A Two-step Bidding Price Decision Algorithm under Limited

Man-Hours in EPC Projects

Nobuaki Ishii

1

, Yuichi Takano

2

and Masaaki Muraki

2

1

Faculty of Information and Communications, Bunkyo University, 1100, Namegaya, Chigasaki, Kanagawa, Japan

2

Graduate School of Decision Science and Technology, Tokyo Institute of Technology, Tokyo, Japan

Keywords: Competitive Bidding, Cost Estimation Accuracy, EPC Contract, Project Management, Project Selection.

Abstract: In Engineering-Procurement-Construction (EPC) projects, the contractor accepts an order through a

competitive bidding process. If the contractor’s bidding price is set higher than that of a competitor due to

cost estimation error, the contractor could fail to receive the order. Conversely, if the cost estimation error

results in an underestimation of the cost, the contractor would be granted the order; however, he would

eventually suffer a loss on this order. Thus, a bidding price decision in consideration of the cost estimation

accuracy and the deficit order probability is essential for the contractor in EPC projects. In this paper, we

develop a two-step bidding price decision algorithm. It allocates MH (Man-Hour) for cost estimation, which

determines the cost estimation accuracy, to each order under the limited volume of MH, and then

determines the bidding price for maximizing the expected profit under the deficit order probability

constraint. Numerical examples show that the bidding price decision in consideration of the cost estimation

accuracy and the deficit order probability is essential for the contractor to make a stable profit in EPC

projects, and that the developed algorithm is effective for making such bidding price decision.

1 INTRODUCTION

Among various types of project contracts, the

importance of Engineering, Procurement,

Construction (EPC) projects (Ranjan, 2009), where

contractors design and build unique products or

services based on the client requirements, is widely

recognized in practice in the field of construction,

civil engineering, plant engineering, and so on. In

EPC projects, the contractor has a single

responsibility for project cost, quality, and schedule

under a fixed-price that is determined before the

start of the project as a lump-sum contract. Thus, a

reduced project cost and shorter schedule are

expected (Jinru, 2011).

Although several shortcomings, for instance,

decisions on relatively detailed issues have to be

made early on in the project delivery process, have

been pointed out e.g., in Elfving et al. (2005),

competitive bidding is widely used for selecting a

contractor who carries out the project. In the

competitive bidding, the client usually evaluates

contractors on the basis of the multi-attribute bid

evaluation criteria, such as bidding price, past

experience, past performance, company reputation,

and the proposed method of delivery and technical

solutions (Watt et al., 2009). Then, the client

basically selects the contractor who proposes the

lowest price if there is not much difference in other

criteria.

In EPC projects, accordingly, it is necessary for

any contractor to determine the bidding price based

on precise cost estimation. If the contractor’s

bidding price, which is obtained as a sum of the

estimated cost and the target profit, is higher than

that of the competitor due to cost estimation error,

then the contractor could not accept the order and

hence obtain no profit. In contrast, the contractor

would increase the chance of accepting the order if

the estimated cost is low due to cost estimation

error. In this case, however, the profit could be

below the contractor’s expectation because of being

over-budget, and he possibly suffers a loss on this

order.

Namely, for stable profit from EPC projects, the

contractor must determine the bidding price in

consideration of cost estimation accuracy and deficit

order probability. Cost estimation, however, is a

highly intellectual task of predicting the costs of

products or services to be provided in the future

393

Ishii N., Takano Y. and Muraki M..

A Two-step Bidding Price Decision Algorithm under Limited Man-Hours in EPC Projects.

DOI: 10.5220/0004418903930403

In Proceedings of the 3rd International Conference on Simulation and Modeling Methodologies, Technologies and Applications (SIMULTECH-2013),

pages 393-403

ISBN: 978-989-8565-69-3

Copyright

c

2013 SCITEPRESS (Science and Technology Publications, Lda.)

based on the analysis of the client’s requirements

and his tacit knowledge. Thus, experienced and

skilled human resources, i.e., MH (Man-Hour), are

required for accurate cost estimation. Those

resources, however, are limited for any contractor.

For these reasons, it is important to realize

appropriate allocation of MH for cost estimation to

each order to maximize the profits under the

constraints on the volume of total MH. In addition,

contractors should consider the possibility of

realizing a loss due to cost estimation error and a

competitive relationship with bidders. For example,

the bidding price needs to be cut to some extent to

accept the order successfully under a severe

competitive environment; however, a low bidding

price would reduce profit, or even worse, would

create a large loss. Moreover, just a few deficit

orders would result in the significant reduction of

realized profits when the number of accepted orders

is limited. (Note, in this paper, that we refer to the

order creating an eventual loss as a deficit order.)

In this paper, we develop a two-step bidding

price decision algorithm in consideration of the cost

estimation accuracy and the deficit order probability

under limited MH in EPC projects. The algorithm

assumes that the costs are estimated at the same time

for all orders. At the first step, the algorithm

allocates MH for cost estimation to each order

according to the ranking of orders under the

constraints on the volume of total MH. The MH

allocation determines the cost estimation accuracy of

each order. At the second step, it determines the

bidding price for maximizing the expected profit

under the deficit order probability constraint.

We develop a mathematical model for simulating

competitive bidding. Through the numerical results

obtained by using this model, we show that the

bidding price decision in consideration of the cost

estimation accuracy and the deficit order probability

is essential for the contractor to make a stable profit

in EPC projects, and that our two-step bidding price

decision algorithm is effective for making such

bidding price decisions.

2 RELATED WORK

Among the research related to the bidding price

decision, there are order acceptance and project

selection problems.

Order acceptance is basically the problem of

making a decision to accept each order or not in

Make-To-Order (MTO) manufacturing (Kolisch,

2001), and its objective is to maximize profits with

capacity limitations. As literature surveys done by

Slotnick and Morton (2007), Herbots et al. (2007),

and Rom and Slotnick (2009) have shown, there

exists a variety of related research topics. Project

selection, on the other hand, is the problem of

creating a mix of projects from candidate projects to

help achieve an organization’s goals within its

resource constraints. Research and development

(R&D), information technology, and capital

budgeting are typical application fields of the project

selection. Researchers have applied various kinds of

methods to these problems (Dey, 2006; Medaglia et

al., 2007; Wang et al., 2009).

Most of the literature dealing with the order

acceptance and the project selection problems has

assumed that the contractor can select orders or

projects according to the contractor’s own criteria

and by the contractor’s own initiative. In

competitive bidding, however, the contractor

basically offers a bidding price and accepts the order

based on the client’s decision.

A variety of studies, such as bidding theory,

bidding model, and auction design, have been

conducted on competitive bidding (see Ballesteros-

Pérez et al., 2012 for detailed references). In

particular, a number of papers regarding the

competitive bidding strategy date back to Friedman

(1956), who presented a method to determine an

optimal bidding price based on the distribution of

the ratio of the bidding price to cost estimate.

However, little attention has been paid to profit

volatility risk, which cannot be ignored in EPC

projects. When, for instance, the number of accepted

orders is limited, the realized total profit from the

projects might be sharply lower than expected

because the profit is significantly affected by a few

deficit orders. Accordingly, the deficit order

probability should be considered in the bidding price

decision.

