MINING AND MODELING DECISION WORKFLOWS FROM

DSS USER ACTIVITY LOGS

Razvan Petrusel

Faculty of Economical Sciences and Business Management, Babeş-Bolyai University

T. Mihali Street 58-60, 400569, Cluj-Napoca, Romania

Keywords: Decision process mining, Decision workflow, Financial decisions, Process mining.

Abstract: This paper introduces the concept of decision workflows, regarded as the sequence of actions of the decision

maker in decision making process. We show how, based on a decision support system we previously

created, we log the behaviour of the decision maker. The log is then imported into ProM framework and

mined using existent process mining algorithms. The mined model will show us the control-flow

perspective (which is the order of decision maker’s actions), the organisational perspective (which is the

actual relationship among decision makers in group decisions), and the case perspective (what kind of

support is required by each type of decisions). The aim of our research is to automate the creation of

decision making patterns. Once obtained, the workflows can be merged into a financial enterprise model,

which, properly validated, can become a financial reference model.

1 INTRODUCTION

There is a great variety of financial decisions among

small and medium enterprises in Romania. We

previously researched those decisions using a mixed

approach based on questionnaires, direct

observations and interviews (Petrusel, 2008). We

evaluated financial decision making in over 50 small

and medium enterprises in Romania. In the sample,

we observed that decision makers use similar

information sources and perform the same activities

for similar decisions. This led us to believe that, up

to a certain point, a decision process is actually very

similar to a workflow. Our final target is to use

decision workflows in order to create decision

reference models. Those models will allow us to

assess the quality of the decision procedures and the

overall quality of decision making.

We rely on the work in process mining presented

in (van der Aalst, 2002), (van der Aalst, 2004),

(Wynn, 2008), etc. By using our approach, we argue

that existing process mining algorithms can be

employed in modelling decision making processes.

We show how a DSS can be used to create a log

regarding the decision makers’ actions. This log will

be mined using process mining algorithms in order

to extract a decision making workflow. Several such

workflows, extracted for similar decisional situation,

can become a model of a decision making process.

We will present in this paper the first experiment

on creating a financial decision model derived from

workflows. We present in Section Two our research

framework and several research questions. In the

third section we will show how we used our DSS in

order to create a log of the financial decision making

activities. Then, we will show how we used process

mining algorithms to create decision workflows. In

Section Four, we will present our conclusions after

this first experiment.

2 RESEARCH FRAMEWORK

There are several research questions that we try to

answer in this section:

a) “Can enterprise financial decisions be treated

as workflows?”,

b) “Are there any tools for mining financial

decision process models?”

c) “How can decision process models be used in

order to create an enterprise model?”,

Workflows are regarded as a depiction of the

sequence of operations performed by an individual

(Van der Aalst, 2002). A decision is an outcome of a

cognitive process leading to the selection of an

alternative from several possible choices. The

144

Razvan P. (2009).

MINING AND MODELING DECISION WORKFLOWS FROM DSS USER ACTIVITY LOGS.

In Proceedings of the 11th International Conference on Enterprise Information Systems - Information Systems Analysis and Specification, pages

144-149

DOI: 10.5220/0001987701440149

Copyright

c

SciTePress

decision process implies sequential activities starting

with the recognition of the need for a decision and

ending with the choice of one alternative. The

enterprise financial decisions involve several

activities that the decision maker undertakes from

the moment the need for a decision arises and until

an alternative is chosen. We believe that these are

enough reasons to argue that the decision process

can be approached as a workflow.

The problem is that most of the decision related

activities take place inside the mind of the decision

maker. However, some of the mental activities need

support and require additional information. But, in

order to get that support, the decision maker

interacts with the software, therefore leaving a trace

regarding the sequence of his activities that can be

logged. This is why our first goal is to create means

to map decision processes to software tools,

especially decision support systems.

The styles and methods of decision making may

vary greatly among individuals because personal

cognitive style will influence decision making

(Martinsons, 2001). This is why we narrowed the

research topic to decisions regarding the finances of

the enterprise. We argue that, if decision making is

seen as a workflow, for a specific set of decisions,

comparisons between different enterprises and

different individual decision makers are possible.

