FACTORIAL ANALYSIS TO MEASURE DEVELOPING

ABILITY OF LISTED RETAIL ENTERPRISES

Yi Feng

Beijing Jiaotong University, Shangyuancun Street, Beijing, China

Keywords: Developing ability, Listed retail enterprises, Factorial analysis, Operating component, Profit component.

Abstract: Retail business is the first to start and achieve the marketization in China. In recent years, China’s retail

business market has been developing rapidly, and in the meantime its status has been rising steadily. The

2008’s financial crisis struck the China’s retail business to some degree, but the government’s effective

policy of expanding domestic demand plays an important role in its development. Improving the

development of retail business industry will positively influence itself, but also the whole market and the

national economy. According to the factor analysis model,by using the method of empirical analysis, this

paper objectively evaluates the developing ability of our country’s listed retail enterprises and the key

factors which influence its developing ability. Meanwhile some proposals are put forward for the

development of our country’s retail business.

1 INTRODUCTION

Retail business is the industry selling products

directly to consumers or community groups. With its

growing effect in the national economy, retail

business has already become a leader to guide the

production and consumption. China’s retail business

has experienced a process from small to large,

closed to open, single to multiple in the nearly 30

years, and its position is rising in the global market

year by year. In 2009, the amount of China’s total

retail sales of social consumer goods is 12.53 trillion

Yuan, up 15.5% over 2008, and consumer-driven

economic growth is 3.9%. Therefore, I think doing

some analysis and research on China’s retail

business will be profound significant.

1.1 Literature Review

The achievement of factorial analysis in stock value

overseas is the conclusion that factorial analysis is

suitable for stock market, which contributed by S.

Genesalingam and Kuldeep Kumar in 2001. They

drew conclusions after analyzing some companies'

data obtained from US stock market from 1986 to

1991.

The application of factorial analysis in stock

market of China is some concrete analysis based on

the existing theories.

Limei Li and Xiangdong Liu. Factorial Analysis

in Stock Market. They choose five stocks from New

York stock market and abstracted two factors finally

to calculate scores and ranking of every enterprise.

Bing He and Xingsan Qian. Cluster Analysis and

Factorial Analysis in stock market. They divided

stocks of listed automobile companies into blue-chip

share, average share and trash share by cluster

analysis, and extracted three integrated factors to

reflect companies’ financial position which used to

evaluate the value of these companies.

1.2 The Trail of Thought

The author selected factorial analysis model to

conduct a research on the developing ability of

China’s retail business. First, I established a set of

financial index and collected data of listed retail

enterprises as samples. Second, I extracted main

components by Spss and drew a score function to

elicit a developing ability function. Third, I

calculated the scores of all companies and ranked

them based on the scores. At last, I made a sound

analysis according to the analysis integrated

practical situation.

553

Feng Y..

FACTORIAL ANALYSIS TO MEASURE DEVELOPING ABILITY OF LISTED RETAIL ENTERPRISES.

DOI: 10.5220/0003584705530556

In Proceedings of the 13th International Conference on Enterprise Information Systems (PMSS-2011), pages 553-556

ISBN: 978-989-8425-56-0

Copyright

c

2011 SCITEPRESS (Science and Technology Publications, Lda.)

2 MODEL AND INDEX

2.1 Factorial Analysis Model

The author selected factorial analysis as the main

method in this article. Factorial analysis is proposed

by British psychologist C. Spearman and used in the

field of psychology and social pedagogy. It is a

method extracting only a few integrated components

from a mass of figures based on the internal

correlation matrix. The fundamental idea of factorial

analysis is dividing the original variables into some

groups conformed to the principle that every

variable in the group is high related with each other,

while variables in different groups have low

correlative level. Every group is an integrated factor

called component which expresses an aspect of

essential features of original data.

2.2 Index

The author selected capital value-retaining and

value-increasing rate as dependent variable to

evaluate the developing ability of corporations.

Capital value-retaining and value-increasing rate

equals to the equity at the end of the year dividend

by equity at the beginning of the year. Higher this

figure is, better the condition of enterprise's capital

preserving ability, in turn stronger developing ability.

The author selected six financial ratios as the

independent variables:

1. Asset-to-debt ratio equals to the total assets

dividend by total debts. Asset-to-debt ratio reflects

the borrowing proportion in the total assets. The

higher the ratio is, the bigger the financial risk

enterprises are facing.