In addition to the profit volatility risk, we

consider the allocation of MH for cost estimation to

each order when making a decision on the bidding

because certain MH is necessary to estimate cost

accurately in EPC projects. Several papers have

analysed the problem of allocating scarce resources

in competitive bidding (see Rothkopf and Harstad,

1994 for detailed references). Among them,

Kortanek et al. (1973) considered sequential bidding

models where the obtained contracts require the use

of restricted resources, such as production capacity,

at the time of actual production. Ishii et al. (2012)

develop a mathematical model where bidding prices

are determined in consideration of the MH allocation

for cost estimation to maximize the expected profit

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

394

from the projects. Their model assumes that the

contractor has no preference orders for bidding,

although the contractor usually ranks the orders

according to the multi-criteria, such as technical

feasibility, relationship with clients, and so on, in

addition to the expected profits.

Regarding cost estimation accuracy, various

types of research have been performed. Oberlender

and Trost (2001) studied determinants of cost

estimation accuracy and developed a system for

predicting cost estimation accuracy. Bertisen and

Davis (2008) analysed costs of 63 projects and

evaluated the accuracy of capital cost estimation

statistically. In addition, several researchers have

studied cost estimation methods and their accuracy.

For example, Towler and Sinnott (2008) studied

relations among cost estimation methods, cost

estimation data, and their accuracy in the field of

plant engineering. More crucially, they suggested

that the cost estimation accuracy is positively

correlated with the volume of MH for cost

estimation.

In EPC projects, the bidding price decision

affects the expected profit and the deficit order

probability. Since the bidding price is determined

based on the project cost estimated before starting

the project, cost estimation accuracy is clearly a

major factor to lead an EPC project to a successful

conclusion. Nevertheless, as stated above, few

studies have ever attempted to analyse the bidding

price decision problem in terms of cost estimation

accuracy and deficit order probability under limited

MH in EPC projects.

3 FEATURES OF THE BIDDING

PRICE DECISION PROBLEM

IN EPC PROJECT

There are several ways to select a contractor from

bidders in competitive bidding (Steel, 2004; Elfving

et al., 2005; Helmus, 2008; Wang et al., 2009). In a

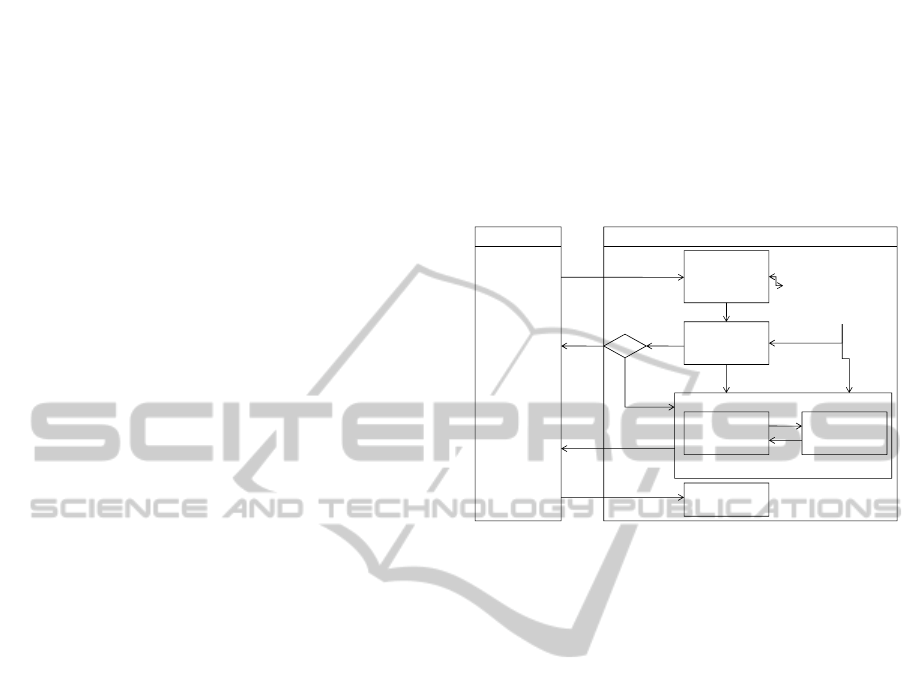

generic competitive bidding process shown in Figure

1 (Ishii and Muraki, 2011), the client prepares a

Request For Proposal (RFP) and invites several

potential contractors to the bidding. The contractor

first carries out the preliminary evaluation followed

by the bid or no-bid decision. In the preliminary

evaluation, the contractor evaluates the RFP and

estimates the preliminary cost based on limited

information, such as the order information provided

by the RFP and the past project data of the

contractor. In the bid or no-bid decision, the

contractor evaluates the order from the viewpoints of

profitability, technical feasibility and so on, and

makes a decision whether to bid or not. If the

contractor decides to place the bid, he then starts the

bidding price decision process, that is, he estimates

the cost more accurately and determines the bidding

price. At the end of the competitive bidding, the

client assesses the proposals offered by contractors

and selects one contractor as a successful bidder.

Figure 1: An overview of contractor’s activities of

competitive bidding.

The preliminary evaluation and bid or no-bid

decision are usually made by senior managers based

on the RFP, past project data, competitive

environment, target profit rate, and so on.

As shown in Figure 1, the bidding price decision,

for which this paper develops an algorithm in

Section 4.2, is made based on order information,

such as estimated cost, target profit rate, and

competitive environment, so that the contractor can

accept profit-making orders successfully. As Ishii et

al. (2012) pointed out, since the contractor must

determine the bidding price using the limited

information above, he should consider the following

features of the competitive bidding.

The first feature is relevant to the accuracy of

cost estimation. The bidding price is basically

determined by adding the target profit to the

estimated cost. However, the contractor cannot

estimate the precise cost in the process of

determining the bidding price because of limited

information and restricted time. Thus the bidding

price, which is affected by estimation errors, has a

probability distribution. We define the cost

estimation accuracy as the standard deviation of the

estimated cost or the bidding price depending on the

context. A lower deviation indicates a higher

accuracy.

The bidding price with the lower cost estimation

- Preparation of

Request For

Quotation

(RFQ)

-Bid

Evaluation

- Contractor

Selection

Preliminary

Evaluation

Bid or No-Bid

Decision

Bidding Price

Decision

Declination

of bid

- Past project data

- Competitive

environment

- Target total expected

orders

- Target profit rate

Preliminary cost

Bid

No-Bid

Bid reply

Accepted

Order

Contractor selection

result

Preliminary cost

Contractor (Bidder)

Client

Request For Proposal

(RFP)

Preparation of

Proposal &

Cost Estimation

Cost Estimation

MH

Estimated

Cost

ATwo-stepBiddingPriceDecisionAlgorithmunderLimitedMan-HoursinEPCProjects

395

accuracy is likely to be accepted as the deficit order,

from which the contractor suffers an eventual loss.

The bidding price with the low accuracy also has a

tendency to be very high compared to the other;

however, the chance of the order being accepted

becomes smaller as the bidding price increases under

a competitive environment where many competitors

would offer low bidding prices. Based on these

observations, it can be seen that consideration of the

cost estimation accuracy and deficit order

probability is essential for the contractor to make a

stable profit in EPC projects, and the bidding price

decision process needs to include all these factors.

