Investment Support System using the EVOLINO Recurrent Neural

Network Ensemble

Algirdas Maknickas

1

and Nijol˙e Maknickien˙e

2

1

Department of Information Technologies, Vilnius Gediminas Technical University, Saultekio 11, Vilnius, Lithuania

2

Department of Finance Engineering, Vilnius Gediminas Technical University, Vilnius, Lithuania

Keywords:

Ensembles, EVOLINO, Finance, Forecasting, Investment Portfolio, Orthogonality.

Abstract:

The chaotic and largely unpredictable conditions that prevail in exchange markets are of considerable interest

to speculators because of the potential for profit. The creation and development of a support system using

artificial intelligence algorithms provides new opportunities for investors in financial markets. Therefore, the

authors have developed a support system that processes historical data, makes predictions using an ensemble of

EVOLINO recurrent neural networks, assesses these predictions using a composition of high-low distributions,

selects an orthogonal investment portfolio, and verifies the outcome on the real market. The support system

requires multi-core hardware resources to allow for timely data processing using an MPI library-based parallel

computation approach. A comparison of daily and weekly predictions reveals that weekly forecasts are less

accurate than daily predictions, but are still accurate enough to trade successfully on the currency markets.

Information obtained from the support system gives investors an advantage over uninformed market players

in making investment decisions.

1 INTRODUCTION

Exchange markets are extremely dynamic, chaotic,

and largely unpredictable. They are influenced by

market participants, as well as by banking interven-

tions, manipulations, geopolitical events, natural dis-

asters, and other external events. However, the real

challenge of creating a support system for speculators

can be realized by artificial intelligence.

Decision making in uncertain markets requires

complex solutions covering several fields of science,

artificial intelligence, and investment. In the sci-

entific field of artificial intelligence, we found a

very interesting algorithm named EVOLINO (EVolu-

tion of recurrent systems with Optimal LINear Out-

put) (Schmidhuber et al., 2005a) , (Wierstra et al.,

2005). When trained using LongShort-Term Memory

(LSTM) (Hochreiter and Schmidhuber, 1997), (Gers

et al., 2000) recurrent neural networks (RNNs) with

co-evolving hidden neurons, EVOLINO can learn to

predict several time series that traditional RNNs can-

not. EVOLINO has been used to predict superim-

posed out-of-phase sine waves, certain input streams

based on grammatical rules, the parity problem with

display, and the Mackey–Glass time series (Schmid-

huber et al., 2005b), (Schmidhuber et al., 2007), as

well as in the modelling of competence as a self-

organizing process (Scharnhorst and Ebeling, 2005)

and robotic knot winding (Mayer et al., 2008).

Single neural networks have the qualities needed

to achieve this objective, but a group of them, con-

nected in different ways, can provide qualitatively

new solutions. Ensembles of neural networks have

been used to predict exchange rates (Zhang et al.,

2001), in single-step-ahead and multi-step-ahead pre-

diction problems (Assaad et al., 2008), for bankruptcy

prediction and credit scoring (Tsai and Wu, 2008),

wind power forecasting (Felder et al., 2010), and

noisy non-linear time series (Sheng et al., 2013).

The probabilities given by these ensemble predictions

are used in climate change research (Collins, 2007)

and probabilistic wind vector forecasting (McLean

Sloughter et al., 2013).

In investment theory, most attention is focused

on investment portfolio formation. The best known

studies in this area were conducted by Markowitz

(Markowitz, 1952), (Markowitz, 1987), (Markowitz,

2014), who proposed equations for maximizing

profit and minimizing risk. The adequate portfo-

lio (Rutkauskas, 2000) added a third component—

reliability. The formation and usage of this adequate

portfolio has been analysed in terms of profit stochas-

138

Maknickas, A. and Maknickien

˙

e, N..

Investment Support System using the EVOLINO Recurrent Neural Network Ensemble.

In Proceedings of the 7th International Joint Conference on Computational Intelligence (IJCCI 2015) - Volume 3: NCTA, pages 138-145

ISBN: 978-989-758-157-1

Copyright

c

2015 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

ticity (Rutkauskas and Stankeviˇciene, 2003). Orthog-

onal portfolios were investigated in the context of a

saving and investment portfolio (Roll, 1980), and the

optimal orthogonal portfolio has become an important

risk management tool in investment decision making

processes (Asgharian and Hansson, 2005), (Asghar-

ian, 2011).

Investment strategies based on extremal data have

also been studied (Corwin and Schultz, 2012), (Ca-

porin et al., 2013). Hence, the high and low prices

in an exchange market are frequently predictable and

profitable for speculation.

One of the most important measures of feature

predictions is time. Short-term predictions of the

future behavior of a time series, using information

based only on past values, have been researched

(Farmer and Sidorowich, 1987), as has the predic-

tion of chaotic time series using artificial intelligence

(Samanta, 2011), (Chen, 2014), (Fonseca and G´omez-

Gil, 2014).