There are a lot of different software tools that

help the creation of workflows and business process

models. In order to create the process models,

usually, there is a need for an expert that can

examine the environment. There are also tools and

algorithms that can be used to extract workflows

from logs. But what if a log is not available because

the decision making is done inside the mind of the

user? And what if the use of experts requires a lot of

time in order to get acquainted with the specific

environment of each studied enterprise and this way

the costs far exceed the benefits? We approach this

problem by logging the actions of the decision

maker while using a DSS. Based on the logged

behaviour, we argue that a workflow can be created

for each type of decision using existing process

mining algorithms and software tools. This log is

even more important in the case of a group decision.

The type of log that is mined determines what

type of results will be available and which are the

perspectives over the organisation that can be

obtained (Dumas, 2005). By using process mining

algorithms, we wish to gain some insights into the

control flow of the activities perspective, and into

the organisational perspective.

The control flow perspective gives insights into

the tasks that are executed and the order of their

execution (van der Aalst, 2002). It should also be

possible to link the tasks in the model to the process

instances performed.

The organisational perspective shows

information regarding the social networks in an

enterprise based on work transfer or on work

subcontracting (van der Aalst, 2002). This is a very

interesting perspective for our research because it

gives a clear picture on who is the person with the

most initiatives, who depends on other persons or

who delegates the responsibility.

If the log has enough data, a case perspective can

help improve the case-based forecasts regarding

future decisions. And it can also enable the creation

of a decisional profile for each decision maker.

The three perspectives discussed above relate to

the most important questions in financial decision

situations: “who?” (organisational perspective),

“What?” (case perspective) and “How?” (control-

flow perspective). Therefore, the general purpose

statement of our research can be: “Who decides, on

what decides and how is the decision made?”.

In order to answer those three questions we

decided to use the ProM framework for process

mining the logs obtained from CFAssist. The ProM

framework is an open-source tool tailored to support

the development of process mining plug-ins. This

tool already contains a wide variety of plug-ins,

some of them going beyond process mining (like

doing process verification, converting between

different modelling notations etc) (Verbeek, 2006).

Can current financial decision processes be

reengineered by using new software and

technologies? Is it possible to improve current

processes? An approach to reengineering is to

analyze current workflows and then try and improve

them. How important is the possibility that for

different enterprises the approach over decision

making process is different? It is clear that, at

international level, decisions have different premises

(Martinsons, 2001). We argue that, an approach

based on decision processes in the same region can

be successful. We will start by analyzing decision

making processes in our region. We will then create

enterprise models for different views over the

companies (the first one will be the financial view).

We aim then to compare different workflows so that

we have a better understanding of how decisions are

made. If the occurrence of some decisional patterns

is high, we can then propose them as reference

models (or best practices) for certain types of

decisions. For the companies interested in improving

MINING AND MODELING DECISION WORKFLOWS FROM DSS USER ACTIVITY LOGS

145

their competitiveness this can be the best first step in

reengineering their decision processes.

3 THE PROCESS MODEL

3.1 Creating the Log

The starting point of our research was the evaluation

of enterprises in search for some kind of a log of

overall operations. This log is supposed to be the

foundation on which process models can be created.

The conclusion is that Romanian small and medium

enterprises do not use advanced ERP systems or any

other software responsible for overall enterprise

workflow management. The only exceptions are the

companies that needed ISO certification. However,

we found that even those companies do not use

software to log all the activities for all the

employees.

The first problem we faced was the need to

create a log of actions regarding the financial

operations, and, more specific, financial decision

making. Our previous research was focused on

creating a decision support system (CFAssist) based

on cash-flows that aimed to improve financial

decision making in small and medium enterprises

(Petrusel, 2008). We improved this system so that

every action of the decision makers was logged,

giving us a raw source of data. We created a

different version of CFAssist that presents all

available decision tools (what-if analysis, scenarios,

indicators, reports, expert systems) in different

windows. If a user needs to use several tools he

always must open new windows. We also created

forms, menus, and buttons that aim to associate each

mental process to an action. We logged the actions

of the user while using CFAssist as well as the time

stamps for each action. This gave us a fair idea

regarding how much time the user spent viewing

data, running what-if scenarios and simulations. The

whole concept is based on the assumption that

CFAssist is the only tool used in researching a

decisional problem and choosing an alternative.