The second feature is the MH allocation for cost

estimation. Cost estimation is a series of activities

where experienced engineers analyse requirements

of clients, thus the MH for cost estimation affects its

accuracy significantly. However, although the

contractor often has more than one order at the same

time, the number of MH of experienced engineers is

limited. Namely, the contractor needs to allocate

MH to each order effectively. Since the bidding

conditions are different in each order, the contractor

needs to prioritize orders and allocate more MH to

the potential orders to improve the expected profits.

The third feature is the effectiveness of adjusting

the bidding price. The contractor’s profit increases

as the bidding price rises. On the other hand, the

probability of accepting the order increases as the

bidding price goes down. This is because the

contractor can basically accept the order when the

contractor’s bidding price is lower than that of the

competitor. However, the contractor would accept

the deficit order when the bidding price is very low.

Namely, we can see that there is a bidding price that

maximizes the contractor’s expected profit under a

competitive environment.

Based on the above observations, we introduce a

parameter for adjusting the bidding price in view of

the cost estimation accuracy of one’s own company

and that of a competitor’s, as well as the deficit

order probability.

4 A BIDDING PRICE DECISION

PROCESS MODEL

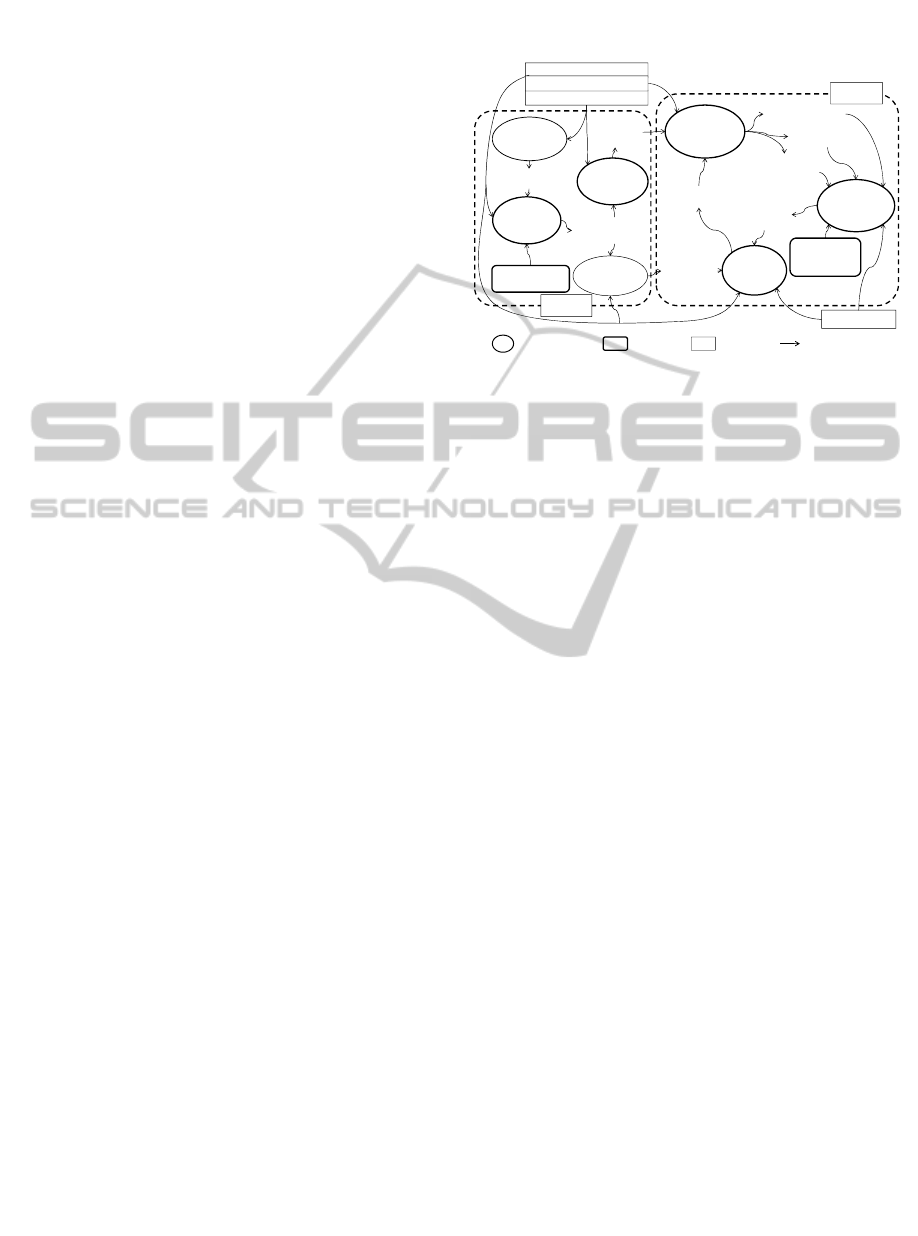

Figure 2 shows a bidding price decision process

model (Ishii et al., 2012), which represents

fundamental factors and their interactive processes,

to determine the bidding price in EPC projects based

on the observations in the previous section. The

model consists of three kinds of factors, i.e.,

decision processes, constraints, and given

conditions.

Figure 2: A bidding price decision process model in EPC

projects.

The model enables us to evaluate the expected

orders, the expected profits, and the deficit order

probability, based on the bidding price, the cost

estimation accuracy, and the information on

competitive environment. The bidding price is

determined based on the estimated cost, the target

profit rate, and the risk parameter for adjusting the

bidding price. The estimated cost and the cost

estimation accuracy are both determined depending

on the MH allocated to each order for cost

estimation. The MH allocation is determined

according to the ranking of orders provided by the

pre-evaluation of orders processed under the total

MH constraint as shown in Figure 2.

4.1 A Mathematical Model on Bidding

Price Decision

4.1.1 Evaluation of Cost Estimation

Accuracy

Since cost estimation requires a detailed analysis

conducted by experienced engineers, it can be seen

that the MH for cost estimation significantly affects

the cost estimation accuracy. In fact, Towler and

Sinnott (2008) suggest that the cost estimation

accuracy is positively correlated with the volume of

MH for cost estimation. It is also clear that the

marginal rate of cost estimation accuracy approaches

zero according to the increase of the volume of MH.

Thus, in this paper, we define the cost estimation

accuracy (σ) as the function of the MH for cost

estimation per order (PMH) based on the logistic

curve (Ishii and Muraki, 2011) as follows:

:Decision process :Constraint :Condition :Information flow

MH

allocation

for cost

estimation

Pre

evaluation

of orders

Bidding

price

decision

Setting

risk

parameter

Evaluation

of bidding

price

Deficit order

probability

Expected orders

Expected profit

Bidding price

Cost

Estimation

Evaluation

of cost

estimation

accuracy

Cost estimation

MH of each order

Estimated

cost

Risk

Parameter

Ranking of orders

Cost

estimation

accuracy

Target profit rate

Total MH for

cost estimation

Upper limit of

deficit order

probability

Preliminary cost

Past project data

Competitive environment

Step One

Step Two

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

396

})(/{)(

maxminmaxmaxmin

PMHC

ePMH

(PMH > 0.0) (1)

where σ

min

and σ

max

are the minimum and the

maximum value of the standard deviation of the

bidding price, and C is a parameter of the logistic

curve. In practice, the contractor could determine

these parameters from past project data.

4.1.2 Evaluation of Bidding Price

In the model, we consider n contractors (k=1,2,…,n)

and the bidding for L orders (i=1,2,…,L).

