the clear sepa-

ration between mobility services and mobility ser-

vice provider including suppliers of mobility services.

Additionally, the different kind of relations between

ecosystem entities are not yet encoded in the visual

Towards an Understanding of the Connected Mobility Ecosystem from a German Perspective

547

language. Due to the high amount of relations, es-

pecially for automotive OEMs and part suppliers, the

proposed visualization language is only feasible when

selecting one specific ecosystem entity.

5 CONCLUSION AND FUTURE

WORK

In this paper, we presented a model of the connected

mobility ecosystem, which contains a description of

the connected mobility industry. The provided visu-

alization fosters the understanding of the interaction

of ecosystem companies providing different mobility

services. Thereby, ecosystem stakeholders, which are

not directly involved in providing a service, can gain

knowledge about mobility services they are enabling

by providing their services. Secondly, the knowledge

about what components are necessary to provide a

mobility service is increased.

We plan to continue researching on the presented

visual approach of the connected mobility ecosystem,

in order to address the limitations discussed previ-

ously. We envision a connected mobility ecosystem

explorer focusing on the user-centered visualization

and interpretation of the connected mobility environ-

ment. In order to provide such a tool, the various mo-

bility scenarios will be gathered, evaluated and visu-

alized.

ACKNOWLEDGEMENTS

This work is part of the TUM Living Lab Connected

Mobility (TUM LLCM) project and has been funded

by the Bavarian Ministry of Economic Affairs and

Media, Energy and Technology (StMWi) through the

Center Digitisation.Bavaria, an initiative of the Bavar-

ian State Government.

REFERENCES

Basole, R. C., Huhtam

¨

aki, J., Still, K., and Russell, M. G.

(2016). Visual decision support for business ecosys-

tem analysis. Expert Systems with Applications,

65:271–282.

Basole, R. C. and Karla, J. (2011). On the evolution of mo-

bile platform ecosystem structure and strategy. Busi-

ness and Information Systems Engineering, 3(5):313–

322.

Basole, R. C., Russell, M. G., Huhtam

¨

aki, J., Rubens, N.,

Still, K., and Park, H. (2015). Understanding Busi-

ness Ecosystem Dynamics: A Data-Driven Approach.

ACM Transactions on Management Information Sys-

tems, 6(2):1–32.

BMW Group (2017). Intelligent Sslutions for

everyday life on the move. Available at

http://www.bmw.com/com/en/insights/corporation/

bmwi/mobility services.html?, accessed: 2017-01-24.

Bosch, J. (2016). Speed, Data, and Ecosystems: The Future

of Software Engineering. IEEE Software, 33(1):82–

88.

Botsman, R. (2015). The Power of Sharing: How Collabo-

rative Business Models are Shaping a New Economy.

Digital Transformation Review, 7:28–34.

Cohen, B. and Kietzmann, J. (2014). Ride On! Mobility

Business Models for the Sharing Economy. Organi-

zation & Environment, 27(3):279– 296.

Collingwood, L. (2016). Privacy implications and liability

issues of autonomous vehicles. Information and Com-

munications Technology Law, pages 1–14. cited By 0;

Article in Press.

Daimler AG (2017). Mobility Ser-

vices Our offers. Available at

https://www.daimler.com/products/services/mobility-

services/, accessed: 2017-01-24.

Etherington, D. and Kolodny, L. (2016). Googles self-

driving car unit becomes Waymo. Available at

https://tinyurl.com/zl5zxkl, accessed: 2017-01-23.

Germany Trade & Invest (2013). The Automotive Industry

in Germany. Germany Trade & Invest, (2016):14.

Henfridsson, O. and Lindgren, R. (2005). Multi-

contextuality in ubiquitous computing: Investigating

the car case through action research. Information and

Organization, 15(2):95–124. cited By 45.

Hevner, A. R. (2007). A three cycle view of design sci-

ence research. Scandinavian journal of information

systems, 19(2):4.

ITS Finland (2015). ITS vocabulary. Available at http://its-

finland.fi/index.php/en/mita-on-its/its-sanasto.html,

accessed: 2017-01-24.

Iyer, B. R. and Basole, R. C. (2016). Visualization to un-

derstand ecosystems. Communications of the ACM,

59(11):27–30.

Kelly, E. (2015). Introduction: Business ecosystems come

of age. Deloitte Business Trends Series, pages 3–16.

Mathes, R., Hitzemann, B., and Meiners, J. (2015).

World Car Trends 2015 Connected Mo-

bility and Digital Lifestyle. Available at

http://www.wcoty.com/files/2015 World Car PR

Trends Report.pdf, accessed: 2017-01-23.

Mitchell, W. (2010). Reinventing the automobile : personal

urban mobility for the 21st century. Massachusetts

Institute of Technology, Cambridge, Mass.

Mosquet, X., Russo, M., Wagner, K., Zablit, H.,

and Arora, A. (2015). Accelerating Innova-

tion New Challenges for Automakers. Available

at http://www.bcg.de/documents/file153102.pdf, ac-

cessed: 2017-01-23.

Nachira, F. (2002). Towards a network of digital business

ecosystems fostering the local development. Ecosys-

tems, (September):23.

AEM 2017 - 1st International Workshop on Advanced Enterprise Modelling

548

Nayak, S. (2016). Automotive OEMs + Tech Star-

tups = Autonomous Ecosystem. Available at

https://tinyurl.com/z2sa3h9, accessed: 2017-01-23.

Plum, T. (2016). Available at

http://www.mechatronics.rwth-

aachen.de/cms/Mechatronics/

Forschung/Allgemeines/ fzpe/Vernetzte-

Mobilitaet/?lidx=1, accessed: 2017-01-23.

Robert Bosch GmbH (2012). An-

nual report 2012. Available at

http://www.bosch.com/content2/publication forms/en/

downloads/GB 2012 EN.pdf, accessed: 2017-01-20.

Rossbach, C., Winterhoff, M., Reinhold, T., Boekels,

P., and Remane, G. (2013). Connected Mobil-

ity 2025 - Neue Wertsch

¨

opfung im Personen-

verkehr der Zukunft. Technical report, Roland

Berger Strategy Consultants GmbH. Available

at https://www.rolandberger.com/publications/

publication pdf/roland berger tas connected mobility

e 20130123.pdf, accessed: 2017-01-20.

Taylor, M. (2016). Apple confirms it is working on self-

driving cars. Available at https://tinyurl.com/j2j3bzv,

accessed: 2017-01-23.

TUM LLCM (2015). TUM Living Lab Connected Mobil-

ity TUM LLCM. Available at http://tum-llcm.de/en/,

accessed: 2017-01-12.

Towards an Understanding of the Connected Mobility Ecosystem from a German Perspective

549