Our aim is to integrate knowledge of investment

theory and artificial intelligence to develop a support

system for speculating on the exchange markets. In-

formation obtained from the supportsystem must give

investors an advantage in making investment deci-

sions compared with uninformed market players. The

proposed support system for speculators includes five

steps: preparation of historical data, prediction by an

ensemble of EVOLINO RNNs, assessment of predic-

tions, investment portfolio formation, and verification

in the market. Our research compares two portfolios

based on different perspectives of the future: daily

and weekly time series.

2 SUPPORT SYSTEM

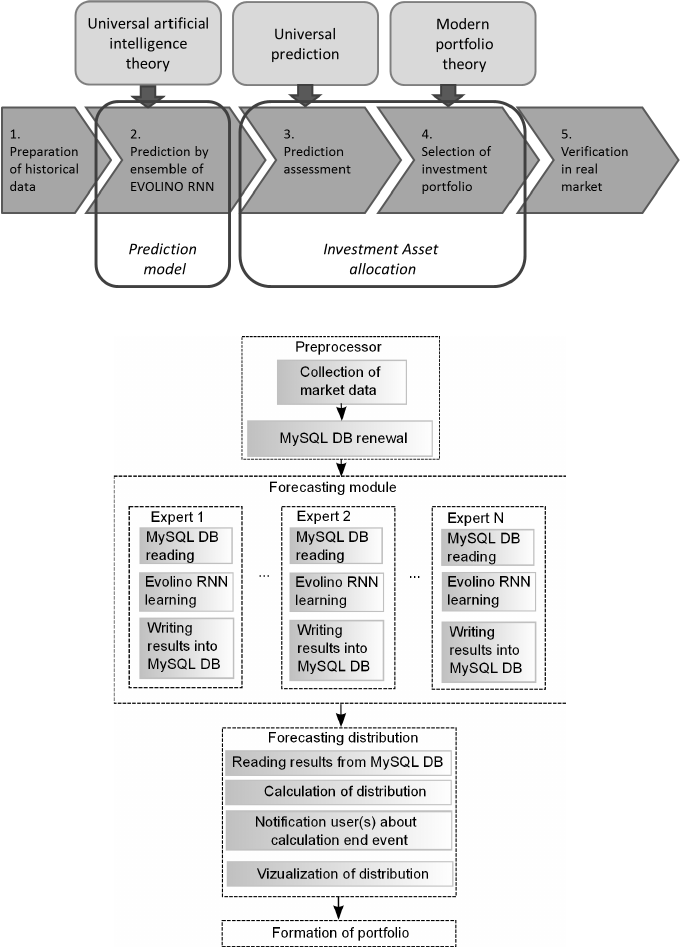

Figure 1 shows a block diagram of different stages

of our support system for investors in the currency

market. The data include historical fluctuations in ex-

change rates. The prediction model provides a full set

of forecasts, which is the basis for investment asset

allocation over the prediction assessment and portfo-

lio optimization. Verification in an imitation market

in real time demonstrates the reliability of the support

system.

2.1 Preparation of Historical Data

The selection of exchange rates for speculation in cur-

rency markets is based on the orthogonality of the

portfolio. Roll (1980) formulated the conditions un-

der which an investment portfolio solves the efficient

portfolio optimization problem. An orthogonal port-

folio is one which satisfies the following condition:

Var = Σ

ij

r

ij

σ

i

σ

j

= 0, (1)

where r

ij

is the correlation coefficient between tools i

and j, σ

i

is the standard deviation of tool i, and σ

j

is

the standard deviation of tool j.

When it is very difficult to reach Var = 0, we can

use ε to denote the degree of closeness to orthogonal-

ity:

Var =

∑

ij

r

ij

σ

i

σ

j

= ε. (2)

In our research, we use the GBP/AUD (British

pounds and Australian dollars), NZD/CAD (New

Zealand dollars and Canadian dollars), EUR/JPY

(Euro and Japanese yen) and USD/CHF (US dollars

and Swiss francs) exchange rates. The weekly ex-

change rates are recorded in a MySQL database on

a daily basis. Additionally, we record the XAUUSD

rate (gold against the US dollar). The optimal orthog-

onality of two “pupil and teacher“ data vectors can be

achieved by varying a ≥ 0 while seeking to minimize

the sum (Maknickas and Maknickiene, 2012):

min

N−1

∑

t=0

η

t

XXX/YYY

η

t−a

XAU/USD

. (3)

The best shift value a is then recorded in the MySQL

database for future usage. Note that we do not

use the direct η

t

i

exchange rate data (where in-

dex i denotes currency exchange rates GBP/AUD,

NZD/CAD, EUR/JPY, USD/CHF), but the following

rational logarithmic data of η

t

i

and η

t−1

i

:

l

j

t

= log(η

t

j

/η

t−1

j

). (4)

