MOBILE FINANCIAL SERVICES: A SCENARIO-DRIVEN

REQUIREMENTS ANALYSIS

Kousaridas Apostolos, Parissis George and Apostolopoulos Theodore

Athens University of Economics and Business, Department of Informatics, Patision str 76, Athens, Greece

Keywords: Electronic payments, electronic banking, mobile services.

Abstract: Mobile devices are expected to extend financial information systems, providing additional communication

interfaces and new dimensions in computing. Several architectures and commercial systems have been

proposed and implemented during the last years for m-payment and m-banking services. However, few of

them have met wide acceptance. In this paper, a real case scenario is described; where payment and banking

services are taking place using a mobile phone. Through this scenario, we identify the main characteristics

and the fundamental functional and technological requirements that should be satisfied by advanced mobile

financial systems.

1 INTRODUCTION

One of the most important processes, in the so called

electronic society, is the attempt to digitalize

economy and financial transactions, by exploiting

communication and computing technologies that are

continuously evolving. Financial electronic services

include banking transactions and payments, which

can take place using various means of payment, like

credit/debit cards, bank transfers and e-coins.

Mobile devices, which may vary from simple cell

phones to advanced smart phones as well as PDAs,

are becoming commodity. Thus, usage of mobile

devices, as payment instruments (Varshney, 2002)

or as bank agents (Mallat et al., 2004), has become

feasible and will surely facilitate electronic business

and more specifically mobile electronic commerce.

During the last years, several payment systems

have been proposed and implemented (Karnouskos,

2004). The research community has proposed

several architectures and systems, as regards as

financial and especially e-payment services, where a

mobile device is the instrument for payments’

initiation, activation and confirmation. Zhang et al.

(Zhang et al., 2004) describe a biometrically enabled

mobile payments’ solution that uses Java Smart Card

technology. Labrou Y. et al. propose a wireless

wallet (Labrou et al., 2004) that supports three types

of financial transactions: Peer-to-Peer, Web-Store

Front and physical Point of Sale (POS). SEMOPS

(Ramfos et al., 2004) is regarded as one of the most

advanced universal payment system that was

developed following the principles of universality,

openness and independence from MNOs, banks and

technology.

Apart from research initiatives there are several

commercial payment systems that have been

recently developed, using different payment

schemes and various technologies, like voice, WAP

and SMS. Mobile FeliCa (Mobile FeliCa, n.d.), Pay

Pal (Pay Pal, n.d.), Pay Box (Paybox, n.d.), Nokia

Wallet (Nokia Wallet, n.d.) and Vodafone’s m-pay

bill (Vodafone’s m-pay bill, n.d.) are some of the

most known commercial solutions.

However, few of them have been widely

adopted, due to technological restrictions, hard to

use front-ends and absence of substantial motives for

involved parties and especially mobile device

owners. Development of universal standards,

regulation and allocation of roles, among involved

entities, are some of the issues that have to be settled

for the evolution of m-payment and m-banking

systems. The development of more sophisticated

mobile devices, the introduction of next generation

mobile communication infrastructures and the

adoption of Internet technologies create new

opportunities for the evolution of financial

information systems. The ability to provide and use

financial services in a multi-stakeholder

environment, taking into account the requirements

that banks, merchants and clients have and the

151

Apostolos K., George P. and Theodore A. (2007).

MOBILE FINANCIAL SERVICES: A SCENARIO-DRIVEN REQUIREMENTS ANALYSIS.

In Proceedings of the Third International Conference on Web Information Systems and Technologies - Society, e-Business and e-Government /

e-Learning, pages 151-156

DOI: 10.5220/0001282501510156

Copyright

c

SciTePress

restrictions that the corresponding actors pose, is

investigated in this paper. By analyzing a real case

scenario, we try to confront different and sometimes

conflicting requirements in order to design a system,

which is able to integrate mechanisms and Internet

technologies for the effective extension of financial

information systems, towards a more mobile

environment.

The remainder of the paper is organized as

follows. In section 2, we describe a simple running

example, which leads us to the identification of

some key functional and technological requirements

that must be taken into consideration, when

designing a system that provides mobile financial

services. Furthermore, the requirements and the

constraints that were extracted from the scenario

analysis are discussed in Section 3, as well as the

proposed technologies and standards that must be

used, in order to deploy such a system. Finally, the

main conclusions, derived from previous sections,

are presented in Section 4.

