Prediction based – High Frequency Trading on Financial Time Series

Farhad Kia and Janos Levendovszky

Department of Telecommunications, Budapest University of Technology and Economics,

Magyar Tudósok krt. 2., Budapest, Hungary

Keywords: Feedforward Neural Networks, High Frequency Trading, Financial Time Series Prediction.

Abstract: In this paper we investigate prediction based trading on financial time series assuming general AR(J)

models and mean reverting portfolios. A suitable nonlinear estimator is used for predicting the future values

of a financial time series will be provided by a properly trained FeedForward Neural Network (FFNN)

which can capture the characteristics of the conditional expected value. In this way, one can implement a

simple trading strategy based on the predicted future value of an asset price or a portfolio and comparing it

to the current value. The method is tested on FOREX data series and achieved a considerable profit on the

mid price. In the presence of the bid-ask spread, the gain is smaller but it still ranges in the interval 2-6

percent in 6 months without using any leverage. FFNNs were also used to predict future values of mean

reverting portfolios after identifying them as Ornstein-Uhlenbeck processes. In this way, one can provide

fast predictions which can give rise to high frequency trading on intraday data series.

1 INTRODUCTION

In the advent high speed computation and ever

increasing computational power, algorithmic trading

has been receiving a considerable interest (A Hanif,

2012) (Pole, 2007) (Kissell, 2006) (Peter Bergan,

2005). The main focus of research is to develop real-

time algorithms which can cope with portfolio

optimization and price estimation within a very

small time interval enabling high frequency, intraday

trading. In this way, fast identification of favorable

patterns on time series becomes feasible on small

time scales which can give rise to profitable trading

where asset prices follow each other in sec or msec

range.

Several papers have been dealt with algorithmic

trading by using fast prediction algorithms (Naik et

al., 2012); (Y. Zuo, 2012) or by identifying mean

reverting portfolios (J.W., 2002) (D’Aspremont,

2011) (Balvers et al., 2000). The paper (L., 2012)

uses linear prediction which however proves to be

poor to capture the complexity of the underlying

time series. Other methods (D’Aspremont, 2011);

(Balvers et al., 2000) are focused on identifying

mean reverting portfolios and launch a trading action

(e.g. buy) if the portfolio is out of the mean and

taking the opposite action when it returns to the

mean.

In our approach, we focus on prediction based

trading by estimating the future price of the time

series by using a nonlinear predictor in order to

capture the underlying structure of the time series.

The investigated time series can either refer to

foreign exchange rates, single asset prices or the

value of a previously optimized portfolio. By using

FFNNs, which exhibit universal representation

capabilities, one can model the nonlinear AR(J)

process (the current value of the time series depends

on J previous values and corrupted by additive

Gaussian noise). Assuming the price series to be a

nonlinear AR(J) process, we first develop the

optimal trading strategy and then approximate the

parameters of nonlinear AR(J) by an FFNN.

In this way, one can obtain a fast adaptive

trading procedure which, in the first stage, runs a

learning algorithm for parameter optimization based

on some observed prices and then, in the second

stage, provides near optimal estimation of future

prices. The numerical results obtained on Forex rates

have demonstrated that the method is profitable and

achieves more than 1% profit in one month with

leverage 1:1 which can be much bigger if we use

leverage.

The paper treats this material in the following

structure:

In section 2, the model is outlined;

In section 3 the optimal strategy is derived first for

trading on mid-prices and then it is extended to

502

Kia F. and Levendovszky J..

Prediction based – High Frequency Trading on Financial Time Series.

DOI: 10.5220/0004555005020506

In Proceedings of the 5th International Joint Conference on Computational Intelligence (NCTA-2013), pages 502-506

ISBN: 978-989-8565-77-8

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

trading in the presence of bid-ask spread;

In section 4 numerical results and performance

analysis is given;

In section 5 some conclusions are drawn.