The logarithmic scale was chosen in case of lognor-

mal distribution of investigating data. So, a neural

network will learn unified data of logarithmic ratio-

nal exchange rates growth/decrease. Thus, in our

case, four different shift values must be found and

stored. When the best shift values have been deter-

mined, the EVOLINO RNN can begin the learning

process. EVOLINO RNN learning data must be in

the range [0,1], so the original data are normalized

according to the maximum value in the interval [0,T],

i.e.

l

1j

t

= l

j

t

/l

j

max

. (5)

The data prepared in this way can be used for LSTM

second-order RNN learning and validation. The pre-

dicted data should be obtained in the reverse algo-

rithm using the same value of l

j

max

. In the prediction

stage, all learned RNN predicted exchange rate val-

ues must be multiplied by l

j

max

. The exponent of each

predicted value is calculated as follows:

η

t

j

= η

t−1

j

exp(l

1j

t

l

j

max

), (6)

where η

0

j

is the first value in the predicted time series.

Investment Support System using the EVOLINO Recurrent Neural Network Ensemble

139

Figure 1: Diagram of support system for investors.

Figure 2: Diagram of prediction model.

2.2 Prediction by an Ensemble of

EVOLINO RNNs

The idea of using LSTM RNNs to predict exchange

rate time series is based on the formers ability to ob-

tain qualified prediction results for the Mackey–Glass

chaotic time series (Gers, 2001). This success could

be explained by investigations of Siegelmann (1999),

who proved that first-order RNNs could work as finite

state automata if their weights were integers, as Tur-

ing machines if their weights were rational numbers,

and as super Turing machines or hyper-computers if

their weights were real numbers. The EVOLINO

RNN is an LSTM second-order RNN, and researchers

(Goudreau et al., 1994) have shown that these are

strictly more powerful than first-order RNNs. Thus,

if LSTM works well for the prediction of Mackey–

Glass chaotic time series, it should work equally well

for the prediction of chaotic exchangerate time series.

The second basic idea of artificial prediction is

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

140

that we should not only predict a single point in the

future, but a distribution of points. This means that

there are no single fixed points in the future, but rather

an infinite number of points with an appropriate prob-

ability of appearing in the future. This was taken

into account by our algorithm using an ensemble of

EVOLINO RNNs to obtain the predicted distribution

of possible exchange rate values. When using an en-

semble, we require unrealistic values to be filtered

out. In this case, the first–last percentile method was

used. Calculating the first and fourth percentiles al-

lows us to remove values in this range as unrealistic.

Finally, we obtain the future single-step ahead

(one week or one day in the current investigation)

distribution of possible exchange rate values, and use

this to make decisions about appropriate investments.

This can be done because the weights are globally

optimized using a genetic algorithm, and each opti-

mization sequence gives different values for a single

prediction point.

G

I

Input

I

Input

II

G

O

G

F

Output

Σ

Π

Π

Π

S

LSTM

LSTM

LSTM

LSTM

LSTM

Input

I

Input

II

Output

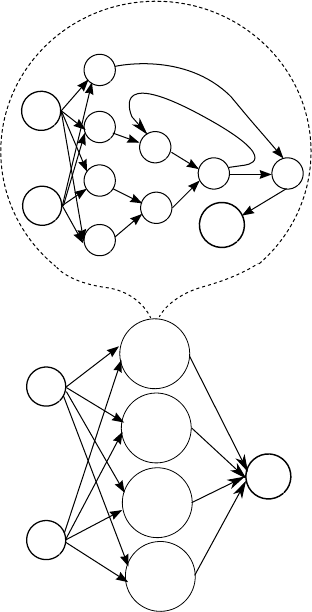

Figure 3: LSTM network with four memory cells.

The block diagram of EVOLINO recurrent neural

network is shown in Figure 3. EVOLINO RNN forms

LSTM network with N = 4n memory cells, where N

is total amount of neurons and n is amount of mem-

ory cells. The genetic evolution algorithm is applied

to each quartet of memory cells separately. The cell

has an internal state S together with a forget gate (G

F

)

that determines how much the state is attenuated at

each time step. The input gate (G

I

) controls access

to the cell by the external inputs that are summed into

the Σ unit, and the outputgate (G

O

) controls when and

how much the cell fires. Nodes Π represent the mul-

tiplication function and the linear regression Moore-

Penrose pseudo-inverse method used to compute the

output circle (Schmidhuber et al., 2005a), (Schmid-

huber et al., 2005b).

