Design and Performance Aspects of Information Security Prediction

Markets for Risk Management

Pankaj Pandey and Einar Arthur Snekkenes

Norwegian Information Security Lab., Gjovik University College, Teknologivn. 22, 2815 Gjovik, Norway

Keywords:

Information Security, Security Economics, Security Risk Management, Prediction Market.

Abstract:

Prediction Markets are the markets designed and operated to mine and aggregate the information scattered

among the traders. Recently, some researchers have started exploring the application of prediction markets in

the information security domain. The information security prediction market will facilitate trading of contracts

to hedge the financial impact of the risks associated with the underlying information security events, such as

discovery of a vulnerability in a piece of software. However, prediction markets differ in their objectives and

requirements, and therefore information security prediction markets need to be carefully engineered to meet

the specific requirements. The contribution of this paper is the identification of a set of design requirements

for an information security prediction market, and associated performance criteria. We present five categories

of design requirements: Contracts, Trading Process, Participants and Incentives, Clearing House, and Mar-

ket Management for the information security prediction market. Furthermore, we present six performance

measures: Information Elicitation, Transparency, Efficiency, Transaction Cost, Liquidity, and Manipulation

Resistance for the performance assessment of information security prediction market.

1 INTRODUCTION

The Global Risk report of World Economic Forum

states that ”Effective methods for measuring and pric-

ing cyber risks may even lead to new market-based

risk management structures which would help in un-

derstanding the systemic interdependencies in the

multiple domain that now depend on cyberspace”

(WEF, 2014). A carefully designed Prediction Market

can be used as a market mechanism for the manage-

ment of information security risks.

Prediction markets are the markets designed and

operated for mining and aggregation of information

which is scattered among the market participants

(Berg and Rietz, 2003). Subsequently this informa-

tion is reflected in the market prices and the prices

have a strong correlation with the probability belief of

the traders (Luckner, 2008). Prediction markets have

been used for various purposes such as prediction of

government policy actions, weather events, economic

indicators, elections, etc. (Luckner, 2008). Prediction

markets have also been attempted in the security and

terrorism domain. A well known (now abandoned)

project in the security domain is ”Future Markets Ap-

plied to Prediction (FutureMAP)” project of Defense

Advanced Research Project Agency (DARPA), USA

(Hanson, 2006). FutureMAP was to be used as an

”Electronic Market-Based Decision Support” system

to improve the approaches for collection of intelli-

gence information (Hanson, 2006).

(Pandey and Snekkenes, 2014a) assessed the ap-

plicability of prediction markets inthe information se-

curity domain as a risk management tool in an intra-

organizational setting as well as in an open setting.

The usefulness of prediction markets in hedging the

(financial impact of)information security risks is ex-

plained in (Pandey and Snekkenes, 2014b). As the

prediction markets differ in their objectives and re-

quirements, an important question in the context of in-

formation security prediction markets (ISPM) is: how

to design and engineer an ISPM to achieve the ob-

jectives of information aggregation and risk manage-

ment? The primary contribution of this article is the

identification of a set of design elements and associ-

ated performance measures for ISPM.

The remainder of the paper is structured as: Sec-

tion 2 explains the research method followed for the

article. Section 3 presents the related work. Sec-

tion 4 presents the design requirements for an ISPM.

Section 5 explains the design elements of an ISPM.

Section 6 presents the performance measures for an

ISPM. Section 7 resents the conclusion and directions

for future work.

273

Pandey P. and Arthur Snekkenes E..

Design and Performance Aspects of Information Security Prediction Markets for Risk Management.

DOI: 10.5220/0005547502730284

In Proceedings of the 12th International Conference on Security and Cryptography (SECRYPT-2015), pages 273-284

ISBN: 978-989-758-117-5

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

2 RESEARCH METHOD

The research follows the Design Science Research

Approach (DSRA). DSRA is useful when innovations

and ideas are created for development of technical ca-

pabilities and products which will be instrumental in

effective and efficient process development for arte-

facts (Johannesson and Perjons, 2014). The steps in

DSRA are as follows:

1. Explicate Problem : The first step is to formulate

the initial problem, justify its importance and in-

vestigate the underlying causes (Johannesson and

Perjons, 2014). To explicate the problem we

started with examining the literature on informa-

tion security markets, and taxonomy of prediction

markets to design an ISPM. This enabled us in

identifying the limitations of existing market en-

gineering frameworks. An overview of reviewed

literature is covered in Section 3.

2. Define Requirements : The second step is to iden-

tify and outline an artefact to address the expli-

cated problem and to elicit requirements for the

artefact (Johannesson and Perjons, 2014). A re-

quirement is the property of the artefact that is de-

sired by stakeholders in practice and is used for

design and development of the artefact. A require-

ment can be functional, structural, or environmen-

tal in nature. The requirements for the artefact

(ISPM) are given in Section 4.

3. Design, Development and Demonstration of the

Artefact : The next step leads to creation and

demonstration of an artefact that fulfils the re-

quirements identified in the previous (second)

step. This includes designing the functionality

and structure of the artefact (Johannesson and Per-

jons, 2014). The demonstration shows that the

artefact can, in fact, solve the problem (or some

aspects of it) in the given situation. The func-

tionality and structure of the artefact (ISPM) are

demonstrated in Section 5.

4. Evaluation of the Artefact : The last step is to

evaluate the artefact. This determines the extent

to which the artefact is able to solve the explicated

problem and its requirements (Johannesson and

Perjons, 2014). We have not evaluated the artefact

(ISPM) in the strictest sense; however we have

identified the performance factors for ISPM in

Section 6. We have used the ’informed argument’

form of evaluation. In this form, researchers eval-

uate the artefact by reasoning and arguments for

its usefulness in meeting the defined requirements

and solving the explicated problem. Informed ar-

gument form of evaluation is often used to evalu-

ate the artefacts which are highly innovative and

are still immature.

3 RELATED WORK

(Weinhardt and Gimpel, 2007) defined a market as ”a

set of humanly devised rules that structure the inter-

action and exchange of information by self-interested

participants in order to carry out exchange transac-

tions at a relatively low cost”. The efficiency and ef-

fectiveness of the market in achieving the specific ob-

jectives depends upon the design and implementation

of the market.

(Spann, 2002) proposed a taxonomy for the imple-

mentation of (prediction) markets. This taxonomyhas

five elements with several sub-components, namely

Market Strategy, Market Design, Information Design,

Market Operationsand Data Interpretation. Out of the

five elements only one element, i.e. Market Design is

relevant for this article. The ’Market Design’ com-

prises of six elements: Underlying (event), Medium

of Exchange, Incentive System, Trading Mechanism,

Market Rules and Kick Off Settings.

(Weinhardt and Gimpel, 2007) proposed a ’Mar-

ket Engineering Framework’ to define a structured,

systematic and theoretically grounded process of de-

sign, implementation, evaluation and introduction of

market platforms. (Plott and Chen, 2002; Luckner,

2008; Sripawatakul and Sutivong, 2010) also present

some guidelines on the design and implementation of

prediction markets.