There were two challenges in improving the data

sources:

a) the users worked with CFAssist so that

their actions were limited by the software

b) the system extracted data from the

accounting system of the enterprise, so not all the

actions of the other actors involved in decision

making were logged.

We created four tables that can be imported into

ProM framework using ProM Import tool (it

converts Access tables to MXML format of ProM

logs).

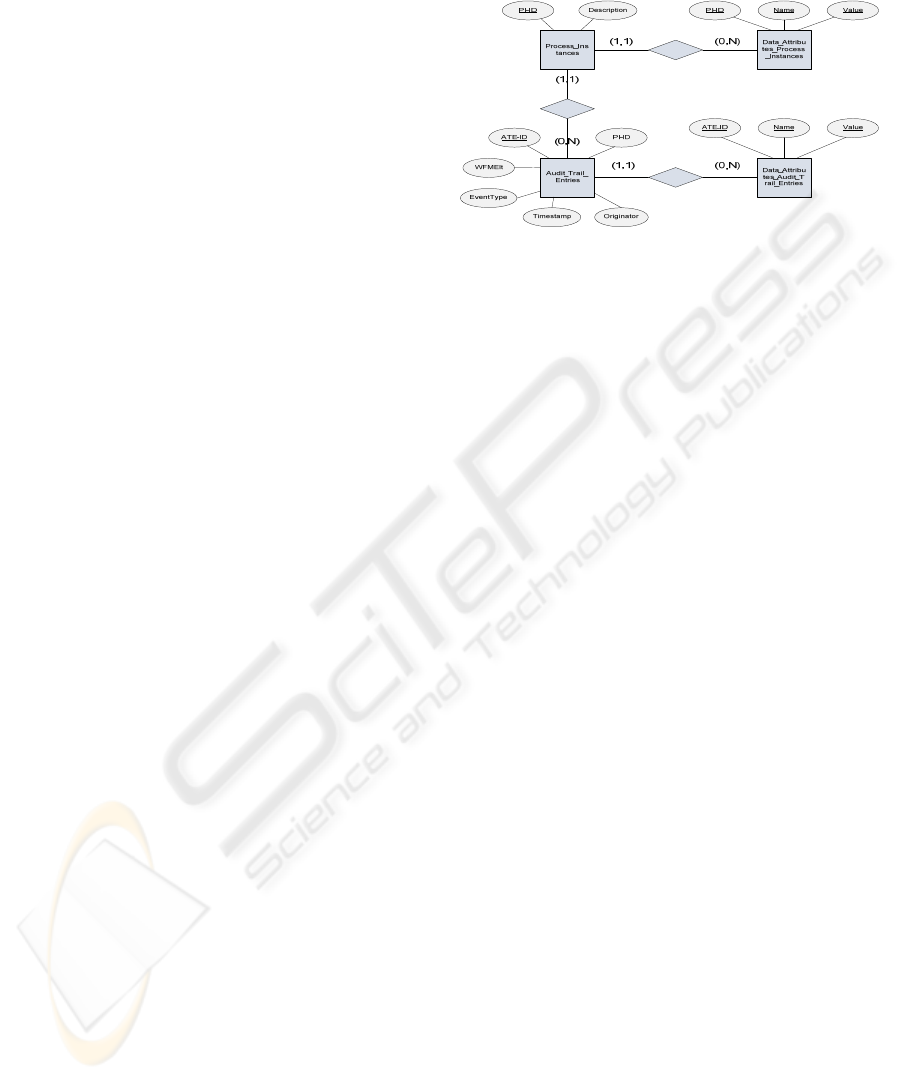

Figure 1: ER diagram for the four Process Mining tables.