The EVOLINO forecasting module is presented

in Figure 2. The module consists of four parts: pre-

processor, forecasting, calculation of distribution and

formation of portfolio. The prerocessor part colect

data into MySQL data base. The forecasting part

learns, validates and predicts each expert(4xLSTM

neural network) in the separate thread. Finally, the

obtained prediction data are using for calculation of

future distribution and formation of portfolio. A de-

tailed description of neural network ensemble learnig,

validation and prediction using EVOLINO RNNs can

be found in Maknickiene and Maknickas (2013). En-

sembles of neural networks can take a number of

hours to reach a satisfactory convergence. Selection

of the optimal number in an ensemble has been inves-

tigated in earlier work (Maknickien˙e and Maknickas,

2013). The cycle of each predictive neural network

is divided into equal intervals, and every interval is

computed on a separate processor node. Hardware

acceleration is achieved using eight nodes of an In-

tel(R) Xeon(R) CPU E5645 @ 2.40 GHz on the

www.time4vps.eu cloud. An ensemble of 1008 pre-

dictive neural networks requires approximately 72 h

computation time. The forecast assumes the distribu-

tion has a particular shape. At the end of this step, the

support system user obtains the distribution and pa-

rameters such as the mean, median, mode, skewness,

and kurtosis.

2.3 Prediction Assessment

The prediction model outputs a multi-modal distribu-

tion, and its shape provides more information for in-

vestors. The standard deviation reflects the riskiness

of a decision, kurtosis indicates the dispersal of possi-

ble values, and skewness indicates the asymmetry of

the decision. Second and third modes also provide in-

formation about changes in the future exchange rate

value. When the historical data consist of closing val-

ues, the distribution of expected values predicts the

closing exchange rate for the next period. However,

close data are less informative for investors. Each in-

vestor makes a decision to buy the lowest data and sell

Investment Support System using the EVOLINO Recurrent Neural Network Ensemble

141

the highest data. Thus, for the prediction assessment,

we use the composition of two distributions, one of

which was produced using low data, the other using

high data. In real markets, decisions are made ac-

cording to the exchange rate value at the moment of

decision-making (Stankeviˇciene et al., 2014).

2.4 Selection of Investment Portfolio

Selection of investment portfolio using the composi-

tion of distributions should be made according to:

max

∑

n

i=1

p

pi

W

i

min

∑

n

i=1

p

li

W

i

,

, (7)

where p

pi

is the probability of profit, p

li

is the proba-

bility of loss, W

i

is part of the investment in exchange

rate i, and n is the number of exchange rates in the

portfolio.

This orthogonal optimal portfolio diversifies risk

and makes investment in exchange markets profitable.

Real-time verification in an imitation market allows

us to evaluate the investor support system in terms of

market profitability, risks, and reliability, as well as

the individual characteristics of the investors specu-

lating on the real market.

3 COMPARISON OF DAILY AND

WEEKLY PREDICTIONS

USING OUR SUPPORT SYSTEM

FOR INVESTORS

The time interval is a very important component in

chaotic processes. Predicting financial markets for

short periods is slightly easier than making long term

predictions. The hourly forecasts given by our sup-

port system required 16–18 h forecasting data. There

are insufficient historical data to produce a long-term

(e.g., monthly or annual) prognosis. The accumulated

experience with daily data forecasting allows us to go

one step into the future and use weekly exchange rate

forecasts.

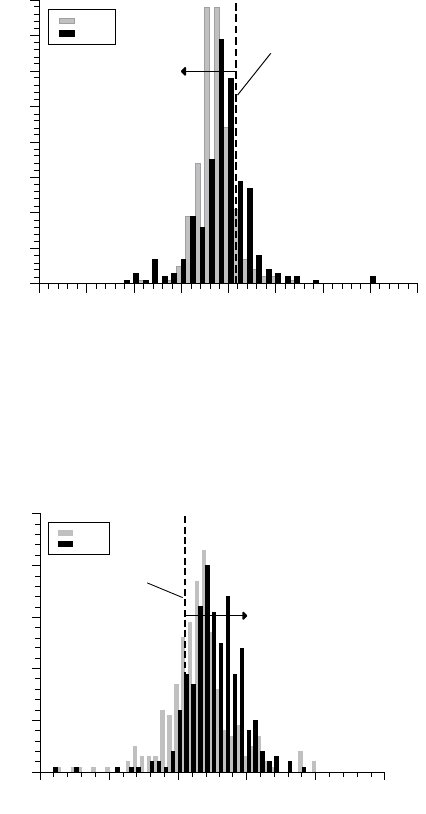

3.1 Daily Predictions

Short-term predictions were made using historical

data on daily highs and lows. Trading decisions can

be made using a composition of two distributions,

taking into account that the close value is the last

known real value. Figure 4 shows the composition

of distributions for the expected GBP/AUD exchange

rate. The modes of these distributions are to the left

of the close value, thus the trading decision must be

to sell. The modes of the EUR/JPY (Figure 5) and

NZD/CAD (Figure 6) exchange rate high-low distri-

butions are to the right of the close values, so the trad-

ing decision in these cases is buy.

GBP/AUD

frequency

0

10

20

30

40

50

60

70

80

exchange rate

1,8 1,85 1,9 1,95 2 2,05 2,1 2,15 2,2

high

low

sell

close value

Figure 4: Composition of high-low distributions of daily

GBP/AUD exchange rate predictions.