However, due to various legal, intellectual prop-

erty and security reasons (Fidler, 2014), the design

and implementation issues discussed in the above arti-

cles do not suffice to address the specific requirements

and objectives of the ISPM. Further, we need specific

parameters to understand and assess the performance

of an ISPM.

4 REQUIREMENTS FOR ISPM

From our systematic review of literature on design

and implementation of prediction markets (Luckner,

2008; Weinhardt and Gimpel, 2007; Spann, 2002;

Plott and Chen, 2002; Sripawatakul and Sutivong,

2010), and existing market methods for management

of information security risks (Fidler, 2014) we have

identified 13 key design requirements for an ISPM.

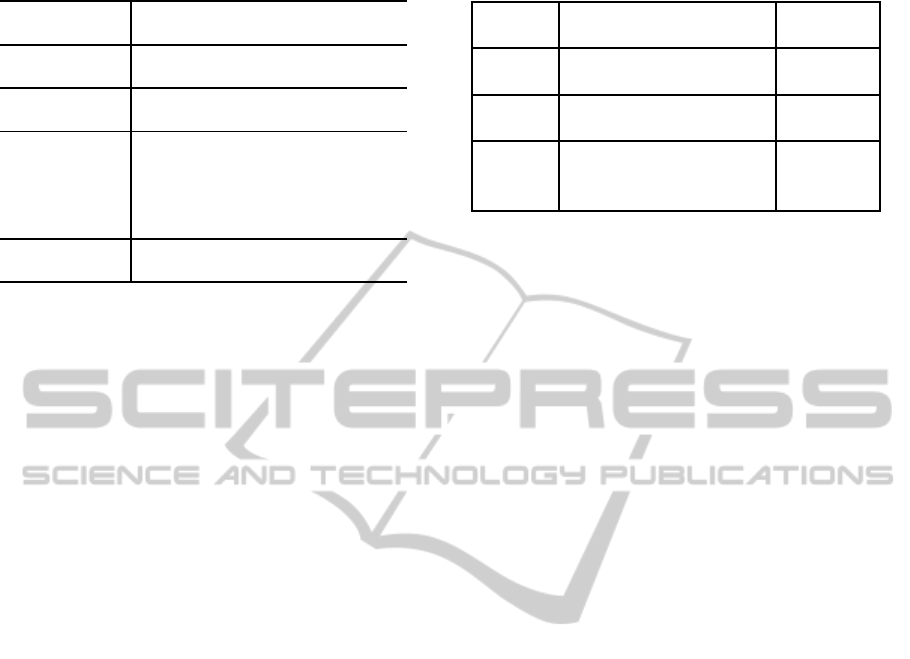

As shown in Table 1, the design requirements are

grouped into five categories: (i) Contracts, (ii) Trad-

ing Process, (iii) Participants and Incentives, (iv)

Clearing House, and (v) Market Management.

SECRYPT2015-InternationalConferenceonSecurityandCryptography

274

Table 1: Requirements for ISPM.

Contracts

Type of Contracts

Contract Specifications

Trading

Process

Trading Mechanism

Anonymous Trading

Participants

and Incentives

Participant’s Motivation

Incentive Structure

Clearing

House

Contract Settlement Criteria

Counterparty Risk Management

Trusted Third Party

Intellectual Property Management

Know Your Trader

Market

Management

Regulated Market

Legal Permission

5 DESIGN ASPECTS OF ISPM

This section explains the design requirements identi-

fied in section 4. This section is divided into five sub-

sections, each for one group of design requirements.

The five subsections are further divided into thirteen

sub-subsections each for one design aspect of ISPM.

5.1 Contracts

An ISPM will be a marketplace to buy and sell con-

tracts with underlying security events. The contracts

must be specific and all the details regarding the de-

cision criteria, payoff, settlement date, etc. should

be specified before the contract is made available for

trading. The contract price will be an approximate

measure of the probability, mean or median of the un-

derlying events at any time. The ability to use market

prices as forward-looking indicators of security prop-

erties will help in establishing information symmetry

between buyers and sellers (i.e. build a quality sig-

nal), and help security stakeholders to make better and

more informed decisions, by differentiating mediocre

security products from good ones. The contract types

and specifications are explained below.

5.1.1 Contract Types

On the basis of payoff mechanism, the contracts can

broadly be categorized into three types: (i) Binary

contracts, (ii) Index contracts, and (iii) Spread con-

tracts. A comparison of contract types is shown in

Table 2.

• Binary Contracts: In binary contracts the payoff

is linked to the occurrence or non-occurrence of

the underlying event. For example, A binary con-

tract that pays $100 to the buyer of the contract

depending on whether the biometric system of

Table 2: Comparison of Contract Types.

Contract

Type

Payoff Mechanism Market

Belief

Binary All or Nothing Probability

Index Proportionate to out-

come

Mean

Spread Double if outcome ex-

ceeds cutoff else noth-

ing

Median

smartphone ’XYZ’ will be found vulnerable to a

spoofing attack by the 31/Mar/2015.If somebody

thinks that the vulnerability does not exist or will

not be found by the contract expiry date, then the

individual will sell the contract. The price of con-

tract will be in the range of $1 to $100, depending

on the beliefs of market participants. For binary

contracts, with a settlement value of $100, the ac-

tual settlement value will be $0 or $100.

• Index Contracts: In case of index contract, the

value of the contract is linked to the outcome of

the underlying event. For example, an index con-

tract that pays $0.01 for every data breach dis-

closed between 01/Mar/2015 to 31/Mar/2015, and

if A thinks that 40 or more such incidents will

be disclosed and B thinks that 80 or less such

incidents will be reported, then the market price

will be between $0.39 and $0.81. A will buy for

strictly less than $0.40 (i.e. $0.39), and B will sell

for strictly more than $0.80 (i.e. $0.81).

• Spread Contracts: Spread contracts can be used

to bet on whether the outcome related to the un-

derlying event will be above or below a certain

value, i.e. the spread. In spread contracts, the cur-

rent market price can be interpreted as the traders’

expectation of the median outcome of the under-

lying event. Let us consider a contract with the

underlying event being the discovery of a vulner-

ability in a software. Let us say the market maker

is quoting at the price (spread) $50-$55, i.e. the

market maker wants to buy at $50 and sell at $55.

If a trader believes that the price will go up (i.e. a

vulnerability will be discovered) he will buy from

the market maker at $55. If after some time, some

new relevant information is known to the mar-

ket participants and the current quote by market

maker is $60-$65. Then, if the trader who pur-

chased the contract at $55 wants to cash out his

profits, he will sell his contracts at $60 to the mar-

ket maker.

DesignandPerformanceAspectsofInformationSecurityPredictionMarketsforRiskManagement

275

5.1.2 Contract Specifications

An important aspect of contract design is the precise

specification of the contract. The contract specifica-

tions should clearly mention the expiry date, settle-

ment date (settlement date can be different from the

expiry date), payoff, decision criteria and other fac-

tors relevant to the underlying event.