2 THE MODEL

Let us assume that we trade on the mid prices, the

corresponding asset price time series is denoted by

n

x

and follows a nonlinear AR(J) process

1,...,nnnJn

xFx x

(2.1)

where F is a Borel measurable function and

0,

n

N

i.i.d.r.v.-s, being independent of

n

x

.

For trading, we construct an estimator

11

,..., , ,..., ,

nnnJM

xNetx xw w Net

xw

,

(2.2)

where

() ( 1) (1)

, ... ...

LL

niijnmnm

ij m

xNet w w wx

xw

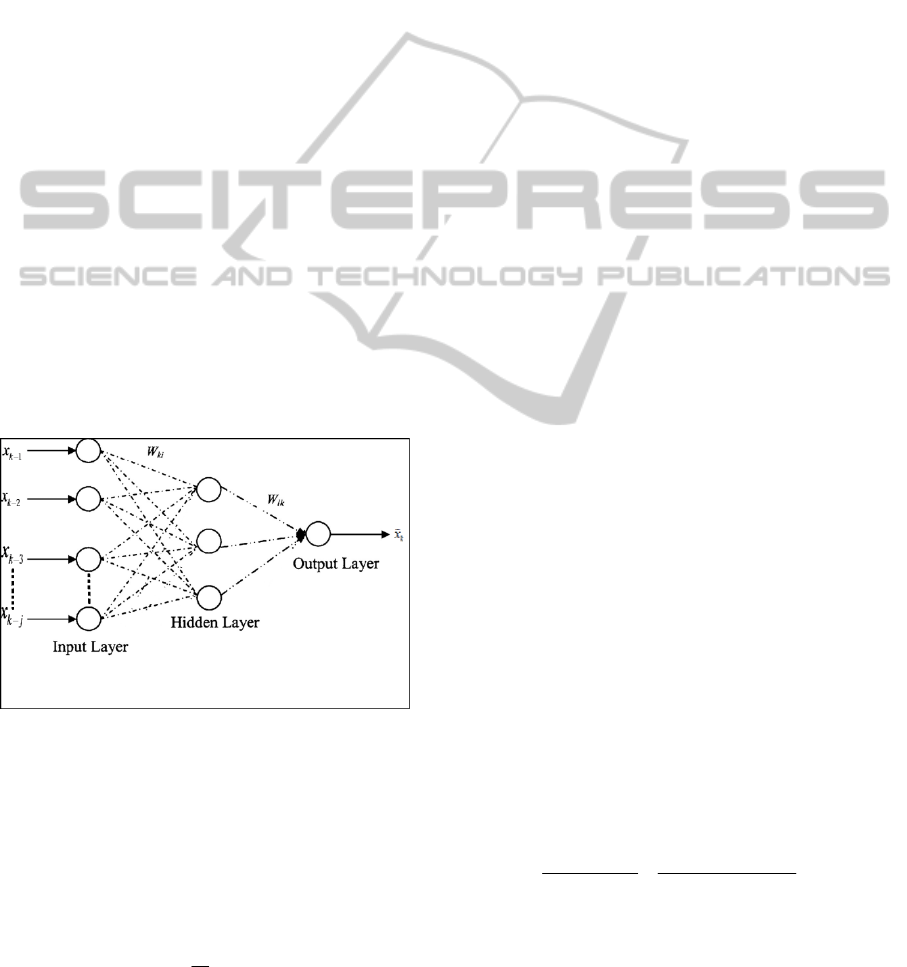

is a Feedforward neural Network (FFNN) depicted

by Figure 2.1 and vector w denotes the free

parameters subject to training.

Figure 2.1: The structure of feed forward neural network

(FFNN).

Trading is performed as follows:

Stage 1. Observing a historical time series and

forming a training set

() ()

, , 1,...,

nn

n

x

nN

x

where

()

1

,...,

n

nJ n

x

x

x

.

Stage 2. Training the weights by minimizing the

objective function

2

()

1

min ,

n

n

xNet

N

w

xw

by the

back propagation (BP) algorithm.