The probability of profit P

p

= 0.89 and the prob-

ability of loss P

l

= 0.11 in the case of the daily

GBP/AUD sell trading decision (Figure 4). For the

EUR/JPY

frequency

0

10

20

30

40

50

exchange rate

130 135 140 145 150 155

low

high

buy

close value

Figure 5: Composition of high-low distributions of daily

EUR/JPY exchange rate predictions.

EUR/JPY buy trading decision, the probability of

profit P

p

= 0.58 and the probability of loss P

l

= 0.42

(Figure 5). The probability of profit P

p

= 0.77 and the

probability of loss P

l

= 0.23 for the daily NZD/CAD

buy trading decision (Figure 6).

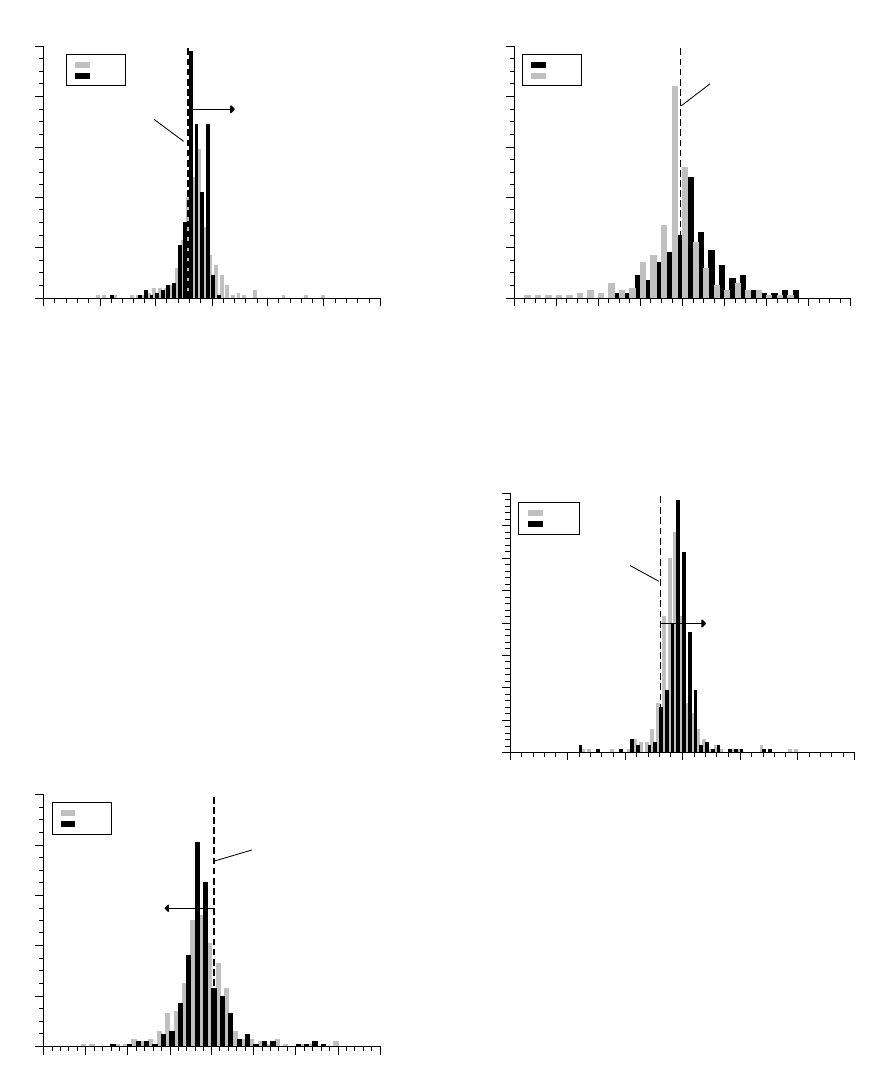

The portfolios are formed using equation (7).

The calculated weights are: W

D,gbp/aud

= 0.53,

W

D,eur/ jpy

= 0.11, and W

D,nzd/cad

= 0.36.

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

142

NZD/CAD

frequency

0

20

40

60

80

100

exchange rate

0,75 0,8 0,85 0,9 0,95 1 1,05

low

high

buy

close value

Figure 6: Composition of high-low distributions of daily

NZD/CAD exchange rate predictions.