For instance, for a contract which is meant to al-

low betting on discovery of vulnerability ’V’ in the

software ’S’ on or before the date ’D’, the contract

specifications must clearly define the vulnerability

’V’ as in what is included and what is not. Secondly,

the specification should include information on the

source which will be considered for the acceptance

or rejection of the vulnerability. The source can be

a government body regularly reporting such informa-

tion, appearance of the said information in the regular

media, reporting by responsible organization such as

Google through its ’ProjectZero’ (Google, 2014), or a

direct reporting by the vulnerability discoverer to the

market operator.

If the vulnerability can be directly reported to the

market operator then the contract should clearly spec-

ify the testing procedure or the testing body which

will certify the existence of the vulnerability. Further,

a proper policy should be crafted regarding the re-

sponsible reporting of vulnerability to the vendor and

the time period during which the vulnerability infor-

mation will be kept secret. In such a scenario when

the vulnerability ’V’ is directly reported to the market

operator and it is reported on or before the date ’D’

but it needs to be kept secret for sometime, then the

contract will expire on the date mentioned as expiry

date specified on the contract but the settlement of the

contract will take place only after the vulnerabilityhas

been tested and reported to the vendor. It is not nec-

essary to wait for the vulnerability patch. The market

operator may set a fix period within which the ven-

dor is expected to release the patch. However, if the

vendor fails to fix the vulnerability within the given

period, the contract will be settled and vulnerability

information (full or partial) will be made public.

As the information security events and therefore

the information security contracts are different from

the traditional sports or political contracts, it is im-

portant to clearly define the underlying event and the

decision criteria, otherwise an ambiguity in specifica-

tions may lead to disputes and confusion. The con-

cern for ambiguity and confusion is likely to be an-

ticipated by the buyers and sellers. Thus in addition

to ’noise’ during the clearing process, buy/sell prices

will be affected by the concern. The cost of trust

(of outcome decision) will be factored into prices of-

fered by the buyer and seller, thus with low trust, there

might not be any trade.

A closely related real world example is from

TradeSports (TradeSports, 2015). In 2006 Trade-

Sports had a contract with a payoff value of 100

if North Korea would launch a test missile and the

missile leaves North Korean air space on or before

11:59:59pm ET on 31st July 2006 otherwise the will

pay 0 (EOG, 2006). The source to be used for the

settlement of the contract was the U.S. Department of

Defense. In early July 2006, the Government of North

Korean claimed to have conducted such a test and this

was reported by various news sources as well. How-

ever, the U.S. Department of Defense did not confirm

the test leading to the settlement of the contract at 0.

Had the contract mentioned some other source for the

decision the contract could have settled at 100. On the

other hand if the contract had multiple sources of con-

firmation then this could have led to disputes between

the traders and the operator.

5.2 Trading Process

Trading process is divided into two parts, namely

trading mechanism and anonymous trading, and are

explained below.

5.2.1 Trading Mechanisms

The selection of trading mechanism depends upon the

type of contract and its specification. As the informa-

tion security prediction markets are meant to provide

a risk management mechanism, it is extremely impor-

tant that the market participants are allowed to adjust

their bets based on the latest information they may

have about the underlying event.

(Pennock, 2004) identified four types of trad-

ing mechanisms, (i) Continuous Double Auction; (ii)

Continuous Double Auction with Market Maker; (iii)

Pari-mutual Market; and (iv) Market Scoring Rule.

However, Pari-mutual market mechanism does not

allow continuous incorporation of information and

therefore it is not useful for the information secu-

rity prediction market. (Pennock, 2004) proposed a

new trading mechanism called Dynamic Pari-mutual

Market, and this mechanism provides the continuous

incorporation of information. These trading mecha-

nisms are compared on the basis of four criteria: (i)

Continuous incorporation of information; (ii) Liquid-

ity guarantee; (iii) Ability to cash out anytime during

the market trading hours; and (iv) Bounded risk to

market operator.

• Continuous Double Auction (CDA): CDA is a

widely used mechanism in the financial markets.

In this model, limit order book is used to match

SECRYPT2015-InternationalConferenceonSecurityandCryptography

276

buy orders with the sell orders. The orders are

matched based on the price and time priority.

Apart from the limit orders, any trader can buy

at the best ask price and sell at the best bid price.

• Continuous Double Auction with Market Maker

(CDAwMM): CDAwMM is a bookie mechanism

which is used in sports betting. This mecha-

nism is like CDAwith an automated marketmaker

which guarantees market liquidity by transferring

the risk to the market operator. The mechanism

allows continuous incorporation of information.

• Dynamic Pari-Mutuel Market (DPM): DPM was

proposed by (Pennock, 2004). In DPM mecha-

nism, traders are allowedto purchase shares at any

time and on any outcome. This mechanism pro-

vides an automated market maker which provides

infinite liquidity to the buyers. The trading prices

are set by the market maker on the basis of a pre-

determined pricing formula. The pricing of con-

tracts allows continuous incorporationof informa-

tion. However, the market maker does not buys

the shares from traders and the CDA mechanism

is used to allow selling of contracts by traders.

• Market Scoring Rule (MSR): MSR was proposed

by (Hanson, 2003) for trading in prediction mar-

kets . He suggested that a scoring rule can be used

to allow betting on the entire probability distribu-

tion over many variables and a scoring rule will

reward the traders for incremental improvements

in the outcome. All the traders are allowed to see

the current probability distribution and if a trader

thinks that the current probability is incorrect then

the trader can readjust the probability. In this case,

each new predictor is paid off for improving the

prediction probability and traders lose money if

their prediction is worse. The final pay off de-

pends on the closeness of trader’s predictions to

the actual outcome.