Particularly, k=1 represents one’s own company,

and k>=2 are its competitors. In the model, based on

standard order cost (STD), each contractor (k) sets a

tentative bidding price (TBP) of the order (i) in

consideration of the relative cost difference from

STD (RC) and target profit rate (e_profit) as follows:

(1 ) (1 _ )

iiii

ki k kk

TBP STD RC e profit rp

(2)

where TBP can be adjusted by changing the value of

risk parameter (rp). If there is no difference in cost-

competitiveness among contractors, RC is set to 0.

The expected volume of order (i) in one’s own

company (k=1) is as follows:

(3)

where

),,(

ii

k

i

k

kk

TBPxp

is the probability density

function of the bidding price (

i

k

x

) of the contractor

(k) for order (i), and its average value and standard

deviation are

i

k

TBP

and

i

k

, respectively. As shown

in Eq. (3), the expected order is the average value of

one’s own bidding price falling below those of all

other contractors (k>=2).

As shown in Eq. (4), the expected profit is the

average excess of the bidding price over the standard

order cost with the relative cost difference (STDR)

as defined in Eq. (5).

(4)

(1 )

ii

ki k

STDR STD RC

(5)

In addition, as shown in Eq. (6), the deficit

order probability is the probability of accepting the

order whose bidding price is lower than STDR.

n

k

x

ii

k

i

k

i

k

i

kk

STDR

iii

i

i

dxdxTBPxpTBPxp

2

1

0

1111

1

1

),,(),,(

(6)

We also assume that the data used in the above

equations, such as the number of competitors (n-1),

standard order cost (STD), relative cost difference

over STD (RC), probability density function of

bidding price (p

k

), and so on, can be provided from

RFP, past project data, several departments of the

contractor, and published data. For example, STD

can be specified in reference to the preliminary cost,

which is estimated by scaling it from the cost data of

past projects, which used similar technology

(Kerzner, 2009). Although a project is a temporary

endeavour undertaken to create a unique product,

similar parts can be found in functional units of past

projects. Accordingly, even if the cost data of

similar projects are not available, the preliminary

cost estimate can be made by breaking down the

project into functional units, and adding up the cost

data of similar functional units in past projects. The

cost data, the number of competitors, and so on, can

also be estimated based on published data in many

industries. For example, magazines related to the

EPC business, such as Chemical Engineering,

Hydrocarbon Processing, publish plant cost indexes,

cost engineering data, EPC project news and surveys,

periodically.

4.2 A Two-step Bidding Price Decision

Algorithm

In this section, we develop a two-step algorithm for

bidding price decision. As shown in Figure 2, this

algorithm determines the allocation of MH for cost

estimation according to the ranking of orders at the

first step, and searches the value of rp for

maximizing the expected profit of each order under

the deficit order probability constraint at the second

step.

4.2.1 Step One: Ranking of Orders and MH

Allocation

There are several procedures to rank orders. For

example, pair-wise comparisons, scoring models,

and analytical hierarchy process (AHP) are

commonly used (Martino, 1995).

In this paper, we shall rank orders based only on

the expected profit so as to assess the effectiveness

of our algorithm from the perspective of profits.

Specifically, we define the ranking score (Score) of

the order (i) as the expected profit based on the

tentative bidding price (TBPF) estimated for the

ranking at rp =1 as follows:

1

1

2

(, , )

i

n

iiiii

i

kk k k k

TBPF

k

Score TBPF p x TBPF dx

(7)

(

1

)(

1

_)

iii

ki k k

TBPF STD RC e

p

ro

f

it

(8)

ii

n

k

x

iii

k

iiii

dxdxTBPxpTBPxpx

k

i

kkk 1

1

1111

0

2

1

),,(),,(

ii

n

k

x

iii

k

iiiii

dxdxTBPxpTBPxpSTDRx

k

i

kkk 1

1

1111

0

2

11

),,(),,()(

ATwo-stepBiddingPriceDecisionAlgorithmunderLimitedMan-HoursinEPCProjects

397

Note that we can modify the ranking score in

consideration of multiple criteria besides the

expected profit, such as technical feasibility,

relationship with clients, and so on.

In the following MH allocation procedure, the

order with the high Score is ranked high because

such an order is expected to generate a large profit.

As described in the procedure below, we

consider three grades of accuracy, A (high

accuracy), B (average), and C (low accuracy), and

we assign one of them to each order. The expected

profit increases according to the increase of cost

estimation accuracy, and hence, the following

procedure results in the grade of high accuracy to

high-ranking orders, and the grade of low accuracy

to low-ranking orders in view of the allowable total

MH.

MH Allocation Procedure

Step 0 [Parameter Setting]: Set the range of

allowable total MH for cost estimation, and set

the accuracy level from (σ

min

, σ

max

) to each

grade; A (high accuracy), B (average), and C

(low accuracy).

Step 1 [Initial MH Allocation]: Set all the orders to

grade B, and allocate the corresponding MH

for cost estimation to each order based on Eq.

(1).

Step 2 [Termination Condition]: Calculate the total

MH required (TMR) by summing up all the

MH allocated to each order. If TMR is within

the range of allowable total MH, stop the

procedure with the current MH allocation. If

TMR is above the allowable range, go to Step

3. If TMR is below the allowable range, go to

Step 4.

Step 3 [Downgrading]: Choose the lowest-ranked

one from grade B orders, and set it to grade C.

If the grades of orders are all C, stop the

procedure with the current MH allocation.

Otherwise, go to Step 5.

Step 4 [Upgrading]: Choose the highest-ranked

one from grade B orders, and set it to grade A.

If the grades of orders are all A, stop the

procedure with the current MH allocation.

Otherwise, go to Step 5.

Step 5 [MH Reallocation]: According to the given

grades, reallocate the MH for cost estimation to

each order based on Eq. (1). Return to Step 2.

4.2.2 Step Two: Searching Risk Parameter

Value for Profit Maximization

Given the MH allocation determined by the

procedure described above, we search the value of

rp by solving the following optimization problem:

Maximize

1

111111 1

0

1

2

()(,,) (,,)

i

n

L

iiiii iiiii

kk k k k

x

i

k

x

STDR p x TBP p x TBP dx dx

(9)

subject to

(1 ) (1 _ )

iiii

i

kkkk

TBP STD RC e profit rp

(i=1,2,…,L; k=1,2,…,n)

(10)

1

1

11 1 1 1

0

2

(, , ) ( , , )

i

i

n

STDR

iii i iiii

kk k k k i

x

k

p

x TBP p x TBP dx dx rprob

i=1,2,….L)

(11)

where

i

rprob is the upper limit of the deficit order

probability of the order (i).

In the above optimization problem, the objective

is to maximize the total expected profit from orders.

Eq. (10) defines TBP, and Eq. (11) is the upper limit

constraint of the deficit order probability. Note that

Eq. (10) can be eliminated from the problem by

substituting Eq. (10) into Eq. (9) and (11).

Moreover, the problem can be separated into L

problems (i=1,2,…,L). As a result, rp of one’s own

company (k=1) is the single decision variable of

each problem. In this paper, we use a simple

iterative algorithm to search for a solution by

gradually eliminating search space.