3.2 Weekly Time Period

Weekly predictions are made in the same way as daily

predictions, but with weekly historical exchange rate

data. Figure 7 shows the composition of weekly

GBP/AUD exchange rate expected value distribu-

tions. The modes of the distributions are to the left

of the close value, so the trading decision must be to

sell. The modes for EUR/JPY (Figure 8) are on oppo-

site sides of the close value, so buy or sell decisions

are very risky. The modes of the weekly NZD/CAD

(Figure 6) exchange rate high-low distributions are to

the right of the close value, so the trading decision

here is to buy. The probability of profit P

p

= 0.78 and

GBP/AUD

frequency

0

20

40

60

80

100

exchange rate

1,6 1,7 1,8 1,9 2 2,1 2,2 2,3 2,4

low

high

close value

sell

Figure 7: Composition of high-low distributions of weekly

GBP/AUD exchange rate predictions.

the probability of loss P

l

= 0.22 in the case of the

weekly GBP/AUD sell trading decision (Figure 7).

For the risky trading decision concerning the weekly

EUR/JPY rates, the probability of profit is P

p

= 0.502

and the probability of loss is P

l

= 0.498 (Figure 8).

EUR/JPY

frequency

0

20

40

60

80

100

exchange rate

60 80 100 120 140 160 180 200 220

high

low

close value

Figure 8: Composition of high-low distributions of weekly

EUR/JPY exchange rate predictions.

For the weekly NZD/CAD exchange rates, the but de-

NZD/CAD

frequency

0

10

20

30

40

50

60

70

80

exchange rate

0,6 0,7 0,8 0,9 1 1,1 1,2

low

high

close value

buy

Figure 9: Composition of high-low distributions of weekly

NZD/CAD exchange rate predictions.

cision gives a probability of profit P

p

= 0.89 and a

probability of loss P

l

= 0.11 (Figure 9). In this sce-

nario, the portfolio is constructed using equation 7

with only GBP/AUD and NZD/CAD data. The calcu-

lated weights are W

W,gbp/aud

= 0.42 and W

W,nzd/cad

=

0.58.

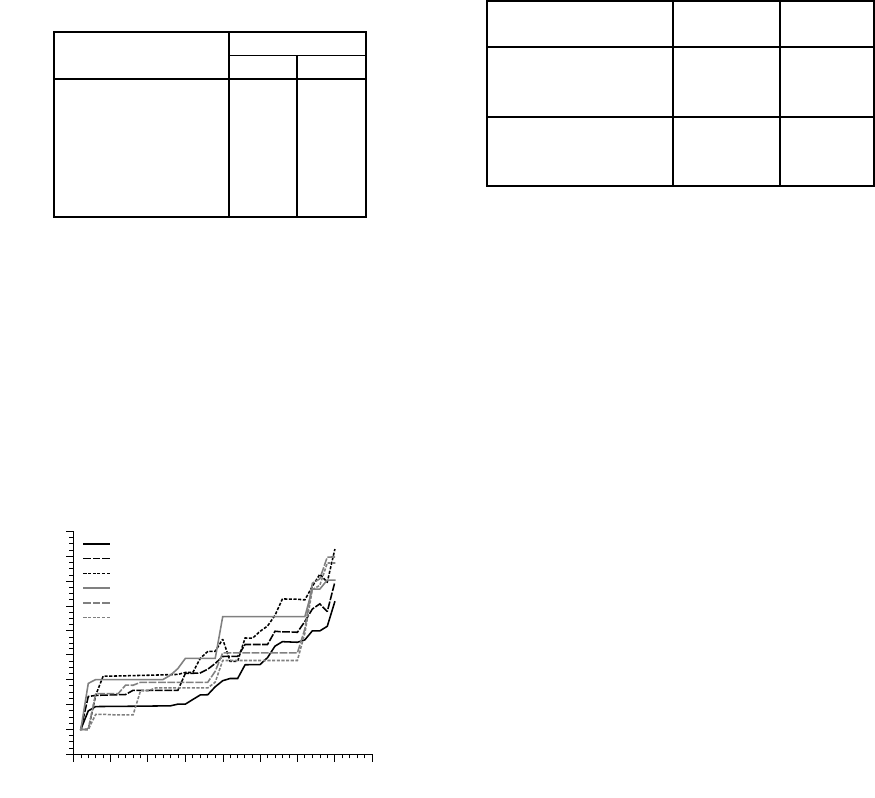

3.3 Comparison of Predictions

The accuracy of predictions based on our support sys-

tem for investors is presented on Table 1. Each ex-

change rate prediction was evaluated according to the

mean absolute percentage error (MAPE) when com-

paring the real future value with the mode of one of

the predicted distributions: high in the case of a buy

decision and low in the case of a sell decision. Our

results demonstrate that daily predictions were more

accurate than the weekly predictions.

Investment Support System using the EVOLINO Recurrent Neural Network Ensemble

143

Table 1: Comparison of the accuracy of daily and weekly

predictions.