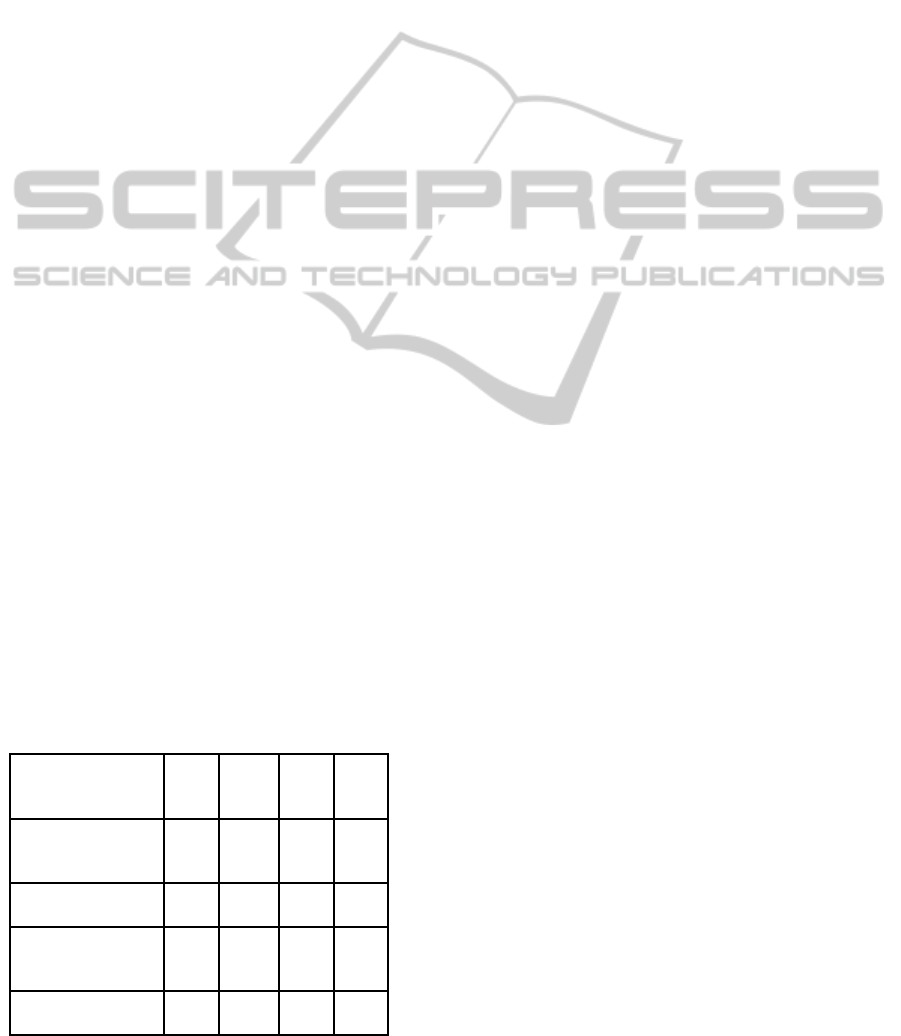

Table 3 presents a comparison of trading mechanisms.

Table 3: Comparison of Trading Mechanisms.

CDA CDA

wMM

DPM MSR

Continuous

Information

Incorporation

Yes Yes Yes Yes

Liquidity Guar-

antee

No Yes Yes Yes

Anytime Cash

Out in Market

Hours

Yes Yes Yes Yes

Bounded Risk to

Market Operator

Yes No Yes Yes

5.2.2 Anonymous Trading

Anonymous trading implies that the identification in-

formation about traders is not revealed to market par-

ticipants. In anonymous trading system, traders with

private information are more likely to participate, as

it would be extremely difficult for other traders to dis-

tinguish between the orders and trades coming from

an informed and an uninformed trader. Furthermore,

threats of retribution by the employer of the trader can

deter the trader participation. On the other hand, secu-

rity researchers working in the field may face certain

ethical concernsor peer pressure against the participa-

tion in the market. In such cases, anonymous trading

will let the insiders with private information to trade

in the market. This will improve the information ag-

gregation and the overall performance (efficiency) of

the market.

5.3 Participants and Incentives

Market participants and participation incentives are

two keydesign aspects of informationsecurity predic-

tion markets. These two factors are explained below.

5.3.1 Participant’s Motivations

ISPMs are expected to attract at least six types of

participants: (i) Product Users; (ii) Cyber-Insurance

Providers; (iii) Investors; (iv) Product Vendors;

(v) Product Vendor Competitors; (vi) Security Re-

searchers. Each of these users may have unique or

similar motivations to participate in the market. For

instance for a contract such as : Vulnerability ’V’ will

be discovered in Product ’P’ on or before 11:59:59

PM(GMT) 31/Mar/2015. The motivation for each of

the participant type to trade in the above contract is

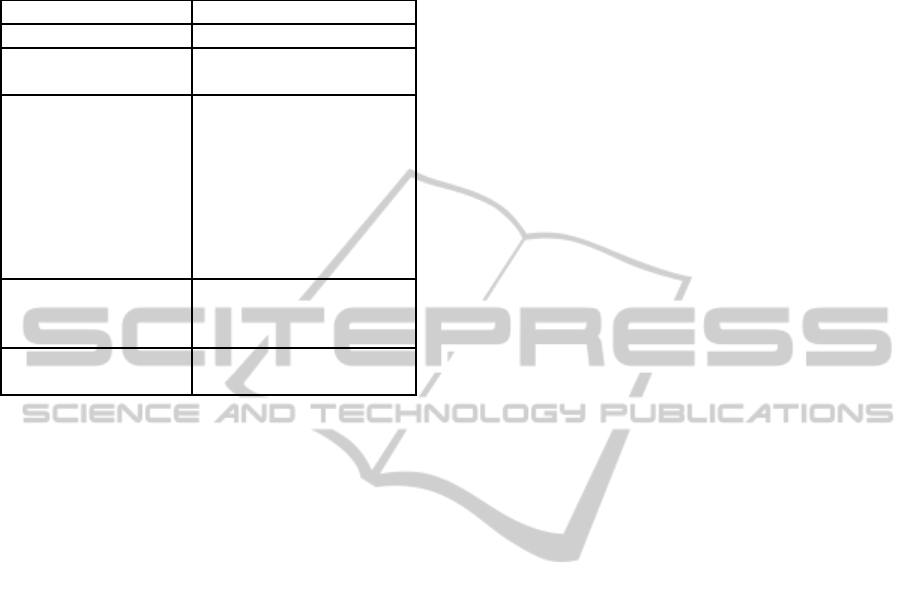

shown in Table 4.

5.3.2 Incentive Structure

An appropriate incentive structure is required to mo-

tivate traders to participate in the market and truth-

fully reveal the information relevant to the underly-

ing the event. The incentives for participation in a

prediction market are either monetary incentives or

non-monetary incentives. However, as the goal of

the ISPM is to provide a risk management mecha-

nism for financial impact associated with the under-

lying information security events, the incentive struc-

ture in this case can only be monetary. The incentive

structure will vary based on the payoff mechanism of

contracts. Different contracts, such as binary, index,

spread, bonds, insurance-linked, etc. will have differ-

DesignandPerformanceAspectsofInformationSecurityPredictionMarketsforRiskManagement

277

ent incentive structure and some contracts may be of

special interest to specific type of participants.

Table 4: Participants and Incentives.

Participants Incentives

Product Users To hedge the productrisk

Cyber Insurance

Providers

To underwrite their cus-

tomer’s cyber-risks

Product Vendors To prove the security of

their software, to sig-

nal its quality with re-

spect to other vendor’s

products,to use it as em-

ployee stock options to

incentivize developers to

develop secure products

Product Vendor

Competitors

To prove that the product

is not as secure as their

own product

Security Researchers To earn profits from the

market

5.4 Clearing House

The clearing house is a body which clears and set-

tles all the trades in the market. In an ISPM, clearing

house will play at least the following four roles.