2 SCENARIO ANALYSIS

As Figure 1 depicts, a mobile device can be used to

conduct advanced or routine banking services

through Internet. It can also be used to issue

electronic payments, using various means, for

remote or local purchases from physical shops,

vending machines or even online shops (Internet

point of sales). Furthermore, a mobile device could

be the instrument for electronic money transfer

among peer mobile devices.

In the sequence, a real-case unified scenario,

which incorporates many issues that financial

transactions raise, is described. By analyzing this

scenario, we try to identify the fundamental

functional and technological requirements as well as

the prospective technological solutions. Most of the

operations, like authentication, authorization and

decision support that Alice conducts are taking place

through the bank, which is considered as a trusted

entity. Bank’s decision support system (DSS) is an

infrastructure that already exists and only a new

interface to the mobile device is exported. On the

other hand, operations like physical interaction with

the POS and e-coins transfer are conducted directly

with the POS or a peer entity. Alice wants to buy a

product from an unmanned POS, which is Bluetooth

enabled, using her intelligent mobile device.

Figure 1: Mobile Payment Context.

She selects the desired product, by physically

interacting with the POS, which provides several

ways for the payment including e-coins, bank

transfers and credit or debit cards. Alice, considering

the amount of the transaction, omits bank’s decision

support system proposal to pay using her credit card,

and she selects to pay using her debit card.

Afterwards, she is informed that debit card’s account

is empty, and, thus, it cannot proceed with the

payment process. Thereafter, Alice decides to use

electronic coins for this micro-payment.

Unfortunately, she notices that she has spent all her

digital cash and decides to ask her friend Bob to lend

her some money. She requests electronic coins from

her friend’s mobile device, conducting peer to peer

money transfer, as happens in our daily transactions,

using paper money or coins. After the

accomplishment of the P2P transfer, Alice can

eventually proceed to pay the vending machine,

using electronic coins. Since payment is completed,

she receives the product, which she has just bought

as well as an electronic receipt.

Further on, our hero chooses to book theater

tickets from an Internet box office, by using her

mobile phone’s browser to fill show’s information,

and her mobile phone, to expedite the electronic

payment. Taking into consideration the payment

means that the online shop accepts and the

restrictions it may pose, Alice, this time, agrees with

the bank’s decision support system proposal and

decides to charge her credit card. After the

accomplishment of the payment, Alice receives the

electronic tickets from the online box office.

Eventually, Alice requests an analytical report with

the transactions that she has conducted during this

day and the total charge of the utilized payment

means.

WEBIST 2007 - International Conference on Web Information Systems and Technologies