In order to conduct our research we started with

a test implementation in three enterprises that

provided the training data. Because following the

daily operations of the enterprises could take a long

while and provide reduced relevance (since some

strategic decisions are made rarely) we developed a

list with nine detailed decisional situations based on

each enterprise’s data. For the first two enterprises

there was only one decision maker while for the

third enterprise there was the need for a group

decision (two decision makers, each decision

required consensus). The decision makers were

required to make a decision based on each scenario.

This provided us with three activity logs that could

be used further in the mining process. The main

scenarios were instantiated to suit the actual data

known by the decision makers.

For example, one of the scenarios regarding the

financing sources of investments was generally

stated as follows: “the company decided to purchase

a new car. The total value is <amount> euro and half

of the total amount will be paid in advance and half

will be paid on delivery (in two months). The

decision alternatives are: finance from internal

sources; bank credit; operational leasing; financial

leasing; a mix of the previous sources; or drop the

financing.” Making a decision requires an evaluation

of the financial position of the enterprise. For our

study it is important which reports are used by the

decision makers, which what-if analyses and

scenarios are run, which indicators are selected for

comparison and what is the final choice. The mined

decision process model for the third company will

be presented in 3.2 sub-section.

For each object in CFAssist we added code to

insert data into the four tables as the decision makers

used it. The actions of the user can be best seen in

the tables Process_Instances, Audit_Trail_Entries

and Data_Atributes_Audit_Trail_Entries. For the

ICEIS 2009 - International Conference on Enterprise Information Systems

146

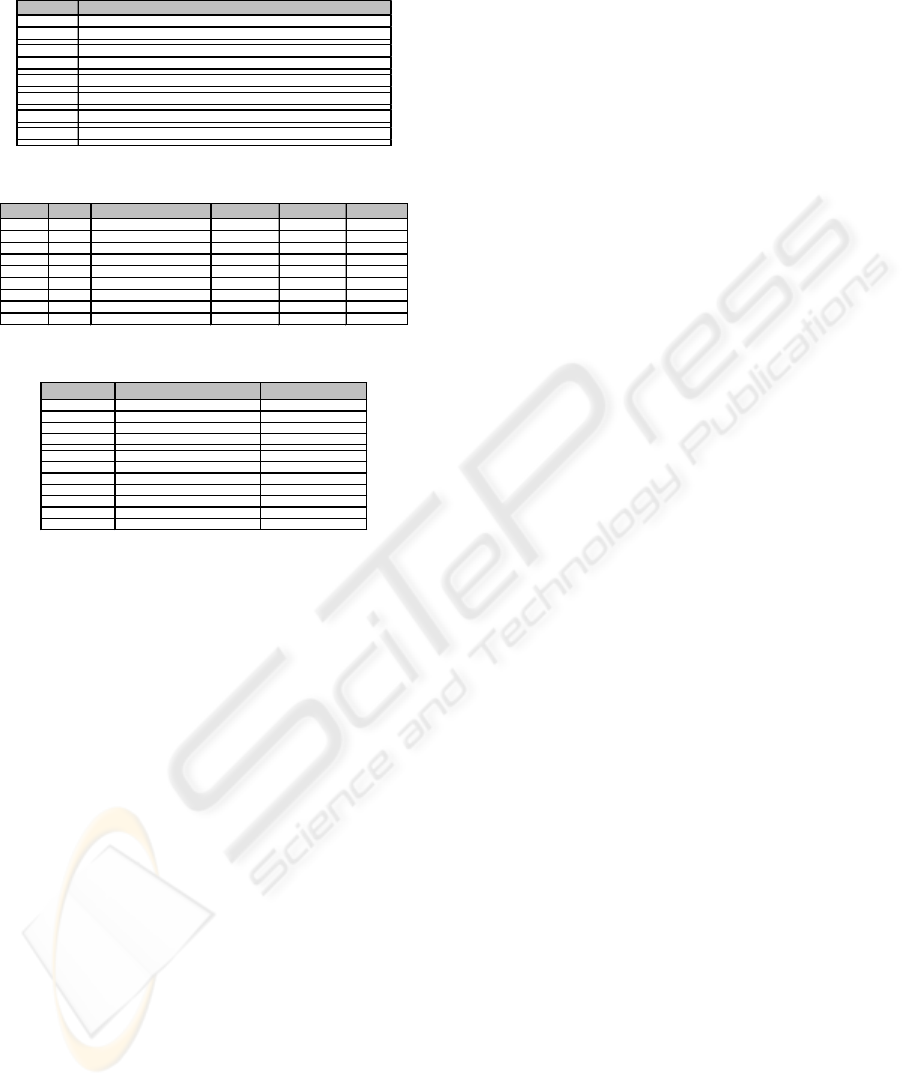

scenario presented above, some of the records of the