5.4.1 Contract Settlement

Due to very technical nature of information security

contracts it will not be easy and straight forward to

decide on the technicalities. For example, in case of a

contract associated with privacy breach at a bank, it is

important to specify and define as in what constitutes

the privacy breach and what is not covered in the con-

tract specification. Thus, the clearinghouse will act as

the final decision body with regards to the settlement

of the contracts. Further, for the contracts related to

vulnerability discovery and when the vulnerability is

directly reported to the market (i.e. to the clearing

house) they have the responsibility to test and accept

or reject the vulnerability. This will lead to settlement

of the contract and final pay outs.

5.4.2 Counterparty Risk Management

The clearing house will act as a guarantee between the

two counterparties involved in the trade. This implies

that the clearing house acts as a buyer for the seller of

the contract and as a seller for the buyer of the con-

tract. In case of zero net supply contracts, the clearing

house has no market risk. However, it is exposed to

the risk associated with failure of any of the counter-

party in the market. Thus, the clearing house needs to

have sufficient capital to cover the risk.

5.4.3 Trusted Third Party

The clearing house will act as a trusted third party for

various activities including but not limited to verifi-

cation of vulnerabilities directly reported to it, keep-

ing the vulnerability information secret for a specified

period, responsibly reporting the vulnerability to the

vendor, etc.

5.4.4 Intellectual Property Management

The ISPMs are likely to have a range of contracts

with various types of underlying events or informa-

tion. Thus, for contracts involving some kind of in-

tellectual property, such as development of an exploit

against the specified discovery will need to be dealt in

an ethical and legal way.

5.4.5 Know Your Trader

Due to the security concerns associated with the infor-

mation related to the underlying events and financial

aspect of trading (incentives), it is utmost important

for the market (clearing house or a separate entity) to

verify the credentials of the market participants. This

is like the know-your-customerpolicy followed in the

banking and financial industry.

Currently, it is extremely difficult to track down

the origin of specific exploit trading in a black mar-

ket. Black-hat hackers operate covertly to succeed in

the game of attack and defense. This intense secrecy

makes it difficult to track and prosecute the exploiter.

So, to prevent the leakage of vulnerability and/or ex-

ploit information from the ISPM to a black-market, it

is must to have a participant’s verification policy.

Know-Your-Trader policy will also help in pre-

venting insider trading. In the financial services sec-

tor, insider trading is defined as the trading of stocks

and other securities of a publicly listed company

by individuals with access to non-public information

about the company. In the information security do-

main, an insider trading can take at least two forms:

(i) A developer working for a company deliberately

leaves some vulnerability in the code, so that it can

be later sold in the ISPM, (ii) A software tester while

working for his/her employer may find some bugs in

an application, however instead of reporting it inter-

nally the individual may decide to sell the information

in the ISPM.

Thus, the traders participating in information se-

curity prediction markets will have to provide some

SECRYPT2015-InternationalConferenceonSecurityandCryptography

278

(under the prevailing laws and regulations) informa-

tion about their finances (to avoid credit default, il-

legal financing, etc.) and personal information. The

personal information is required to fix the account-

ability and responsibility on the trader. If the private

information held with a trader is used for some illegal

activity then the trader can be investigated and held

liable for the same. However, none of this informa-

tion should be made available to other traders in the

market.

5.5 Market Management

The two key aspects of management of information

security prediction markets are regulations and legal

permissions, which are explained below.

5.5.1 Regulated Market

Economic markets can broadly be classified into two

forms, i.e. Free Markets and Regulated Markets. In

a free market economy, the forces of supply and de-

mand are not controlled by a government or authority.

In contrast to a free market, in a regulated or con-

trolled market, government intervenes in supply and

demand through non-market methods such as laws to

control the permissions to participate in the market,

setting of prices, type of products or services, taxa-

tion, etc.

Markets for vulnerabilities will have several issues

such as intellectual property, rights management, non-

disclosure agreements, privacy issues, country spe-

cific laws, industry specific laws, etc. to be dealt in

a fair manner. Thus, the information security predic-

tion market will in most cases be regulated.

5.5.2 Legal Permissions

Currently, there are two main legal issues associ-

ated with information security prediction markets: (i)

compliance with the financial market and gambling

regulations; and (ii) regulations concerning the infor-

mation (cyber-) security.

6 PERFORMANCE MEASURES

FOR ISPM

This section presents the six performance measures

required for effective and efficient functioning of

ISPM, and are explained in the following subsections.

6.1 Information Elicitation

In an ISPM the price of a contract will be informative

only when it is strongly correlated to actual proba-

bility of occurrence of the underlying event. We use

the term ’informative price’ to indicate that there is

a strong - and publicly known- correlation between

price and the aggregated belief of the stakeholders.

Informative prices are extremely vital for the risk

managers to allocate resources (deploy security con-

trols) in an efficient and effective manner.

In financial terms there are two types of values,

i.e. market and intrinsic value, associated with an in-

formation security contract. The market value of a

contract is the current price at which trades can be

executed. The intrinsic value is the expected present

value of the contract with all the available informa-

tion, and accounting for the benefits and costs asso-

ciated with the contract. Since all the information is

not known to all the traders and they differ in their

analysis of information, they have different estimates

about ’true’ probability of occurrence of the underly-

ing event. Therefore, intrinsic values are not perfect

foresight indicators.

Informed traders will estimate the probability of

the underlying event based on the private information

as well as the information available in the public do-

mains. If the intrinsic value estimated by informed

traders is different from the current market price, then

they will buy the undervalued contracts and sell the

overvalued contracts. This difference between the in-

trinsic value and market price is due to noise. There-

fore, the trading by informed traders leads to market

prices closer to the intrinsic value calculated by them.

Let us assume that there are N traders trading a

contract and each of them has a different estimate

of occurrence of the underlying event. Let Pi be the

probability estimate of the i’th trader. Further, let us

say P is an unbiased estimate of T the true probability

of the underlying event. In this case, the forecasted

probability can be expressed as:

P

i

= T + E

i

(1)

where Ei is the error in the probability estimate of i’th

trader. As the probability estimates are unbiased, the

expected forecast error is zero. However, in absolute

terms the individual probability estimate errors might

be quite high.

Let us assume that for each trader the desired po-

sition in the contract Ci is proportional to the differ-

ence between his probability estimate and the current

market price (which indicates probability estimate of

occurrence of underlying event), expressed as:

C

i

= µ(P

i

−M) (2)

DesignandPerformanceAspectsofInformationSecurityPredictionMarketsforRiskManagement

279

where µ is some constant of proportionality, and M is

the current market price. Thus, the i’th trader would

like to buy the contract if his probability estimate is

higher than the current market price. On the other

hand, if the trader’s estimate of probability is less than

the current market price then the trader will (short)

sell the contract to profit from the current higher mar-

ket price (probability).

Further, let us assume that the contract is in ’zero

net supply’. Derivatives like futures and options are

examples of zero net supply financial products. Zero

net supply means that for every winner there is a loser

in the market. Thus, if we sum up the market value

of all the position holders in the market, then we get

an exact zero. This implies that as a whole the market

is not exposed to any market risk, however this is not

true for counterparties individually. Zero net supply

is important because it ensures that there is no upper

limit to the scale of the market.