Stage 3. Trading on the real data as follows:

Calculate

()

,

n

n

xNet xw

,where

()

1

,...,

n

nJ n

x

x

x

and we are in time instant

1n

.

If

1nn

x

x

then buy at time instant

1n

and sell at

time instant

n

. (2.3)

If

1nn

x

x

then sell at time instant

1n

and buy at

time instant

n

. (2.4)

It can be easily proven that this is the optimal

strategy, as far as the expected profit maximization

is concerned.

3 PORTFOLIO OPTIMIZATION

BY MEAN REVERSION

We view the asset prices as a first order, vector

autoregressive VAR (1) process. Let

,it

s

denote the

price of asset

i at time instant t, where

1,...,in

and

1,...,tm

are positive integers and assume that

1, ,

( ,..., )

T

ttnt

s

ss

is subject to a first order vector

autoregressive process, VAR (1), defined as follows:

1

,

tt t

sAs W

(3.5)

where

A is an

nn

matrix and

(0, )

t

N

I

W

are

i.i.d. noise terms for some

0

.

One can introduce a portfolio vector

1

( ,..., )

T

n

rrr

, where component

i

r

denotes the

amount of asset

i held. In practice, assets are traded

in discrete units, so

0,1, 2,...

i

r

but for the

purposes of our analysis we allow

i

r

to be any real

number, including negative ones which denote the

ability to short sell assets. Multiplying both sides by

vector

r (in the inner product sense), we obtain

1

TT T

tt t

rs rs A rW

(3.6)

Following the treatment in (Box and Tiao, 1977) and

(D’Aspremont, 2011), we define the predictability of

the portfolio as

111

var( ) ( )

():

var( )

TTTT

ttt

T

TT

t

tt

E

E

rAs rAs s Ar

r

rs

rssr

,

(3.7)

provided that

() 0E

t

s

, so the asset prices are

normalized on each time step. The intuition behind

this portfolio predictability is that the greater this

Predictionbased-HighFrequencyTradingonFinancialTimeSeries

503

ratio is, the more

1t

s

dominates the noise and

therefore the more predictable

t

s

becomes.

Therefore, we will use this measure as a proxy for

the portfolio’s mean reversion parameter

.

Maximizing this expression will yield the following

optimization problem for finding the best portfolio

vector

r

opt

:

arg max ( ) arg max

TT

T

opt

rr

rAGAr

rr

rGr

,

(3.8)

where G is the stationary covariance matrix of

process

t

s

. This optimization can be performed by

gradient or stochastic search.

4 NUMERICAL RESULTS

We have tested the proposed method for predicting

the price of a single asset and then the value of a

selected mean reverting portfolio in three different

cases:

In the first case we predict the future price based

on mid-price and we also trade on mid-price;

In the second case we still predict by using the

mid-price but we trade in the presence of Bid/Ask

spread.

In third case we predict by using Bid/Ask and also

trade in presence of Bid/Ask spread.

The testing parameters (period length, timeframe

J , initial deposit,...) are the same in all 3 cases and

taken to be: period length = 1 Month (2012.06.01-

2012.07.02); J=5; average training period=20;

timeframe=M15; single asset(EURUSD);

Portfolio(EURUSD,GBPUSD,AUDUSD,NZDUSD;