152

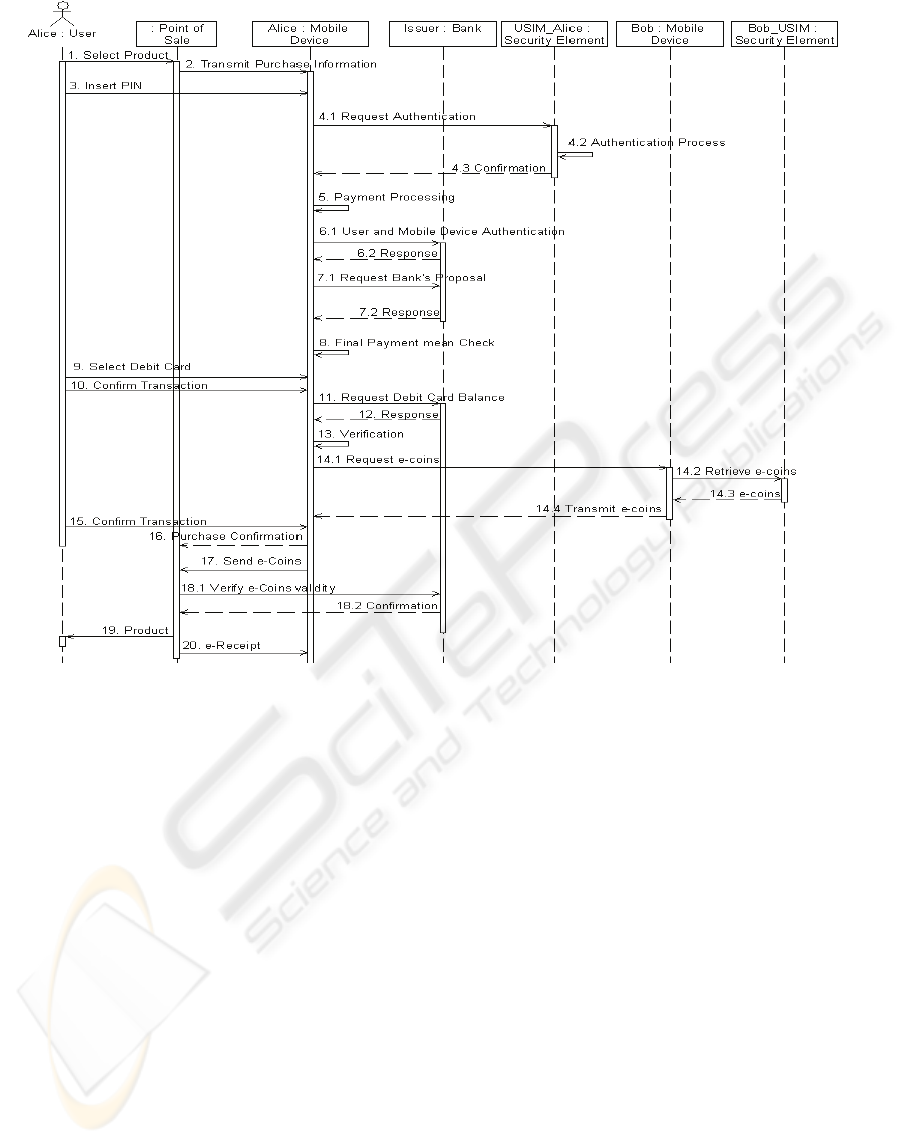

Figure 2: Point of Sale Payment - UML Sequence Diagram.

Figure 2 depicts the interactions among entities

and the sequence of messages, which are necessary

for the implementation of the first part of the above

described scenario. After product’s selection (1), the

user holds her mobile device near merchant’s

Bluetooth interface for transaction’s initiation. The

POS transmits the purchase information to the

mobile device (2). This information may include:

Transaction’s unique code number, Product’s

information (e.g. Product’s Name, Category,

Transaction’s Timestamp, and Price) and POS’s

information (e.g. ID, Place, Available payment

means).

The device issues a request to the user for

authentication in order to proceed with the payment.

Alice initiates the payment procedure, by inserting

her PIN (3) and the authentication process takes

places in the USIM smart card, where critical

information is stored (4.1 - 4.3). Upon user’s local

authentication, transaction’s processing is launched

(5). Bank’s decision support system, after user’s and

mobile device’s authentication (6.1, 6.2), taking into

account the available payment means that the online

shop supports, the amount of the transaction, user’s

profile and transactions’ history, checks her accounts

balance and finally proposes the optimal mean of

payment (7.1, 7.2, 8). In the specific case the DSS

proposes Alice to use her credit card. However, she

prefers to use her debit card (9) and confirms the

transaction (10). The local verification subsystem

checks the balance of the debit card (11, 12) and

informs the user that the debit account is empty, so it

is not possible to continue the transaction and

proceed to the payment phase (13).

Afterwards, Alice decides to pay using electronic

coins, which she will borrow from her friend’s peer

mobile device. Alice requests electronic coins from

Bob’s mobile device (14.1). The digital cash is

transmitted either over the Internet or using short

range wireless technology, if the peer mobile device

is nearby. Bob, after authentication and

authorization process, retrieves the electronic coins

(14.2, 14.3), from his USIM Smart Card, and

transmits them to Alice (14.4). Then, she accepts the

pending purchase (15) and informs the POS that she

will pay, using e-Coins (16).