Given the MH allocation for cost estimation and

the value of rp, the final bidding price is determined

as follows:

11

(1 _ )

ii

i

N

ET e profit rp

(12)

where NET, as shown in Figure 2, is the estimated

cost that is calculated by the allocated MH after the

bid or no-bid decision.

5 NUMERICAL EXAMPLES

In this section, we analyse and discuss the

performance of the two-step bidding price decision

algorithm in EPC projects based on the numerical

examples from the following perspectives: relations

between cost estimation accuracy and expected

profit, effectiveness of bidding price adjustment, and

effect of the upper limit constraint of the deficit

order probability.

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

398

5.1 Problem Setting

5.1.1 Setting of Cases

In this paper, we use the cases shown in Table 1 for

numerical examples. Cases 0 and 1 are set to show

the effectiveness of bidding price adjustment by the

risk parameter. Cases 2 and 3 are set to show the

effects of the competitors’ cost estimation accuracy

on the expected profit and deficit order probability

of one’s own company. The competitors’ cost

estimation accuracy

i

k

(k>=2) in Table 1 are set

based on the expected accuracy for bidding

(Oberlender, 2000).

Table 1: Cases for numerical examples.

Case

i

rp

1

i

k

(k>=2)

Case 0 1.0 8% of STD

i

Case 1 To be searched 8% of STD

i

Case 2 To be searched 6% of STD

i

Case 3 To be searched 10% of STD

i

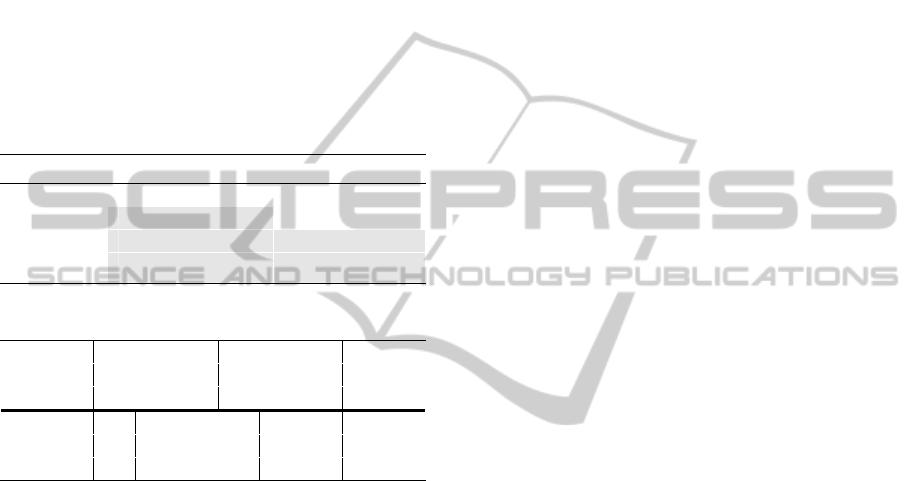

Table 2: Conditions of orders. (NBR: number of bidders).

We set other parameter values through all the

cases as follows:

0.1

i

k

rp

(k >= 2),

0.0

i

k

RC

(k >=

1), rprob

i

=1.0, and

1.0_

i

k

profite

. We set rprob

i

to 1.0 (100%) to maximize the expected profit

without the upper limit constraint of the deficit order

probability. The effect of the constraint is shown in

section 5.2.4.

Note that the value of

i

1

is determined by Eq.

(1) and the allocated MH. We suppose that the

bidding price follows a normal distribution.

Furthermore, we consider four conditions for the

range of allowable total MH for cost estimation, i.e.,

(A) 70-80, (B) 80-90, (C) 90-100, and (D) 100-110

[M MH].

5.1.2 Setting of Orders

In this paper, we assume a midsize EPC contractor

in the chemical plant engineering business, and

consider the conditions of 16 orders in each case as

shown in Table 2.

Regarding the cost estimation accuracy of one’s own

company (see Eq. (1)), we set C to 0.25*100/STD

i

,

and σ

min

and σ

max

to 0.5% and 30% of STD

i

,

respectively. In addition, we set the cost estimation

accuracy level to 5% of STD

i

for grade A, 8% of

STD

i

for grade B, and 15% of STD

i

for grade C

when performing the MH allocation procedure.

5.2 Results of Numerical Calculations

5.2.1 Cost Estimation Accuracy

and Expected Profit

As shown in Table 3, the significant difference in

the total expected profits is caused by the total MH

for cost estimation for all the cases. For example, the

expected profits in Case 0.A (70-80 [M MH]), Case

0.B (80-90 [M MH]), Case 0.C (90-100 [M MH]),

and Case 0.D (100-110 [M MH]) are 28.6, 46.3,

51.7, and 61.5 [MM$], respectively.

Since the cost estimation accuracy depends on

the MH for cost estimation as shown in Eq. (1), the

results indicate that the cost estimation accuracy

affects the expected profit significantly. Namely, the

contractor can expect a higher profit by increasing

the cost estimation accuracy in EPC projects.

However, there is usually a limit to the available

MH for cost estimation. Thus we can conclude that

an effective mechanism to allocate the MH for cost

estimation to each order under the constraint of the

volume of total MH is necessary in the bidding price

decision process.

5.2.2 Effectiveness of Bidding Price

Adjustment by Risk Parameter

Based on the results of Case 0 and Case 1, we

analyse the effect of the bidding price adjustment on

the expected profit. The bidding price is adjusted by

rp to attain the maximum expected profits in Case 1,

and the value of rp is fixed in Case 0.

As shown in Table 3, there is a significant

difference in the expected profits between Case 0

and Case 1. For example, the total expected profits

in Case 0.A and Case 1.A are 28.6 and 53.3 [MM$],

respectively. The bidding price adjustment also

affects the expected orders and profit rate. In Case

0.A, for instance, the expected orders and profits are

1858.2 and 28.6; therefore the expected profit rate is

1.54%. In contrast, in Case 1.A, the expected orders

and profits are 1141.6 and 53.3; therefore the

expected profit rate is 4.67%, which is about three

times as high as that in Case 0.A.

Order id (i) 1 2 3 4 5 6 7 8

STD

i

100.0 200.0 300.0

N

BR (n) 2 3 4 2 3 4 2 3

Order id (i) 9 10 11 12 13 14 15 16

STD

i

400.0 500.0 600.0

N

BR (n) 4 2 3 4 3 4 3 4

ATwo-stepBiddingPriceDecisionAlgorithmunderLimitedMan-HoursinEPCProjects

399

Table 3: Expected orders (EO; Eq. (3)) and Expected

profits (EP; Eq. (4)).

[MM$]

The Range of Allowable Total MH for Cost

Estimation [M MH]

70-80 80-90 90-100 100-110

Case 0 Case 0.A Case 0.B Case 0.C Case 0.D

EO 1858.2 1817.9 1823.3 1809.0

EP 28.6 46.3 51.7 61.5

Case 1 Case 1.A Case 1.B Case 1.C Case 1.D

EO 1141.6 1238.1 1269.5 1357.2

EP 53.3 56.4 60.9 69.1

Case 2 Case 2.A Case 2.B Case 2.C Case 2.D

EO 1275.2 1395.2 1437.6 1547.3

EP 48.0 51.3 56.3 65.5

Case 3 Case 3.A Case 3.B Case 3.C Case 3.D

EO 1061.6 1143.7 1168.1 1236.6

EP 60.2 63.5 67.5 74.8

The deficit order probability is significantly

decreased by the adjustment of the bidding price as

shown in Table 4. For example, the range of deficit

order probability in the orders is between 11.0% and

25.8% in Case 0.A, and between 0.777% and 5.81%

in Case 1.A. In Case 0.A, the MH allocation

procedure results in the low cost estimation accuracy

level (grade C) to the orders 2, 3, 6, and 9, and these

orders result in negative earnings as shown in Table

5. However, in Case 1.A, the bidding price

adjustment decreases the deficit order probabilities

of these orders and improves the expected profits.