three tables are presented in Figures 2, 3 and 4:

PI- ID De s c r i

p

tion

1

C

1

S

1 rank

p

a

y

ment o

f

accounts

p

a

y

able

2

C

2

S

1 rank

p

a

y

ment o

f

accounts

p

a

y

able

……

……..

10

C1

S4

cas

hi

n

g

met

h

o

d_b

onuses

11

C

2

S

4 cashin

g

method

_

bonuses

……

……..

16

C

1

S

6 decide on

f

inancin

g

sources to bu

y

car

……

……..

19

C1

S

7

d

ec

id

e on

b

u

ildi

n

g

ac

q

u

i

s

i

t

i

on

……

…….

22

C

1

S

8 decide on car ac

q

uisition

……

……..

2

5

C1

S9

d

ec

id

e on ex

p

ans

i

on

Figure 2: Some records in Process_Instances table.

ATE

-

ID

PI

-

ID

WFMEl

t

E

vent

T

ype

Ti

mes tamp

O

r

i

g

i

nator

87

18

d

ec

i

s

i

on nee

d

e

d

s

t

ar

t

24

-

O

c

t

-

08

D1

88

18

d

ec

i

s

i

on nee

d

e

d

s

t

ar

t

24

-

O

c

t

-

08

D2

89

18

hi

s

t

or

i

c c-

f

s

t

ar

t

24

-

O

c

t

-

08

D1

90

18

c-

f

s

i

mu

l

a

ti

on s

t

ar

t

24

-

O

c

t

-

08

D1

91

18

hi

s

t

or

i

c c-

f

s

t

ar

t

24

-

O

c

t

-

08

D2

92

18

c-

f

s

i

mu

l

a

ti

on s

t

ar

t

24

-

O

c

t

-

08

D2

93

18

i

n

p

u

t

d

a

t

as

t

ar

t

24

-

O

c

t

-

08

D1

94

18

c-

f

s

i

mu

l

a

ti

on s

t

ar

t

24

-

O

c

t

-

08

D1

95

18

revenues an

d

ex

p

e

n

s

t

ar

t

24

-

O

c

t

-

08

D1

Figure 3: Some records in Audit_Trail_entries table.

ATE-ID Name Value

87

typ

e

t

es

t

co

d

ec

3

s

6

88

typ

e

t

es

t

co

d

ec

3

s

6

89

c

h

oose

p

er

i

o

d

:

b

e

gi

ns

j

anuar

y

89

c

h

oose

p

er

i

o

d

: en

d

soc

t

o

b

er

……

………..

………….

107

vo

t

e

fi

nanc

i

a

l

l

eas

i

n

g

108

vo

t

e

fi

nanc

i

a

l

l

eas

i

n

g

109

consensus

y

es

112

d

ec

i

s

i

on:

D1

execu

t

e

112

d

ec

i

s

i

on:

D2

execu

t

e

112

d

ec

i

s

i

on: resu

lt

fi

nanc

i

a

l

l

eas

i

n

g

112

d

ec

i

s

i

on: sen

d

e-ma

il

Figure 4: Some records in Data_Attributes_Audit_Trail

_Entries table.