MOBILE FINANCIAL SERVICES: A SCENARIO-DRIVEN REQUIREMENTS ANALYSIS

153

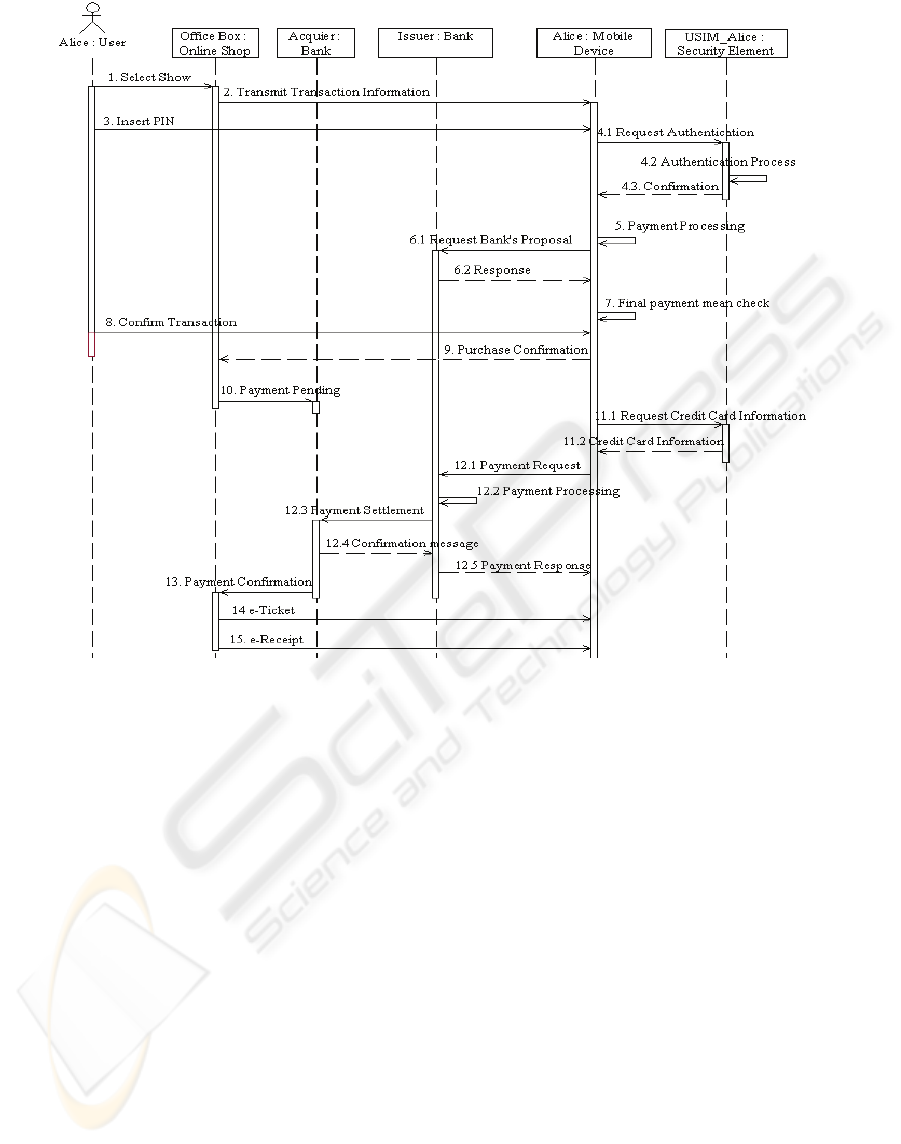

Figure 3: Online Payment - UML Sequence Diagram.

Alice’s mobile phone transmits the e-Coins to the

POS (17). The latter can verify their validity from

the issuing authority (18.1, 18.2). The recipient and

each entity that stores electronic coins can verify

digital coins’ authenticity and validity through its

issuing bank, preventing the forgery of the digital

money. After payment’s settlement, the vending

machine delivers the product (19) and sends the

electronic receipt to Alice mobile device (20).

Figure 3 illustrates the second part of the

scenario, regarding the online payment procedure for

the theater’s tickets booking. Alice uses her browser

to fill the necessary information regarding the

desired show and proceeds to the payment phase (1).

The online shop processes her choice and transmits

the transaction’s information as well as the available

payment means to the mobile device (2). Mobile

device’s local payment application undertakes to

finalize the payment procedure, through the

corresponding payment API, by interacting with the

browser. Transactions information that the online

shop sends are utilized from the above mentioned

payment API, which is responsible for online

payments. Alice inserts her PIN (3) in order to

authenticate herself locally (4.1, 4.2, 4.3) and the

payment process is initiated (5). If the previous

established session, with the issuing bank, has

expired, user and mobile device’s authentication

process is repeated, as described in Figure 2. Alice

accepts bank’s proposal (6.1, 6.2) and selects the

way she wants to pay, which for the specific case is

her credit card (7, 8). The online shop is informed

that the user has accepted the purchase (9) and

asynchronously informs its acquirer that a payment

is pending and that it is expecting a confirmation for

the specific transaction (10). Its transaction is

identified by a unique code number, which the

online shop sends to the mobile device. The

application requests and retrieves from the USIM

smart card the credit card information (11.1, 11.2)

and over UMTS or WiFi communication network,

asks from the issuer to credit the account that is

associated with the specific credit card (12.1). The

issuer processes the request (12.2) and calls the

acquirer to settle the pending transaction (12.3).