The current market price for zero net supply con-

tracts can be calculated by summing all the desired

positions equal to the net supply and computing the

resulting equation for M (Harris, 2002):

N

∑

i=1

C

i

=

N

∑

i=1

µ(P

i

−M) = µ

N

∑

i=1

P

i

−NµM = 0 (3)

The market price M is represented as

M =

1

N

N

∑

i=1

P

i

(4)

is an average of the individual probability estimates of

underlying events. Substituting Equation 1 into Equa-

tion 4 gives:

M = T + E

mp

(5)

where Emp is the market price forecast error repre-

sented as follows:

E

mp

=

1

N

N

∑

i=1

E

i

(6)

If the forecast errors of individual traders is indepen-

dent of each other, then the law of large numbers will

come into play and with an increase in the number of

traders, the market price forecast error Emp will ap-

proach zero. Also, if the number of traders is small

and if the individual trader errors are not identical

then the average market price forecast error will be

less than the average market price forecast error of in-

dividual traders. Therefore, the information security

prediction markets will be most informative if the in-

formed traders independently collect the information.

6.2 Transparency

Transparency is an important characteristics. Trans-

parency deals with the information about the trading

process such as prices, book size, etc. which is made

available to the traders. The market transparency will

ensure that the clearing house and market regulators

are aware of the positions of individual traders. Thus,

if a market participant becomes too exposed to mar-

ket risk or is accumulating big positions which could

affect the overall market, then the authorities can ini-

tiate the necessary risk management and legal actions.

Transparency in an ISPM can be divided into pre-

trade transparency and post-trade transparency. Pre-

trade transparency is about the information on bids,

offers, book size, order depth and other such infor-

mation which is useful before a trade has been made.

Post-trade transparency is about providing informa-

tion related to executed trades, such as time of trade,

price at which it was executed, size of the trade,

etc. The identity of traders should not be revealed

to other traders, neither in pre-trade information nor

in post-trade information. Further, Information re-

lated to vulnerability and/or exploits (if it has been

directly reported to the market operator) cannot be

fully disclosed to market participants until a patch has

been released or the vendor was given adequate (as

mentioned in the trading contract description) time to

fix the same. However, historical trading prices, or-

ders and other trade related and settlement informa-

tion should be made available to the market partici-

pants. This information has twofold benefits. First,

it lets the traders analyze the historical information

and secondly the information can be used by cyber-

insurance and information security rating companies

for the pricing of insurance contracts and rating of

product vendors respectively. Higher transparency in

the market is expected to lead to transparent pricing

of contracts.

Further, information security researchers cur-

rently face the problem of lack of data to validate

various models of information security investments in

security controls, estimating security strength of a se-

curity control, reputation of security product vendors,

and so on. The data released by information secu-

rity prediction markets will be highly useful in such

scenarios where researchers and practitioners face the

problem of lack of data. The data can further be use-

ful in devising successful risk mitigation strategy, de-

velopment of secure software, among various other

benefits.

6.3 Efficiency

In an efficient market, market prices reflect all the in-

formation that can be acquired by traders and prof-

itably acted upon (Fama, 1970). However, some in-

formation may be too expensive to acquire or of lit-

SECRYPT2015-InternationalConferenceonSecurityandCryptography

280

tle value if it cannot be used to profit from the trade.

Therefore, market prices can never reflect all the in-

formation which informed traders can collect and act

on. The market efficiency can be categorized into

three types (Fama, 1970):

1. Weak Efficient Market: In the weak-form of ef-

ficient markets, the market prices reflect all the

past information and no one can make profit by

knowing the past information only. In this case,

prices simply follow a random walk. Therefore,

this form of market efficiency is not useful for in-

formation security prediction market.

2. Semi-strong Efficient Market: In the semi-strong

form of efficient markets, the market prices reflect

all the information available in the public domain.

In this case, no one can predict the future market

price by using only the information in public do-

main. In semi-strong form of markets, informed

traders can profit by having access to some pri-

vate information. In an ISPM security researchers

may have private information about certain vul-

nerability in a software and they can profit from

it. Also, if a contract is listed for discovery of

a vulnerability in a particular software then secu-

rity researchers can use their domain knowledge

to discover the said vulnerability before the ex-

piry date, thus making profit from trading in the

market.

3. Strong-Form Efficient Market: In the strong form

of efficient markets, the market prices reflect all

the information available in the public domain

as well as the private information as soon as it

is known. In such a scenario, informed traders

have no advantage over uninformed traders and

therefore they can never make profit in the mar-

ket. Therefore, this type of market efficiency is

not useful for ISPMs.

6.4 Transaction Cost

Transaction cost will include all the cost associated

with trading in the ISPM. These costs can be divided

into following three categories (Harris, 2002):

• Explicit Transaction Costs: This includes costs

like brokerage paid, exchange fees, taxes paid.

This also includes cost of acquiring relevant in-

formation such as information related to a vulner-

ability, software product, etc. Further, it includes

the cost associated with time spent and resources

used by a security researcher to discover vulner-

ability in a software. The security researcher can

use this private information about the existence of

vulnerability in the software to trade relevant con-

tract(s) listed on the information security predic-

tion market.

• Implicit Transaction Costs: This type of trading

cost arises when traders have an impact upon the

market prices. For instance, if a trader buys at the

ask price and sells at the bid price then he ends up

paying the bid-ask spread price. Similarly, when

traders push up the price while executing large

buy orders, and push down the prices when exe-

cuting a large sell order, the impact of their trading

on the prices constitutes transaction cost.

• Missed Trade Opportunity Costs: This is the cost

associated with failure to get orders executed or

if the orders are partially filled or if the orders

are not filled in a timely manner. In other words,

missed trade opportunity cost is the difference be-

tween getting the trade at the desired price, and

the first next opportunity. So, it is the cost associ-

ated with delay in transaction.

In the financial industry, the simplest and commonly

used method for calculation of transaction costs is

’Quoted Spreads’ (Teschner, 2012). This can be cal-

culated using the trade and order book data. Let us

say Bidc,t is the bid price for a contract ’c’ at time ’t’

and Askc,t is the corresponding ask price for the con-

tract ’c’ at time ’t’. The mid quote of Mid price of the

contract c is denoted as Midc,t. The quoted spread can

thus be calculated as:

QuotedSpread

c,t

=

(Ask

c,t

−Bid

c,t

)

2∗Mid

c,t

(7)

The spread paid when executing a market order

against a limit order is termed as effective spread. Let

us say Pricec,t is the execution price then the effective

spread can be calculated as:

E f f ectiveSpread

c,t

= S

c,t

∗

(Price

c,t

−Mid

c,t

)

Mid

c,t

(8)

Sc,t denotes the trade side, +1 for a buy order and -1

for a sell order.

The realized spread denotes the revenues of liq-

uidity supplier (Bessembinder and Kaufman, 1997).