Table 6 shows the effects of the competitors’

cost estimation accuracy on the value of rp, the

expected profit, and the deficit order probability of

each order. Note that the competitors’ cost

estimation accuracy of Case 2.B, Case 1.B, and Case

3.B is 6%, 8%, and 10% of

i

STD

, respectively. As

shown in Table 6, as the competitors’ cost

estimation accuracy increases, the value of rp

searched for by the algorithm decreases and the

deficit order probability of each order increases.

This is because the high accuracy of the

competitors’ cost estimation reduces the chance of

accepting the orders at high prices, and

consequently, a small rp is chosen to accept such

orders.

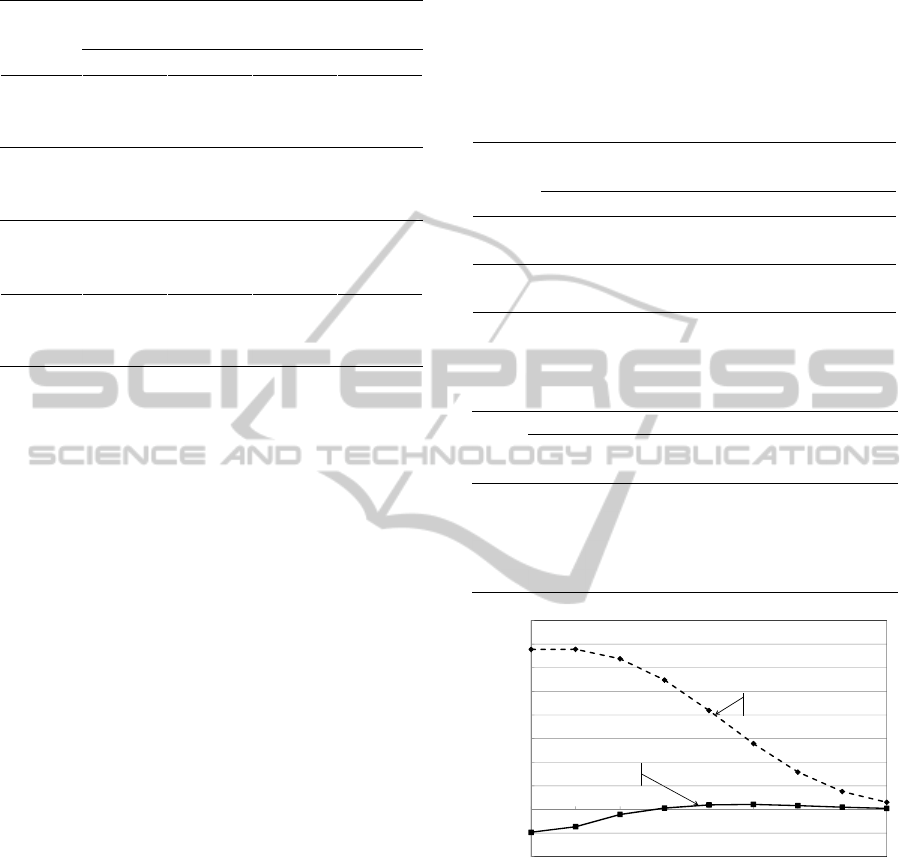

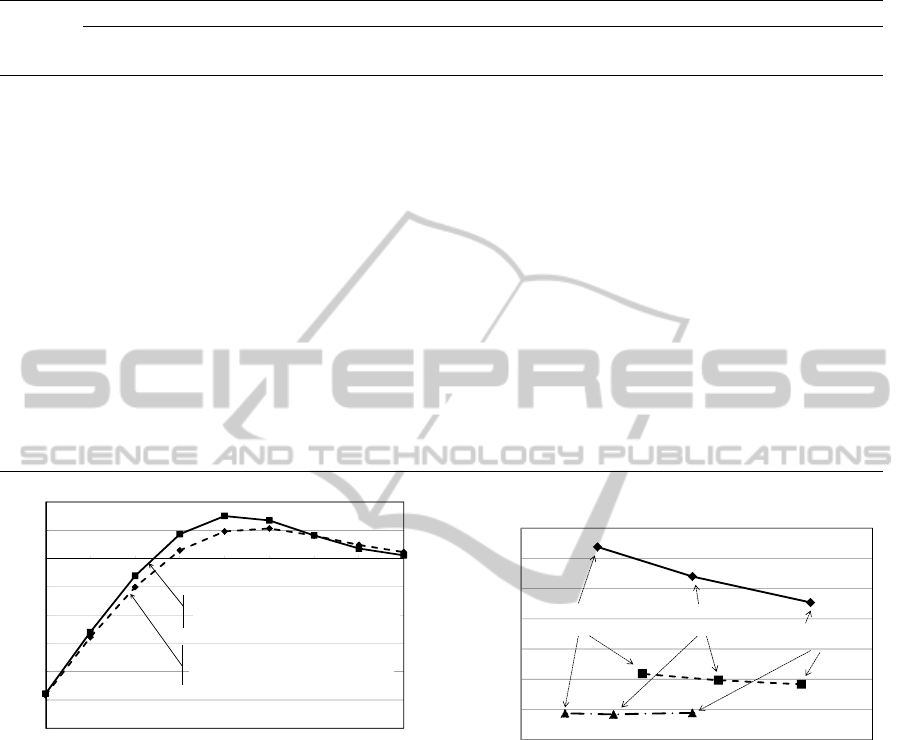

Figure 3 depicts the relation of the expected

order and profit of the order id 10 with the value of

rp in Case 1.B. In addition, Figure 4 depicts the

relation of the expected profits of the order id 10

with the value of rp in Case 1.B and Case 1.C, each

of which corresponds to a different range of

allowable total MH. Figure 3 shows that the

expected order decreases as the value of rp

increases. However, it is found from Figures 3 and 4

that there is a value of rp that attains the maximum

expected profit. Furthermore, Figure 4 tells us the

higher cost estimation accuracy, i.e., more MH for

cost estimation, makes the maximum expected profit

higher.

Table 4: Range of deficit order probability (Eq. (6)) [%].

The range of allowable total MH for cost

estimation [M MH]

70-80 80-90 90-100 100-110

Case 0 Case 0.A Case 0.B Case 0.C Case 0.D

11.0-25.8 11.0-12.1 3.20-12.1 2.98-12.1

Case 1 Case 1.A Case 1.B Case 1.C Case 1.D

0.777-5.81 4.33-5.81 1.77-5.81 1.77-5.81

Table 5: Effectiveness of bidding price adjustment by risk

parameter. (EP: Expected Profit, DOP: Deficit Order

Probability).