After acquirer’s confirmation (12.4), the issuer

WEBIST 2007 - International Conference on Web Information Systems and Technologies

154

informs the mobile device that the transaction has

successfully concluded (12.5). The inter-banking

system realizes the real transfer of money from the

issuer to the acquirer according to their business

agreement and not necessarily in real time. The

online box office is also informed by the acquirer

that it has been paid for the pending transaction (13).

Finally, the Internet shop delivers to the mobile

device the electronic tickets (14) and the

corresponding electronic receipt (15).

The last part of the scenario describes a usual

banking transaction, where Alice requests a report

for the transactions that she has conducted during

this day. She is also informed about the payment

means she has used and the respective charging. The

direct communication channel allows the

information system of the bank organization to offer

Alice, personalized services according to her needs

and alert messages for unusual operations.

3 SYSTEM REQUIREMENTS

In this section we outline the main technological and

functional requirements that are derived from the

aforementioned unified scenario and we are trying to

identify system properties, which could drive to a

complete and sophisticated mobile financial

services’ system development. First of all, the

development of user friendly interfaces at the mobile

side, which facilitate browsing and eliminate

information insertion and thus, make transactions

faster, is an important factor for user acceptance.

Smart client model is regarded as the most

appropriate way to develop mobile device

application, by providing greater autonomy and

extension attributes. For instance, Java 2 Micro

Edition (J2ME) programming language could be

used to implement a smart client model (Java 2

Platform Micro Edition, n.d.).

Platform and language independence is a key

requirement, in order to design a universal system.

Usage of various programming languages and

operating systems, on the involved entities (mobile

device, banks and POS), should not affect payment

and banking procedures, as described in the

scenario. Web services and especially WSDL files

are appropriate for definition of communication

interfaces, allow language independence and assure

the desired platform interoperability and openness.

Mobile Web Services (Pilioura et al., 2003) is the

technology that could be used for the

implementation of such interfaces among mobile

device, POS and bank application servers. Web

Services model uses Simple Object Access Protocol

(SOAP) and Web Services Definition Language

(WSDL), for service provision and service

description respectively. WSDL files describe how

to use software service interfaces and operations that

the bank and the POS offer to the mobile device.

Furthermore, WSDL files outline the messages, with

the corresponding parameters, and data types, which

are being exchanged between these entities.

Financial services could be invoked over the World

Wide Web using SOAP messages, which are XML-

based, and could be used for the implementation of

communication between involved entities and for

exchanging structured information.

Furthermore, security is regarded as one of the

most crucial factors for mobile financial systems’

adoption by the involved entities (users, banks and

merchants). Mobile device’s user local

authentication is necessary prior to payment or

banking process initiation, to ensure that only the

owner of the mobile device uses the financial

application. The user inserts the corresponding PIN

number and her authentication and authorization is

taking place at the USIM smart card, which has

advanced security mechanisms and is considered as

a safe execution environment. Alternatively,

biometric mechanisms that provide advanced

security could also be exploited. Java Card USIM

(Java Card 2.2 Platform Specification, n.d) could be

used to store critical information and Java Card

applications could be implemented using Java card

platform. For the communication between the

mobile device and the Smart Card, ”Security and

Trust Services API” (SATSA) (JSR 177: Security

and Trust Services API for J2ME, n.d.) could have

been utilized. USIM smart card is a safe place to

store e-coins, since, in case a user wants to switch to

a new mobile device, she only has to replace the

corresponding USIM.

User should also be authenticated to the bank

organization, when she wants to conduct a payment

through the issuer or to use a bank service.

Furthermore, data transmission should be

confidential. Each mobile device has communication

and cooperation interfaces with bank organizations

(issuer), local or remote POS and some other peer

mobile devices. Bank organizations must be the

central entity in a mobile financial services’ system,

since it is trusted by users. This fact allows the

implementation of advanced security measures. On

the other hand, mobile device may transact with

several points of sale or peer mobile devices, which

regularly change. This makes security issues

complex and requires mobile device to avoid

MOBILE FINANCIAL SERVICES: A SCENARIO-DRIVEN REQUIREMENTS ANALYSIS

155

interchanging crucial information with these entities,

during payment phase, in order to reduce potential

threats and establish simple secure connections. The

approach to conduct payments through the issuer,

utilizing bank’s guaranties, ensures that critical

information, like credit or debit card numbers, are

securely transmitted, since different and safer

channels are used. Kerberos system or a Public Key

Infrastructure (PKI) could be used for user’s

authentication and authorization at the side of the

bank. In case of peer-to-peer communication or a

local payment, the connection with the

corresponding peer entity is established through a

short range technology like Bluetooth, NFC or

Infrared.