3.2 Importing the Log

After the log was obtained, a pre-processing was

needed. This activity aimed to remove all data that is

not necessary or that is incomplete. We consider

that, a complete decision process starts with the

detection of the need for a decision and ends with

the choice of one alternative. Therefore, the start

point of every process must be the “decision

needed” task. This task is logged when the decision

maker starts CFAssist and clicks the “Decision

Support” button on the start-up form (as presented

above). In the log tables along with the event is also

stored the timestamp. The decision process is ended

either with “communicate decision” or with “drop

decision” tasks. Each task is logged when the user

clicks either “send decision” button or “discard

decision” button. All the actions of the user between

those two tasks, logged as events for the objects in

the systems, represent the decisional process.

Incomplete processes that either do not start with

“decision needed” task or are not ended with

“communicate decision” or with “drop decision”

tasks were removed from the log. In our simulated

test environment there were only a couple of such

processes. Even in real conditions we do not expect

numerous such processes once the users get to know

the system.

We used data filters when mining different

decision processes. In order to mine the decision

process of choosing the financing sources, along

with the raw log we also used the filtered log by

each of the decision makers. The filtered logs

allowed us to create a separate decision workflow

for each decision maker that can be compared.

3.3 Decision Process Models

After the logs were obtained and cleaned we used

ProM framework in order to create the workflows.

The main reason for our choice is that there are

numerous plug-ins available that allow extensive

mining and analyzes of the logs. Each plug-in gives

us the opportunity to use a different algorithm to

mine the available log.

We used alpha++, heuristic miner and fuzzy

miner algorithms to order activities in the logs. The

resulting models mined after using the three plug-ins

were almost identical. This was caused by the fact

that the test logs were almost noiseless due to the

controlled test environment.

The order of decision making activities gives us

a control-flow perspective over the decision process.

The final goal is to establish dependencies among

tasks. In decision making processes this means

answering to several questions: which activity

precedes which, are there any activities that imply

others, are there concurrent activities (we observed

that in decision processes concurrent activities

usually means reviewing information from two

sources) and if there are any loops (in decision

processes we observed that loops appear mainly

when what-if analyses and scenarios are reviewed).

Another important piece of information is whether a

path is more frequent than the others. If there is not a

high frequency for one path it means that the user

does not have a routine but searches for information

in different places. This was found mainly in

unstructured decisions that appear rarely (like

strategic decisions and sometimes tactical ones). In

operational decisions, the path is almost always the

same. In this case, if the same path is followed by

many enterprises, we can create some best-practice

recommendations and have a base for a reference

model. We will discuss two of the models obtained

by using alpha++ algorithm on the logs filtered for

the scenario presented in the previous sub-section:

