Multi-payment Solution for Smartlet Applications

G. Vitols

1

, N. Bumanis

1

, J. Smirnova

2

, V. Salajevs

3

, I. Arhipova

3

and I. Smits

1

1

IT Competence Centre, Riga, Latvia

2

Faculty of Information Technologies, Latvia University of Agriculture, Jelgava, Latvia

3

Ecommerce Accelerator, Riga, Latvia

Keywords: Mobile Payments, Smartcards, Payment Integration, Multi-payment.

Abstract: Organizations from different fields show more and more interest towards an effective solution, which would

allow integrating and combining services and products from different providers into the single mobile or

smartcard application for easy and comfortable usage by clients. For reaching these demands the need for

certain service emerges, which would allow transformation of developer's knowledge to the technological

solution in a form of application. We propose to solve these issues with smartlets, role distribution and

integrated payment pool for business services. Proposed integrated payment pool was used to design Norvik

Bank A-card product in Latvia where multiple payment applications were integrated into single smartcard.

1 INTRODUCTION

The results of researches performed in multiple

countries lead to conclusion of rapidly growing

market particularly in mobile application area.

However the same researches show that many of

applications become unused after they are installed

on the mobile device. In Finland, for example, users

who used their mobile device for internet access, on

average, downloaded 17 mobile application, whereas

only 35% of them were used in the last month period

(Ipsos, 2012). On the other hand, research performed

in USA shows that around 26% of application’s

users become loyal to it, and use it, on average, more

than 10 times (Empson, 2011).

It can be explained as most of applications are

aimed towards single product or service promotion

and purchase. This method doesn’t give the brand

holder ability to combine his services and products

with other services and products, which potentially

could be used by the same client, but the source of

which are other providers. The same problem

persists in smartcards – it is rarely used as source for

unifying multiple products and applications, even

multiplication smartcards are becoming widely used.

One of the challenges lies in realization of

possibility to use different payment methods for one

or multiple applications in simplified way during e-

commerce applications’ development and usage

period. Existing solutions usually offer one payment

method, or multiple payment methods that can be

added manually, which requires time consuming

procedures of integration (Information and

Communication Technology Competence Center,

2014a).

The market is beginning to offer some solutions,

for example, Apple Pay, which is meant to offer

possibility to address this need. However, usually

these solutions are closed or available only to

particular company. Amazon, for example, tries to

create new system of settlements, which would use

digital currency, whereas mobile payments are

exactly the ones rapidly growing (Meļķis, 2014).

Such companies as Apple, Google and PayPal

consider the mobile payment options; however, there

are no standards to perform such payments using

smartphones (Melkis, 2014). Company named Weve

in collaboration with MasterCard tries to create

similar e-commerce solution in Great Britain. Weve

tries to create system of settlements, which would

unify bank cards with mobile devices’ SIM cards.

Even Asia seeks solution to such mobile commerce

problems. In China, for example, this problem is

being actively researched by countries biggest e-

commerce companies (Melkis, 2014), such as

Tencent, Baidu and Alibaba, with the aim of

creation multitask mobile platforms for e-commerce.

Recently Apple presented Apple Pay, which is

668

Vitols G., Bumanis N., Smirnova J., Salajevs V., Arhipova I. and Smits I..

Multi-payment Solution for Smartlet Applications.

DOI: 10.5220/0005462406680673

In Proceedings of the 17th International Conference on Enterprise Information Systems (ICEIS-2015), pages 668-673

ISBN: 978-989-758-097-0

Copyright

c

2015 SCITEPRESS (Science and Technology Publications, Lda.)

system of mobile payments, and allows paying for

purchases or services using mobile phone. At the

moment, Apple Pay system is available only in

USA, but implementation of the system in Europe is

planned in 2015 (Kerris and Muller, 2014). Apple

Pay system usage requires saving of bank cards into

system. Card issuer must support Apple Pay system.

Bank cards are saved into secure element’s chip.

Today there are no commerce usage mobile

payments in Baltic countries, and experts predict the

implementation of such only in 2015 (Igaune, 2014).

Also there are no solutions in literature, which

would provide possibility to register in unified

environment both smartlet and mobile applications.