2. EPS reflects the profit level of common stock.

The compare between corporations contributes to

the evaluating of relative profit ability.

3. Net profit margin equals to the net income

divided by sales.

4. Cost-to-operating income ratio equals to

operating cost divided by operating income. It is an

important figure to evaluate the efficiency of

corporations' operation.

5. Total assets turnover equals to operating income

divided by average assets. It is an important figure to

evaluate the efficiency of assets turnover.

6. Equity turnover equals to sales divided by

average equity. It reflects the efficiency of the

management of assets.

3 ANALYSING PROCESS

3.1 Selecting Sample Data

This article gathered financial ratios from 58 listed

industrial retail enterprises in 2009 as the sample

data. According to China’s law, A-share and B-share

followed different accounting standards, so the

compare of their financial ratios is unreasonable.

Therefore, the author excluded B-stock listed

companies from research. In order to study theses

corporations' developing ability in the market full of

fierce competition, the author selected financial

ratios of all A-stock listed companies.

3.2 Resource of Data

All data used in this article is collecting from

Guotaian database (http://www.gtarsc.com).

3.3 Factorial Analysis

The author analyzed sample data by Spss.

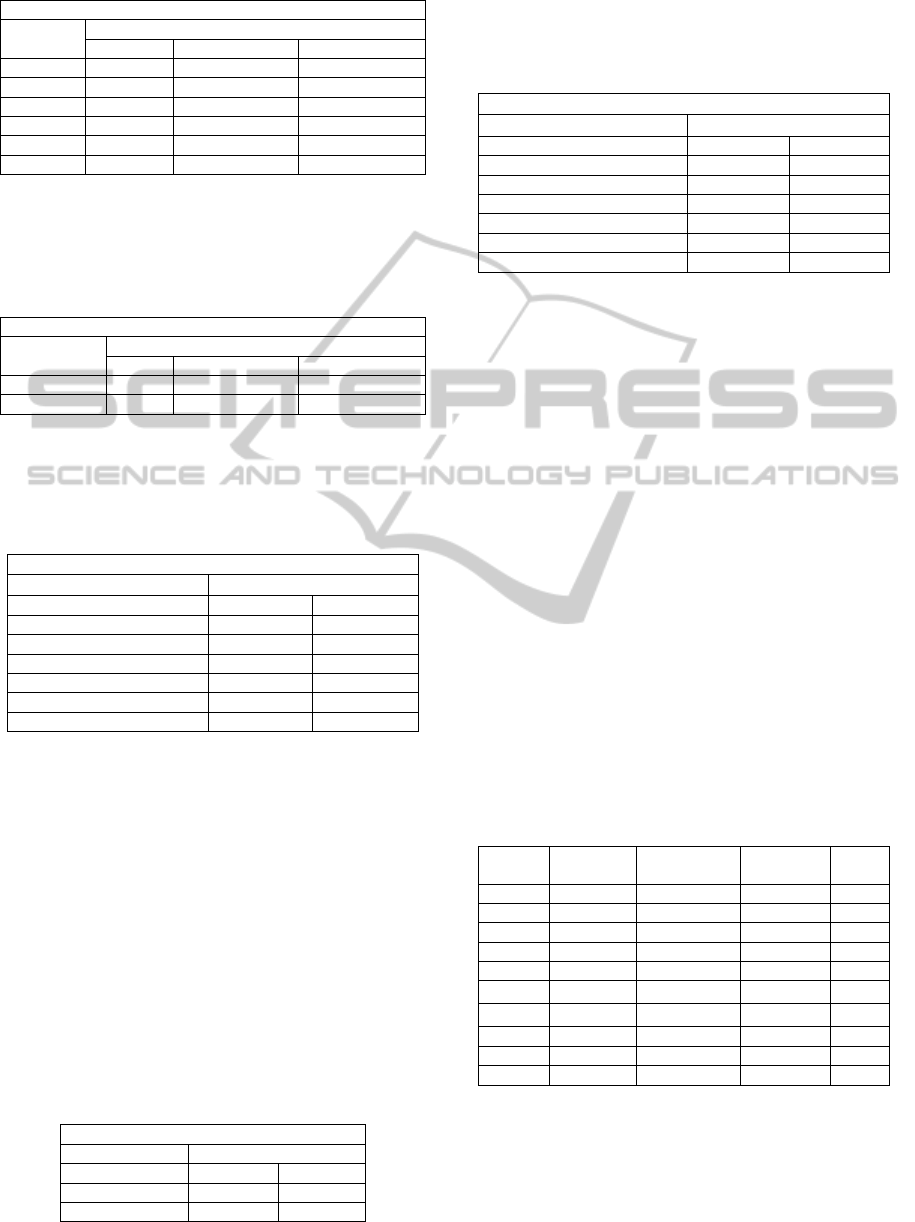

Table 1: KMO and Bartlett's Test.

KMO and Bartlett's Test

Kaiser-Meyer-

Olkin Measure of

Sampling

Adequacy.

.487

Bartlett's Test of

Sphericity

Approx. Chi-

Square

109.553

df 15

Sig. .000

KMO test before analysis. The p value is 0.000,

less than 0.005. So we can conclude that factorial

analysis is available.

Table 2: Communalities.

Communalities

Initial Extraction

Asset-to-debt 1.000 .759

EPS 1.000 .606

Net profit margin 1.000 .522

Cost-to-operating income 1.000 .438

Total asset turnover 1.000 .849

Equity turnover 1.000 .764

The rate of extraction is quite high, which

indicates that most information has been extracted

by factorial analysis. So the analysis is effective. For

example, 0.759 means 75.9% information of sample

data has been extracted.

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

554

Table 3: Total Variance Explained.

Total Variance Explained

Component Initial Eigenvalues

Total % of Variance Cumulative %

1 2.276 37.935

2 1.662 27.704

3 .752 12.535 78.174

4 .685 11.419 89.593

5 .484 8.071 97.664

6 .140 2.336 100.000