MINING AND MODELING DECISION WORKFLOWS FROM DSS USER ACTIVITY LOGS

147

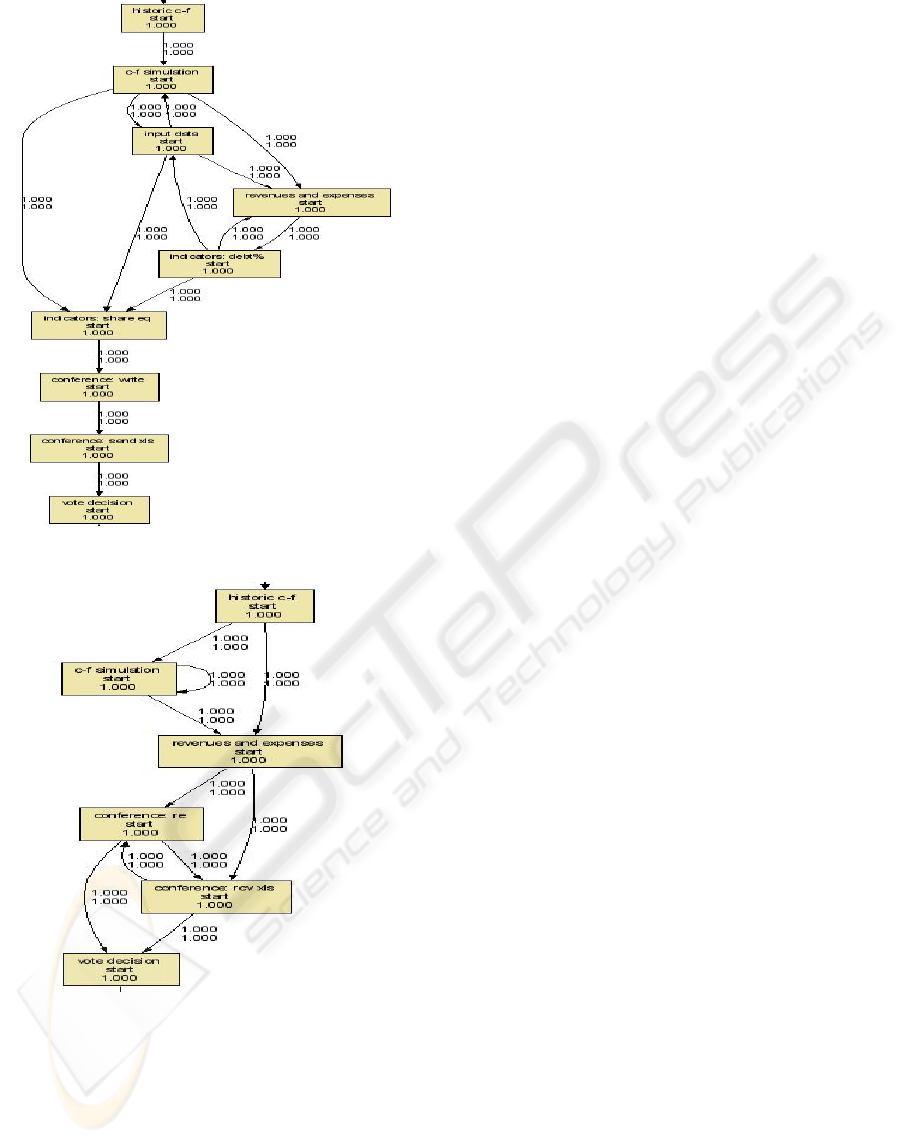

Figure 5: Partial decision workflow for D1.

Figure 6: Partial decision workflow for D2.

Figure 5 and Figure 6 show a part of the decision

workflow for the filtered logs. We discuss the

decision analysis part because it better describes the

strategies that are employed by the two users. It can

be seen that D1 is more analytical and relies on more

simulations and what-if analyses. By feeding new

data into CFAssist he changes the initial values and

tries to broaden his perspective over the decisional

situation. D2 relies only on simulations based on

accounting data and jumps to the decision without

careful consideration. It also can be seen that D1

initiates the debate over the right decision and sends

an Excel file to support his option. By following the

two decision workflows we can argue that D1 has

carefully considered all the alternatives and his

choice is based on an analysis. Meanwhile, D2

briefly reviewed available data and jumped to the

decision (possibly relying on experience). Even

though the decision needs consensus, it can be

argued that D1 influenced the final decision since he

initiated a debate and sent a file to D2 in order to

back up his choice.

In the decision workflows of the other scenarios

the same trend could be observed. While there is no

difference between the two decision makers from the

point of view of former experience and studies (both

have worked around eight years in similar positions

and have graduated an economics faculty) it can be

said that D1 is more involved in decision making

and usually influences the other.

When we disclosed our findings regarding their

decision profiles, both decision makers agreed that,

in the majority of cases, the alternative suggested by

D1 is the one chosen. Decision makers from the

other enterprises also validated our decisional

patterns as being close to reality.

With the extension of CFAssist, the creation of

social networks became an important issue. In case

of decision groups there is another important issue:

“how are the communications between actors

performed and what are the dependencies between

the decision makers?”. This question can be

answered by mining for social networks. In the test

enterprises the first part of the question was relevant.

But, in case the importance of each decision maker

is not equal, or if the decision is taken in steps, at

several management levels, the second question can

also become important. Another thing that can be

discovered in group decision making (especially

where consensus is needed) is if there are any

decision makers that rely on the opinions of other

decision makers.