Aim of this article is to propose integrated

payment pool for business services solution in

Latvia that allows registering various service

distributors and providers into integrated system and

offers clients to use various payment systems from

single application.

Following tasks has been brought forward:

1. Identify typical role distribution in mobile

and smartcard payment infrastructure.

2. Propose the solution for development of

integrated payment pool for business

services.

3. Evaluate concepts of the solution by

implementing payment pool in Norvik A-

card product.

2 ROLE DISTRIBUTION IN

MOBILE PAYMENT

INFRASTRUCTURE

Mobile payments can be divided into four groups

(Bumanis et al., 2014). In the framework of the

research new conceptual term was introduced -

smartlet, which is union of main application types.

Roles, usually used in e-commerce solutions, can

be proposed to use for mobile payments as well:

client, service provider and service distributor.

However, as there is a need for centralized solution,

the role responsible for smartlet’s management

platform is required. In case of smartlet application

this role is usually delegated to platform manager

also known as Trusted Service Manager (TSM)

(Akram et al., 2012; Madlmayr et al., 2009).

Trusted service manager is intermediary, which

manages business relations and technical solutions,

for example, between mobile operators, between

mobile device developers or in other infrastructure

(GlobalPlatform, 2010; The Role of the Trusted

Service Manager in Mobile Commerce, 2013).For

example, trusted service manager role can be

executed by certain IT company; however, for deals

using bank cards, other role can be proposed –

smartlet manager. TSM term is widely used by

organizations like GMS Association and Global

Platform. However, proposed solution requires a

role, which has different expertise compared to

TSM, and would be able to maintain payment pool,

as well as collaboration between distributor and

provider.

Therefore, for providing the management of

proposed roles the role of concentrator was

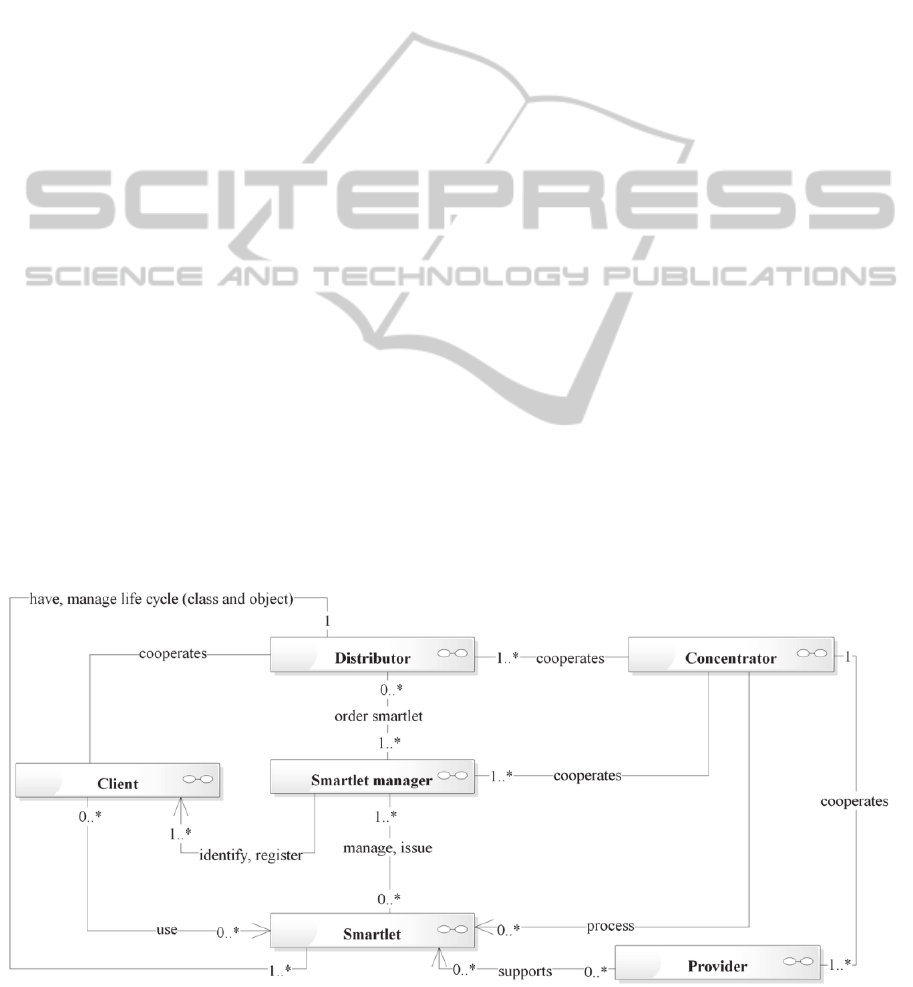

Figure 1: Proposed role distribution in mobile and smartcard payment infrastructure.