According to Table 3, the first two factors'

eigenvalues is more than 1. So I extracted them as

the main factors.

Table 4: Total Variance Explained.

Total Variance Explained

Component Extraction Sums of Squared Loadings

Total % of Variance Cumulative %

1 2.276 37.935 37.935

2 1.662 27.704 65.638

The accumulated contribution rate of two factors

is 65.638%, largely reflected most information of the

original variables.

Table 5: Rotated Component Matrix.

Rotated Component Matrix

Component

1 2

Asset-to-debt .319 -.811

EPS .553 .548

Net profit margin .020 .722

Cost-to-operating income .637 -.180

Total asset turnover .878 .280

Equity turnover .830 -.273

Rotated component matrix reflects the

correlation coefficient between two components and

six variables.

Component 1 has a heavy loading on cost-to-

operating income, total asset turnover and equity

turnover, which indicates that operating capacity is

an important factor related to developing ability.

Therefore, I defined component 1 as Operating

Factor.

Component 2 has a heavy loading on asset-to-

debt, EPS and net profit margin, which indicates that

the proportion of loan and ability to profit are

important factors related to developing ability.

Therefore, I defined component 2 as Profit Factor.

Table 6: Component Transformation Matrix.

Component Transformation Matrix

Component

1 2

1 .998 -.060

2 .060 .998

The absolute value of correlation coefficient

between component 1 and component 2 is 0.06,

which indicates that they are irrelevant.

Table 7: Component Score Coefficient Matrix.

Component Score Coefficient Matrix

Component

1 2

Asset-to-debt .133 -.484

EPS .248 .335

Net profit margin .016 .434

Cost-to-operating income .278 -.102

Total asset turnover .389 .177

Equity turnover .363 -.156

I arrived at two component score functions by

regression method, using the information in Table 7:

1123

456

0.133 0.248 0.016

0.278 0.389 0.363

F

LLL

LLL

2123

456

0.484 0.335 0.434

0.102 0.177 0.156

F

LLL

LLL

Now, the variables applying to developing ability

analysis of retail business are 2 component variables

instead of 6 basic variables. Due to different

influence on the developing ability, I gave the two

components different weight which is their % of

variance.

1

2

Developing ability 0.37935

0.27704

F

F

I calculated the scores of developing ability of the 58

listed industrial retail enterprises according to the

developing ability equation. Followings are the top

five and last five ones:

Table 8: Scores.