Legacy applications integration is an important

acceptance factor for financial organizations and

merchants. Applications should be developed using

an adaptable and upgradeable perspective, taking

into consideration the fact that there are various

types of mobile devices, which have different radio

air interfaces (RATs) or hardware resources, and

various POS, which support different

communication, payment or security mechanisms.

Each financial transaction should be adapted

according to the common available technologies that

the involved entities support. Mobile device and

POS financial applications can be easily upgraded,

utilizing over-the-air management and download

mechanisms (OMA Download over the Air, n.d.).

More sophisticated services must be provided, in

order to exploit cooperation between banking and

payment modules and introduce intelligence into

mobile device, which must not be considered as a

simple graphical interface but as a device that takes

decisions and makes proposals.

Moreover, the cost for using mobile financial

services and the operational cost that is imposed on

banks and POS is an issue that should be considered,

during system design. Legacy applications

integration retains cost low for banks and POS,

while offline browsing, which is feasible using smart

client model, enables user to use her device without

the need to continuously interact with the bank or

POS server.

4 CONCLUSIONS

In this paper, we have firstly presented the

technological background and the related work in

the field of mobile financial services. The

technological restrictions and the fact that these

systems were designed to satisfy only specific cases

have led to limited adoption of mobile payment and

banking solutions. A real-case unified scenario was

utilized in order to identify the fundamental

functional and technological requirements as well as

the prospective technological solutions, regarding

the design and implementation of such systems.

User friendly interfaces at the mobile side, mobile

device autonomy, platform and language

independence, end to end security, legacy

applications integration and low operational costs

are some of the derived requirements for a

successful mobile financial system development.

REFERENCES

Varshney, U. (2002). Communications: Mobile payments.

COMPUTER, 35(12):120–121.

Mallat, N., Rossi, M., and Tuunainen, V. K. (2004).

Mobile banking services. Commun. ACM, 47(5):42–

46.

Karnouskos, S. (2004). Mobile payment: A journey

hrough existing procedures and standardization

initiatives. IEEE Communications Surveys and

Tutorials, 6(4).

Zhang, Q., Moita, J. N. B., Mayes, K., and Markantonakis,

K. (2004). The secure and multiple payment system

based on the mobile phone platform. In Workshop on

Information Security Applications (WISA).

Labrou, Y., Agre, J., Ji, L., Molina, J., and lun Chen, W.

(2004). Wireless wallet. mobiquitous, 00:32–41.

Ramfos, A., Karnouskos, S., Vilmos, A., Csik, B.,

Hoepner, P., and Venetakis, N. (2004). Semops:

Paying with mobile devices. In I3E, pages 247–261.

Mobile FeliCa. Retrieved January 11, 2006, from

http://www.felicanetworks.co.jp/index.html.

Pay Pal. Retrieved January 11, 2006, from

http://www.paypal.com.

Paybox. Retrieved January 11, 2006, from

http://www1.paybox.com.

Nokia Wallet. Retrieved January 11, 2006, from

http://www.forum.nokia.com/info/sw.nokia.com/id/37

ae0410-6e97-4f23-9a8a-

c23ba7c0fd25/Wallet_Release_2_0_en.pdf.html.

Vodafone’s m-pay bill. Retrieved January 11, 2006, from

http://www.vodafone.co.uk/mpay.

Java 2 Platform, Micro Edition (J2ME). Retrieved January

11, 2006, from http://java.sun.com/j2me/index.jsp.

Pilioura, T., Tsalgatidou, A., Hadjiefthymiades S., (2003).

Scenarios of using Web Services in M-Commerce.

ACM SIGecom Exchanges, 3(4): 28–36.

Java Card 2.2 Platform Specification. Retrieved January

11, 2006, from http://java.sun.com/products/javacard.

JSR 177: Security and Trust Services API for J2ME.

Retrieved January 11, 2006, from,

http://java.sun.com/products/satsa.

OMA Download over the Air. Retrieved January 11, 2006,

from http://www.openmobilealliance.org

WEBIST 2007 - International Conference on Web Information Systems and Technologies

156