Order

id (i)

Case 0.A Case 1.A

i

rp

1

EP

[MM$]

DOP

[%]

i

rp

1

EP

[MM$]

DOP

[%]

2 1.0 -1.92 25.8 1.20 0.155 2.32

3 1.0 -2.25 25.2 1.26 0.0290 0.777

6 1.0 -4.50 25.2 1.26 0.0581 0.777

9 1.0 -6.75 25.2 1.26 0.0871 0.777

Figure 3: Relations among expected order, expected profit,

and risk parameter. (Case 1.B; Order id = 10).

We can see that the higher cost estimation

accuracy reduces the chance of accepting orders at

very low price and thus increases the expected

profit. However, the higher cost estimation accuracy

also reduces chance of accepting profitable orders

when the value of rp is high. In Figure 4, for

instance, the expected profit in Case 1.C is lower

than that in Case 1.B when rp is 1.15 or more.

Expected order

Expected profit

-100.0

-50.0

0.0

50.0

100.0

150.0

200.0

250.0

300.0

350.0

400.0

0.8 0.85 0.9 0.95 1 1.05 1.1 1.15 1.2

Expected order and profit [MM$]

Risk parameter (rp)

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

400

Table 6: Bidding price adjustment with different competitors’ accuracy (80-90 [M MH]). (EP: Expected Profit, DOP:

Deficit Order Probability).

Order id

(i)

Case 2.B Case 1.B Case 3.B

i

rp

1

EP

[MM$]

DOP

[%]

i

rp

1

EP

[MM$]

DOP

[%]

i

rp

1

EP

[MM$]

DOP

[%]

1 1.026 2.27 7.12 1.035 2.70 5.44 1.045 3.14 4.09

2 1.026 0.916 6.99 1.030 0.983 5.81 1.035 1.09 4.73

3 1.035 0.444 5.44 1.040 0.418 4.32 1.042 0.436 3.63

4 1.026 4.54 7.12 1.035 5.40 5.44 1.045 6.29 4.09

5 1.026 1.83 6.99 1.030 1.97 5.81 1.035 2.18 4.73

6 1.035 0.888 5.44 1.040 0.836 4.32 1.042 0.872 3.63

7 1.026 6.81 7.12 1.035 8.11 5.44 1.045 9.43 4.09

8 1.026 2.75 6.99 1.030 2.95 5.81 1.035 3.27 4.73

9 1.035 1.33 5.44 1.040 1.25 4.32 1.042 1.31 3.63

10 1.026 9.08 7.06 1.035 10.8 5.54 1.044 12.6 4.13

11 1.026 3.67 6.99 1.030 3.93 5.81 1.035 4.36 4.73

12 1.035 1.78 5.44 1.040 1.67 4.32 1.042 1.74 3.63

13 1.026 4.58 6.99 1.030 4.91 5.81 1.035 5.45 4.73

14 1.035 2.22 5.44 1.040 2.09 4.32 1.042 2.18 3.63

15 1.026 5.50 6.99 1.030 5.90 5.81 1.035 6.54 4.73

16 1.035 2.66 5.44 1.040 2.51 4.32 1.042 2.62 3.63

Figure 4: Relations among expected profit, total MH for

cost estimation, and risk parameter. (Case 1.B, Order id

=10, Total MH for cost estimation: 80-90 [M MH]; and

Case 1.C, Order id =10, Total MH for cost estimation 90-

100 [M MH]).

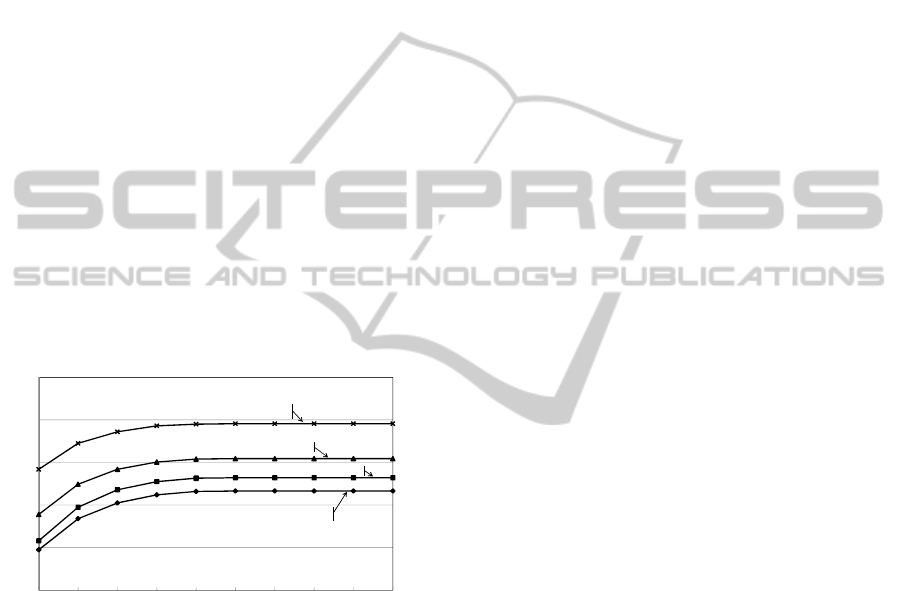

5.2.3 Effect of the Number of Bidders

Figure 5 depicts the relation of the expected profit

and the deficit order probability of the order id 1, 2

and 3 in Cases 2.B, 1.B, and 3.B. Note that the

number of bidders is set to two, three, and four for

the order id 1, 2 and 3, respectively. Also, in Cases

2.B, 1.B, and 3.B, the competitors’ cost estimation

accuracy is set to 6%, 8%, and 10% of STD

i

. As

shown in Figure 5, the effect of the competitors’ cost

estimation accuracy on the expected profit and the

deficit order probability becomes smaller as the

number of bidders increases.

Figure 5: Relations among expected profits and deficit

order probability. (Case 2B, 1B, and 3B; Order id 1, 2, and

3) (CCEA: Competitors’ Cost Estimation Accuracy).

For instance, in Order id 1, i.e., when the number

of bidders is two, the difference of the expected

profit between Case 3.B and Case 2.B is 0.87

[MM$]. In contrast, in Order id 3, i.e., when the

number of bidders is four, the difference of the

expected profit between Case 3.B and Case 2.B is

0.008 [MM$]. The difference in the deficit order

probability between Case 3.B and Case 2.B is also

reduced from 3.03 [%] (in the case of Order id 1) to

1.81 [%] (in the case of Order id 3).

High degree of competition significantly reduces

the chance of accepting orders at high prices as well

as at low prices regardless of the competitors’ cost

estimation accuracy. Consequently, it reduces the

-60.0

-50.0

-40.0

-30.0

-20.0

-10.0

0.0

10.0

20.0

0.8 0.85 0.9 0.95 1 1.05 1.1 1.15 1.2

Expected profit [MM$]

Risk

p

aramete

r

(rp)

Total MH for cost estimation: 90-100 [M MH]

Case 1.C, Order id =10

Cost estimation accuracy (σ): 21 [MM$]

Total MH for cost estimation : 80-90 [M MH]

Case 1.B, Order id =10

Cost estimation accuracy (σ): 35.2 [MM$]

0

0.5

1

1.5

2

2.5

3

3.5

3.04.05.06.07.08.0

Expected profit [MM$]

Deficit order probability [%]

Order id 1

(No of bidders: 2)

Order id 2

(No of bidders: 3)

Order id 3

(No of bidders: 4)

Case 2.B

CCEA: 6% of STD

i

Case 1.B

CCEA: 8% of STD

i

Case 3.B

CCEA: 10% of STD

i

ATwo-stepBiddingPriceDecisionAlgorithmunderLimitedMan-HoursinEPCProjects

401

effect of the competitors’ cost estimation accuracy

on the expected profit and the deficit order

probability.