Stock

code

F1 F2 Scores Rank

ing

600729 5.16200 -0.08833 1.93373 1

600306 4.61499 0.32048 1.83948 2

600693 4.17611 -0.95516 1.31959 3

600361 3.75471 -0.47394 1.29305 4

600560 3.14885 0.28592 1.27373 5

600738

0.41196 -0.29371 0.07491

54

600515

0.25753 0.37288 0.00561

55

600628 0.44913 0.92913 0.08703 56

600774 0.31733 -0.83568 -0.11114 57

000026 0.32905 -0.90545 -0.12602 58

3.4 Summary

There are two extracting factors affect developing

ability - Operating component and Profit component.

Both of them play crucial roles, while Operating

FACTORIAL ANALYSIS TO MEASURE DEVELOPING ABILITY OF LISTED RETAIL ENTERPRISES

555

component is relatively more important than Profit

component.

Chongqing Department Store (600729) ranked

first in the developing ability, and Commercial City

(600306) landed just behind it. At the bottom of the

table, are Hanshang Group (600774) and FIYTA A

(000026).

The operating ability of Chongqing Department

Store ranked first among the 58 stocks, which

indicates its outstanding asset management ability. It

can be revealed from following figure: Total asset

turnover ratio of Chongqing Department Store is

368.28%, while 10.29% of Hanshang Group. The

high ratio indicates a fast turnover speed of assets

from input to output, in turn a strong sales force.

This result corresponds to reality. Chongqing

Department Store adopted the advanced chain-like

management developing model. Due to splendid

management team, rich market resource and gook

prestige, its brand has stricken root in the hearts of

the consumers. As a result of 2008 Financial Crisis,

retail business experienced a recession. However,

Chongqing Department Store maintained sound

momentum of development.

Among 58 listed companies, the operating ability

of FIYTA ranked the bottom three, and the profit

ability of FIYTA ranked fifth from the bottom.

FIYTA is a leading enterprisee in China’s watch

making industry. Its poor performance in the

analysis should be attributed to 2008 Financial Crisis,

which had many impacts of luxury industry. Facing

this situation, FIYTA has adjusted strategies to tide

over the difficulty and wormed out of trouble in

2010.

4 CONCLUSIONS

The empirical analysis of developing ability of

China’s retail business by using the method of

factorial analysis supports some conclusions as

follows:

First, according to the practical situation, the results

of empirical analysis are in general agreement with

the market status. Hence, the index system, models

the author used in this article is appropriate.

Second, the developing ability equation shows that:

Operating ability and profitability are two key

factors to the development of company. China’s

retail business has been facing severe challenges

since China joined to WTO. Domestic market is

occupied by some well-known multinational groups.

China’s companies won't win this battle only by low

pricing, operation expanding. They need to focus on

improving the operating ability and profitability. Our

government has established lots of policies to

expand domestic demand theses years; it comes

easier to make a profit for most of retail

corporations. However, in a positive situation, many

retail corporations ignore operation management. It

will weaken their developing abilities, make them

expose to huge risk in future development and be in

a position of disadvantage ultimately. So it's very

important for retail corporations to keep high

efficiency and high turnover ratio to avoid breaks of

fund chain which will lead to a financial crisis.

Third, the ranking of retail corporations shows that:

The financial crisis has considerable influenced on

retail business. Some corporations lived through the

difficulty. On one hand, these corporations may have

low price elasticity of revenue. On the other hand,

they have built mature operation and management

systems. To sum up, although the influence of 2008

financial crisis has been weakening gradually, it is

necessary for corporations to learn something from

the experience. Pay more attention to the internal

management. Try to defuse potential risks and adjust

strategies timely to keep a stable condition in any

situation.

REFERENCES

Weidong Li, 2008. Applied Multivariate Statistical

Analysis, Peking University Press. Beijing, 1

st

edition.

Zinai Li, 2008. Econometrics, Higher Education Press.

Beijing, 2

nd

edition.

Quan Liu, 2010. Factorial Analysis Applied in the Stock

Market. In China Academic Journal Electronic

Publishing House(2010).

Banguo Dong and Zhiyong Wang, 2010. The Analysis of

Asset Atructure of Listed Retail Enterprises. In China

Market (2010).

ICEIS 2011 - 13th International Conference on Enterprise Information Systems

556