MAPE (%)

Exchange rate low high

GBP/AUD daily 0.198 0.319

EUR/JPY daily 2.250 1.051

NZD/CAD daily 0.412 2.164

GBP/AUD weekly 1.993 1.874

EUR/JPY weekly 3.696 4.737

NZD/CAD weekly 3.498 2.814

Our support system for currency market was

tested on imitated market Oandainreal time Results of

trading using different strategies is presented in Fig-

ure 10. Strategy is determined by the choice of dif-

ferent risk levels of trading platform and choice of

portfolios. Conservative strategy has 1:10 leverage

and funds are shared equally. Moderate strategy has

1:20 leverage and the funds are divided in proportion

to the projected profit. Aggressive strategy has 1:50

leverage and the funds are divided in proportion to the

projected profit.

balance (euros)

99.800

100.000

100.200

100.400

100.600

100.800

101.000

101.200

101.400

101.600

date(days)

07−12 07−17 07−23 07−28 08−03 08−16 08−21

daily conservative

daily moderate

daily aggressive

weekly conservative

weekly moderate

weekly aggressive

Figure 10: Comparison of daily and weekly balances of dif-

ferent trading strategies in period from 08-07-2015 to 21-

08-2015.

Comparison of daily and weekly trading using dif-

ferent strategies shows sustainable growth of invest-

ment profit of all tests and allows to expect the good

annual results (10-18 %). Our support system for cur-

rency market speculators uses modern portfolio the-

ory for the diversification of risk. Orthogonality in an

investment portfolio (equations (1) and (2)) reduces

the risk of losing. A comparison of daily and weekly

portfolios is presented in Table 2.

Total profit of daily and weekly portfolios are very

similar, but weekly profit per trade is roughly twice

more daily profits per trade. So investor can get same

result with less trading time. Prediction of chaotic

processes like financial markets, is not simple process

where daily historical data easy can be changed by

Table 2: Comparison of daily and weekly portfolios.

portfolio total profit profit

per trade

daily conservative 1030.44 38.2

daily moderate 1186.53 45.6

daily aggressive 1451.83 63.1

weekly conservative 1207.05 100.6

weekly moderate 1393.96 116.2

weekly aggressive 1345.23 112.2

weekly data. Number of different events in one week

can more easy change the tendencies then in one day.

Lots of financial prediction tools can easy predict the

tendencies, but cannot predict extremes of the price

dynamic. Good tool of finance market prediction can

recognize the coming changes.

Investment support system using the EVOLINO

RNN ensemble is multilevel tool for investor. It con-

cludes not only ensemble of EVOLINO RNN with

function of prediction, but there are multilevel com-

putation creativity too.

4 CONCLUSIONS

We have developed a support system for currency

market investors by combining monitoring synergies

between different branches of science (economics,

mathematics, psychology, biology), the latest techno-

logical breakthroughs (online payments and artificial

intelligence), and investor experience. The decision

making support system is a useful tool for speculators

in the relatively risky currency market. Our research

aims to enhance future prospects. The comparison

of daily and weekly predictions provides the ability

to use the support system for the weekly forecasting

of exchange rates. The accuracy of weekly forecasts

is lower than that of daily predictions, but still ac-

curate enough to enable successful trading. Weekly

profit per trade is roughly twice more daily profits

per trade. The support system requires multi-core

hardware resources for timely data processing using

MPI library-based parallel computation. Information

obtained from the support system provides investors

with an advantage in making investment decisions

compared with uninformed market players.

REFERENCES

Asgharian, H. (2011). A conditional asset-pricing model

with the optimal orthogonal portfolio. Journal of

Banking & Finance, 35(5):1027–1040.

NCTA 2015 - 7th International Conference on Neural Computation Theory and Applications

144

Asgharian, H. and Hansson, B. (2005). Evaluating the im-

portance of missing risk factors using the optimal or-

thogonal portfolio approach. Journal of Empirical Fi-

nance, 12(4):556–575.

Assaad, M., Bon´e, R., and Cardot, H. (2008). A new

boosting algorithm for improved time-series forecast-

ing with recurrent neural networks. Information Fu-

sion, 9(1):41–55.

Caporin, M., Ranaldo, A., and De Magistris, P. S. (2013).

On the predictability of stock prices: A case for

high and low prices. Journal of Banking & Finance,

37(12):5132–5146.

Chen, C.-W. (2014). Retracted: Applications of neural-

network-based fuzzy logic control to a nonlinear time-

delay chaotic system. Journal of Vibration and Con-

trol, 20(4):589–605.

Collins, M. (2007). Ensembles and probabilities: a new

era in the prediction of climate change. Philosophical

Transactions of the Royal Society A: Mathematical,

Physical and Engineering Sciences, 365(1857):1957–

1970.

Corwin, S. A. and Schultz, P. (2012). A simple way to esti-

mate bid-ask spreads from daily high and low prices.

The Journal of Finance, 67(2):719–760.

Farmer, J. D. and Sidorowich, J. J. (1987). Predicting

chaotic time series. Physical review letters, 59(8):845.

Felder, M., Kaifel, A., and Graves, A. (2010). Wind power

prediction using mixture density recurrent neural net-

works. In Poster Presentation gehalten auf der Euro-

pean Wind Energy Conference.