initial deposit=1000

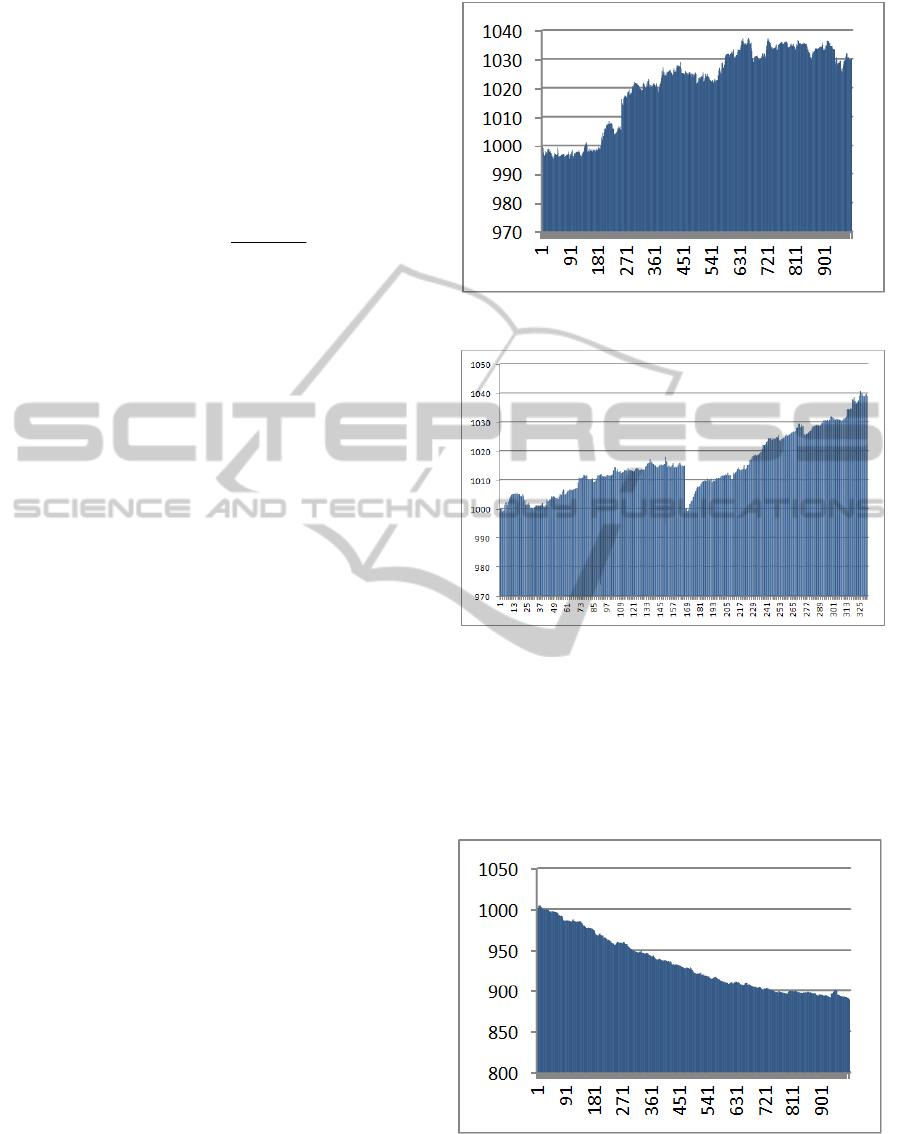

In the figures the number of trades is shown in

the horizontal axis, while the account balance is

indicated on the vertical axis.

4.1 Prediction and Trading

on mid Price

As was mentioned before, in the first case we only

predict and trade on the mid-price. The results are

indicated by figures 4.1.1 and 4.1.2, respectively.

One can see that the we can achieve a 3 % or in

quantity profit= $30.29; Profit=3% ; MAX

Drawdown=0.5%.

One can see that the we can achieve a 3.9 % or in

quantity profit= $39.70; Profit=3.9%; MAX

Drawdown=0.24%.

Figure 4.1.1: Balance with respect to time (single asset).

Figure 4.1.2: Balance with respect to time (Portfolio).

4.2 Training on the mid Price

and Trading on Bid/Ask

In this case we use mid-price for prediction but we

trade on Bid/Ask. Here on horizontal axis we have

the same number of trades as in the previous figure.

Figure 4.2.1: Balance with respect to time (single asset).

The achieved profits are negative -10.70%,-5.8%

(Profit: -110.70$, -58$) MAX Drawdown=3.4%,

2.1%.

IJCCI2013-InternationalJointConferenceonComputationalIntelligence

504

Figure 4.2.2: Balance with respect to time (Portfolio).