Multi-paymentSolutionforSmartletApplications

669

introduced (see Fig. 1). Concentrator is responsible

for maintaining collaboration between distributor

and services’ provider, as well as smartlet

management, but without particular TSM duties,

because it does not perform, for example, payment

processing. Payment processing and payment

application management is performed by

implemented smartlet manager role, which, in

addition, is able to develop application, contrary to

TSM, which doesn’t have such expertise. Smartlet

manager’s role for standard smartcard applications

typically execute banks; however, mobile

applications can be managed, for example, by

certain IT company. If concentrator complies with

particular payment processing requirements, for

example, it has PCI/DSS certificate, then it can

provide payment gateway functions. Payment

gateway functions can be provided by separate

service provider as well. The task of payment

gateways is to provide payment in multiple different

networks. Usage of payment gateway helps to

integrate payment solution into application and to

increase security of payment process.

3 MULTI-PAYMENT SOLUTION

DEVELOPMENT FOR

BUSINESS SERVICES

Smartlet concept describes the united functionality

of midlet, smartcard, point of interaction and weblet

applications (see Fig. 2). The development of

midlet’s and smartcard’s applications is performed

at the same time using electronic wallet technology

(Ma and Wei, 2014).

Smartcard, POI and weblet applications are

executed using smartcard reader and smartcard API.

There are no evidence of unified smartlet

application description in literature, however

separate group of application, for example, mobile

applications can be described using visual

components, such as buttons, text entry fields, etc.

(Lengheimer et al., 2014).

In case of smartlet description it is necessary to

choose the most common applications’ description

methods, for example, using visual component

method would not be appropriate for smartcard or

POI applications’ description.

In proposed novel solution each application type

is described using packages and documents.

Packages include obligatory services, for example,

messaging and user authorization services. Usage of

packages allows realization of interaction between

Figure 2: Proposed architecture for smartlet management.

application types. It is possible for packages to

include fully functional application; however it can

lead to particular integration problems and necessity

of package modification. Electronic wallet

technology implementation into mobile devices

requires integration of payment packages which

allow using EMV interfaces, for example,

MasterCard Debit, which uses of magnetic stripe

reader and contact interface (EMVCo, 2011).

Documents, used in the solution, can be binary or

structured, where structured documents are all

documents describing the application content.

Messaging service’s final product - message itself, is

considered as structured document as well. An

M/Chip advance platform envelopes are one of

binary document examples, and are used in payment

packages. Service provider is responsible for service

package processing, where service packages of

particular service provider may be contained in

midlet and weblet applications. In case of POI APP

the cash register of service provider is used.

Payment provider is responsible for every

payment transaction secure operation. Multiple

payment managers can be assigned to particular

smartlet, whereas only one, chosen by user, will be

used to process the request of purchase/order.

Smartlet manager fulfils the role of TSM,

providing connection between service provider’s

service packages and payment provider’s processing

system. Smartlet manager also deploys midlets to

application stores.

MPS is concentrator’s processing system,

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

670

responsible for overall collaboration between each

and every links. MPS stores, validates, authorizes

and verifies service providers’ service packages,

payment providers’ assignments to service packages,

smartlet managers’ requests for any smartlet status

and content change, as well as all final products. To

develop multi-payment pool for business services,

we designed 5 models (Information and

Communication Technology Competence Center,

2014b), which includes:

Unified mobile and smartcard application

model.

External service integration into mobile

application systems model.

Smartcard data and application

management model.

Unified mobile application’s data

synchronization model.

Smartcard application’s data

synchronization model.