If the log exists and the process model was

already created, the ProM framework allows the

validation of the models by using conformance

checker plug-in. After a process model is created it

can be checked to see how much it matches existing

execution data and to highlight discrepancies. The

validation enables us to check how much a reference

model is different from the actual decision process

of an enterprise. Conformance checker can help us

compare two decision models from different

enterprises. We can determine the differences by

ICEIS 2009 - International Conference on Enterprise Information Systems

148

selecting one model as the prescribed model and

checking it against execution data from the other

enterprise. The points of non-compliance need to be

examined in order to determine the differences.

An important point of interest is the Decision

Point Analysis because it can lead to the discovery

of Business Rules. By analyzing decision points we

can determine the probability for a certain action to

follow another action. This is an important factor

when creating a reference model or when predicting

the outcome of a decision.

4 CONCLUSIONS

This paper approached decision making process as a

workflow. In a decisional workflow, all the actions

of the decision makers are considered tasks that are

sequential to one another. Our research interest

covers the area of financial decision making in small

and medium enterprises. The only way to trace the

actions of the decision makers are by logging their

actions while using software. One essential

condition is to provide the decision makers with a

tool that encourages the user to express all the

personal decision making strategies. In order to do

that, we modified a DSS we previously created so

that all the actions of the decision makers while

using the software are logged. Since the DSS was

developed mainly around Microsoft Access we used

ProM Import tool to convert Access tables to

MXML logs. Those logs were opened in ProM

framework. Using different available plug-ins we

mined the logs for decisional process models and

workflows. We analyzed the models and found that

decisional models are comparable. We also argue

that assertions can be made in connection to decision

styles and strategies of different decision makers

confronted with similar decisional situations.

The results obtained after our first tests are

encouraging. We were able to compare financial

decision making models obtained by mining logs

from three enterprises. It is also relevant the fact that

we could detect different decision making strategies

and relationships in the case of group decisions. All

decision makers involved in the experiment

validated our profiles when we disclosed our

findings.

Overall, we argue that we can approach decision

making as a workflow and, that this approach can

lead to decisional process models and patterns that

can be compared. This comparison can improve

perception of financial decision making in real-life

enterprises and can be used as a base on which

companies can reengineer their processes. The next

phase of our research will aim to mine enough

financial decision process models to create reference

models for most common decisions in Romanian

small and medium enterprises.

ACKNOWLEDGEMENTS

This research was founded through Grant type PN2

no. 91-049 / 2007 “Intelligent Systems for Business

Decision Support (SIDE)”.

REFERENCES

Dumas, M., van der Aalst, W., M., P., ter Hofstede, A., H.,

2005. Process-Aware Information Systems: Bridging

People and Software Through Process Technology.

John Wiley & Sons Inc New York.

Martinsons, M., G., 2001. Comparing the Decision Styles

of American, Chinese and Japanese Business Leaders.

In Best Paper Proceedings of Academy of

Management Meetings.

O'Leary, D. E., Selfridge, P., 2000. Knowledge

management for best practices. In Communications of

the ACM, Volume 43, Issue 11, ACM New York.

Petrusel, R., 2008. A Decision Support System Taylored

for Romanian Small and Medium Enterprises, In

ICEIS’08, 11

th

International Conference on Enterprise

Information Systems, INSTICC Press.

Van der Aalst, W., M., P., van Hee, K., 2002. Workflow

Management: Models, Methods, and Systems, MIT

Press Cambridge.

Van der Aalst W., M., P., Weijters, A., J., M., M.,

Maruster, L., 2004. Workfow Mining: Discovering

Process Models from Event Logs. In IEEE

Transactions on Knowledge and Data Engineering,

Volume 16 Issue 9, IEEE Press New York.

Verbeek, H., M., W., van Dongen, B., F., Mendling, J.,

van der Aalst, W., M., P., 2006. Interoperability in the

ProM Framework. In Proceedings of the CAiSE'06

Workshops and Doctoral Consortium, Presses

Universitaires Namur.

Wynn, M., T., Dumas, M., Fidge, C., J., ter Hofstede A.,

H., M., van der Aalst W., M., P., 2008, Business

Process Simulation for Operational Decision Support,

In LNCS 4928/2008, Springer Heidelberg.

MINING AND MODELING DECISION WORKFLOWS FROM DSS USER ACTIVITY LOGS

149