Fonseca, R. and G´omez-Gil, P. (2014). Temporal validated

meta-learning for long-term forecasting of chaotic

time series using monte carlo cross-validation. In Re-

cent Advances on Hybrid Approaches for Designing

Intelligent Systems, pages 353–367. Springer.

Gers, F. (2001). Long Short-Term Memory in Recurrent

Neural Networks. PhD thesis, ECOLE POLYTECH-

NIQUE FEDERALE DE LAUSANNE.

Gers, F. A., Schmidhuber, J., and Cummins, F. (2000).

Learning to forget: Continual prediction with lstm.

Neural computation, 12(10):2451–2471.

Goudreau, M., Giles, C., Chakradhar, S., and Chen, D.

(1994). First-order vs. second-order single layer re-

current neural networks. IEEE Trans. on Neural Net-

works, 5(3):511.

Hochreiter, S. and Schmidhuber, J. (1997). Long short-term

memory. Neural computation, 9(8):1735–1780.

Maknickas, A. and Maknickiene, N. (2012). Influence of

data orthogonality: on the accuracy and stability of

financial market predictions. In IJCCI 2012, pages

616–619. INSTICC.

Maknickien˙e, N. and Maknickas, A. (2013). Financial mar-

ket prediction system with evolino neural network and

delphi method. Journal of Business Economics and

Management, 14(2):403–413.

Markowitz, H. (1952). Portfolio selection*. The journal of

finance, 7(1):77–91.

Markowitz, H. (1987). Mean-variance analysis in portfolio

choice and capital markets. Blackwell.

Markowitz, H. (2014). Mean–variance approximations to

expected utility. European Journal of Operational Re-

search, 234(2):346–355.

Mayer, H., Gomez, F., Wierstra, D., Nagy, I., Knoll, A., and

Schmidhuber, J. (2008). A system for robotic heart

surgery that learns to tie knots using recurrent neural

networks. Advanced Robotics, 22(13-14):1521–1537.

McLean Sloughter, J., Gneiting, T., and Raftery, A. E.

(2013). Probabilistic wind vector forecasting using

ensembles and bayesian model averaging. Monthly

Weather Review, 141(6):2107–2119.

Roll, R. (1980). Orthogonal portfolios. Journal of Financial

and Quantitative analysis, 15(05):1005–1023.

Rutkauskas, A. V. (2000). Formation of adequate invest-

ment portfolio for stochasticity of profit possibilities.

Property management, 4(2):100–115.

Rutkauskas, A. V. and Stankeviˇciene, J. (2003). Formation

of an investment portfolio adequate for stochasticity

of profit possibilities. Journal of Business Economics

and Management, 4(1):3–12.

Samanta, B. (2011). Prediction of chaotic time series us-

ing computational intelligence. Expert Systems with

Applications, 38(9):11406–11411.

Scharnhorst, A. and Ebeling, W. (2005). Evolutionary

search agents in complex landscapes-a new model

for the role of competence and meta-competence

(evolino and other simulation tools). arXiv preprint

physics/0511232.

Schmidhuber, J., Gagliolo, M., Wierstra, D., and Gomez,

F. (2005a). Evolino for recurrent support vector ma-

chines. arXiv preprint cs/0512062.

Schmidhuber, J., Wierstra, D., Gagliolo, M., and Gomez, F.

(2007). Training recurrent networks by evolino. Neu-

ral computation, 19(3):757–779.

Schmidhuber, J., Wierstra, D., and Gomez, F. (2005b).

Evolino: Hybrid neuroevolution/optimal linear search

for sequence prediction. In In Proceedings of the

19th International Joint Conference on Artificial In-

telligence IJCAI. Citeseer.

Sheng, C., Zhao, J., Wang, W., and Leung, H. (2013).

Prediction intervals for a noisy nonlinear time series

based on a bootstrapping reservoir computing network

ensemble. Neural Networks and Learning Systems,

IEEE Transactions on, 24(7):1036–1048.

Stankeviˇciene, J., Maknickiene, N., and Maknickas, A.

(2014). Investigation of exchange market prediction

model based on high-low daily data. In The 8th inter-

national scientific conference ”Business and Manage-

ment 2014”. Vilnius.Technika.

Tsai, C.-F. and Wu, J.-W. (2008). Using neural network en-

sembles for bankruptcy prediction and credit scoring.

Expert Systems with Applications, 34(4):2639–2649.

Wierstra, D., Gomez, F. J., and Schmidhuber, J. (2005).

Modeling systems with internal state using evolino.

In Proceedings of the 7th annual conference on Ge-

netic and evolutionary computation, pages 1795–

1802. ACM.

Zhang, G. P., Berardi, V., et al. (2001). Time series forecast-

ing with neural network ensembles: an application for

exchange rate prediction. Journal of the Operational

Research Society, 52(6):652–664.

Investment Support System using the EVOLINO Recurrent Neural Network Ensemble

145