4 PROPOSED SOLUTION

APPLICATION FOR

DEVELOPING A-CARD

This research is based on approach presented in

previous studies (Information and Communication

Technology Competence Center, 2014; Zacepins et

al., 2014). Proposed solution was successfully

integrated in Norvik bank A-card project in Latvia.

In this project there is following role distribution:

Service provider: Norvik Bank, JSC;

Distributor: Jelgava City Council;

Concentrator: Complete Payment Systems,

JSC;

Smartlet manager: Norvik Bank, JSC;

Client: client who apply for receiving

Norvik A-card;

Smartlet: Norvik A-card.

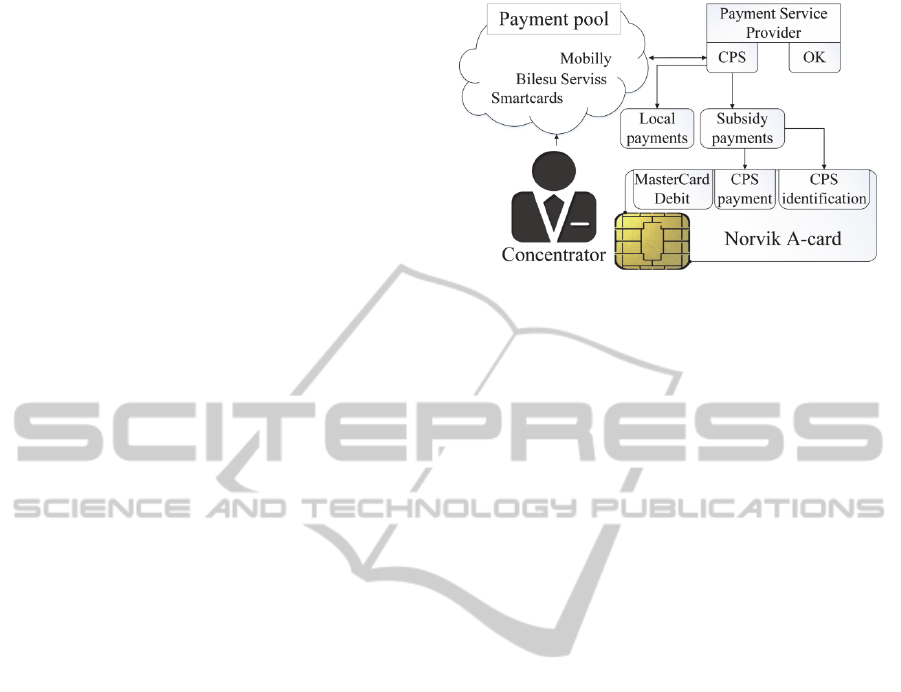

Payment pool that is managed by concentrator

includes various integrated payment services, such

as mobile application services "Bilesu Serviss" and

"Mobilly" and multiple smartcard payment services.

In case of Norvik A-card, two payment service

providers are registered and provide smartcard

payment services. Mainly CPS payment services are

used that process local payments and subsidy

payments. Norvik A-card contains three

applications: CPS payment, MasterCard Debit

payment and CPS identification (see Fig. 3).

Norvik A-card payment card is specific product

Figure 3: Norvik A-card interaction with multi-payment

solutions payment pool.