The result is not so good as we have negative

balance growth on vertical axis. However, as

expected this is due to the fact we have not exploited

the information given in the bid and ask series.

4.3 Training on the Bid/Ask

and Trading on the Bid/Ask

In this case, we use following model to cover the

spread.

(y, x, w)

Bid

k

Netx

(4.9)

(y, x, u)

Ask

k

Nety

(4.10)

1kk

x

y

BUY

1kk

yx

SELL

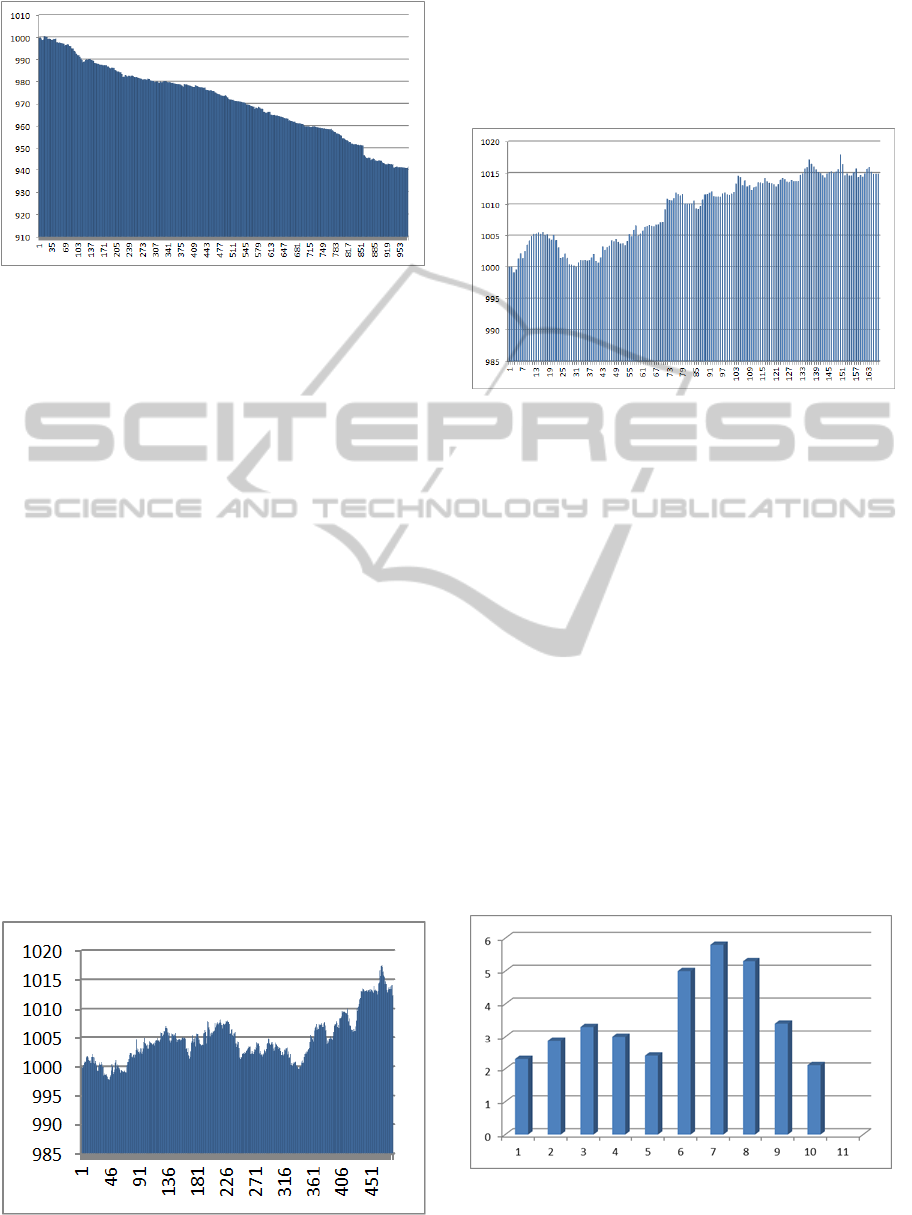

In the figure bellow we have smaller number of

trades on horizontal axis in comparison to previous

cases because it might happen that the predicted

value is not greater than Ask Price or it is not even

less than Bid Price, therefore in some cases we do

not trade. Again on the vertical axis we have account

balance but this time we have some positive growth.