(Glosten and Milgrom, 1985) model highlights that

if the risk of trading against asymmetrically informed

traders is high then the spread is wide to compensate

the informed traders for their losses. After ’n’ minutes

of trade execution, the realized spread is calculated as:

RealizedSpread

c,t

= S

c,t

∗

(Price

c,t

−Mid

c,t+n

)

Mid

c,t

(9)

One of the recently proposed spread estimator method

which can be used for ISPMs is (Corwin and Schultz,

2012). As all the orderbook data may not be available

DesignandPerformanceAspectsofInformationSecurityPredictionMarketsforRiskManagement

281

or the data availability will be limited in the ISPM, the

transaction price method proposed by (Corwin and

Schultz, 2012) will be useful. They derived an esti-

mator for the bid-ask spread based on the daily high

and low prices. Daily high prices Hp is almost always

the execution price of buy order and daily low price Lp

is most likely the execution price of a sell order. The

price ratio of high-to-low price is due to the volatil-

ity which proportionately increases with the length of

trading intervals. Hence, they proposed an estimate of

a contract’s bid-ask spread as a function of the high-

to-low price ratio for a single two day period. The

high-to-low ratio for two consecutive trading days is

(Hp, p+1, Lp, p+1). They defined the spread estimator as:

SpreadEstimate =

2(e

α

−1)

1+ e

α

(10)

where

α =

p

(2β) −

p

β

3−2

√

2

−

r

γ

3−2

√

2

(11)

β = (ln

H

p

L

p

)

2

+ (ln

H

p+1

L

p+1

)

2

(12)

γ = (ln

H

p, p+1

L

p, p+1

)

2

(13)

6.5 Liquidity

Liquidity can be defined as the ability to execute large

size orders quickly, at low cost and at any time during

the market hours (Harris, 2002). Liquidity is an im-

portant market characteristic for market stakeholders.

High liquidity allows traders to execute their trades

in an efficient and cost-effective manner. Market op-

erators like a liquid market because it attracts many

traders to the market, and improves liquidity and in-

formation efficiency in the market. Market regulators

like liquid markets as the liquid markets are often less

volatile than the illiquid markets.

The (Amihud, 2002) illiquidity measure can be

used for (il)liquidity measurement in the ISPM. The

method uses the daily ratio of absolute returns for a

specific contract at a given time, in relation to the trad-

ing volume. Let us say that |Rct| represents the return

for contract ’c’ in the time period ’t’, and Volct rep-

resents the trading volume for the contract ’c’ in the

time period ’t’, and TDi denotes the number of trading

days in that period. The illiquidity for the contract ’c’

represented as ILc is expressed as:

IL

c

=

1

T

Di

T

Di

∑

t=1

|R

ct

|

Vol

ct

(14)

Let us say, there is a futures contract listed on ISPM

which pays $1 if a vulnerability is discovered in the

biometric authentication system of mobile phone ’M’

on or before ’X’ date and pays nothing otherwise. If

all the traders who do not have any private informa-

tion and believe that there is 40 percent probability of

discovery of vulnerability in the said system and on or

before the expiry date, then the price of the contract

will be 40 cents.

On the other hand an information security re-

searcher who has some knowledge about the system

believesthat he can discovera vulnerability before the

expiry date, Thus for him the probability of vulnera-

bility discovery is higher than 40 percent. Thus the se-

curity researcher believes that the probability of vul-

nerability discovery stands at 100%, denoted by ’λ’.

In this case the security researcher is well informed

and no one else has this information. So, when he

starts buying contracts starting from 40 cents, he is

pushing up the price.

Let us say, that average buy price for the security

researcher is represented as:

P

AVB

= 0.4+

T

c

L

(15)

where PAVB is the average buy price, Tc denotes the

total number of contracts purchased, and L is a pa-

rameter that characterizes the market liquidity. If the

market is very liquid then the security researcher can

buy a large number of contracts without significantly

affecting the market price.

The number of contracts which the security re-

searcher should buy to maximize his profits depends

upon λand L. As the contract pays $ 1 with probabil-

ity λ, the expected value of owning the contract is λ.

Therefore, the expected value of security researcher’s

holding is λTc. The total cost incurred on acquisi-

tion of this position stands at PAVBTc. So the expected

profit for the security researcher can be represented

as:

λT

c

−(P

AVB

T

c

) = λT

c

−(0.4T

c

+

T

c

L

)T

c

(16)

The expression shows that the security researcher

with good information can make more money in a liq-

uid market.

6.6 Manipulation Resistance

Manipulation in information security prediction mar-

kets can take at least two forms. Firstly, when a trader

tries to control the rate of information revelation and

decides to temporary trade against the information. A

trader who is confident that no one else has the same

information may prefer to do several small size trades

instead of one big trade. Also, to avoid signaling to

other traders, the trader needs to avoid pattern, such as

SECRYPT2015-InternationalConferenceonSecurityandCryptography

282

same order size in his small size trades (Chakraborty

and Yilmaz, 2004). This form of manipulation (hiding

true information) is relatively less harmful. However,

if the trader fears that other traders may also acquire

the same information then the trader may actually do

a big trade thereby revealing (signaling) the informa-

tion to other traders.

A second type of manipulation of prices is pos-

sible when traders trade in opposite of the informa-

tion they have and later the trades are not reversed.

Traders sometimes do this to create confusion in the

market and let the contracts trade at or around a par-

ticular price. This type of manipulation can be tack-

led by limiting the trade limit of traders, so that if

they trade against the information they will lose on

the trades. Also, if they do not trade quickly on the in-

formation they have then other may acquire the same

information and trade accordingly thereby deepening

the losses for those who did not trade or traded in

the opposite direction. Researchers have studied var-

ious models of financial market microstructure with

consideration of various types of noise traders such

as those who trade randomly, traders who have ma-

nipulate the closing price for higher futures market

settlement, traders who need immediate liquidity, and

traders who have quadratic preferences over the cur-

rent market price (Kumar and Seppi, 1992; Hillion

and Suominen, 2004; Hanson et al., 2006).

These studies have proved that manipulators are

just another type of noise traders and in effect they

improve the price accuracy. A trader seeking to ma-

nipulate the prices has hidden bias towards the direc-

tion and extent to which he intends to manipulate the

price. Other traders participating in the market are ex-

pected to have average bias. When the manipulator’s

bias and average trader bias is exactly equal then the

markets perform as if there is no price manipulation.

On the other hand, if the manipulator bias is lower or

higher than the average bias then this will be reflected

in market prices. However, speculators competition

leads to correction in average price and the price ac-

curacy is not affected with manipulative noise trading.

The studies based on market data confirms the theory

that average price accuracy is not affected by manip-

ulators. Though there has been one case of successful

manipulation (Hansen et al., 2004) but others have re-

ported that manipulators have not been successful in

decreasing the price accuracy, in the field (Camerer,

1998), historically (Rhode and Strumpf, 2004), and

in the laboratory (Hanson et al., 2006).