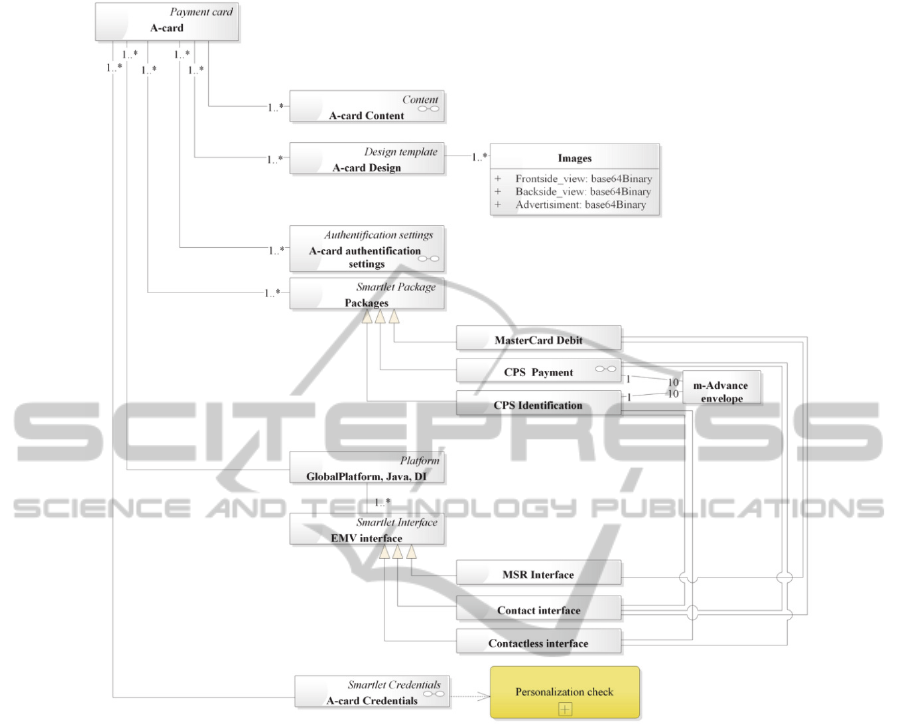

of A-card (see Fig. 4), where A-card is a smartlet

meant to be used for payment operations, including

subsidy administration in public transport.

A-card is a union of multiple applications

building components, used in every smartlet

application in different combinations, as well as

internationally approved smartcard application and

physical unit’s standards. A-card is based on

GlobalPlatform, Java and DI platforms.

A-card Content describes card’s application’s

content and stores it as binary document – m-

Advance envelope. A-card may contain multiple

applications, whereas Norvik A-card’s main

application is used for subsidy administration

(Zacepins et al., 2014). A-card, in addition, may be

used as an average banking card in any store

supporting MasterCard standard, because of

integrated MasterCard Debit application (see Fig 3.).

A-card design describes the visual look of the

card. Visual design is stored as image files in

base64Binary format. The advertisement image is

seen as row style banner on the card, and is not

obligatory component.

There are three roles distributed in authentication

settings – registration provider, identification

provider and authentication provider. Registration of

a client accordingly to issuing institution is

performed by registration provider, and in case of A-

card, by A-card distributor. Norvik A-card clients

are registered by Jelgava City Council, whereas

information about clients may come from schools.

Identification is performed when an issuing

institution receive registration information about a

client. Identification is common process for Issuer

bank. Authentication is performed when a client

receives his card. A-card is constructed around three

main packages responsible for payment operations

and safety of these operations. MasterCard Debit

package relies on international EMV standard of

Multi-paymentSolutionforSmartletApplications

671

Figure 4: Developed A-card model.

MasterCard credit cards, and allow using A-card as

everyday payment card. CPS Payment package is

based on Latvia’s local payment processor system

organization called Complete Payment Systems. The

difference between the first is usability of

contactless interface in union with contact interface

depending on the receiving systems specification,

whereas MasterCard uses either Magnetic stripe

reader or contact interface. CPS Payment consists of

ten m-Advance envelopes – card info, list of custom

EMV configuration IDs and custom EMV

configuration parameters, where all of envelopes are

used in subsidy calculation and administration.

A-card credentials describe the credential

information about cards user, be it personal,

containing forename, surname, personal id and

photo, or employment, department, etc. A-card may

be constructed using either both personal and

employment information, or only one of them, when

in case of using only employment information

A-card is considered anonymous.

5 CONCLUSIONS

Offered multi-payment solution for smartlet

application is simplified and unified way to register

multiple payment service providers and distributors.

In result, for example, users can perform multiple

service use from a single application, such as buying

a ticket to theatre and paying parking fee in a single

application. Centralized solution also allows unified

smartlet processing.

Smartlet concept includes four application types

which can be managed with five roles. Proposed

solution includes two new roles: concentrator and

smartlet manager.

Proposed solution concept was successfully

integrated in Norvik bank A-card project in Latvia.

Three payment services in form of smartcard

ICEIS2015-17thInternationalConferenceonEnterpriseInformationSystems

672

applications were integrated into Norvik A-card

from payment pool, including CPS payment,

identification and MasterCard Debit.