Figure 4.3.1: Balance with respect to time (single asset).

The achieved profit 1.23 %( Profit: $12.30)

which is good in the presence of bid-ask spread.

MAX Drawdown=0.85%. One can see that even

in the presence of bid-ask spread the method can

materialize profit.

Figure 4.3.2: Balance with respect to time (Portfolio).

The achieved profit is 1.48 %(Profit:$14.8)which is

good in the presence of bid-ask spread. Max

Drawdown=0.29%.

5 OPTIMIZING THE STEP

So far in our main model we only predicted the next

candle(time instant), but we can also predict more

than one candle. It can help us to better cover the

spread and possibly extend our profit, as we let the

price series change more dominantly to get out of

the spread and materializing more profit. Here our

goal is to find the optimal step parameter, where the

step is defined as how many candles in the future we

predict.

The next figure shows the result regarding the

step parameter, i.e. the account profit in percentage

(optimization period is 6 months) is plotted as a

function of the step parameter.

Figure 5.1: Profit as a function of prediction step.

From Figure 5.1, one can conclude that the optimal

step parameter is 7.

Predictionbased-HighFrequencyTradingonFinancialTimeSeries

505

6 CONCLUSIONS AND FURTHER

WORK

In this paper we used FFNN based prediction for

trading on financial time series. The optimal trading

strategy has been derived by using the fact that

FFNN can represent the conditional expected value.

Furthermore, we have optimized the prediction step

parameter numerically. In the case of trading on the

mid-price a considerable amount of profit can be

accumulated. In the case of trading in the presence

of bid-ask spread the method is still profitable but

the achieved profit is more modest.

The methods presented here can pave the way

towards high frequency, intraday trading.

Furthermore, in our tests we did not use leverage,

but with these low drawdowns which we had, we

can easily use bigger leverages to magnify our

profit. Although the ability to earn significant profits

by using leverage is substantial, leverage can also

work against investors. For example, if the currency

underlying one of the trades moves in the opposite

direction of what the investor believed would

happen, leverage will greatly amplify the potential

losses. To avoid such a catastrophe, Forex traders

usually use money management techniques.

ACKNOWLEDGEMENTS

The work reported in the paper has been partly

developed in the framework of the project „Talent

care and cultivation in the scientific workshops of

BME" project. This project is supported by the grant

TÁMOP - 4.2.2.B-10/1--2010-0009.

REFERENCES

A Hanif, R., 2012. Algorithmic, Electronic and Automated

Trading.

Box, G. E., Tiao, G.C. , 1977. A canonical analysis of

multiple time series.

D’Aspremont, A., 2011. Identifying small mean-reverting

portfolios.

J. W., 2002. Portfolio and Consumption Decisions under

Mean-Reverting Returns: An Exact Solution for

Complete Markets.

Kissell, R., 2006. Algorithmic trading strategies.

L., C., 2012. Predictability and Hedge Fund Investing..

Peter Bergan, C., 2005. Algorithmic Trading What Should

You Be Doing?.

Pole, A., 2007. Algorithmic trading insights and

techniques.

R. Balvers, Y. W., E Gilliland , 2000. Mean Reversion

across National Stock Markets and Parametric

Contrarian Investment Strategies.

R. L. Naik, D. R., B Manjula, A Govardhan, 2012.

Prediction of Stock Market Index Using Genetic

Algorithm.

Y. Zuo, E. K., 2012. Up/Down Analysis of Stock Index by

Using Bayesian Network.

IJCCI2013-InternationalJointConferenceonComputationalIntelligence

506