5.2.4 Effect of Upper Limit Constraint

of the Deficit Order Probability

We examine how the upper limit constraint of the

deficit order probability shown in Eq. (11) affects

the expected profit. Figure 6 depicts the relation of

the upper limit of the deficit order probability and

the total expected profit in Case 1. As explained in

Sections 2 and 3, the risk of unexpected loss from

the deficit orders should be avoided especially when

only a small number of orders can be accepted. As

shown in Figure 6, the small upper limit of the

deficit order probability decreases the total expected

profit; however, it is found that the deficit order

probability can be reduced from 5.0% to 1.0% at the

expense of the total expected profits of 10 to 15

[MM$].

Bidding for a large-scale EPC project involves a

substantial risk. Our framework developed for EPC

projects will certainly be helpful for any contractor

to avoid large deficit from accepted orders.

Figure 6: Relations among expected profits, total MH for

cost estimation, and upper limit of deficit order probability

(Case 1).

6 CONCLUSIONS

In this paper, we develop a two-step bidding price

decision algorithm under limited MH in EPC

projects. The algorithm allocates MH for cost

estimation to each order under the limited volume of

MH, and then determines the bidding price to

maximize the expected profit under the deficit order

probability constraint.

We develop a mathematical model for simulating

competitive bidding. Through the numerical results

obtained by using the model, we show that the

bidding price decision in consideration of the cost

estimation accuracy and the deficit order probability

is essential for the contractor to make a stable profit

in EPC projects, and that the two-step bidding price

decision algorithm developed in this paper is

effective for making such bidding price decisions.

There are several issues which require further

research. For example, the procedure for modifying

the MH allocation and adjusting the bidding price

dynamically in response to each order arrival is

required for practical application. In addition, our

two-step algorithm does not consider the duration

for estimating cost and for carrying out the project.

The MH allocation procedure should consider the

time cost-trade-off and its implication on the cost

estimation accuracy and profit. It is also necessary to

compare the performance of our procedure with

other project scheduling methods dealing with the

optimum allocation of resources for multiple

projects.

ACKNOWLEDGEMENTS

The authors would like to thank all the reviewers for

their valuable comments.

REFERENCES

Ballesteros-Pérez, P., González-Cruz, M

a

. C., Cañavate-

Grimal, a., 2012. on Competitive Bidding: Scoring and

Position Probability Graphs. International Journal of

Project Management, in Press.

Bertisen, J., Davis, G. a., 2008. Bias and Error in Mine

Project Capital Cost Estimation. the Engineering

Economist. 53, 118-139.

Dey, P. K., 2006. Integrated Project Evaluation and

Selection using Multiple-Attribute Decision-Making

Technique. International Journal of Production

Economics. 103, 90-103.

Elfving, J. a., Tommelein, I. D., Ballard, G., 2005.

Consequences of Competitive Bidding in Project-

based Production. Journal of Purchasing & Supply

Management. 11, 173-181.

Friedman, L., 1956. a Competitive-Bidding Strategy. the

Journal of the Operations Research Society of

America. 4, 104-112.

Helmus, F. P., 2008. Process Plant Design: Project

Management from Inquiry to Acceptance. Wiley-

VCH, Weinheim.

Herbots, J., Herroelen, W., Leus, R., 2007. Dynamic Order

Acceptance and Capacity Planning on a Single

Bottleneck Resource. Naval Research Logistics.

54, 874-889.

Total MH for cost estimation: 100-110 [M MH]

Total MH for cost estimation: 90-100 [M MH]

Total MH for cost estimation: 80-90 [M MH]

Total MH for cost estimation: 70-80 [M MH]

30.0

40.0

50.0

60.0

70.0

80.0

1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0%

Expected profit [MM$]

Upper limit of deficit order probability

SIMULTECH2013-3rdInternationalConferenceonSimulationandModelingMethodologies,Technologiesand

Applications

402

Ishii, N., Muraki, M., 2011. a Strategy for Accepting

Orders in ETO Manufacturing with Competitive

Bidding. Proceedings of 1st International Conference

on Simulation and Modeling Methodologies,

Technologies and Applications (SIMULTECH 2011).

380-385.

Ishii, N., Takano, Y., Muraki, M., 2012. Decision on

Bidding Prices under Limited Man-Hours in EPC

Projects. Submitted to Computers & Industrial

Engineering.

Jinru, Z., 2011. Study on Cost Management under EPC

General Contracting Model. Advanced Materials

Research, 181/182, 49-53.

Kerzner, H., 2009. Project Management: a Systems

Approach to Planning, Scheduling, and Controlling.

John Wiley & Sons, New Jersey.

Kolisch, R., 2001. Make-to-Order Assembly Management.

Springer-Verlag, Berlin.

Kortanek, K. O., Soden, J. V., Sodaro, D., 1973. Profit

Analyses and Sequential Bid Pricing Models.

Management Science, 20, 396-417.

Martino, J. P., 1995. Research and Development Project

Selection. John Wiley & Sons, New York.

Medaglia, a. L., Graves, S. B., Ringuest, J. L., 2007. a

Multiobjective Evolutionary Approach for Linearly

Constrained Project Selection under Uncertainty.

European Journal of Operational Research. 179, 869-

894.

Oberlender, G. D., 2000. Project Management for

Engineering and Construction. Mcgraw-Hill, New

York.

Oberlender, G. D., Trost, S. M., 2001. Predicting

Accuracy of Early Cost Estimates based on Estimate

Quality. Journal of Construction Engineering and

Management. May/June, 173-182.

Ranjan, M., 2009. EPC: a Better Approach, Chemical

Engineering World. 44, 7, 46-49.

Rom, W. O., Slotnick, S. a., 2009. Order Acceptance using

Genetic Algorithms. Computers & Operations

Research. 36, 1758-1767.

Rothkopf, M. H., Harstad R. M., 1994. Modeling

Competitive Bidding: a Critical Essay. Management

Science. 40, 364-384.

Slotnick, S., Morton, T. E., 2007. Order Acceptance with

Weighted Tardiness. Computers & Operations

Research. 34, 3029-3042.

Steel, G., 2004. Tender Management, in: Morris, P. W. G.,

Pinto, J. K., (Eds.). the Wiley Guide to Managing

Projects. John Wiley & Sons, New Jersey.

Towler, G., Sinnott, R., 2008, Chemical Engineering

Design Principles, Practice and Economics of Plant

and Process Design. Elsevier, Burlington.

Wang, J., Xu, Y., Li, Z., 2009. Research on Project

Selection System of Pre-Evaluation of Engineering

Design Project Bidding. International Journal of

Project Management. 27, 584-599.

Watt, D. J, Kayis, B., Willey, K., 2009. Identifying Key

Factors in the Evaluation of Tenders for Projects and

Services. International Journal of Project

Management, 27, 250-260.

ATwo-stepBiddingPriceDecisionAlgorithmunderLimitedMan-HoursinEPCProjects

403