Norvik A-card is based on GlobalPlatform, Java

and DI platforms and use proposed role distribution

in management. In A-card solution smartlet manager

role is executed by Norvik Bank, but concentrator

role is executed by Complete Payment Systems,

JSC.

ACKNOWLEDGEMENTS

This research is part of a project "Competence

Centre of Information and Communication

Technologies" run by IT Competence Centre,

contract No. L-KC-11-0003, co-financed by

European Regional Development Fund. More

information at http://www.itkc.lv/?lang=en.

REFERENCES

Akram, R. N., Markantonakis, K., & Mayes, K. (2012).

Information and Communications Security. (T. W.

Chim & T. H. Yuen, Eds.)Lecture Notes in Computer

Science (including subseries Lecture Notes in

Artificial Intelligence and Lecture Notes in

Bioinformatics) (Vol. 7618, pp. 214–227). Berlin,

Heidelberg: Springer Berlin Heidelberg.

doi:10.1007/978-3-642-34129-8.

Bumanis, N., Vitols, G., Smits, I., Smirnova, J., Arhipova,

I., & Salajev, V. (2014). Service oriented solution for

managing smartlets. ICTE in Regional Development

(In Press).

Empson, R. (2011). Mobile App Users Are Both Fickle

And Loyal: Study. Retrieved April 07, 2013, from

http://techcrunch.com/2011/03/15/mobile-app-users-

are-both-fickle-and-loyal-study/

EMVCo. (2011). EMV Integrated Circuit Card

Specifications for Payment Systems: Cardholder,

Attendant, and Acquirer Interface Requirements (p.

154).

GlobalPlatform. (2010). GlobalPlatform Launches Trusted

Service Manager Working Group. Retrieved January

07, 2014, from http://www.globalplatform.org/

mediapressview.asp?id=783.

Igaune, S. (2014). For Latvia mobile wave is still ahead

(Latvijā mobilo maksājumu vilnis vēl priekšā). Dienas

Bizness, pp. 4–5. Riga.

Information and Communication Technology Competence

Center. (2014). Summary of Cross-industries mobile

application and smartcard web service management

system’s object-oriented system modelling (p. 9). Riga.

Ipsos. (2012). Our Mobile Planet: Finland -

Understanding the Mobile Consumer (p. 42). Retrieved

from http://www.thinkwithgoogle.com/insights/emea/

library/studies/our-mobile-planet-Finland/

Kerris, N., & Muller, T. (2014). Apple Announces Apple

Pay. Retrieved October 19, 2014, from

http://www.apple.com/pr/library/2014/09/09Apple-

Announces-Apple-Pay.html.

Lengheimer, M., Binder, G., & Rosler, T. (2014). Content

management systems for mobile, context-dependent

augmented reality applications. In 2014 37th

International Convention on Information and

Communication Technology, Electronics and

Microelectronics (MIPRO) (pp. 1521–1526). IEEE.

Ma, X., & Wei, W. (2014). The architecture of mobile

wallet system based on NFC (near field

communication). Research Journal of Applied

Sciences, Engineering and Technology, 7(12), 2589–

2595. Retrieved from http://www.scopus.com/

inward/record.url?eid=2-s2.0-84899077249& partner

ID=tZOtx3y1.

Madlmayr, G., Langer, J., Kantner, C., Scharinger, J., &

Schaumuller-Bichl, I. (2009). Risk Analysis of Over-

the-Air Transactions in an NFC Ecosystem. In 2009

First International Workshop on Near Field

Communication (pp. 87–92). IEEE.

Melkis, D. (2014). Mobile payments - bait for customers

(Mobilie maksājumi - ēsma pircējiem). Dienas

Bizness, p. 4. Riga.

The Role of the Trusted Service Manager in Mobile

Commerce. (2013). GSMA (p. 21). London.

Zacepins, A., Bumanis, N., & Arhipova, I. (2014).

Administration of government subsidies using

contactless bank cards. In S. Hammoudi, L.

Maciaszek, & J. Cordeiro (Eds.), ICEIS 2014 -

Proceedings of the 16th International Conference on

Enterprise Information Systems (Vol. 3, pp. 128–132).

Lisbon: SciTePress.

Multi-paymentSolutionforSmartletApplications

673