The evidence that noise trading generally leads to

increase in market accuracy suggests that there is little

to worry about price manipulation attempts in the in-

formation security prediction markets. As long as the

traders with correct information and rational behavior

outnumber the manipulators in terms of trading size,

the net effect will lead to increase in average price

accuracy. In other words, the impact of price manip-

ulation in information security prediction market will

depend upon the financial muscles of the manipulator.

7 CONCLUSIONS AND FUTURE

WORK

In this article, we identified a set of design require-

ments for the ISPM. We explained three types of con-

tracts: binary, index, and spread. Also, we explained

the importance of clear and unambiguous specifica-

tion of contracts. We explained four different types

of trading mechanisms, CDA, CDAwMM, DPM, and

MSR. The trading mechanisms are compared on the

four criteria: continuous incorporation of informa-

tion, liquidity guarantee, bounded risk to market op-

erator, and cash out option during the market hours.

The specific features of the trading mechanisms can

be used to design contracts to achieve the specific

objectives. We explained the significance of clear-

ing house in settlement of trading contracts, coun-

terparty risk management, role of trusted third party,

and as a custodian of confidential information and in-

tellectual property. Also, we identified several types

of traders who are expected to participate in ISPM.

Also, trader’s motivation and incentivesfor the partic-

ipation is explained. The importance of market reg-

ulation and specific legal permissions is briefly dis-

cussed. Furthermore, we identified six performance

measures for ISPM: Information elicitation, Trans-

parency, Efficiency, Transaction Cost, Liquidity, and

Manipulation resistance. We explained these individ-

ual factors in the light of information security specific

objectives of the prediction market.

In future, we intend to design, demonstrate and

evaluate some financial contracts to address a partic-

ular type of security risks. Then, we plan to demon-

strate a complete design and model of risk hedging in

an information security prediction market.

REFERENCES

Amihud, Y. (2002). Illiquidity and stock returns: cross-

section and time-series effects. Journal of Financial

Markets, 5(1):31–56.

Berg, J. E. and Rietz, T. A. (2003). Prediction markets as

decision support systems. Information Systems Fron-

tiers, 5(1):79–93.

DesignandPerformanceAspectsofInformationSecurityPredictionMarketsforRiskManagement

283

Bessembinder, H. and Kaufman, H. M. (1997). A cross-

exchange comparison of execution costs and informa-

tion flow for NYSE-listed stocks. Journal of Financial

Economics, 46(3):293–319.

Camerer, C. F. (1998). Can asset markets be manipulated?

a field experiment with racetrack betting. Journal of

Political Economy, 106:457–482.

Chakraborty, A. and Yilmaz, B. (2004). Manipulation in

market order models. Journal of Financial Markets,

7(2):187–206.

Corwin, S. A. and Schultz, P. (2012). A simple way to es-

timate bidask spreads from daily high and low prices.

Journal of Finance, 67(2):719–760.

EOG (2006). Tradesports’ bad call.

http://forums.eog.com/showthread.php/39353-

Tradesports-Bad-Call.

Fama, E. F. (1970). Efficient capital markets: A review of

theory and empirical work. The Journal of Finance,

25(2):383–417.

Fidler, M. (2014). Anarchy of Regulation: Controlling the

Global Trade in Zero-Day Vulnerabilities. PhD thesis,

Stanford University.

Glosten, L. R. and Milgrom, P. R. (1985). Bid, ask and

transaction prices in a specialist market with heteroge-

neously informed traders. Journal of Financial Eco-

nomics, 14(1):71–100.

Google (2014). Projectzero.

http://googleprojectzero.blogspot.be/.

Hansen, J., Schmidty, C., and Strobelz, M. (2004). Manip-

ulation in political stock markets - preconditions and

evidence. Applied Economics Letters, pages 459–463.

Hanson, R. (2003). Combinatorial information market de-

sign.

Hanson, R. (2006). Designing real terrorism futures. Public

Choice, 128(1-2):257–274.

Hanson, R., Oprea, R., and Porter, D. (2006). Information

aggregation and manipulation in an experimental mar-

ket. Journal of Economic Behavior & Organization,

60(4):449–459.

Harris, L. (2002). Trading and exchanges: Market mi-

crostructure for practitioners. Oxford University

Press.

Hillion, P. and Suominen, M. (2004). The manipula-

tion of closing prices. Journal of Financial Markets,

7(4):351–375.

Johannesson, P. and Perjons, E. (2014). An Introduction to

Design Science. Springer International Publishing, 1

edition. ISBN: 978-3-319-10631-1.

Kumar, P. and Seppi, D. J. (1992). Futures manipula-

tion with cash settlement. The Journal of Finance,

47(4):1485–1502.

Luckner, S. (2008). Prediction markets: Fundamentals,

key design elements, and applications. The 21st Bled

eConference, eCollaboration: Overcoming Bound-

aries Through Multi-Channel Interaction.

Pandey, P. and Snekkenes, E. (2014a). Applicability of pre-

diction markets in information security risk manage-

ment. In Database and Expert Systems Applications

(DEXA), 2014 25th International Workshop on, pages

296–300.

Pandey, P. and Snekkenes, E. (2014b). Using prediction

markets to hedge information security risks. In Mauw,

S. and Jensen, C., editors, Security and Trust Man-

agement, volume 8743 of Lecture Notes in Computer

Science, pages 129–145. Springer International Pub-

lishing.

Pennock, D. M. (2004). A dynamic pari-mutuel market for

hedging, wagering, and information aggregation. In In

Proc. of the 5th ACM Conf. on Electronic Commerce,

pages 170–179.

Plott, C. R. and Chen, K.-Y. (2002). Information Aggre-

gation Mechanisms: Concept, Design and Implemen-

tation for a Sales Forecasting Problem. W.P. 1131,

California Institute of Technology.

Rhode, P. W. and Strumpf, K. S. (2004). Historical presi-

dential betting markets. The Journal of Economic Per-

spectives, 18(2):127–141.

Spann, M. (2002). Virtuelle B¨orsen Als Instrument Zur

Marktforschung. Deutscher Universit¨ats-Verlag.

Sripawatakul, P. and Sutivong, D. (2010). Decision frame-

work for constructing prediction markets. In The 2nd

IEEE Int. Conf. on Information Management and En-

gineering (ICIME), 2010.

Teschner, F. (2012). Forecasting Economic Indices De-

sign, Performance, and Learning in Prediction Mar-

kets. PhD thesis, Karlsruher Institut fr Technologie.

TradeSports (2015). Tradesports.

https://www.tradesports.com/.

WEF (2014). Global risks 2014. Insight Report 9th Edn.,

No.: 090114, World Eco. Forum, Geneva.

Weinhardt, C. and Gimpel, H. (2007). Market engineering:

An interdisciplinary research challenge. In Jennings,

N., Kersten, G., Ockenfels, A., and Weinhardt, C., ed-

itors, Negotiation and Market Engineering, number

06461. IBFI, Germany.

SECRYPT2015-InternationalConferenceonSecurityandCryptography

284